1. Introduction

With the advancement of humanity in Internet technology, the online lifestyle is gradually replacing many of the chores in people's real life. As one of the most apparent advances, online shopping, or platform economy, is increasing. This increasing trend has become especially pronounced with the new coronavirus pandemic and the inconvenience of lock-down policies. In 2021, e-commerce trade sales in the U.S. exceeded $870 billion. But just a decade ago, in 2011, total U.S. online shopping spending was only 200.39 billion U.S. dollars, an increase of more than four times in just ten years [1].

However, the rapid growth of the platform economy is built on many sacrifices. To make transportation networks and guarantee services, platform economy companies significantly impact the environment, wasting resources and failing to recycle. Amazon generated 709 million pounds of plastic waste in 2021, an 18 percent increase from 2020 [2]. At the same time, it affects the interests of workers, manufacturers, and consumers to a certain extent. In a 2019 survey, 75% of independent retailers said Amazon's dominance in e-tailing poses a significant threat to their survival [3]. However, such a multi-faceted problem has multiple causes.

Environmental damage is one of the most significant adverse impacts of current package delivery systems. As a necessary part of the transportation of goods, the production of cartons around the globe was about 66 million tons in 2020, equivalent to the combined weight of 11 million adult elephants. And where do these cartons come from? The source is pulp made from trees. In 2021, 3 billion trees will be used as raw material for cardboard boxes, occupying an area roughly 2.5 times larger than New York State (141,300 km2). The massive consumption of trees is a huge disruption to the planet's natural environment.

In shipping, how to effectively deliver in the last mile is always a critical issue that companies are trying to solve because of the challenges it brings regarding sustainability, costs, time pressure, and an aging workforce [4]. As the name suggests, Last-mile delivery (LMD) is transporting goods and products from the closest distribution to their destination, such as homes or offices. As an indispensable part of the delivery process, platform economy companies in various countries have launched their solutions. In the U.S., Amazon has established an excellent service to provide free and fast LMD service to users by charging membership fees and negotiating with producers. In China, Taobao and other companies use courier lockers or Cainiao post stations to solve the LMD problem in a fixed location. But unfortunately, none of these solutions have perfectly solved the adverse effects of LMD and even worsened the harm caused by LMD to some extent.

Domestic and international academics have studied last-mile delivery, and several published articles have been accumulated. In this paper, we will point out the problems in environmental sustainability, labor efficiency, and consumer attitudes based on the different last-mile delivery solutions of platform economy companies in China and the United States, analyze the differences in consumer shopping habits and consumption levels, and propose corresponding countermeasures based on cultural characteristics to promote the development and improvement of last-mile delivery.

As part of an industry already scaling up, solving the LMD problem will significantly benefit people worldwide. If these problems are solved, people can maximize environmental protection, soil conservation, tree populations, and global climate stability while keeping the transportation industry operating. Furthermore, governments can better regulate the interests of platform economy companies, manufacturers, and consumers, creating a more balanced economic system. But if these problems are not solved, the natural environment will face significant threats, such as soil erosion and global warming. The home that human beings depend on for survival will not be protected, and consumers and producers will invariably receive damage to their interests.

2. Literature Review

Online shopping and e-commerce have become increasingly prevalent among customers during the past few years, especially during the COVID-19 pandemic [5]. As a result, companies have become intensely competitive in online shopping among different platforms. Companies like Amazon have free shopping delivery options to attract consumers from continuing to rely on online platforms for shipping and stay dominant in the competitive market. Free sounds like an attractive word at first, and it has indeed won many users for many companies' LMD services. However, a company seeking profit will not launch a truly free project. LMD's current service initiatives are enabling platform economy companies to make perverse profits on consumers and manufacturers. Whether manufacturers or retailers must pay for the delivery cost in online shopping history [6]. In other cases, companies might find alternatives to let customers pay the price, typically by raising the selling price or charging them through membership fees. [7]. In effect, platform economy companies are depriving manufacturers of profits and creating an unjustified competitive system. However, besides those direct costs associated with the currency, other social costs, such as labor efficiency and the environment, are often neglected. The truck delivery and routing would emit greenhouse gas. LMDs have a significant impact on commercial vehicle traffic throughout urban areas. Their essential characteristics significantly impede the logical operation of traffic, including high dispersion and the use of vehicle cargo loading compartments. The importance of this type as interest in remote shopping continues to grow, and delivery services grow, so do these issues. [8,9]. Furthermore, the delivery of packages generates a large amount of solid waste in Chinese cities [10].

2.1. Management System

Furthermore, due to the increase in online shopping orders, the labor efficiency of LMD also needs to be continuously improved. The situation in which buyers and delivery personnel cannot be accurately matched in time makes the express delivery process often unable to be completed on time. The repeated phenomenon that is constantly staged, the labor efficiency of LMD has received specific challenges. Improving the efficiency of LMD labor not only alleviates the cumbersomeness of delivery personnel to complete orders but also avoids uncontrollable situations caused by delays in delivery time, such as lost or damaged items [11].

2.2. Depot & Delivery Node Systems

Innovative LMD methods are constantly emerging on the market, most notably Cainiao. Cainiao is a global parcel delivery and tracking Chinese brand company. It is not responsible for the delivery of packages. It cooperates with other delivery companies to track the delivery progress of boxes, which provides a logistics information platform that can quickly connect courier partners, warehouses, and merchants to enable people to receive their packages in a timelier manner, ensuring that the courier can arrive at the Cainiao station within the estimated delivery time. During manual delivery, the courier no longer needs to hand over the item to the buyer face-to-face but can store the courier in a Cainiao store guarded by humans through temporary storage. This not only saves the time and transportation costs of couriers to deliver to each household but alleviates the problem of carbon emissions and improves the efficiency of express delivery [12].

We assume that in China, the population is large and dense, and the living environment is mostly in high-rise buildings. However, the population density in the United States is very low, and they usually live in separate houses with a certain distance between each home [13]. The specifics of the problems posed by current LMD services vary from country to country. Regarding LMD, China is famous in many small reception lockers and pick-up stations with delivery men putting in. In contrast, the delivery men in the US generally deliver the package directly to the residence's front door.

In the US, consolidation has traditionally been prioritized during the fulfillment process. There is typically a big hub outside the city where bulk shipments of commodities are made. Because it takes longer and a large container truck is used to transfer the packages, there can only be one trip per day. By contrast, a significant Chinese city has between 50 and 100 service facilities. Smaller trucks make many daily pickup trips to these centers. Thus, package storage is typically sparser. These men frequently ride motorcycles through traffic to distribute packages throughout the city. However, the number of transportation options is constrained in the US. In cities, distribution to customers is frequently done by truck. In addition to the fact that shipping services cannot reach customers in rural areas, these can be converted into real and intangible costs (time delays, customer services) [12]. Transporting B2B deliveries in urban areas may still be cost-effective. However, the time and fuel consumed while carrying B2C goods in cities might not be worth it for a single delivery. The package may occasionally be left outside the door when recipients are absent. As a result, there are more lost packages and fewer satisfied customers.

History plays some role in those differences. Unlike in the US, since there were no private parcel suppliers sixteen years ago, China Post was the sole player in the market. Little local private companies started to appear as the market opened up. They established little service centers that provide local solutions in response to the demand for nearby same-day assistance. Even as they grew and started creating connections across cities, the tiny service centers remained the focus of the pickup and delivery business. Between 50 and 100 service centers for all the leading courier services are currently located in the major cities where drivers are deployed. These facilities may be quickly and inexpensively built up because their sizes range from 1000 to 3000 square feet [11].

People are inclined to purchase online in the US because of its convenience. The in-person experience is generally positive, and getting to stores is simple. Therefore, US internet merchants can only draw clients by promising to save time or by providing better pricing. US e-commerce moved traditional retail online; it is not a question of need but of convenience [14].

In China, as well as many other Asian markets, this is vastly different. Due to traditional retail's poor infrastructure, when rural regions grow and people get wealthier, they cannot access the necessary goods. Because of this, e-commerce has been expanding so quickly because of all of the people in cities other than major metropolises. China's market is also distinct in that many purchases are made through mobile devices. Nearly 79% of all sales on Alibaba and JD.com are made through mobile devices [12]. The expansion of rural regions is another simple explanation for this. From having no access to the internet, millions of people now have mobile phone access. The use of a personal computer was skipped. One of Alibaba's significant advantages is its experience in mobile shopping, as both Amazon and eBay would be thrilled to see even 25% of their sales come from mobile devices. Indeed, China had explosive growth in online shopping even before Covid pandemic. It increased by 86% from 2016 to 2017 [12].

3. Case Studies

3.1. Alibaba

In China, as the most dominant e-commerce company, Alibaba has started to innovate in their methods regarding packaging method and transportation to reduce the environmental cost of delivery since 2013. Cooperating with thirty-two international partners, Cainiao Network launched this green logistics initiative in 2013. (Table 1 shows) It emphasizes environmentally friendly approaches such as promoting eco-friendly packaging and recycling, introducing electric delivery trucks in nearly 20 locations, and employing big data to boost logistics effectiveness. The initiative saved 1 billion packing boxes in 2015 and sent 0.5 million parcels to customers entirely made of biodegradable materials. By 2020, the project hopes to lower 3.62 million tonnes of carbon emissions from the sector while making the most of available resources and consuming less energy. Later, in 2016, Alibaba and other companies invested 300 million RMB in enhancing green logistics, consumption, and supply chain management (Table 1).

Table 1: Cainiao’s international cooperation with different investors starting in 2013 (Source: https://ecommerceiq.asia/cainiao-logistics-southeast-asia/).

Investor | Specialty | Share | Role in Cainiao |

Alibaba | Ecommerce | 43% | Data platform, financial reconciliation |

Yintai | Property | 32% | Warehouse management |

Fosun | Conglomerate/Investments | 10% | Warehouse construction |

FORCHN.com.cn | Logistics | 10% | Line-haul |

YTO.net.com.cn | Logistics | 1% | Last mile |

SF | Logistics | 1% | Last mile |

STO.cn | Logistics | 1% | Last mile |

YundaEx.com | Logistics | 1% | Last mile |

ZTO.com | Logistics | 1% | Last mile |

Cainiao adopted many cutting-edge technologies to enhance its sustainability effort, which successfully lessened 15% of the material waste and soared the packaging efficiency among 510 million parcels. It has a smart-packaging algorithm that automatically recommends the optimal

size and package combination. Through its mobile phone app, Amap, Cainiao directs its customers to the nearest recycling stations. Customers can receive incentives when they scan a QR code through their mobile app Taobao to receive "green power" in a popular game called ant forest which tracks users' carbon footprint. This method has been applied to 5000 recycling stations in 200 cities, gathering more than 3.5 million shipping boxes for recycling at various delivery locations, academic institutions, and commercial structures [12].

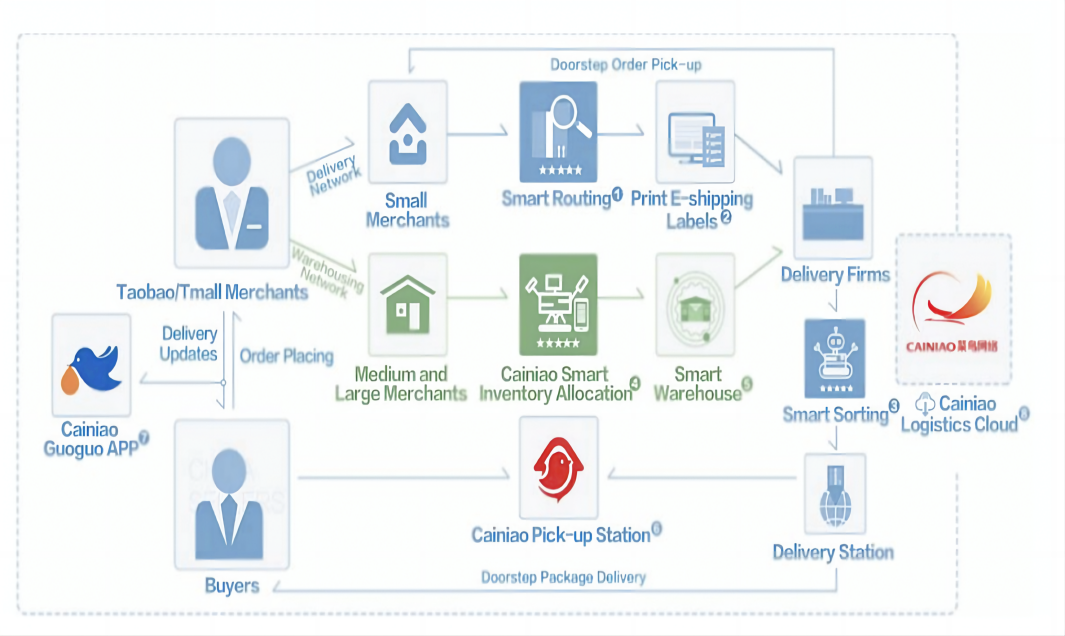

With the courier pick-up and delivery storage services provided by Cainiao Post Station, its operating model has alleviated the problem of reduced efficiency caused by face-to-face delivery, and failed face-to-face delivery situations to a certain extent, at the same time, assuages the pain point that expresses cabinets cannot store large express delivery due to their limited size. Figure 1 displays the entire delivery system of Cainiao.

Figure 1: Delivery system of Cainiao (Source: https://www.alizila.com/wp-content/uploads/2016/09/Cainiao-Factsheet.pdf?x95431).

This mode of last-mile delivery has its drawback. In many cases, consumers are not satisfied with the management of the pick-up stations in terms of efficiency and the environment. A pick-up station usually serves a community like schools or residential areas. In contrast, the stations are simply not large enough to fill out all the packages in order, which causes inconvenience for the customer to pick them up by themselves. It is essential to plan the layout of the shelf arrangement reasonably. The manager for the station should arrange the shelf and place each package according to the package sizes and weight. Otherwise, typically, consumers need to spend lots of time tracking the package they purchase. Utilizing networks in the community like the university and the official Cainiao Wrapp app is proposed to solve this problem. In this way, consumers can receive a notification with an authentication permit. Then, they prove their identity through the app and place a pick-up order in advance so that they can give an express email to the employees working in the station to put everything together for them to pick up [15]. In general, the regulation needs to be more mature.

Moreover, since Cainiao Station is a manually guarded and supervised pick-up point, its business hours are limited, usually from 9 a.m. to 8 p.m. This customer's flexible pickup schedule is a significant constraint, especially for people whose jobs often require overtime. Even though it has slightly alleviated the low time elasticity from face-to-face delivery to a certain extent, it cannot fully solve the inconvenience of time limitations [16]. If they work after 8 p.m., their deliveries often cannot be picked up on time. For another example, if people's parcels are urgently needed, when they realize that the fields are urgently required, it has already exceeded the business hours of Cainiao Station. The customers' urgently required items will not be received on time, which will cause a lot of inconvenience to the customers.

Finally, Cainiao has added one more process to the LMD, which means that when a package goes missing, the accountability process becomes more cumbersome. At the same time, Cainiao does not have strict control and inspection in the process of customers picking up a package. Tracing the box and claiming compensation will become more complicated if others take the package [16].

3.2. Amazon

As of June 2022, the U.S. leading retail e-commerce company Amazon has a market share of 37.8% [17]. Amazon has been so successful in the platform economy not only because of its diverse merchandise but also because it noticed early on the importance of the shipping segment in the overall platform economy sales model. In other words, Amazon realized that if the products were not delivered on time, everything else, including marketing and websites, is not helpful [18]. So, Amazon launched Prime - by becoming an Amazon Prime member, users can receive their purchases from the platform for free within two days. In a survey of more than 2,000 e-shoppers, the vast majority of whom were Amazon Prime members, the results of the Prime service were precise, with five out of four of these consumers saying they chose the Amazon platform because of the free, fast shipping offered by the Prime service [19]. These customers choose Amazon because of two keys in LMD Amazon - fast and free.

However, the so-called "free" Prime service is not free. Underneath the appearance of not paying for the service, Prime service costs a lot.

Because of the speed of Prime, many orders that could have been shipped together will be split into separate packages, causing a dramatic increase in the number of boxes shipped. Amazon itself used over 5 billion packages for Prime shipping in 2017 [20]. And during the 2020 epidemic, it generated a third more plastic packaging waste than it would otherwise have, nearly 270,000 tons. An organization called Oceana estimates that this assortment of plastic products, up to 10,700 tonnes and equivalent to the value of one delivery truck every 67 minutes, will likely end up in the ocean [21].

Moreover, the Prime service became the only motivation for some of Amazon's customers. 24.5% of those 2000 people in the survey said that Amazon wouldn't be their choice if they had to pay for shipping [19]. In other words, Amazon's Prime service is sapping people's reliance on Amazon. When it becomes the only reason for users to use Amazon, similar services from other companies can easily cost Amazon a lot of users.

At the same time, Amazon itself has invested heavily in the service. It has leased 15 Boeing 737-800 jets, purchased thousands of semi-trailers, and assembled a team of 40 large aircraft for package delivery in 2019 [22]. In addition, Amazon currently runs over 75 fulfillment centers and 25 sorting centers. (Which group of goods by destination) across the U.S. Some of these distribution centers are truly immense, exceeding a million square feet. Besides the extremely high financial cost, Amazon's LMD strategy has also brought extremely high costs on carbon footprints. With the surge in online shopping demand caused by the epidemic, Amazon emitted 71.54 million tons of carbon dioxide in 2021. That's an 18% increase over 2020 and almost 40% over 2019.

But who exactly bears the monetary cost of the Prime service? Most of the costs are imposed on manufacturers by Amazon. Since 2020, manufacturers have reported that Amazon has gone from being their cheapest to their most expensive channel - by a wide margin. However, the average consumer still bears some "hidden" costs. However, the exact percentage is not known. Amazon charges Prime and non-Prime customers differently for its products. Using pricing data, Amazon makes it possible for users searching for items as Amazon Prime members to select "free one-day shipping," resulting in a higher average listing price for the same item than non-Prime members. Therefore, although Prime members are advertised as getting "free" one-day shipping, these customers spend more on delivery [23]. More specifically, when an item retails for $20 and shipping is $5, the retailer charges $25 and announces "free shipping". The customer happily pays and thinks they've made a switch. And this practice is still common on sites like Amazon [6].

Due to the potential problems brought by Prime service, it is still not the most optimal solution to the last mile delivery problem; how to improve the architecture of Prime service and combine it with Taobao's last-mile delivery model will be the main problem of this paper.

4. Discussion

4.1. Strategies & Incentives for Change

4.1.1. Rewards & Punishments

When improving the unfavorable status quo around us, there are two traditional strategies, one is to regulate according to the terms, and the other is to achieve the goal of solving the problem through policy incentives [24]. There are many cases today where environmental change for the better has become famous through financial incentives. With market incentives, as long as the new reform of LMD provides economic value to enterprises and individuals, the change of the LMD method will be accepted by people [25].

If the government wants people to leave their homes and drive or walk farther than they used to get a package at their doorstep, they need to let people know they can benefit from it. Otherwise, the government wants people to accept the new The idea of picking up parcels at the parcel station in the current LMD method is more damaging in the eyes of buyers, making the implementation effect even less ideal.

By establishing incentive systems such as picking up five packages at the post station or express collection point, buyers can gain one chance of free shipment in their next online purchase. The economic value and profit provided by people from adapting the newly designed LMD are apparent. Corresponding to buyers' psychological path and willingness to do online shopping, a "free ride" on a purchase's shipping fee increases their desire to follow the newest instructions and inventions of LMD.

Rewarding individuals to devote some time to collect their packages and creating subsidies for retail platforms and shipping companies to adopt an environmental-friendly, efficient LMD strategy would bring out a more widely adopted system. Incentives for individuals can be free shipment after completing self-pick-up several times and include content such as the low-interest rate for installment purchases and a coupon for discounts when buying new products. Along, subsidies for firms can consist of grants and favorable tax incentives. By doing so, the visible financial benefits created for buyers and firms participating in the LMD process would continue to follow and implement the plans proposed by the government more actively [25].

Once the government and shipping companies increase their effort in marketing these value gains that people can earn by actively following and adapting to the new structure of LMD, customers will participate enthusiastically to help governments stabilize the new form of LMD over the country.

While incentivizing consumers to adopt a more beneficial approach to LMD through rewards is a viable measure, the government should further promote the LMD problem by simultaneously adopting punitive measures. Tips alone may cause some people to change their online shopping habits, but for many, the mere absence of rewards is not a reason to change; they have nothing to lose. Therefore, penalties to push people to change will be necessary.

In 2019, the U.S. received 21 packages per capita per year, while China received 70 packages per capita in the same year. While the survey was conducted primarily in major cities such as Beijing and Shanghai, it still reflects the high demand for packages among Chinese and Americans. Therefore, the government should require companies to charge segmented rates for parcel delivery. A benchmark should be set according to each country's average consumption habits. In the U.S., the government could implement segmentation fees on the Amazon platform, charging individuals a standard price for the first 15 packages annually, an additional 30 percent shipping fee for the following 15 packages, and so on. And in China, each fee segment can be 25 pieces.

In this way, consumers will be more inclined to buy all the items they need in one online shopping trip to reduce the number of cartons, gasoline, and other materials used for repeated shipments in the same period.

Although it can be effective, rewards and penalties can only solve specific problems from the consumer's perspective. For Amazon's macro problem, we can apply Taobao's LMD approach in China to solve the problem.

4.1.2. Smart Parcel Locker Application in the US

Given the successful applications of the intelligent parcel locker paradigm in China, we want to delve into the potential application of this paradigm in the US to solve the problems of traditional delivery in terms of cost and time efficiency and point out some common issues with the existing application of this paradigm in the US.

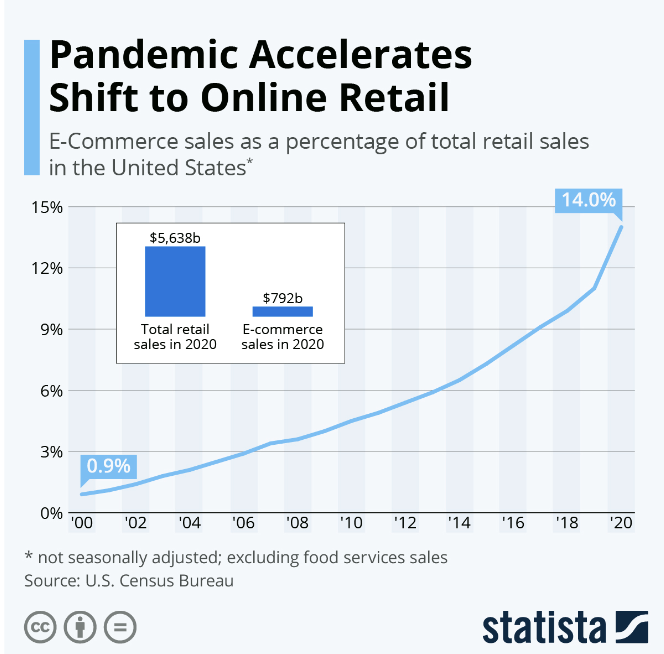

Because consumers are not constantly at work or home to pick up their packages, and the Covid-19 pandemic still affects our lives, there has been an increase in demand for contactless delivery options. Besides, the accelerating number of consumers choosing online shopping during pandemics requires companies to develop innovative last-mile delivery options. Businesses had to face the fact that most customers demand minimal or nonexistent delivery prices because of the growing importance of online sales and the resulting decline in physical sales. As a result, a new service was created: Click and Collect. Compared to the same period in 2019, click-and-collect sales, often called "curbside" pick-up, increased by 106.9% in the US. The "Curbside" collection offers both immediacy and familiarity with comparatively easy and safe, bridging the gap between the isolation of e-commerce and the annoyance of traditional in-person retail. Click-and-collect spending by US consumers reached $72.46 billion in 2020, up 106.9% from the previous year. From a 5.8% to a 9.1% of retail e-commerce sales, click and collect increased, along with the customer's shift to online retail. (Figure 2 shows) Real buyers increased by 12.9%, from 127.4 million to 143.8 million, in this period.

Target, based in Minneapolis, started beta testing the current DriveUp service in 2017. However, after the pandemic outbreak, its popularity has skyrocketed, increasing by more than 1,000% compared to the same period in 2019. Also, Target self-reported that this flexibility of picking up outside the store by consumers enhances their satisfaction, giving rise to 30% of the customer purchasing more items.

Figure 2: Soaring shift to online retail during a pandemic (Source: https://www.statista.com/chart/14011/e-commerce-share-of-total-retail-sales/).

The dominant online shopping platform Amazon in the US already has its innovative parcel locker paradigm. However, it has many issues in expanding its service. It requires consumers to possess an Amazon membership and is limited to a set of partners. Also, unlike many other prevalent intelligent parcel lockers, such as UPS and DPD Groupe in European and Chinese market, which has B2C or C2C business model, Amazon currently has a private business model by definition, confining the use of the network to a single enterprise and run against the principles of the Physical Internet and the benefits of cooperation and collaboration. Thus, customers' needs and the company's overall competitive strategy are considered when deciding where to place lockers. These objectives may not always align with locker allocations based on equity or need. Indeed, Amazon's locker placements only accommodate customer demand and purchasing power, not the needs of populations that require accessible and affordable lockers.

More locker sites are required to reduce the distance that delivery vehicles must travel, which would reduce their energy consumption and emissions. It is increasingly challenging to motivate clients to leave their houses, get in their cars, and drive ten minutes to pick up a shipment. Logistics firms can work with retailers close to densely populated regions, such as residences, malls, and dormitories, to open modest warehouses (maybe just a small office or store room). These small warehouses temporarily store items for those who are not always at home, allowing them to pick up packages while out shopping for groceries or while they are already at the store. By doing this, e-commerce companies can enable customers to drive or walk to pick up packages without having to offer discounts. For example, some enterprises, such as Penguin Pick-up & Penguin Fresh, are using small stores and expanding their corporate retailers as their agent points for last-mile delivery, just like what China is doing [26].

The shift in the US to an improved, innovative delivery locker paradigm is a plausible outcome. With the high number of users in online shopping, this paradigm caters to their increasing demand for contactless alternative package pick-up options after Covid. It reduces the inevitable environmental problems in online shopping caused by delivery. The obvious obstacles to adopting this locker paradigm in the US would be the inaccessibility and the inconvenience. The current locker companies should cooperate with as many retailers as possible to maximize their adoption for online consumers. They should scatter the pick-up locker stations to small stores and shops throughout the cities to provide a consistent experience of picking up packages so that the consumers can pick up their delivery within a short commuting distance.

The existing employees' management toward the innovative locker paradigm should be adjusted to achieve these purposes. The newly distributed pick-up stations in the stores that the company works with should require no additional employees near the locker. Instead, the safe needs to be completely automatic so that the consumers can easily pick it up by themselves without the assistance of staff in the store. Companies should not hire extra staff to monitor the machine. Instead, the efficient way would be to provide the device's 24/7 contact information, email address, and phone number. The saved finances from hiring the employees can be used to expand the intelligent locker paradigm to enhance accessibility and convenience further.

Under the presentation of this new LMD method, the benefits to local people, government, and distribution companies become more prominent. For residents, contactless delivery prevents the possibility of covid cross-infection and does away with the requirement for truck distribution. Every household will produce less air pollution when it usually operates. For delivery companies, this also solves the problem of inefficiency in completing delivery caused by their inability to ensure the availability of customers during express delivery.

5. Conclusion

In summary, with the continuous advancement of technology, more and more people tend to use online shopping to gain convenience and save time. However, the demand for LMD is also increasing due to the surge in shopping orders. Therefore, the government has to formulate a new LMD plan to optimize couriers' delivery efficiency, money costs, the convenience of express delivery, and reducing carbon dioxide emissions, etc., minimizing environmental pollution. With comprehensive discussions and analysis of current situations such as the claim of free shipping with hidden fees behind, labor inefficiency of hardship to complete face-to-face courier delivery; upcoming issues of rising greenhouse gases pollution, increasing emerge in solid waste from packaging; delivery differences among China and the USA; and existing LMD cases of Amazon in America and Cainiao as a Chinese LMD case; two proposals of solving current problems, and bringing up a better structure for LMD are proposed. By creating incentives such as rewards and punishments and adopting the intelligent parcel locker system in the USA, this paper tends to optimize the present structure of LMD and develop it more sustainably and efficiently.

Acknowledgment

Haofei Yan, Chengqiang Li, Haoran Yu contributed equally to this work and should be considered co-first authors.

References

[1]. Daniela Coppola, Apr 23. “Total and e-Commerce U.S. Retail Trade Sales 2021.” Statista, 23 Apr. 2022, https://www.statista.com/statistics/185283/total-and-e-commerce-us-retail-trade-sales-since-2000/.

[2]. Brad Dress, December 15,2022, Amazon’s plastic waste increased by 18 percent in 2021: report, https://thehill.com/policy/energy-environment/3775185-amazons-plastic-waste-increased-by-18-percent-in-2021/

[3]. Miller, Andrea. “Why 'Free' Shipping Isn't Free.” CNBC, CNBC, 31 Mar. 2022, https://www.cnbc.com/amp/2022/03/31/why-free-shipping-isnt-free.html.

[4]. Boysen, Nils, et al. “Last-Mile Delivery Concepts: A Survey from an Operational Research Perspective - or Spectrum.” SpringerLink, Springer Berlin Heidelberg, 21 Sept. 2020, https://link.springer.com/article/10.1007/s00291-020-00607-8.

[5]. Brewster, Mayumi. “Annual Retail Trade Survey Shows Impact of Online Shopping on Retail Sales during COVID-19 Pandemic.” Census.gov, 3 Oct. 2022, https://www.census.gov/library/stories/2022/04/ecommerce-sales-surged-during-pandemic.html.

[6]. Leigh, Andrea. “Amazon Free Shipping: The Truth about Who Pays Shipping Cost.” Ideoclick, 1 Nov. 2021, https://ideoclick.com/2020/02/27/the-truth-about-who-pays-for-amazon-free-shipping/.

[7]. Frischmann, Tanja. “Search Results.” 8 Dec, 2014 Search Results | Taylor & Francis Online, https://www.tandfonline.com/author/Frischmann%2C+Tanja.

[8]. Stainstaw Iwan, Kinga Kijewska, Justyna Lemke. “Analysis of Parcel Lockers’ Efficiency as the Last Mile Delivery Solution – The Results of the Research in Poland”. 25 Feb, 2016. https://www.sciencedirect.com/science/article/pii/S2352146516000193

[9]. Tajik, Tavakkoli Moghaddam, Behnam Vahdani, S. Meysam Mousavi “A robust optimization approach for pollution routing problem with pickup and delivery under uncertainty” Journal of Manufacturing Systems. April 2014

[10]. Xiao, Yiming, and Boya Zhou. “Does the Development of the Delivery Industry Increase the Production of Municipal Solid Waste?—An Empirical Study of China Author Links Open Overlay Panel.” Huazhong University of Science and Technology, 2019.

[11]. Noppakun Tiwapat , Choosak Pornsing, Peerapop Jomthong. “Last Mile Delivery: Modes, Efficiencies, Sustainability, and Trends”,https://www.researchgate.net/profile/Choosak-Pornsing/publication/328262489_Last_mile_delivery_modes_efficiencies_sustainability_and_trends/links/5e005726299bf10bc3719648/Last-mile-delivery-modes-efficiencies-sustainability-and-trends.pdf

[12]. Yen, Benjamin and Wong, Grace, "Case Study: Cainiao and JD.com Leading Sustainability Packaging in China" (2019). ICEB 2019 Proceedings (Newcastle Upon Tyne, UK). 18.https://aisel.aisnet.org/iceb2019/18

[13]. Statistics Times, “United States vs China by population”, 2022. https://statisticstimes.com/demographics/china-vs-us-population.php#:~:text=China%20is%20four%20times%20denser,to%2036%20of%20the%20US.

[14]. Jennifer, Dublino,“Buying Online vs. Buying in Person.” Business.com, 2022 https://www.business.com/articles/retail-or-e-tail-buying-online-vs-buying-in-person/.

[15]. Liu, Lu, et al. “Investigation and Research on User Satisfaction of Cainiao Courier Station of Sichuan University of Arts and Sciences.” Voice of the Publisher, Scientific Research Publishing, 3 Sept. 2020, https://www.scirp.org/journal/paperinformation.aspx?paperid=103227.

[16]. Yike Zhu, Maria Socorro. “The service quality of community courier collection points (Cainiao Courier Station).” 2022. http://www.assumptionjournal.au.edu/index.php/odijournal/article/view/6106

[17]. Stephanie Chevalier, Aug 26, 2022, Market share of leading retail e-commerce companies in the United States as of June 2022, from https://www.statista.com/statistics/274255/market-share-of-the-leading-retailers-in-us-e-commerce/

[18]. Hahn Yoonah, Kim Dongho, Youn Myoung-Ki, April 30, 2018, A Brief Analysis of Amazon and Distribution Strategy, from https://koreascience.kr/article/JAKO201816357065337.page

[19]. Richard Kestenbaum, February 5, 2020,Amazon Could Be Vulnerable To Competition, And This Is How, from https://www.forbes.com/sites/richardkestenbaum/2020/02/05/amazon-could-be-vulnerable-to-competition-and-this-is-how/?sh=511b356852a0

[20]. Shawn Baldwin, July 13, 2019, Amazon’s top cardboard box makers face challenges from plastic mailers, from https://www.cnbc.com/2019/07/13/amazon-prime-ships-cardboard-boxes-from-westrock-international-paper.html

[21]. Karen McVeigh, December 15, 2021, Amazon’s plastic waste soars by a third during pandemic, Oceana report finds, from https://www.theguardian.com/environment/2021/dec/15/amazon-plastic-waste-soars-by-a-third-amid-pandemic-finds-oceana-report

[22]. Doug Cameron, June 18, 2019, Amazon Rents More Jets to Expand Next-Day Delivery, from https://www.wsj.com/articles/amazon-rents-more-jets-to-expand-next-day-delivery-11560889819

[23]. Steffens, Isabel, 2018. “Amazon Prime and “Free” Shipping.” University of California, Santa Barbara. https://escholarship.org/uc/item/0681j9rr

[24]. OECD, “Creating Market Incentives for Greener Products”, 2019 https://www.oecd.org/environment/outreach/EN_Policy%20Manual_Creating%20Market %20Incentives%20for%20Greener%20Products_16%20September.pdf

[25]. US EPS, “Economic Incentives”. Sept 2nd, 2022. https://www.epa.gov/environmental-economics/economic-incentives

[26]. Toneguzzi, Mario. “Penguin Pick-up Expands Click-and-Collect with Retailer Partnerships.” Retail Insider, 5 Aug. 2022, https://retail-insider.com/retail-insider/2018/01/penguin-pick-up/.

Cite this article

Yan,H.;Li,C.;Yu,H. (2023). Rewards, Penalties and Real Case References: Improvement of the Last Mile Delivery in USA. Advances in Economics, Management and Political Sciences,21,203-213.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 2023 International Conference on Management Research and Economic Development

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Daniela Coppola, Apr 23. “Total and e-Commerce U.S. Retail Trade Sales 2021.” Statista, 23 Apr. 2022, https://www.statista.com/statistics/185283/total-and-e-commerce-us-retail-trade-sales-since-2000/.

[2]. Brad Dress, December 15,2022, Amazon’s plastic waste increased by 18 percent in 2021: report, https://thehill.com/policy/energy-environment/3775185-amazons-plastic-waste-increased-by-18-percent-in-2021/

[3]. Miller, Andrea. “Why 'Free' Shipping Isn't Free.” CNBC, CNBC, 31 Mar. 2022, https://www.cnbc.com/amp/2022/03/31/why-free-shipping-isnt-free.html.

[4]. Boysen, Nils, et al. “Last-Mile Delivery Concepts: A Survey from an Operational Research Perspective - or Spectrum.” SpringerLink, Springer Berlin Heidelberg, 21 Sept. 2020, https://link.springer.com/article/10.1007/s00291-020-00607-8.

[5]. Brewster, Mayumi. “Annual Retail Trade Survey Shows Impact of Online Shopping on Retail Sales during COVID-19 Pandemic.” Census.gov, 3 Oct. 2022, https://www.census.gov/library/stories/2022/04/ecommerce-sales-surged-during-pandemic.html.

[6]. Leigh, Andrea. “Amazon Free Shipping: The Truth about Who Pays Shipping Cost.” Ideoclick, 1 Nov. 2021, https://ideoclick.com/2020/02/27/the-truth-about-who-pays-for-amazon-free-shipping/.

[7]. Frischmann, Tanja. “Search Results.” 8 Dec, 2014 Search Results | Taylor & Francis Online, https://www.tandfonline.com/author/Frischmann%2C+Tanja.

[8]. Stainstaw Iwan, Kinga Kijewska, Justyna Lemke. “Analysis of Parcel Lockers’ Efficiency as the Last Mile Delivery Solution – The Results of the Research in Poland”. 25 Feb, 2016. https://www.sciencedirect.com/science/article/pii/S2352146516000193

[9]. Tajik, Tavakkoli Moghaddam, Behnam Vahdani, S. Meysam Mousavi “A robust optimization approach for pollution routing problem with pickup and delivery under uncertainty” Journal of Manufacturing Systems. April 2014

[10]. Xiao, Yiming, and Boya Zhou. “Does the Development of the Delivery Industry Increase the Production of Municipal Solid Waste?—An Empirical Study of China Author Links Open Overlay Panel.” Huazhong University of Science and Technology, 2019.

[11]. Noppakun Tiwapat , Choosak Pornsing, Peerapop Jomthong. “Last Mile Delivery: Modes, Efficiencies, Sustainability, and Trends”,https://www.researchgate.net/profile/Choosak-Pornsing/publication/328262489_Last_mile_delivery_modes_efficiencies_sustainability_and_trends/links/5e005726299bf10bc3719648/Last-mile-delivery-modes-efficiencies-sustainability-and-trends.pdf

[12]. Yen, Benjamin and Wong, Grace, "Case Study: Cainiao and JD.com Leading Sustainability Packaging in China" (2019). ICEB 2019 Proceedings (Newcastle Upon Tyne, UK). 18.https://aisel.aisnet.org/iceb2019/18

[13]. Statistics Times, “United States vs China by population”, 2022. https://statisticstimes.com/demographics/china-vs-us-population.php#:~:text=China%20is%20four%20times%20denser,to%2036%20of%20the%20US.

[14]. Jennifer, Dublino,“Buying Online vs. Buying in Person.” Business.com, 2022 https://www.business.com/articles/retail-or-e-tail-buying-online-vs-buying-in-person/.

[15]. Liu, Lu, et al. “Investigation and Research on User Satisfaction of Cainiao Courier Station of Sichuan University of Arts and Sciences.” Voice of the Publisher, Scientific Research Publishing, 3 Sept. 2020, https://www.scirp.org/journal/paperinformation.aspx?paperid=103227.

[16]. Yike Zhu, Maria Socorro. “The service quality of community courier collection points (Cainiao Courier Station).” 2022. http://www.assumptionjournal.au.edu/index.php/odijournal/article/view/6106

[17]. Stephanie Chevalier, Aug 26, 2022, Market share of leading retail e-commerce companies in the United States as of June 2022, from https://www.statista.com/statistics/274255/market-share-of-the-leading-retailers-in-us-e-commerce/

[18]. Hahn Yoonah, Kim Dongho, Youn Myoung-Ki, April 30, 2018, A Brief Analysis of Amazon and Distribution Strategy, from https://koreascience.kr/article/JAKO201816357065337.page

[19]. Richard Kestenbaum, February 5, 2020,Amazon Could Be Vulnerable To Competition, And This Is How, from https://www.forbes.com/sites/richardkestenbaum/2020/02/05/amazon-could-be-vulnerable-to-competition-and-this-is-how/?sh=511b356852a0

[20]. Shawn Baldwin, July 13, 2019, Amazon’s top cardboard box makers face challenges from plastic mailers, from https://www.cnbc.com/2019/07/13/amazon-prime-ships-cardboard-boxes-from-westrock-international-paper.html

[21]. Karen McVeigh, December 15, 2021, Amazon’s plastic waste soars by a third during pandemic, Oceana report finds, from https://www.theguardian.com/environment/2021/dec/15/amazon-plastic-waste-soars-by-a-third-amid-pandemic-finds-oceana-report

[22]. Doug Cameron, June 18, 2019, Amazon Rents More Jets to Expand Next-Day Delivery, from https://www.wsj.com/articles/amazon-rents-more-jets-to-expand-next-day-delivery-11560889819

[23]. Steffens, Isabel, 2018. “Amazon Prime and “Free” Shipping.” University of California, Santa Barbara. https://escholarship.org/uc/item/0681j9rr

[24]. OECD, “Creating Market Incentives for Greener Products”, 2019 https://www.oecd.org/environment/outreach/EN_Policy%20Manual_Creating%20Market %20Incentives%20for%20Greener%20Products_16%20September.pdf

[25]. US EPS, “Economic Incentives”. Sept 2nd, 2022. https://www.epa.gov/environmental-economics/economic-incentives

[26]. Toneguzzi, Mario. “Penguin Pick-up Expands Click-and-Collect with Retailer Partnerships.” Retail Insider, 5 Aug. 2022, https://retail-insider.com/retail-insider/2018/01/penguin-pick-up/.