1. Introduction

A nation's banking system is a crucial part of its overall financial structure and is critical for the functioning of the financial system. When consumers cannot finance their purchases with their funds, they frequently turn to bank loans. Loans can also increase a bank's liquidity. For the bank to get a consistent monthly cash flow and for part of the revenue to be enhanced through personal loan interest rates, the borrower must make timely monthly repayments of principal and interest after issuing the loan. These are the explanations behind banks' introduction of a range of loan products. Many loans are available from banks to qualified clients. Commercial banks' assets are composed of the loans they issue. Banks must abide by pertinent regulatory requirements during the loan-issuing process, including lending limitations and lender liability concerns.

2. Individual Home Loans

The U.S. consumer housing credit market has developed over time and has become an essential element in the national economy. Housing finance in the U.S. has broadly gone through two stages: the traditional single housing finance system with a deposit and loan structure before the 1970s and the secondary market finance system with mortgage securities from the late 1970s to the present [1]. To achieve the goal of adequate housing for all residents, the U.S. federal government has extensively used the financial institutions established to promote homeownership and home building through mortgage lending. It has provided various incentives to home buyers, including lower interest rates on loans and personal income tax exemptions on interest paid on the home mortgage.

Mortgages are the traditional dominant form of housing credit in the United States. Home mortgages account for about 90% of the U.S. banking system, making it the world's most significant housing finance market [1]. In the U.S. housing mortgage market, housing finance differs from the traditional indirect financing mechanism dominated by depository financial institutions. The rise of a large number of non-depository financial institutions such as mortgage bank pension funds, insurance companies, mutual funds, etc., economic innovation, and the development of electronic information technology has provided new opportunities for the increasing securitization, marketization, and globalization of U.S. residential finance [2].

When consumers are buying a home, they usually choose the right type of home loan for them. U.S. banks have different types of home loans, roughly divided into adjustable-rate mortgages and fixed-rate mortgages. A fixed-rate mortgage (FRM) is a type of loan where the interest rate does not change over the life of the loan. The monthly interest rate you pay on a mortgage does not change throughout the life of the loan. The interest rate on this type of mortgage is fixed and is not affected by market fluctuations. This type of home loan is the most popular mortgage in the United States. An adjustable-rate mortgage (ARM) is a loan where the interest rate changes periodically. Compared to fixed-rate mortgages, ARM generally has relatively low initial interest rates and lower monthly interest payments. After the initial fixed-rate period, the interest rate and monthly payments may change [3].

In contrast to FRM, ARM comes with risks. The lender will pay more interest each month because there is a risk of rising interest rates with ARM. ARM might be cheaper than fixed-rate mortgages, and FRM rates are usually slightly higher than ARM. However, once the lower rate period for ARM is over, later rates may increase, resulting in higher monthly payments. Lenders can save a lot of money if ARM rates drop later in the year. It can be a good choice if a lender is applying for a home mortgage when interest rates are high. However, if the initial mortgage rate is low, it may be better to use a fixed-rate mortgage.

Home mortgages in China are mainly adjustable-rate mortgages (ARM). The interest rate for housing loans in China, like other deposit and loan rates, is based on the benchmark interest rate set by the central bank for the corresponding term. Under the stipulated benchmark interest rate, each commercial bank can fluctuate appropriately according to its credit rating, the borrower, and different bargaining power. However, in general, banks give preferential interest rates to their customers to compete for customer resources and expand their market share for mortgage loans. The number of houses purchased corresponds to different lending policies. If the borrower purchases affordable housing, the down payment ratio shall not be less than 20% of the total purchase price; if the borrower purchases the first housing other than affordable housing, the down payment ratio shall not be less than 30% of the total purchase price; if the borrower purchases the second housing, the down payment ratio shall not be less than 60% of the total purchase price. If the borrower buys an existing house, the total purchase price of the house shall be lower than the house's appraised value and the purchase contract's total price. The maximum amount of the first housing loan is 1.2 million RMB, and the benchmark interest rate is enforced. The benchmark mortgage rate is a guideline issued by the People's Bank of China to commercial banks. Commercial banks will set their portfolio of deposit rates based on this benchmark rate. The maximum amount of the second housing loan is 600,000 RMB, and the loan interest rate is 1.1 times the benchmark interest rate for the same period [4].

One of the differences between home mortgages in the U.S. and China is the difference in market-driven products. Home mortgages in China are mainly adjustable-rate mortgages (ARM) [5], where the interest rate is adjusted in accordance with changes in market interest rates. In the U.S., home mortgage loans are mainly fixed-rate mortgages (FRM) [3]. Although adjustable-rate loans are growing faster, they still do not account for as much market share as fixed-rate loans. There are also differences in the adjustment of interest rates between the banks of the two countries. Interest rates in China are not set autonomously. It was controlled by the People's Bank of China. Housing loan interest rates, like other deposit and loan rates, are based on the benchmark interest rate set by the central bank for the corresponding term. Under the stipulated benchmark interest rate, each commercial bank can float appropriately according to the borrower's credit rating with different bargaining power. However, in general, banks give preferential interest rates to their customers to compete for customer resources and expand their market share in mortgage lending. Adjustable rates in the U.S. are adjusted according to the market rate for a certain period of time, and the adjustment period varies for different mortgages that lock in different reference indices. Therefore, ARM in the U.S. is more sensitive to changes in interest rates than ARM in China.

Banks in both countries lend to different people. U.S. home mortgages are designed to solve the housing problems of buying a house when you’re young. However, Chinese home mortgage loans are granted to borrowers who meet certain loan application requirements. The borrower's income profile and credit rating are relatively high, with strict down payment restrictions.

Banks in both countries have different models of mortgage lending. There are more models of mortgages in the United States, including variable-rate mortgages, revolving residential mortgages, installment mortgages, standard fixed-rate mortgages, and jumbo pay-off mortgages. Because interest rates have not been fully marketed and liberalized in China, market interest rates are still set by the People's Bank of China, and commercial banks have very little autonomy.

The last difference between home mortgages is the Chinese and American insurance institutions. Currently, only commercial insurance companies provide insurance coverage for home buyers in the primary market in China's individual home mortgage insurance market. The secondary market for Chinese home mortgages is still underdeveloped and does not transfer bank risks well. At the same time, when the bank as the mortgagee, wants to file a lawsuit or apply for arbitration in court, it must pay the corresponding fees, increasing the running cost of realizing the claim. Therefore, when a borrower defaults, the home mortgage market needs an alternative to default to mitigate the risk's impact on the Chinese banks. The U.S. home mortgage insurance mechanism is a typical combination of a government agency and a commercial insurance company. The Federal Housing Administration (FHA), VA, and others directly intervene in the housing market to provide home loan insurance for low- and moderate-income residents to defuse the banks' lending risks [6].

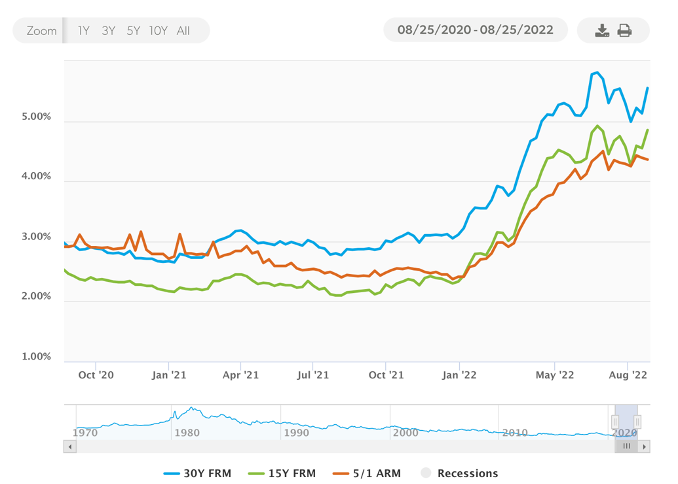

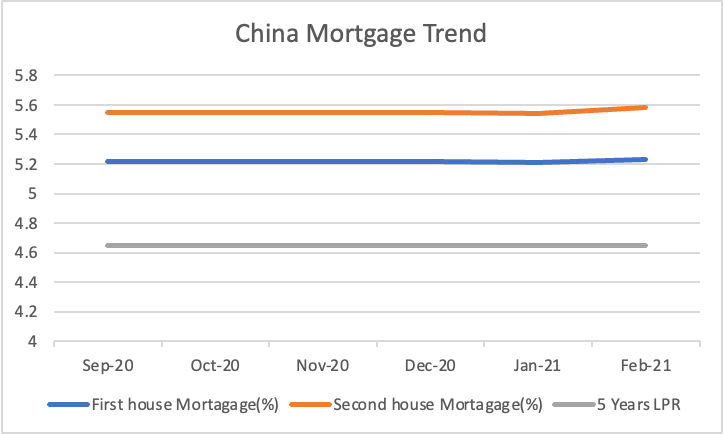

The People's Bank of China stipulates that the maximum term of personal and commercial housing loans is ten years. In contrast, Wells Fargo, the largest mortgage lender in the United States, has a maximum term of 30 years. According to pre-pandemic data, housing loans in mainland China are about 4.9%-6.37%, compared with 3.69% in the United States, an interest rate one point lower than in China. This low-interest rate has given the U.S. property market the space and impetus to rise wildly. However, at the beginning of January this year, the average interest rate on a 30-year fixed mortgage in the United States was 3.25%, and then rose to 5.27% in May this year and has now peaked at 6.13%. In contrast, China's latest 1-year LPR is 3.7%, and the 5-year LPR is 4.45%. China's central bank has cut mortgage rates to the lowest in nearly two decades. Figure 1 below is an indicator chart of the U.S. 5-year, 15-year, and 30-year mortgage interest rates rising since 2020. Since the Fed's interest rate hike in January 2022, the hawkish attitude has become obvious, and US housing loans have risen rapidly. In contrast, in Figure 2, China's housing loans did not fluctuate much during the same period.

Figure 1. LPR data of United States in pre-pandemic session.

Figure 2. Mortgage rate trends.

This time, the inversion of mortgage interest rates between China and the United States is caused by differences in central bank policies. Now the United States has entered an interest rate hike cycle, raising interest rates by 25 basis points for the first time in nearly two years in March, and the Federal Reserve expects that there will be more aggressive interest rate hikes in the future to deal with high inflation. On the contrary, China's economy is slowing down, and the central government has indicated that it will be moderately loose, so interest rate expectations will moderately decline. Treasury bond interest rates will maintain a moderate downward trend. Due to the rising and falling interest rate cycle, the interest rate of China and the United States has finally been inverted.

Through the great difference in loan interest rates between the two countries during the same period, we can further compare the differences in the LPR mechanisms of the two countries. The U.S. Loan Prime Rate (LPR) originated during the Great Depression in the 1930s, when the Federal Reserve chose the Federal Funds Target Rate (FFTR) as the interest rate anchor for LPR [6]. When an interest rate cut occurs, market investors will be overly optimistic, making the real interest rate fall more than the interest rate anchor, the federal fund's target rate, and the deviation caused by the pessimism caused by the relative interest rate hike will be greater.

Calculated as follows:

US LPR = Federal Funds Target Rate + 300BP

On the other hand, the People's Bank of China defines LPR as the interest rate quoted in the loan market. The interest rate anchor is based on open market operations, mainly referring to the medium-term lending facility rate (MLF) [6]. This reflects the marketization of interest rates by the central bank.

In the context of global inflation, using bank loans to purchase real estate, commodities, and other assets closely related to inflation is both a hedge against inflation and an important means of getting rich. The change of mortgage mainly depends on the impact of the policy. Nowadays, different banks offer different mortgage loan denial offers, including rates and discounts. Many banks will set lower interest rates or give various preferential policies to attract customers. Then home buyers can save a lot of money by choosing these banks with stronger offers. When the house increases in value, we will have more money. The most important thing is that your property will increase in value yearly, which is called appreciation. Conservative estimates suggest that the average U.S. home price appreciates by more than 3%, which is not a staggering rate. Let's consider a $100,000 single-family home investment where you put $20,000 towards a 30-year mortgage at 5%, and this $80,000 loan will be paid back by someone else in 30 years, during which time you should earn $3,000 per year, for a total of $90,000. Many individuals in the United States have made much money this way.

3. Student Loan

Student loans are an important part of personal loans. These loans are usually provided to College Students who cannot afford huge amounts of tuition. Student loans are quite special because they are probably less profitable than other personal loans. Interest rates of student loans are usually lower than interest rates of other personal loans. Some banks even provide student loans with zero interest rates. Banks may even lose money from lending money to students with loan defaults. However, as tuition fees rise, more and more students who pursue higher education need to borrow money from banks and pay for their tuition and other expenses in school. The percentage rise in tuition fees even exceeds that of the inflation rate. College tuition is becoming more and more expensive. To provide students equal chances to attend College, governments subsidize students and institutions. Therefore, the purpose of student loans is to provide equality instead of making profits. Low-interest rates and policy support also encourage students to borrow student loans from banks and attend Universities [7].

4. Comparison of College Loan Systems in China and the United States

Comparison of college loan systems in China and the United States: This paper only compares and analyzes three aspects of the loan management institutions, loan operation mechanisms, and loan repayment guarantees.

4.1. Governing Body of the Loan

The U.S. student loan system is extensive and complex. For example, Stafford Loan, Perkins Loan, and PLUS Loan are collectively called "Federal Family Education Loan Program" in the U.S. loan application [7]. Therefore, the management of the system is multi-level, multi-channel, and diversified. The main parties involved in managing the loans are the government public institutions responsible for managing the entire loan program and setting goals. At the same time, the government also provides subsidies to encourage banks to grant loans to students.

Besides, the government must also provide an administrative fee to the banks to share the cost of administration of the lending institutions. The second is the lending institution, which is responsible for the overall implementation of the loan program. The lending institution can be either a commercial bank or a non-financial institution that issues student loans. The third is the guarantor agency, the state government higher education guarantors. In addition to state higher education guaranty agencies, special private guaranties act as "credit third parties" to prevent defaults. The fourth is the servicing agency, mainly a loan recovery agency responsible for recovering the student's payment after graduation.

China's student loan management agencies are: First, the government agencies are mainly composed of the central-level national money management center, the Ministry of Education, the Ministry of Finance, and the People's Bank of China. The management center is mainly responsible for implementing student loan policies and promoting related work, coordinating the relationship between education, finance, banking, and other departments and schools. The Ministry of Education, on the other hand, studies how to utilize the policies related to national student loans according to the development of education in the country. The Ministry of Finance is responsible for allocating funds for student loan subsidies to schools affiliated with the national ministry and monitoring the use of the subsidized funds. The People's Bank of China determines the loan-running banks, approves the relevant methods, and supervises the implementation of the loans by the applicable national policies. Secondly, the lending institutions are mainly undertaken by the operating banks, primarily responsible for formulating specific management measures for national student loans and managing the approval, issuance, and recovery of national student loans [7].

The above comparison shows that the U.S. student loan administration is well established, with a clear hierarchy of responsibilities. From the formulation of loan policies to the implementation of loan disbursement to the guarantee of loan recovery, there are transparent management agencies to complete their work, especially the participation of guarantee agencies and service agencies in the management to ensure the effective and smooth implementation of loans. In China, the loan management agency involves the National Loan Management Center, Ministry of Education, Ministry of Finance, banks, and schools, which perform the duties of policy formulation, allocation of subsidy funds, loan implementation, and recovery, respectively. Still, the loan guarantee and recovery services are slightly lacking from the management agency, which is not conducive to the active disbursement of loans and increases the banks' concerns about the risk of loan repayment [7].

4.2. Mechanism of Loan Operation

Among the major types of federal loans in the U.S., the Perkins Student Loan is a government loan issued by the school. The Stanford Student Loan is a commercial banking system that lends money to students and is guaranteed by state educational guaranty agencies on behalf of the government. And the Undergraduate Parent Loan Program is a program in which banks or other financial institutions lend money to students' parents to enable them to finance their children's undergraduate studies. The federal government provides "special grants" and "special allowances" to increase the incentive for banks to participate in the program [7]. At the same time, the government also provides overhead subsidies to guarantee agencies share their administrative costs. Servicers are intermediaries between lenders and borrowers and are responsible for recovering loans from borrowers. The guarantor is another intermediary between the lender and the borrower and is responsible for paying the loan due to the lender in the event of a default in repayment. At the same time, the borrower also pays a guarantee management fee to the guarantor to share its management costs. The whole operation mechanism reflects the multi-participation of the government and the market and risk-sharing characteristics.

The development of student loans in the U.S. is also mainly due to the operation of the secondary market for loans, in which banks sell student loans to financial enterprises that operate student loans. The enterprises then sell the loans they hold to investors in securities and notes, thus realizing the "securitization of assets" or the secondary market for student loans. Since the federal government guarantees student loans, investors are willing to buy securitized securities.

There are three primary forms of student loans for college students in China [7]:

• National student loans

• Interest-free loans for students from colleges and universities with school funds

• General commercial student loans

National student loans are an essential measure the state takes to financially finance students from low-income families in colleges and universities. Interest-free loans for students from colleges and universities with school funds are reformed from the people's grant system. Besides, general commercial student loans are a kind of commercial loans for students, their parents or their guardians in colleges and universities to support students in completing their studies, guided by credit principles. Loans. Among them, the national student loans have the most considerable financial support and scale and are the main content of student loans for college students.

In China's operation mechanism, national student loans are bank loans operated by banks, education administration departments, and colleges and universities specifically to help students from low-income families in colleges and universities. The operation process is mainly as follows: First, determine the loan plan. The school will qualify the borrower's application and then submit the school loan application report to the loan management center. After reviewing and summarizing the school loan application reports, the Management Center will allocate the loan amount of each school according to the ratio of economically disadvantaged students to students in school. Moreover, according to the guiding plan of national student loans for schools determined by the inter-ministerial coordination group and the annual subsidy funding approved by the Ministry of Finance, issued to the schools and copied to the lending institutions. Second, issue loans. After the lending institution receives the borrower's application materials, the contract of applying for the national student loan, and other materials reported by the school, it will prepare the notice of loan release and notify the borrower's school after the examination and approval. Then the bank will directly transfer the loan to the account designated by the borrower's school according to the academic year. Third, the loan subsidy is allocated. At the end of each quarter, the Management Center checks the national student loan subsidy interest list provided by the head office of the bank that handles the loan. After the verification, the national student loan subsidy funds allocated by the Ministry of Finance will be deposited into the head office of the bank that handles the loans.

In comparison, it can be seen that the two governments have adopted "special subsidies" and "financial subsidies" to stimulate lending institutions to grant loans actively. However, in terms of operation mechanism, U.S. student loans also rely on the operation of the secondary market so that more social funds can participate, providing more funds for student loans and increasing the liquidity of the funds. Education financier Bruce Johnstone said, "If student loan notes can be sold to private capital holders, they can become an asset with a potential investment value in the private capital market." This is a good inspiration for our student loans, and developing a secondary market for loans should also be considered in our loan operation mechanism.

4.3. Loan Repayment Guarantee

Loan recovery is another critical aspect of American student loans: The U.S. Department of Education has developed a number of approaches for banks and related interest groups to manage loan recovery and reduce defaults. More stringent qualifications and requirements have been imposed on the eligibility of loan applications. For example, in the 1998 amendment to the Higher Education Act, the eligibility requirements for a student suspected of committing a crime and for schools with a delinquency rate of 25 percent or more have also been established [7]. They are taking into account the impact of changes in family contribution factors due to changes in family income, etc., on the need for financial aid. The federal and state ministries of education have strict regulations requiring lending institutions to make efforts to collect loans. If a borrower cannot repay a loan, then the government must repay the loan as a guarantor. At the same time, since the guarantee amount charged by the guarantor depends on the default rate, the lower the default rate, the higher the guarantee amount. The guarantor will try to lower the default rate to get a higher guarantee, thus enhancing the recovery of loans. In a well-established credit system, each citizen has a record of the social security number and bank account number, and other personal credit files. The U.S. student loan program can be more from the borrower to mitigate the risk, thus maximizing the loan repayment.

China adopts the form of credit guarantee for student loans. That is, besides requiring the borrower to have excellent academic performance, obey the law and be of good moral character during his study period, he only needs to provide the valid ID cards of his parents and himself, the income certificates of his family members and the valid ID cards and income of his guarantors, as well as to provide witnesses and introducers, to apply for student loans from banks. In the "Regulations on the Administration of National Student Loans (for Trial Implementation)" promulgated by the People's Bank of China, the Ministry of Education, and the Ministry of Finance in 1999, it is stipulated that "the bank that handles the loans is responsible for managing the approval, issuance, and recovery of national student loans." The banks mainly make the recovery of the loans. However, the last article in the "Measures for the Administration of Student Loans" issued by the People's Bank of China in 2001 states that "any bad or doubtful loans issued by commercial banks shall be verified by the head office of each commercial bank and written off following the actual amount incurred before income tax [7].

The above comparison shows that the U.S. has reduced the risk of loan repayment at the source due to the strict restrictions and examination of applicant qualifications. The introduction of guarantee institutions and service institutions has strengthened the guarantee of loan repayment from the system, and the perfect credit system has effectively controlled the loan risk from the root. In China, loan recovery is mainly made by the handling bank, and credit loans are implemented for borrowers. At the same time, it is difficult for banks to assess the creditworthiness of borrowers effectively. The certainty of loan repayment is difficult to guarantee, coupled with the lack of a loan guarantee mechanism, which causes banks to be cautious and slow in selecting borrowers. Hence, it is imperative to establish a national guarantee system and a personal credit system.

5. Thoughts on College Loans of China

5.1. Introduction of Intermediaries and Servicers and a Sound National Guarantee Mechanism

The intermediaries (guarantors and servicers) are responsible for intermediating the guarantee and recovery of loans, as seen in the loan management institutions in the United States. Establishing and introducing non-bank financial intermediaries in China is necessary to make the loans operate more effectively and clarify the government's responsibilities. The government can formulate and grasp loan policies from a macro perspective, provide funding for loan subsidies, provide information, supervise intermediaries, etc. In contrast, intermediaries perform micro-operations such as day-to-day management. The introduction of intermediaries can effectively share banks' risks, effectively mobilize their enthusiasm and solve their worries; it can improve the loan management mechanism.

In the economic sense, student loans can promote the reform of college education finance and the more effective distribution of education resources; in the sociological sense, the implementation of student loans can encourage the popularization of higher education and the fairness and equality of opportunities. Therefore, national student loans implement credit guarantees for borrowers, which means no guarantee, and lending institutions have to bear a more significant share of the risk. This also makes lending institutions afraid to issue national student loans on a large scale, making it difficult to use part of the financial subsidy funds to their full potential. As the government, schools, and society are all beneficiaries of state loans, China can consider setting up a state guarantee mechanism involving banks, schools, social groups, and individuals and establishing a state guarantee fund for student loans, which is mainly used to compensate for the principal and interest of loans that are not recovered despite the banks' efforts to collect them. Establishing a national guarantee mechanism can promote the participation of multiple parties to achieve expected benefits and risk sharing.

5.2. Developing the Secondary Market of Students Loans and Improving the Operation Mechanism of College Loans

From the perspective of loan operation mechanism, the successfully established secondary market is an essential feature of student loans in the United States, which also provides a good reference for China. We can consider actively developing the secondary market of national student loans. In other words, under the premise of establishing a guarantee or insurance system for student loans. The provincial and local governments will provide security and insurance, the central government will "re-guarantee" and "re-insure" the loans, and the banks can sell the student loans to some education financing groups that operate student loans. These groups then package the loans and sell them to investors as securities and notes, creating a secondary market for student loans. The function of the secondary market is to create a market for the transfer of state student loan debt. In the secondary market, financial institutions transfer loans out for purchase by third parties for asset and liability management purposes. Through the operation of the secondary market, private and non-government funds are attracted to participate in student loans together, which solves the contradiction between the limited loan funds of banks and the unlimited loan demand and helps to form suitable capital financing. Securitization also overcomes the disadvantage that the non-securitization method of student loans cannot diversify the risk. The high credit rating of the national development banks is a major advantage of the national development banks. With their issuance of education bonds for student loans and national credit as guarantees, the prospect of national student loans should be very optimistic.

5.3. Strengthen the Responsibility and Cooperation Between Banks and Schools and Establish a Standard Management System

China's college student loans adopt a commercial operation mode. The characteristics of current student loans in China are mainly a large number of loans, a small amount, a low-interest rate, a more extended repayment period, and high management costs. Coupled with the low integrity of loan students and the lack of a loan guarantee mechanism caused the low motivation of banks to issue loans. As members of society cannot only take economic interests as a guide for decision-making but also strengthen the sense of social responsibility. Banks indeed bear certain risks and losses, but they should see the obligatory and noble nature of state student loans and the importance of access to higher education for poor students. Therefore, banks should also strengthen their sense of social responsibility while trying to build their commercial brand awareness.

Although it is stipulated in the management of student loans in China that the school is the primary institution and the bank and the school are jointly managed, the school only plays the role of an introducer and a witness. However, the school, as the borrower's manager, is the most appropriate communicator between the borrower and the lender because it knows more about the student's situation than the bank and can more easily supervise the student's repayment. Therefore, in the loan activity, schools should strengthen their management function. Firstly, they should reinforce the qualification examination system for the applicants so that impoverished students can get the loans in time. Secondly, they should strengthen the lender's tracking and management of the loan usage during the loan distribution process and give feedback to the bank in time, and strengthen the credit and integrity education of the students. Thirdly, they should assist the bank in enhancing the recovery of the loans after the loans expire—the work.

Banks and schools should strengthen their sense of responsibility and cooperation and establish a broad and effective joint management mechanism. The focus should be on strengthening the school's commitment to risk management, such as making the university bear particular financial responsibility to enhance the school's sense of responsibility effectively. On the other hand, banks should strive to improve financial services and provide more accessible, faster, and more efficient loan services. With the active participation of banks in student loans and the cooperation of schools, the development of student loans can be sustainable.

6. Personal Consumption Loan

Personal consumption credit is a loan offered by commercial banks for personal consumption purposes. Consumer loans appeared in the U.S. financial market around the second World War. Since borrowing and consumption have become habitual consumption features of U.S. residents, the FED reports that the current scale of consumer credit in U.S. banks has exceeded 6.2 trillion dollars. Generally accounting for about 30% of the entire credit market. In contrast, China's relatively short consumer credit history appeared around 1977. Mainly because after the reform and opening up, we tried to achieve a virtuous circle of social production and supply reproduction through consumer credit under the background of a relative surplus product supply [8].

7. Comparison of Personal Consumer Credit Between China and the United States

This article compares and analyzes two aspects of the loan business category and risk management.

7.1. Loan Business Category

In the commercial banking system of the United States, the categories of consumer credit mainly fall into the following four categories. (1) Installment loan, also known as closed loan. Installment loans include traditional installment loans, where tangible goods are used as collateral, and home equity loans, which are bank loans secured by real property equity and where the bank's credit relationship with the borrower has a definite expiration date through which consumers can obtain secondary mortgages. (2) Open revolving loan. This type of loan includes a pre-approved line of credit, the maximum credit a customer can use. The consumer's credit relationship with the bank lasts as long as the borrower repays the loan regularly, according to the agreement. (3) One-off repayment of the loan. It is generally a short-term loan with a term of one year or less. Usually, 30 days, 60 days, 90 days, half a year, and one year, the loan is repaid in one go at the end of the term, also known as a bill loan. Loans may be unsecured, and if required by banks, the collateral is usually the cash value of government bonds and life insurance contracts, savings accounts, cars, or other easily cashable personal property. (4) Residential mortgage loans. This would not have been a separate category. It could also have been an installment loan, as above. However, due to the large proportion of residential mortgage loans in China's current personal consumption loans, it is specially listed separately. A residential mortgage is a loan in which real estate is used as a mortgage asset. According to whether the interest rate is fixed, it can be divided into fixed-rate mortgages and adjustable-rate mortgages [9].

In China's banking system, consumer loans are also mainly divided into four categories, which are more detailed and limited compared to the division of the business. (1) Housing consumption loans. Including self-employed personal housing loans, entrusted personal housing loans, and personal housing portfolio loans. Self-employed means the business is invested by individuals and engaged in business activities to make profits. It is issued by the lender to the borrower to purchase ordinary houses for self-use or for urban residents to repair or build houses. The mortgage, pledge, or guarantee approved by the lender is used to deposit the first installment of the house in the bank [10]. The maximum loan amount is the house payment. 70% of the RMB special loan with a term of up to 30 years. (2) Auto loan: including housing mortgage auto consumption loan, securities pledged auto consumption loan, performance insurance auto loan, zero down payment auto loan series, and taxi operation certificate pledged auto loan. It is the guarantee provided by the lender to the borrower who purchases the car at the special dealer to purchase the car, pledged with the right recognized by the lender, or has the ability to compensate the unit or individual as the guarantor for the repayment of the principal and interest and the joint and several liabilities. A special RMB loan with a maximum loan amount of 70% of the vehicle payment and a maximum term of no more than 5 years by depositing the first installment of the vehicle in the loan bank. (3) Personal student loans, including national student loans, general student loans, and study abroad loans [10]. It is a special RMB loan issued by the lender to undergraduate and junior college students in financial difficulties in full-time institutions of higher learning to pay tuition fees and living expenses, and the “student loan special account fund” established by the education department to provide discounted interest. (4) Other personal consumption loans. Including decoration loans, medical loans, personal durable consumer goods loans, personal travel loans, credit card loan consumption and deposit certificate or treasury bond pledge loan, personal title certificate pledge loan, personal credit loan, personal comprehensive consumption loans, personal online loans, home consumption loan, personal Salary guarantee loan, high-quality unit employee credit business [9].

7.2. Loan Risk Management

Credit regulation follows the development of personal credit. The United States has a sound and sound personal credit system and laws. From ancient times to the early 20th century, starting with the True Lending Act of 1968, the Fair Credit Reporting Act of 1970, and the Equal Credit Opportunity Act of 1974 and 1976, from the way loan interest rates are marked, information about Standardize the behavior of lending institutions in various aspects such as the disclosure of loans, and the behavior of loan and collection [11]. The establishment of the personal credit evaluation system, which is at the core of risk management, is accomplished through the establishment of consumer credit reporting agencies, which are obtained from consumers' work units, public sectors such as government agencies, and financial institutions that have had credit relationships with consumers. Collect information about consumers' personal credit and then sell to other financial institutions and retailers who need to know this information to judge the applicant's repayment ability and willingness to pay. The establishment of a perfect personal credit registration system has formed a culture of trustworthiness in society, which has greatly promoted the development of the consumer credit market in the United States [11]. In turn, it has played an extremely important role in the standardized development of the consumer credit market.

In contrast, the risk of the consumer credit business of Chinese commercial banks is relatively high. This is mainly because the credit system and legal systems of Chinese banks are not sound enough. At present, China does not have a nationwide personal credit information system, and commercial banks lack authoritative personal credit evaluation standards and systems. It is difficult for banks to grasp the true status of personal income, which is not conducive to risk control in pre-loan review. Not only that, but the imperfect legal system has also become one of the reasons for the high default risk of consumer credit. Currently, the laws and regulations in the field of credit consumption in China are not perfect. First, the current guarantee laws of various commercial banks in my country lack uniformity, authority, and operability. Secondly, the relevant laws on the credit system are almost blank, credit activities cannot be followed, and there are no clear operating rules and legal guarantees for each link in credit economic activities. Third, there is a lack of consumer credit intermediaries, an effective liquidity market that provides risk protection for banks, and an imperfect risk transfer mechanism. In addition, due to the uneven development of consumer credit in various provinces, municipalities, and autonomous regions in China, fraudulent loans and overdue loan repayments have occurred in some regions, and the non-performing loan rate is rising. Among them, the risk of personal vehicle loans is relatively high. Default rates on student loans are also starting to rise. Due to the high loan overdue rate, high loss rate, and low recovery success rate, insurance companies have to withdraw from the vehicle loan insurance market. The withdrawal of insurance companies makes financial institutions face greater risk losses.

8. Conclusion

Overall, there are still significant differences between the loan systems and policies in China and the U.S. As explored in personal home loans, the LPR index in the U.S. is increasing during the epidemic, while the 5-year LPR index in China tends to be stable. This shows that the Chinese government has an absolute say in the macro-control of the housing market in the global inflation situation. Inflation in the United States has been slightly rapid, and loan rates have plummeted but are still under control. This is the result of different housing loan policies. Secondly, at the student loan level, the Chinese side has a stringent review mechanism for student loans, unlike the U.S., where third-party institutions or the investment market can authorize student loans can dictate the loans. Finally, on the personal business loan level. The U.S. commercial banking system has a full range of consumer credit and a healthy credit assessment system, and individual credit is extremely important. In contrast, Chinese commercial banks' consumer credit business is relatively risky. This is mainly because Chinese banks' credit and legal systems are not yet sound. Currently, China does not have a nationwide personal credit system, and commercial banks lack authoritative personal credit assessment standards and systems. In the future, we will continue to elaborate on the depth and breakdown of the lending business in China and the United States. As a college student, you should continue to pay attention to international financial forms and explore their ways.

Acknowledgement

Hongdi Hu, Jiahao Qian, Xiaotong Niu and Kaiyue Zheng contributed equally to this work and should be considered co-first authors.

References

[1]. 2022 What are the latest personal housing loan policies (n.d.). Retrieved August 26, 2022, from https://mip.66law.cn/laws/457647.aspx?ivk_sa=1023345q

[2]. Housing loans. GovLoans. (n.d.). Retrieved August 26, 2022, from https://www.govloans.gov/categories/housing-loans/

[3]. McMillin, D. (n.d.). Fixed-rate mortgages: A guide. Bankrate. Retrieved August 26, 2022, from https://www.bankrate.com/mortgages/what-is-a-fixed-rate-mortgage/

[4]. Mortgage loan options. What are your mortgage loan options? | Central Bank. (n.d.). Retrieved August 26, 2022, from https://www.centralbank.net/mortgage-center/loan-types/

[5]. U.S. Bank Adjustable Rate Mortgage (ARM). Adjustable-rate mortgage loans | ARM rates | U.S. Bank. (2022, August 15). Retrieved August 26, 2022, from https://www.usbank.com/home-loans/mortgage/adjustable-rate-mortgages.html

[6]. H.R.6 - 105th congress (1997-1998): Higher Education Amendments of 1998 ... (n.d.). Retrieved September 1, 2022, from https://www.congress.gov/bill/105th-congress/house-bill/6

[7]. Woodhall, M. (1987). Lending for learning: Designing a student loan programme for developing countries. Commonwealth Secretariat.

[8]. Mortgage rates. Freddie Mac. (n.d.). Retrieved September 1, 2022, from https://www.freddiemac.com/pmms

[9]. Personal consumer credit: A comparison between China and the United States. (n.d.). Retrieved September 4, 2022, from http://rdbk1.ynlib.cn:6251/Qk/Paper/342816#anchorList

[10]. Smyth, D. (2021, February 2). How much do homes increase in value in 10 years? Home Guides | SF Gate. Retrieved September 9, 2022, from https://homeguides.sfgate.com/much-homes-increase-value-10-years-100948.html

[11]. Personal consumer credit_Baidu encyclopedia. Baidu encyclopedia. (n.d.). Retrieved September 4, 2022, from https://baike.baidu.com/item/%E4%B8%AA%E4%BA%BA%E6%B6%88%E8%B4%B9%E4%BF%A1%E8%B4%B7/960595

Cite this article

Hu,H.;Qian,J.;Niu,X.;Zheng,K. (2023). Comparison of Chinese and American Banks' Loan Financing Business. Advances in Economics, Management and Political Sciences,18,1-13.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 2023 International Conference on Management Research and Economic Development

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. 2022 What are the latest personal housing loan policies (n.d.). Retrieved August 26, 2022, from https://mip.66law.cn/laws/457647.aspx?ivk_sa=1023345q

[2]. Housing loans. GovLoans. (n.d.). Retrieved August 26, 2022, from https://www.govloans.gov/categories/housing-loans/

[3]. McMillin, D. (n.d.). Fixed-rate mortgages: A guide. Bankrate. Retrieved August 26, 2022, from https://www.bankrate.com/mortgages/what-is-a-fixed-rate-mortgage/

[4]. Mortgage loan options. What are your mortgage loan options? | Central Bank. (n.d.). Retrieved August 26, 2022, from https://www.centralbank.net/mortgage-center/loan-types/

[5]. U.S. Bank Adjustable Rate Mortgage (ARM). Adjustable-rate mortgage loans | ARM rates | U.S. Bank. (2022, August 15). Retrieved August 26, 2022, from https://www.usbank.com/home-loans/mortgage/adjustable-rate-mortgages.html

[6]. H.R.6 - 105th congress (1997-1998): Higher Education Amendments of 1998 ... (n.d.). Retrieved September 1, 2022, from https://www.congress.gov/bill/105th-congress/house-bill/6

[7]. Woodhall, M. (1987). Lending for learning: Designing a student loan programme for developing countries. Commonwealth Secretariat.

[8]. Mortgage rates. Freddie Mac. (n.d.). Retrieved September 1, 2022, from https://www.freddiemac.com/pmms

[9]. Personal consumer credit: A comparison between China and the United States. (n.d.). Retrieved September 4, 2022, from http://rdbk1.ynlib.cn:6251/Qk/Paper/342816#anchorList

[10]. Smyth, D. (2021, February 2). How much do homes increase in value in 10 years? Home Guides | SF Gate. Retrieved September 9, 2022, from https://homeguides.sfgate.com/much-homes-increase-value-10-years-100948.html

[11]. Personal consumer credit_Baidu encyclopedia. Baidu encyclopedia. (n.d.). Retrieved September 4, 2022, from https://baike.baidu.com/item/%E4%B8%AA%E4%BA%BA%E6%B6%88%E8%B4%B9%E4%BF%A1%E8%B4%B7/960595