1. Introduction

In recent years, the frequency of extreme climate disasters is increasing, and the growing economic losses they cause have led to the activation of related insurance in the stock market [1]. Many climate-sensitive industries (manufacturing, transportation, real estate, etc.) are also affected by extreme climate disasters, which negatively affects the overall performance of their financial markets and the repayment ability of the companies involved [2]. Typhoons, as a representative of extreme heavy rainfall events, have been strongly focused on due to their great destructive power, persistence, extensiveness and group occurrence.

As a populous country with the world's third-largest land area, China has been suffering from typhoon events all year round, especially in the southeastern coast and some inland areas. China's common stock (A-share) market is the core of Chinese domestic stock market and has a relatively objective response to domestic economic development, investor behaviour, market and industry operating conditions. Analyzing the influence of typhoon occurrences on the A-share market not only facilitates a more thorough evaluation of their economic and financial impacts, but also aids in identifying how various industries react to such events. Moreover, it contributes to a deeper understanding of the market's ability to self-regulate when facing losses caused by natural disasters. This knowledge enables investors and policymakers to more accurately gauge risks and implement preventive strategies. Accordingly, this study examines the stock market's reaction to extreme typhoon events over the decade from 2014 to 2023.

2. Literature review

To conduct a study on the impact of typhoons on China's financial markets, it is important to understand the broader context of climate disasters over the past decade and to summarize existing research on the impact of natural or climate disasters on the financial system.

2.1. Global warming and climate instability

Over the last 50 years, global warming has been progressing at a rate unprecedented in the past two millennia. Ongoing warming has intensified the volatility of the climate system, causing a rise in the frequency and magnitude of extreme weather and climatic events, with increasingly varied consequences [3]. According to the 2024 China's Climate Blue Book, the number of typhoons making landfall in China has remained relatively consistent, however, since the late 1990s, the fluctuations in their average intensity have shown a marked increase [4]. The growing frequency and intensity of these extreme climate disasters have garnered significant attention from researchers seeking to better understand their economic repercussions.

2.2. Financial impacts of extreme climate events

Research investigating the relationship between extreme climate events and financial markets has unveiled a range of intricate and multifaceted effects. The event study methodology has been extensively employed in climate finance area research to gauge how markets react to climate hazards and natural disasters. For instance, Worthington and Valadkhani explored the short- and long-term consequences of 42 significant natural disasters, including fires, hurricanes, and earthquakes, on the Australian stock market by utilizing an intervention analysis model. Their study revealed that hurricanes and earthquakes had the most pronounced influence on market returns, with hurricanes causing a markedly negative effect. Earthquakes, though initially having a short-term detrimental impact on the stock market, exhibited positive recovery trends over time [5]. Extreme weather events can amplify uncertainty within financial markets, and the severity of such events often leads to heightened stock price volatility, primarily driven by investors' emotional and behavioral responses to the perceived risks of future economic instability [6]. In a subsequent study conducted in 2008, Worthington found that the overall impact on stock returns from 1980 to 2003 was not statistically significant, implying that the long-term financial implications of these disasters may depend on various factors such as the type of event, industry risk, and the geographic regions affected [7]. In the U.S., researchers have observed that the stock market experiences negative returns ahead of climate disasters, followed by increased volatility, particularly in industries like energy and utilities [8]. This represents that in addition to direct economic damage, investor sentiment in the industry can exacerbate stock price volatility as market participants respond to the perceived risk by withdrawing their investments, further driving market volatility, with investor responses varying by industry, the intensity of the disaster, and the economic damage caused. Together, these studies suggest that extreme climate events can act as a catalyst for uncertainty in financial markets, receiving a more sensitive response in financial markets in the short term, which in turn has a potential impact on market liquidity and stock valuations in the long term [9,10]. Natural disasters are universal and complex in the international context, and market responses vary across countries depending on the type of disaster, market structure and coping mechanisms. This provides an important comparative context for analyzing the disaster response of the Chinese market.

Among climatic disasters, the impact of typhoons is highly geographic and seasonal, and typhoon events are often accompanied by strong winds, heavy rains, and floods that cause huge economic losses compared to other disasters. In recent years, scholars have gradually begun to pay attention to the impact of this particular type of climatic disaster on China's stock market. Shao and Zheng examined the impact of typhoons on abnormal stock returns in A-share market and found that smaller firms and privately held companies were more negatively impacted after typhoon events, mainly due to their limited ability to absorb financial shocks [11]. Overall, however, the existing research on natural and climatic disasters in China focuses on property damage and corporate asset pricing, with less research literature on the response of financial markets at different stages [2,11]. Therefore, this study aims to specifically examine the impact of typhoons on China's a-share market, assess its response to typhoon events in different windows, test the immediacy and accuracy of market responses, and examine whether market fluctuations are in line with expectations. This study will enrich the understanding of the stock market's response to extreme weather events, and in particular provide empirical evidence and policy recommendations for the Chinese a-share market and investors.

3. Data and methodology

3.1. Sample and data

According to China Meteorological Administration (CMA), there are an average of 27 typhoons per year in the Northwest Pacific Ocean and the South China Sea [12]. In this study, 77 typhoons that made landfall in mainland China between 2014 and June 1st 2024 were downloaded from the CSMAR database, and the location where the typhoon first made landfall in mainland China was used as the landfall area. Since typhoon disasters have a more prominent impact on China's coastal areas, this study focuses on typhoons that made landfall in Fujian and Guangdong provinces. Typhoon events with a landfall date that is not a stock market opening day are not considered. Then, based on the criteria of the China Meteorological Administration (CMA), this study classified the typhoons into five classes according to the maximum wind speed at the sea surface near the center and selected five typhoons from them. They are “Higos” (level 3), “Doksuri” (level 4), “Hato” (level 4), “Maria “ (level 4) and “Rammasun” (level 5).

Among the numerous typhoon disasters, this study focuses on Typhoons Maria, Hato, Higos, Rammasun and Doksuri as the sample events. These particular typhoons were chosen due to their significant impact compared to other events and their landfall occurring on trading days, providing ample data for analysis.

Corresponding to these sample events, the study uses regional stock indices from the Fujian and Guangdong provinces during the typhoon events. The regional indices consist of daily closing prices from Jan 2nd 2014 to Aug 8th 2024, the regional daily returns are derived from the changes in closing prices. All data were sourced from the Tonghuashun (THS) iFind database.

3.2. Research strategy

This paper utilizes the event study method as the fundamental research strategy of the empirical analysis for this study. In fact, the event study method is recognised as a standardised financial measurement method, which was proposed by Dollev, and then Fama, Fisher, Jensen and Roll continued to expand and improve it and finally finalised it, which mainly analyses the price fluctuation of the research object in a certain period of time before and after a particular incident occurs and tests the abnormal return [13,14]. This study chooses several typhoon events as cases and analyses the performance in the regional market for stocks before and after each typhoon's landfall, so as to reveal the actual mechanism of the typhoon's influence on the market.

3.3. Carhart four-factor model

The event study approach is used to examine how unexpected events affect the stock prices of local publicly traded companies. In determining the event window, the day of the event is defined as the event day (denoted as t = 0).

For the return estimation model used in the event study, the market model is used to predict abnormal returns (AR). To obtain more accurate abnormal return data, this study utilizes the Carhart four-factor model, which includes the momentum factor. The specific steps are as follows:

First, the expected normal return is defined, which reflects the expected return of each stock if the sudden event had not occurred.

In the equation,

The size factor,

Ordinary least squares (OLS) is applied to estimate the coefficients in equation, with the estimation period set to 2022-07-28 --- 2023-08-07 before the event. The estimated coefficients

The abnormal return of each stock is obtained by subtracting the expected.

In this equation,

Calculate the arithmetic mean of the abnormal returns for all the stocks to obtain the sample's average abnormal return

Finally, calculate the sample's cumulative average abnormal return

3.4. Intervention analysis

Intervention analysis is primarily applied to measure the impact of specific events on time series data. This method was introduced by Box and Tiao’s 1975 study, in which classified intervention variables into two types: step variables and pulse variables [15]. Also, intervention events are categorized into four types depending on whether the intervention event manifests suddenly or gradually, and whether its impact is long-term or temporary.

This study concerns the cumulative abnormal returns (CAR) methodology adopted by Zhao, Shen and Wu and focuses on the effect of typhoons with major influential characteristics on stock prices [16]. Considering the typhoon's unique nature and intervention analysis on Typhoon Hogo [17], this study adopts a gradual occurrence and short-lasting event type, analyzed using the Autoregressive Integrated Moving Average (ARIMA) model.

Firstly, we conduct a time series analysis of the impact of typhoon-induced shocks on stock prices, using the abnormal returns (AR) derived from the Carhart four-factor model. AR is employed to isolate the impact of the event shock, followed by the establishment of an intervention variable model to evaluate the degree of event decay over time.

For the setup of the intervention analysis, we begin with a unit root test using Augmented Dickey-Fuller (ADF) to assess the stationarity data and determine whether differencing is required. We then plot the Autocorrelation Function (ACF) and Partial Autocorrelation Function (PACF) to help select the appropriate ARIMA model order. Next, we define the intervention variable and intervention function as follows:

Pulse intervention variables:

It is used to represent and capture the direct impact in the short term.

Model-setting:

The iterative process for

Next, assuming that in the steady state, AR converges to a stable value

Finally, calculate

4. Findings

4.1. Findings and analysis for carhart four-factor model

4.1.1. Short-term impact typhoons

Based on the effect of typhoon events on the stock market of the province where the landfall occurs, this paper classifies typhoons that have made landfall in China in the past decade into two types: short-term impact typhoons and long-term impact typhoons. Three typhoons with short-term impacts are selected as samples for the study, including Hato, Higos and Doksuri. The range and direction of their cumulative abnormal returns (CAR) are shown in the following table:According to the impact of typhoon events on the regional stock index where the landfall occurs, this paper classifies typhoons that have made landfall in China in the past decade into two types: short-term impact typhoons and long-term impact typhoons. Three typhoons with short-term impacts are selected as samples for the study, including Hato, Higos and Doksuri. The range and direction of their cumulative abnormal returns (CAR) can be found in the following table:

|

CAR |

Hato (Level 4) |

Higos (Level 3) |

Doksuri (Level 4) |

|||

|

23-Aug-17 |

19-Aug-20 |

28-Jul-23 |

||||

|

Range |

Direction |

Range |

Direction |

Range |

Direction |

|

|

[-1,0] |

-0.000731 |

Negative |

-0.002318314 |

Negative |

-0.000470768 |

Negative |

|

[0,0] |

-0.000731 |

Negative |

-0.002318 |

Negative |

-0.000471 |

Negative |

|

[0,2] |

0.00647081 |

Positive |

0.002875308 |

Positive |

/ |

/ |

|

[0,5] |

0.010490337 |

Positive |

0.001934884 |

Positive |

0.004115953 |

Positive |

|

[0,10] |

0.012676365 |

Positive |

-0.004021133 |

Negative |

0.009263829 |

Positive |

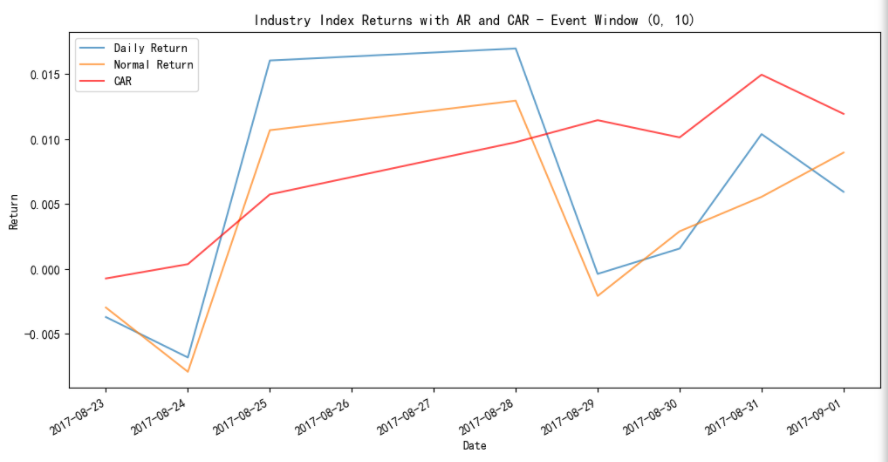

Hato is a level 4 typhoon that made landfall on 23 August 2017 in Guangdong Province, China. On the day before Hato made landfall, the regional stock index for Guangdong Province showed a negative abnormal return. On the day Hato made landfall, the regional stock index for Guangdong Province experienced a negative abnormal return. However, the cumulative abnormal return rose back to positive on the first day after the typhoon's landfall date, and then, despite minor oscillations, it rose significantly during the (0,10) window.

Higos is a level 3 typhoon that made landfall on 19 August 2020 in Guangdong Province, China. On the day before Hagos made landfall, the regional stock index for Guangdong Province experienced a negative abnormal return. Moreover, the cumulative abnormal return went on to falling on the day of Higos’s landfall. On the second day after landfall, the cumulative abnormal return briefly rose to positive and then continued to fluctuate around zero, before showing a clear downward trend from the sixth day after landfall.

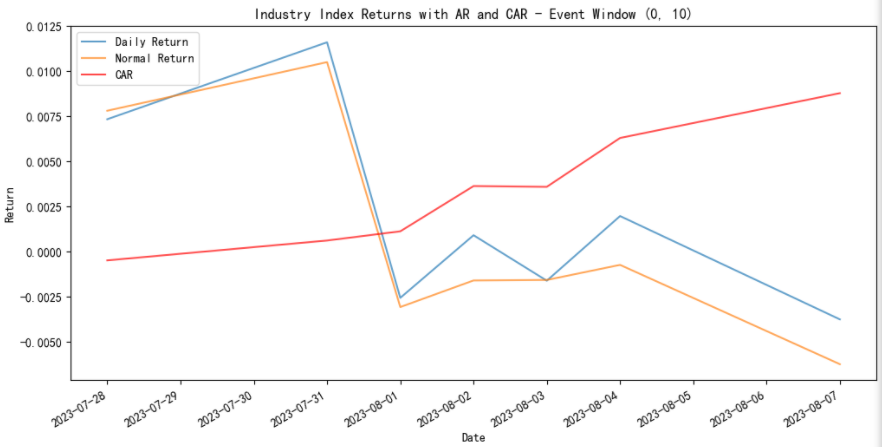

Doksuri is a level 4 typhoon that made landfall on 28 July 2023 in Fujian Province, China. The day before Doksuri made landfall, the regional stock index for Fujian Province experienced a negative abnormal return, and the cumulative abnormal return kept declining on the day of Doksuri's landfall. Then, it began to rise, breaking through zero and reversing to positive on the third day after landfall. Thereafter, it maintained an upward trend until the cut-off date of the 10-day time window chosen for this paper, when it reached its highest value during the time window.

Based on the above description, the regional stock indices of the provinces where the above 3 typhoons made landfall all show negative abnormal returns on the day of the landfall, which suggests that typhoon incursions have a negative impact on the local stock market. This is due to the fact that typhoon landfalls may bring short periods of heavy rainfall, strong winds and other inclement weather. These meterological conditions may not only cause natural disasters such as floods and mudslides, but also damage to buildings, trees and infrastructure, leading to frequent power outages and traffic accidents, and even affecting the lives of residents and agricultural production. As a result, business activities are halted, agriculture is affected, business operations and regional economic activities are disrupted by typhoons. Consequently, investors may be wary of the stocks of companies in the affected areas, resulting in lower stock prices and negative abnormal returns. In addition, due to typhoons’ fast moving speed, stock markets tend to react quickly to typhoon events, and information about the event can be transmitted quickly and efficiently throughout the market.

In some cases, the geographic stock indices of the provinces where the typhoon made landfall already have negative abnormal returns the day before the typhoon's landfall date. It indicates that investors were anticipating the hazards posed by the upcoming typhoon. This is due to the fact that modern weather forecasting techniques are able to accurately track the path and landfall time of a typhoon and anticipate the risks posed by its landfall. When a typhoon is about to make landfall, investors may be less willing to invest for fear of the damage it will cause, and companies may stop work or take precautionary measures ahead of time, affecting to a certain extent the production, the sale of goods, the supply chain logistics and transport. These factors combine to negatively affect local economic activity and market sentiment before the typhoon makes landfall.

Cumulative abnormal returns tend to rise quickly after the typhoon landfall date and return to positive on days 1-3 after the typhoon landfall date. Afterwards, a continuing increasing trend of positive cumulative abnormal returns is shown. This suggests that the negative impact of typhoon events on the stock market of the province where the landfall occurs is quickly cancelled out, and that typhoon have less long-term impact on the stock market. This is due to the fact that typhoons are a common meteorological disaster during the summer months along the southeastern coast of China, and Chinese investors have extensive experience with typhoon events, as they are able to effectively assess the damages caused by typhoons. As a result, the uncertainty and panic caused by typhoon events are relatively short-lived. After the market experienced initial negative expectations, investors reassessed the risks and might believe that the worst period was over or that the damage was less than expected, thus confidence was restored and stock prices began to rebound. In addition, government-led disaster prevention and mitigation measures are effective in minimising the damage of typhoon disasters on economic activities. Moreover, the high participation of state-owned enterprises tends to smooth out market volatility, so optimistic expectations for reconstruction and economic recovery of the stock market in disaster-stricken areas can be effective in driving a sustained improvement in cumulative abnormal returns.

4.1.2. Long-term impact typhoons

Based on the effect of typhoon events on the stock market of the province where the landfall occurs, this paper classifies typhoons that have made landfall in China in the past decade into two types: short-term impact typhoons and long-term impact typhoons. Two typhoons with long-term impacts are selected as samples for the study, including Rammasun and Maria. The range and direction of their cumulative abnormal returns (CAR) are shown in the following table:

|

CAR |

Rammasun (Level 5) |

Maria (Level 4) |

||

|

18-Jul-14 |

11-Jul-18 |

|||

|

Range |

Direction |

Range |

Direction |

|

|

[-1,0] |

-0.002013533 |

Negative |

-0.001501747 |

Negative |

|

[0,0] |

-0.002014 |

Negative |

-0.001502 |

Negative |

|

[0,2] |

/ |

/ |

-0.001570116 |

Negative |

|

[0,5] |

-0.004909983 |

Negative |

-0.002209524 |

Negative |

|

[0,10] |

-0.007519795 |

Negative |

-0.000424173 |

Negative |

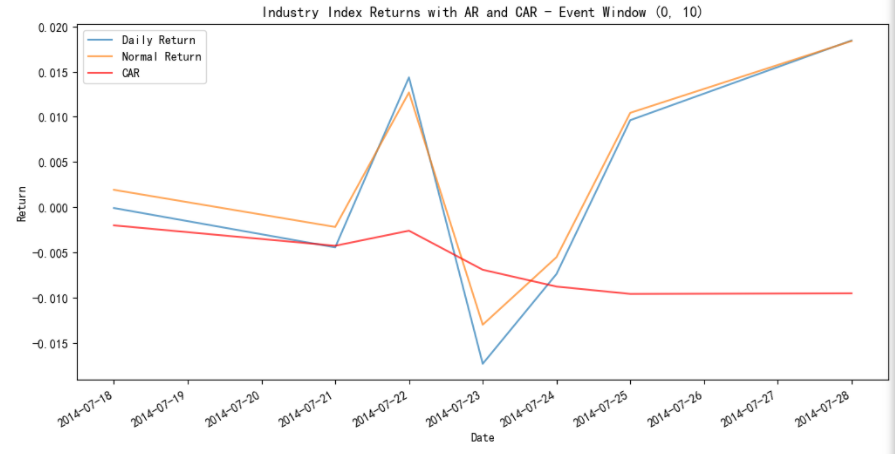

Rammasun is a level 5 typhoon that made landfall on 18 July 2014 in Guangdong Province, China. The day before Rammasun made landfall, the regional stock index for Guangdong Province showed a positive abnormal return. On the day of Rammasun's landfall, the cumulative abnormal return was negative and continued to decline for three days after landfall, then rose and then fell, maintaining the downward trend until the cut-off date of the 10-day time window chosen for this paper. At that time, it reached the lowest value during the 10-day time window.

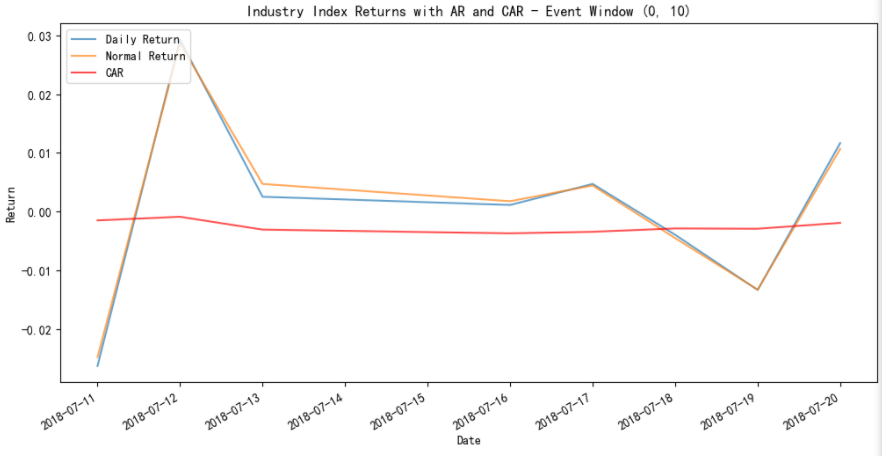

Maria is a level 4 typhoon that made landfall on 11 July 2018 in Fujian Province, China. On the day before Maria's landfall, the regional stock index for Fujian Province experienced a negative abnormal return. On the day of Maria's landfall, the cumulative abnormal return continued to fall. Thereafter, the cumulative abnormal return fluctuated slightly below 0 and remained negative during the 10-day time window period selected in this paper.

The cumulative abnormal returns of the geographic stock indices of the provinces where the above 2 typhoons are located all show negative values on the event date and during the subsequent 10-day window period, and they have a clear downward trend, reaching their lowest values on the time window cut-off date. This indicates that cumulative abnormal returns are negatively affected by the typhoon event in the long run. This could be attributed to the fact that all of the above typhoons are strong level 4-5 typhoons, which cause wider and more severe material damage and disruption of business activities, resulting in longer recovery time. At the same time, in the face of strong typhoons, it is more costly for the government to rescue and rehabilitate damaged facilities and businesses. Moreover, the implementation and effectiveness of contingency measures are relatively lagging behind, and the pressure on insurance companies to pay out claims has increased considerably. These factors may bring about a decline in investors’ confidence in the future economic outlook, leading to a longer period of market pessimism. In addition, the frequency of typhoon disasters may draw investors' attention to long-term climate change and environmental risks, prompting them to reassess their investment strategies, which may also be reflected in the stock market.

4.2. Findings and analysis for intervention analysis

Before analyzing the abnormal returns (AR) derived from the Carhart four-factor model, intervention analysis conducted a unit root test by Augmented Dickey-Fuller (ADF) to ensure the stationarity of the data. Based on the test results, the abnormal return series of the typhoon events Doksuri, Maria, and Rammasun demonstrated stationarity, indicating that these series could be directly used for further model analysis. In contrast, the abnormal return series for Hato and Higos showed non-stationarity, necessitating first-order differencing followed by the construction of an Autoregressive Integrated Moving Average (ARIMA) model.

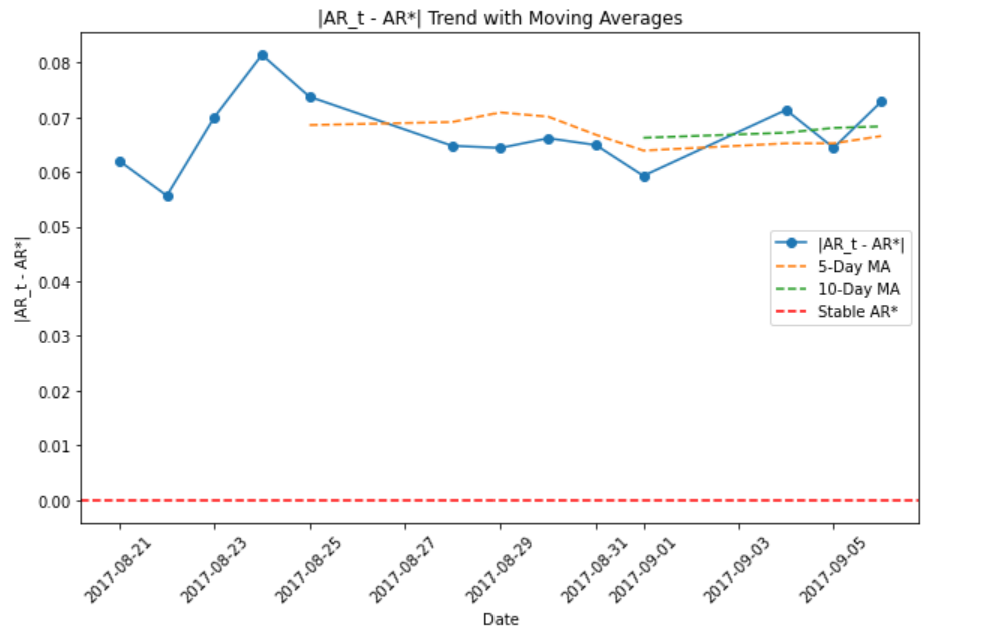

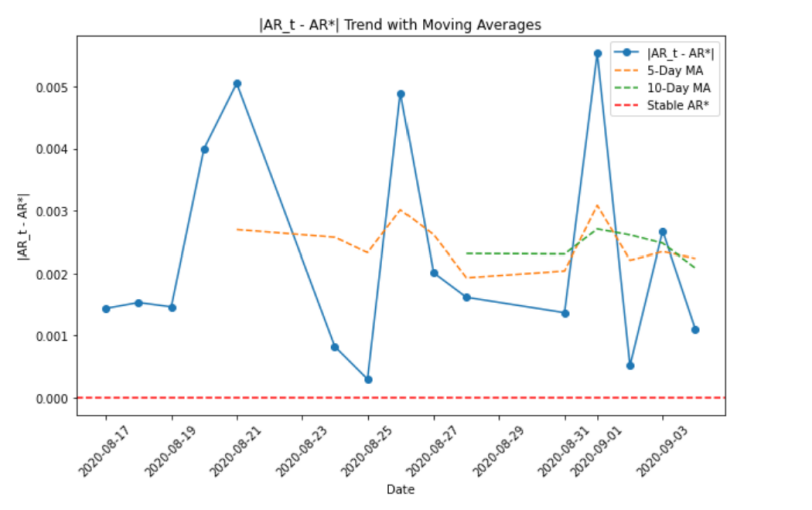

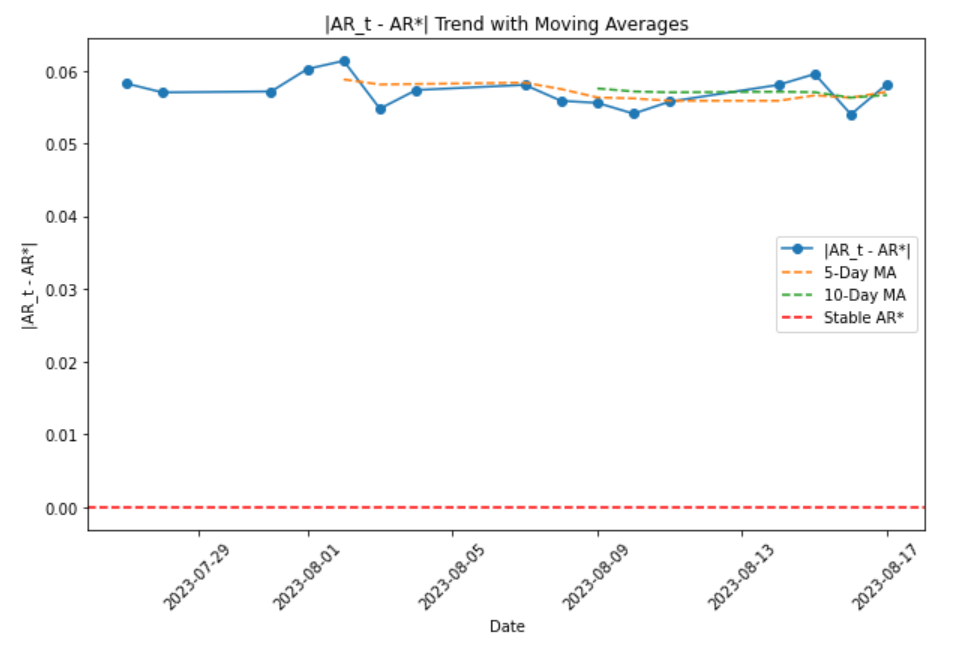

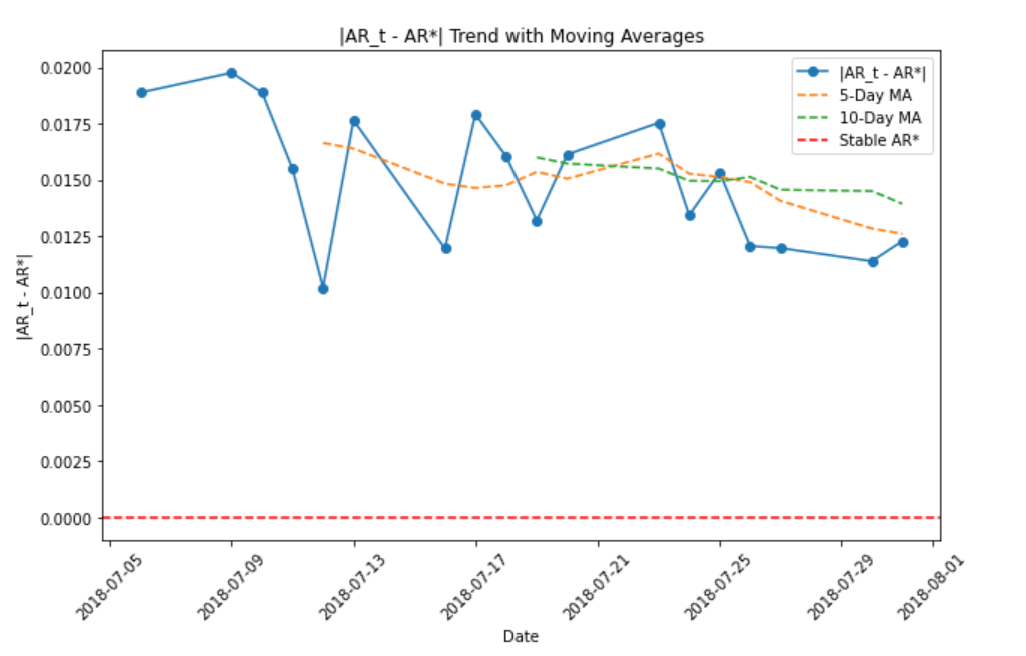

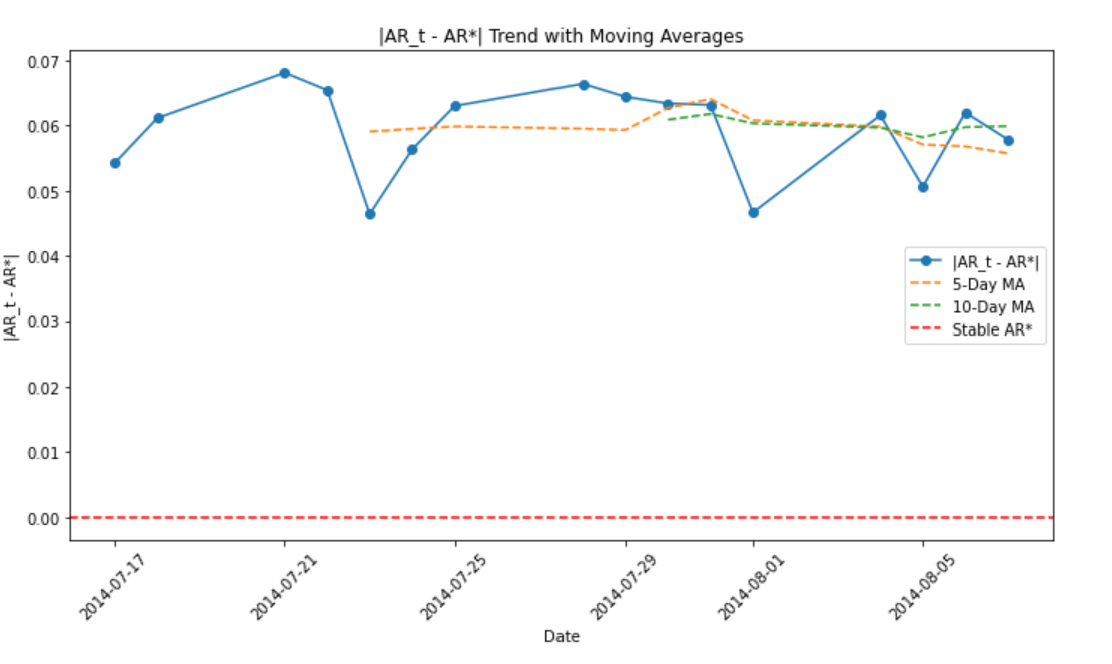

Subsequently, to further analyze the market's volatility characteristics and trend changes under the impact of typhoons, the study applied moving averages (MA) to the constructed absolute deviation

4.2.1. Short-term impact typhoon

Typhoon Hato made landfall on August 23, 2017, and

Higos made landfall on August 19, 2020, the series shows considerable volatility, though the impact was similarly permanent. Before landing,

When Doksuri made landfall on July 28, 2023,

4.2.2. Long-term impact typhoon

Maria made landfall on July 11, 2018. Before landfall, the series showed relatively stable characteristics. After landfall,

Rammasun made landfall on July 18, 2014. Before landing, magnitude of

Typhoons Hato and Higos (Doksuri is extremely stable) had relatively short-lived effects after landing, and the market responded quickly. The fluctuations decreased rapidly after the landfall, but the absolute values indicating the shock dissipation showed only a slight change. In contrast, typhoons Maria and Rammasun caused more severe and longer-lasting fluctuations, and it took the market longer to gradually digest the shocks. During this process, temporary decreases in the absolute value series were often combined with a resurgence of volatility, indicating repeated fluctuations when the market responded to the typhoon impact. This repeated situation of market reactions actually prolonged the duration of the shock.

5. Conclusion

This study comprehensively analyzes the impact of major typhoon events on China's A-share market from 2014-2023. Using the event study methodology, Carhart's four-factor model and intervention analysis, the abnormal returns of major industries and sectors under five major typhoon events are evaluated. The findings suggest that typhoons can negatively affect stock market performance in the short term. Typhoons such as Hato, Higos, and Doksuri caused significant damage in the short term, but then the market corrected quickly. Meanwhile, more severe typhoons such as Rammasun and Maria caused more lasting effects and negative abnormal returns. In sum, the study suggests that while typhoon events cause temporary market volatility, the Chinese stock market tends to stabilize quickly, thus limiting the long-term financial impact of these natural disasters. These results highlight the resilience of the A-share market and provide important insights for investors and policymakers to manage the risks associated with climate-related shocks. Future research could continue to focus on the coastal provinces and beyond, examining how different geographic regions in China react to major climate events.

Acknowledgement

Jiani Hao, Siru Lai, Yan Tian, Hanhe Zhang contributed equally to this work and should be considered co-first authors.

References

[1]. Chen, J., (2024). Global catastrophe bond issuance has surged as extreme weather events take hold. Paper.cnstock.com. Retrieved from https://paper.cnstock.com/html/2024-07/08/content _1940344 .htm

[2]. Ji, Q., Zhao, W., Zhang, D., Guo, K.(2022). Climate Risk Perception and Its Impacts on Financial Markets: Micro-Evidence from Listed Firms in China. China Journal of Econometrics, 2022, 2(3): 666-680 https://doi.org/10.12012/CJoE2021-0067

[3]. Intergovernmental Panel on Climate Change (IPCC). (2021). Sixth Assessment Report. Retrieved from https://www.ipcc.ch/assessment-report/ar6/

[4]. China Meteorological News Press. (2024). Blue Book on Climate Change of China 2024 unveiled. Retrieved from https://www.cma.gov.cn/en/research/news/202407/t20240705_6401691.html

[5]. Worthington, A., & Valadkhani, A. (2004). Measuring the impact of natural disasters on capital markets: An empirical application using intervention analysis. Applied Economics, 36(19), 2177–2186. https://doi.org/10.1080/0003684042000282489

[6]. Kmetz, A., Kruttli, M., Tran, B., Watugala, S. and Yan, A. (2024). Extreme Weather and Financial Market Uncertainty. FRBSF Economic Letter. [online] Available at: https://www.frbsf.org/research-and-insights/publications/economic-letter/2024/01/extreme-weather-and-financial-market-uncertainty/#brigitte-roth-tran.

[7]. Worthington, A., (2008), The Impact of Natural Events and Disasters on the Australian Stock Market: A GARCH-M Analysis of Storms, Floods, Cyclones, Earthquakes and Bushfires, Global Business and Economics Review, 10(1): 1-10

[8]. Li, C., Liu, Y. & Pan, L.(2024). A study of impact of climate change on the U.S. stock market as exemplified by the NASDAQ 100 index constituents. Sci Rep 14, 15468. https://doi.org/10.1038/s41598-024-66109-7

[9]. Lanfear, M. G., Lioui, A., & Siebert, M. (2017). Are value stocks more exposed to disaster risk? Evidence from extreme weather events. SSRN Electronic Journal. https://doi.org/10.2139/ssrn.2892948

[10]. Malik, I. A., Faff, R. W., & Chan, K. F. (2019). Market response of US equities to domestic natural disasters: Industry-based evidence. Accounting & Finance. https://doi.org/10.1111/acfi.12484

[11]. Shao, L. B., & Zheng, Z. (2023). Typhoons’ effect, stock returns, and firms’ response: Insights from China. Journal of University of Science and Technology of China, 53(0), 1–1. https://doi.org/10.52396/justc-2022-0157

[12]. China Meteorological Administration (CMA). (2024). Data News: Typhoon generation and landfall numbers are low, 'Yagi' started the process of fall typhoon - China Meteorological Administration government portal. [online] Available at: https://www.cma.gov.cn/2011xwzx /2011xqxxw/2011xqxyw/202409/t20240903_6531065.html?from=singlemessage.

[13]. Dolley, J.C. (1933). Characteristics and Procedures of Common Stock Split-Ups. Harvard Business Review. Apr. 1933, 11, pp. 316-26.

[14]. Fama, E. F., Fisher, L., Jensen, M. C., & Roll, R. (1969). The Adjustment of Stock Prices to New Information. International Economic Review, 10(1), 1–21. https://doi.org/10.2307/2525569

[15]. Box, G. E. P., & Tiao, G. C. (1975). Intervention Analysis with Applications to Economic and Environmental Problems. Journal of the American Statistical Association, 70(349), 70-79. https://doi.org/10.1080/01621459.1975.10480264

[16]. Zhao, J., Yu, S., & Wu, F.(2014). Natural disasters and social violences events and stock prices. Journal of Management Sciences in China, [online] 17(4), pp.1–15. Available at: http://jmsc.tju.edu.cn/jmsc/article/abstract/20140406

[17]. Yin, R., & Newman, D. H. (1999). intervention analysis of Hurricane Hugo's effect on South Carolina's stumpage prices. Canadian journal of forest research, 29(6), 779-787. https://doi.org/10.1139/x99-035

Cite this article

Hao,J.;Lai,S.;Tian,Y.;Zhang,H. (2025). Impact of Extreme Climate Events on Chinese Stock Market: Event Study of Typhoons. Advances in Economics, Management and Political Sciences,217,70-83.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 4th International Conference on Financial Technology and Business Analysis

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Chen, J., (2024). Global catastrophe bond issuance has surged as extreme weather events take hold. Paper.cnstock.com. Retrieved from https://paper.cnstock.com/html/2024-07/08/content _1940344 .htm

[2]. Ji, Q., Zhao, W., Zhang, D., Guo, K.(2022). Climate Risk Perception and Its Impacts on Financial Markets: Micro-Evidence from Listed Firms in China. China Journal of Econometrics, 2022, 2(3): 666-680 https://doi.org/10.12012/CJoE2021-0067

[3]. Intergovernmental Panel on Climate Change (IPCC). (2021). Sixth Assessment Report. Retrieved from https://www.ipcc.ch/assessment-report/ar6/

[4]. China Meteorological News Press. (2024). Blue Book on Climate Change of China 2024 unveiled. Retrieved from https://www.cma.gov.cn/en/research/news/202407/t20240705_6401691.html

[5]. Worthington, A., & Valadkhani, A. (2004). Measuring the impact of natural disasters on capital markets: An empirical application using intervention analysis. Applied Economics, 36(19), 2177–2186. https://doi.org/10.1080/0003684042000282489

[6]. Kmetz, A., Kruttli, M., Tran, B., Watugala, S. and Yan, A. (2024). Extreme Weather and Financial Market Uncertainty. FRBSF Economic Letter. [online] Available at: https://www.frbsf.org/research-and-insights/publications/economic-letter/2024/01/extreme-weather-and-financial-market-uncertainty/#brigitte-roth-tran.

[7]. Worthington, A., (2008), The Impact of Natural Events and Disasters on the Australian Stock Market: A GARCH-M Analysis of Storms, Floods, Cyclones, Earthquakes and Bushfires, Global Business and Economics Review, 10(1): 1-10

[8]. Li, C., Liu, Y. & Pan, L.(2024). A study of impact of climate change on the U.S. stock market as exemplified by the NASDAQ 100 index constituents. Sci Rep 14, 15468. https://doi.org/10.1038/s41598-024-66109-7

[9]. Lanfear, M. G., Lioui, A., & Siebert, M. (2017). Are value stocks more exposed to disaster risk? Evidence from extreme weather events. SSRN Electronic Journal. https://doi.org/10.2139/ssrn.2892948

[10]. Malik, I. A., Faff, R. W., & Chan, K. F. (2019). Market response of US equities to domestic natural disasters: Industry-based evidence. Accounting & Finance. https://doi.org/10.1111/acfi.12484

[11]. Shao, L. B., & Zheng, Z. (2023). Typhoons’ effect, stock returns, and firms’ response: Insights from China. Journal of University of Science and Technology of China, 53(0), 1–1. https://doi.org/10.52396/justc-2022-0157

[12]. China Meteorological Administration (CMA). (2024). Data News: Typhoon generation and landfall numbers are low, 'Yagi' started the process of fall typhoon - China Meteorological Administration government portal. [online] Available at: https://www.cma.gov.cn/2011xwzx /2011xqxxw/2011xqxyw/202409/t20240903_6531065.html?from=singlemessage.

[13]. Dolley, J.C. (1933). Characteristics and Procedures of Common Stock Split-Ups. Harvard Business Review. Apr. 1933, 11, pp. 316-26.

[14]. Fama, E. F., Fisher, L., Jensen, M. C., & Roll, R. (1969). The Adjustment of Stock Prices to New Information. International Economic Review, 10(1), 1–21. https://doi.org/10.2307/2525569

[15]. Box, G. E. P., & Tiao, G. C. (1975). Intervention Analysis with Applications to Economic and Environmental Problems. Journal of the American Statistical Association, 70(349), 70-79. https://doi.org/10.1080/01621459.1975.10480264

[16]. Zhao, J., Yu, S., & Wu, F.(2014). Natural disasters and social violences events and stock prices. Journal of Management Sciences in China, [online] 17(4), pp.1–15. Available at: http://jmsc.tju.edu.cn/jmsc/article/abstract/20140406

[17]. Yin, R., & Newman, D. H. (1999). intervention analysis of Hurricane Hugo's effect on South Carolina's stumpage prices. Canadian journal of forest research, 29(6), 779-787. https://doi.org/10.1139/x99-035