1. Introduction

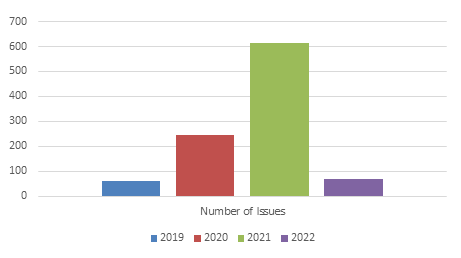

SPACs are essentially shell companies sponsored and issued by investors or management teams. They allow private companies to go public through a two-step process [1]. In the first step, the SPAC sponsor established an empty holding company. The sponsors purchase warrants and invest minimum capital in exchange for 20% of the SPAC. The public investor will exchange the price of $10 per share and possible warrants for the promise of a shell company that can eventually make an acquisition. They received 80% of the shares of SPAC. After both parties complete this step, the cash proceeds are similar to those in the initial public offering. The second step is called SPAC merger, which identifies a private company that wants to be listed and negotiates the acquisition of the company to become a major shareholder. After the transaction is announced, SPAC shareholders vote on the transaction, and if they are not satisfied with the result, they can redeem their shares [2]. If the transaction is approved, the target company will be merged into the SPAC, and the company's balance sheet will also be merged. The company effectively raised funds, just like a normal IPO. At the same time, other investors at this stage can also contribute to the form of private equity investment. Initial public offering (IPO) is a limited sale of new shares by a startup after it decides to go public. Both public investors and institutional investors can purchase new shares to obtain financial support for the development of the company. After the IPO, the startup officially became a listed company and began trading on the national stock exchange. Special purpose acquisition companies are not a new investment concept, but their popularity has increased recently. In 2021, 613 SPACs participated in initial public offerings, and their total income also increased from $83 billion in 2020 to more than $160 billion in 2021. But in the first and second quarters of 2022, only 68 SPAC IPOs were listed [3]. The decline in the IPO issuance of SPACs is partly due to the strengthening of the regulatory review of SPACs. The securities and Exchange Commission of the United States has made new regulations on the disclosure of certified equity and information about the initiators of SPACs and potential conflicts of interest of initiators. These affect the distribution activities to a certain extent. The following chart shows the annual number of SPAC IPOs listed on the US stock exchange from January 2019 to June 2022.

Figure 1: Annual number of US SPAC IPOs.

(Source from: SPACInsider. SPAC IPO Transactions: Summary by Year)

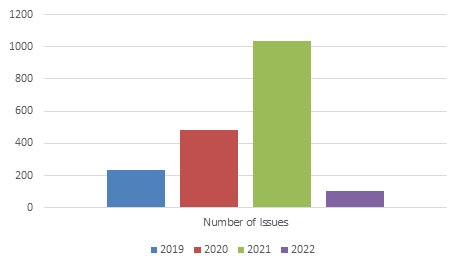

For traditional initial public offerings, since the number of transactions reached a record high in 2021, IPO activity dropped sharply in the first half of 2022. According to data from STOCKANALYSIS, there were 1900 IPOs between 2019 and 2022. Among them, the number of IPOs in 2021 reached 1035, a record high. IPO activity dropped sharply in the first half of 2022, with only 153 [4]. The global IPO issuance reached a five-year low in the second quarter of 2022, and the transaction volume significantly dropped month on month. The total global IPO issuance was 36.6 billion US dollars, down more than 70% compared with the second quarter of 2021[5]. Among them, only 41 transactions were completed in the Americas, raising $250 million in revenue. The number of transactions decreased by 73%, and the revenue decreased by 95% year-on-year. Geopolitical tensions, as well as macroeconomic factors, have led to increased market volatility and declining valuations. Figure 2 shows the statistics of initial public offerings in the US stock market from 2019 to June 2022.

Figure 2: Annual number of US IPO.

(Source from: Stockanalysis. Number of IPOs by Year)

This article introduces and analyzes the specific processes and characteristics of SPAC and traditional IPO respectively and summarizes their development trends. At the same time, it will compare the two from three aspects: the ease of implementation of listing, corresponding regulations, and taxes, and summarize the development trends of SPAC IPOs and traditional IPO.

This part will analyze the formation, capital, timeline, and merger of SPACs to understand how they operate concretely, and then analyze why companies choose SPAC as a listing channel and what are the advantages and disadvantages of adopting this method. Finally, this article will summarize which companies are suitable for listing by SPAC by comparing the traditional public offering and SPAC.

2. First Form of Fund-raising: SPAC

2.1. SPAC IPO

2.1.1. Formation and Fund of SPAC

Generally, SPACs are composed of experienced management teams or initiators of nominal investment capital, who usually hold about 20% of the equity of SPACs which is called founder shares. About 80% of the remaining equity is held by public investors.

2.1.2. Timeline of SPAC

After the initial public offering, the proceeds obtained by SPAC will be deposited into trust accounts. SPAC usually has 18-24 months to determine and complete the merger with the target company. If the merger is not completed within the time limit, the SPAC will liquidate and return the IPO proceeds to the public shareholders. If the target company is determined and the merger is announced, the public shareholders of SPAC can decide whether to implement the transaction by voting. If the SPAC needs additional funds to complete the merger, the SPAC may obtain sufficient funds by issuing debt or additional shares, such as private equity investment.

2.1.3. The SPAC Merger

Once established, SPACs usually need to seek shareholders' approval for the merger and prepare to submit a power of attorney. The power of attorney documents includes various matters seeking shareholders' approval, as well as descriptions of merger and governance matters. At the same time, the document will also include the financial information of the target company, such as historical financial statements.

2.2. Why Are SPACs So Popular

In this part, we discuss why SPACs are so popular and what should be paid attention to when implementing SPAC trading or investment through discussions with private companies and IPO investors.

2.3. Private Company

2.3.1. Private Companies May Sell Themselves at a Higher Price than Traditional IPOs

The pricing of IPO is usually to encourage the stock price to rise on the first day of trading, so the price is relatively low. In contrast, the merger of SPACs can be negotiated at fair value. It helps to protect the value from market uncertainty. Private companies can use forward-looking statements when introducing themselves to SPACs which is attractive to fast-growing companies [6]. To avoid legal liability when the traditional IPO prospectus fails to meet the forecast, it is necessary to display the historical financial data of the company.

2.3.2. Provide Opportunities for the Company to Cooperate with Experienced Sponsors

SPAC is composed of skilled business professionals, and a team with a business mind can provide the company with appropriate guidance on how to accelerate growth. However, it should be noted that the selection of suitable SPAC sponsors is the key because the buyer and the seller need to seek the appropriate synergy between the two sides of the business and have long-term business development goals. A key objective of SPAC transactions is to ensure that the target has sufficient funds to succeed after the merger. Since SPAC investors have the right to withdraw from this investment at the close of the market.

2.3.3. Stable Stock Price

The stock price of companies listed through traditional IPO is generally uncertain. The stock price of a company depends on its popularity with investors, market conditions at that time, and the company's basic business valuation [7]. In addition, the stock price of the traditional IPO is determined by bankers, which means that there is a possibility of error in the pricing of the company. However, SPAC transactions completely avoid price uncertainty, so they are very attractive. The management team of the company can negotiate a purchase price that is most suitable for the company, although this may cause its valuation to be slightly lower than the valuation obtained by the company through traditional IPO.

2.4. SPAC IPO Investor

Investors in SPAC IPOs can choose to redeem their shares at the price and interest they pay, which means they basically hold a money back guarantee. In addition, investors also have a warrant, which may be very valuable if the SPAC is successful. This warrant is similar to a risk-free bet on the success of SPACs.

2.5. Retail Investor

Retail investors refer to individual investors who directly purchase securities [8]. Such investors are generally not allowed to invest in traditional IPOs, and to a large extent, they are excluded from the upward space of IPOs. However, the SPAC IPO structure allows retail investors to participate in SPAC after its listing but before the merger is announced.

2.6. What Risks Should Be Paid Attention to When Implementing SPAC

First, there is a risk that the equity will be diluted. SPAC promoters usually own 10% of SPAC through founder shares and purchase more shares through warrants. At the same time, SPAC initiators also benefit from the profit part, which means that companies listed through SPAC will lose a lot of valuable equity and be diluted. Investors may also be disadvantaged by investing in SPACs. Due to the time limit imposed by the SPAC process, the founder of SPAC may be eager to find the company to be acquired, which may lead to the acquisition of financial situation to a certain extent.

Second, the cost of a SPAC IPO may be very expensive, although on the surface, it may be cheaper than a traditional IPO. The underwriter's fee is 2% of the amount raised in advance, and the other 3.5% depends on the occurrence of the transaction. This 5.5% amount is lower than the 7% normally charged by traditional IPOs. But because most shareholders usually redeem their shares, it means that SPACs can only retain a small part of the IPO proceeds in the end.

Third, quality of the target company. Since the implementation process of SPAC only takes 3 to 4 months, which is much faster than the traditional IPO, SPAC is more attractive to some companies in trouble. At the same time, as mentioned above, some private companies may use some forward-looking statements when introducing their own companies to SPAC initiators, which may also lead to wrong judgment on the actual operation of the target company [9]. For example, Nikola automobile company was listed through SPAC merger in June 2020 [10]. Milton, its former CEO, called his company an innovative developer of zero emission alternative fuel trucks, and stimulated investors' demand for Nikola's shares, making its company's share price higher than its market value.

3. Second Form of Fund-raising: The Traditional IPO

In this part, by analyzing the procedures, advantages, and disadvantages of traditional IPO, we discuss why some private companies prefer to go public through traditional IPO rather than SPAC IPO. It also analyzes the investment of traditional IPO and SPAC IPO in terms of ease, regulatory system, and tax.

3.1. Initial Public Offering

An initial public offering is a process in which a private company sells shares to the public. This process marks the maturity and growth of the company. After listing, the company will usually face strict review of its performance, operation and financial status by regulators and investors.

3.2. Mode of Operation

Private companies usually start by hiring banking services. The process in which an investment bank handles and advises the listing process is called underwriting. The underwriter helps the company submit a prospectus to the securities and Exchange Commission, which includes financial data, financial forecasts, and initial public offering earnings.

If the IPO is approved, the underwriter will introduce the company and the IPO transaction to institutional investors through roadshows. If institutional investors are interested in buying, the underwriter will allocate them a certain proportion of shares. Before listing, the company selects the stock exchange and stock code with the help of the underwriter. The underwriter will then purchase the shares from the company and transfer them to the public market. It is worth noting that there is a lock up period for IPO, during which senior managers and early investors are not allowed to sell their shares in the public market.

4. Why Is the Company Listed Through Traditional IPO Instead of SPAC

Traditionally, companies go public through IPO in order to raise more funds, provide early stakeholders with exit opportunities and greater liquidity, and strive for more publicity. At the same time, the company may choose traditional IPO instead of SPAC IPO for the following reasons.

4.1. Uncertainty in SPAC

The SEC has updated some regulatory requirements for SPACs, and more policy changes may be accompanied. Compared with the regulation of SPAC, the regulation of traditional IPO is still a real operation mode that can stand the test. Since the SPAC initiator must decide the target company to be acquired, SPAC merger actually provides less control for the company to be listed than traditional IPO [11]. The uncertainty of the merger time and the real-time changes of market regulatory measures may affect the company's finance and operation for initial public offerings, the implementation of regulatory requirements is often much more, which is to protect the interests of investors.

4.2. Create a Sensation

The marketing and successful launch of the company's IPO will create a considerable publicity effect for the company, which will create additional publicity for the start-up company.

4.3. Risks of Traditional IPO

IPO investment is risky. Traditional IPOs are expensive. Besides underwriters and investment banks, hiring top talents to attract investors to participate in IPOs will increase the company's economic pressure.

5. The Comparison Between SPAC IPO and Traditional IPO

5.1. Ease of Use

For most investors, it is relatively easy to buy IPO shares and SPACs, and only one economic account and stock code are required. In addition, warrants belonging to SPAC units cannot be traded until 52 days after the IPO.

Price: SPACs stock price is usually $10 per share, and a relatively low share price may be favored by individual investors. The stock price of traditional IPOs is rarely high because underwriters reduce the stock price to attract people's attention on the first day of trading.

5.2. Regulation

As mentioned above, SPACs will adopt forward-looking statements when introducing themselves to investors. When making forward-looking statements, SPAC has greater regulatory flexibility. Therefore, investors must carefully examine and weigh the realistic business prospects of the company. Investors will face greater uncertainty in the future than SPACs. In contrast to SPAC, the regulatory rules of SPAC are quite mature and stable, which can better protect the interests of investors.

5.3. Tax

SPAC usually has two years to find the target company to be merged. If it fails to merge within the specified time, SPAC will be dissolved, and investors will recover their investment funds and corresponding interest. How to tax investors depends on whether investors generate profits when they receive the funds returned to them and the duration of investment. For SPAC warrants, when investors exercise this right, the difference between the exercise price and the actual price of shares is taxable income. This is usually taxed as ordinary income, so the tax rate is higher.

6. Looking Forward to the Future: The Development Trend of SPAC and Traditional IPO

The future development of the IPO will not be threatened. In recent years, many companies wishing to go public in the next few years have chosen to go public in the traditional way rather than through SPACs. Airbnb, a short-term leasing company, said "thanks, but no thanks" to Bill Ackman's proposal for the merger and listing of special purpose acquisition companies [12]. Subsequently, the company submitted the IPO documents to the US Securities and Exchange Commission.

For the SPAC IPO, the SEC has proposed the same and stricter regulatory plan as the traditional IPO, which has led to a sharp decline in the number of applications for SPAC to a certain extent, highlighting the fragility of the market. In addition, other regions have less interest in SPAC than the United States. In Asia, few stock exchanges allow SPACs. In Europe, SPACs face stricter regulation.

7. Conclusion

Although SPAC has existed for decades, it has attracted the attention of a large number of investors, start-ups and regulators in recent years. However, due to the impact of the pandemic, geopolitics and other macro factors, its market has great uncertainty. SPAC merger may continue to exist, but it may change and improve its own form in response to the supervision of regulators. The future development of traditional IPO will not be threatened. Each investor or company should make the most suitable choice for its own development or investment based on its own actual situation and analysis of the market situation.

References

[1]. Klausner, M., Ohlrogge, M. and Ruan, E., 2022. A Sober look at SPACs. [ebook] european corporate governance institute, p.10. Available at: <http://dx.doi.org/10.2139/ssrn.3720919>

[2]. Shachmurove, Y. and Vulanovic, M., 2017. SPAC IPOs. [ebook] p.29. Available at: <http://https ://ssrn.com/abstract=2898102>

[3]. SPAC Insiders. 2022. SPAC IPO Transactions Statistics. [online] Available at: <https://spacinsider.com/stats/>

[4]. Stock Analysis. 2022. IPO Statistics and Charts | Stock Analysis. [online] Available at: <https://stockanalysis.com/ipos/statistics/>

[5]. EY, Dealogic, 2022. YTD 2022 saw dramatic slowdown in global IPO activity from a record year in 2021. [online] Available at: <https://www.ey.com/en_gl/news/2022/06/ytd-2022-saw-dramatic-slowdown-in-global-ipo-activity-from-a-record-year-in-2021>

[6]. Blomkvist, M. and Vulanovic, M., 2020. SPAC IPO Waves. SSRN Electronic Journal, [online] 197(109645). Available at: <https://doi.org/10.1016/j.econlet.2020.109645>.

[7]. Malhotra, N. and Tandon, K., 2013. Determinants of Stock Prices: Empirical Evidence from NSE 100 Companies. [ebook] International Journal of Research in Management & Technology, p.86. Available at: <https://d1wqtxts1xzle7.cloudfront.net/51750156/1_Determinants_of_Stock_Prices_Empirical_Evidence_from_NSE_100_Companies-with-cover-page-v2.pdf?Expires=1662909485&Signature=AqK7sfDNVKMBNlU98i2sbpqF-Cu35IOaiv6zunJuGLcY~CimeG64PjcrGcO566ZNqvMsft5wovWn6ccBAjsmc8SMbiMuxIwIXa1CqgN7DvjMWqVLA4mqgO3dovTLBSp6abqJHQLW6PvZC6hazeSiePQtOoO49q8S5rdSKFoDZ7kBkyy2LGVoeC8HDYlv2EQ3WMpt~fPFcusoYXIkdW0UFt53jO9I9u9Z7ggc0QqIKr9jJHiIysQiN9ERJtD6XNlDs~sVs3udjYnAqOo17O0zl47k8Ztljo9~IgJ-QsqrnNmZOvTKCYZuf3yBToHyv3AiZUnFVLmC0M9ar6d9-9yvCw__&Key-Pair-Id=APKAJLOHF5GGSLRBV4ZA>

[8]. Chandrasekhar, C. and Malik, S., n.d. The elusive retail investor: How deep can (and should) India's stock markets be?. [ebook] pp.7-9. Available at: <https://www.sebi.gov.in/sebi_data/DRG_Study/elusiveretailinvestor.pdf>

[9]. Datar, V., Emm, E. and Ince, U., 2012. Going public through the back door: A comparative analysis of SPACs and IPOs. [ebook] p.32. Available at: <http://ccsu.financect.net/FTC205/BFR0920Papers/224-851-1-PB.pdf> [Accessed 12 September 2022].

[10]. CNBC, 2021. DOJ and SEC send warning to SPACs with criminal charges against Nikola founder Trevor Milton. [online] Available at: <https://www.cnbc.com/2021/08/02/nikola-founder-criminal-charges-puts-other-spacs-on-notice.html>

[11]. Henry-Reid, T., 2022. Three reasons to prefer an Initial Public Offering Over a SPAC. [ebook] Available at: <http://dx.doi.org/10.2139/ssrn.4078371> [Accessed 12 September 2022].

[12]. PYMNTS, 2020. Why Airbnb is Saying 'Thanks, But No Thanks' To Bill Ackman's SPAC. [online] Available at: <https://www.pymnts.com/news/ipo/2020/why-airbnb-is-saying-thanks-but-no-thanks-to-bill-ackmans-spac/> [Accessed 12 September 2022].

Cite this article

Li,T. (2023). Characteristics and Application of Corporate Fund-raising Forms: Based on SPAC and IPO. Advances in Economics, Management and Political Sciences,11,24-31.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 2nd International Conference on Business and Policy Studies

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Klausner, M., Ohlrogge, M. and Ruan, E., 2022. A Sober look at SPACs. [ebook] european corporate governance institute, p.10. Available at: <http://dx.doi.org/10.2139/ssrn.3720919>

[2]. Shachmurove, Y. and Vulanovic, M., 2017. SPAC IPOs. [ebook] p.29. Available at: <http://https ://ssrn.com/abstract=2898102>

[3]. SPAC Insiders. 2022. SPAC IPO Transactions Statistics. [online] Available at: <https://spacinsider.com/stats/>

[4]. Stock Analysis. 2022. IPO Statistics and Charts | Stock Analysis. [online] Available at: <https://stockanalysis.com/ipos/statistics/>

[5]. EY, Dealogic, 2022. YTD 2022 saw dramatic slowdown in global IPO activity from a record year in 2021. [online] Available at: <https://www.ey.com/en_gl/news/2022/06/ytd-2022-saw-dramatic-slowdown-in-global-ipo-activity-from-a-record-year-in-2021>

[6]. Blomkvist, M. and Vulanovic, M., 2020. SPAC IPO Waves. SSRN Electronic Journal, [online] 197(109645). Available at: <https://doi.org/10.1016/j.econlet.2020.109645>.

[7]. Malhotra, N. and Tandon, K., 2013. Determinants of Stock Prices: Empirical Evidence from NSE 100 Companies. [ebook] International Journal of Research in Management & Technology, p.86. Available at: <https://d1wqtxts1xzle7.cloudfront.net/51750156/1_Determinants_of_Stock_Prices_Empirical_Evidence_from_NSE_100_Companies-with-cover-page-v2.pdf?Expires=1662909485&Signature=AqK7sfDNVKMBNlU98i2sbpqF-Cu35IOaiv6zunJuGLcY~CimeG64PjcrGcO566ZNqvMsft5wovWn6ccBAjsmc8SMbiMuxIwIXa1CqgN7DvjMWqVLA4mqgO3dovTLBSp6abqJHQLW6PvZC6hazeSiePQtOoO49q8S5rdSKFoDZ7kBkyy2LGVoeC8HDYlv2EQ3WMpt~fPFcusoYXIkdW0UFt53jO9I9u9Z7ggc0QqIKr9jJHiIysQiN9ERJtD6XNlDs~sVs3udjYnAqOo17O0zl47k8Ztljo9~IgJ-QsqrnNmZOvTKCYZuf3yBToHyv3AiZUnFVLmC0M9ar6d9-9yvCw__&Key-Pair-Id=APKAJLOHF5GGSLRBV4ZA>

[8]. Chandrasekhar, C. and Malik, S., n.d. The elusive retail investor: How deep can (and should) India's stock markets be?. [ebook] pp.7-9. Available at: <https://www.sebi.gov.in/sebi_data/DRG_Study/elusiveretailinvestor.pdf>

[9]. Datar, V., Emm, E. and Ince, U., 2012. Going public through the back door: A comparative analysis of SPACs and IPOs. [ebook] p.32. Available at: <http://ccsu.financect.net/FTC205/BFR0920Papers/224-851-1-PB.pdf> [Accessed 12 September 2022].

[10]. CNBC, 2021. DOJ and SEC send warning to SPACs with criminal charges against Nikola founder Trevor Milton. [online] Available at: <https://www.cnbc.com/2021/08/02/nikola-founder-criminal-charges-puts-other-spacs-on-notice.html>

[11]. Henry-Reid, T., 2022. Three reasons to prefer an Initial Public Offering Over a SPAC. [ebook] Available at: <http://dx.doi.org/10.2139/ssrn.4078371> [Accessed 12 September 2022].

[12]. PYMNTS, 2020. Why Airbnb is Saying 'Thanks, But No Thanks' To Bill Ackman's SPAC. [online] Available at: <https://www.pymnts.com/news/ipo/2020/why-airbnb-is-saying-thanks-but-no-thanks-to-bill-ackmans-spac/> [Accessed 12 September 2022].