1. Introduction

1.1. Development History

McDonald's is a fast food chain that originated in 1940, founded by the McDonald brothers in California, U.S.A. In 1955, Ray Kroc joined McDonald's and promoted the franchise model, which led to its rapid growth. Over the decades, McDonald's has expanded globally, entering markets in Asia, Europe and other regions. During this time, McDonald's continued to innovate and introduce new product lines to meet different market needs [1]. To date, McDonald's has become one of the most famous and successful fast food brands in the world.

1.2. Market Size

McDonald's, the largest fast food business in the world, holds a market share of roughly 17%. With yearly sales of over $21 billion, the corporation has more than 40,000 stores in more than 100 countries. McDonald's is widely popular in the US market, where it makes the majority of its profits, but it is also widely popular in other nations including China, Japan, and Canada.

As one of the most well-known fast food chains in China, McDonald's has been there for more than 30 years. It has more than 4,500 locations and more than $23 billion in yearly sales in China by 2022. In the Chinese fast food business, the company has a sizable market share of about 7%. In China, McDonald's faces competition from other fast food chains such as KFC and Burger King, but it still maintains its position as one of the most popular fast food chains in China.

1.3. Products on Offer

McDonald's sells a lot of things, like Angus MAX Thick Beef Bacon Burger, Double Cheeseburger, grilled chicken burger and so on.

2. Company Strategy

McDonald's unique QSCV business philosophy and the "signature burger, real estate profit" business model have earned McDonald's a strong reputation. McDonald's business philosophy emphasises quality, service, cleanliness and value (QSCV), with a focus on customer focus and standardisation and consistency of products and services. In addition to this, McDonald's is innovative and adaptable, actively adapting to the needs of different markets and cultures. McDonald's is also socially responsible, focusing on environmental protection, sustainability and employee well-being, as well as supporting charitable causes [2].

2.1. Business Model

The company generates major profits from complimentary products, technical service support to suppliers, improving the supply chain, building the McDonald's business district and driving real estate [3].

The earnings from selling hamburgers at McDonald's are negligible or nonexistent. This is due to the fact that a burger of this caliber must be prepared with the finest beef, bread, and oil; otherwise, it cannot be sold in ten minutes and must be discarded. With such expensive expenditures, in addition to rent, employee salaries, and promotion expenses, McDonald's does not truly profit on its hamburgers. Instead, it makes money from unnoticeable items like coke and fries. For example, a Coke costs $6.50 and may gross up to $4.50, which is where it makes a small profit.

Meanwhile, McDonald's profits come out when it does centralised sourcing of beef, flour and potatoes used in tens of thousands of shops around the world. However, McDonald's is much more brilliant. It not only generate steady profits through centralized sourcing, but also actively participates in the transformation of the supply chain by transforming the supply chain actively to reduce the cost of the supply chain, and shares the reduced supply chain cost with its partners.

For example, 1kg of potatoes used to cost 10 RMB and the yield was only 3,000kg per acre, McDonald's provided the farm with improved potato cultivation technology, free of charge. When the farm gets the free improved potato growing technology, the acre yield goes up from 3,000kg to 10,000kg. In the past few years, the income per acre was 30,000 yuan, with a unit price of 10 yuan and an acre yield of 3,000 kg. Now, after the acre yield reached 10,000 kg, the farmers could lower the price to 4 yuan per kilogram, so that the total income per acre reached 40,000 yuan, an increase of 10,000 yuan over the past 30,000 yuan, which made the farm enterprise happy. But without a doubt, McDonald's Corporation is the largest winner, as their $10 unit pricing has been reduced to $4 thanks to a huge drop in unit cost [4].

In addition to this, McDonald's has the expertise to select sites by building a McDonald's restaurant culture and creating McDonald's shopping districts, through which it continues to pull people to McDonald's and nearby shopping districts. This method actively and directly increases property prices, which is the secret to McDonald's being the "best real estate company ever". Rather than passively waiting for property values to rise, it proactively drives property prices up over time [5].

In comparison, KFC is still being suppressed by McDonald's in the global market. Therefore, in terms of product positioning, KFC focuses on chicken-based products, which are more suitable for Chinese tastes, and spares no effort to meet the different needs of Chinese consumers and develop products that suit Chinese tastes [6]. In addition, KFC develops more new products than McDonald's and updates them faster than McDonald's. The constant introduction of new products brings customers a constant sense of freshness, which is superior to McDonald's on another level [7].

The most noteworthy point is that KFC's marketing is highly tied to internet tools and consumer trends, launching the "Crazy Thursday" campaign recent years. The "Crazy Thursday literature" itself is not very difficult to create, the threshold is low and it can be reworked by applying templates from the Internet. It can be filled with a variety of fresh content, triggering the creation and dissemination of content by internet users. In a time when the Internet is so influential, the "KFC Crazy Thursday" literary craze is created every Thursday. No other fast food brand, including McDonald's, has achieved the same level of marketing power as KFC.

Through advertising and marketing, Burger King has reasonably spoofed McDonald's and advancedly hacked its rivals on all fronts to get them to promote themselves [8]. However, if we can reasonably grasp the scale and find our own positioning, to a certain extent, it can help to promote the development of both sides and win-win cooperation [9]. At the same time, Burger King is focusing on the younger generation based on its own strengths, and its "fire-roasted, not fried" feature can meet not only the younger generation's demand for quality, but also their demand for health.

In addition, Burger King has chosen to adopt the same localisation strategy as KFC to find the right taste for Chinese people, adding pork and chicken burgers to the original beef-based burger category, and replacing the chicken breast with chicken thigh meat, which is preferred by Chinese consumers. Taste adjustments will also be made in different regions according to the differences between the north and the south [10,11].

Under pressure from competitors, McDonald's has made significant progress in recent years in digital development, sustainability, product innovation and market expansion. They have invested in mobile ordering, takeaway services and self-ordering machines to enhance the customer experience, while focusing on environmental protection and sustainability, such as reducing plastic waste, using renewable energy and promoting eco-friendly packaging. In addition, McDonald's continues to introduce new products to meet the needs of different markets and consumers, such as plant-based meat burgers and low-calorie menus. Globally, McDonald's continues to expand its markets, particularly in promising markets such as Asia and Africa, and has partnered with major brands to increase brand exposure, all to great effect.

2.2. Operating Index

Table 1 show some information about these three brands’ stores. In terms of statistics, McDonald's has 32,000 shops worldwide [12], which is a large number that crushes the other two fast food brands, but KFC's number in China is nearly twice that of McDonald's and seven times that of Burger King, which shows the importance that KFC attaches to the Chinese market [13]. In addition, McDonald's and Burger King have a global presence in over 100 countries, which is more extensive than KFC's. This shows the limitations of KFC in the global market. In summary, McDonald's has a high global share, but is no match for KFC in the Chinese market [14].

3. Recent Financial Situation

3.1. Operation Capability

3.1.1. Fixed Asset Turnover Ratio.

McDonald's global fixed asset turnover ratio will be 0.4 in 2020 and 0.5 in both years thereafter, and McDonald's higher fixed asset turnover ratio indicates that the company is using its fixed assets more efficiently and is generating more return per dollar invested.

3.1.2. Total Asset Turnover Ratio.

McDonald's will have a global total asset turnover ratio of 0.38 in 2020. 0.44 in 2021, and the same in 2022 as in 2021. McDonald's Corporation has seen a gradual increase in each of the last three years, with the higher ratio indicating a gradual increase in the operational quality and efficiency of the use of assets, that the company is using its assets more effectively, and that the return per dollar invested is increasing.

3.1.3. Days Sales Outstanding.

McDonald's accounts receivable turnover days for the last three years are 41.2, 31.3 and 31.4, which shows high figures. This may indicate that McDonald's Corporation is experiencing difficulties in collecting payments from its customers, which can lead to cash flow problems and the company may not have enough cash to pay its own bills and expenses. The company may need to take steps to improve its customer relationships to encourage timely payments. Overall, a longer accounts receivable turnover period is a red flag for investors and creditors alike.

In summary, McDonald's operating capacity analysis based on financial ratios shows that the company is using its fixed and total assets effectively to generate revenue. The company's DSO is relatively low, which suggests that it is collecting payments from customers at a reasonable price. Overall, McDonald's is a strong operation, but the company needs to continue to monitor its financial ratios to ensure efficient performance.

3.2. Solvency

3.2.1. Interest Cover Ratio.

McDonald's interest cover ratio shows the ratio of the company's EBITDA to its interest expense. in 2020, McDonald's interest cover multiple is 5.92, in 2021 it is 8.33, and in 2022 it rises to 8.57. that is, EBITDA is almost 9 times higher than interest. The higher interest cover ratio means that McDonald's Corporation has a low risk of defaulting on its debt and a strong long-term solvency.

3.2.2. Current Ratio.

McDonald's current ratio shows the company's ability to use its current assets to pay off short-term debt. in 2020, McDonald's global current ratio is 1.01. it increases to 1.78 in 2021 and decreases to 1.42 in 2022. a higher current ratio indicates that the company has a greater ability to pay off short-term debt and that its assets are more liquid.

3.2.3. Quick Ratio.

McDonald's quick ratio shows the company's ability to use its quick assets, which are liquid assets that can be easily converted to cash, to pay off short-term debt. McDonald's has a high quick ratio, which indicates that the company has a strong ability to service its short-term debt without relying on inventory sales.

3.3. Profitability

3.3.1. Gross Margin.

In 2020, McDonald's global gross margin is 50.8%. This indicates that for every dollar of revenue, the company retains a gross profit of $0.508. In the following year, 2021, its gross margin is 54.2%, increasing to 57% in 2022. The higher gross margin indicates that McDonald's Corporation is generating more profit from its sales. At the same time, it has strong pricing power, efficient supply chain management, and control over its production costs. It is able to offer products or services at a higher price than its competitors, thus maintaining a competitive advantage in the market.

3.3.2. Net Profit Margin.

In 2020, McDonald's will have a global net profit margin of 24.6%. This indicates that for every dollar of revenue, the company retains $0.246 as net profit. 32.5% and 26.6% in 2021 and 2022 respectively. These figures are at a high level compared to peer companies and the higher net profit margin indicates that the company's business is generating more profits. In addition to this, McDonald's Corporation has strong control over its costs and expenses, high operational efficiency and effective asset and liability management.

3.3.3. Operating Margins.

In 2020, McDonald's global operating margin is 37.5%. 42.5% in 2021 and 44.6% in 2022. This indicates that for every $1 of revenue, the company's operating profit is close to $0.45. Before operating expenses, interest and taxes, McDonald's is able to generate more profit from its core business. This indicates that the company has strong control over operating costs, efficient operations and effective resource management.

3.3.4. Earnings Per Share (EPS).

The portion of McDonald's profits allotted to each outstanding share of common stock is known as earnings per share. In 2020, McDonald's global earnings per share will be $6.31. The latter two years will be $10.04 and $8.33 respectively. With McDonald's eps peaking in 2021, higher EPS indicates higher profits per share, which may attract more investors. Higher EPS indicates that McDonald's is able to generate more profit per common share. This indicates that it is able to generate more income for shareholders and has a strong financial performance. Higher earnings per share can also indicate that McDonald's has strong pricing power, efficient operations and effective resource management.

3.3.5. Return on Assets (ROA).

Return on assets shows the ability of the company to generate profits from its assets. in 2020, McDonald's global ROA is 9.4%. The following two years are 14.2% and 11.8% respectively. A high ROA indicates that McDonald's Corporation has strong management of its assets and is able to generate significant profits from them, has strong control over its costs and expenses, efficient operations and effective resource management.

In conclusion, the financial statistics examined show that McDonald's has good profitability and makes money through operations, sales, and shareholder investments. The company's high gross margin, net margin, operating margin, earnings per share, ROA and safe operating margin show that it is making more money from sales and operations and is making better use of its resources and capital. Overall, McDonald's is quite successful, but to ensure long-term prosperity, the business must keep an eye on its financial measures [15].

3.4. Future Prospect

3.4.1. P/E Ratio.

McDonald's P/E ratios for the last three years are 34.01, 26.7 and 31.64 respectively, which shows that the values are generally high and investors expect high returns from the stock and are more optimistic about McDonald's growth prospects. However, a higher share price also means a higher investment risk, and investors need to analyse this in conjunction with other data [16].

3.4.2. Stock Trend Analysis.

McDonald's stock has generally been on the rise over the past few years, with some minor fluctuations due to market conditions and company-specific news. However, given McDonald's financial performance, competitive landscape and growth prospects in recent years, Northcoast Research recently upgraded its rating on McDonald's to Buy from Neutral and gave the stock a price target of $321 [17]. Of course, valuations need to be viewed with caution in light of changing consumer preferences, competitive pressures, economic conditions and regulatory changes.

3.4.3. Future Prospects Analysis.

McDonald's has been in a strong financial position with continued revenue growth and strong profitability, but is in a very competitive industry with many competitors vying for market share. It faces competition from traditional fast food chains such as KFC and Burger King, as well as new entrants such as Shake Shack. To maintain its competitive position, it needs to comply with various regulations relating to food safety, labour practices and environmental sustainability, and continue to make changes in product innovation, marketing and customer experience. Invest in digital projects to improve the customer experience and drive sales and expand into new markets.

4. Comparison

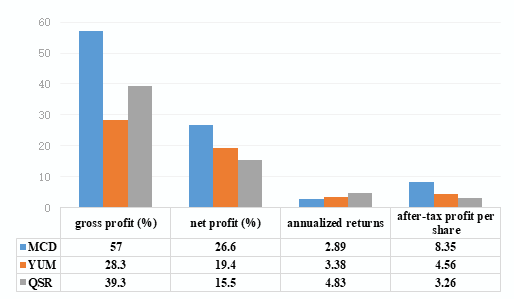

Figure 1: Earning Performance.

Based on these ratios of earning performance, as is shown in figure 1, McDonald's appears to be the most profitable of the three companies, with higher gross, operating and net margins. McDonald's has the highest ROA, which indicates that it is more profitable relative to its assets and equity. yum has the second highest profitability with a high gross margin but lower operating and net profit margins. Of the three companies, QSR has the lowest profitability, with a lower gross margin and lower ROA. McDonald's had the lowest annualised ROA and the highest after-tax EPS. YUM had a lower ROA and after-tax EPS, but was still respectable. In contrast, QSR had the lowest ROA and earnings per share after tax. However, these ratios do not provide a full picture of a company's financial performance and other factors, like market trends, should be taken into account when assessing profitability.

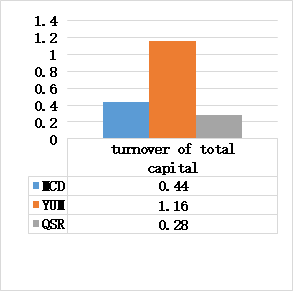

Figure 2: Turnover of total capital.

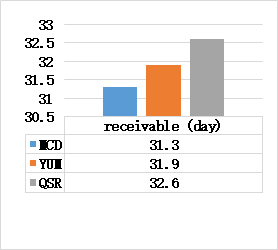

Figure 3: Receivables.

The total asset turnover ratio measures the relationship between a company's annual sales revenue and total assets. As shown in figure 2, YUM has the highest total asset turnover ratio among the three companies, indicating that YUM is the most efficient in utilising its total assets and is able to generate more sales revenue each year. This may be due to YUM's strengths in operational management, marketing strategies and productivity. In contrast, McDonald's has a lower turnover of total assets and requires more assets to generate the same amount of sales revenue. This may be due to some problems in McDonald's operational management, productivity, etc. QSR has the lowest total asset turnover ratio and only generates very little sales revenue per year.

Days in accounts receivable is a measure of the average time taken by a company to collect its accounts receivable and is an important indicator to assess a company's ability to collect its accounts. As shown in figure 3, days to collect accounts receivable for McDonald's, YUM and QSR were 31.3 days, 31.9 days and 32.6 days respectively. The three companies have similar accounts receivable and have advantages in terms of customer credit assessment and account collection policies.

5. Conclusion

McDonald's is a well-run company with not only a premium brand but also industry-leading margins and an anti-decline business model. Channel surveys also show that McDonald's sales performance has been strong so far this year. McDonald's has taken several steps to drive growth and improve its competitive position, including menu innovation, digital initiatives and expansion into new markets. Overall, McDonald's is a very promising company for the industry, maintaining its position as the industry leader in the fast food industry.

References

[1]. Wikipedia Contributors (2019). History of McDonald’s. Wikipedia. Available at: https://en.wikipedia.org/wiki/History_of_McDonald%27s [Accessed 15 Apr. 2023].

[2]. Kaur, G. (2021). McDonald’s Business Model and Marketing Strategies Explained. JungleWorks.Available at: https://jungleworks.com/mcdonalds-business-model-and-marketing-strategies-explained/ [Accessed 9 Apr. 2023].

[3]. Pereira, D. (2022). McDonald’s Business Model. businessmodelanalyst.com. Available at: https://businessmodelanalyst.com/mcdonalds-business-model/#:~:text=McDonald [Accessed 15 Apr. 2023].

[4]. Keller, C.R. (2014). How McDonald’s Became The Leader In The Fast Food Industry - Marketing Strategy. Profitworks.ca. Available at: https://profitworks.ca/blog/541-how-mcdonalds-became-the-leader-fast-food-industry-marketing-strategy [Accessed 13 Apr. 2023].

[5]. Wenhan,Q.: Optimistic about the Chinese market, a number of US companies to expand business in China. Liberation Daily(008), (2023).

[6]. HUANG, W. and HAN, S.: Strategies for localized marketing of foreign catering in China:based on the comparative analysis of KFC and McDonald’s. National Circulation Economy(30), 4-7 (2022).

[7]. Majaski, C. (2021). McDonald’s vs. Burger King: What’s the Difference? [online] Investopedia. Available at: https://www.investopedia.com/articles/markets/111015/mcdonalds-vs-burger-king-comparing-business-models.asp [Accessed 8 Apr. 2023].

[8]. Kelly, C. (2022). Burger wars: How Burger King’s rivalry with McDonald’s reverberates through adland. Marketing Dive. Available at: https://www.marketingdive.com/news/mcdonalds-burger-king-brand-rivalry-burger-wars/621713/ [Accessed 7 Apr. 2023].

[9]. Butterworth, W. (2022). McDonald’s Vs. Burger King (7 Differences, Pros, Cons, Verdict). The Cold Wire. Available at: https://www.thecoldwire.com/mcdonalds-vs-burger-king/ [Accessed 11 Apr. 2023].

[10]. Statista. “McDonald’s: Number of Restaurants Worldwide.” Statista, 8 Apr. 2022, www.statista.com/statistics/219454/mcdonalds-restaurants-worldwide/. [Accessed 11 Apr. 2023].

[11]. Adcock, P. (2022). McDonald’s Vs. Burger King: Which Is Better in 2022? www.sbxl.com. Available at: https://www.sbxl.com/mcdonalds-vs-burger-king/ [Accessed 13 Apr. 2023].

[12]. Statista. “KFC: Restaurants Worldwide 2022 | Statistic.” Statista, Statista, 2022, www.statista.com/statistics/256793/kfc-restaurants-worldwide-by-geographic-region/. [Accessed 13 Apr. 2023].

[13]. Lock, S. Burger King: Restaurants 2009-2022 | Statista. Statista, 2023, www.statista.com/statistics/222981/number-of-burger-king-restaurants-worldwide/. [Accessed 15 Apr. 2023].

[14]. Lock, S. (2022). McDonald’s: revenue 2005-2022 | Statista. Statista. Available at: https://www.statista.com/statistics/208917/revenue-of-the-mcdonalds-corporation-since-2005/ [Accessed 7 Apr. 2023].

[15]. Corporate.Mcdonalds.com.(2023).Investors.Available at: https://corporate.mcdonalds.com/corpmcd/investors. html [Accessed 6 Apr. 2023].

[16]. consumeradvisory.co.uk. (2022). KFC Vs McDonalds - Which Is Best? - Consumer Advisory. Available at: https://consumeradvisory.co.uk/kfc-vs-mcdonalds/ [Accessed 11 Apr. 2023].

[17]. Maybach, G. (2023). Northcoast Research Upgrades Mcdonald’s (MCD). Nasdaq.com. Available at: https://www.nasdaq.com/articles/northcoast-research-upgrades-mcdonalds-mcd [Accessed 16 Apr. 2023].

Cite this article

Bian,Y. (2023). Who Dominates The Fast Food Industry? -- Take McDonald's as an Example and Compare it With KFC (YUM) & Burger King (QSR). Advances in Economics, Management and Political Sciences,34,43-51.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 7th International Conference on Economic Management and Green Development

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Wikipedia Contributors (2019). History of McDonald’s. Wikipedia. Available at: https://en.wikipedia.org/wiki/History_of_McDonald%27s [Accessed 15 Apr. 2023].

[2]. Kaur, G. (2021). McDonald’s Business Model and Marketing Strategies Explained. JungleWorks.Available at: https://jungleworks.com/mcdonalds-business-model-and-marketing-strategies-explained/ [Accessed 9 Apr. 2023].

[3]. Pereira, D. (2022). McDonald’s Business Model. businessmodelanalyst.com. Available at: https://businessmodelanalyst.com/mcdonalds-business-model/#:~:text=McDonald [Accessed 15 Apr. 2023].

[4]. Keller, C.R. (2014). How McDonald’s Became The Leader In The Fast Food Industry - Marketing Strategy. Profitworks.ca. Available at: https://profitworks.ca/blog/541-how-mcdonalds-became-the-leader-fast-food-industry-marketing-strategy [Accessed 13 Apr. 2023].

[5]. Wenhan,Q.: Optimistic about the Chinese market, a number of US companies to expand business in China. Liberation Daily(008), (2023).

[6]. HUANG, W. and HAN, S.: Strategies for localized marketing of foreign catering in China:based on the comparative analysis of KFC and McDonald’s. National Circulation Economy(30), 4-7 (2022).

[7]. Majaski, C. (2021). McDonald’s vs. Burger King: What’s the Difference? [online] Investopedia. Available at: https://www.investopedia.com/articles/markets/111015/mcdonalds-vs-burger-king-comparing-business-models.asp [Accessed 8 Apr. 2023].

[8]. Kelly, C. (2022). Burger wars: How Burger King’s rivalry with McDonald’s reverberates through adland. Marketing Dive. Available at: https://www.marketingdive.com/news/mcdonalds-burger-king-brand-rivalry-burger-wars/621713/ [Accessed 7 Apr. 2023].

[9]. Butterworth, W. (2022). McDonald’s Vs. Burger King (7 Differences, Pros, Cons, Verdict). The Cold Wire. Available at: https://www.thecoldwire.com/mcdonalds-vs-burger-king/ [Accessed 11 Apr. 2023].

[10]. Statista. “McDonald’s: Number of Restaurants Worldwide.” Statista, 8 Apr. 2022, www.statista.com/statistics/219454/mcdonalds-restaurants-worldwide/. [Accessed 11 Apr. 2023].

[11]. Adcock, P. (2022). McDonald’s Vs. Burger King: Which Is Better in 2022? www.sbxl.com. Available at: https://www.sbxl.com/mcdonalds-vs-burger-king/ [Accessed 13 Apr. 2023].

[12]. Statista. “KFC: Restaurants Worldwide 2022 | Statistic.” Statista, Statista, 2022, www.statista.com/statistics/256793/kfc-restaurants-worldwide-by-geographic-region/. [Accessed 13 Apr. 2023].

[13]. Lock, S. Burger King: Restaurants 2009-2022 | Statista. Statista, 2023, www.statista.com/statistics/222981/number-of-burger-king-restaurants-worldwide/. [Accessed 15 Apr. 2023].

[14]. Lock, S. (2022). McDonald’s: revenue 2005-2022 | Statista. Statista. Available at: https://www.statista.com/statistics/208917/revenue-of-the-mcdonalds-corporation-since-2005/ [Accessed 7 Apr. 2023].

[15]. Corporate.Mcdonalds.com.(2023).Investors.Available at: https://corporate.mcdonalds.com/corpmcd/investors. html [Accessed 6 Apr. 2023].

[16]. consumeradvisory.co.uk. (2022). KFC Vs McDonalds - Which Is Best? - Consumer Advisory. Available at: https://consumeradvisory.co.uk/kfc-vs-mcdonalds/ [Accessed 11 Apr. 2023].

[17]. Maybach, G. (2023). Northcoast Research Upgrades Mcdonald’s (MCD). Nasdaq.com. Available at: https://www.nasdaq.com/articles/northcoast-research-upgrades-mcdonalds-mcd [Accessed 16 Apr. 2023].