1. Introduction

In early 2020, COVID-19, which has been described as the sixth public health emergency of global concern since the 21st century, interrupted the steady trend of international financial markets and led to dramatic turmoil in international financial markets, such as the four primary meltdowns in the U.S. stock market in 2020, the devaluation of the Turkish lira by more than forty percent in 2021 and the worldwide economic stimulus efforts in 2022 [1-3]. The COVID epidemic has led to a systemic and comprehensive shock to the global economy.

As part of the globalized market, China's financial markets were also hit hard, resulting in entirely new financial economics and market restructuring. These changes will dramatically impact the future of financial firms and investment markets. The trends in China's financial markets are very different from those of other markets due to the unique nature of the policies and national conditions and the lagging and persistent nature of the epidemic's impact. The epidemic embargo has changed market allocation and provided investors and entrepreneurs with new growth opportunities.

Since the winter of 2021, the frequency of domestic COVID outbreaks has increased, and the cycle duration has become longer. Due to China's particular epidemic policy, the number of confirmed cases, duration of control, regional coverage, and depth of industry caused by the new strain in the latest round of outbreaks since March 2022 have surpassed the January-March 2020 outbreak period. In addition, this round of attacks is concentrated in the core areas of China's economy, critical areas of the industrial supply chain, and window areas for foreign investment and foreign trade. It is concentrated at special times, such as high energy and other commodities prices and the Fed's monetary policy shift to contraction [4, 5]. For example, in the second quarter, the GDP of Shanghai, the center of the Chinese economy, fell by 13.7 percent year-on-year due to a series of control measures caused by the epidemic, which determined that the impact of the current round of the outbreak on the Chinese economy was more rapid and far-reaching [6].

China's economy in 2022 shows a variety of development patterns. China's macroeconomic recovery has slowed significantly in the first half of 2022 due to a combination of domestic and international adverse factors, especially the impact of the current epidemic round, with more significant downward pressure. According to data released by the China Bureau of Statistics, actual Gross domestic product (GDP) grew 4.8% year-on-year in the first quarter and 1.3% sequentially, which was lower than expected at the beginning of the year; GDP in the second quarter was RMB 2,924.64 billion, up 0.4% year-on-year, both lower than expected at the beginning of the year. GDP in the year’s first half was 562,642 billion yuan, up 2.5% year-on-year at constant prices [7].

To understand the systemic financial risks in China in the post-epidemic era and to propose a reasonable capital allocation plan, this paper will complete an analysis of investment options in various segments of China's financial market, taking into account the historical background of the Chinese market and the changing characteristics of the financial market during the epidemic, and refer to various literature to summarize the laws of risk change and clarify the development of the future market.

2. Domestic Economy

China's domestic economy is divided into three main sectors [8]. These three significant industries can be divided into production, consumption, and investment, depending on their characteristics. However, these three categories can often be viewed through business and personal aspects. The display can reflect the success of past state and market policies and thus determine future trends; consumption is often used to determine market preferences. Therefore, future production policies and investments are based on whether past production results have been sold well and invested in more profitable industries. The smoothness of the transition between production, consumption, and investment often reflects whether a country or region has a well-functioning market and whether society is active or conservative in its use of assets.

The production market is currently characterized by sectoral differentiation. According to China's National Bureau of Statistics, driven by high export growth and the development of industrial upgrading, China's manufacturing value reached 27.4% of GDP in 2021, while the proportion was as high as 28.8% in the first half of 2022 [9]. This is the first time since 2011 that the proportion of China's manufacturing value added to GDP has risen. Although this is good for the industrial structure of developing countries, the increase in the share of manufacturing reflects the downturn in other sectors, as the part of the manufacturing industry tends to be divided into services as the signal of development of the manufacturing industry; it also increases the risk of market operation [10]. Affected by the dual control policy of energy consumption, the upstream industries, such as mining and raw materials, maintain low growth; affected by factors such as weak market demand, the downstream consumer goods manufacturing industry is relatively sluggish [9]. This has brought a financial crisis to private enterprises, causing a premature decline in manufacturing, and making the transition to high-end manufacturing more complex and riskier [11].

The combination of declining market demand and rising production costs led to a significant deterioration in corporate performance. Total corporate profits in 2022 showed negative growth in April, and the loss surface expanded. From January to April, total profits of industrial enterprises above the national scale grew by 3.5% year-on-year, down 5.0 percentage points from the growth rate in the first quarter; among them, total profits in April fell by 8.5% year-on-year, down 17.0 percentage points from the growth rate in the first quarter In April, total profits fell by 8.5% year-on-year, down 17.0 percentage points from the first quarter growth rate [12]. From January to April, the number of industrial enterprises with losses increased by 15.5% year-on-year, accounting for 27.8%, and the number of casualties increased by 39.7% year-on-year, accounting for 20.5% of total profits [12]. 1-4 months, in 41 industrial industries, 20 industries with total profits decreased year-on-year, five more than the first quarter, and only 19 industries with total profits showed Year-on-year growth, five less than the first quarter. It should be noted that the deterioration in the performance of the service sector and MSMEs is harder to quantify and measure so the impact may be more severe than the above industrial enterprises.

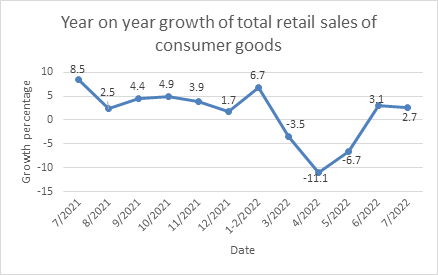

The service sector’s future is particularly bleak (see Fig. 1). Although the services production index rose by 1.8 percent year-on-year in August 2022, this was based on a 0.3 percent decrease in the production index from January to July. The service sector continues sluggish due to the economic crisis and policies. At the same time, due to the specificity of the clearance policy, the epidemic tends to affect the service sector in one or more cities over a period to a much greater extent than its impact on the manufacturing industry. As a result, while the services production index is relatively stable overall, it is more volatile for specific regions.

Figure 1: Service industry production index from 2018 to 2022 [12].

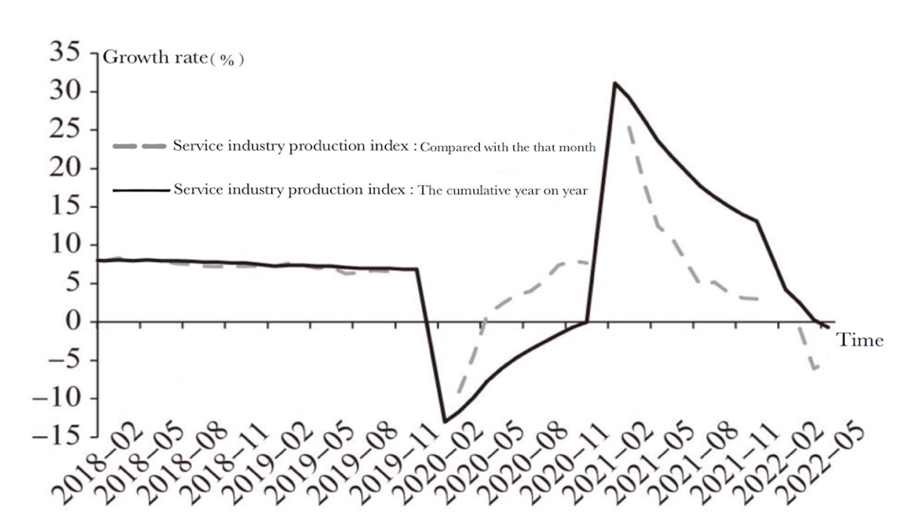

As for consumption, according to the National Bureau of Statistics of China, the total retail sales of consumer goods from January to July 2022 was 246.32 billion yuan, down 0.2% year-on-year [13]. What can be seen is that the overall trend of total retail sales of consumer goods is down and continued to decline sharply in March, April, and May, in contrast to the general trend in the second half of 2021 (see Fig. 2). The consumer market, which was hit hard by the epidemic and policies, did not show intense consumption growth when the market rebounded in June, but rather a slow rebound. This implies that Chinese expectations for consumption are low due to the policy impact of the first and second quarters.

|

Figure 2: Growth of total retail sales of consumer goods from 2021 to 2022 [13]. |

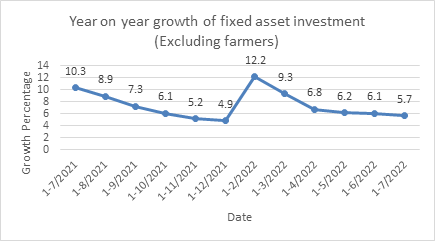

In contrast to the sluggish consumer market, the investment market performs well. Despite the shrinking GDP, investment in fixed assets has been increasing. From January to July 2022, the national investment in fixed assets (excluding rural household registration) was 3198.12 billion yuan, up 5.7% year-on-year [14]. Among them, private investment in fixed assets of 178.073 billion yuan, up 2.7% year-on-year [14]. On a month-on-month basis, fixed asset investment (excluding rural household registration) grew by 0.16 percent in July (see Fig. 3) [14]. This reflects that the public continues to be conservative in their investment choices, expecting more stability and certainty and no longer pursuing high-profit and high-risk investment options. As for official investment, industrial investment grew by 10.5% year-on-year, while infrastructure investment (excluding electricity, heat, gas, and water production and supply) grew by 7.4% year-on-year [14]. Among them, investment in the water management industry grew by 14.5%, investment in the public facilities management industry grew by 11.7%, investment in the road transportation industry fell by 0.2%, and investment in the railroad transportation industry fell by 5.0% [14]. Due to the specificity of the policy, the government's investment possesses a localized and fundamental character, intended to reduce the excessive youth unemployment rate (19.9%) and to boost local consumption and business investment [15].

Figure 3: Growth of fixed asset investment from 2021 to 2022 [14].

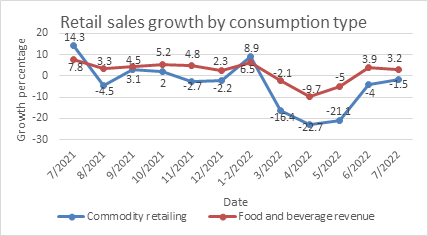

Analyzing consumer markets by type of consumption allows for a more precise analysis of the outlook for a segment of the market, allowing for a more granular and accurate political and economic impact received by a specific type of company. According to China's National Bureau of Statistics, the restaurant industry took the biggest hit, while retail goods were much better off. Total spending in the restaurant sector fell at a rate of less than 20% between March and May and had not recovered by July (see Fig. 4) [13]. It is reasonable to assume that the massive hit to the restaurant market will be challenging to recover from in the near term, as the immediate impact of a total shrinkage of more than fifty percent is readily observable. This will directly impact investors' future investment choices and leave the entire restaurant market in a negative cycle of lack of investment - declining restaurant numbers - lower ratings - less investment. It is worth noting that such a situation is often the first to hit restaurant outlets in shopping streets and malls. These stores often rely on high monthly revenues to cover their high rent and labor costs.

Retail goods, on the other hand, compare much better. Surprisingly, the retail merchandise sector has been picking up since June (see Fig. 4) [13]. Although the nearly ten percent decline in April seems severe, people rely more on retail goods than restaurants [13]. With China's well-developed e-commerce and logistics network, they have lower prices due to the lack of rent, and the number of brick-and-mortar retail stores can be predicted to decrease further after this blow. It is reasonable to assume that these stores will be transformed into stores that sell the experience, as this is something that cannot be purchased online.

Figure 4: Retail sales growth from 2021 to 2022 [13].

According to data from the People's Bank of China, in the first half of 2022, the balance of deposits in domestic and foreign currencies of China's financial institutions reached 257.68 trillion yuan, of which the ratio of deposits was 113.69 trillion yuan, in the first half of the year alone, China's household deposits increased by 10 trillion yuan [16]. According to China's population of 1.413 billion, in the first half of the year, the per capita deposit balance has reached 80,500,000 yuan, an increase of 10% from the end of 2021 [16]. Given the low growth in total GDP and the high growth in per capita deposit balances, it is reasonable to infer that nationals across the Chinese region have a low appetite for consumption in the consumer market and tend to be more conservative in their investment choices, investing in fixed assets rather than financial assets. The nation wants to save and thus have a higher level of risk tolerance rather than consume to satisfy their short-term desires or seek risky profits.

The outlook for China's domestic economy is relatively negative, considering industry production, the consumer market, the investment market, and per capita savings. The manufacturing sector is under pressure from raw material purchases and commodity piling. The consumer market is facing a significant blow, with an overall downward trend, with the restaurant industry being particularly hard hit. In the investment market, national investment choices are gradually becoming more conservative, preferring fixed asset investment and savings. The negative impact of the financial sector is evident, as reflected in the slightly higher growth rate of liabilities than growth. It is foreseeable that market liberalization, increased market competition, and support for small and medium-sized real enterprises will be the leading tone of China's domestic market in the future to stimulate the national consumption economy. Considering the specificity of China's national situation and policies, how to motivate the young generation with a high unemployment rate and high competitiveness will be regarded as the focus of policies, and college students' entrepreneurship may be promoted.

3. International Economy

China's international economy can be measured mainly by the import/export trade balance, foreign investment, and the currency exchange rate. The import/export trade balance reflects the international influence of China's manufacturing sector and the extent of China's participation in the global market, foreign investment means whether the Chinese market is attractive to the international community, and the currency exchange rate acts as a leveraging agent in international trade. A comprehensive view of these three aspects can reflect whether China reaps profits and development prospects in internationalization.

On the import and export side, in August, the total import and export of goods were 3,712.4 billion yuan, up 8.6% year-on-year. Among them, exports of 212.41 billion yuan, up 11.8%; imports of 158.82 billion yuan, up 4.6%. Import and export offset, trade surplus of 535.9 billion yuan. In 1-8 months, the total import and export of goods were 273,026 billion yuan, an increase of 10.1%. Among them, exports of 154,831 billion yuan, an increase of 14.2%; imports of 118,195 billion yuan, an increase of 5.2%. 1-8 months, general trade imports and exports accounted for 64.3% of the total imports and exports, a rise of 2.3 percentage points over the same period last year. Private enterprises accounted for 50.1% of the total imports and exports, an increase of 2.1 percentage points over the same period the previous year. Exports of electrical and mechanical products increased by 9.8% year-on-year, accounting for 56.5% of the total exports [17]. It is not difficult to see that China's import and export trade is still in the profit-making stage; the electromechanical category is China's main export commodity. On the one hand, this means that China's electromechanical sort is welcomed in international trade. Still, on the other hand, it also means that the competition in the electromechanical category is going to be more intense, which gives other goods higher export possibilities.

In terms of foreign investment input, from January to June 2022, the actual amount of foreign investment used nationwide was RMB 723.31 billion, up 17.4% year-on-year on a comparable basis. From an industry perspective, the actual use of foreign investment in the service sector amounted to RMB 537.13 billion, up 9.2%. The primary benefit of foreign investment in high-tech industries increased by 33.6%, including 31.1% in high-tech manufacturing and 34.4% in high-tech services [18]. In the past, China attracted foreign investment mainly in the manufacturing sector, and foreign investment promoted China's industrialization process, but to further improve the level of development of the manufacturing industry and promote the high-quality development of the manufacturing industry is inseparable from the development of the service sector, especially high-tech services, and modern services. China has a massive demand in the fields mentioned above, and service-oriented multinational companies have the corresponding advantages. Therefore, the general and high-tech service industries are the main forces attracting foreign investment. As the domestic manufacturing industry is warming up again, it is foreseeable that China's manufacturing chain will be further improved, and the demand for service industries will be further expanded. The continued influx of foreign capital can judge the expanding market gap [19].

In terms of the currency exchange rate, starting from June 2020, with the policy advantage and rapid economic recovery, workers resumed work, and the industrial chain entire Chinese manufacturing industry created economic growth in the world economic downturn in 2020 with the boom of RMB appreciation. As the world economy recovers in 2021, the RMB will generally maintain a slight preference. In 2022, however, the RMB depreciates rapidly due to a slowdown in domestic economic growth, an epidemic that hits the export supply chain, moderate monetary easing by the PBoC, narrowing interest rate differentials between the U.S. and China, increased pressure on capital outflows, and a solid external U.S. dollar [20]. At the same time, the epidemic raided central cities such as Beijing and Shanghai. In addition, many towns went into city closures from time to time, causing economic expectations to deteriorate rapidly. The Chinese government's desire to save the economy is getting increasingly urgent, even requiring local governments to stimulate the economy by "all means necessary,” with interest rate cuts becoming one of the most important [4]. With the Fed raising interest rates, the Chinese central bank's interest rate cuts may not stimulate the domestic economy and may even lead to capital outflows. The devaluation of the currency is evidence that this policy has had little effect. It is unacceptable for the current giant economic bubble because it would reduce the procedure’s efficiency and dampen the motivation and confidence of producers and consumers [21]. But considering the relatively limited size of the overseas RMB relative to the total domestic currency and the country’s complete industrialization system and supporting infrastructure, there is still much room for macro policy regulation [22, 23]. But as the epidemic continues to grow in prevalence, the effect of the policy appears to be stretched and even hurt the exchange rate in the future.

4. Suggestions

Domestic development, production, investment, and consumption have very different development patterns. Manufacturing will remain the hot spot for the show until the end of epidemic prevention and control in China. And with the unsealing of large cities, a rebound in the service sector can be expected. This is due to the continued inflow of foreign capital in the service sector and the country's need for industrial upgrading in the manufacturing industry. In other words, while the manufacturing industry will remain steady to positive for some time, the service sector has higher room for growth. Due to the blow suffered by the production sector, choosing the right time to invest may be able to catch the wave of economic recovery.

The situation in the consumer sector will be a bit more complicated. Since e-commerce has gained a higher market share after this economic fluctuation, the choice of electronic sales channels and small factory production has become a more popular business model. Considering the possible future support policies of the state for MSMEs and people's dependence on retail goods, future growth seems to be guaranteed. Meanwhile, the restaurant industry has suffered a massive blow in exchange for the rise of fast food. It is foreseeable that the restaurant industry will stumble for some time. The transition to offline after opening the market through investment in fast food will cater to the future development trend.

As far as international economic development is concerned, foreign capital will keep flowing into China for profits because China has a service market that cannot be ignored; at the same time, it becomes a challenge to keep the gains in the country because of the devaluation of the Chinese currency. What can be confirmed is that stimulating domestic manufacturing and increasing trade surplus will be the mainstream of household and international manufacturing companies in the future.

5. Conclusion

China has one of the world's most sophisticated industrial chains, which has contributed significantly to the stability of the globalized world economy in the face of the epidemic and an auspicious service sector that has raised the hopes of domestic and foreign investors. With a market mechanism that is very different from the free-market economy prevalent in the Western world, China's government often has significant influence over the market. This is well reflected in the continued growth of the Chinese economy in 2020 and now in the recession.

In the short term, the manufacturing sector will still be able to maintain its upward trend for a short period, while the service sector will depend entirely on the opening of policies and events; investors will focus more on fixed assets caused by the Chinese government's continuous investment in infrastructure development and water systems, as well as by the conservative choice of the market as a whole; from the consumer's point of view, due to the change of habits and the deepening of the concept of epidemic prevention, the restaurant industry It is challenging to return to the scale before the epidemic. Still, due to people's reliance on retail goods, e-commerce retail will further squeeze the profit margins of brick-and-mortar stores, which benefits entrepreneurs because of smaller costs. Still, it will additionally be a blow to large mall retail stores, and stores selling experiences and services will occupy a larger share of brick-and-mortar stores. The future Chinese market will emphasize the development of the service sector, as it is the primary channel to upgrade the manufacturing industry and sustain the real economy. Focusing on the service sector will be a good choice for producers, investors, and consumers, bringing them a broader market, higher profits, and a better consumer experience.

References

[1]. WHO, https://www.who.int/publications/m/item/covid-19-public-health-emergency-of-international-concern-(pheic)-global-research-and-innovation-forum, last accessed 2022/10/11.

[2]. China News, https://www.chinanews.com.cn/cj/2020/03-19/9130130.shtml, last accessed 2022/10/11.

[3]. Thomson Reuters, https://www.reuters.com/article/turkey-lira-2021-depreciation-1231-idCNKBS2JB13O, last accessed 2022/10/11.

[4]. BBC, https://www.bbc.com/zhongwen/simp/business-61906975, last accessed 2022/10/11.

[5]. Fitch Ratings, https://www.fitchratings.com/research/zh-cn/corporate-finance/20229-27-09-2022, last ac-cessed 2022/10/11.

[6]. RFA, https://www.rfa.org/mandarin/yataibaodao/hcm-07152022011538.html, last accessed 2022/10/11.

[7]. Gov. CN, http://www.gov.cn/xinwen/2022-07/15/content_5701194.htm, last accessed 2022/10/11.

[8]. Stats., http://www.stats.gov.cn/tjsj/tjbz/hyflbz/201905/P020190716349644060705.pdf, last accessed 2022/10/11.

[9]. Wang, J. & Zhao, F. (2022). China's Economy in 2022: Prospects for China's economic situation in 2022. Metallurgical Economics and Management (04), 12-13, 17.

[10]. MOF, http://tradeinservices.mofcom.gov.cn/article/yanjiu/pinglun/202103/114667.html, last accessed 2022/10/11.

[11]. Huang Qunhui & Yang Hutao.(2022). The Phenomenon of "Internal and external difference" in the propor-tion of China’s manufacturing industry and its implication of "deindustrialization". Social Science Ab-stracts (08), 78-80.

[12]. Liu Xiaoguang, Liu Yuanchun & Yan Yan, China Macroeconomic Analysis and Forecasting Research Group, Renmin University of China. (2022). China's macro economy will be stable in 2022. Economic Theo-ry and Economic Management (08),4-22.

[13]. Stats., http://www.stats.gov.cn/tjsj/zxfb/202208/t20220814_1887335.html, last accessed 2022/10/11.

[14]. Stats., http://www.stats.gov.cn/tjsj/zxfb/202208/t20220814_1887336.html, last accessed 2022/10/11.

[15]. VOA, https://www.voachinese.com/a/china-s-young-graduates-faces-highest-unemployment-rate-in-history-when-economy-continues-to-tumble-20220818/6707293.html, last accessed 2022/10/11.

[16]. https://www.163.com/dy/article/HGETRIVR055327AG.html, last accessed 2022/10/11.

[17]. Gov. CN, http://www.gov.cn/xinwen/2022-09/16/content_5710311.htm, last accessed 2022/10/11.

[18]. MOF, http://www.mofcom.gov.cn/article/xwfb/xwsjfzr/202207/20220703336835.shtml, last accessed 2022/10/11.

[19]. MOF, http://tradeinservices.mofcom.gov.cn/article/yanjiu/pinglun/202103/114667.html, last accessed 2022/10/11.

[20]. Think China, http://www.china.com.cn/opinion/think/2022-09/20/content_78429202.htm, last accessed 2022/10/11.

[21]. Chen Jixiang.(2021). An Analysis of economic bubbles in modern financial economy. World of Public Rela-tions (24), 150-151.

[22]. Gov. CN, http://www.gov.cn/xinwen/2022-05/20/content_5691495.htm, last accessed 2022/10/11.

[23]. People, http://finance.people.com.cn/n1/2022/0916/c1004-32527652.html, last accessed 2022/10/11.

Cite this article

Shen,X. (2023). Analysis of Chinese Financial Market under COVID-19. Advances in Economics, Management and Political Sciences,16,32-39.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 2nd International Conference on Business and Policy Studies

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. WHO, https://www.who.int/publications/m/item/covid-19-public-health-emergency-of-international-concern-(pheic)-global-research-and-innovation-forum, last accessed 2022/10/11.

[2]. China News, https://www.chinanews.com.cn/cj/2020/03-19/9130130.shtml, last accessed 2022/10/11.

[3]. Thomson Reuters, https://www.reuters.com/article/turkey-lira-2021-depreciation-1231-idCNKBS2JB13O, last accessed 2022/10/11.

[4]. BBC, https://www.bbc.com/zhongwen/simp/business-61906975, last accessed 2022/10/11.

[5]. Fitch Ratings, https://www.fitchratings.com/research/zh-cn/corporate-finance/20229-27-09-2022, last ac-cessed 2022/10/11.

[6]. RFA, https://www.rfa.org/mandarin/yataibaodao/hcm-07152022011538.html, last accessed 2022/10/11.

[7]. Gov. CN, http://www.gov.cn/xinwen/2022-07/15/content_5701194.htm, last accessed 2022/10/11.

[8]. Stats., http://www.stats.gov.cn/tjsj/tjbz/hyflbz/201905/P020190716349644060705.pdf, last accessed 2022/10/11.

[9]. Wang, J. & Zhao, F. (2022). China's Economy in 2022: Prospects for China's economic situation in 2022. Metallurgical Economics and Management (04), 12-13, 17.

[10]. MOF, http://tradeinservices.mofcom.gov.cn/article/yanjiu/pinglun/202103/114667.html, last accessed 2022/10/11.

[11]. Huang Qunhui & Yang Hutao.(2022). The Phenomenon of "Internal and external difference" in the propor-tion of China’s manufacturing industry and its implication of "deindustrialization". Social Science Ab-stracts (08), 78-80.

[12]. Liu Xiaoguang, Liu Yuanchun & Yan Yan, China Macroeconomic Analysis and Forecasting Research Group, Renmin University of China. (2022). China's macro economy will be stable in 2022. Economic Theo-ry and Economic Management (08),4-22.

[13]. Stats., http://www.stats.gov.cn/tjsj/zxfb/202208/t20220814_1887335.html, last accessed 2022/10/11.

[14]. Stats., http://www.stats.gov.cn/tjsj/zxfb/202208/t20220814_1887336.html, last accessed 2022/10/11.

[15]. VOA, https://www.voachinese.com/a/china-s-young-graduates-faces-highest-unemployment-rate-in-history-when-economy-continues-to-tumble-20220818/6707293.html, last accessed 2022/10/11.

[16]. https://www.163.com/dy/article/HGETRIVR055327AG.html, last accessed 2022/10/11.

[17]. Gov. CN, http://www.gov.cn/xinwen/2022-09/16/content_5710311.htm, last accessed 2022/10/11.

[18]. MOF, http://www.mofcom.gov.cn/article/xwfb/xwsjfzr/202207/20220703336835.shtml, last accessed 2022/10/11.

[19]. MOF, http://tradeinservices.mofcom.gov.cn/article/yanjiu/pinglun/202103/114667.html, last accessed 2022/10/11.

[20]. Think China, http://www.china.com.cn/opinion/think/2022-09/20/content_78429202.htm, last accessed 2022/10/11.

[21]. Chen Jixiang.(2021). An Analysis of economic bubbles in modern financial economy. World of Public Rela-tions (24), 150-151.

[22]. Gov. CN, http://www.gov.cn/xinwen/2022-05/20/content_5691495.htm, last accessed 2022/10/11.

[23]. People, http://finance.people.com.cn/n1/2022/0916/c1004-32527652.html, last accessed 2022/10/11.