1. Introduction

In today's increasingly globalized world, the environment in which businesses operate has become increasingly complex and uncertain. This places higher demands on the capabilities and backgrounds of senior CEOs. To maintain a strategic edge in international competition, companies are increasingly relying on CEO teams with international perspectives and diverse experiences. In recent years, an increasing number of companies have begun to prioritize the diversity of their executive teams, particularly those with overseas backgrounds, which include experience living or studying overseas [1]. Such experiences can enhance their cross-cultural communication skills in order to help them access broader international resources and business networks [2].

CEO profile often has a direct impact on leadership style. Education, gender, and age may influence executive strategic decision-making tendencies and risk preferences [3]. These individual differences can profoundly impact their leadership of a company's investment decisions, risk-taking, and resource allocation [4]. Cao et al. point out that executives with international experience are more likely to drive corporate overseas expansion, technological innovation, and investments, thereby potentially increasing corporate market valuation [5]. Executives with overseas background are more likely to drive corporate overseas expansion and cross-border strategic, which helps companies access international resources and market advantages [1]. Additionally, an overseas background provides executives with greater knowledge diversity and cross-cultural capabilities, thereby promoting technological innovation and knowledge absorption within the company, which enhances market competitiveness [1]. CEOs with international experience are likely to be more rational in risk identification and resource allocation, tending to suppress high-risk investments and increase safe investments, thereby reducing the company's financial and market volatility risks [6].

This study seeks to understand what kind of impact the overseas backgrounds of CEOs have on their company market value. In order to measure company market value, this study uses the variable of Tobin's Q as its core indicator. Tobin's Q is typically regarded as a variable for company market value, calculated by dividing the company's total market capitalization (i.e., the sum of equity market value and book liabilities) by the total book value of assets [7]. Tobin’s Q is widely used to indicate a company’s market value. An empirical model was used to analyze whether CEOs with overseas backgrounds influence the Tobin’s Q value. This study draws its sample from Chinese listed companies to investigate whether CEOs' international experience can enhance company market value or if its effect is context dependent, and whether such influence is moderated by external institutional environments or corporate governance structures. The results of this study can help companies assess the value and risks of CEOs with international backgrounds.

2. Literature review

2.1. Overseas backgrounds

Nguyen Thanh Huong and Ha Phuoc Vu concluded a proportional relationship between the overseas background of CEOs and their firm performance [8], which is measured in Tobin’s Q. They developed two hypotheses: H1a, which states that firms led by CEOs with oversea background display higher performance than their counterparts, and H1b, which suggest the opposite conclusion. Supported by data - a coefficient of Foreign_Exp that is significantly positive at the 1% level – H1a is corroborated. Furthermore, interaction term between Foreign_Exp and CEO_Tenure is shown to be positive and significant, indicating that longer CEO tenure enhances the impact of oversea background on firm performance. However, this paper primarily focused on Vietnam, which is a developing country. Therefore, it is not surprising that Vietnam might have experienced fluctuations in the market and led to the over-significance of results. Moreover, their samples, driven from 2013 to 2021, cannot match with our whole sets of samples, which are from 2008 to 2018.

More paper, without reaching Tobin’s Q straightly, turned their attention to its factors. Different aspects - including investment, innovations and corporate overseas expansion of the companies - all state positive correlations with Tobin’s Q.

2.2. Investment

Produced by Xueman Xiang et al., an essay that focused on the investment aspect highly associated with our topic [9]. It used 22,498 firm-year observations of 3,291 Chinese A-share listed companies from 2008 to 2018. Xueman Xiang et al. asserted that a one-standard-deviation rise in the share of CEOs with overseas background would increase the sensitivity of investment to growth opportunities (Tobin’s Q) by roughly 50%. Specifically, they suggested two aspects of investment growth: reducing “overspending” and alleviating “underspending”. Furthermore, they pointed out that “the positive impact of directors with foreign experience on investment efficiency is more prominent at firms with weaker corporate governance, less transparent information environment, and higher financial constraints.” In fact, Hanna Mysaka and Ivan Derun suggested that if Tobin’s Q is greater than 1, the company’s market value exceeds its replacement cost, which typically means that the company has a higher investment appeal and would attract investment attention[10]. In one sentence, investment has a proportional impact on Tobin’s Q and vice versa, again indicating that Xueman Xiang et al.’s result is highly relevant with our topic and variables.

2.3. Innovations

Xianlong Cao et al. asserted that CEOs’ overseas background has a positive impact on firms' innovation performance [4]. This effect is mediated by research and development (R&D) investment and disclosure quality. That the advantage of CEOs with overseas backgrounds is more prominent in high-tech firms and firms with stronger internal controls is also founded.

2.4. Corporate overseas expansion

Bumjo Kim asserted that overseas background is beneficial to corporate overseas expansion [11]. The paper was conducted on 299 venture firms listed on KOSPI and KOSDAQ in Korea, with data covering 2011-2015. Bumjo Kim defined CEOs’ overseas background as whether the CEO has studied or worked overseas – the same as how we defined it. It also mentioned that the expansion in overseas market will increase the overall revenue and profits of the company, which is one of the manifestations of an increase in Tobin’s Q. As a result, Bumjo Kim concluded that CEO's international experience has a positive moderating effect on the relationship between overseas background and financial performance; specifically, such effect is significant in the FDI entry mode, but not in export entry mode. However, the data was driven in a relatively short period (4 years), which means it may affect the generalizability and reliability of the results and cause bias.

2.5. Conclusion of our hypothesis

The above-mentioned essays all supported one main idea: overseas background will do good to companies. However, we could not deny that bias may still exist since the aspects we discussed previously - investment, innovations and corporate overseas expansion – are indirect variables. What’s more, different regions and time periods chosen by different essays may also contribute to the data deviation in results. Regardless, these essays are still strong, as the overseas background of CEOs is a global topic and does not restrict in China. Therefore, given the supporting data and essays, we hypothesized that the oversea background of a CEO would have a positive impact on Tobin’s Q of the company, which we named Hypothesis 1 (H1). The opposite one is then Hypothesis 2 (H2). For the above reasons, we are inclined to vote for H1 but remain skeptical.

3. Sample and data sources

3.1. Data source

Our primary dataset was derived from the CSMAR database, encompassing 33,995 appointed executives serving as CEOs in Chinese enterprises listed on the Shanghai and Shenzhen exchanges between 2008 and 2024. Since our analysis concentrates on domestic CEOs and companies traded in these two markets, we removed firms classified under special treatment or particular transfer status. The excluded entities did not significantly differ from the retained sample in terms of corporate outcomes, and the demographic attributes of CEOs (such as age and gender) remained largely comparable.

3.2. Dependent variable: Tobin’s Q

To assess our dependent variable, corporate performance, we adopted Tobin’s Q, which contrasts a firm’s market valuation with the replacement cost of its assets. It is among the most widely applied indicators of investment in existing research. A key strength of this metric is its ability to capture multiple forms of investment[12].

3.3. Independent variable: CEO’s oversea background

This study examines the impact of executives' overseas background on firms’ market value, so we use a dummy variable that equals one if a person has studied or work outside mainland China, and zero otherwise (OveseaBack).

3.4. Control variables

|

Variable name |

Description |

|

age |

Executives’ age |

|

degree |

Executives’ degree |

|

gender |

Executives’ gender |

|

Size |

Company size,(natural logarithm of total assets) |

|

Lev |

Asset-liability ratio |

|

ATO |

Total assets turnover |

|

Cashflow |

Cash flow ratio |

|

REC |

Proportion of accounts receivable |

|

INV |

Inventory proportion |

|

FIXED |

Proportion of fixed assets |

|

Growth |

increase rate of business revenue |

|

Loss |

Loss or not |

|

Board |

Numbers of board |

|

Indep |

Ratio of independent directors |

|

Dual |

CEO duality |

|

Top10 |

The shareholding ratio of the top ten shareholders |

|

BM |

Book-to-market |

|

SOE |

Ownership property |

|

ListAge |

Listed years |

|

Mshare |

Level of managerial share ownership |

|

Mfee |

Management expense ratio |

|

Occupy |

The occupation of funds by major shareholders |

3.5. Specific model

To examine the impact of senior executives’ oversea background on firm market value, we estimate the following regression model:

4. Results and discussion

4.1. Descriptive statistics

|

Variables |

Obs |

Mean |

Std.Dev. |

Min |

Max |

|

TobinQ |

33995 |

2.003 |

1.210 |

0.849 |

7.885 |

|

OveseaBack |

33995 |

0.102 |

0.303 |

0.000 |

1.000 |

|

age |

33995 |

50.011 |

6.928 |

25.000 |

82.000 |

|

degree |

33995 |

3.642 |

1.277 |

1.000 |

7.000 |

|

gender |

33995 |

0.928 |

0.258 |

0.000 |

1.000 |

|

Size |

33995 |

22.078 |

1.248 |

19.648 |

26.104 |

|

Lev |

33995 |

0.408 |

0.203 |

0.053 |

0.907 |

|

ATO |

33995 |

0.646 |

0.423 |

0.067 |

2.625 |

|

Cashflow |

33995 |

0.047 |

0.069 |

-0.176 |

0.247 |

|

REC |

33995 |

0.126 |

0.102 |

0.000 |

0.470 |

|

INV |

33995 |

0.138 |

0.123 |

0.000 |

0.685 |

|

FIXED |

33995 |

0.206 |

0.152 |

0.002 |

0.708 |

|

Growth |

33995 |

0.156 |

0.365 |

-0.603 |

2.267 |

|

Loss |

33995 |

0.120 |

0.324 |

0.000 |

1.000 |

|

Board |

33995 |

2.260 |

0.249 |

1.609 |

2.890 |

|

Indep |

33995 |

0.385 |

0.073 |

0.154 |

0.600 |

|

Dual |

33995 |

0.315 |

0.465 |

0.000 |

1.000 |

|

Top10 |

33995 |

0.585 |

0.155 |

0.223 |

0.904 |

|

BM |

33995 |

9.531 |

10.334 |

0.974 |

66.826 |

|

SOE |

33995 |

0.279 |

0.449 |

0.000 |

1.000 |

|

ListAge |

33995 |

1.933 |

0.922 |

0.000 |

3.401 |

|

Mshare |

33995 |

0.166 |

0.210 |

0.000 |

0.694 |

|

Mfee |

33995 |

0.088 |

0.071 |

0.008 |

0.523 |

|

Occupy |

33995 |

0.015 |

0.025 |

0.000 |

0.234 |

4.2. CEO’s overseas background

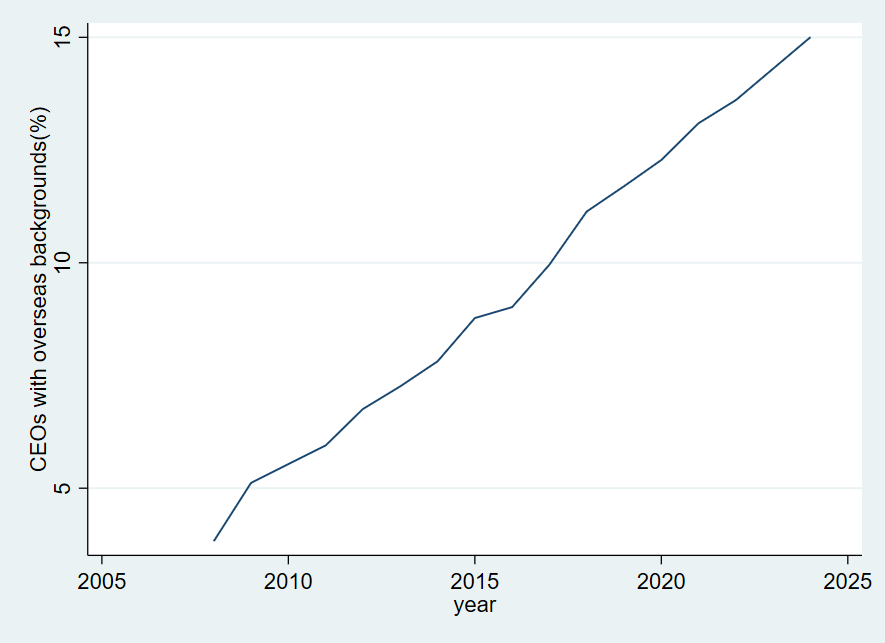

As shown in Figure 2, the proportion of CEOs with overseas backgrounds has exhibited a consistent upward trend over the sample period. This pattern implies a growing organizational preference for appointing executives with international experience, possibly reflecting the increasing value placed on global exposure and cross-cultural competencies in corporate leadership selection.

4.3. Baseline regression results

|

TobinQ |

Coef. |

St.Err. |

t-value |

p-value |

[95% Conf |

Interval] |

Sig |

||||

|

OveseaBack |

0.122 |

0.018 |

6.60 |

0.000 |

0.086 |

0.158 |

*** |

||||

|

age |

0.010 |

0.008 |

1.30 |

0.194 |

-0.005 |

0.025 |

|||||

|

age2 |

-0.000 |

0.000 |

-1.05 |

0.293 |

-0.000 |

0.000 |

|||||

|

degree |

0.008 |

0.004 |

1.89 |

0.059 |

-0.000 |

0.017 |

* |

||||

|

gender |

0.011 |

0.021 |

0.50 |

0.614 |

-0.031 |

0.053 |

|||||

|

Size |

-0.155 |

0.007 |

-22.80 |

0.000 |

-0.168 |

-0.142 |

*** |

||||

|

Lev |

-0.020 |

0.039 |

-0.51 |

0.613 |

-0.095 |

0.056 |

|||||

|

ATO |

0.082 |

0.015 |

5.46 |

0.000 |

0.052 |

0.111 |

*** |

||||

|

Cashflow |

2.203 |

0.089 |

24.82 |

0.000 |

2.029 |

2.377 |

*** |

||||

|

REC |

0.287 |

0.062 |

4.59 |

0.000 |

0.164 |

0.409 |

*** |

||||

|

INV |

0.237 |

0.051 |

4.61 |

0.000 |

0.136 |

0.337 |

*** |

||||

|

FIXED |

-0.423 |

0.042 |

-10.01 |

0.000 |

-0.506 |

-0.340 |

*** |

||||

|

Growth |

0.254 |

0.016 |

16.16 |

0.000 |

0.223 |

0.284 |

*** |

||||

|

Loss |

0.065 |

0.019 |

3.43 |

0.001 |

0.028 |

0.102 |

*** |

||||

|

Board |

0.000 |

0.024 |

0.02 |

0.987 |

-0.046 |

0.047 |

|||||

|

Indep |

0.572 |

0.077 |

7.42 |

0.000 |

0.421 |

0.723 |

*** |

||||

|

Dual |

0.055 |

0.013 |

4.28 |

0.000 |

0.030 |

0.081 |

*** |

||||

|

Top10 |

0.209 |

0.044 |

4.80 |

0.000 |

0.124 |

0.295 |

*** |

||||

|

BM |

-0.044 |

0.001 |

-57.75 |

0.000 |

-0.046 |

-0.043 |

*** |

||||

|

SOE |

-0.078 |

0.015 |

-5.14 |

0.000 |

-0.107 |

-0.048 |

*** |

||||

|

ListAge |

0.293 |

0.009 |

33.46 |

0.000 |

0.276 |

0.310 |

*** |

||||

|

Mshare |

-0.466 |

0.033 |

-13.94 |

0.000 |

-0.531 |

-0.400 |

*** |

||||

|

Mfee |

3.073 |

0.095 |

32.51 |

0.000 |

2.888 |

3.259 |

*** |

||||

|

Occupy |

1.212 |

0.230 |

5.27 |

0.000 |

0.761 |

1.662 |

*** |

||||

|

Constant |

4.200 |

0.239 |

17.61 |

0.000 |

3.732 |

4.667 |

*** |

||||

|

Mean dependent var |

2.003 |

SD dependent var |

1.210 |

||||||||

|

R-squared |

0.308 |

Number of obs |

33995 |

||||||||

|

F-test |

628.810 |

Prob > F |

0.000 |

||||||||

|

Akaike crit. (AIC) |

96994.595 |

Bayesian crit. (BIC) |

97205.444 |

||||||||

*** p<.01, ** p<.05, * p<.1

Table 3 reports the estimation results derived from Equation (1). The coefficient of interest is statistically significant at the 1% level, suggesting a robust positive relationship between the presence of a CEO with an overseas background and firm value. This result lends empirical support to the hypothesis that internationally experienced CEOs may enhance firm market valuation through mechanisms such as global expansion, innovation-driven strategies, and more effective investment decisions. These results are in line with the findings of Cao et al., reinforcing the notion that CEOs with international experience positively influence firm market valuation [4].

4.4. Robust test

|

Pre2019 |

After2019 |

|||

|

(1) |

(2) |

(3) |

(4) |

|

|

VARIABLES |

TobinQ |

TobinQ |

TobinQ |

TobinQ |

|

OveseaBack |

0.1482*** |

0.1486*** |

0.0663** |

0.0742*** |

|

(0.0243) |

(0.0228) |

(0.0284) |

(0.0281) |

|

|

Control |

YES |

YES |

YES |

YES |

|

year |

NO |

YES |

NO |

YES |

|

industry |

NO |

YES |

NO |

YES |

|

N |

21764 |

21764 |

12231 |

12231 |

|

r2_a |

0.334 |

0.419 |

0.286 |

0.304 |

In Table 4, we conduct additional robustness checks to validate the reliability of our regression results. Given that corporate operations were significantly affected by the COVID-19 pandemic, we split the sample into two subsamples based on the year 2019 and conducted regressions separately. The results show that the estimated coefficients remain positive and statistically significant (at the 1% level) both before and after the pandemic, indicating that CEOs with overseas backgrounds continue to exert a positive influence on firm market value. Therefore, we conclude that our main findings are robust.

However, it is worth noting that the coefficient after the pandemic is approximately half of that before the pandemic. One possible explanation is that the pandemic caused severe disruptions in global supply chains and business operations, thereby weakening the advantages associated with international experience. Additionally, the proportion of CEOs with overseas backgrounds may have increased after the pandemic. Although overseas experience remains a relatively scarce resource, the rising proportion may have diluted its marginal contribution to firm value.

4.5. Heterogeneity analysis

Considering the large sample size in our study, baseline regressions alone may mask important heterogeneity across different subgroups. To address this, we conduct heterogeneity analyses to explore whether and how the impact of CEO overseas background on firm value varies across firm size or CEO’s age.

4.5.1. Firm size

|

small |

large |

interaction |

|

|

(1) |

(2) |

(3) |

|

|

VARIABLES |

TobinQ |

TobinQ |

TobinQ |

|

OveseaBack |

0.1239*** |

0.0947*** |

1.1613*** |

|

(0.0229) |

(0.0207) |

(0.3158) |

|

|

Size |

-0.2119*** |

||

|

(0.0069) |

|||

|

Ove_Size |

-0.0470*** |

||

|

(0.0143) |

|||

|

Control |

YES |

YES |

YES |

|

year |

YES |

YES |

YES |

|

industry |

YES |

YES |

YES |

|

N |

16997 |

16998 |

33995 |

|

r2_a |

0.578 |

0.329 |

0.366 |

In Table 5, we categorize the sample firms into two subgroups—large and small—according to the median firm size and incorporate an interaction variable to assess whether firm scale moderates the association between CEOs’ overseas experience and corporate market value. The empirical findings reveal that the beneficial influence of international exposure persists across both categories, though the effect is more substantial in smaller enterprises.

This finding may be explained by the fact that large firms typically have more hierarchical and complex organizational structures, which can lead to slower decision-making processes and lower managerial efficiency, potentially dampening the market’s valuation of such firms. Moreover, large firms are often already operating in mature or saturated markets, where growth opportunities are limited. Even when growth occurs, the rate may appear lower due to the larger base size. In contrast, smaller firms, which are generally more agile and growth-oriented, may be rewarded with valuation premiums by the market, particularly when led by CEOs with overseas experience that can contribute to innovation, expansion, and strategic flexibility.

4.5.2. CEO’s age

|

Below39 |

40-44 |

45-49 |

50-54 |

55-59 |

Over60 |

|

|

(1) |

(2) |

(3) |

(4) |

(5) |

(6) |

|

|

VARIABLES |

TobinQ |

TobinQ |

TobinQ |

TobinQ |

TobinQ |

TobinQ |

|

OveseaBack |

-0.0314 |

-0.0529 |

0.1078*** |

0.2026*** |

0.2730*** |

0.1313* |

|

(0.0483) |

(0.0452) |

(0.0404) |

(0.0352) |

(0.0399) |

(0.0671) |

|

|

Control |

YES |

YES |

YES |

YES |

YES |

YES |

|

year |

YES |

YES |

YES |

YES |

YES |

YES |

|

industry |

YES |

YES |

YES |

YES |

YES |

YES |

|

N |

2315 |

4717 |

8516 |

9473 |

6614 |

2359 |

|

r2_a |

0.444 |

0.406 |

0.385 |

0.365 |

0.347 |

0.368 |

In Table 6, we divide the sample into six groups based on CEO age, with each group spanning five years. The regression results reveal that CEOs aged between 45 and 59 with overseas backgrounds have the most significant positive impact on firm market value. The effect is also positive, though less pronounced, among older CEOs, while it is statistically insignificant among younger CEOs.

These findings are well aligned with the life-cycle theory. Middle-aged executives are typically at the peak of their professional capabilities. They possess substantial industry experience, have often undergone transformational leadership experiences, and hold sufficient organizational influence to drive strategic initiatives—factors that enhance their ability to positively affect firm value.

Older CEOs may bring deep industry knowledge and strong reputational capital; however, their cognitive resources may be outdated, and they may be less inclined toward innovation or adaptive change in response to evolving market conditions. Conversely, younger CEOs, while likely to have up-to-date technical knowledge and a strong grasp of emerging trends, may lack the managerial experience, contextual understanding of the local market, and leadership authority necessary to exert a significant impact on firm performance.

5. Conclusion

In the context of globalization and increased uncertainty, enterprises face more intense international competition. To respond quickly to changes in the marketplace, companies are placing higher demands on the capabilities of their executives. Many companies have begun to emphasize the overseas experience of their executives, including study or overseas work background. Enterprises hope that the international perspective and cross-cultural competence of these executives will enhance global strategy execution. Therefore, we raised a question: How will CEOs with overseas background affect Tobin’s Q. In this paper, we stated overseas background as either overseas studying experiences or overseas working experiences; Tobin’s Q is a measure of companies’ market value and is commonly used in accessing corporate performance. In the first place, we hypothesized a positive relationship between the two above-mentioned variables. With many essays supporting our hypothesis, we launched the study. This study is based on the core idea of Upper Echelons Theory (UET) that executive characteristics affect firms' strategic decisions, which in turn affect firm performance [3]. In this framework, overseas background is viewed as a key human capital variable that may influence executives' strategic preferences and resource allocation approaches. Overseas background may affect executives' performance in investment judgment, innovation promotion, and internationalization strategies [4][8][11]. These perspectives provide theoretical ideas and analytical frameworks for this study. At the same time, the inclusion of overseas background in the discussion of executive characteristics expands the direction of previous research that mainly focused on static variables such as education and gender, making the issue more multi-dimensional and close to reality. For the results, the coefficient of interest is statistically significant at the 1% level, suggesting a robust positive relationship between the presence of a CEO with an overseas background and firm value. Also, the samples are divided into two groups by the year 2019. Samples before 2019 in one group, and the samples after 2019 in another group. The reason why divide into two groups is that finding the COVID-19’s effect to our results. The result is that COVID-19 did not influence the correlation between firm’s value and the CEO with the oversea -background. Also, samples are divided into different groups based on the firm’s size. The finding is that the CEO with the oversea-background had a huge effect on the value of small size company, and had a small effect on the value of the big size company. Finally, samples are divided into 5 groups based on the age. The result followed the quadratic function, which CEO in the middle-age with the oversea-background can generate the most value to the firm. In summary, the following conclusions can be drawn: Among the sample of Chinese A-share listed companies from the Shanghai and Shenzhen stock exchanges selected for this study, having a CEO with an overseas background significantly enhances the market value of the firm. This finding remains robust across various time periods and company sizes. The conclusion not only expands the research dimensions of executive human capital's impact on corporate performance, but also provides new empirical evidence for understanding the chain of logic in the "executive characteristics—corporate behavior—external performance" framework. For the imitations of this research, despite the contributions of this study, there are still certain limitations. For instance, the definition of "overseas background" remains relatively simplistic, relying solely on whether individuals have studied or worked outside of mainland China. This approach does not differentiate between types of overseas experience, the duration of such experience, or country-specific differences. Moreover, although some variables were controlled for, the potential issues of omitted variables and sample selection bias cannot be entirely ruled out. Therefore, future research could incorporate multidimensional indicators of overseas experience or combine qualitative interviews to enhance explanatory power. From a policy perspective, the results of this study provide data-driven support for corporate boards when selecting executives. In the context of increasing pressure for internationalization, executives with international experience may contribute to enhancing a firm's global strategic capability and market responsiveness. Additionally, regulatory bodies could improve the transparency of executive credentials in information disclosure, which would help the market better understand the relationship between executive characteristics and company performance. In conclusion, this study highlights the significance of executives' overseas backgrounds as a crucial human capital variable. Not only does it have implications for corporate internal governance, but it also has a substantive impact on a company's external market performance. We look forward to further exploration of this topic in more diverse samples and broader contexts in future studies, which will provide richer theoretical and practical insights for corporate governance and talent strategy.

Acknowledgement

Qinhan Li, Yuxuan Liu, Yunxin Zhang and Yunfan Zeng contributed equally to this work and should be considered co-first authors.

References

[1]. Aini, S. N., Harymawan, I., Nasih, M., & Kamarudin, K. A. (2024). CEO overseas experience and sustainability report disclosure: Evidence from Indonesia. Corporate Social-Responsibility and Environmental Management, 31(6), 5837–5849.

[2]. Sarto, F., Saggese, S., Ricci, F., & Corte, G. (2025). Sustainability Reporting Assurance in Italian Listed Companies: Understanding the Role of CEO Characteristics. Business Strategy and the Environment, 34(4), 4622–4641.

[3]. Wang, G., Holmes Jr, R. M., Oh, I.-S., & Zhu, W. (2016). Do CEOs Matter to Firm Strategic Actions and Firm Performance? A Meta-Analytic Investigation Based on Upper Echelons Theory. Personnel Psychology, 69(4), 775–862.

[4]. Cao, X., Wang, Z., Li, G., & Zheng, Y. (2022). The impact of chief executive officers’ (CEOs’) overseas experience on the corporate innovation performance of enterprises in China. Journal of Innovation & Knowledge, 7(4), Article 100268.

[5]. Gu, J. (2022). Do at home as Romans do? CEO overseas experience and financial misconduct risk of emerging market firms. Research in International Business and Finance, 60, Article 101624.

[6]. Liang, S., Niu, Y., Xin, F., & Jiang, L. (2024). CEO foreign experience and corporate financial investment. International Review of Economics & Finance, 93(1), 929–946.

[7]. Bin Haron, R., & Ahmad Baharul Ulum, Z. K. (2021). Non-linear relationship between foreign currency derivatives and firm value: Evidence on Sharī’ah compliant firms. Islamic Economic Studies (IES), 28(2), 156–173.

[8]. Huong, N. T., & Vu, H. P. (2023). CEO foreign experience and firm performance: Does CEO tenure matter? The University of Danang Journal of Science and Technology, 21(12.2).

[9]. Xiang, X, Chen, CR, Liu, Y, Mughal, A & Tao, Q (2023). 'Are directors with foreign experience better monitors? Evidence from investment efficiency', Review of Quantitative Finance and Accounting.

[10]. Mysaka, H., & Derun, I. (2021). Corporate Financial Performance and Tobin’s Q in Dividend and Growth Investing. VIZJA University.

[11]. Kim, B. (2019). The relationship between globalization and performance of venture firms in Korea: The moderating effect of CEO international experience (Doctoral dissertation). Seoul National University, College of Business Administration.

[12]. Chen, Y., Chen, C., & Lin, Y. (2023). Are directors with foreign experience better monitors? Evidence from China.Journal of Financial and Quantitative Analysis, 58(3), 1215-1254.

Cite this article

Li,Q.;Liu,Y.;Zhang,Y.;Zeng,Y. (2025). The Impact of CEO’s Overseas Backgrounds on Firm Market Value: A Tobin’s Q Perspective. Advances in Economics, Management and Political Sciences,245,45-55.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of ICFTBA 2025 Symposium: Data-Driven Decision Making in Business and Economics

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Aini, S. N., Harymawan, I., Nasih, M., & Kamarudin, K. A. (2024). CEO overseas experience and sustainability report disclosure: Evidence from Indonesia. Corporate Social-Responsibility and Environmental Management, 31(6), 5837–5849.

[2]. Sarto, F., Saggese, S., Ricci, F., & Corte, G. (2025). Sustainability Reporting Assurance in Italian Listed Companies: Understanding the Role of CEO Characteristics. Business Strategy and the Environment, 34(4), 4622–4641.

[3]. Wang, G., Holmes Jr, R. M., Oh, I.-S., & Zhu, W. (2016). Do CEOs Matter to Firm Strategic Actions and Firm Performance? A Meta-Analytic Investigation Based on Upper Echelons Theory. Personnel Psychology, 69(4), 775–862.

[4]. Cao, X., Wang, Z., Li, G., & Zheng, Y. (2022). The impact of chief executive officers’ (CEOs’) overseas experience on the corporate innovation performance of enterprises in China. Journal of Innovation & Knowledge, 7(4), Article 100268.

[5]. Gu, J. (2022). Do at home as Romans do? CEO overseas experience and financial misconduct risk of emerging market firms. Research in International Business and Finance, 60, Article 101624.

[6]. Liang, S., Niu, Y., Xin, F., & Jiang, L. (2024). CEO foreign experience and corporate financial investment. International Review of Economics & Finance, 93(1), 929–946.

[7]. Bin Haron, R., & Ahmad Baharul Ulum, Z. K. (2021). Non-linear relationship between foreign currency derivatives and firm value: Evidence on Sharī’ah compliant firms. Islamic Economic Studies (IES), 28(2), 156–173.

[8]. Huong, N. T., & Vu, H. P. (2023). CEO foreign experience and firm performance: Does CEO tenure matter? The University of Danang Journal of Science and Technology, 21(12.2).

[9]. Xiang, X, Chen, CR, Liu, Y, Mughal, A & Tao, Q (2023). 'Are directors with foreign experience better monitors? Evidence from investment efficiency', Review of Quantitative Finance and Accounting.

[10]. Mysaka, H., & Derun, I. (2021). Corporate Financial Performance and Tobin’s Q in Dividend and Growth Investing. VIZJA University.

[11]. Kim, B. (2019). The relationship between globalization and performance of venture firms in Korea: The moderating effect of CEO international experience (Doctoral dissertation). Seoul National University, College of Business Administration.

[12]. Chen, Y., Chen, C., & Lin, Y. (2023). Are directors with foreign experience better monitors? Evidence from China.Journal of Financial and Quantitative Analysis, 58(3), 1215-1254.