1. Introduction

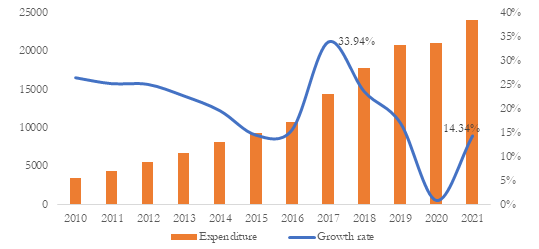

As far as the current population structure and trends are concerned, Guillén found that the aging population, declining birth rate and the extension of the average life expectancy have gradually formed a silver-haired economy and aging finance [1]. Although China has relied on its strict one-child policy to change population trends, no one could have foreseen that China's fertility rate has fallen sharply since the 1960s [2]. The slowdown in childbearing is due to people's tendency to give their children a better life rather than the number of children in a better changing environment. But it is undeniable that China has enjoyed a demographic dividend thanks to its huge population base. In the past few years, China's annual supply of labor is abundant, and the labor population ratio is comparatively high, ensuring the demand for labor force for economic growth [3]. Since the extremum of population aging has not yet arrived, the burden of social security expenditure is relatively light, also the speed of wealth accumulation is relatively fast, these make China owns abundant labor resources and cost advantages. China is undoubtedly the world's factory and the engine of world economic growth. Now, China’s social security expenditures are showing signs of weakness. From the medical insurance expenditures in the past two years, it is not difficult to see that the era of China's demographic dividend is over. Figure 1 shows the total annual medical insurance expenditure and its increment. Since 2017, the increment of medical insurance expenditure has been decreasing year by year and in 2020 bottomed out. Although government spending on healthcare has increased steadily since 2010, its growth rate has fluctuated widely. In 2020, its growth rate is close to 0. At the end of 2019, the COVID-19 epidemic broke out in China. According to data, in 2020, in order to do a good job in the prevention and control of the epidemic, local medical insurance departments have allocated special funds of 19.4 billion yuan to designated institutions for the treatment of patients with COVID-19. The cumulative settlement of medical expenses for patients with new coronary pneumonia throughout the year was 2.84 billion yuan, of which 1.63 billion yuan was paid by the medical insurance fund [4].

Figure 1: Expenditure of medical insurance and its growth rate from 2010 to 2022(Photo credit: Original Data source: National Bureau of Statistics.) (2022) [5]

This study will explain the relationship between health insurance expenditure and population aging and how population aging affects China's economic market. The first part of the paper will discuss the existing research on the link between public health care and population aging, then, the second part will explain the data and research model, this part will forecast next few years trend based on the past data. The third part will explain the empirical results, the impact of population aging on China's medical expenditure and GDP, consider the future trend on the economic impacts. At the end, this paper will discuss how the Chinese market should respond to this trend and some points on existing policies based on the results.

2. Literature Review

2.1. Aging Population and Public Health

Population aging has deepened the prevalence of chronic diseases and complex medical conditions, and the future health care system is challenged by population aging [6]. While China is facing severe medical challenges, traditional pension methods and insufficient pension resources have exacerbated challenges of the elderly [7]. In response to this challenge, the Beijing City Government has adjusted its development strategy and established a medical and health service system suitable for the elderly. The implementation of the system will increase the awareness and support of the whole society, is good for millions of elderly people, and facilitate Beijing's sustainable financial development and social harmony [8]. Jiang [9] analyzed the weaknesses of China's social security system and the accelerated population aging problem from the aspects of pensions and medical expenses. The research shows that China cannot bear the problem of rapid aging. In particular, population aging has significantly changed the age structure of the insured people, and medical insurance expenditures for the elderly have grown rapidly.

2.2. Aging Populations and Burdens

For Streptococcus pneumoniae, Wroe et al. [10] described the prediction that the aging population will bring more patients, which will cause a huge medical cost burden and disease burden in the United States. The burden of population aging will be more reflected on women, the majority of the elderly population, mainly women living in urban centers [11]. Population aging may impose a burden on the labor market, especially for elder workers which are less adapted to changing global conditions, but research by Serban [12] shows that the impact of this unfavorable demographic condition in the labor market can be offset by education. The research of Wroe et al. [10] also reiterated the burden of population aging on the economy. In the study, population aging tripled the cost burden of Streptococcus pneumoniae, assuming the unit cost of health care remained constant. China's aging population is growing rapidly, and the needs of this aging population can be addressed by improving geriatrics and gerontology education, encouraging elderly institutions and elderly care, and changing the traditional concept of death by introducing hospice care [13].

2.3. Aging Population and Economic Growth

Population aging poses a huge challenge to economic growth. From the 1950s to the early 2000s, the average price-to-earnings ratio of all public companies in the United States followed a pattern: it fell as the population grew and rose as the population got younger [14]. This is related to changes in investment psychology and consumption patterns. As people grow older, people generally become more risk-averse, so the elderly will buy more bonds with low risk and start to cash out or buy annuity insurance [15]. As they grow older, consumption will downgrade, and the elderly will change their consumption behavior, they will no longer buy cars, real estate, etc., which means that as the global population aging goes faster, the price-earnings ratio will no longer be as high as it used to be. On the bright side, an aging population will spur demand for products such as advisory services, asset management and annuity insurance. Population aging brings both challenges and opportunities.

3. Research Design

3.1. Data Source

In order to obtain the most comprehensive and abundant data about China, the data is collected from the National Bureau of Statistics of China, which is official real data. The institution is affiliated with the State Council and has contributed to various economic accounting work in China. This study extracted China's GDP from 1990 to 2021, and the number of elderly population (age above 65) and medical insurance expenditures from the agency's official website in the same year.

Data processing is required to figure out the impact of increased aging population in China on health expenditure and GDP. Specifically, aging population in China by dividing total population to obtain the proportion of people above 65. With the updated edited data, Stata was used to analyses the data and construct models for further exploration.

3.2. ADF Test

Testing whether or not the data are stationary is the first step before proceeding. Based on the ADF test conducted in Stata, the p-value in Table 1 for GDP is smaller than 0.05, which is considered statistically significant. The p-values for proportion for aging people and health insurance expenditure in China are not statistically significant. This part then use the differencing value to construct the model, as their p-values in table 1 shows quite statistically significant. Due to these findings, the model built on the data is feasible and the data are stationary.

Table 1: ADF test.

Variables | t-statistic | p-value |

Raw | ||

GDP | -3.978 | 0.0094*** |

Proportion of 65+ | 1.831 | 1.000 |

Expenditure | -1.313 | 0.8847 |

Difference | ||

Proportion of 65+ | -5.121 | 0.0001*** |

Expenditure | -6.160 | 0.0000*** |

3.3. Vector Auto-regression (VAR) Model

The use of VAR model on time series can be traced back to a study on empirical analysis of macroeconomic [16]. The VAR model requires little theoretical basis and does not need to distinguish between endogenous and exogenous variables [17], the all-explanatory variables were predicted using lagged variables. Although the Guillén study [1] pointed out that population aging will have an impact on the future investment direction of public health care, there is no research on China that shows a strong relationship between medical insurance expenditure and the proportion of aging people. In this case, the VAR model is chosen, and there are three independent time series variables denoted as \( {Y_{t}} \) , \( {X_{t}} \) , \( {Z_{t}} \) , and resulted in VAR(p) model.

\( {Y_{t}}={α_{1}}+{φ_{11}}{Y_{t-1}}+...+{φ_{1p}}{Y_{t-p}}+{β_{11}}{X_{t-1}}+...+{β_{1p}}{X_{t-p}}+{δ_{11}}{Z_{t-1}}+...+{δ_{1p}}{Z_{t-p}}+{e_{1t}} \) (1)

\( {X_{t}}={α_{1}}+{φ_{21}}{Y_{t-1}}+...+{φ_{2p}}{Y_{t-p}}+{β_{21}}{X_{t-1}}+...+{β_{2p}}{X_{t-p}}+{δ_{21}}{Z_{t-1}}+...+{δ_{2p}}{Z_{t-p}}+{e_{2t}} \) (2)

\( {Z_{t}}={α_{1}}+{φ_{31}}{Y_{t-1}}+...+{φ_{3p}}{Y_{t-p}}+{β_{31}}{X_{t-1}}+...+{β_{3p}}{X_{t-p}}+{δ_{31}}{Z_{t-1}}+...+{δ_{3p}}{Z_{t-p}}+{e_{3t}} \) (3)

The above equations (1), (2) and (3) are the proportion of aging people in China, GDP and medical insurance expenditure in China, respectively. Equation 1 contains the linear function of the past lag of the proportion of aging people and the past lag of new data every year, e is the error term. Similarly, the equation structure of the other two variables is the same, but the coefficients have changed.

4. Empirical Results and Analysis

4.1. Order of VAR Model

To find out the optimal lag order for the VAR model, the LR statistic and other information criterion of each lag should be assessed. An asterisk sign (*) appears after the data to tell the optimal lag order.

Table 2: VAR model identification.

Lag | LL | LR | p | FPE | AIC | HQIC | SBIC |

0 | 68.843 | 2.0e-07 | -6.93085 | -6.90561 | -6.78172 | ||

1 | 133.033 | 128.38 | 0.000 | 6.0e-10 | -12.7404 | -12.6394 | -12.1439 |

2 | 136.706 | 7.3451 | 0.601 | 1.1e-09 | -12.1796 | -12.0029 | -11.1357 |

3 | 146.007 | 18.602 | 0.029 | 1.4e-09 | -12.2113 | -11.9589 | -10.7201 |

4 | 163.611 | 35.207 | 0.000 | 1.0e-09 | -13.1169 | -12.7888 | -11.1783 |

5 | 234.626 | 142.03 | 0.000 | 6.0e-12* | -19.6448 | -19.241 | -17.2589 |

6 | 1628.52 | 2787.8 | 0.000 | . | -165.424 | -164.944 | -162.59 |

7 | 1652.18 | 47.303 | 0.000 | . | -167.913 | -167.434 | -165.08 |

8 | 1681.56 | 58.776 | 0.000 | . | -171.007 | -170.527 | -168.173 |

9 | 1675.92 | -11.278 | . | . | -170.413 | -169.934 | -167.58 |

10 | 1687.3 | 22.753 | 0.007 | . | -171.611 | -171.131 | -168.777 |

11 | 1674.59 | -25.415 | . | . | -170.273 | -169.794 | -167.44 |

12 | 1725.56 | 101.94* | 0.000 | . | -175.638* | -175.159* | -172.805* |

Table 2 shows that lags 5 and 12 have that sign. As there do not have FPE after lag 5, and the difference of AIC between lag 5 and lag 12 is quite obvious, the present optimal lag order for VAR model should be 5.

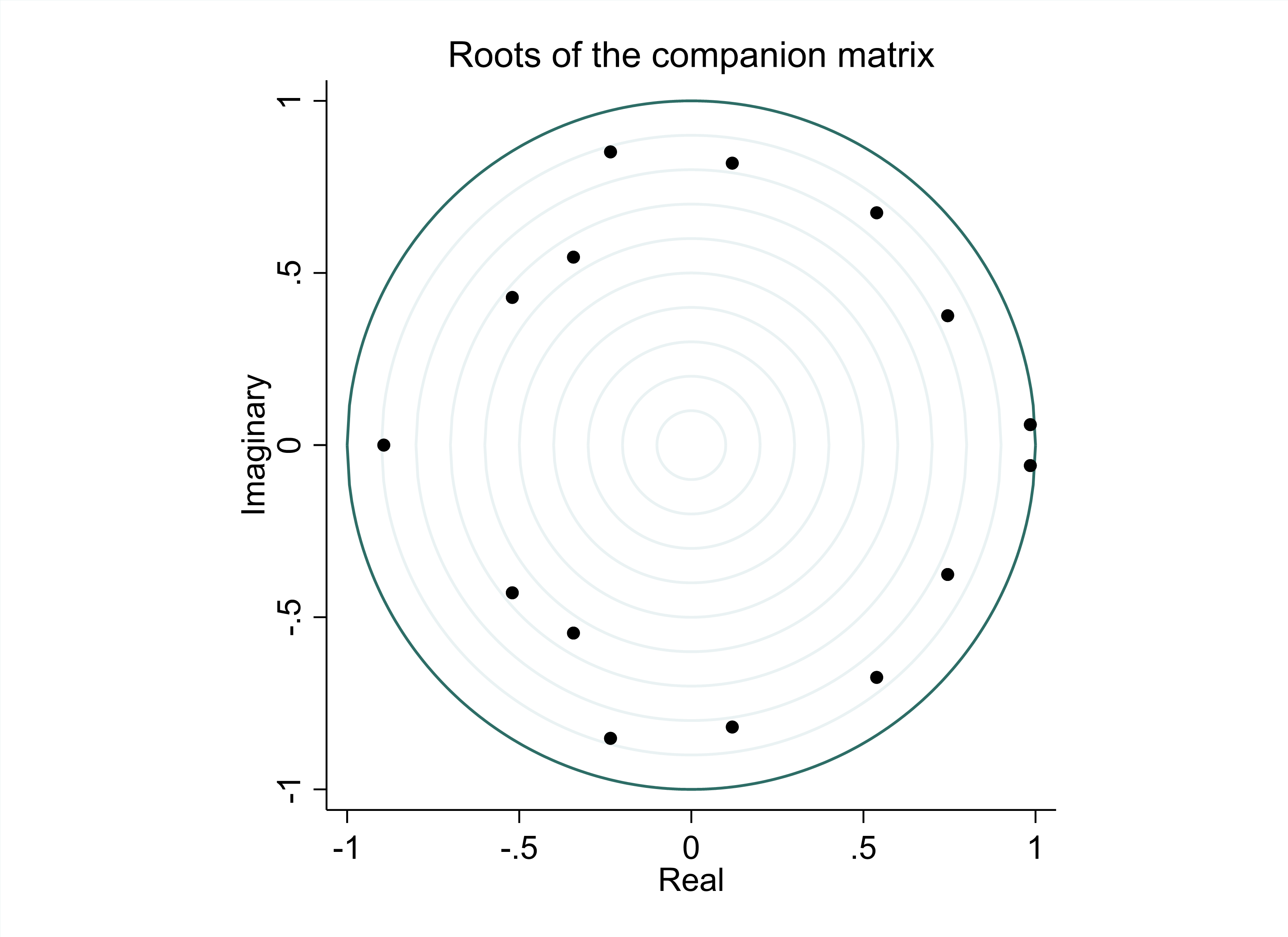

After determining the VAR model, it is necessary to check whether the model is stable. If the model is non-stationary, the impulse response function will not converge to zero. As showed in Figure 2, the study determined the applicability of the model by performing a unit root test and plotting a unit circle with the roots. All roots are clearly within the circles in Figure 1, which means that the three-variable VAR (5) is a stable model without re-evaluating the lag order.

Figure 2: Unit circle test. (Photo credit: Original)

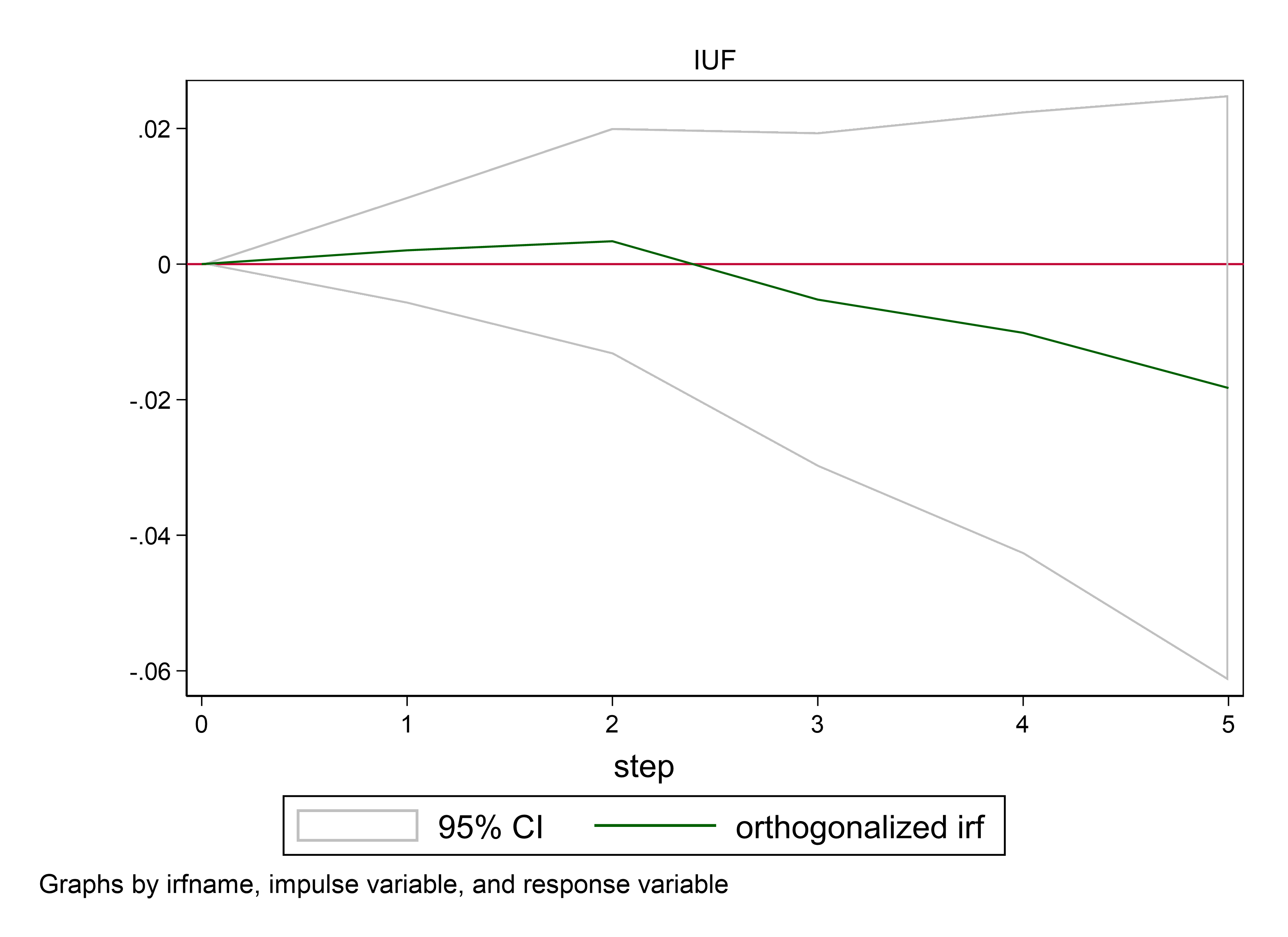

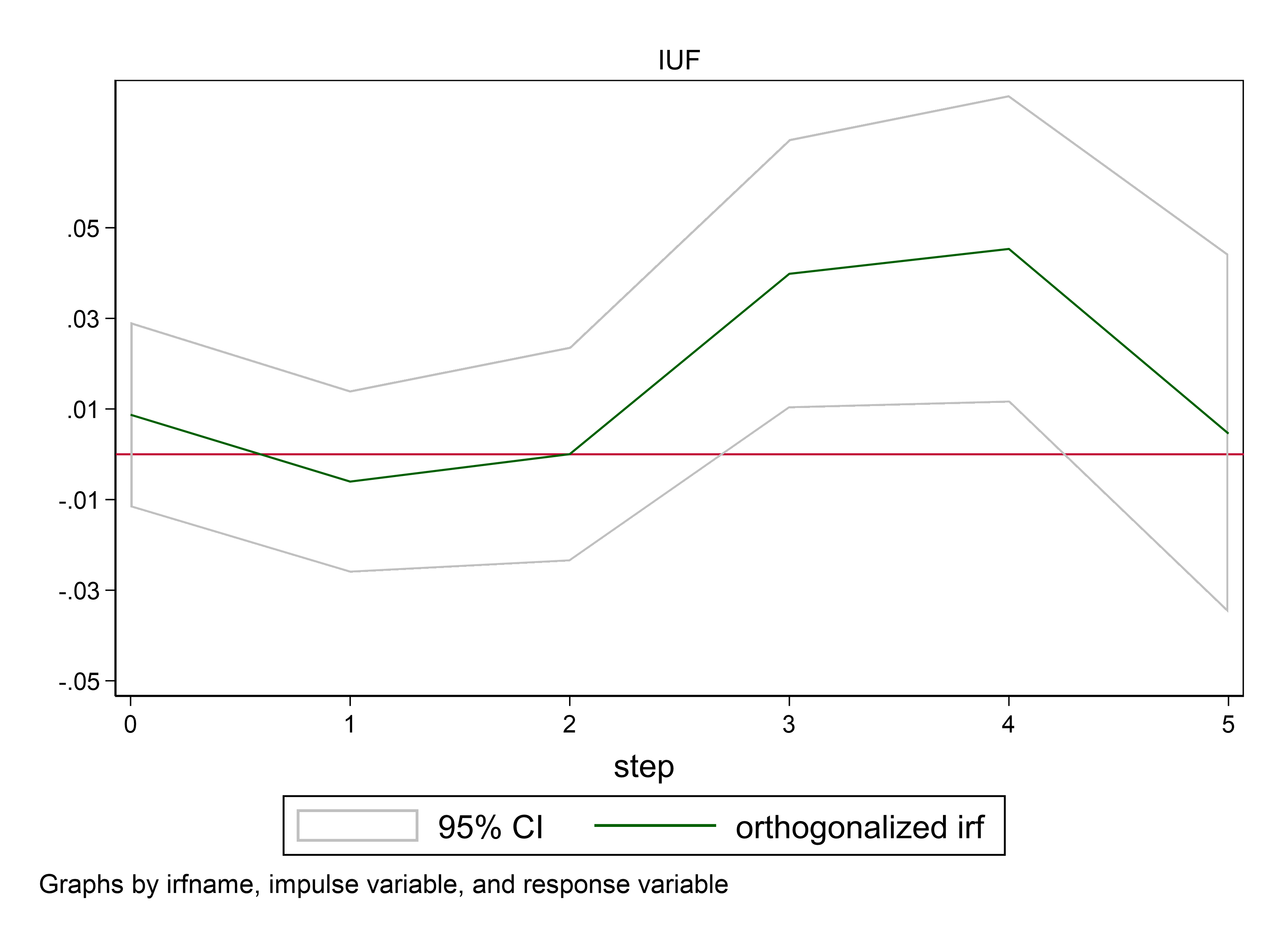

4.2. Impulse Response

This paper examines how population aging affects China's economy, especially its public health care. The impulse variables of these two graphs are the degree of aging, and the response variables are GDP and medical insurance expenditure. As shown in the impulse response diagram (Figure 3), when GDP growth is between t=0 and t=2, population aging has an obvious positive effect, while degree of population aging increase 1%, GDP would increase and at t=2, the effect of demographic dividend is still very obvious. But after that, the disadvantage of population aging gradually manifests itself, and the negative impact gradually increases as t increases. When t=5, as the degree of population aging increase 1%, the GDP would negatively response this trend by approximately 2%, which means the population aging in this duration, would have negative impact on economic growth.

Insurance health care spending climbs 1% at t=0, before t=2 population aging has a slight negative impact on it, but after that the impact is overall positive and, importantly, at t=4, the positive impact reached about 4.5%, but then declined rapidly. At t=5, the positive impact was already less than 1%. What is different from GDP is that it will be affected by the positive impact of population aging in the later stage, even if this positive impact will disappear after 5 steps, it is not a long-term positive state. When it comes to deeper population aging after t=2, the healthcare insurance expenditure of government would response positively in this duration, which actually means a heavier burden for the government expenditure. As the degree of population aging increase 1%, the healthcare insurance expenditure would increase 3% and 4.5% respectively when t=3 and t=4.

Nevertheless, this paper can still see that even though China's overall economic trend is affected by population aging, the government is still trying to invest in medical insurance expenditures, but as time goes by, the aging deepens, and the government is also tired of spending in this regard. Therefore, it is not difficult to see that China's pension stock is in an embarrassing position.

GDP Expenditure

Figure 3: Impulse response. (Photo credit: Original)

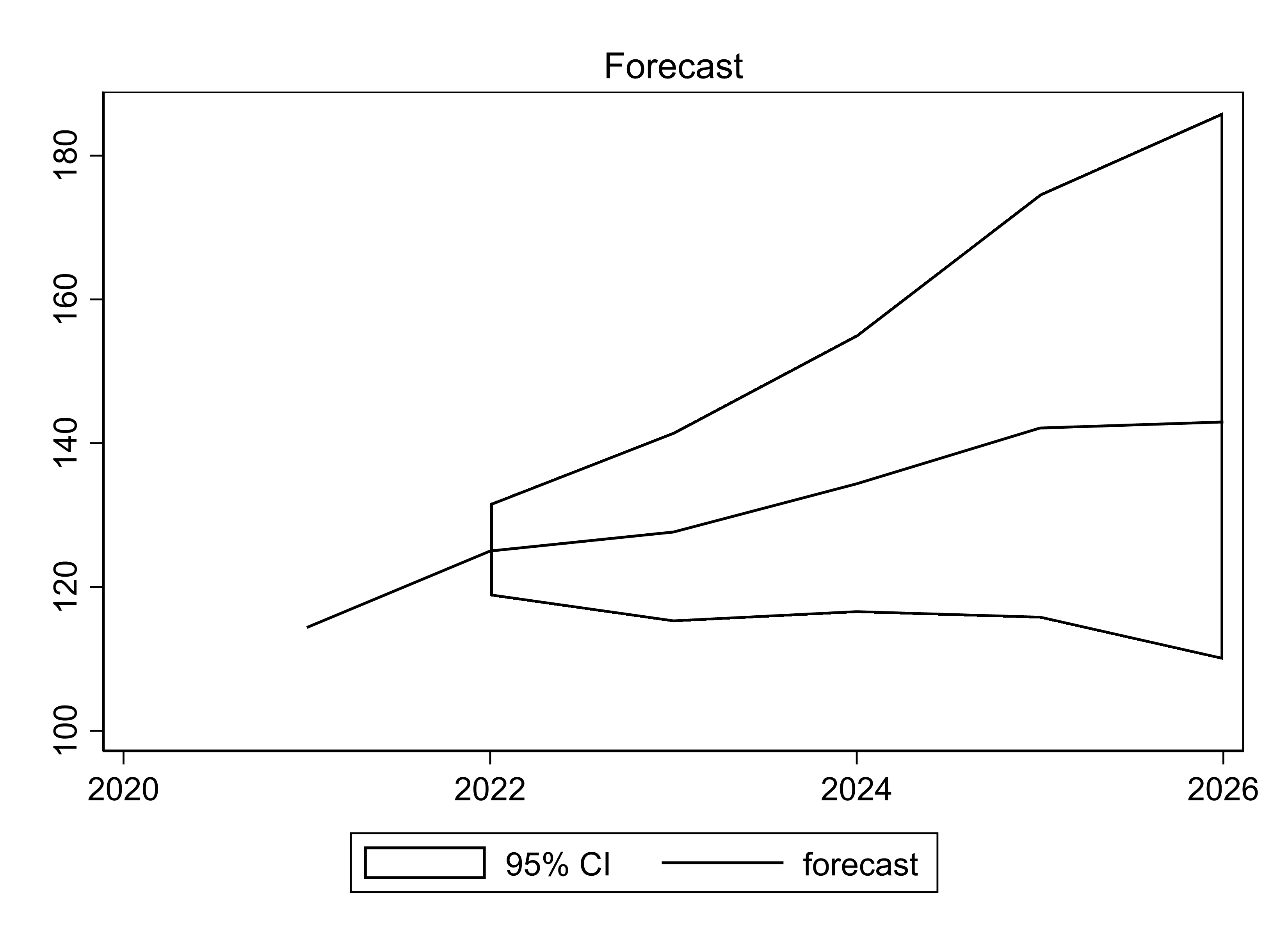

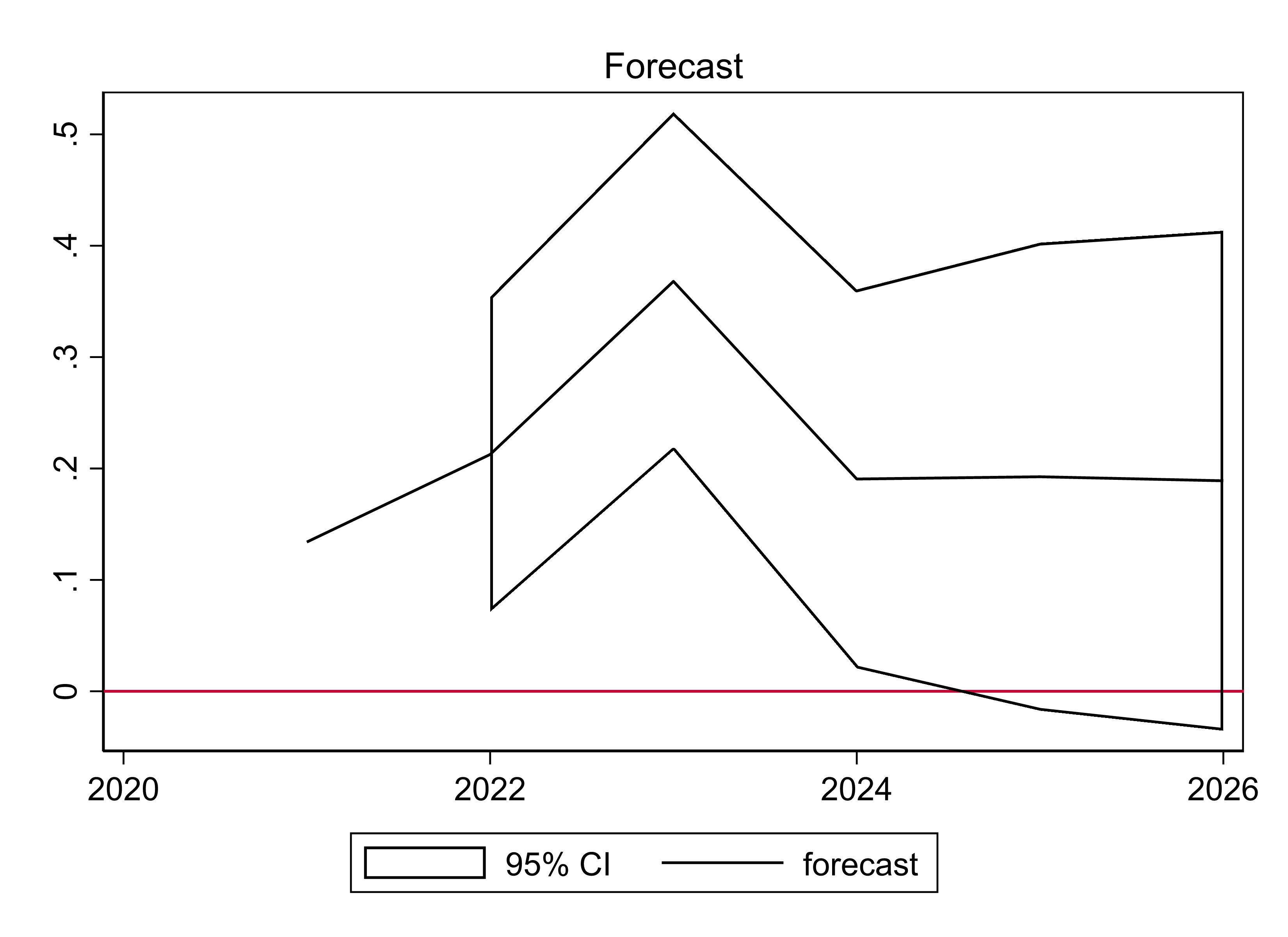

4.3. Forecast Trend

The study builds a model based on data before 2021 to make four-year forecasts for GDP and health care expenditure in 2022, 2023, 2024, and 2025(shown in Figure 4). It is expected that in the next few years, as the degree of aging deepens, GDP will grow steadily, and the growth rate will slow down in 2025. The government healthcare insurance expenditure is expected to show a fluctuating trend. In 2023, the expenditure will reach the peak of these four years, then decline and begin to level off in 2024. However, compared with the actual expenditure before 2022, the expected future medical insurance expenditure has an overall increase.

GDP Expenditure

Figure 4: Forecast. (Photo credit: Original)

5. Discussion

In this regard, first of all, postponing the retirement age can be considered, because the physical and mental health of modern 65-year-old retirees is much healthier than that of their peers in previous eras, and China will implement a progressive retirement age policy in 2022 [18]. There is a positive correlation between population aging and government spending. Continuing the current pension policy into the future would put considerable fiscal pressure on the government [19]. However, the postponement of the retirement age has been opposed by many people, who believe that this is an erosion of the pension they have been able to get, so that they can get less. This must be designed in the mechanism, and there are already several provinces in China [18]. The government must take into account the incentive mechanism when making reforms. After the retirement age is postponed for the elderly, on the one hand, they have to get wages when they work, and on the other hand, they also pay fees when they work. The paid part of the money should be given to the 65-year-old after the real retirement, and the overpaid money will be returned to the 65-year-old after the real retirement. above the pension. While the government postpones the retirement age to solve the pension system, it should give back benefits to the elderly who are about to retire.

Second, a good way to solve the financial problems brought about by the aging population is to increase labor productivity. However, the aging population will still have some negative impacts on the future development of the economy. This is reflected in entrepreneurship. People who start businesses are quite young, the research of Liang et al. [20] showed that the older the age, the lower the entrepreneurial rate. The people with the highest entrepreneurial rate are around 30 years old. If you are younger, you have not yet accumulated enough experience and enough funds to start a business. To start a business, you need to have some economic foundation, and you are not too young, so you are willing to take risks, because starting a business is risky , so such people are most willing to start a business. Aging will have some negative impacts on the rate of entrepreneurship, and entrepreneurship is a contributing factor to economic growth. Therefore, the state has continuously improved the relevant policies of talent introduction in recent years, which can stimulate entrepreneurship to a large extent. At the same time, advanced countries can consider introducing immigrants to supplement the shortage of young and middle-aged population to support the precarious pension system [1, 21].

Finally, with the popularity of working from home, it means that the elderly population has more opportunities to engage in productive activities with limited physical strength.

6. Conclusion

The purpose of the study was to examine how China's public healthcare would be affected as the population aging, with a focus on medical insurance. For this purpose, VAR models are introduced, which explore the impulse response and make predictions of future trends. The study came to its conclusion after conducting an empirical investigation.

Finally, this article shows that in the context of deepening population aging, the government’s expenditure on medical insurance has indeed been reduced compared to the past, but it does not mean that the government will continue to reduce the expenditure on medical insurance, but it is a short-term way to relieve the government’s economic burden. In the short-term forecast, GDP expectations and the trend that the government may increase medical insurance expenditures all show that the aging of the population will indeed have a negative impact in the short term, but after the government adjusts on policy, economic structure or any other solutions, it will attract new investment opportunities to improve the situation and even aging globalize finance will be served as a breakthrough. The short-term negative impact of population aging on public healthcare will eventually weaken and return to normal with the general trend of economic growth under the long-term high positive impact on the future.

References

[1]. Guillén, M.F., 2020. 2030: How Today's Biggest Trends Will Collide and Reshape the Future of Everything. St. Martin's Press.

[2]. Zhang, J., 2017. The evolution of China's one-child policy and its effects on family outcomes. Journal of Economic Perspectives, 31(1), pp.141-60.

[3]. Wang, F. and Mason, A., 2007. Demographic dividend and prospects for economic development in China. In United Nations Expert Group Meeting on Social and Economic Implications of Changing Population Age Structures (Vol. 141). New York: U. N.

[4]. National Healthcare Security Administration. (2021) 2020 Statistical Bulletin of Medical Security Development. http://www.nhsa.gov.cn/art/2021/3/8/art_7_4590.html

[5]. National Bureau of Statistics. (2022) Data research. http://www.stats.gov.cn

[6]. Dall, T.M., Gallo, P.D., Chakrabarti, R., West, T., Semilla, A.P. and Storm, M.V., 2013. An aging population and growing disease burden will require alarge and specialized health care workforce by 2025. Health affairs, 32(11), pp.2013-2020.

[7]. Fang, E.F., Scheibye-Knudsen, M., Jahn, H.J., Li, J., Ling, L., Guo, H., Zhu, X., Preedy, V., Lu, H., Bohr, V.A. and Chan, W.Y., 2015. A research agenda for aging in China in the 21st century. Ageing research reviews, 24, pp.197-205.

[8]. Chen, Z., Yu, J., Song, Y. and Chui, D., 2010. Aging Beijing: challenges and strategies of health care for the elderly. Ageing research reviews, 9, pp.S2-S5.

[9]. Jiang, Q., Yang, S. and Sánchez-Barricarte, J.J., 2016. Can China afford rapid aging?. Springerplus, 5(1), pp.1-8.

[10]. Wroe, P.C., Finkelstein, J.A., Ray, G.T., Linder, J.A., Johnson, K.M., Rifas-Shiman, S., Moore, M.R. and Huang, S.S., 2012. Aging population and future burden of pneumococcal pneumonia in the United States. The Journal of infectious diseases, 205(10), pp.1589-1592.

[11]. Restrepo, H.E. and Rozental, M., 1994. The social impact of aging populations: some major issues. Social science & medicine, 39(9), pp.1323-1338.

[12]. Serban, A.C., 2012. Aging population and effects on labour market. Procedia Economics and Finance, 1, pp.356-364.

[13]. Dong, B. and Ding, Q., 2009. Aging in China: a challenge or an opportunity?. Journal of the American Medical Directors Association, 10(7), pp.456-458.

[14]. Liu, Z., & Spiegel, M. M. (2011). Boomer retirement: headwinds for US equity markets?. FRBSF Economic Letter, 2011, 26.

[15]. Wilson, E. (2009). Find Hidden Opportunities in the Senior Market. Entrepreneur,(accessed August 2, 2016), April, 16.

[16]. Clements, M.P. and Mizon, G.E., 1991. Empirical analysis of macroeconomic time series: VAR and structural models. European Economic Review, 35(4), pp.887-917.

[17]. Sims, C.A., 1980. Macroeconomics and reality. Econometrica: journal of the Econometric Society, pp.1-48.

[18]. CN GOV. (2022) Strategic Planning Outline for Expanding Domestic Demand (2022-2035). http://www.gov.cn/xinwen/2022-12/14/content_5732067.htm

[19]. Murphy, R., & Tuszynski, M. (2017). Aging Populations and the Size of Government. Available at SSRN 3060834.

[20]. Liang, J., Wang, H., & Lazear, E. P. (2018). Demographics and entrepreneurship. Journal of Political Economy, 126(S1), S140-S196.

[21]. Liu, J. (2014). Ageing, migration and familial support in rural China. Geoforum, 51, 305-312.

Cite this article

Ren,M. (2023). The Economic Impact of Aging on China’s Public Health: A Short-term Perspective. Advances in Economics, Management and Political Sciences,19,48-55.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 2023 International Conference on Management Research and Economic Development

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Guillén, M.F., 2020. 2030: How Today's Biggest Trends Will Collide and Reshape the Future of Everything. St. Martin's Press.

[2]. Zhang, J., 2017. The evolution of China's one-child policy and its effects on family outcomes. Journal of Economic Perspectives, 31(1), pp.141-60.

[3]. Wang, F. and Mason, A., 2007. Demographic dividend and prospects for economic development in China. In United Nations Expert Group Meeting on Social and Economic Implications of Changing Population Age Structures (Vol. 141). New York: U. N.

[4]. National Healthcare Security Administration. (2021) 2020 Statistical Bulletin of Medical Security Development. http://www.nhsa.gov.cn/art/2021/3/8/art_7_4590.html

[5]. National Bureau of Statistics. (2022) Data research. http://www.stats.gov.cn

[6]. Dall, T.M., Gallo, P.D., Chakrabarti, R., West, T., Semilla, A.P. and Storm, M.V., 2013. An aging population and growing disease burden will require alarge and specialized health care workforce by 2025. Health affairs, 32(11), pp.2013-2020.

[7]. Fang, E.F., Scheibye-Knudsen, M., Jahn, H.J., Li, J., Ling, L., Guo, H., Zhu, X., Preedy, V., Lu, H., Bohr, V.A. and Chan, W.Y., 2015. A research agenda for aging in China in the 21st century. Ageing research reviews, 24, pp.197-205.

[8]. Chen, Z., Yu, J., Song, Y. and Chui, D., 2010. Aging Beijing: challenges and strategies of health care for the elderly. Ageing research reviews, 9, pp.S2-S5.

[9]. Jiang, Q., Yang, S. and Sánchez-Barricarte, J.J., 2016. Can China afford rapid aging?. Springerplus, 5(1), pp.1-8.

[10]. Wroe, P.C., Finkelstein, J.A., Ray, G.T., Linder, J.A., Johnson, K.M., Rifas-Shiman, S., Moore, M.R. and Huang, S.S., 2012. Aging population and future burden of pneumococcal pneumonia in the United States. The Journal of infectious diseases, 205(10), pp.1589-1592.

[11]. Restrepo, H.E. and Rozental, M., 1994. The social impact of aging populations: some major issues. Social science & medicine, 39(9), pp.1323-1338.

[12]. Serban, A.C., 2012. Aging population and effects on labour market. Procedia Economics and Finance, 1, pp.356-364.

[13]. Dong, B. and Ding, Q., 2009. Aging in China: a challenge or an opportunity?. Journal of the American Medical Directors Association, 10(7), pp.456-458.

[14]. Liu, Z., & Spiegel, M. M. (2011). Boomer retirement: headwinds for US equity markets?. FRBSF Economic Letter, 2011, 26.

[15]. Wilson, E. (2009). Find Hidden Opportunities in the Senior Market. Entrepreneur,(accessed August 2, 2016), April, 16.

[16]. Clements, M.P. and Mizon, G.E., 1991. Empirical analysis of macroeconomic time series: VAR and structural models. European Economic Review, 35(4), pp.887-917.

[17]. Sims, C.A., 1980. Macroeconomics and reality. Econometrica: journal of the Econometric Society, pp.1-48.

[18]. CN GOV. (2022) Strategic Planning Outline for Expanding Domestic Demand (2022-2035). http://www.gov.cn/xinwen/2022-12/14/content_5732067.htm

[19]. Murphy, R., & Tuszynski, M. (2017). Aging Populations and the Size of Government. Available at SSRN 3060834.

[20]. Liang, J., Wang, H., & Lazear, E. P. (2018). Demographics and entrepreneurship. Journal of Political Economy, 126(S1), S140-S196.

[21]. Liu, J. (2014). Ageing, migration and familial support in rural China. Geoforum, 51, 305-312.