1. Introduction

The Federal Reserve (Fed) is the central bank of the United States whose function is to facilitate the efficient functioning of the U.S. economy [1]. For other countries, higher interest rates bring more returns to the countries that hold the currency, which will attract foreign capital and make the U.S. dollar increase against the Canadian dollar, which decreases relatively. As an open and small economy, Canada is greatly influenced by the development of the global economy [2], especially affected by the US. Canada has always maintained good trade relations with the United States, which is the second largest trade partner. For example, Canada and the United States are both members of the North American Free Trade Area (NAFTA). NAFTA is one of the largest free trade areas in the world, involving countries with very different production structures, leading to the creation of cross-border production chains, which can be seen in the large amount of intermediate products and intra-industry trade between member countries [3]. In 2019, Canada was the largest market for U.S. merchandise exports and its third largest supplier of merchandise imports. U.S. foreign direct investment (FDI) in Canada was $402.3 billion that year, up 9.2 percent from the previous year, compared to Canada's $495.7 billion in the US [4]. An increasing number of U.S. multinationals such as Amazon, Tesla and Uber have been attracted to invest and expand in Canada due to industry and government collaboration, the most educated talents, government-backed incentives and preferential market access [5].

On the basis of the context, the main research goal of this paper is to explore the impact of the Fed's interest rate hike on Canada from two aspects, including the financial market and multinational corporations. Discussing the impacts, on the one hand, will help the Canadian monetary authorities and fiscal authorities respond to the impacts of the Fed's interest rate hike. On the other hand, it will also help multinational companies respond reasonably and quickly, adjusting import and export strategies. Moreover, for Canadian investors, the analysis can also provide some reference for their investments in the financial market.

In the following statement, the research will be divided into three parts. At first, the article will analyze the impacts from the perspective of financial markets, consisting of the foreign exchange market, stock market and bond market. In terms of foreign exchange market, changes in the exchange rate of international capital flows and the response strategies of the Canadian monetary authorities will be studied. Secondly, from the perspective of international trade, this part will take Cenovous Energy as an example of a multinational corporation to discuss the current situation of international trade under the background of interest rate hikes, and conduct a case analysis based on the company's status. Finally, some conclusions would be drawn in detail, containing a brief review of the research, main findings and implications. Above all, some effective suggestions will be given for different subjects, such as monetary authorities, fiscal authorities or investors.

2. Financial Market

2.1. Exchange Rate Market

Both the U.S. and Canada have flexible exchange rates, which is decided by the market [6]. Figure 1 shows the money supply situation in the United States when the Fed raises interest rates. As interest rates rise, the money demand curve shifts to the right, and the total dollar demand increases. In other words, with the quantities supplied constant, investors prefer to hold dollars instead of selling them. For the exchange rate market as is shown in Figure 2, the demand curve shifts to the right, in order to earn higher interest rates, people often exchange their Canadian dollars for U.S. dollars, making the U.S. dollar's exchange rate increase and the Canadian dollar's exchange rate decrease. When the Canadian dollar depreciates, Canadian exports become cheaper to the U.S. and imports become more expensive.

Figure 1: The Money Market. Photo credit: Original |

Figure 2: Exchange Rate Market. |

Photo credit: Original |

Generally speaking, Bank of Canada intervenes infrequently in exchange rates, with the aim of letting the market determine the value of the currency. The last time an intervention affected the Canadian dollar was in September 1998 [7]. However, if the Canadian dollar continues to depreciate, then Canada's productivity may be lower, which also reduces the purchasing power of foreign goods [8]. In addition, exchanging Canadian dollars for U.S. dollars may reduce the number of Canadian dollars in circulation as people are more likely to hold U.S. dollars. When the situation was serious enough that there were signs that the market was about to crash, Canadian monetary authority would respond in various ways. Bank of Canada could emulate the U.S. by raising its own nominal interest rates in order to strengthen the Canadian dollar. Moreover, according to the previous research, for Canada, in the short term, domestic fiscal variables have no impact on the real exchange rate, but changes in interest rates, money supply growth, commodity prices and the US debt per GDP have a negative impact on the real exchange rate [9]. That is to say, on one hand, in order to boost the real exchange rate, Bank of Canada can issue Canadian Treasury bonds, decreasing the amount of Canadian dollars people hold. On the other hand, banks can also sell some of the holding US Treasury. Either way, the main purpose of the monetary authority is to make people more willing to keep Canadian dollars in their hands, rather than convert them into US dollars, so that the Canadian dollar exchange rate will rise.

2.2. Stock Market

Canada's financial markets are part of Canada’s open economy, which are considered to be closely related to those of the US [10]. Stock market, as a part of financial markets, is also affected by US monetary policy.

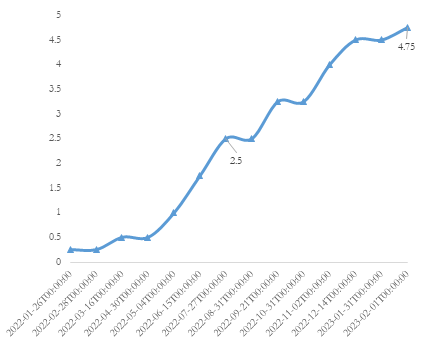

|

Figure 3: Interest Rate of the US from Mar 2022 to Mar 2023. |

Data source: Investing |

Photo credit: Original |

|

Figure 4: Canada Stock Market Index (TSX) from Mar 2022 to Mar 2023. |

Data source: Investing |

Photo credit: Original |

Figure 3 shows U.S. interest rates for the year, while Figure 4 shows major Canada stock market index [11]. It is not difficult to see from the comparison in the Figure 4 that TSX had been maintained at a relatively high level until May 2022. However, after May, the Fed raised interest rates, and TSX suddenly fell. The TSX hit a rock bottom after the Fed kept raising interest rates. At this time, Canadian investors may have expected that the Fed will continue to raise interest rates, so the Canadian stock market rebounded. The drop in the TSX since then may have been related to oil prices [12]. In November 2022, the Federal Reserve will raise interest rates again. Meanwhile, the Canadian stock market continued to improve, and the TSX had been rising. Overall, however, the TSX never returned to previous levels when the Fed kept raising its rates.

In 2022, the biggest gains for the TSX came from energy, consumer staples and materials, while the biggest drags came from the healthcare, technology and real estate sectors [12]. According to previous studies, there may be a long-term equilibrium relationship between the US money supply and long-term interest rates and TSX from 2010 to 2018. Nevertheless, using the data after 2010, the US money supply and long-term interest rates cannot explain any TSX [13]. It should be noted that the Fed hadn’t adjusted its interest rate until May 2022. Consequently, when the interest rate was suddenly rise in May 2022, it might cause investors to buy more dollars, leading to a sudden drop in the TSX.

2.3. Bond Market

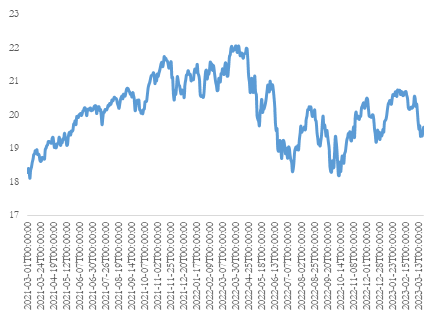

Canada ten-year bond is issued by the national government of Canada and denominated in Canadian dollars. The yield investors get on bonds typically reflects inflation expectations and the likelihood of debt repayments [14]. As is shown in Figure 5, in a recent year, Canadian government bond has fluctuated about the same as U.S. government bonds. Surprisingly, when the Federal Reserve raised interest rates, which raised U.S. bond yields, Canadian bond yields rise in tandem. At some points when interest rates suddenly increased, bond yields ushered in a relatively high increase. However, there were times when higher interest rates do not lead to higher bond yields, which may be influenced by other factors, such as people's psychology.

| ||

Figure 5: Canada and the US 10Y Bond Yield (percent) from Mar 2022 to Mar 2023. | ||

Data source: Investing | ||

Photo credit: Original | ||

Interest rate risk refers to the fact that when market interest rates rise, the price of fixed-rate bonds falls, and fixed-rate bond yields are higher [15]. At this time, people prefer to hold savings rather than bonds because the price of bonds is lower and saving is less risky. Based on the former study, the Fed would engage in large-scale asset purchases, which has significantly affected international bond yields, especially in Canada [16]. When the Fed raised interest rates, the price of Canadian government bonds held by Canada would fell. Moreover, because the exchange rate caused the Canadian dollar to depreciate, the price of Canadian government bonds held by the US also decreases, forcing the Canadian government to raise yields to attract investors.

3. Case Study Based on Transnational Corporation in International Prospect

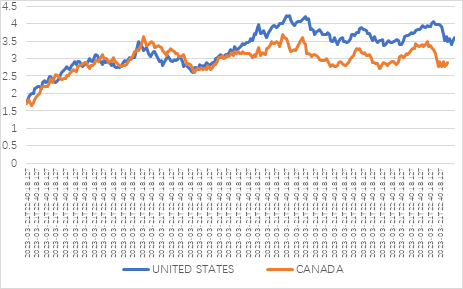

3.1. International Trade between Canada and the US under the Background of Rising Interest Rates

For a advanced economy like Canada that not only has the Canadian dollar pegged to the US dollar, but also trades heavily with the US, a US rate hike would have a strong Canadian reaction through the exchange rate and trade channels. The relative depreciation of the Canadian dollar has increased Canada's exports to the United States, while its imports have decreased, which is conducive to the export of Canadian goods. In order to better understand international trade when the Fed raises interest rates, the study will choose the three years from the beginning of 2020 to the end of 2022 as the period to observe the import and export situation.

| |

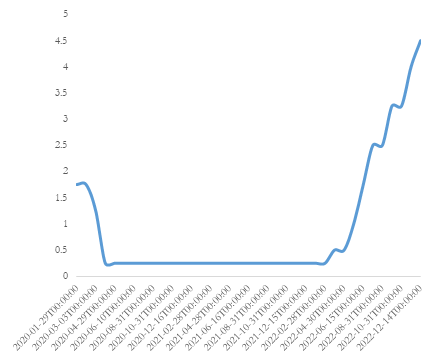

Figure 6: Interest Rate of the US from Jan 2020 to Dec 2022. | |

Data source: Investing | |

Photo credit: Original | |

| |

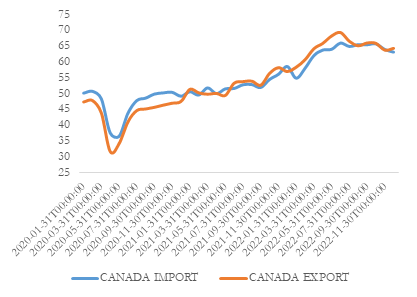

Figure 7: Canada’s exports to the United States from 2020 to 2022 and Canada’s imports to the United States from 2020 to 2022. | |

Data source: Investing | |

Photo credit: Original | |

As is shown in Figure 6, from 2020 to 2022, Fed ongoing rate hikes provide a favorable context for the analysis. According to Figure 7, which reflects Canada’s exports to the US, and Figure 8, which reflects Canada’s imports to the US it is obvious that from 2020 to 2022, before the Fed raised interest rates in July 2022, both imports and exports maintained a relatively slow growth trend, except for the sharp drop in imports and exports caused by the impact of the COVID-19 pandemic in 2020. However, after the Fed suddenly raised interest rates, Canada’s exports to the US reached the peak in the past three years, and with the Fed’s continuous interest rate hiked in 2022, the Canadian dollar continued to depreciate against the US dollar, and the international trade between the two countries were also more active than before.

In 2020, Canada's largest exports to the United States were energy and automobiles [17]. Historically, Canada's exports have included a wide variety of primary commodities and energy products, which account for a significant share of exports. When the exchange rate of the Canadian dollar fell, it would naturally attract more consumption [18]. The international trade situation between Canada and the United States indicated the impacts of the Fed's interest rate hike.

3.2. Case Study

Cenovus Energy Inc. (CVE), a Canadian integrated oil and natural gas company, is Canada's third largest producer of crude oil and natural gas and the second largest Canadian refiner and upgrader [19]. In 2015, the company obtained a crude oil export license from the United States and carried out some business of exporting crude oil to the US [20] According to what was analyzed above, CVE undoubtedly benefited from the massive increase in Canadian fuel exports to the U.S. during the three years between 2020 and 2022 when the Federal Reserve raised interest rates. The 2021 CVE results when the Fed did not raise interest rates and the 2022 CVE results when the Fed’s rise interest rates will be focused and compared below.

From the perspective of financial, since product sales prices of CVE are determined with reference to US benchmark prices, most of its revenue is affected by foreign exchange risk. In other words, a stronger Canadian dollar would have a negative impact on its revenues. Compared with 2020, not only the Canadian dollar doubled in value against the US dollar in 2021, but there were still four unconverted bill payments by the end of the year, resulting in a foreign exchange loss of more than 200 million US dollars after the conversion of US dollar debts. By 2022, despite the appreciation of the U.S. dollar and the depreciation of the Canadian dollar, its foreign exchange losses still were as high as more than 300 million U.S. dollars

20], which may have relation to the business expansion of CVE. In the case of stock market, for one thing, giving TSX, CVE's stock price showed cyclical fluctuations after June 2022, which had nothing to do with the continuous interest rate hike of the US dollar. On the other hand, taking NYSE into consideration, the stock price of CVE reached its peak at the beginning of June and fell all the way before the beginning of July, which had little to do with the Fed’s tightening policy.

Table 1: Consolidated Statements of Earnings (Loss) Source: CVE.

For the years ended December 31, ($ millions, except per share amounts) | ||||

NOTES | 2022 | 2021 | 2020 | |

Revenues | 1 | |||

Gross sales | 71765 | 48811 | 13914 | |

Less Royalties | 4868 | 2454 | 371 | |

Expenses | 1 | 66897 | 46357 | 13543 |

Purchased Product | 33801 | 23326 | 5681 | |

Transportation and Blending | 11530 | 8038 | 4728 | |

Operating | 5569 | 4716 | 1955 | |

(Gain)Loss on Risk Management | 37 | 1636 | 995 | 308 |

Depreciation, Depletion and Amortization | 11202123 | 4679 | 586 | 3464 |

Exploration Expense | 101 | 18 | 91 | |

(Income)Loss From Equity-Accounted Affiliates | 22 | (15) | (57) | - |

General and Administrative | 6 | 865 | 849 | 292 |

Finance Costs | 7 | 820 | 1082 | 536 |

Interest Income | (81) | (23) | (9) | |

Integration and Transaction Costs | 8 | 106 | 349 | 29 |

Foreigner Exchange (Gain) Loss, Net | 9 | 343 | (174) | (181) |

Revaluation | 5 | (549) | - | - |

Re-measurement of Contingent Payments | 28 | 162 | 575 | (80) |

(Gain) Loss on Divestiture of Assets | 10 | (269) | (229) | (81) |

Other (Income) Loss, Net | 12 | (532) | (309) | 40 |

Earnings (Loss) Before Income Tax | 8731 | 1315 | (3230) | |

Income Tax Expense (Recovery) | 13 | 2281 | 728 | (851) |

Net Earnings (Loss) | 6450 | 587 | (2379) | |

Net (Earnings) Loss Per Common Share | 14 | |||

Basic | 3.29 | 0.27 | (1.94) | |

Diluted | 3.20 | 0.27 | (1.94) | |

In terms of business, what is indicated in Table 1 is the consolidated statements of earnings of CVE from 2020 to 2022, in 2022, there is no doubt that gross sales increased by nearly half of which in 2021. Moreover, Table 2 displays the income tax expense of CVE, reflecting the better performance. In 2022, compared with the income that CVE failed to pay taxes in the United States in 2021, by 2022, CVE paid up to 104 million US dollars in taxes. Considering that both upstream and downstream segments of CVE have cooperation with the United States, and CVE own refineries in the United States, and have invested in some local energy companies, it proved that in 2022, CVE's business in the United States greatly expanded and its exports increased. All in all, a Fed rate hike could be beneficial for Canadian companies in several sectors that export the most to the United States.

Table 2: Income Tax Expense Source: CVE.

FOR THE YEARS ENDED DECEMBER 31, | |||

2022 | 2021 | 2020 | |

Current Tax | |||

Canada | 1252 | 104 | (14) |

United States | 104 | - | 1 |

Asia Pacific | 262 | 171 | - |

Other International | 21 | 1 | - |

Total Current Tax Expense (Recovery) | 1639 | 276 | (13) |

Deferred Tax Expense (Recovery) | 642 | 452 | (838) |

2281 | 728 | (851) | |

4. Conclusion

Based on what is analyzed above, it is found that Canada is a small open economy, with energy exports making up a significant portion of its exports. As a geographical neighbor and one of the most important trading partners of the United States, Canada is vulnerable to the changes of US monetary policy.

This paper illustrates the impacts of the Fed rate hike on Canada from two perspectives, including financial markets and international trade. In terms of the financial market, the sudden interest rate hike makes investors more willing to exchange their Canadian dollars for US dollars, resulting in the appreciation of US dollars and the depreciation of Canadian dollars, which is in line with the general macroeconomic model. Although the sudden interest rate hike changes investors' expectations and may have a certain impact on the Canadian stock market in the short term, in the long term, the interest rate hike no longer changes investors' expectations, and the Fed's interest rate hike has almost nothing to do with the stock market volatility. Surprisingly for the bond market, Canadian bonds moved almost in lockstep with U.S. Treasuries, which lowered prices and raised yields as the Fed raised rates, as did Canadian bonds. From the perspective of international trade, when the Fed raises interest rates, Canada's exports to the United States increase in tandem with imports. Especially for the energy sector, the Fed's interest rate hike has boosted Canadian energy exports to the US, which is beneficial to energy multinationals, such as CVE.

These conclusions are very useful, whether for the Canadian monetary authority, or for multinational corporations and individual investors. Different subjects can have different responses according to these conclusions. Although the exchange rate of the Canadian dollar depends on the free adjustment of the market, for Bank of Canada, when the Fed continues to raise interest rates, the bank can also act to maintain the trade balance between the two countries. For example, the central bank can raise interest rates and issue Canadian Treasury bonds in order to reduce people's holdings of money. In addition, the central bank could sell some Treasury securities. For multinational companies, especially those denominated in U.S. dollars like CVE, they must take into account the losses caused by exchange rate changes and make timely decisions on the handling of currency holdings based on monetary or fiscal policies. When the U.S. dollar appreciates, multinational companies may need to hold more U.S. dollars than Canadian dollars. In this case, for individual investors, on the one hand, they can take the opportunity to buy stocks of companies that may perform better. For example, when the depreciation of the Canadian dollar causes the United States to import more Canadian energy, investors can buy shares of Canadian energy companies for income. On the other hand, investors can also convert Canadian dollars into U.S. dollars.

References

[1]. About the Fed. Federal Reserve Board - About the Fed. (n.d.) (2023). https://www.federalreserve.gov/aboutthefed.htm

[2]. Caves, R. E., Porter, M. E., Spence, M., & Scott, J. T. (1980). Competition in the open economy: A model applied to Canada (No. 150). Harvard University Press.

[3]. Caliendo, L., & Parro, F. (2015). Estimates of the Trade and Welfare Effects of NAFTA. The Review of Economic Studies, 82(1), 1-44.

[4]. U.S.-Canada Trade Facts. United States Trade Representative. (n.d.). Retrieved March 2, 2023, from https://ustr.gov/countries-regions/americas/canada

[5]. Why U.S. companies from all industries are flocking to Canada. Invest in Canada. (n.d.). Retrieved March 2, 2023, from https://www.investcanada.ca/blog/why-us-companies-all-industries-are-flocking-canada

[6]. Murray, J. (2000). Why Canada needs a flexible exchange rate. The North American Journal of Economics and Finance, 11(1), 41-60.

[7]. Understanding Exchange rates. Bank of Canada. (2020, August 13). Retrieved March 3, 2023, from https://www.bankofcanada.ca/2020/08/understanding-exchange-rates/

[8]. HAYES, A. D. A. M. (2019, July 6). How to understand the foreign exchange graph. ReviewEcon.com. Retrieved March 3, 2023, from https://www.reviewecon.com/foreign-exchange

[9]. Kia, A. (2013). Determinants of the real exchange rate in a small open economy: Evidence from Canada. Journal of International Financial Markets, Institutions and Money, 23, 163-178.

[10]. Munro, E. (2014). Comovements of the U.S. and Canadian Financial Markets. Retrieved March 3, 2023, from https://econ.columbia.edu/wp-content/uploads/sites/41/2018/03/munroe.pdf

[11]. Trading economics: 20 million indicators from 196 countries. TRADING ECONOMICS | 20 million INDICATORS FROM 196 COUNTRIES. (n.d.). Retrieved March 4, 2023, from https://tradingeconomics.com/

[12]. Poshnjari, I. (2022). TSX in 2022: A look back at how it performed - BNN Bloomberg. BNN Bloomberg. Retrieved March 3, 2023, from https://www.bnnbloomberg.ca/tsx-in-2022-a-look-back-at-how-it-performed-1.1864456

[13]. Bhuiyan, E. M., & Chowdhury, M. (2020). Macroeconomic variables and stock market indices: Asymmetric dynamics in the US and Canada. The Quarterly Review of Economics and Finance, 77, 62-74.

[14]. Lo Conte, R. (2009). Government bond yield spreads: A survey. Giornale degli Economisti e Annali di Economia, 341-369.

[15]. Interest rate risk — when interest rates go up, prices of fixed-rate ... U.S. SECURITIES AND EXCHANGE COMMISSION. (2013). Retrieved March 3, 2023, from https://www.sec.gov/investor/alerts/ib_interestraterisk.pdf

[16]. Bauer, M. D., & Neely, C. J. (2014). International channels of the Fed's unconventional monetary policy. Journal of International Money and Finance, 44, 24-46.

[17]. State of Trade 2020. GAC. (2022). Retrieved March 4, 2023, from https://www.international.gc.ca/gac-amc/publications/economist-economiste/state-of-trade-commerce-international-2020.aspx?lang=eng

[18]. Charnavoki, V., & Dolado, J. J. (2014). The effects of global shocks on small commodity-exporting economies: lessons from Canada. American Economic Journal: Macroeconomics, 6(2), 207-237.

[19]. Husky Energy Inc. (2021). Transaction to combine husky and Cenovus closes. GlobeNewswire News Room. Retrieved March 4, 2023, from https://www.globenewswire.com/news-release/2021/01/04/2152438/0/en/Transaction-to-combine-Husky-and-Cenovus-closes.html

[20]. Surran, C. (2015). Report: Cenovus Energy Secures U.S. Crude Export License (NYSE: CVE). Seeking Alpha. Retrieved March 4, 2023, from https://seekingalpha.com/news/2761546-report-cenovus-energy-secures-u-s-crude-export-license

Cite this article

Zhang,Y. (2023). The Impacts of the Fed’s Interest Rate Hike on Canada: Financial Markets and Prospect of International Companies. Advances in Economics, Management and Political Sciences,24,50-59.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 2023 International Conference on Management Research and Economic Development

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. About the Fed. Federal Reserve Board - About the Fed. (n.d.) (2023). https://www.federalreserve.gov/aboutthefed.htm

[2]. Caves, R. E., Porter, M. E., Spence, M., & Scott, J. T. (1980). Competition in the open economy: A model applied to Canada (No. 150). Harvard University Press.

[3]. Caliendo, L., & Parro, F. (2015). Estimates of the Trade and Welfare Effects of NAFTA. The Review of Economic Studies, 82(1), 1-44.

[4]. U.S.-Canada Trade Facts. United States Trade Representative. (n.d.). Retrieved March 2, 2023, from https://ustr.gov/countries-regions/americas/canada

[5]. Why U.S. companies from all industries are flocking to Canada. Invest in Canada. (n.d.). Retrieved March 2, 2023, from https://www.investcanada.ca/blog/why-us-companies-all-industries-are-flocking-canada

[6]. Murray, J. (2000). Why Canada needs a flexible exchange rate. The North American Journal of Economics and Finance, 11(1), 41-60.

[7]. Understanding Exchange rates. Bank of Canada. (2020, August 13). Retrieved March 3, 2023, from https://www.bankofcanada.ca/2020/08/understanding-exchange-rates/

[8]. HAYES, A. D. A. M. (2019, July 6). How to understand the foreign exchange graph. ReviewEcon.com. Retrieved March 3, 2023, from https://www.reviewecon.com/foreign-exchange

[9]. Kia, A. (2013). Determinants of the real exchange rate in a small open economy: Evidence from Canada. Journal of International Financial Markets, Institutions and Money, 23, 163-178.

[10]. Munro, E. (2014). Comovements of the U.S. and Canadian Financial Markets. Retrieved March 3, 2023, from https://econ.columbia.edu/wp-content/uploads/sites/41/2018/03/munroe.pdf

[11]. Trading economics: 20 million indicators from 196 countries. TRADING ECONOMICS | 20 million INDICATORS FROM 196 COUNTRIES. (n.d.). Retrieved March 4, 2023, from https://tradingeconomics.com/

[12]. Poshnjari, I. (2022). TSX in 2022: A look back at how it performed - BNN Bloomberg. BNN Bloomberg. Retrieved March 3, 2023, from https://www.bnnbloomberg.ca/tsx-in-2022-a-look-back-at-how-it-performed-1.1864456

[13]. Bhuiyan, E. M., & Chowdhury, M. (2020). Macroeconomic variables and stock market indices: Asymmetric dynamics in the US and Canada. The Quarterly Review of Economics and Finance, 77, 62-74.

[14]. Lo Conte, R. (2009). Government bond yield spreads: A survey. Giornale degli Economisti e Annali di Economia, 341-369.

[15]. Interest rate risk — when interest rates go up, prices of fixed-rate ... U.S. SECURITIES AND EXCHANGE COMMISSION. (2013). Retrieved March 3, 2023, from https://www.sec.gov/investor/alerts/ib_interestraterisk.pdf

[16]. Bauer, M. D., & Neely, C. J. (2014). International channels of the Fed's unconventional monetary policy. Journal of International Money and Finance, 44, 24-46.

[17]. State of Trade 2020. GAC. (2022). Retrieved March 4, 2023, from https://www.international.gc.ca/gac-amc/publications/economist-economiste/state-of-trade-commerce-international-2020.aspx?lang=eng

[18]. Charnavoki, V., & Dolado, J. J. (2014). The effects of global shocks on small commodity-exporting economies: lessons from Canada. American Economic Journal: Macroeconomics, 6(2), 207-237.

[19]. Husky Energy Inc. (2021). Transaction to combine husky and Cenovus closes. GlobeNewswire News Room. Retrieved March 4, 2023, from https://www.globenewswire.com/news-release/2021/01/04/2152438/0/en/Transaction-to-combine-Husky-and-Cenovus-closes.html

[20]. Surran, C. (2015). Report: Cenovus Energy Secures U.S. Crude Export License (NYSE: CVE). Seeking Alpha. Retrieved March 4, 2023, from https://seekingalpha.com/news/2761546-report-cenovus-energy-secures-u-s-crude-export-license