1. Introduction

Federal Reserve System (Fed) was established on December 23,1913 as The United States’ central bank. It is the largest holder of U.S. federal debt and reached the net profit of 88.8 billion U.S. dollars in 2020 [1]. Fed has the responsibility to maintain employee rate and product prices by adjusting credit conditions related to the nation’s monetary policy. It also aims for maintaining the stability and stimulating the economic growth in the United States. Furthermore, Fed plays a significant role in regulating and supervising financial institutions such as banks to ensure consumers have their credit rights protected [2].

The fundamental of Fed interest rate raise is mainly based on two parts. Firstly, Fed officials will make corresponding adjustments towards the unemployment rate, GDP growth and inflation expectations respectively, if the attitude towards the U.S. economy is positive, then Fed rate raise is in expectation [3].Secondly, when trade conflicts bring negative impacts, there is the need of increasing Fed interest rate to avoid potential risks by decreasing the supply of U.S. dollars and to prompt repatriation of currency by the increasing the attraction of U.S. dollars [3].

The global monetary system and trade settlement system is dominated by U.S. dollars, which is the world currency. Hence, the Fed interest rate increase has impacts on both American economy and global economy. From the perspective of financial market, Fed interest rate raise means that liquidity of U.S. dollars decreases. The U.S. dollar index is then strengthened, and rate of scarcity of U.S. dollars will increase. In the process of raising Fed interest rate, there is the need to sell U.S. bonds in order to achieve payback of U.S. dollars. This suggests the number of bonds in the market will increase so the price of U.S. bonds start to fall, pushing the rate of return of U.S. bonds to rise [4]. For the U.S. stock market, the Fed interest rate hike has the goal of increasing financial costs of U.S. dollars by recovering liquidity of dollars. There will be a downward adjustment in the market due to change in liquidity in dollars, stock price in American market falls. But in a period, the reflow of capital from oversea markets brought by Fed interest rate growth brings the price of U.S. stocks higher. The cheap dollars and debt in the interest rate cut cycles during the earlier periods will be resolved. As a result, U.S. financial market will accomplish a smooth transition by resolving asset bubbles and debt risks. Looking at the business cycle, while the employment rate and U.S. economy reaches stability, Fed enters a cycle of raising interest rates. The large amount of capital reflow will boost the real economy of U.S., imply expansion of production capacity, not only resolve the problem of inflation, but also maintains the growth of U.S. economy [4].

However, Fed rate rise obviously have negative impacts on the global stock market. According to the research by Fratzscher and Ehrmann, the two companies analyze the sample of 50 countries including emerging markets and developed countries, the result shows that while Fed interest rate raise 100 basis points, the stock price in other countries goes down by 3.8% [5]. Fed interest rate hike led to the escape of emerging markets viewing from the perspective of international capital flows, bringing a shock to the global financial market. The funds that originally flowed into emerging markets turned to the U.S. market seeking for higher interest returns. Since most of emerging markets are dependent on the U.S. dollar hegemony system and can convert to U.S. dollars freely [4]. Huge amounts of funds flow out and go towards the U.S. market, causing shortage of liquidity in the country and lack of financial stability.

Companies’ stock prices vary due to the Fed interest rate hike. For example, the company this paper focus on is Cisco Systems. Cisco Systems is an American-based multinational cooperation which focus on technology services such as software and telecommunication equipment. It was founded by Leonard Bosack and Sandra Lerner from Stanford University in 1984 and it went public in 1990 [6]. Cisco Stock (CSCO) was included in NASDAQ-100 Index, Russell 1000 Index, and was added to the Dow Jones Industrial Average in June 2009 [7]. Cisco has purchased more than 70 technology companies, while reaching the sales of 189.28 million dollars, electrical equipment such as routers made by Cisco have covered up 80% of communication system around the world, becoming leader in each field it enters [8]. As a multinational enterprise, it will be significantly affected by the changes in global economy.

This paper involves using the ARIMA model to predict the Cisco stock price after the first time of Fed interest rate hike in 2022. By comparing the forecasting graph with the actual one, the difference between is caused by the Fed rate raise. And further providing possible reasons for the differences between prediction and actual price.

The following sections of this paper is structured as: data source information, brief introduction and design of ARIMA model related to Cisco Stock price in Part 2. Analyzing the predicted model and other components of the model in Part 3. Additionally, in Section 4, there will be discussions focusing on reasons that cause the difference between the prediction and the fact, following by how investors and policy makers should understand the results. Finally, Part 5 will restate a brief conclusion.

2. Research Design

2.1. Data Source

Cisco Systems, as one of the most well-known American-based multinational cooperation, is representative as an example for exploring the effect of Fed interest hike on stock price. This research extracts the data of Cisco’s daily stock price from March 1, 2021, to December 08, 2022, this data set will allow comparison of actual value with the prediction. The predicted stock price is forecasted using ARIMA model from March 16, 2022, because the first time of Fed interest rate raise in 2022 is on March 15. The data source is collected from the organization “Investing”, which is a professional website including stock price of variety of companies, providing data with high accuracy. For constructing models’ prediction and analyzing, STATA was used.

2.2. Augmented Dickey-Fuller (ADF) Unit Root Test

The ADF test conducted in STATA is necessary, as the time series need to be stationary before using the ARIMA model. From Table 1, the ADF test suggests the price is not stable but the rate of return is stable. The p-value is not 0 at the start, so drop lags is needed until the last lag is statistically significant [9]. Differencing refers to the transforming the data by using t to subtract p, where t is the point at time and p is some specific lag value [10]. Until p-value in the table becomes 0, the variable has no unit roots, so that the data is stationary and a shift in time will not change the data distribution shape.

Table 1: ADF test.

Variables | t-statistic | p-value |

Raw | -3.107 | 0.1046 |

Difference | -13.204 | 0.0000*** |

2.3. Autoregressive Integrated Moving Average (ARIMA)

Autoregressive Integrated Moving Average describes the correlations in data, in order to forecast future values by relating to the past observations and forecast errors [10]. This model is used to predict Cisco stock price after the first time of Fed interest rate hike in 2022.

For general model ARIMA (p, d, q), the formula is

\( {F_{t}}={L_{t}}+{Ω_{1}}{D \prime _{t-1}}+…+{Ω_{p}}{{D^{ \prime }}_{t-p}}+{B_{1}}{E_{t-1}}+…+{B_{q}}{E_{t-q}} \) (1)

where \( {F_{t}} \) is forecast point at time t, \( {L_{t}} \) is the level at time t, \( {{D^{ \prime }}_{t-p}} \) refers to previous differenced observed data points, \( {E_{t-q}} \) is the error in prediction from previous points, \( B \) and \( Ω \) are smoothing constants [10]. P refers to the order of autoregressive lags, d represents the order of differencing and q is the order of moving average lags.

3. Empirical Results and Analysis

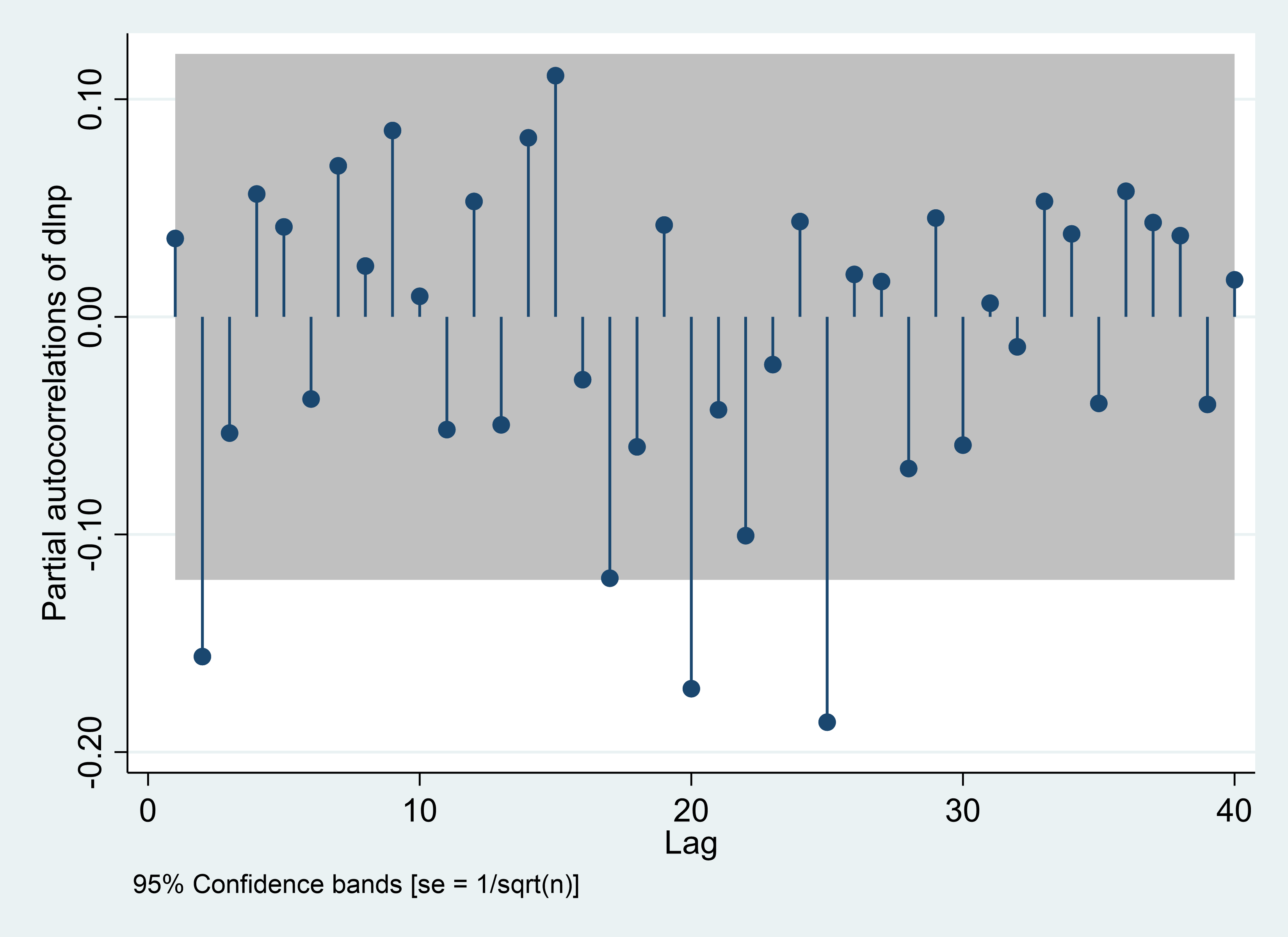

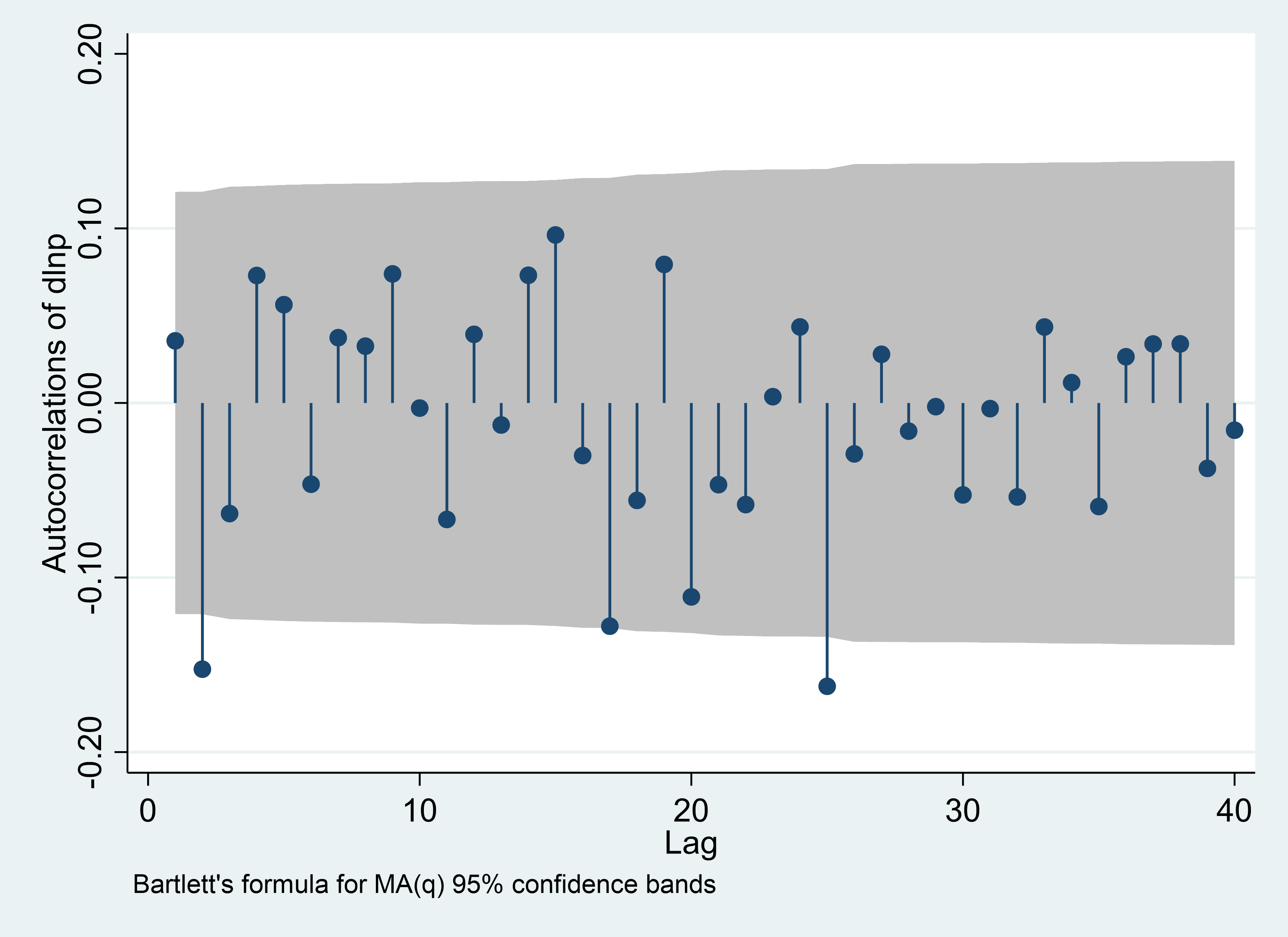

3.1. Order of Autoregressive Lags (AR)

When present value of time series can be known from the previous values, the time series is AR [11]. AR is (2, 20, 25) from the PACF graph in Figure 1, which is a partial auto-correlation function. p is set to be the lag value after PACF plot first crosses the confidence bands. In the study, p=2, which means using 2 previous data points and level at that point for making predictions. This can be represented by the formula:

\( {F_{t}}={L_{t}}+{Ω_{2}}{D \prime _{t-2}}+{Ω_{20}}{{D^{ \prime }}_{t-20}}+{Ω_{25}}{{D^{ \prime }}_{t-25}} \) (2)

3.2. Order of Moving Average Lags (MA)

The MA process is to define the present value of series as a linear combination of past errors [11]. MA is (2,25) from the ACF graph in Figure 1, which is the auto-correlation function. In the study, q=25, it can be used to correct prediction errors according to the formula:

\( {F_{t}}={L_{t}}+{B_{2}}{E_{t-2}}+{B_{25}}{E_{t-25}} \) (3)

PACF | ACF |

|

|

Figure 1: PACF and ACF. | |

Photo credit: Original | |

From the ADF test, d=1 in the study. Doing first order differencing makes the data stationary, this is formulated as

\( {D \prime _{t}}={D_{t}}-{D_{t-1}} \) (4)

Hence, the ARIMA model for graphing is set to be ARIMA (2,1,25).

The residual test (Table 2) suggests that the data is white noise as Prob>chi2 is smaller than 1, so that the ARIMA model can be applied.

Table 2: Residual test.

Portmanteau (Q) statistic | Prob > chi2 |

27.6942 | 0.9296 |

3.3. Forecasting Model

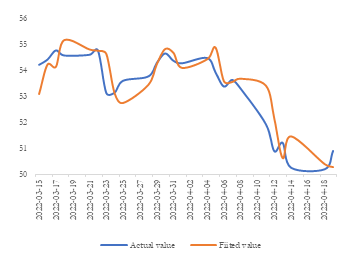

In Figure 2 include the graph of actual value of Cisco stock price from March 1, 2021, to December 8, 2022 and the graph of fitted value comparing with actual value.

The actual value represents the data of Cisco stock price from March 16, 2022, where Fed interest rate hike is involved. The predicted value by ARIMA (2,1,25) suggests the stock price without the Fed interest rate hike. The differences between stock price on the graph from March 15,2022 is due to Fed interest rate rise.

Actual Value |

|

Actual and Fitted Value |

|

Figure 2: Actual and fitted value. ( Photo credit: Original) |

Cisco Stock price decrease due Fed interest rate raise. As a American-based company, it does not only rely on domestic business, global economy can bring more impacts on it. While Fed interest rate hike, the U.S. stock price will eventually raise, but on the other hand, according to the funds flow out from other countries and come to the U.S. market, lowering the liquidity in these countries, thus Cisco stock price decrease because it is a multinational corporation.

4. Discussion

Comparing with other papers which focus more on the global pandemic’s impact , this article focuses on the impact caused by Fed interest rate hike on the stock price of a well-known technology company, Cisco. Some articles mentioned about the Fed interest rate hike but using other prediction models such as VAR model and TGARCH model. The similarity with other paper is that ARIMA model is commonly used in predicting stock price.

The result of the study implies that Fed interest rate hike result in the decrease the value of Cisco Stock price. Although Cisco is an American-based company, it is dependent on global economy as it has businesses across the world. When Fed interest rate raise, the U.S. stock price will fall but rise back again in a period, then reaching a higher level, however, because of funds flow out from other countries and go into the U.S. market, liquidity in these countries decrease. The lower financial stability in other countries brings negative impacts on Cisco stock price because it is a transnational corporation.

Through this article managers of the American-based multinational technology companies should pay more attention to the global business during the period of Fed interest rate hike, as the income from other countries is likely to decrease. Additionally, investors should have a clearer view when buying stocks of American technology companies when Fed interest rate starts to increase by considering how much the company depends on the global economy.

5. Conclusion

Fed interest rate hike for 6 times in 2022 before December while the first time is on March 15, bringing shock on both the U.S. and global economy, including stock price of variety of companies. This study focuses on the impact caused by Fed interest rate hike on the stock price of an American-based multinational corporation, Cisco.

ARIMA model is introduced for the prediction of Cisco stock price. ARIMA (2,1,25) is selected as the model that fits the best which involves data collecting, ADF test, AR, MA process and residual test for white noise. The estimation with Arima model can suggest the case of Cisco stock price without Fed rate hike. The case with Fed rate hike which is the actual data of Cisco stock price. The difference between is caused by the Fed interest rate hike.

Actual stock price of Cisco after Fed rate hike is lower than the predicted model. The reason behind might be Fed interest rate hike can resolve inflation problems and maintain the growth of U.S. real economy, however having negative impacts on global economy. Since Cisco is a transnational corporation which largely depends on global market rather than only U.S. market, Fed interest rate raise cause the fall of Cisco stock price.

References

[1]. Federal Reserve History. (2021). Overview: The History of the Federal Reserve. https://www.federalreservehistory.org/essays/federal-reserve-history

[2]. Board of Governors of the Federal Reserve System. (2016). What is the purpose of the Federal Reserve System? https://www.federalreserve.gov/faqs/about_12594.htm

[3]. Science and Technology Think Tank Thematic Research Group. (2018). Fed rate hike impact on global economy. http://www.cnki.com.cn/Article/CJFDTotal-YNJR201715003.htm

[4]. ZhiHu. (2021). What is the impact of Fed interest rate rise. https://zhuanlan.zhihu.com/p/419390279

[5]. Chen, Z., Fang, Y., & JunZhi, W. (2019). Reasons for the Fed's gradual rate hikes and Its Impact on Global Capital Markets. Modern Management Science-Macroeconomics. http://www.cqvip.com/qk/90311x/201903/7001189277.html

[6]. Britannica. (2022). Cisco Systems. https://www.britannica.com/place/San-Jose-California

[7]. MBA Library. (2009). Introduction to Cisco Systems. https://wiki.mbalib.com/wiki/%E6%80%9D%E7%A7%91%E7%B3%BB%E7%BB%9F%E5%85%AC%E5%8F%B8

[8]. Contractor UK. (n.d.). Cisco. https://www.contractoruk.com/contracting-jobs-rates/cisco.html

[9]. Statistics How To. (n.d.) ADF — Augmented Dickey Fuller Test. https://www.statisticshowto.com/adf-augmented-dickey-fuller-test/

[10]. Cisco. (2020). Analytics & Intelligent Automation. Time Series Analysis with ARIMA: Part 2. https://blogs.cisco.com/analytics-automation/arima2

[11]. Jayesh, S. Towards Data Science. (2019). Significance of ACF and PACF Plots In Time Series Analysis. https://towardsdatascience.com/significance-of-acf-and-pacf-plots-in-time-series-analysis-2fa11a5d10a8

Cite this article

Jia,J. (2023). Changes in Cisco Stock Prices under the Uncertain Interest Rate Policy: Based on ARIMA Model. Advances in Economics, Management and Political Sciences,19,56-61.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 2023 International Conference on Management Research and Economic Development

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Federal Reserve History. (2021). Overview: The History of the Federal Reserve. https://www.federalreservehistory.org/essays/federal-reserve-history

[2]. Board of Governors of the Federal Reserve System. (2016). What is the purpose of the Federal Reserve System? https://www.federalreserve.gov/faqs/about_12594.htm

[3]. Science and Technology Think Tank Thematic Research Group. (2018). Fed rate hike impact on global economy. http://www.cnki.com.cn/Article/CJFDTotal-YNJR201715003.htm

[4]. ZhiHu. (2021). What is the impact of Fed interest rate rise. https://zhuanlan.zhihu.com/p/419390279

[5]. Chen, Z., Fang, Y., & JunZhi, W. (2019). Reasons for the Fed's gradual rate hikes and Its Impact on Global Capital Markets. Modern Management Science-Macroeconomics. http://www.cqvip.com/qk/90311x/201903/7001189277.html

[6]. Britannica. (2022). Cisco Systems. https://www.britannica.com/place/San-Jose-California

[7]. MBA Library. (2009). Introduction to Cisco Systems. https://wiki.mbalib.com/wiki/%E6%80%9D%E7%A7%91%E7%B3%BB%E7%BB%9F%E5%85%AC%E5%8F%B8

[8]. Contractor UK. (n.d.). Cisco. https://www.contractoruk.com/contracting-jobs-rates/cisco.html

[9]. Statistics How To. (n.d.) ADF — Augmented Dickey Fuller Test. https://www.statisticshowto.com/adf-augmented-dickey-fuller-test/

[10]. Cisco. (2020). Analytics & Intelligent Automation. Time Series Analysis with ARIMA: Part 2. https://blogs.cisco.com/analytics-automation/arima2

[11]. Jayesh, S. Towards Data Science. (2019). Significance of ACF and PACF Plots In Time Series Analysis. https://towardsdatascience.com/significance-of-acf-and-pacf-plots-in-time-series-analysis-2fa11a5d10a8