1 Introduction

The past few years witnessed the unprecedented development of numerous fintech companies in China, which attracted great attention from all walks of life. For nearly two decades, the lending industry's market's growth and risk level have continued to climb as more and more institutions are engaged in this industry to seek profits. The leverage rate of this industry is pretty high, though those fintech companies created a huge market that greatly benefits the Chinese economy. Also, the bad debt rate created by lending activities is high and exceeds the safety line. Considering all these facts and situations, the governments have introduced a series of policies and rules to regulate the industry. The Chinese government has gradually realized that the lending business conducted by those fintech companies is a double-edged sword with both advantages and disadvantages. The main goal of these policies taken by the Chinese government is to use such a double-edged sword to benefit the whole society and reduce the risks created during this process.

From 2011 to 2017, with the rapid development of fintech companies in China, the micro-loans market size reached a peak of 980 billion CNY. To some extent, these companies play the same role as banks. However, they are not regulated by the government institutions as banks are because they are not regarded as banks in China; thus, people call such fintech companies "shadow banks." They offer loans to consumers to earn interest from consumers. A typical example is Ant financial. Alibaba, which runs Ant Financial, provides consumers with Yu'E Bao for saving and Jie Bei for borrowing. The appearance and ever-expanding of China's micro-loans market are also boosted by people's increasing demand for loans as the traditional banking system is difficult to meet the increasing capital needs of the working class and the self-employed because most of them cannot get loans from the banks due to their financial performance. Microfinance companies can also benefit society by promoting people's consumption and controlling deflation. On the other hand, numerous self-employed people can expand their business through such loans, contributing to China's GDP growth and economic development.

The fintech companies benefit from asset-backed securities, also known as ABS, which have gained wide recognition by investors in China. ABS is a tool that helps lending companies to create their creditors' rights and sell them to investors such as banks or funds, giving lending companies more money to lend to consumers. Though ABS keeps benefitting the market, it has also caused several problems and crises that fintech companies deal with.

When these companies use their creditors' rights to finance from banks and investors through ABS tools, the risk of these loans is transferred from these companies to the whole society. Such risks have attracted the great attention of the Chinese regulators in this market. With the rapid development of such borrowing and lending services, many enterprises have established relationships with fintech companies with huge financial risks. The average leverage ratio of microfinance companies is 11.3%, while the bad debt ratio has reached 8.3% (China micro-credit::: companies association). Besides the high leverage ratio, some microfinance companies are engaged in illegal activities. For example, between 2016 and 2017, there were many illegal peer-to-peer borrowing and lending services, known as P2P and Ponzi schemes. P2P companies acquire money from new investors and then repay their previous investors. In other words, they do not make profits but make investors believe that they have profitability through continuous financing activities. This phenomenon still exists today, and Hongling Capital is a leading enterprise of fintech companies in China. It was suspected of illegal fund-raising and fraud in 2022 (Shenzhen Municipal People's Procuratorate). The number of such microfinance institutions peaked at nearly 9,000 at the end of 2015 and then started to decline at an average annual rate of nearly 5% after the Chinese government started to regulate this market (Chinese Micro-credit Companies Association). To limit illegal activities and control the excessive leverage, according to the provisions of the CBRC, microfinance companies can only use the integration funds from no more than two banking financial institutions, and their external financing is not allowed to exceed 50% of the net capital. By the end of June 2021, the small loan balance was 886 billion CNY, and the loan balance decreased by 2.249 billion CNY compared to 2020 (people's Bank of China). [1]

The emergence and expansion of petty consumer loans show that there is still a huge capital demand in the Chinese market, and petty consumer loans may be one of the future development trends of the financial market in China. Developing the petty consumer loan industry properly has become the main task of the relevant authorities of the Chinese government. In response to the risks brought by ABS tools for financial companies to obtain more funds in the past few years, the China Securities Regulatory Commission has suspended the IPO plan of the leading fintech company, Ant Financial, due to its too high leverage ratio. At the same time, the vast majority of microfinance companies have expanded their customer groups and built their credit rating data, and the reliability of these data determines the repaying capability of the borrowers. The Chinese government has then incorporated the credit rating system of each loan company into the national credit investigation system. As such a practice can have numerous impacts on the market, it is imperative to better understand microfinance companies' market demands and risks. A deeper understanding of the microfinance company's market can provide useful information for people to invest in microfinance companies and learn more about their related products and China's enacted policies and regulations.

The author's study focuses on those fintech companies, analyzing their usage of ABS and policies the government should adopt to control potential risks and benefit the society. The author also touches upon some areas not covered by previous research and gives some recommendations to eliminate potential risks in the industry.

It is hoped that the author's research can provide new insights regarding the microfinance market and the key points that investors need to pay attention to when investing in the microfinance market. [2]

2 The Definition of China's Consumer Loan Asset-backed Securities (ABS)

Consumer loan asset-backed securities are pass-through securities that entitle the holders to receive payments based on the cash flow from balances outstanding under consumer loans. These securities generally have the following characteristics: (1) the accounts have standardized payment terms and require fixed monthly payments of both principal and interest; (2) the balances of ABS comprise the obligations of numerous borrowers and accordingly represent a very diversified pool of obligor's credit risk; and (3) the repayment stream of such balances depends on the redemption schedule of the balance amounts and many other factors including prepayment rates and charge-offs.

2.1 Characteristics of China's Consumer Loan Asset-backed Securities

Characteristics of China's Consumer Loan ABS's Issuers.

Institutions that create asset-backed securities for personal consumer loans in the interbank market include banks and consumer finance companies. A consumer finance company is a non-bank financial institution that the CBRC (China Banking Regulatory Commission) approves to be established without taking public deposits and provides microfinance to individual residents in China for consumption purposes in multiple ways.

The government strictly reviews and approves the consumer finance licenses, with only 30 companies approved as of October 2020. The government mainly issues such licenses in economically developed regions, with three in Beijing, Shanghai and Chongqing.

Fig. 1. Source: China Banking Regulatory Commission

Consumer finance companies make individual consumers their targeted consumer group, and their business areas cover loans on consumer durables such as housing and automobiles and general-purpose personal consumption loans.

China's Consumer Loan ABS Development.

China's consumer loan securitization products have a late start, a low proportion in total issuance, and banks serve as the main providers of funds. Please see the table below.

A late Start. Since the pilot securitization of credit assets was launched in China in 2005, it was not until 2015 that the first interbank consumer loan asset securitized product - Yong Ying 2015 Phase I Consumer Credit Asset-Backed Securities, was issued, showing a late start compared to other varieties of interbank ABS products.

ABS issuance rose steadily from 2016 to 2019 compared to the previous year; however, credit ABS issuance decreased in 2020 due to the covid-19 pandemic and rose in 2021 but still did not reach the size of 2019.

Fig. 2. : (Source: China Banking Regulatory Commission)

2.2 The Low Share in Total Issuance.

RMBS and Auto-Loan ABS are the main components of the credit ABS market; consumer loan ABS accounted for only 5% of the total issuance in 2021 (see pie chart below).

Fig. 3. : (Source: China Banking Regulatory Commission)

2.3 Features of the Underlying Assets of Consumer Loan ABS

• The high degree of diversification.

The high degree of diversification is the most notable feature of the underlying assets of consumer loan ABS. The average number of loans for the 28 consumer loan ABS underlying assets issued in the interbank market was 305,787.11, with an average principal balance of only 85,900 CNY per loan, and the good diversification of the underlying assets can mitigate the risk of default due to overdue individual assets.

• The credit lending approach is predominantly credit-based.

Generally, it does not have credit enhancements such as collateral or pledges attached. Personal consumer loans are mainly credit-based and generally lack sufficient collateral. Therefore, the personal consumer loans have relatively low post-default recovery rates (By the end of 2020, the overall recovery rate of China's public bond market is 10.65%) once they become non-performing assets. The credit enhancements such as collateral are adopted on some products to improve the quality of the underlying assets.

• The weighted average lending rate is high, protecting against the excess spread.

The average loan interest rate of the 28 interbank consumer loans ABS issued was 14.00% per annum, significantly higher than the consumer loan ABS initiated by the bank, which is around 20%.

2.4 Structure of Consumer Loan ABS

Transaction Process Structure of Consumer Loan ABS.

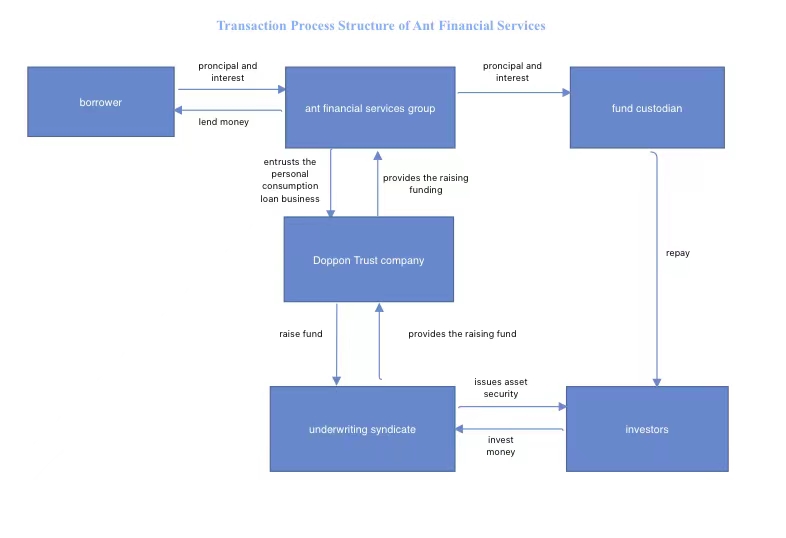

The author introduces the transaction process structure of consumer loan ABS operated by Fintech companies before analyzing the risks posed by a Fintech company. As one of the biggest Fintech companies in China, the author takes Ant Financial Services Group (An Internet financial lending company in China ) as an example to introduce the transaction process structure of consumer loan ABS.

Ant Financial Services Group is an Internet financial lending company in China. Its business model utilizes many customer data resources from its internet e-commerce platform. It satisfies the financing needs of merchants on the platform through microfinance. The process from loan application to lending is simple and completed online with great business efficiency.

Fig. 4. transaction process structure of Ant Financial Service

To begin with, Ant Financial Services Group plays a role as an originating institution. It signs a Trust Institution contract with Doppon Trust Company and entrusts the personal consumption loan business it holds as credit assets to Doppon Trust Company as the trustee. The Doppon Trust Company then raises funds through an underwriting syndicate. Underwriting syndicate issues asset securities backed by trust property to investors and pays the raised funds to the originator - Ant Financial Services Group.

After Ant Financial Services raises funding from Doppon Trust Company, it issues small consumer loans to borrowers. Online shopping platforms such as Taobao, Tianmao and small lending products such as "Hua bei" and "jiebei" under the Ant Financial Services provide customers with installment services for goods consumed on the platform.

Finally, the borrowers repay the principal and interest to Ant Financial, and Ant Financial then transfers the principal and interest to the fund custodian for custody.

Below are another two important points about Ant Financial Services that need to be illustrated in detail:

The Source of Funding for Ant Financial Services:.

In 2010, Alibaba founded a microfinance company in Hangzhou, Zhejiang Province, called Ali Microfinance, with a registered capital of 600 million CNY to issue loans to merchants on its platform. More than 26 billion CNY of loans were issued through Ali Microfinance in just two months, with interest rates exceeding 1 million CNY per day. The borrowing rate of Ali Microfinance is about 8%, and that of the external loan is 12% to 18%. Alibaba obtained another microfinance license in Chongqing in 2011 (Ant Small Loan).

In 2013, Ant Financial Services registered the Ant Small Loan with the capital of Approx. 3 billion CNY using the special local regulatory policies in Chongqing and acquired Approx. 6 billion CNY from the bank, forming an online microfinance provider with a capital of 9 billion CNY. Ant Financial Services serves as one of the important funding sources for Ant Financial Services.

2.5 The Application Process of Ant Financial Services Group:

Step 1: A borrower fills in the basic information on the given website, the amount of the money applied, then reviews the loan information.

Step 2: After the borrower applies for a loan, Ant Microfinance uses the database to search the merchant's transaction records, check the merchant's credit status, and conduct relevant investigations on the loan-involved business through an independent third-party organization.

Step 3: Ant assesses the borrower's credit and uses a data model to predict the risk of default and categorize the customer's basic business.

Step 4: Ant determines the loan amount and repayment terms based on the customer's credit rating score under its finance risk pre-warning model.

Step 5: For post-loan management, Ant mainly uses a post-loan collection scoring model to monitor the borrower's cash flow and reduce the risk of default. If the repayment is overdue, the interest rate is to be increased by 50%, and a financial handling fee of 3% of the loan amount is added.[3]

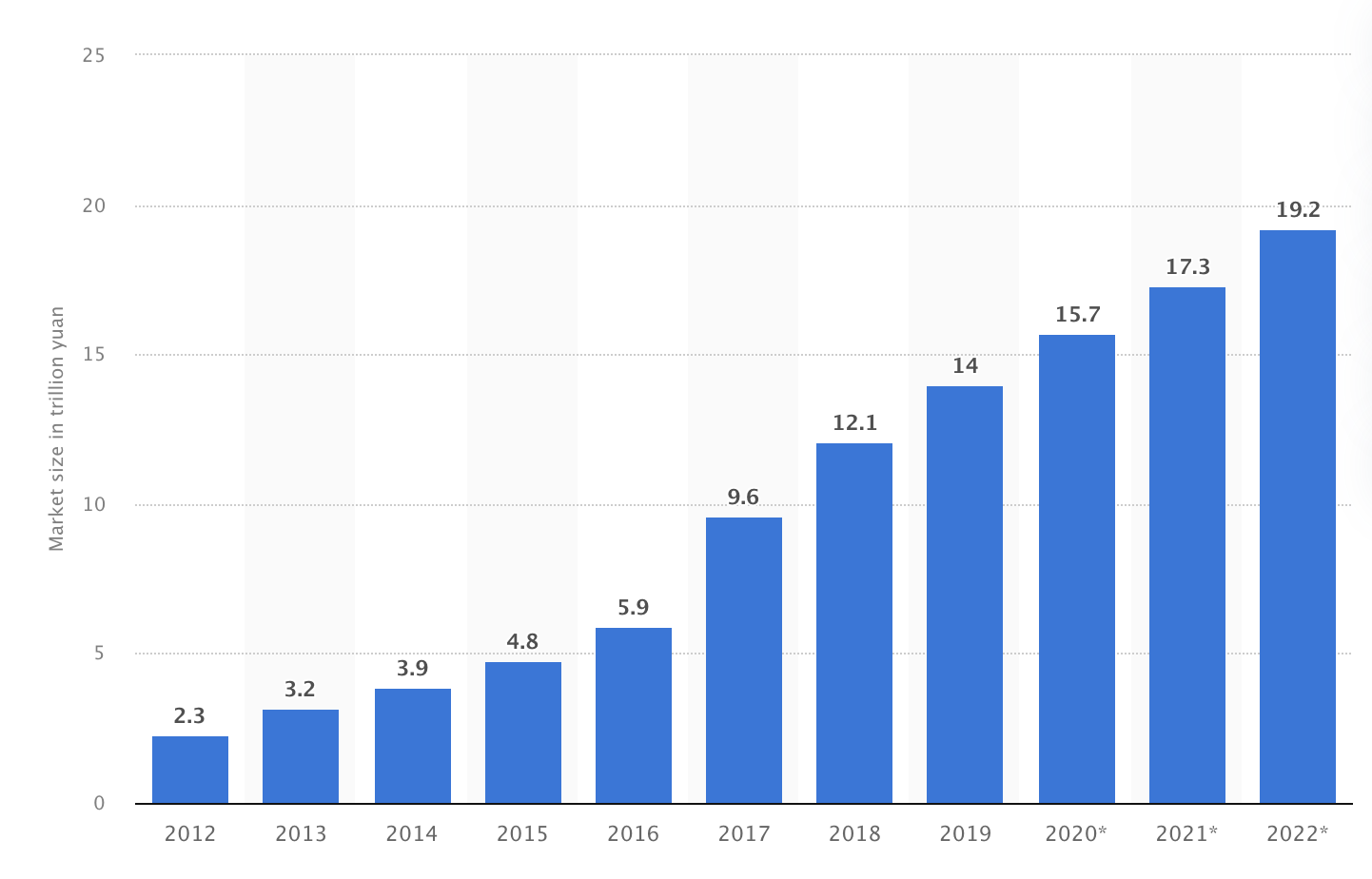

Fig. 5. The market size of the consumer finance industry in China from 2012 to 2019, with forecasts for 2022 (in trillion CNY)

According to MobTech [4], the consumer finance industry is expected to grow by 19.2 trillion CNY by 2022. It is widely recognized that more attention shall be paid to this industry. It is quite difficult for people to borrow money from banks due to the relevant authorities' strict rules and regulations. Those individuals or businesses unable to get a loan from banks would turn to fintech companies for financial support. In some cases, consumers prefer to borrow money from fintech companies because it is easier and more convenient to borrow money from fintech companies than from banks, as the loan application from fintech companies can be simply completed on an applet (e.g., Huabei from Ant Group). However, the rapid growth of fintech companies has also posed many potential risks to society.

2.6 Credit

Banks make loan decisions based on people's credit history. It is critical to evaluate whether borrowers can pay back the money or not before giving the loan. People usually borrow money from friends or families based on their "personal connection credit" - trust for the small borrowing amount. However, not every borrower has a formal credit record. When it comes to larger loans such as car loans, mortgages, or business-used loans, it is very difficult for banks to decide whether to approve them.

On the other hand, many financial institutions are unwilling to share borrowers' credit information or loan history, making it more difficult for individuals or businesses to obtain loans from different institutions. When fintech companies enter the market, their credit scoring systems may not truly reflect people's actual loan repayment ability. For example, fintech companies can only evaluate the borrower's creditworthiness based on the borrower's usage of their products or Apps. They have no access to know how the borrower repays the loans, making the market difficult to regulate, leading to a higher default rate and illegal activities.

First, as fintech companies provide customers with more options than banks, people without credit history prefer to apply for loans from those companies, which can reduce commercial banks' income, posing threats to the survival and development of those commercial banks in China. Secondly, the fintech companies pose threats to the borrower's privacy. According to Ant Group's IPO prospectus, its App users will reach around 111 million by June 2020. The borrower's data recorded by Ant Group cover the borrower's education, income, credit card information, shopping habit, spending habit, travel history, social connections (whom they transfer money to and receive money from), etc. Such personal data collected and analyzed by fintech companies raise concerns about data privacy. Policies and regulations need to be put into place to safeguard the users' data security. It is critical for authorities and regulators to manage the personal data when the borrowers apply for loans from the fintech companies to avoid privacy violations. Such management shall clarify what kind of data fintech companies can get from the borrowers, how these companies process such data, and whom they can share these data with.

The Chinese government has taken robust measures to deal with the issues. The government has founded a company named Baihang that provides personal credit scoring to create and maintain a healthy and efficient credit investigation environment. Some fintech giants are their shareholders. Such a governmental practice aims to break the monopoly of the fintech giants on borrowers' data. Fintech companies are required to share their credit data with Baihang, and they also have access to the data possessed by Baihang.

Such government regulations on fintech companies can bring numerous benefits to the market. Prioritizing the consumer's privacy and managing the consumer's data can better protect individuals' private data. The government regulates the use of personal data by limiting the data use right and standardizing the data using the procedure. An integrated system implemented by the government is easier to monitor and control the market. Also, a designated credit scoring company can provide more accurate and up-to-date information for banks and institutions to make lending decisions. It is expected that the regulations would create a sound mechanism to improve market efficiency and stability. However, fintech companies such as Ant Group and Tencent have hundreds of millions of users with abundant user data information, Baihang also needs to take great efforts and time to manage the borrower's credit data information to standardize the financial practices of fintech companies and banks.

2.7 ABS + Leverage

Fintech companies shall pay more attention to the potential risks when combining ABS and financial leverage. The fintech companies may have limited cash assets to provide to their borrowers as loans. Therefore, the companies would use ABS to increase their capital and provide more loans to more customers on their platforms. According to Tellimer, consumer loans made on Ant Group's CreditTech platform by June 2020 reached 1,732billion CNY, among which 98% of the loans were either directly underwritten by partner institutions or gained by ABS [5].

The use of leverage can increase the interest revenue of fintech companies and add some potential risks. When fintech companies borrow money from the investors and lend money to consumers simultaneously, they can operate smoothly when the market economic environment is healthy. However, when the economic environment is unfavorable to the fintech companies, borrowers might not be able to repay the debt, increasing the bad debt ratio and even the breakdown of the whole system. When a debt market worth billions of dollars goes wrong, the consequence is more serious than fintech companies may be unable to get their money back and go bankrupt, and millions of investors who invested in consumer loans may lose money and suffer great losses. The market worsens, and more problems can be caused when investors cannot get their investment money back. Also, since Fintech companies use the financial tool of Asset-Backed Security, these companies have little or even no information about who is repaying the loan to the investors. Banks are the main investing institutions that buy this type of security package, and they can be risky when they have little information about the borrowers.

To minimize the potential risks, Chinese regulators sought public opinions and recommendations regarding the interim measures for supervising online small lending on November 2nd, 2020. According to the draft of the policy, a microloan lender's financing balance acquired via issuing standard credit assets such as bonds and asset-backed securities should not exceed four times the size of its net assets. It also clarifies the number of online microloans issued to individuals with standards.

Through the new policies and the authorities' strict supervision, it is expected that fintech companies would keep enough cash to cover the bad debt that may appear and reduce the use of leverage when conducting consumer loans. Such policies and supervision also warn the fintech companies to stop relying too much on financial tools such as ABS for survival and development. Such government practices are believed to play a critical role in regulating the consumer loan industries and minimizing potential risks.

Like many developed countries, China does not have an independent authority to supervise the fintech industry. Based on the types of financial products and services, fintech is under the supervision of the financial regulatory authorities, including the People's Bank of China (PBOC), China Banking and Insurance Regulatory Commission (CBIRC) and China Securities Regulatory Commission (CSRC). Under these three main financial regulatory authorities, the local government plays a critical role in exercising power and implementing the needed policies based on the local financial situation; an example is that the government sought public opinions and recommendations on the interim measures for supervising online small loan on November 2nd, 2020. On the other hand, the authorities also strengthened regulations on fintech companies making consumer loans across provinces, and a special license is required for fintech companies to conduct cross-provincial business.

Such policies are essential, and CBIRC would be responsible for managing such policies. However, such policies may also bring negative consequences. People might think the fintech industry is overregulated, strict policies may dampen the confidence of companies and customers, and such policies may also discourage entrepreneurship. Therefore, authorities should take proper measures to balance regulation and free-market development.

3 Literature Review

3.1 Development and Trend of Asset Securitization Market (Macro)

In 2021, the number of credit ABS products increased, with 206 products issued, 22 more than the previous year. Issue volume increased steadily from the previous year, with 882.798 billion CNY, a 7.26% annual increase from the previous year [6]. In recent years, e-commerce financial services using big data technologies have greatly impacted the traditional financial services in China. Consumer finance refers to that people use the loan for personal consumption with characteristics of a small single credit line, quick approval, no mortgage guarantee, and flexible service models, thus, gaining great popularity among different consumer groups. In recent years, the biggest consumer group demanding loans are those under 34 years living in third-tier cities of China, which accounted for 57.4% of the total customers. Also, the low-income students, people buying a house on mortgage and pregnant require increasing consumer finance [7].

The licensed consumer finance companies are divided into banking and non-banking systems. The profitability of licensed banking consumer finance companies is stronger than that of non-banking companies. The fourth-ranked Industrial Bank Co., Ltd. has a net margin of more than 20 percent, while the first-ranked HC Consumer Finance has 6.7 percent. With big data, artificial intelligence, and other high technologies, the non-bank fintech companies also take great market share in the consumer finance industry [8].

1.1. Construction and Development of Consumer Credit System

Fintech companies can operate and expand their businesses based on consumer credit and credit information. However, there is no unified standard for extension credit information outside China. Credit construction depends on a convention, especially in the initial stage of credit construction in a certain country. The law and regulations for credit construction in this stage are not sound and mature, and social and economic behaviors are standard, so it is particularly difficult to define the interest rates of the credit. The root of the problem lies in people's insurance. The relationship between protecting privacy and assessing credit status remains to be clarified.

Ant Financial

3.2 Why does Ant financial operate better than Jingdong Finance?

At present, China's e-commerce big data finance is developing rapidly. Ant Financial and Jingdong Finance are successful e-commerce big data financial platforms. Ant Financial occupies a larger market share than JD Finance. In 2017, Ant Financial ranked first and JD Finance 18th in the start-up valuation list released by "Kuaibaihui." According to their official websites, by the end of 2017, JD Finance's operating revenue was 10.30 billion CNY, while Ant Financial's pre-tax profit was 13.189 billion CNY. In April 2018, Essence Securities valued Ant Financial at $160 billion, and the company's net profit was about $5.48 billion, making Ant Financial the biggest one, followed by JD Finance in China [9].

Ant Financial possesses the following advantages over JD Finance. The first is platform advantage. Alibaba is the biggest e-commerce trading platform with the largest market share in China, with substantial customer resources and big data information resources for Ant Financial to develop its business. Second, Ant Financial has better risk control capabilities as it uses Alipay's big data-based risk control system. Thus, Ant Financial enjoys extremely strong risk control capabilities. Ant Financial's another advantage is its robust credit system. Ant Financial receives customer behavior information from payment, financing, financial planning, and insurance platforms through Ant Financial cloud and then collects information through a third party. The Zhima Credit with Cloud Computing, machine learning, and other technologies under Ant Financial can truly reflect the credit status of small and micro-enterprises. In addition, Ant Financial's another advantage is its efficient data usage scenarios. Ant Financial has established a credit evaluation system through the credit data acquired from e-commerce platforms and built a more integrated financial platform on the Ali platform. Ant Financial cooperates with various financial institutions to provide more diversified financial services for small and micro-enterprises.

Fintech credit providers like Ant Financial and Jingdong Finance enjoy stronger competitive advantages over banks due to their low-cost distribution channels and greater information resources. Such advantages help borrowers with low credit scores to acquire loans to do what they need. Thus, the fintech credit providers have captured a larger market share in the consumer finance industry. Fintech companies can also expand their businesses to fields previously excluded by banks in the credit market.

In conclusion, fintech credit contributes to a more inclusive financial system which creates easier credit access for borrowers than traditional bank credit. The fintech credit may attract increasing popularity in emerging markets like China with underdeveloped credit systems. Fintech credit, with its uniform national credit distribution, can integrate China's highly fragmented local credit markets for small businesses. Fintech credit can also provide better access to China's largely rural population [10].

4 Conclusion

Like fire brings humans both warmth and hurts, Fintech loan companies possess both opportunities and risks. Dealing with this market has become a critical practice for relevant authorities in China. Considering the rising market demands and the adverse impacts of consumer finance in China, the Chinese government shall introduce robust policies to regulate this industry. History has proved that excessive leverage would always lead to financial risks and ignoring the market demand can hinder economic development. The Chinese government is required to control the financing scale and has done that already. At the same time, the government shall also encourage the development of those fintech companies to make more people benefit from such financial services.

ACKNOWLEGEMENT

All the authors are the first author.

References

[1]. Li Meng "Statistical Data Report of Microfinance Companies in the First Half of 2021.", People's Bank of China, http://www.gov.cn/xinwen/2021-07/28/content_5627905.htm.

[2]. Zhong Guo Xiao e Dai Kuan Gong Si Hang Ye Fa Zhan Bao Gao 2005-2016. Zhongguo Jing Ji Chu Ban She, 2016.

[3]. Zhao, Y.N. (2017) Research on the Consumer Finance System of Ant Financial Service Group. American Journal of Industrial and Business Management, 7, 559-565. https://doi.org/10.4236/ajibm.2017.75041

[4]. MobTech. (2020) 2020 Chinese Commercial Finance Industry Research Report. https://www.mob.com/mobdata/report/121

[5]. Rohit Kumar, and Rahul Shah, (2021) China takes another swipe at Ant Group: Credit and data assets split out. https://tellimer.com/article/china-takes-another-swipe-at-ant-group-credit

[6]. DAGONG GLOBAL CREDIT RATING CO., LTD. "Credit Asset Securitization Market." Credit Asset Securitization Market 2021 Annual Report n. pag. Web. April 20th. 2022.

[7]. 2020 China's Consumer Finance Industry The Research Report." MobTech, n.d. Web. April 20th. 2022.

[8]. Zhang, Luoyu, and Yongmao Wang. "Research on Financing Mode of Small and Micro Enterprises under E-Commerce Big Data Finance." 2018.07 (2018): n. pag. Web. April 20th. 2022.

[9]. Hou, Jia Liang. "Innovation and Supervision of Consumer Credit Asset Securitization Business." N.p., n.d. Web. April 21st. 2022.

[10]. Wen, Yicun. "The\ Establishment and Development of Consumer Credit System." 17.1 (2021): n. pag. Web. April 21st. 2022.

Cite this article

Jia,Z.;Chen,Y.;Lang,J.;Li,P. (2023). The Analysis of Asset-Backed Security Backed by Online Consumer Loan. Advances in Economics, Management and Political Sciences,4,292-302.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 6th International Conference on Economic Management and Green Development (ICEMGD 2022), Part Ⅱ

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Li Meng "Statistical Data Report of Microfinance Companies in the First Half of 2021.", People's Bank of China, http://www.gov.cn/xinwen/2021-07/28/content_5627905.htm.

[2]. Zhong Guo Xiao e Dai Kuan Gong Si Hang Ye Fa Zhan Bao Gao 2005-2016. Zhongguo Jing Ji Chu Ban She, 2016.

[3]. Zhao, Y.N. (2017) Research on the Consumer Finance System of Ant Financial Service Group. American Journal of Industrial and Business Management, 7, 559-565. https://doi.org/10.4236/ajibm.2017.75041

[4]. MobTech. (2020) 2020 Chinese Commercial Finance Industry Research Report. https://www.mob.com/mobdata/report/121

[5]. Rohit Kumar, and Rahul Shah, (2021) China takes another swipe at Ant Group: Credit and data assets split out. https://tellimer.com/article/china-takes-another-swipe-at-ant-group-credit

[6]. DAGONG GLOBAL CREDIT RATING CO., LTD. "Credit Asset Securitization Market." Credit Asset Securitization Market 2021 Annual Report n. pag. Web. April 20th. 2022.

[7]. 2020 China's Consumer Finance Industry The Research Report." MobTech, n.d. Web. April 20th. 2022.

[8]. Zhang, Luoyu, and Yongmao Wang. "Research on Financing Mode of Small and Micro Enterprises under E-Commerce Big Data Finance." 2018.07 (2018): n. pag. Web. April 20th. 2022.

[9]. Hou, Jia Liang. "Innovation and Supervision of Consumer Credit Asset Securitization Business." N.p., n.d. Web. April 21st. 2022.

[10]. Wen, Yicun. "The\ Establishment and Development of Consumer Credit System." 17.1 (2021): n. pag. Web. April 21st. 2022.