1. Introduction

Today, the market has more and more demand for luxury watches. Many popular mass-produced watches are reserved by second-hand merchants, even if they are not already sold on the official counter. The condition of “one watch hard to get” especially happens in the limited edition watch. Many independent customers have to either buy their own watches at a high price from watch dealers or buy a few unpopular watches at the counters according to the sales suggestions. But with the spread of the epidemic in recent years, the economy has generally been in a downturn, so why are more and more people continuing to buy luxury watches at high prices? Therefore, this paper mainly studies the reasons for the relationship between the rise in the price of luxury watches and the economic downturn. This research is helpful for people to predict the future luxury prices.

2. Analysis of the Current Situation of Watch Prices

This paper will introduce several luxury watch brands and different types of watches to show that the whole luxury watch market’s prices fluctuate.

Rolex was founded as "Wilsdorf and Davis" by Hans Wilsdorf and Alfred Davis in London in 1905. The company registered "Rolex" as the brand name of its watches in 1908. Having specialized in wristwatches since its inception, Rolex moved its base of operations to Geneva, Switzerland and quickly became one of the most prominent manufacturers of watches in Switzerland. Today, every watch produced by Rolex is mechanical and chronometer-rated. This combination of extreme precision and tried-and-tested robustness is also part of the success of Rolex. Rolex watches have also become highly collectable, with some models reaching extremely high prices on the vintage market and on auctions – such as the Daytona worn by Paul Newman, the most expensive wristwatch ever auctioned [1].

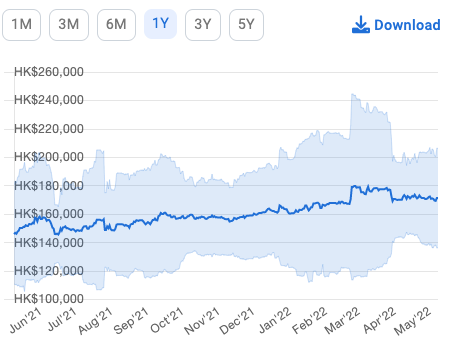

A lot of different models of Rolex prices have experienced an exaggerated increase.Day-Date President 18238. In the private sales market, the average price of Day-Date President increased by 17.6% from 2021 May 8 to 2022 May 8.

Figure 1: The price of day-date president 18238 [2].

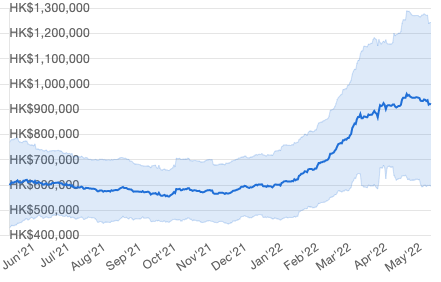

A 17% increase in a year appears absurd. However, other models of Rolex have more exaggerated gains. It is the Rolex 116508 Cosmograph Daytona’s price that increased more than 53% in one year in the private sales market even compared with the TSLA stock price, which is a popular stock that has been increasing rapidly recently. Rolex's increase is much higher than TSLA’s stock. What is surprising is not only the incredible increase of Rolex in the private market, but also that its private market price is several times higher than that of official retail stores. The retail price of the Rolex 116508 Cosmograph Daytona is HK$294,762. Although the official retail price is already an expensive price, its private market price is 3 times higher than the retail price. So what caused this situation?

3. Analysis of the Reasons for the Rise in Watch Prices

First, the Rolex Daytona is rare, with limited production runs. The Rolex Daytona is such a hard watch to find because it has relatively limited production runs. In order to maximise the profit and, specifically, the Daytona, they need to make sure that the Daytona is scarce enough. In other words, this luxurious and rare watch satisfies the vanity of the holder.

Figure 2: The price of rolex 116508 cosmograph Daytona [3].

Second, the Rolex Daytona has a long waitlist. After the consumer pays for the front money, they still need to wait for a long time, not just a few days. People who buy a Daytona in an official retail store, even after waiting for the watch for 2 years, still do not get the watch. Some people wouldn’t like to wait a long time. They prefer to buy it on the private market at a higher price.

Third, the most important thing that makes the price of the Daytona so expensive in the private market is that a lot of retail store clerks get a “benefit” from selling the watch to a private vendor. If the clerk sells the watch to an individual consumer, he or she can only take a little percentage from the company. However, if the clerk sells the watch to a private watchmaker, they can get more returns. Moreover, the private vendor always reserves a lot of watches at a time. It helps the sales don’t need to worry about whether the performance meets the standard. When a small number of people master most of the rare and hot watches, it will be easier to control the luxury watch market. They can make the popular watches have a higher premium and therefore have more space for speculation [4].

Actually, not only does Rolex perform well in the private market, but other classical brands of luxury watches also increase significantly. Known as the best watch manufacturer in the world, Patek Philippe is a Swiss watch manufacturer founded in 1839 by Antoine Norbert de Patek and François Czapek.Since 1932, it has been owned by the Stern family and is one of the oldest watch manufacturers, with an uninterrupted watchmaking history since its founding. Patek Philippe is considered as one of the most prestigious watch manufacturers and produces high-end watches, including some of the most complicated mechanical timepieces [5].

5711/1A-010 is one of the Patek Philippe watches that was announced to be discontinued in February 2021. Since then, the 5711/1A-010’s price has started to surge. In 2021, the price only 107711$. In February 2022, that is, one year after the shutdown of 5711/1A-010 was announced. Its price has come to its peak which is 237,218$. It is 2.23 times higher than last year’s price. Although recently it price decrease, the price of 5711/1A-010 has always remained around $200000. The price of 5711/1A-010 surge proves that the scarcity of the watch will stimulate the price of the watch to increase. At the same time, the soaring price in the private market is exactly the effect that watch companies hope to achieve by stopping production, because it helps make their brand more topical. The topicality of a brand can make the consumer more likely to buy a product, because it can satisfy the consumers’ vanity. It can also be that the brand has more confidence in realizing the cooperation or business plan.

So, as expected at the end of 2021, Patek Philippe sent out a heavy message. In order to celebrate on the one hand, the 170th anniversary of the cooperation between Patek Philippe and Tiffany. On the other hand, to celebrate LVMH’s acquisition of Tiffany. They worked with Tiffany to launch a watch the 5711 with a Tiffany green. Only Tiffany stores in New York, Beverly Hills and San Francisco sell a limited number of 170 cooperative watches. Although the official price of this watch is $52635, it was sold for more than $6 million by Phillips the Auctioneers in New York. This means that the price of this watch has increased 100 times [6].

Actually, the popularity of this watch not only benefits Patek Philippe and Tiffany but also drives the price of watches with the same color, even though they are produced by other companies. The “Rolex Mint Oyster Perpetual 41 124300 Tiffany Discontinued” is a great example. This watch has the same color as the “Patek Philippe 5711/1A-018”. Before the “Patek Philippe 5711/1A-018” launches, “Rolex Mint Oyster Perpetual 41 124300 Tiffany Discontinued” remained at the price of 15000$. However, when the "Rolex Mint Oyster Perpetual 41 124300 Tiffany Discontinued" was released, the price of the "Rolex Mint Oyster Perpetual 41 124300 Tiffany Discontinued" rose to 25000 dollars in one month, but it has remained higher than 21000 dollars to this day.

This section shows a lot of examples of the incredible increase in the price of watches. However, in a market, if there are commodities with rising prices, there will also be commodities with falling prices. As mentioned before, if people want to buy a popular watch from an official retail store, they need to follow the "suggestion" given by the salesperson and buy a popular watch bundled with several regular watches. Tudor’s watches are always tied up. Tudor is a brand under the Rolex watch brand, as a popular version of Rolex. In the 1930s, because the Rolex price was so high ordinary people. In order to increase the sales volume, Rolex create the Tudor, a cheaper version of the Rolex [7].

Tutor’s watch has a great deal on the private market, but most of its price fluctuation has been relatively stable even if it has decreased in the private market. “Tudor Black Bay Fifty-eight ” is a watch launched by Tudor. As this model comes in, its price trend continues to decline in the private market. Its price fell 30% in a year.

Another watch brand,“ Omega”, also faces the same condition just like” Tudor”. Omega was founded in 1848 by Louis Brandt in La Chaux-de-Fonds, Switzerland. Known as La Generale Watch Co. Omega known by many as a competitor to Rolex, has become the choice for militaries around the world, the Olympic Games, NASA and most recently, James Bond. Omega has not one, but several legendary models in its portfolio [8].

The“Speedmaster Moonwatch ” is one of the legendary models produced by Omega. It is famous for the Speedmaster Professional Chronograph, worn by Buzz Aldrin, who became the first watch on the Moon in 1969. However, its price is underperforming in the private market. In the past year, its price has decreased 5%. Compared to Omega’s competitor Rolex’s famous model “ Daytona”, their priced are quite different.

Another mode of Omega, “Swatch Moonswatch "Mission To Mercury" Swatch x Omega NEW”. This watch is Omega’s work with another watch brand “Swatch” to launch out together. Its price in the private market has evaporated by half in two months. In fact, at the beginning of this watch’s launch, its price had a great fluctuation because of the cooperation between two large watch companies and the official retail store only sold a small amount of this watch. It leads to nobody knowing if that watch will continue to sell or just stop. It gives the speculator more room to hype. Meanwhile, Omega and Swatch can keep it topical. So, when Omega and Swatch increase the sales of this watch, the private market price suddenly decreases and the topical of this watch also disappears gradually.

This study discusses the reasons that cause the price of luxury watches to rise or decline. The next section will summarize them.

This tight supply-demand relationship has led to higher prices for luxury watches, as the supply of many timepieces cannot keep up with demand. In other words, there are far fewer watches sold in official retail stores than people want to buy. When people go into a Rolex retailer, there are very few watches to sell.

Brands like F.P. Journe and Patek Philippe produce even fewer watches than Rolex. Therefore, some people accuse these companies of deliberately "starvation marketing". Nonetheless, "hunger marketing" is a tactic used by most luxury goods companies. Conversely, if you have enough income, you can easily buy most types of Tudor watches. That's because Tudor produces a large number of watches every year and sells them at official retailers.

In fact, luxury watch brands such as Audemars Piguet and Patek Philippe always release new watches in limited editions. Only 300 of a particular type of watch were produced. Compared with the huge demand, the decrease in supply has caused the price of watches to soar. When customers enter the store, there is very little choice of merchandise.

For companies like Tudor or Omega that make a lot of watches, their sales are always worried about their performance. First, it is directly related to their salary. Second, their company may fire them if they don't sell enough watches each year. Therefore, every customer who enters the retailer, the salesman will be eager to sell and show the customer different types of watches. This is to show customers more choices for consumption, thus making it easier to sell watches. And the more sales, the more wages they get.

But if it's a sales job for a company like Rolex. They will not be enthusiastic about consumers, and if consumers are not very loyal, salespeople will not even pay attention to them. The reason for this is that when a new watch is launched, the sale will immediately complete the show.

Sales at Rolex or Audemars Piguet they have a few scalpers who can afford most of the watch types they sell. The more important reason for sales to provide watches to scalpers is that the scalpers will bring some "benefits" to the sales. In other words, scalpers would bribe sales to get an unfair package deal.

One might wonder whether watch companies would penalize salespeople for the phenomenon. In fact, Rolex did come up with some policies to prohibit such transactions. However, these policies not only did not prevent the reduction of unfair package deals, but also stimulated prices in the private market. This study argues that companies like Rolex, despite their different regulations, are turning a blind eye to this shady deal. Because first of all, they always benefit from scalpers, just like they sell to individual customers. Second, the fast sell-out of the watch can keep the brand hot.

The lack of regulation and limiting the number of watches have led to huge speculation in watch sales. This article will explain this in detail next.

As mentioned earlier, most of the new limited edition watches of popular styles are quickly owned by private luxury merchants as soon as they are launched. When a large number of products are held by a few people, the market becomes a monopoly. Moreover, in the hot market of luxury timepieces, price control and hype have become common and easy.

A lot of people buy a watch from the private market and their main need for this watch is not only to use it, but they want the price to go up. Then, when the price of the watch goes up, these people who own the watch will sell it. In this way, the individual buyer will also be the seller of the watch. In other words, watches are once again a monopoly product [9].

Luxury oligarchs will produce more news that can push watch prices to their peak. When the time comes, the oligarchs will sell all the watches they hold as quickly as possible. In this way, oligarchies make huge incomes that we can't believe. However, most individual speculators fail.

4. Conclusion

To sum up, the reasons for the large fluctuations in luxury watches can be summarized as the following 3 points. First, the relationship between supply and demand. The price of luxury watches has been in short supply for a long time, which has caused the price of some styles to soar. Second, the relationship between Retailer Sales and Scalpers. Third, the relationship between ordinary consumers and oligarchic businessmen. This article has some flaws. It only shows long-term data on watch prices, not daily fluctuations in prices. Also, the data analysis of each website is different, but this study did not take these factors into account. It is hoped that future research can incorporate more influencing factors.

References

[1]. (MONOCHROME) ROLEX https://monochrome-watches.com/rolex/

[2]. (WatchCharts) Rolex 18238Day-Date President https://watchcharts.com/watch/1302-rolex-day-date-president-18238/overview

[3]. (WatchCharts)Rolex 116508Cosmograph Daytona https://watchcharts.com/watch/743-rolex-cosmograph-daytona-116508/overview

[4]. Paul Altieri (Mar 02,2021) (Bob’s Watches) Why Is It So Hard to Find the Rolex Daytona? https://www.bobswatches.com/rolex-blog/rolex-news/why-is-rolex-daytona-hard-to-find.html

[5]. (MONOCHROME) Patek Philippe https://monochrome-watches.com/patek-philippe/

[6]. Evan Wong (Dec 12, 2021)(HYPEBEAST) Patek PhilippeThe first "TIFFANY BLUE" commemorative watch was hammered with $6.5 million https://hypebeast.com/zh/2021/12/tiffany-co-blue-patek-philippe-nautilus-5711-6-5-million-usd-phillips-new-york-auction-price

[7]. (WatchCharts) Tudor https://watchcharts.com/watches/brand/tudor

[8]. (MONOCHROME)Omega https://monochrome-watches.com/omega/

[9]. John Steiger ( August 17, 2021) (JAZTIME BLOG) What is Causing Luxury Watch Prices to Skyrocket?https://www.jaztime.com/blog/luxury-watch-high-prices/

Cite this article

Yang,S. (2023). Analysis of the Reasons behind the Rise in Watch Prices. Advances in Economics, Management and Political Sciences,9,108-113.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 2nd International Conference on Business and Policy Studies

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. (MONOCHROME) ROLEX https://monochrome-watches.com/rolex/

[2]. (WatchCharts) Rolex 18238Day-Date President https://watchcharts.com/watch/1302-rolex-day-date-president-18238/overview

[3]. (WatchCharts)Rolex 116508Cosmograph Daytona https://watchcharts.com/watch/743-rolex-cosmograph-daytona-116508/overview

[4]. Paul Altieri (Mar 02,2021) (Bob’s Watches) Why Is It So Hard to Find the Rolex Daytona? https://www.bobswatches.com/rolex-blog/rolex-news/why-is-rolex-daytona-hard-to-find.html

[5]. (MONOCHROME) Patek Philippe https://monochrome-watches.com/patek-philippe/

[6]. Evan Wong (Dec 12, 2021)(HYPEBEAST) Patek PhilippeThe first "TIFFANY BLUE" commemorative watch was hammered with $6.5 million https://hypebeast.com/zh/2021/12/tiffany-co-blue-patek-philippe-nautilus-5711-6-5-million-usd-phillips-new-york-auction-price

[7]. (WatchCharts) Tudor https://watchcharts.com/watches/brand/tudor

[8]. (MONOCHROME)Omega https://monochrome-watches.com/omega/

[9]. John Steiger ( August 17, 2021) (JAZTIME BLOG) What is Causing Luxury Watch Prices to Skyrocket?https://www.jaztime.com/blog/luxury-watch-high-prices/