1. Introduction

Logistics companies connect firms to markets by providing various services, including multimodal transportation, freight forwarding, warehousing, and inventory management [1]. During the COVID-19 pandemic, all kinds of transportation have been negatively affected. In this research paper, the strategies logistics companies implemented from the beginning of the pandemic to the time when the market gradually adapts are discussed, and the effects on the aviation industry are focused on.

The main motive of this research is to deliberate the reasons why logistics companies made such decisions to respond to the crisis. For example, what kind of efficient supply chain has the company built up, and how the company introduces the new effective logistical processes in order to reduce the costs while still maintaining company effectiveness. Meanwhile, this research also uncovers the additional advantages brought by the pandemic to logistics companies, such as a burst of demand in cold chain transportation, and analyses the logistics company from four different aspects, namely accessibility, shortage in transportation resources, changing in the demand, and rising in cost in logistics. Therefore, the significance of this research is to understand how logistics companies boost their competitiveness and change their marketing patterns.

2. Threat and Opportunity the Logistics Company Faces under the Pandemic

2.1. Threat: Maintenance of Means of Transport

Firstly, one of the severe issues logistics companies face is the storage of means of conveyance, for example, vehicles, cargo ships, air crafts, etc.

As one of Hong Kong's flag carriers, Cathay Pacific offers passenger and cargo services to around 200 cities in Asia, Europe, North America, Africa, and Australia [2]. It has been trying to deal with the management of the rapid surge in the number of aircraft lying idle, which is caused by a decline in travel demand during the COVID-19 pandemic. As 70% of its aircraft were grounded during the outbreak of the pandemic, parking, protection, and reactivation of aircraft lying idle become the prime task.

The disbursement and costs of parking and maintenance of parked aircraft are just as much as they are for an aircraft that is flying. The loss of Cathay Pacific was US$2.79 billion in the 2020 calendar year [3]. According to Cathay Pacific Group Chairman Patrick Healy, Cathay Pacific was trying to achieve 25% of its 2019 capacity in the first six months of 2021 in operation [4]. Due to a sudden decrease in travel demands due to travel restrictions, the company decided to use long-term storage facilities in Spain and Australia. Companies needed to consider the environmental conditions of storing as the cost of maintenance and repair was considerable.

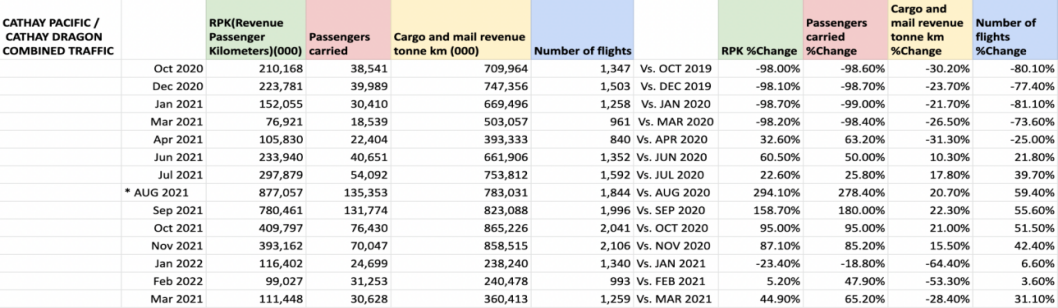

Therefore, Cathay Pacific started to pay attention to cargo transportation. “As has been the case for most of this year, our cargo business continues to be the better performer.” [5]. Figure 1 shows the traffic figures from 2020 to 2022.

Figure 1: Cathay Pacific recovery in air travel.

*RPK (revenue passenger kilometers) measures the air traffic for airbus and aircraft using the formula: RPK or RPM = P*D where P is the total of revenue paying passengers and D is the distance traveled in kilometers.

**Cargo tonne-kilometres means the product obtained by multiplying the number of tonnes of revenue load carried on each flight stage by the stage distance flown measured in kilometres.

Figure 1 demonstrates the recovery in air travel and cargo transportation. However, when comparing the percentage change of Revenue Passenger Kilometers (RPK) with cargo revenue, it can be seen that although there was a decrease in cargo revenue, the influence due to travel restrictions on cargo was much smaller than on passengers traveling. The market was most severely impacted by the implementation of travel restrictions in the fourth quarter of 2020 and the first quarter of 2021.

2.2. Opportunity: An Increase in the Revenue from Cargo Transportation

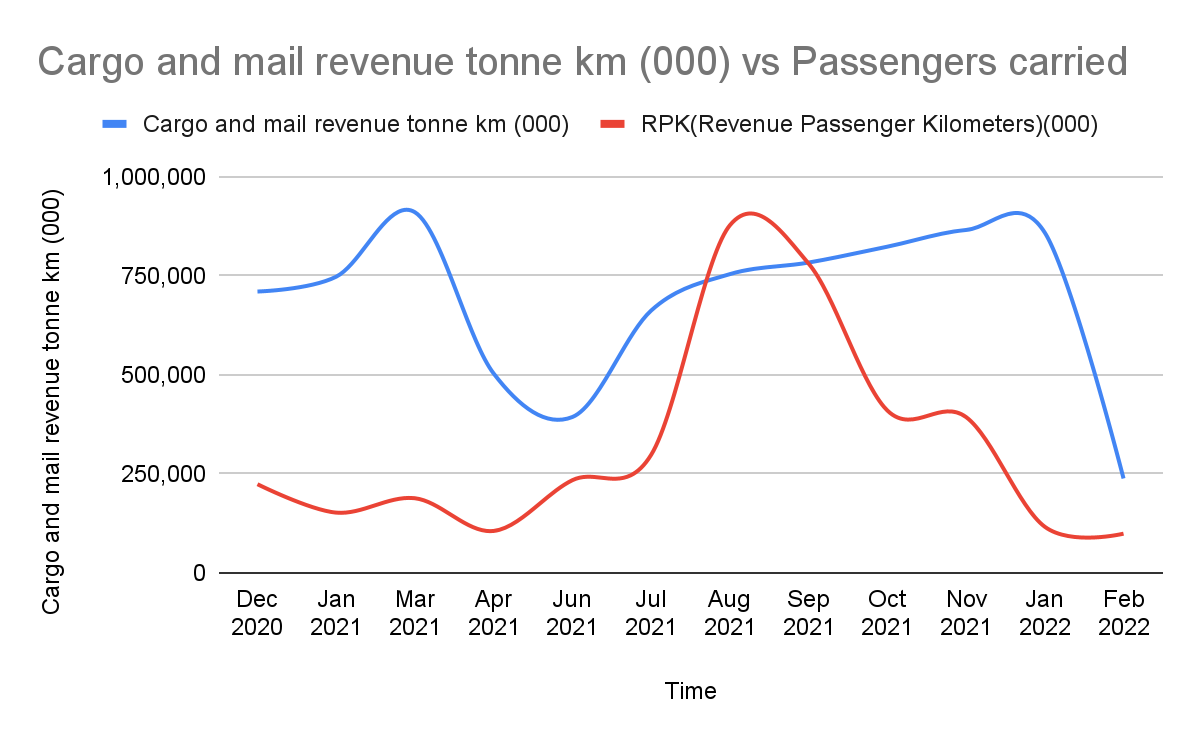

The strict crew quarantine rules in Hong Kong limited overall cargo capacity, resulting in a 39.4% year-over-year decrease in capacity in March 2021. This happened in spite of the efforts to increase the number of cargo-only passenger flights and contracted freighter flights out of the subsidiary. Figure 2 demonstrates the changes in cargo and freight transportation.

Figure 2: Cargo & mail & passenger flight.

The strategy of most logistics companies was to focus on cargo transportation due to fewer travel restrictions. In March 2021, the demand for cargo on Cathay Pacific was boosted due to the reduction in the length of the quarantine for crew members. Nevertheless, for the next few months, as shown in Figure 2, the capacity for cargo and mail remained significantly affected due to the difficulty in crew rostering lead time. The number of regularly operating cargo-only passenger flights and freighters was at the lowest level since the pandemic started. The situation started turning good after April because of increasing demand of COVID-19 vaccines. There were around 15 million vaccines being shipped by Cathay Pacific around the world. Thanks to the reduction in costs and strong cargo demand, airlines earned 79% of revenue from cargo transportation in 2021 [5].

3. Marketing Strategy Development under the Pandemic

3.1. Vaccine Transport

Since the beginning of 2021, when the promotion of vaccination started to overwhelm, the transportation of vaccines has been a challenge for logistic companies. The shipping of billions of COVID-19 vaccines around the world is being more and more difficult. Logistics companies such as DHL, FedEx, and UPS were working on distribution plans in the USA. As a consequence of observed spikes in demand for related medical and healthcare goods, companies started to focus on using all capabilities to speed up the delivery of these vital shipments.

Until December 2021, UPS, which is a logistics company offering international packages and freight transportation, surpassed one billion COVID-19 vaccine doses, since it is one of the logistic companies that are responsible for the Pfizer-BioNTech corporation's COVID-19 vaccine delivery.

The UPS network not only assisted healthcare businesses and international organizations but also participated in public-private partnerships to distribute vaccines by using the cold chain to remote areas. In order to achieve this, UPS Healthcare identified around 500 trade channels to facilitate international vaccination shipments. To accomplish this, UPS had to implement ultra-cold freeze to facilitate equitable distribution, as well as UPS Healthcare subsidiary - Marken, which UPS acquired in 2016. It played an important role since it was involved in nearly all vaccines and treatments in development today. Aviation companies, like Cathay Pacific, decided to load temperature-sensitive cargo [6]. This strategy has helped them to maintain their cargo services. Despite the fact that some of the passenger flights were grounded, this really gives them opportunities to boost and expand because passenger planes and their pilots are able to transport vaccines to regions of the world.

Along with the demand for vaccine transportation, technology innovation in each logistics company becomes the "centrepiece." Cold chain transportation became mainstream transportation during the pandemic. The cold chain refers to the transportation of temperature-sensitive products along a supply chain through thermal and refrigerated packaging methods and the logistical planning to protect the integrity of these shipments.

3.2. Grocery and Food Delivery

With the consumption upgrade and the new retail innovation model opening up online and offline, the consumption scenarios will be more multiple.

Therefore, not only during the transportation of vaccines but also during COVID-19 lockdowns, grocery and food deliveries have become a necessity. Waitrose, one of the major grocery stores in the UK, has developed a delivery business due to a change in customer shopping behaviour. More customers are relying on online ordering instead of going to the shop by themselves. In early 2022, Waitrose collaborated with Deliveroo, which is an online food delivery company. “It is important that we continue to evolve along with shopping behaviour to give our customers more options for how and when they want to shop with us.” [7].

Being this case, logistics companies are trying to make collaborations or making acquisitions with companies that need a large amount of delivery service, which helps them in expanding their services.

3.3. Talent and Technology Management

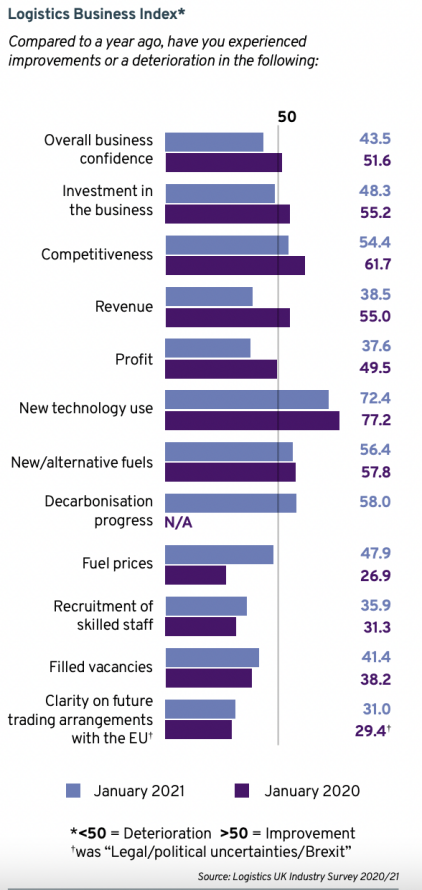

Along with the cancellation of quarantine rules and safety measures in most countries, logistics companies no longer depend on vaccine transportation only but also on the construction of a highly synergistic and sustainable supply chain [8]. This will then lead to an increase in fitter, mechanic and technician roles, and staff gross pay in the future. However, due to the high demand in advanced technology, the use of automated and connected technology is expected to grow.

Figure 3: Change in logistics business (Source: Logistics UK Industry Survey 2020/21).

4. Conclusion

The findings in this paper show that the COVID-19 epidemic has significantly impacted the logistics industry as a result of travel restrictions, a national lockdown, and safety measures that slowed down the shipment process. However, when vaccine production increased, logistics companies began to take steps in that direction, such as applying for medical licenses that allow them to transport vaccines and deliver other healthcare items, to help them achieve the expansion before the competitive market was saturated [9]. Along with the pandemic is the return to normal. The logistics market will still obtain many opportunities as people gradually realise the importance of logistics. Also, with the government supporting policy, leading logistics companies with strong network operation capabilities, leading digital capabilities, and good service quality are expected to benefit from policy benefits [10].

Moreover, due to the rapid development of the logistics industry, there are many small and irregular companies that may cause market disruption [11]. However, along with the development, most small companies will choose to make alliances and cooperation. Thus, more valuable competition will then occur, and the differentiated layout of products and the improvement of service quality will be the main characteristics that consumers need.

References

[1]. Parking and reactivation: How we are storing aircraft during the pandemic. Cathay. (n.d.). Retrieved October 5, 2022, from https://www.cathaypacific.com/cx/en_US/offers/cathay-stories/alice-springs.html.

[2]. Following in the footsteps of a COVID-19 vaccine shipment. Cathay Pacific. (n.d.). Retrieved October 9, 2022, from https://www.cathaypacific.com/cx/en_US/about-us/community-stories/covid-19-vaccines-shipment.html.

[3]. IFC (International Finance Corporation). The Impact of COVID-19 on Logistics. Retrieved October 9, 2022, from https://www.ifc.org/wps/wcm/connect/2d6ec419-41df-46c9-8b7b-96384cd36ab3/IFC-Covid19-Logistics-final_web.pdf?MOD=AJPERES&CVID=naqOED5.

[4]. CFLP (China Federation of Logistics & Purchasing). 7 important factors will affect the future development of the logistics industry. China Post Express News. China Logistics and Purchasing Network. (n.d.). (2017). Retrieved September 30, 2022, from http://www.chinawuliu.com.cn/zixun/201701/10/318354.shtml.

[5]. Cathay Pacific Airways Ltd. Nikkei Asia. (n.d.). Retrieved October 5, 2022, from https://asia.nikkei.com/Companies/Cathay-Pacific-Airways-Ltd.

[6]. How we keep COVID-19 vaccines cold. Cathay Pacific. (n.d.). Retrieved October 5, 2022, from https://www.cathaypacific.com/cx/en_US/about-us/community-stories/covid-19-vaccines-cold.html.

[7]. Waitrose and Deliveroo trial new rapid grocery service (2022). Retail Bulletin. (n.d.). Retrieved October 9, 2022, from https://www.theretailbulletin.com/food-and-drink/waitrose-and-deliveroo-trial-new-rapid-grocery-service-11-02-2022/.

[8]. How the coronavirus has changed logistics (2021). DB Cargo. (n.d.). Retrieved October 9, 2022, from https://www.dbcargo.com/rail-de-en/logistics-news/how-the-coronavirus-has-changed-logistics-coronavirus-pandemic-6341844.

[9]. Burman, J. How logistics companies are continuing to respond to COVID-19. SHD Logistics. (n.d.). (2021). Retrieved October 8, 2022, from https://www.shdlogistics.com/covid-19/how-logistics-companies-are-continuing-respond-covid-19-crisis.

[10]. Chu, F., Saxon, S., Wang, R., Zhao, G. Five things to know about the Chinese logistics market for 2022. McKinsey. (n.d.). (2022). Retrieved September 30, 2022, from https://www.mckinsey.com/industries/travel-logistics-and-infrastructure/our-insights/five-things-to-know-about-the-chinese-logistics-market-heading-into-2022.

[11]. Guide to Reshaping Supply Chains in the Post-epidemic Era No. 4: Logistics Strategy in the Post-epidemic Era: Building a Resilient, Highly Collaborative and Sustainable Logistics Supply Chain. Deloitte China. (n.d.). (2022). Retrieved October 8, 2022, from https://www2.deloitte.com/cn/zh/pages/strategy-operations/articles/project-management-manufacturing-of-a-guide-to-sustainable-logistics-supply-chain-whitepaper.html.

Cite this article

Hua,B. (2023). A Study on the Marketing Strategy Development of Logistics Companies under COVID-19. Advances in Economics, Management and Political Sciences,17,71-75.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 2nd International Conference on Business and Policy Studies

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Parking and reactivation: How we are storing aircraft during the pandemic. Cathay. (n.d.). Retrieved October 5, 2022, from https://www.cathaypacific.com/cx/en_US/offers/cathay-stories/alice-springs.html.

[2]. Following in the footsteps of a COVID-19 vaccine shipment. Cathay Pacific. (n.d.). Retrieved October 9, 2022, from https://www.cathaypacific.com/cx/en_US/about-us/community-stories/covid-19-vaccines-shipment.html.

[3]. IFC (International Finance Corporation). The Impact of COVID-19 on Logistics. Retrieved October 9, 2022, from https://www.ifc.org/wps/wcm/connect/2d6ec419-41df-46c9-8b7b-96384cd36ab3/IFC-Covid19-Logistics-final_web.pdf?MOD=AJPERES&CVID=naqOED5.

[4]. CFLP (China Federation of Logistics & Purchasing). 7 important factors will affect the future development of the logistics industry. China Post Express News. China Logistics and Purchasing Network. (n.d.). (2017). Retrieved September 30, 2022, from http://www.chinawuliu.com.cn/zixun/201701/10/318354.shtml.

[5]. Cathay Pacific Airways Ltd. Nikkei Asia. (n.d.). Retrieved October 5, 2022, from https://asia.nikkei.com/Companies/Cathay-Pacific-Airways-Ltd.

[6]. How we keep COVID-19 vaccines cold. Cathay Pacific. (n.d.). Retrieved October 5, 2022, from https://www.cathaypacific.com/cx/en_US/about-us/community-stories/covid-19-vaccines-cold.html.

[7]. Waitrose and Deliveroo trial new rapid grocery service (2022). Retail Bulletin. (n.d.). Retrieved October 9, 2022, from https://www.theretailbulletin.com/food-and-drink/waitrose-and-deliveroo-trial-new-rapid-grocery-service-11-02-2022/.

[8]. How the coronavirus has changed logistics (2021). DB Cargo. (n.d.). Retrieved October 9, 2022, from https://www.dbcargo.com/rail-de-en/logistics-news/how-the-coronavirus-has-changed-logistics-coronavirus-pandemic-6341844.

[9]. Burman, J. How logistics companies are continuing to respond to COVID-19. SHD Logistics. (n.d.). (2021). Retrieved October 8, 2022, from https://www.shdlogistics.com/covid-19/how-logistics-companies-are-continuing-respond-covid-19-crisis.

[10]. Chu, F., Saxon, S., Wang, R., Zhao, G. Five things to know about the Chinese logistics market for 2022. McKinsey. (n.d.). (2022). Retrieved September 30, 2022, from https://www.mckinsey.com/industries/travel-logistics-and-infrastructure/our-insights/five-things-to-know-about-the-chinese-logistics-market-heading-into-2022.

[11]. Guide to Reshaping Supply Chains in the Post-epidemic Era No. 4: Logistics Strategy in the Post-epidemic Era: Building a Resilient, Highly Collaborative and Sustainable Logistics Supply Chain. Deloitte China. (n.d.). (2022). Retrieved October 8, 2022, from https://www2.deloitte.com/cn/zh/pages/strategy-operations/articles/project-management-manufacturing-of-a-guide-to-sustainable-logistics-supply-chain-whitepaper.html.