1. Introduction

To keep pace with economic development and technological progress, more and more companies are trying to achieve excess profits through economies of scale. Although economies of scale bring more surplus value, they also exacerbate various risks, such as higher management costs, reduced information reliability, lower operational efficiency, and less group control, so the concept of sharing comes to the fore in this context.

A financial shared service center is a complex system project based on the concept of sharing, involving a change in concept and awareness, staff organization, business processes, and information systems, which requires constant optimization and improvement. With the advent of the Big Data era, the global economy is increasingly connected by data chains. Business boundaries are becoming increasingly blurred, and the battle for value chains is taking center stage. More and more companies are working to expend the length and breadth of their value chains. As companies grow in size and upstream and downstream supply chains become increasingly interconnected, financial shared service centers are achieving cost reductions and efficiency gains by exploiting the synergies of sharing. In this context, there is a need to examine financial shared services based on the value chain theory.

Financial sharing has always aimed to solve the management dilemmas that globalization brings to companies, to help them create value, and to support their growth [1]. The perspective of value chain analysis can help companies improve their business processes, and highly standardized business processes are the basis for applying financial sharing. In addition, by adopting a value chain perspective and gradually sorting out the process of value enhancement, problems in the application process can be identified. Optimizing the process, building on its strengths, and avoiding its weaknesses can promote the development of the financial management function, providing greater scope for adding value to the enterprise.

Mengniu Group is the first to implement financial shared services in the dairy industry, which is also an exploration and expansion of the financial function and business model. The study of Mengniu's financial shared services provides insight into how this new business model can improve the company's operational efficiency and promote the timeliness and effectiveness of management information. On the other hand, this paper's in-depth study of the financial sharing model of the company under study helps to summarise the experiences that the Mengniu Group should learn from and the shortcomings that can be improved in the implementation of financial sharing. We hope this paper will provide feasible suggestions for future financial sharing in Mengniu and explore the application of the financial sharing model in other companies.

2. Literature Review and Theoretical Background

2.1. Theoretical Basis of Financial Sharing

2.1.1. Information Silos Theory

The traditional financial sharing model suffers from the problem of "information silos". The different comparability of data between companies makes it difficult to collect, process, or export data across companies. It increases costs and reduces the efficiency of information use. On the other hand, even within enterprises, the scope and content of financial sharing are relatively limited due to differences between departments, and no real financial sharing has been achieved.

2.1.2. Process Re-engineering Theory

Process re-engineering is a management concept. According to this concept, the organisational structure of an enterprise breaks through the traditional pyramidal management level and is more inclined to a flat structure. Using the innovation and re-engineering of the internal operational processes of the enterprise, the layers of information interaction are reduced, and the efficiency of internal communication can be improved, thereby reducing communication costs.

2.1.3. Synergy Theory

Synergy refers to the rational allocation of internal or external resources to achieve higher profitability. By actively playing and utilising external synergies, the goal of enhancing competitiveness and creating value can be achieved. It can be divided into three categories: operational synergy, management synergy, and financial synergy. Firstly, operational synergies can shorten the commodity circulation cycle and reduce transaction costs through vertical integration between external value chain enterprises. Secondly, resources between enterprises with different management efficiencies can be integrated by coordinating the management modes of value chain enterprises, thus effectively reducing management costs. Thirdly, the synergistic effect of finance promotes improving the financial level and efficiency of value chain enterprises and integrating financial resources so enterprises can effectively use idle funds in fund-raising and financing, investment, and other aspects. The above synergy effects are better realized through the combing and reconstruction of the value chain, thus promoting the far-reaching development of enterprises.

2.2. Value Chain Model of Financial Sharing

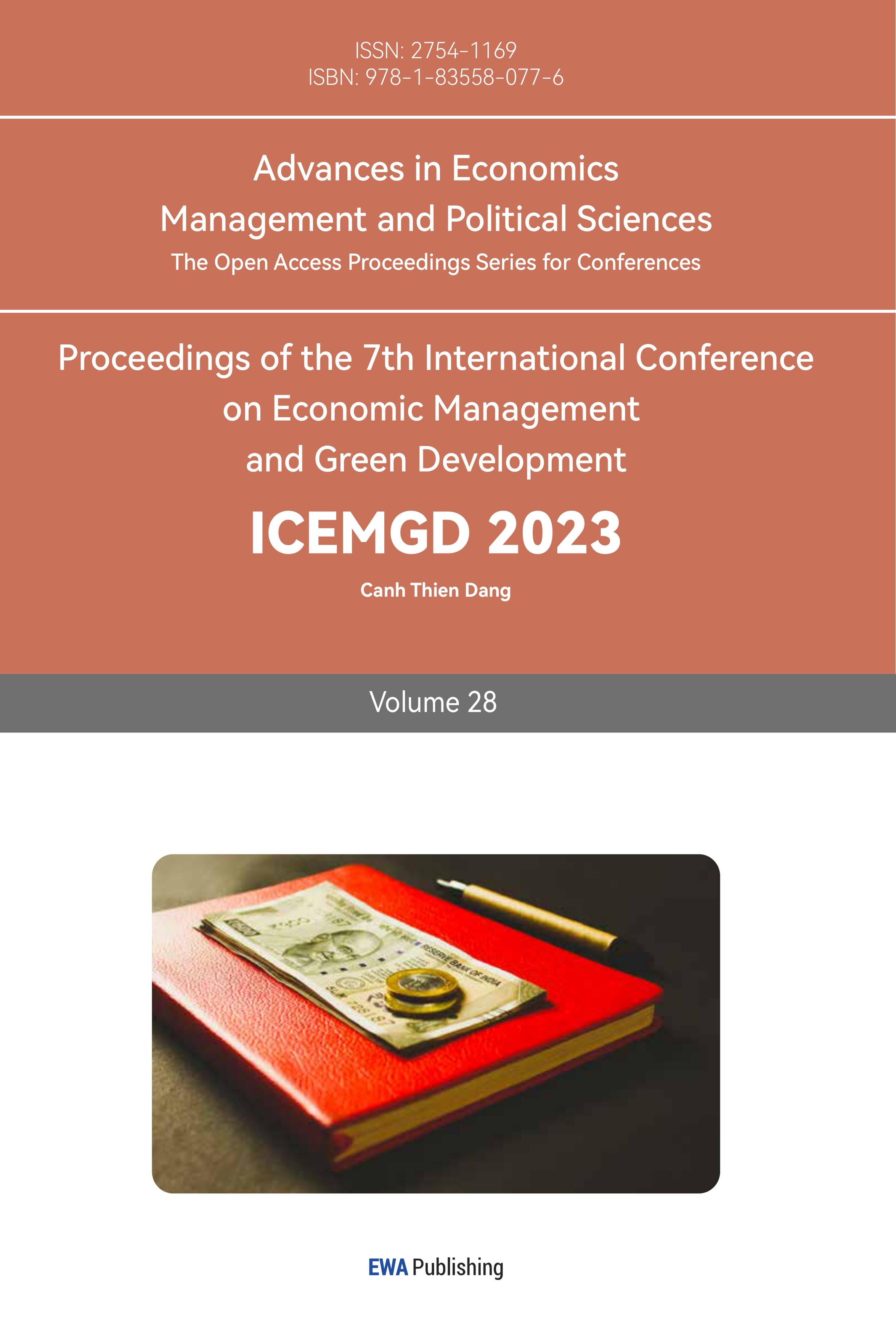

A financial shared service centre aims to add value to an enterprise and improve its competitiveness. The value creation of a financial shared service centre is determined by its support and core activities, as shown in Figure 1.

Figure 1: The FSSC value chain model (Photo credit: Original).

2.3. Value Chain Theory

2.3.1. The Spatial Dimension of the Value Chain

The distinction between internal and external value chains is based on the spatial dimension of value chains. An internal value chain is a value-creation process that links the different business activities within a company in a predetermined way, using the company as a boundary. It covers the entire process from acquiring the means of production to manufacturing value-added products. After separating the value activities of a company, the intrinsic relationships between the activities are then reorganised so that a complete value chain is created.

External value chain analysis is mainly used for industry analysis, which refers to the analysis of companies up and down the value chain as well as companies with which they are comparable. External value chain analysis helps companies to determine their position in an industry, identify their strengths and weaknesses, formulate strategies, decide to enter or exit an industry, strengthen ties between companies, and avoid or exploit risks.

2.3.2. The Temporal Dimension of the Value Chain

Temporal value chain analysis includes ex-ante, post-post, and ex-post value chain analysis, covering the entire process of assessing the value of a company from a time horizon.

Ex ante value chain analysis mainly helps companies to define the objectives of value chain management, assess the feasibility of value chain management plans and strategies, and evaluate the budget of the chosen solution [2]. Internally, it dynamically monitors various business processes and the flow of various types of funds at any time, maximises capital utilisation; externally, through value chain analysis, it captures the completion of the activities of value chain enterprises at any time, provides insight into the dynamics of internal and external fund settlement of enterprises, and helps enterprises to complete the optimisation and refinement of various resource allocations.

The main purpose of the ex-post value chain analysis is to regularly assess the performance of the entire value chain, compare the actual performance with the targets, compare the budget and final accounts, find feasible solutions, and provide timely feedback on the assessment results.

2.3.3. Hierarchical Dimensions of the Value Chain

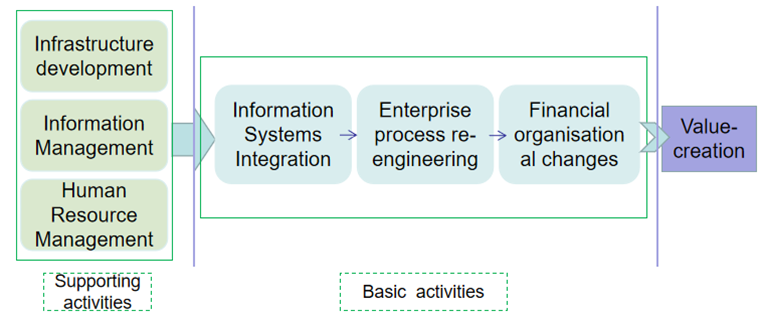

The value-adding process of an enterprise is the physical flow (or "business flow") formed by the flow of goods, the financial flow formed by the flow of money, and the information flow formed by the convergence of various transaction data and information, as shown in Figure 2.

Figure 2: The Intra-firm value chain model (Photo credit: Original).

3. Method

3.1. Literature Analysis Method

3.1.1. Status of Information System

Information systems can improve business efficiency, implement convenient conditions in enterprises' internal control and risk management, and effectively enhance information technology. With the help of the financial sharing platform, the interoperability and integration between business and economic systems are completed, laying the foundation for digital transformation. In practical application, enterprises should continuously optimize their economic shared service center information systems, realize more business scenario applications and improve financial automation. Generally speaking, the higher the level of information technology, the more mature the operation of the financial shared service centre, and the more effective it can be in reducing costs, increasing efficiency, creating value, and controlling risks. The basic information systems in China's current financial shared service centers mainly include financial accounting, expense reimbursement, electronic imaging, fund management and interconnection of banking and enterprises, and electronic archives. More than half of the financial shared service centers contain more than six systems [3].

3.1.2. Status of Business Processes

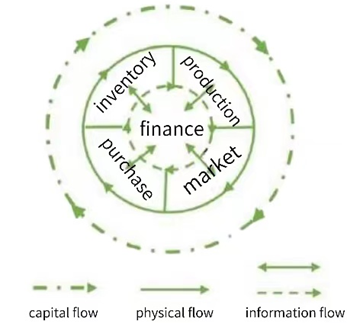

The specialization, standardization, and unification of business processes are the essences of constructing and operating financial shared service centers. The number of business processes covered by a financial shared service center is positively correlated with the range of services provided and largely influences the maturity of the operation. In the current operation of financial shared services in enterprises, as the processes related to daily operations are high in business volume, easy to standardize, and involve few subjective judgment factors, these form an obvious complement to financial sharing [4]. And thus, it becomes the main content of the processes of financial shared service centers, as shown in Figure 3.

Figure 3: FSSC business process coverage (Photo credit: Original).

3.2. Case Study

3.2.1. Functions of the Financial Shared Service Centre

The project has sorted out the business processes of Mengniu Group's financial shared service center. Based on combing results, it conducted a field survey of economic internal control points, identified 35 business reforms, and established seven departments based on business discussions and integration. It covers the whole business of milk sourcing, procurement, sales, expense reimbursement, general ledger, service support, integrated support, integrating business processes, service performance, process optimization, document management, and backup.

3.2.2. Financial Shared Service Centre Positioning

Data Centres

One of the key roles of the Mengniu Group in establishing a financial shared service center is to improve the efficiency of business processing, provide quality data to all parties in the value chain promptly and on time, and support decision-making. The trend of data collection is also shifting from result data to the comprehensive collection. 2019, Mengniu will make digital transformation a strategic plan to deepen the role of big data in supporting the business modules of the industry chain, digitize business processes and make decisions based on data at each step. After the digitization of business, it continues to explore the commercialization of data so that data support business decisions. The core purpose of Mengniu's digital transformation is to add value, use data to guide the business, and improve the enterprise's profitability.

Service Center

Of the four operating models of the Financial Shared Services Service Centre, Mengniu Group's Financial Shared Services Service Centre is trying to transition from a basic model to a market model [5]. Both parties will agree on the services' scope, standards and requirements by providing various types of services at pre-agreed levels. The shared centre will provide services to customers according to the approved content.

3.2.3. Basic Activities in the Value Chain of the Financial Shared Service Center

Through process re-engineering, Mengniu connects existing independent systems such as computing, human resources, and capital into a value chain through a financial sharing integration platform based on the direction of data flow, comprehensively breaking through the barriers between each system, realising real-time data flow between systems in the chain and achieving dynamic monitoring of budget execution while improving efficiency. The sharing of funding systems reduces manual involvement in business processes and increases automation significantly. Not only can payroll and funds payments be fully automated, but efficiency and quality have been improved to varying degrees from the original basis. End-to-end data is collected in one complete set. Multi-system data is derived from the entire operational process. Data coverage is more comprehensive and values mines more extensively. High-quality and rapid feedback is moving towards powerful decision support. This paper examines the basic activities that can add value to the value chain: information systems integration and business process re-engineering.

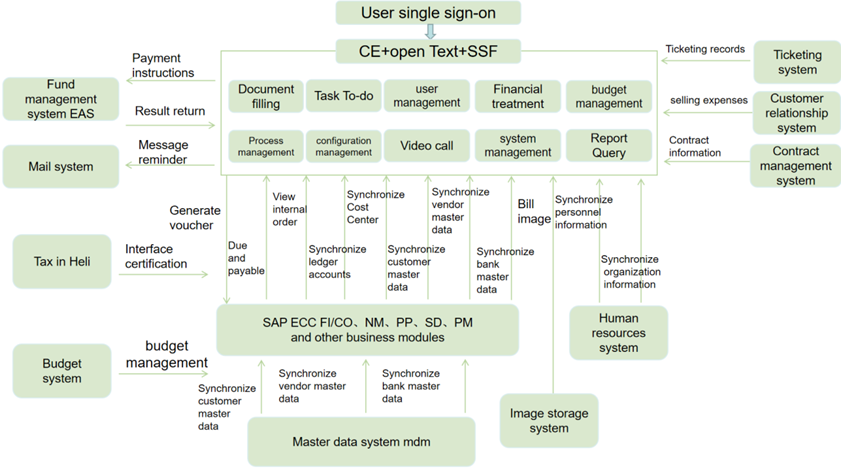

3.2.4. Information Systems Integration

Information systems integration is at the heart of the Mengniu Financial Shared Service Centre. Central to integrating the financial shared service center with related business and operational management systems is the internal and external service output of the financial shared service center. The front-end business system acts as the business engine, carrying the actual business and realizing the practical support of the relevant areas. In contrast, the operation and management system of the Financial Shared Service Centre acts as the service output platform to support the business and provide the corresponding functional support. As the front-end business engine, the core component of the Financial Shared Service Centre is the SAP-E CC system, with the main lines of "expense reimbursement, shared operation, approval management, and image transmission". The system integrates several essential techniques, such as fund management, human resources, budget management, master data support, customer relations, contract management, and email [4]. It establishes a complete financial data transmission platform to guarantee shared services, as shown in Figure 4.

These engines output service requests for the shared service platform, while the shared service platform acts as a centralized management intermediary for the services, providing the corresponding process and operational support in the process of service output. As the front-end business engine, the core component of the Financial Shared Service Centre is the SAP-E CC system, with "expense reimbursement, shared operation, approval management, and image transmission" as the main line. The system integrates several basic techniques, including fund management, human resources, budget management, master data support, customer relationship, contract management, and mail. It sets up a complete business and financial data transmission platform to provide a guarantee for shared services [4].

Figure 4: Mengniu Finance Shared Service Centre information system (Photo credit: Original).

3.2.5. Business Process Re-engineering

Process re-engineering is an essential part of enterprise circulation process management. Process re-engineering breaks the original process management model and reconstructs it according to optimization principles. A good process re-engineering plan identifies the business environment, locates key aspects, finds obstacles, proposes solutions, eliminates non-value-added modules, simplifies operations, and increases efficiency. During this, key processes should be carefully selected for reorganisation and optimisation. Mengniu Group conducted field research on the pilot business modules during the re-engineering process. Firstly, each business type that may be involved in the process of re-engineering was documented, and the improvement needs were summarised. Secondly, a discursive discussion was held around the prerequisite assumptions for process implementation, the corresponding cut-off of responsibilities and other issues, and a comprehensive evaluation of their feasibility and possible input-output benefits was conducted; again, a unified design of the business processes was carried out to strive for the unification, standardisation, and systematisation of the entire process. Finally, key indicators such as business assurance, internal space traction, and efficiency improvement were integrated, and the transformed methods were tested and assessed to complete the process. Finally, the process will be tested and evaluated to complete the process re-engineering. In addition, methods are not static and should be adjusted according to operational management needs. Due to the inherent lag of organisational change, the process management process should be given due attention, and problems should be summarised and adjusted promptly so that the enterprise can adapt to the changing market and economic environment more quickly, which is conducive to the continuous improvement of enterprise competitiveness.

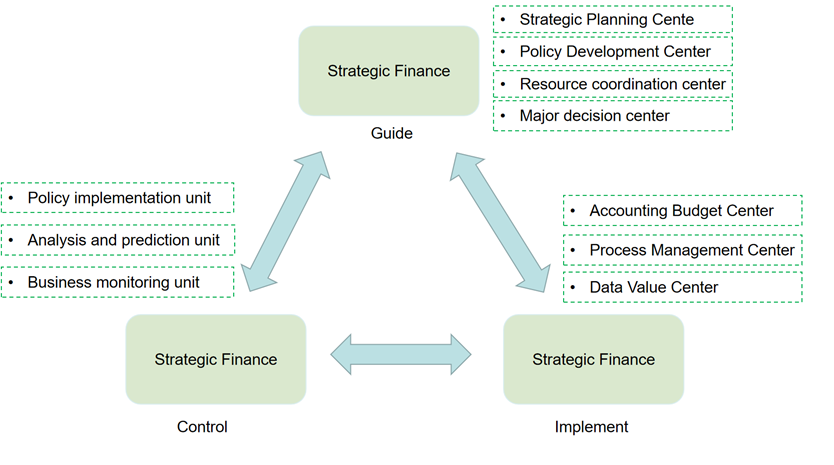

3.2.6. Financial Organisation Change

The finance organization divides finance into commonly shared finance, operational task finance, and strategic finance according to career performance positioning. Along with creating the Mengniu Group Finance Shared Service Centre, the finance organisation has also changed. The new finance management model covers the three main functions of finance: shared, operational, and strategic, as shown in Figure 5.

Figure 5: Mengniu Group Finance Shared Service Centre functions (Photo credit: Original).

Shared finance is positioned as the executive level of financial management, responsible for accounting, process management, and data reporting. Mengniu Shared Finance implements standardised accounting processes and coordinates front- and back-end processes well. It centrally manages the Group's financial data, prepares relevant financial statements and precipitates business data efficiently and in all periods, and provides high-quality financial data for business finance and strategic finance.

Business finance, the grassroots finance department, is generally a financial body composed of local finance staff. Their main task is to follow the policies and systems issued by strategic finance, cooperate with the company's financial management of various matters, and implement management guidelines from top to bottom. Business finance is positioned to be responsible for implementing corporate policies, analysis, forecasting, and business monitoring. And it is the control layer of financial management. Mengniu's grassroots finance has many business and finance staff who play a fully dynamic role as partners of the business department, providing tools and methods for front-end business operation analysis, issuing operation analysis reports from a financial perspective, and providing vital support for business operation decisions. It is also the main body of financial risk control, playing an indispensable role in monitoring the compliance of economic activities and the authenticity of financial data.

Strategic Finance, the financial management commander-in-chief, conducts in-depth finance research and participates in the enterprise's financial planning and strategic decision-making. Strategic Finance is positioned to be responsible for the overall strategic planning, policy formulation, resource coordination, and significant financial management decision-making [6]. It is the guiding layer of financial management. The strategic finance of Mengniu is responsible for the centralised control of the company's financial management through the research, formulation and publication of daily policies. It supports implementing the company's strategy from a macro level and provides strategic guidance to the company's financial management. In the area of capital management, the company's funds are centrally coordinated to optimise resource allocation and support the effective operation of the company's activities; in tax planning, the company uses the concept of overall planning and reasonable tax avoidance to manage investment, financing, and process. In addition, it makes forecasts on the economic outlook and provides scientific and practical advice for financial management and the company's overall significant decisions. Implementing strategic finance effectively improves the degree of control of the economic value chain in advance.

4. Analysis

When an enterprise introduces a financial sharing centre, it has certain strategic significance to understand the objectives of the financial sharing service centre in advance. Judging from the practical results of domestic and international companies, their strategic objectives are threefold: (1) to improve efficiency and reduce costs, (2) to strengthen control and reduce risks, and (3) to promote the digital transformation of finance [4].

Mengniu Group integrated its business model when establishing its financial sharing centre and adopted a full-coverage design with a phased operation plan. The programme considered all business segments in the value chain and was successfully piloted in 2015 and fully rolled out in 2016. Mengniu's shared service centre is the first shared centre in the Chinese dairy industry. The construction of this centre has an important role to play in achieving its strategic objectives.

4.1. Impact on Cost Efficiency Based on the Spatial Dimension of the Value Chain

Mengniu Group is the leading company in China's dairy industry, with an extraordinarily long industrial chain. The most important feature of its financial sharing centre is the one-step completion of the whole business module and the synchronised financial accounting and fund settlement centre of the whole process. This paper selects one of the expense reimbursement operations and studies the financial shared service centre's effectiveness based on the value chain's spatial dimension.

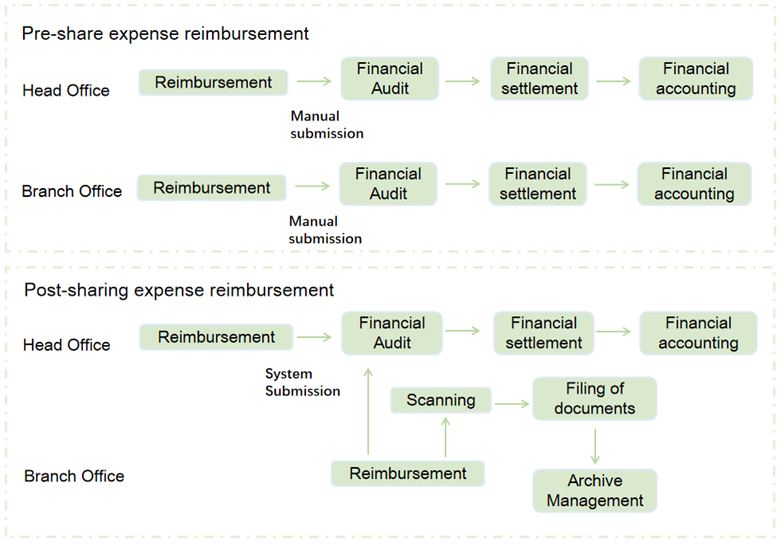

4.1.1. Expense Reimbursement Business

Before establishing the financial shared service centre, Mengniu's head office had a low frequency of review and weak supervision of each business unit, resulting in frequent over-reimbursement, which posed a huge challenge to the company's cost control. After the image transmission and web-based reimbursement, systems were embedded in the financial shared services, the reimbursement process was greatly optimised and costs effectively controlled. As shown in Figure 6.

Figure 6: The reimbursement process before and after the implementation of financial sharing in Mengniu (Photo credit: Original).

4.1.2. Improving Reimbursement Efficiency

Based on the above diagram, the Financial Shared Service Centre standardises the business processing process, enabling the company to adapt to the fast pace of development, reducing risk while improving the quality of data. Especially for a large and business unit decentralised company like Mengniu, adopting this standardised and centralised operation is an effective and cost-efficient way.

The image capture of the imaging system has no time and geographical restrictions, allowing employees to reimburse online anytime and anywhere, which makes off-site reimbursement no longer a problem and increases the speed of reimbursement by 36%.

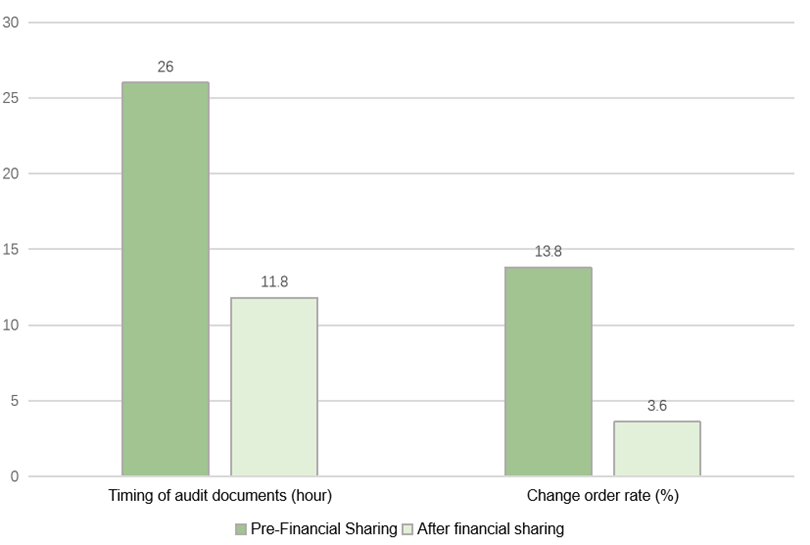

The web-based reimbursement system can automatically classify receipts and generate vouchers, which greatly improves efficiency and results in fewer errors compared to manual work, reducing the change order rate from 13.8% to 3.6%, a reduction of 73.91%. As shown in Figure 7.

Figure 7: Comparison of the reimbursement timeframe before and after the implementation of financial sharing in Mengniu Group [7].

4.1.3. Reducing Labour Costs

After implementing the Finance Shared Centre at Mengniu, the new management model is that the head office unifies the accounting system and supervises its implementation through the service centre. The duplication of accounting organizations within the enterprise has been eliminated, and the number of positions has been greatly reduced. The Finance Shared Service Centre employees handle the same business of each subsidiary within the group, thus effectively reducing manpower costs.

4.2. Impact on the Finance Function Based on the Time Dimension of the Value Chain

4.2.1. Finance Role Enhancement

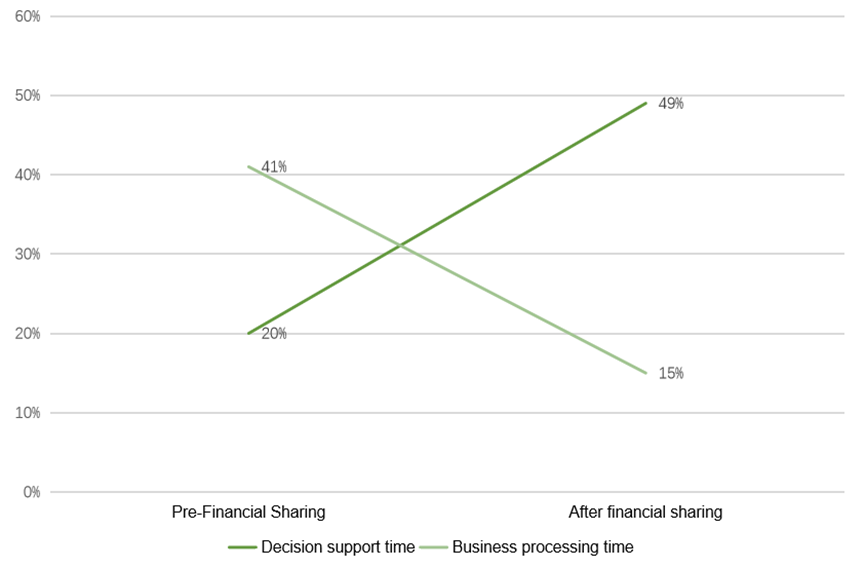

Traditionally, finance work was mainly focused on statistics, accounting, and other operations, and the effect was not obvious at the level of decision support. With the establishment of Mengniu's Finance Shared Service Centre, the time cost of business processing has been greatly reduced due to the increased efficiency of financial groundwork. This electronic data collection is more comprehensive and accurate than the traditional financial model, thus allowing for easier and faster summarisation and analysis. The time spent on financial decision-making at Mengniu has increased from 20% initially to 49%, and business processing time has been reduced from 41% to 15%. As shown in Figure 8.

Figure 8: Comparison of time efficiency of Mengniu Group before and after the implementation of financial sharing [7].

Significant efficiency improvements have facilitated the transformation of operational finance into strategic finance. Enables management to make quick, guiding decisions about finance.

4.2.2. Strengthening the Effectiveness of Internal Controls

The network reimbursement system in financial sharing not only standardises the content of reimbursements but also restricts the reimbursement process. All operations are subject to double auditing by the business and the finance supervisor, so risks are controlled, as shown below.

(1) The approval process is configured in the reimbursement system according to the pre-set financial authority relationship according to the internal control needs. After the Receipts are submitted, they automatically flow to the corresponding approver in the corresponding approval level according to the submitting department and position, avoiding irregular approvals such as inter-departmental and cross-grade.

(2) The system is set up to approve and pay later so that the system will not pay unapproved, thus eliminating the use of money before making up the bill.

(3) In the travel reimbursement system, the reimbursement documents are automatically matched with the allowance rate according to the table corresponding to the approved employee's rank and travel location to avoid over-range and over-amount reimbursement.

(4) The reimbursement system is connected to the budget system and automatically identifies whether the submitted reimbursement is within the budget. After that, the reimbursement within the budget enters the reimbursement process and the reimbursement outside the budget is automatically rejected. The reimbursed data is automatically fed back to the budget system and can be queried by the budget department in real-time, making the budget change from post-facto statistics and analysis to pre-establishment, mid-facto tracking, and control. Post-facto analysis covers all aspects of the budget, better utilising its functions and improving its quality.

Through the effective implementation of the Financial Services Centre, the time of internal control is brought forward, from post-analysis to ex-ante control and mid-event tracking, thus strengthening the degree of risk control.

4.3. Impact of Financial Transformation Based on the Value Chain Hierarchy Dimension

The hierarchical dimension is the business flow and the vertically extended capital and information flow. The information flow comprises individual transaction data brought together, and the financial shared service centre provides this data. The enterprise does online real-time data statistics through the financial shared centre and puts real-time business data into practice.

In 2019, Mengniu adopted a dual-centre platform for its digital transformation. 2020, Mengniu realises that the dual-centre platform and digitalisation must bring the business online. And it is here that the Finance Shared Service Centre plays this crucial role.

4.3.1. Data Integration Achieved

Through the SAP system, the business management of the industrial chain is integrated into the information system, realising the information management of the entire value chain from purchasing, production to sales. Once data is entered, it can be shared across the entire chain. Enterprises can directly access the precise original data, realising data integration and supporting subsequent data cleaning and analysis.

4.3.2. A Technical Bridge Is Built

The digitalisation of finance must be combined with a wide range of information technologies, and the Finance Sharing Centre meets this new requirement for digital transformation. Finance Sharing brings together SAP, ECC, FI/CO, NM, PP, SD, PM and many other systems, allowing the finance department to take new automation and intelligent technologies, improve them and apply them in practice.

4.3.3. Stockpiled Data Resources

One of the core strengths of a financial shared service centre is the storage and analysis of large volumes and complex data. In 2021, Mengniu changed its IT department to a digital science and innovation department, reflecting two key objectives: "digital" and "technological innovation". For digital transformation, information Digitisation is the first step. Mengniu uses financial shared services as the basis for data collection, driving data-driven processes and promoting Mengniu's "two-wheel drive strategy".

5. Problems and Suggestions

5.1. Problems

5.1.1. Data Value Chain Mining Is Still Shallow

During business operation, a large amount of data is generated, including internal and external data, which is the basis for business managers to make decisions [8]. The Mengniu Group Smart Manufacturing Digital Factory Project aims to cover the whole process of production operation with an automated manufacturing execution system, which core relies on an automatic data collection platform to connect the production equipment layer data and support the operation of each functional module of the manufacturing execution system, to realize the intelligent construction of the factory as a whole. The quality of the entire industrial chain can be traced with one click, and each production link can be viewed in real-time, realising the intelligence and visualisation of factory production [9].

Financial work is precisely the collection of data; in the course of the Mengniu Group's operations, only data related to accounting accounts and a few data related to accounting dimensions are counted by the finance department, while all other data are streamlined, discarded, or used only for production management, not for financial analysis, and are in a "dormant" state. analysis, and are in a "dormant" state.

5.1.2. Lack of Internal Value Chain Management Functions

In terms of internal value-added activities, Mengniu's financial sharing service is more concerned with improving the efficiency of business processing, but the process of value-adding activities within the enterprise itself is not effectively integrated and does not reflect the management function of the value-adding process. Therefore, although Mengniu has a "digital factory", its digitalisation process is focused on the "factory", and the integration with "finance" is low.

5.1.3. Insufficient External Value Chain Sharing

Mengniu's financial shared service centre has integrated eight systems, including the capital system, human resources system, budget system, master data, contract management system, SMS and email system, and travel booking system, to build a complete information platform for the flow of business and financial data [10]. However, the whole system has not touched on the vertical value chain. The vertical value chain mainly comprises the upstream milk source and the downstream consumers. In the post-2018 period, Mengniu has been able to achieve integrated management of raw milk assets upstream of the vertical value chain, through a smart farming platform with a real-time view of milk collection nationwide and comprehensive dynamic optimisation in production arrangements and logistics planning based on big data analysis. However, this optimisation still does not cover consumers downstream in the value chain. Moreover, the digital management of the supply chain is more focused on the material flow and information flow at the business level, with insufficient sharing with finance.

5.2. Suggestions

5.2.1. Building A Data Centre Based on the Data Value Chain

Enterprises wishing to add value to data through the value chain can use the construction of a data centre to achieve this. The data centre is a separate business department under the financial sharing centre, with a centralised management model and access to internal and external corporate data through information devices. The data is then processed by data cleaning, exploration, and algorithms in the value chain and then given to internal feedback or external paid services. Data processing is based on information system analysis, supplemented by financial staff judgment, making the data more scientific and relevant. In this way, information is collected in its entirety, classified rationally, and analysed systematically so that it can be used efficiently and the internal value chain can be fully developed to maximise value.

5.2.2. Tapping into Shared Management Functions

With the emergence of various new management models, the demand for financial management functions has increased. Therefore, although Mengniu's current financial sharing has advantages in terms of cost efficiency, to realise the potential value of management, it is necessary to consider establishing a professional process management team. A well-established management team has significant value in safeguarding business operations. The team collates and summarises sales data and patterns and conducts financial analysis, applying the findings to business decisions so that they are organically integrated with the management function. At the same time, the team should pay attention to the external situation of the industry and adjust the relevant internal operations to external trends, to enhance the adaptability and enable the services of the financial shared service centre to meet the market demand.

5.2.3. Improve Shared Articulation Based on the External Value Chain

The economic business between enterprises is becoming closer and more frequent, and the traditional financial management model can no longer adapt to the development of the times. Value chain enterprises have to expand their competitive advantage from a strategic perspective through collaborative management between chain enterprises. Vertical value chain enterprises include suppliers, producers, and sellers. The internal financial operations of the value chain enterprises are handled by the financial shared service centre which agrees with external enterprises on the scope of data acquisition and will enter the shared data and form a shared database so that each enterprise can exchange information resources within the scope of the shared database and maximise information utilisation. This process effectively improves the financial sharing between enterprises in the value chain.

6. Conclusion

Based on the value chain perspective, this paper has deeply analysed the Finance Shared Service Centre of Mengniu Group and come to the following conclusions.

Firstly, the Finance Shared Service Centre has improved the operational capability of the enterprise. The full business module coverage has significantly boosted data integration and provided a solid foundation for the enterprise's digital transformation.

Second, the financial shared service centre is still in its infancy, with management decision-making functions still to be developed, most of its advantages focused internally, and the interface with the external value chain is still incomplete. To gain more value-added, analysis of financial shared services based on a value chain perspective is a breakthrough for value-added.

Thirdly, the analysis of financial shared service centres based on a value chain perspective is different from traditional thinking. The goal is to achieve a double cycle of internal and external financial sharing, and while considering the internal management and financial operations of enterprises, it also focuses on the value of financial data from the external value chain. Collaboration between value chain enterprises can be strengthened through financial sharing between value chain enterprises.

In the future, the digital transformation of financial shared service centres will start from data, re-engineering, and adding value to the business with the help of technologies such as big data, cloud computing, and artificial intelligence. Big data technology has led to qualitative changes in data production and processing capabilities, allowing data to expand from business to finance and spread internally to externally, providing more room for development in data acquisition and collection, classification and processing, and supporting decision-making.

References

[1]. Zhen, Z. Research on the performance evaluation system of the financial shared service centre of Mengniu Group. Harbin University of Technology, 2020. DOI:10.27063/d.cnki.ghlgu.2020.000369.

[2]. Jiao, Y. Discussion of theories related to enterprise value chain cost management. China Securities and Futures, 2011(02):59.

[3]. Wu, S.D. Research on the Construction of Financial Shared Service Center of G Grid Company[D]. South China University of Technology,2017.

[4]. Analysis of the Construction of Enterprise Financial Sharing Center -- Take Mengniu Group as an Example Yang Xin-National Circulation Economy - October 8, 2020

[5]. Ma, Y.X. Research on the construction of group financial shared service centre. Beijing Printing Institute,2018.

[6]. Zhong, D.H. Exploration of strategic support group-based financial control system--Based on the financial practice of Y Corporation[J]. Friends of Accounting,2014(15):4-8.

[7]. Sun, N. Research on performance evaluation of company Y under the financial sharing model. Jilin University, 2020. DOI:10.27162/d.cnki.gjlin.2020.001632.

[8]. Leung, M.Y. Construction of an accounting decision support system under an information integration environment. Enterprise Economics,2012,31(02):77-80.DOI:10.13529/j.cnki.enterprise.economy.2012.02.049.

[9]. Building a new Mengniu with digital intelligence. Agricultural Product Market,2022(18):24-25.

[10]. Leng, J.B, Yang S.H. Research on management accounting framework of industry-finance integration in the context of "Internet+". Friends of Accounting,2019(12):19-23.

Cite this article

Wei,M.;Ye,S.;Zou,J. (2023). Research on the Application of Financial Sharing Center Based on Value Chain Theory Take the Mengniu Company as an Example. Advances in Economics, Management and Political Sciences,28,62-76.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 7th International Conference on Economic Management and Green Development

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Zhen, Z. Research on the performance evaluation system of the financial shared service centre of Mengniu Group. Harbin University of Technology, 2020. DOI:10.27063/d.cnki.ghlgu.2020.000369.

[2]. Jiao, Y. Discussion of theories related to enterprise value chain cost management. China Securities and Futures, 2011(02):59.

[3]. Wu, S.D. Research on the Construction of Financial Shared Service Center of G Grid Company[D]. South China University of Technology,2017.

[4]. Analysis of the Construction of Enterprise Financial Sharing Center -- Take Mengniu Group as an Example Yang Xin-National Circulation Economy - October 8, 2020

[5]. Ma, Y.X. Research on the construction of group financial shared service centre. Beijing Printing Institute,2018.

[6]. Zhong, D.H. Exploration of strategic support group-based financial control system--Based on the financial practice of Y Corporation[J]. Friends of Accounting,2014(15):4-8.

[7]. Sun, N. Research on performance evaluation of company Y under the financial sharing model. Jilin University, 2020. DOI:10.27162/d.cnki.gjlin.2020.001632.

[8]. Leung, M.Y. Construction of an accounting decision support system under an information integration environment. Enterprise Economics,2012,31(02):77-80.DOI:10.13529/j.cnki.enterprise.economy.2012.02.049.

[9]. Building a new Mengniu with digital intelligence. Agricultural Product Market,2022(18):24-25.

[10]. Leng, J.B, Yang S.H. Research on management accounting framework of industry-finance integration in the context of "Internet+". Friends of Accounting,2019(12):19-23.