1. Introduction

In the Chinese context, it is imperative to adopt the progressive notion that "green water and green mountains are golden mountains and silver mountains" and elevate our thinking to achieve a serene cohabitation between humanity and the natural world [1]. Special emphasis on green and low-carbon economic and social development is the key to China's high-quality, sustainable development. In order to implement the requirements of ecological environment construction as soon as possible, various economic entities in my country regard the transformation of economic development mode and the development of green industries as a new development trend. Under the guidance, all sectors of society are also trying to reduce corporate pollution levels, enhance social responsibility, and improve governance capabilities. Within this framework, a surge in eco-friendly investments has been noted over the past few years, with an increasing number of businesses focusing on revealing details concerning environmental impact, societal duties, and corporate governance. As the linkage between ESG revelations and interested parties grows stronger, the calibre of ESG-related data put forth by corporations is garnering heightened scrutiny from various sectors. The correlation between a company's ESG revelations and the expenses associated with equity funding has emerged as a pivotal subject of debate.

Lately, there has been a surge in the focus on sustainable progression. Stakeholders exert greater influence on corporations to embrace eco-friendly actions and thoroughly showcase their sustainable initiatives. As a result, the revelation of non-monetary information has become pivotal. The correlation between the transparency of ESG revelations and the expense of obtaining equity funding is now a prominent subject of debate [2].

This study explores the effects of Environmental, Social, and Governance (ESG) factors on equity financing costs. During the investigation, we considered the progression of ESG framework development in China, along with pertinent theoretical foundations, selecting publicly traded A-share corporations in the Shanghai and Shenzhen stock exchanges, focusing on the years 2023 and 2024 as our sample population. The study incorporated additional control variables sourced from the WIND database, which specialises in corporate financial metrics, as well as information from Sina Financial News. By employing regression analytical techniques, we sought to ascertain the influence of ESG ratings on equity financing costs. Our findings indicate that Over the period from 2023 to 2024, there is an inverse relationship between the extent of ESG transparency in Shanghai and Shenzhen A-share listed firms and their equity financing costs, with higher ESG disclosure correlating with reduced financing expenses [3].

Studying the relationship between the quality of ESG information disclosure and the cost of equity financing can provide a reference for our government departments to formulate relevant policies. By understanding the impact of ESG information disclosure on the cost of equity financing, the government can formulate corresponding policies and measures to encourage enterprises to disclose ESG information more actively and improve the transparency and quality of information disclosure [4].

2. Literature review and background

As China's economy gradually moves towards the road of high-quality development, the role of the ecological environment in economic development is becoming increasingly important, and green low-carbon transformation and sustainable development have gradually become the focus of economic and social attention. China's quest for high-calibre sustainable progression hinges significantly on the pursuit of eco-friendliness and growth in both economic and social spheres [5]. The pressing agenda is to diligently advance towards peak carbon emissions and achieve carbon neutrality while persistently driving the transformation in energy production and bolstering the ecological system's carbon sequestration potential. Within this context, the pursuit of sustainable progression and the shift towards eco-friendly metamorphosis have garnered widespread international attention. Concurrently, the phenomenon of climate variation is acknowledged universally as among the paramount dangers that humankind is encountering [6]. The predominant factor contributing to this climatic shift is the discharge of gases that trap heat, with carbon dioxide being the paramount among them. Under the Paris Agreement, countries around the world need to take action to develop deep emission reduction strategies to achieve zero emissions targets. China's emission reduction task is particularly important as one of the world's largest carbon dioxide emitters. In order to achieve the goal of zero emissions, the Chinese government promised on September 22, 2020, to achieve peak carbon dioxide emissions by 2030 and achieve carbon neutrality by 2060 [7]. This goal is called the "double carbon" goal. In the "2021 Government Work Report", my country put forward the "double carbon" goal for the first time. It emphasised that enterprises are the main practitioners and implementers of sustainable development and green and low-carbon. Enterprises need to gradually establish a green and sound governance mechanism and pay attention to themselves. The impact of business activities on the environment and society [8]. Enterprise ESG performance has gradually become the core content of measuring the level of sustainable development. In the 20th National Congress report released in October 2022, the ecological environment was again emphasised [9].

Based on China's energy and resource endowment, the report points out that the Chinese government will implement the carbon peak action in a planned and phased manner and actively and steadily promote the realisation of China's "double carbon" goal. Under the requirements of sustainable development and green and low-carbon, the people of the whole country need to work together. Among them, enterprises, as the backbone of implementing the requirements of green, low-carbon and sustainable development, are not only required enterprises to pay attention to the impact of business activities on the environment and society but are also required enterprises to build a green and perfect governance mechanism. Over time, the performance of enterprises in ESG (environmental, social and governance) has gradually become an important indicator to measure the level of sustainable development of enterprises. The above-mentioned method of evaluating a company's sustainability by examining its environmental, social and governance indicators is called the ESG concept. As an important tool to promote the early realisation of the "double carbon" and sustainable development goals, the ESG concept has become an important strategy for modern enterprises. It plays an irreplaceable role in the long-term development of enterprises. The Environmental, Social, and Governance (ESG) framework was established to emphasise extra-financial aspects alongside conventional monetary data for corporations and interested parties. The origins of ESG can be dated to the 1970s, when the public started to recognise the importance of a company's ecological impact, societal duties, and governance practices, eventually integrating these factors into the broader discourse of corporate accountability [7,8].

However, in the early 2000s, the ESG concept began to gain wider attention and acceptance. In 2004, the UN Global Compact officially unveiled the ESG paradigm, signifying the critical role of environmental, societal, and managerial elements in corporate operations [10]. This framework underscores the integral link between ESG criteria and the sustained value generation within companies. Two years later, in 2006, the UN Secretary-General initiated the United Nations Principles for Responsible Investment (UNPRI). This initiative is geared towards prompting all financial entities and asset managers to integrate ESG aspects as a pivotal factor in their investment choices, thereby fostering the adoption of ESG principles among investors. With the passage of time and the development of the economy, the concept of ESG has been increasingly widely recognised and applied. In the 2020s, epidemics and extreme weather occur frequently worldwide [11]. Social problems such as "black life is also life", "data hegemony", and the monopoly of large enterprises are also becoming important factors threatening human security and fairness. The international community is paying more and more attention to the issue of environmental protection. Against this backdrop, the ESG investment philosophy has evolved rapidly. More than 60 countries and regions have integrated ESG concepts into operational management and investment decisions [12]. The government, major investment institutions and large enterprises pay more attention to environmental protection, social responsibility and corporate governance and regard them as important issues in policy formulation and investment decision-making. Among them, China is becoming the core driver of ESG investment development. In the context of the new era, to ensure the steady progress of China's ecological and environmental protection work and achieve the goals of low-carbon, green and sustainable development on schedule, the Chinese government has raised the ESG investment concept to a policy level. Since introducing China's "double carbon" target, the Chinese government has issued a series of ESG-related policies. First, corporate ESG disclosure will be an important direction for capital market regulation. ESG disclosure is the cornerstone of the ESG system and refers to the disclosure of non-financial information by an enterprise to the requirements of the relevant departments. Lately, the ESG ideology has gained significant traction, prompting a growing number of corporations globally to focus on revealing and enhancing their ESG data to cater to their stakeholders' sustainable progression and societal accountability demands. In alignment with the United Nations Sustainable Stock Exchange Initiative, it has been noted that a total of 55 stock exchanges across the globe are now offering guidelines for ESG revelations to their listed entities. The EU has taken the lead in introducing regulatory requirements related to ESG disclosure, including the Non-Financial Disclosure Directive and the Transparency Directive.

As the leading emerging nation on the global stage, China is committed to the philosophy of a global community, actively drawing from the global practices of ESG transparency and directing the ESG reporting practices of its publicly traded entities. In June 2018, the China Securities Investment Fund Industry Association released the Provisional Green Investment Guidelines, marking the first instance where an ESG disclosure framework for publicly listed firms was introduced. That same year, the China Securities Regulatory Commission (CSRC) updated the Corporate Governance Code for Listed Companies, mandating the disclosure of ESG-related information. Moving forward to January 2022, the Shanghai Stock Exchange (SSE) published the Notice Regarding the Disclosure of 2021 Annual Reports for Companies Listed on the SSE Main Board, highlighting the necessity for ESG-related disclosures within these reports [10]. It also encouraged the preparation and separate publication of ESG reports when applicable. Subsequently, in April 2022, the CSRC issued the Guidelines on the Management of Investor Relations for Listed Companies, aiming to enhance the efficacy of communication between listed entities and their shareholders, with a particular emphasis on the inclusion of ESG information as a key component of this communication within investor relations management.

Under a series of initiatives to promote ESG information disclosure in China, according to the Green Governance Database of Nankai University, 1,366 ESG information reports were issued by China's a-share listed companies in 2021, accounting for 29.42 per cent of all listed companies, up 7.82 per cent from 2017 [13]. Among them, the number of enterprises disclosing ESG information as a proportion of the total number of a-share enterprises remains relatively stable every year, indicating that implementing the ESG concept and introducing ESG-related policies have achieved initial results. Some companies have recognised the importance of sustainable development and ESG concepts and have taken relevant measures, such as developing environmentally friendly policies and optimising the supply chain. Regarding financing methods, equity investors have more volatile returns than creditors. Therefore, to measure risk, they are usually more willing to invest in companies with good ESG performance and high disclosure at a lower rate of return to reduce the cost of equity financing for the company. This paper discusses the impact of ESG information disclosure quality on the cost of equity financing.

3. Research hypothesis

Based on the discussion above, we assumed that:

Higher ESG scores Lead to Lower Equity Financing Costs

The prevalent belief is that an elevated ESG rating correlates with a diminished cost of equity capital. This correlation is potentially attributed to the notion that these firms are deemed less volatile and possess superior long-term growth potential, attracting a larger pool of investors and lowering the expected equity returns. Moreover, entities that exhibit robust environmental, societal, and governance standards might encounter fewer sanctions from regulators and fewer operational interruptions, which diminishes their risk quotient and the expenses associated with obtaining financing.

The results of this paper have important theoretical and practical significance for policymakers, enterprises and market investors and provide a theoretical basis for Chinese enterprises to ease financing constraints and reduce equity financing costs. On a conceptual plane, the present manuscript serves as both an enhancement to exploring ESG doctrine within the Chinese context and an in-depth examination of ESG doctrine concerning the cost of corporate financing. Initially, it contributed to the scholarly discourse on ESG in China. Despite the growing focus on ESG progression in China over the past few years, the existing research on this topic still needs to be expanded. The manuscript leverages ESG metrics from independent agencies that encapsulate three pivotal dimensions, enabling a more objective and holistic assessment of corporate ESG transparency. This approach also offers valuable insights and a benchmark for future scholarly inquiries into the realm of ESG transparency. Furthermore, it bridges the gap in the literature pertaining to the disclosure of ESG information and the costs associated with equity financing, presenting fresh evidence that elucidates the connection between ESG information and the expenses of financing through equity. Little literature discusses the relationship between ESG three-dimensional information disclosure and equity financing cost, and the mechanism of the two has yet to be fully explored. There needs to be more literature to analyse the possible impact of heterogeneity in different industries on research questions. Based on the study of ESG information disclosure and equity financing, this paper further analyses the possible impact of different industry heterogeneity on research problems complements the relevant literature on ESG information disclosure and equity financing costs and encourages enterprises to treat information disclosure more actively and improve the quality of information disclosure. It provides a new theoretical perspective for promoting the high-quality development of the national economy.

With the rapid development of the financial market in China, the competition among enterprises is intensifying. More and more enterprises choose equity financing to support capital, which requires enterprises to pay more attention to the cost and return of equity financing. The cost of equity financing comes mainly from stock prices and dividend distributions, while the return rate depends on the company's performance and stock price changes.

The data used in this study is limited to A-share listed companies in 2023-2024, and the ESG score is from Sustainalytics. The 40 companies selected in this paper's sample cannot completely represent all Chinese entities, which may impact the accuracy of the research conclusions.

4. Research methodology

This study will use a quantitative approach to analyse publicly listed companies' ESG ratings and equity financing costs. By utilising regression analysis, the research will identify correlations and causal relationships between ESG performance and equity financing costs. Data will be sourced from reliable financial databases and ESG rating agencies to ensure accuracy and comprehensiveness.

5. Explanation of main variables' definition

5.1. ESG

The ESG framework guides interested parties to assess an entity's handling of risks and prospects concerning ecological, societal, and managerial aspects, otherwise known as ESG elements. This approach maintains that sustainability is not confined to ecological concerns alone. Although ESG is frequently associated with investment discussions, the group of stakeholders encompasses more than just investors; it also includes clients, vendors, and the workforce, all of whom are growing more concerned with the sustainability of a company's activities. To elaborate, ESG is an abbreviation that represents ecological, societal, and managerial dimensions. Ecological aspects pertain to the influence a company has on the environment and its strategies for managing environmental risks. This encompasses both direct and indirect emissions of greenhouse gases, the company's oversight of natural assets, and its ability to withstand environmental threats such as climate shifts, inundations, and wildfires.

Community engagement pertains to an entity's connections with its various interest groups. Key performance indicators that a business might be assessed on encompassing workforce management indicators (such as equitable compensation and staff involvement) and the entity's influence on the neighbourhoods it is active in. A defining characteristic of ESG is broadening societal influence anticipations beyond the corporate perimeter to encompass the supply network, especially in emerging markets where ecological and work-related regulations might be weaker. Organisational stewardship pertains to the guidance and administration of a company. ESG experts aim to gain a clearer insight into how the motivations of the management team correspond with the demands of the stakeholders, the perspective and treatment of investor privileges, and the nature of the internal mechanisms in place to foster openness and responsibility among the leaders.

Plus, an ESG score ranges from 0 to 100, allowing shareholders to compare a company's success with that of other companies in the same industry and with companies in different industries. A score below 50 indicates underperformance, while an overall score above 70 indicates excellent performance.

5.2. The cost of equity financing

The cost of costs are fees incurred when borrowing funds for business operations. They can include interest payments on loans, lending fees, and other charges associated with obtaining capital. Financing is affected by many factors, the most important of which is its financing structure. The financing structure refers to the ratio of debt financing to equity financing. Different financing structures will lead to different financing costs.

The required rate of return a firm must achieve as compensation for a particular investment or initiative is referred to as the equity financing expense. It is the minimum return a business must earn before creating value. It is the product of separating the right of ownership and use of funds. Equity financing is more expensive than debt financing because equity investors demand a higher risk premium. Several academics argue that there is a significant correlation between ESG and the expenses associated with equity funding. Botosan developed a metric to gauge the extent of transparency and analysed the connection between transparency levels and equity funding costs [14]. The study inferred that disclosing high-calibre ESG data can successfully decrease equity financing costs.

5.3. Book-to-market value

The discrepancy between a company's total assets and its total liabilities, as indicated on its balance sheet, constitutes the book-to-market value.

6. Log of capitalisation

Regression analysis typically involves a set of independent variables and a dependent variable. If the linear regression model has heteroscedasticity, using the traditional least squares method to estimate the model will result in either ineffective or asymptotically effective parameter estimates. At this time, conducting significance tests on the model parameters is also impossible. Logarithmic transformation can solve the problems of data nonnormality and heteroscedasticity, thereby improving the reliability of regression results.

7. Sample selection

As this paper's research scope is domestic companies in China, the sample object mainly selects A-share listed companies. However, considering the time cost and other factors, we selected 20 representative A-share listed companies.

The initial step involves the choice of the autonomous factor, ESG data. ESG is a multifaceted notion encompassing ecological, societal, and managerial aspects. The process for evaluating ESG encompasses three primary stages: initially, the aggregation of data and the derivation of insights; subsequently, the establishment of metrics, the allocation of scores, and the assignment of ratings, culminating in the compilation of the rating outcomes; finally, these ratings are catalogued to create investment offerings tailored for client needs. Considering the accuracy and credibility of the ESG evaluation data, we decided to select an ESG composite evaluation score of 2023 from the Sina Finance ESG Evaluation Center Sustainalytics. Sina Finance ESG Rating Center launched the ESG rating inquiry platform in 2001, covering the rating results of more than ten mainstream rating agencies at home and abroad, of which the Sustainalytics ESG evaluation data is very detailed [15]. The lower the Sustainalytics's ESG score, the higher the company's

The subsequent step involved gathering information pertinent to computing the equity financing cost for the dependent variable. We sourced the final share prices of A-share corporations listed on the Sina Finance platform, capturing data from the latter part of 2023 and the beginning of 2023. These figures were then utilised to derive the marginal cost percentage data for equity financing.

Finally, this paper discusses the selection of control variables that may affect the cost of equity financing. This paper uses common stockholders' equity and market capitalisation as control variables.

8. Empirical results

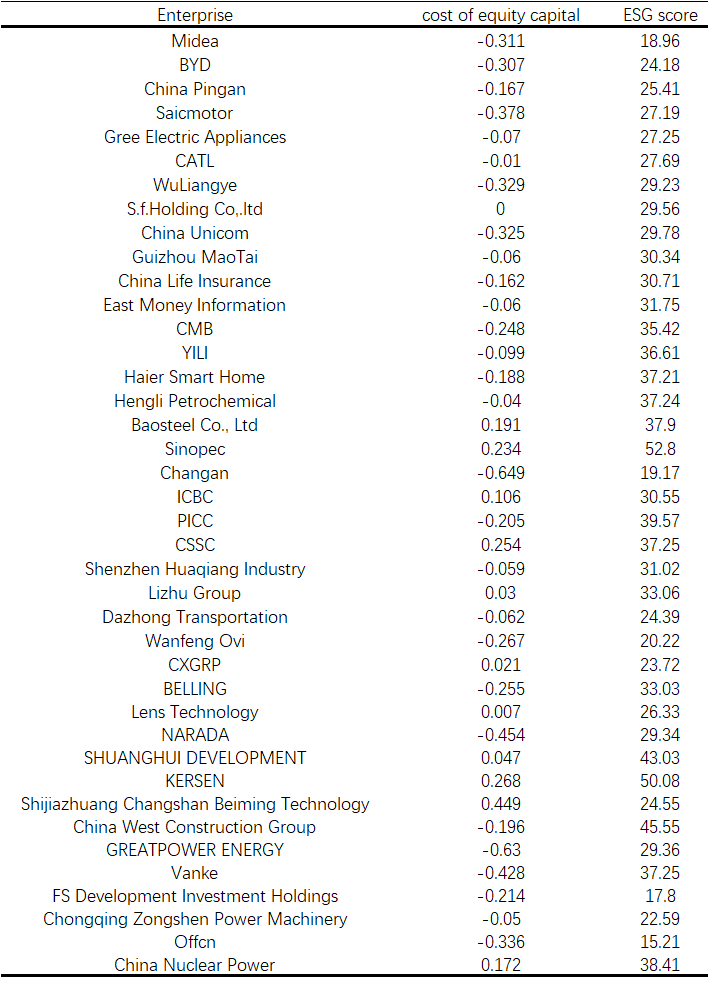

Figure 1 covers 40 randomly selected Chinese companies listed on the A-share market. The cost of equity capital is the ratio of the company's year-end closing price minus the year-end closing price divided by the year-end closing price, reflecting the company's operating conditions within a year. The last column is the ESG rating of 40 companies from the Sustainalystics database.

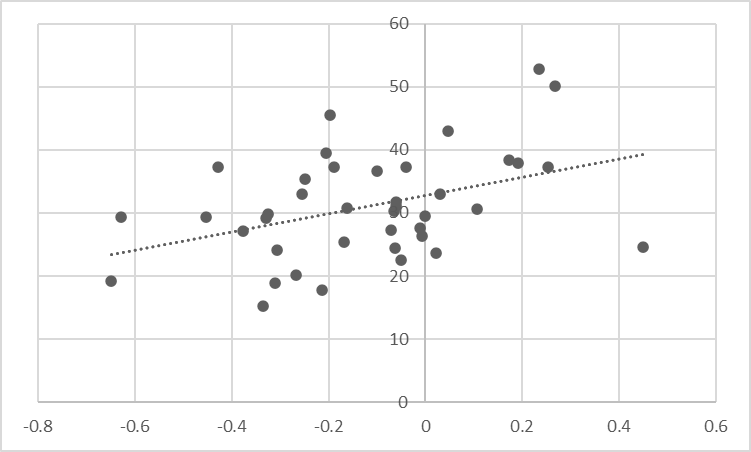

Figure 2 is a scatter plot drawn from the data in Figure 1, with ESG scores as the independent variable and cost of equity capital as the dependent variable. Because of random noise, the data are subject to vertical scatter around the true line that describes the relationship between ESG and the cost of equity financing. According to Sustainalytics evaluation criteria, the lower a company's ESG scores are, the higher the quality of its ESG information is. So, the cost of equity capital gets lower with a higher quality of ESG information disclosure. There is a negative correlation between ESG and the cost of equity capital.

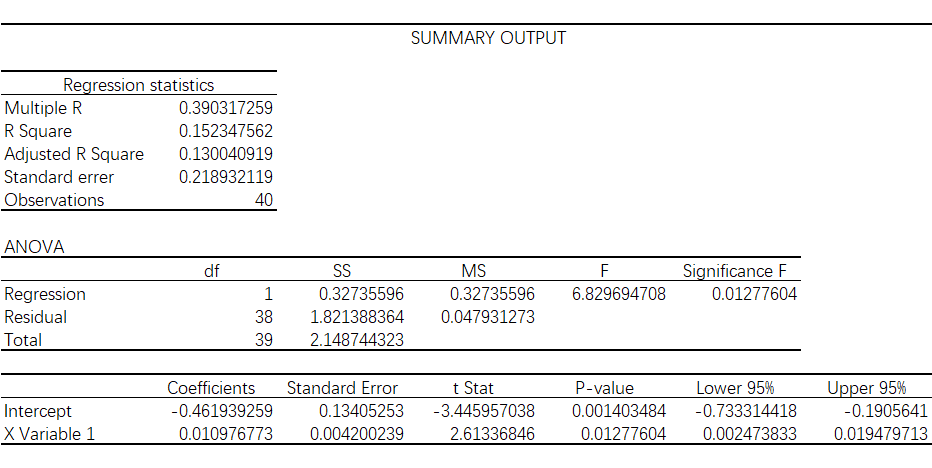

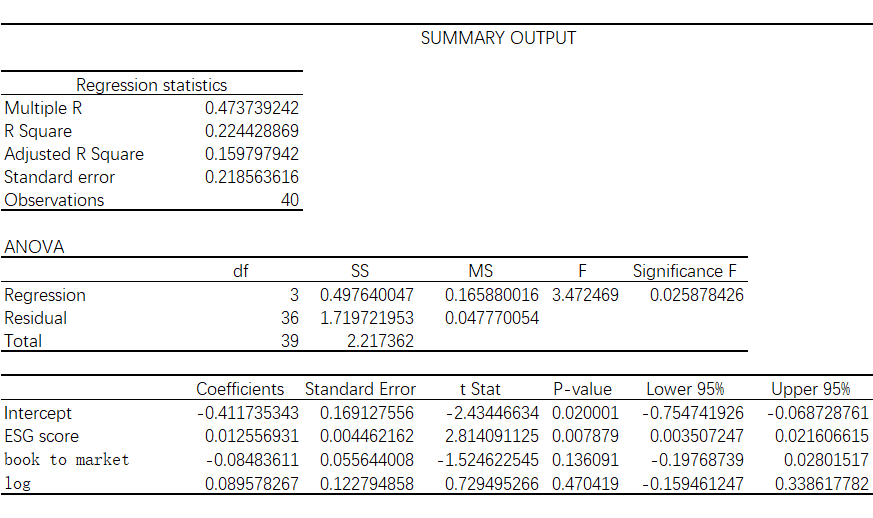

In Figure 3, we conducted a regression analysis using Excel with ESG data as the independent variable and cost of equity capital as the dependent variable. The P-value is small, which makes the finding more convincing. In Figure 4, after we added two control variables, we found that the relation between ESG scores and the cost of equity capital is stronger.

According to Sustainalystics'evaluation criteria, higher ESG scores mean lower ESG ratings.

9. Conclusion

Firstly, the findings categorically demonstrate that as the extent of ESG revelations escalates, the equity financing costs diminish. This finding diverges from earlier research which primarily concentrated on the influence of ESG data facets on equity financing costs or their interplay. Some perspectives even suggested that the augmentation of non-financial revelations could potentially damage shareholders' and other stakeholders' interests, possibly adversely affecting the corporation. However, this study's outcomes resoundingly contradict that notion: enhanced ESG revelation levels by companies lead to reduced equity financing costs, ultimately benefiting the corporations. This revelation carries significant repercussions and practical significance for both businesses and investors.

The investigation's findings underscore the critical role that environmental, societal, and managerial elements play in shaping investment choices and corporations' comprehensive fiscal well-being. Enterprises that integrate environmental, societal, and managerial criteria into their business practices foster sustainable progress and enjoy reduced costs associated with equity funding. This dual advantage reinforces the strategic value of ESG integration in business management.

In summary, ESG performance is a key determinant of a company's cost of equity financing. Companies that perform well in environmental, social, and governance areas can be rewarded with lower financing costs, thereby improving their competitive position and long-term sustainability. Future research should explore the subtle effects of each ESG component on each financial indicator to provide a more complete understanding of the impact of ESG on a company's finances.

Acknowledgement

Fengming Qiu, ZhenghaoYang, Hancheng Ni, and Yueliang Zhou contributed equally to this work and should be considered co-first authors.

References

[1]. Zhong, Q. (2019). Ecology: Clean, Clear Waters and Lush Mountains, "Gold and Silver Mountain". The Chinese Dream and Zhejiang's Practice—General Report Volume, 187-214.

[2]. Lee, J., & Song, C. Y. (2013). Estimation of submerged-arc welding design parameters using Taguchi method and fuzzy logic. Proceedings of the Institution of Mechanical Engineers, Part B: Journal of Engineering Manufacture, 227(4), 532-542.

[3]. Chen, S., Song, Y., & Gao, P. (2023). Environmental, social, and governance (ESG) performance and financial outcomes: Analysing the impact of ESG on financial performance. Journal of Environmental Management, 345, 118829.

[4]. Yu, G., & Wang, B. (2016). The impact of information disclosure quality on the cost of equity financing—based on time series perspective. Journal of Financial Risk Management, 5(3), 107-112.

[5]. Xie, Z. (2017). Promoting Green and Low-Carbon Development to Address Challenges of Climate Change. Chinese Journal of Urban and Environmental Studies, 5(2), 1750008.

[6]. Haluza‐DeLay, R. (2014). Religion and climate change: varieties in viewpoints and practices. Wiley Interdisciplinary Reviews: Climate Change, 5(2), 261-279.

[7]. Wang, Y., Guo, C. H., Chen, X. J., Jia, L. Q., Guo, X. N., Chen, R. S., ... & Wang, H. D. (2021). Carbon peak and carbon neutrality in China: Goals, implementation path and prospects. China Geology, 4(4), 720-746.

[8]. Achumba, I. C., Ighomereho, O. S., & Akpor-Robaro, M. O. M. (2013). Security challenges in Nigeria and the implications for business activities and sustainable development. Journal of economics and sustainable development, 4(2).

[9]. Christie, R. (2024). ESG Reporting as a Sustainability Performance Measurement in Educational Institutions (Doctoral dissertation, Hochschule Rhein-Waal).

[10]. Prencipe, R. (2024). The G in ESG: an analysis of the impact of Corporate Governance indicators on firm performance.

[11]. Clarke, B., Otto, F., Stuart-Smith, R., & Harrington, L. (2022). Extreme weather impacts of climate change: an attribution perspective. Environmental Research: Climate, 1(1), 012001.

[12]. Park, S. R., & Jang, J. Y. (2021). The impact of ESG management on investment decision: Institutional investors’ perceptions of country-specific ESG criteria. International Journal of Financial Studies, 9(3), 48.

[13]. Xiaoyu, H. (2023). Corporate ESG performance and financing constraints: Empirical evidence from Chinese listed companies. Journal of Applied Finance and Banking, 13(5).

[14]. Botosan, C. A. (1997). Disclosure level and the cost of equity capital. Accounting Review, 323-349.

[15]. Yu, K., Wu, Q., Chen, X., Wang, W., & Mardani, A. (2023). An integrated MCDM framework for evaluating the environmental, social, and governance (ESG) sustainable business performance. Annals of Operations Research, 1-32.

Cite this article

Qiu,F.;Yang,Z.;Ni,H.;Zhou,Y. (2025). The Impact of ESG on the Cost of Equity Financing Evidence from China. Advances in Economics, Management and Political Sciences,217,10-20.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 4th International Conference on Financial Technology and Business Analysis

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Zhong, Q. (2019). Ecology: Clean, Clear Waters and Lush Mountains, "Gold and Silver Mountain". The Chinese Dream and Zhejiang's Practice—General Report Volume, 187-214.

[2]. Lee, J., & Song, C. Y. (2013). Estimation of submerged-arc welding design parameters using Taguchi method and fuzzy logic. Proceedings of the Institution of Mechanical Engineers, Part B: Journal of Engineering Manufacture, 227(4), 532-542.

[3]. Chen, S., Song, Y., & Gao, P. (2023). Environmental, social, and governance (ESG) performance and financial outcomes: Analysing the impact of ESG on financial performance. Journal of Environmental Management, 345, 118829.

[4]. Yu, G., & Wang, B. (2016). The impact of information disclosure quality on the cost of equity financing—based on time series perspective. Journal of Financial Risk Management, 5(3), 107-112.

[5]. Xie, Z. (2017). Promoting Green and Low-Carbon Development to Address Challenges of Climate Change. Chinese Journal of Urban and Environmental Studies, 5(2), 1750008.

[6]. Haluza‐DeLay, R. (2014). Religion and climate change: varieties in viewpoints and practices. Wiley Interdisciplinary Reviews: Climate Change, 5(2), 261-279.

[7]. Wang, Y., Guo, C. H., Chen, X. J., Jia, L. Q., Guo, X. N., Chen, R. S., ... & Wang, H. D. (2021). Carbon peak and carbon neutrality in China: Goals, implementation path and prospects. China Geology, 4(4), 720-746.

[8]. Achumba, I. C., Ighomereho, O. S., & Akpor-Robaro, M. O. M. (2013). Security challenges in Nigeria and the implications for business activities and sustainable development. Journal of economics and sustainable development, 4(2).

[9]. Christie, R. (2024). ESG Reporting as a Sustainability Performance Measurement in Educational Institutions (Doctoral dissertation, Hochschule Rhein-Waal).

[10]. Prencipe, R. (2024). The G in ESG: an analysis of the impact of Corporate Governance indicators on firm performance.

[11]. Clarke, B., Otto, F., Stuart-Smith, R., & Harrington, L. (2022). Extreme weather impacts of climate change: an attribution perspective. Environmental Research: Climate, 1(1), 012001.

[12]. Park, S. R., & Jang, J. Y. (2021). The impact of ESG management on investment decision: Institutional investors’ perceptions of country-specific ESG criteria. International Journal of Financial Studies, 9(3), 48.

[13]. Xiaoyu, H. (2023). Corporate ESG performance and financing constraints: Empirical evidence from Chinese listed companies. Journal of Applied Finance and Banking, 13(5).

[14]. Botosan, C. A. (1997). Disclosure level and the cost of equity capital. Accounting Review, 323-349.

[15]. Yu, K., Wu, Q., Chen, X., Wang, W., & Mardani, A. (2023). An integrated MCDM framework for evaluating the environmental, social, and governance (ESG) sustainable business performance. Annals of Operations Research, 1-32.