1. Introduction

With the development and iterative renewal of high-tech industries, socio-economic development has gradually started to move to an era of digital economy. Big data, artificial intelligence, chip manufacturing, and smart sensors are becoming more and more popular all over the world. Digital products are closely related to people's lives. Companies are beginning to improve their own innovation capabilities to develop new technologies, and digital technologies are deeply integrated with corporate values. The state has paid particular attention to the development of the digital economy in recent years.

In the context of the proposed deep integration of new technologies with the real economy, some questions are supposed to be answered, for instance, whether companies will find this development trend and create an advantage in various industries, whether R&D and innovation play an important role in the development of companies, what the reaction of investors and customers is to innovative products, and how good or bad the trend of such companies is in the stock market. This paper will answer the above questions and help to clearly identify the relationship between R&D innovation and enterprise development. The paper also provides data and evidence for companies or new entrepreneurs in the development of innovative products and policies.

This paper compares the relevant high-tech development company and that of other industries. The proof such as asset load sheets, income, and expenditure status will be collected through data provided by the company. This paper also analyses the stock market situation of chip and new energy industries in different countries. By digging into the level of the development of high-tech industries in cities above the prefecture level to examine the advantages and impacts brought by R&D innovation, this paper enriches the proofs. Besides, the data collected in this paper helps companies to find a better direction in R&D innovation, especially for small and medium enterprises in the process of digitalization. A more adequate perspective is provided to entrepreneurial investors to help them to analyse and organise the industry market.

2. Analysis of Research Development and Innovation in BYD

Through the collection of information about the company, it is found that R&D innovation has advantages for the company. In the development of innovative technologies, the car company BYD has been gradually shedding fuel vehicles to invest in the business of electric and batteries. The scale of production of new energy vehicles has been expanded and several offline activities have been launched to support the consumption of new energy. BYD has set up a professional R&D team to update and upgrade its products, and it insists on promoting new energy vehicles with pure electric and plug-in hybrid power. BYD is also introducing more efficient vehicles to meet customer demand. Despite the impact of the COVID-19 epidemic and the downturn in the automotive industry in recent years, many companies are in a loss-making situation. However, BYD's revenue in the first half of 2022 was $390 million, an increase of $210 million over the same period of the previous year, due to technological updates in research and development [1]. In comparison to the development of many traditional companies, the high-tech industry is not prone to lose profits. This phenomenon shows that new products in R&D innovation can help companies to survive difficult times and create advantages for high-tech companies.

In the high-tech industry, electric vehicles and new energy vehicles have been widely concerned and developed among enterprises. BYD, as a giant company in the private automobile industry, is focusing more on research and development. As a car manufacturer of an independent Chinese brand, BYD has taken advantage of the technology accumulation of new energy vehicles to take a leading share of the market. In 2008, it became a long-term investment partner with BERKSHIRE HATHAWAY ENERGY, accounting for 7.86% of BYD Group's total shares. 79 million ordinary shares were issued to the public in 2011 [2]. The enterprise changed the company's production structure in 2022, stopping the production of fuel vehicles in March and focusing on helping the new energy vehicle industry. The 2022 half-yearly report of A-share shows that BYD increased its investment in technology research and development by $6.47 billion [3]. BYD has developed safer and higher energy-density batteries for use in electric vehicles. In 2022, when China's automotive industry has been hit hard, BYD's sales of new energy vehicles were around 2.65 million, achieving an increase of 1.2 times. Based on the development philosophy of technology as the king and innovation as the foundation, BYD has invested significantly in R&D innovation over a long term to ensure the safety and intelligence of its products. This has also enabled it to gain an advantage in the rapid and large-scale development of the new energy vehicle industry. In 2022, the market share of new energy vehicles rose by 24.7% in the first half of the year, becoming the global sales champion. Car sales have increased more than three times year-on-year, with a continuous increase in order intake and market recognition [1]. At the same time, the company's governance combines with national policies, and the external governance focuses more on the promotion of green travel advertising, responding to the needs of the new era and the way humans travel. BYD applies for 2,231 patents in 2020, and BYD's electric vehicle industry chain fills the gap in China's small-capacity rail transportation technology and industry, providing an effective urban governance solution [4].

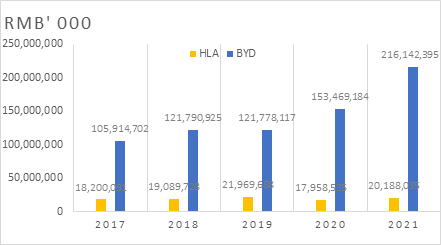

Figure 1: Profit comparison between BYD and HLA (Source: 2017~2021 BYD annual report and HLA annual report).

Figure 1 shows the amount of profits between BYD in the new energy vehicle high-tech industry and HLA in the traditional clothes industry from 2017 to 2021. During these 5 years, BYD's profitability has been on an upward trend. However, the amount of earnings of HLA has been trending down between 2019 and 2020, from $2.1 billion to $1.7 billion. The overall profitability is lower than the total value of the high-paying technology industry. 2019-2021 is a special period during the COVID-19 epidemic, due to which the overall world consumption decreases. However, in the daily consumption of food, clothing, traveling, and housing, BYD, as a new energy vehicle to solve people's travel problems, has always maintained increasing profitability.

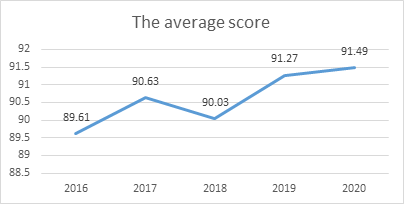

Figure 2: Customer satisfaction with the product after use (Source: BYD CRS Report).

Figure 2 shows the level of satisfaction of BYD customers after experiencing the new products developed. It can be found that BYD Sales Satisfaction Index is generally on an upward trend from 2016, from 89.61 to 91.49 points. Although it dropped to 90.03 between 2017 and 2018, it has since rebounded to 91.27. Previous studies have proven that customer satisfaction will generate high returns for companies and also influence capital flows to investors. The ability to combine product and capital markets will enable companies to obtain more business and investment capital [5]. This can enable firms to consistently outperform the market and thus make a profit.

3. Analysis of Research Development and Innovation in Pfizer

For biopharmaceutical companies, innovation in research and development has contributed to the development of the company and has generated a lot of revenue for the company in the stock market. During the epidemic, the biopharmaceutical industry was able to generate substantial profits for a long period of time thanks to the development of medical devices and pharmaceutical products. In 2018, Pfizer added more than 180 new research and development collaborations. Pfizer has developed a state-of-the-art supercomputing centre that makes flexible use of digital technology to improve patient health. Large-scale simulations and databased analysis are conducted to predict the structure of COVID-19 oral drug candidates while improving the stability of the mRNA vaccine [6]. Pfizer made a large number of novel coronavirus vaccines and drugs in 2021, reaching an estimated 1.4 billion patients and increasing its net profit revenue by 12 million. In the same year, Pfizer also initiated 13 clinical studies and increased its investment in R&D innovation to 10.5 billion. Earnings per share increased from $3.85 to $4.42 during the year [7]. The Price/Earnings ratio to Growth (PEG) is 0.53. A PEG equal to 1 indicates that the stock's valuation adequately reflects its future growth performance; If the PEG is greater than 1, the stock is probably overvalued and should not be bought; when the PEG is less than 1, the market undervalues the stock and it is generally a suitable point to buy [8]. The estimated PEG for Pfizer since 2022 is 0.56, so it is a good option for investors. The net profit of Pfizer grows from 11 million in 2018 to 21million in 2021.

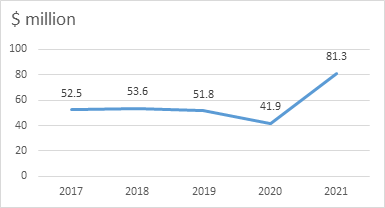

Figure 3 represents the amount of revenue of Pfizer between 2017 and 2021. The revenue drops significantly from 2019 to 2020 from 51.8 million to 41.9 million, but it then rises sharply to 81.3 million. It can be inferred that Pfizer is greatly impacted by the epidemic. In 2020, the company began to develop a vaccine against the novel coronavirus and upgraded its medical equipment. It also set up a dedicated R&D innovation team to study a wide range of diseases. The development of the vaccine is generating a huge amount of money for Pfizer. Reports suggest that the stock market is trending well for biopharmaceuticals. The biopharmaceutical industry has a long lifeline and biotech stocks can be stable in a volatile economic environment for the global sector, providing a safe haven for investors [9].

Figure 3: Pfizer's annual revenue (Source: Pfizer annual report).

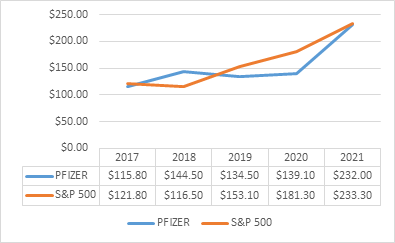

Figure 4 represents an investment of $100 starting in 2017, reinvesting the company's dividend in the company's common stock. Compared to the S&P 500 index which is dominated by Europe and the US group of companies, it can be seen that the Pfizer group is in a slow decline between 2018 and 2020, but after 2020, there is a significant increase. In addition to the resumption of production, the development of new pharmaceutical products by Pfizer has also led to this significant increase.

Figure 4: Chart of Pfizer and S&P 500 (Source: PFIZER PERFORMANCE DATA).

4. Suggestions for BYD and Pfizer

BYD may face the risk of having its property rights seized by its peers, high costs, and the bottleneck of not being able to get great breakthroughs in technology. Therefore, companies in the high-tech industry can strengthen their internal governance to raise their awareness of labour rights and educate their employees on intellectual property laws. In addition, companies can hire highly paid research professionals and provide them with a good working environment by subdividing each product group within the company. Companies can always collect and investigate the product preferences of investors and customers, and add personalised services and technologies for different groups of people with different needs to their research and development. This increases their competitiveness and market presence in the industry. When governing internally, companies can join forces with the government, adding financial input and policy assistance from government departments to increase publicity, thus reducing the cost of R&D and investing on a larger scale.

For Pfizer, the biggest competition in the market may be, on the one side, the pressure from peer-to-peer biopharmaceutical research and development, which needs to be constantly developed and therapeutically effective. On the other side, the same products may have been developed in other countries in global operations, which could result in the loss of a large number of foreign customers. To address these issues, Pfizer needs to accelerate its own research and development, as well as learning more about the social epidemic situation so that predictions can be done in advance according to the development and direction of the disease. In addition, there is a need for Pfizer to strengthen its legal understanding of intellectual property rights and patent more items to prevent the risk of information stealing or counterfeit goods marketing from other businesses. Companies can inform their audiences in advance of drug counterfeiting and enhance the use of logos or the uniqueness of pharmaceutical formulation. At the same time, Pfizer could initiate a takeover and merger program for small and medium enterprises in the pharmaceutical industry, reducing the number of multifaceted channels and allowing the flow of funds in a unique direction. Companies in the pharmaceutical industry could improve the reputation and customer satisfaction of the products used in their medicines, thus attracting more investors to invest in their projects.

5. Conclusion

This paper intends to examine what impacts R&D innovation has on companies and whether the impacts are all positive. From the analysis of the data of the individual companies, it is clear that R&D innovation can have a good revenue effect on the companies and can make the stock market have high expectations. In terms of limitations, this paper lacks the action of a separate survey on the market and uses few principles when conducting case studies, which may not be comprehensive enough in the analysis. Future studies can investigate how companies can improve their R&D innovation and how they can use it to improve their corporate governance and planning, as well as discussing what disadvantages high-tech industries have in the stock market and how companies should prevent the problems.

References

[1]. BYD. (2022). ANNUAL REPORT [Online]. Available: https://www.bydglobal.com/sitesresources/common/tools/generic/web/viewer.html?file=%2Fsites%2FSatellite%2FBYD%20PDF%20Viewer%3Fblobcol%3Durldata%26blobheader%3Dapplication%252Fpdf%26blobkey%3Did%26blobtable%3DMungoBlobs%26blobwhere%3D1600575229768%26ssbinary%3Dtrue [Accessed 10.1 2022].

[2]. BYD. (2021). ANNUAL REPORT [Online]. Available: https://www.bydglobal.com/sitesresources/common/tools/generic/web/viewer.html?file=%2Fsites%2FSatellite%2FBYD%20PDF%20Viewer%3Fblobcol%3Durldata%26blobheader%3Dapplication%252Fpdf%26blobkey%3Did%26blobtable%3DMungoBlobs%26blobwhere%3D1600575206087%26ssbinary%3Dtrue [Accessed 10.4 2022].

[3]. Lin, Z.: Perspective A - share half annual report: R & D real investment innovation acceleration [Online]. (2022). Available: https://kns.cnki.net/kcms/detail/detail.aspx?dbcode=CCND&dbname=CCNDLAST2022&filename=SHZJ202208310050&uniplatform=NZKPT&v=utc-8PMZc0naj4J7c9Z-sizzQjg-TvWIxAECLoMGO7PMqHOCDTaVS4rW0iPdpZ3rGMfRXE8XHZE%3d [Accessed 10.06 2022].

[4]. BYD. (2020). CSR report [Online]. Available: https://www.bydglobal.com/sitesresources/common/tools/generic/web/viewer.html?file=%2Fsites%2FSatellite%2FBYD%20PDF%20Viewer%3Fblobcol%3Durldata%26blobheader%3Dapplication%252Fpdf%26blobkey%3Did%26blobtable%3DMungoBlobs%26blobwhere%3D1600575179495%26ssbinary%3Dtrue [Accessed 10.2 2022].

[5]. Fornell, C., Mithas, S., Morgeson, F.V., Krishnan, M. S.: Customer Satisfaction and Stock Prices: High Returns, Low Risk [Online]. (2006). Available: https://www.bydglobal.com/sitesresources/common/tools/generic/web/viewer.html?file=%2Fsites%2FSatellite%2FBYD%20PDF%20Viewer%3Fblobcol%3Durldata%26blobheader%3Dapplication%252Fpdf%26blobkey%3Did%26blobtable%3DMungoBlobs%26blobwhere%3D1600575179495%26ssbinary%3Dtrue [Accessed 10.09 2022].

[6]. PFIZER. (2021a). Fueling Tomorrow’s Breakthrough Therapies Through the Power of Data at Scale [Online]. Available: https://www.pfizer.com/sites/default/files/investors/financial_reports/annual_reports/2021/story/breakthrough-therapies-through-data/ [Accessed 10.03 2022].

[7]. PFIZER. (2021b). Performance data [Online]. Available: https://www.pfizer.com/sites/default/files/investors/financial_reports/annual_reports/2021/files/Pfizer_Performance_Annual_Review.pdf [Accessed 10.02 2022].

[8]. Wang, Y.F. PEG valuation method is recommended for high P/E stocks [Online]. (2021). Available: https://kns.cnki.net/kcms/detail/detail.aspx?dbcode=CCND&dbname=CCNDLAST2021&filename=XJRB202111190052&uniplatform=NZKPT&v=EYpqibmuFanqceDdShEhILPzt2BpoIU2X7WfniAqiakKA4tw1jSQ1pcfcEx24mVtHkAxFMPJmKM%3d [Accessed 10.12 2022].

[9]. Gatlin, A.: Something Unusual Is Happening Right Now With Biotech Stocks [Online]. (2022). Available: https://www.investors.com/news/technology/biotech-stocks-notch-blazing-path-2022/ [Accessed 10.07 2022].

Cite this article

Wang,Y. (2023). The Impact of Research Development and Innovation on Enterprise Development: Case Study of BYD and Pfizer. Advances in Economics, Management and Political Sciences,17,65-70.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 2nd International Conference on Business and Policy Studies

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. BYD. (2022). ANNUAL REPORT [Online]. Available: https://www.bydglobal.com/sitesresources/common/tools/generic/web/viewer.html?file=%2Fsites%2FSatellite%2FBYD%20PDF%20Viewer%3Fblobcol%3Durldata%26blobheader%3Dapplication%252Fpdf%26blobkey%3Did%26blobtable%3DMungoBlobs%26blobwhere%3D1600575229768%26ssbinary%3Dtrue [Accessed 10.1 2022].

[2]. BYD. (2021). ANNUAL REPORT [Online]. Available: https://www.bydglobal.com/sitesresources/common/tools/generic/web/viewer.html?file=%2Fsites%2FSatellite%2FBYD%20PDF%20Viewer%3Fblobcol%3Durldata%26blobheader%3Dapplication%252Fpdf%26blobkey%3Did%26blobtable%3DMungoBlobs%26blobwhere%3D1600575206087%26ssbinary%3Dtrue [Accessed 10.4 2022].

[3]. Lin, Z.: Perspective A - share half annual report: R & D real investment innovation acceleration [Online]. (2022). Available: https://kns.cnki.net/kcms/detail/detail.aspx?dbcode=CCND&dbname=CCNDLAST2022&filename=SHZJ202208310050&uniplatform=NZKPT&v=utc-8PMZc0naj4J7c9Z-sizzQjg-TvWIxAECLoMGO7PMqHOCDTaVS4rW0iPdpZ3rGMfRXE8XHZE%3d [Accessed 10.06 2022].

[4]. BYD. (2020). CSR report [Online]. Available: https://www.bydglobal.com/sitesresources/common/tools/generic/web/viewer.html?file=%2Fsites%2FSatellite%2FBYD%20PDF%20Viewer%3Fblobcol%3Durldata%26blobheader%3Dapplication%252Fpdf%26blobkey%3Did%26blobtable%3DMungoBlobs%26blobwhere%3D1600575179495%26ssbinary%3Dtrue [Accessed 10.2 2022].

[5]. Fornell, C., Mithas, S., Morgeson, F.V., Krishnan, M. S.: Customer Satisfaction and Stock Prices: High Returns, Low Risk [Online]. (2006). Available: https://www.bydglobal.com/sitesresources/common/tools/generic/web/viewer.html?file=%2Fsites%2FSatellite%2FBYD%20PDF%20Viewer%3Fblobcol%3Durldata%26blobheader%3Dapplication%252Fpdf%26blobkey%3Did%26blobtable%3DMungoBlobs%26blobwhere%3D1600575179495%26ssbinary%3Dtrue [Accessed 10.09 2022].

[6]. PFIZER. (2021a). Fueling Tomorrow’s Breakthrough Therapies Through the Power of Data at Scale [Online]. Available: https://www.pfizer.com/sites/default/files/investors/financial_reports/annual_reports/2021/story/breakthrough-therapies-through-data/ [Accessed 10.03 2022].

[7]. PFIZER. (2021b). Performance data [Online]. Available: https://www.pfizer.com/sites/default/files/investors/financial_reports/annual_reports/2021/files/Pfizer_Performance_Annual_Review.pdf [Accessed 10.02 2022].

[8]. Wang, Y.F. PEG valuation method is recommended for high P/E stocks [Online]. (2021). Available: https://kns.cnki.net/kcms/detail/detail.aspx?dbcode=CCND&dbname=CCNDLAST2021&filename=XJRB202111190052&uniplatform=NZKPT&v=EYpqibmuFanqceDdShEhILPzt2BpoIU2X7WfniAqiakKA4tw1jSQ1pcfcEx24mVtHkAxFMPJmKM%3d [Accessed 10.12 2022].

[9]. Gatlin, A.: Something Unusual Is Happening Right Now With Biotech Stocks [Online]. (2022). Available: https://www.investors.com/news/technology/biotech-stocks-notch-blazing-path-2022/ [Accessed 10.07 2022].