1. Introduction

Since the reform and opening up, the pace of development of China's general aviation has gradually accelerated, and its status and role in economic and social development have become increasingly prominent, playing an increasingly important role. And with the continuous progress of society, airplanes have gradually become the preferred mode of transportation for people, which has also brought huge benefits to China's aviation industry. However, since 2020, due to the emergence of the new crown epidemic, all major industries have been affected to a certain extent, especially the aviation industry. According to the International Civil Aviation Organization: the emergence of the new crown epidemic has caused a continuous blow to international travel, and the total number of international passengers in 2020 has dropped by 60%. The emergence of this situation has also had a major economic impact on the entire industry, and even led to the bankruptcy and restructuring of individual airlines - Hainan Airlines. Hainan Airlines, the second largest private enterprise in China with assets worth one trillion yuan, and one of the top four domestic airlines listed on both A and B shares, ranks among the top in the world in terms of scale and operating capabilities. Now it's in bankruptcy. On January 29, 2021, HNA Group received the "Notice" issued by the Higher People's Court of Hainan Province. The main content is: the relevant creditors applied to the court for bankruptcy and reorganization of Hainan Group because Hainan Group could not pay off the due debts [1]. And implemented the reorganization plan in March of the same year. However, the bankruptcy of Hainan Airlines has already appeared. Due to Hainan Airlines' blind expansion and huge losses in the early stage, its capital chain was broken. At the same time, the company's "self-rescue period" was affected by the epidemic, resulting in damage to profit margins and insufficient capital turnover. It finally announced bankruptcy and reorganization in 2021. To a large extent, the rupture of the capital chain is not only the failure of the internal control of the enterprise, so that the capital flow is seriously beyond the means. At the same time, it was also caused by Hainan Airlines’ bond default and abandonment of redemption of perpetual bonds.

In October 2018, Hainan Airlines announced that it would give up the option to redeem "15 Hainan Airlines MTN00" [2]. According to the survey, the reason why the company gave up the redemption of perpetual bonds is that it is facing operating difficulties, and the company has relatively prominent short-term capital flow problems, resulting in a relatively high level of financing costs. However, this approach can only prolong the existence of a certain period of time and cannot fundamentally solve the financial difficulties of the enterprise. In the next few years, affected by the global new crown epidemic, economic development was pressed to a halt, causing a large number of corporate bond defaults. This paper mainly adopts the method of case study to analyze whether the bond default of Hainan Airlines is the main reason leading to its bankruptcy reorganization. This paper analyzes the reasons for the break of Hainan Airlines' capital chain and the problems of internal control. At the same time, it also mentioned the impact on Hainan Airlines due to the emergence of the new crown epidemic. At the end of the article, the airline puts forward the suggestion after the reorganization and analyzes and summarizes the event.

2. Literature Review

Founded in 1993, HNA Group Co., Ltd. is a multinational enterprise group with the core business of air transportation. Carry out comprehensive strategic cooperation around industries such as air transportation, modern logistics, modern commerce, and modern financial services, and jointly promote the economic development of Meizhou City and eastern Guangdong. However, in 2021, the Higher People's Court of Hainan Province issued a "Notice" to HNA Group, which read: The relevant creditors applied to the court for bankruptcy and reorganization of HNA Group due to the group's inability to pay off due debts. The announcement of this news has aroused great public opinion in related fields. If finally accepted by the court, this will be the largest bankruptcy and reorganization case among Chinese enterprises. Zheng Qinyue believes that the Hainan Airlines bond default incident has been researched and analyzed its reasons, and the main trigger for the current debt default of Hainan Airlines is not the new crown epidemic, but the accumulation of various hidden dangers caused by the accumulation of various hidden factors at the beginning of Hainan Airlines’ listing [3]. Sincerely. And in 2018, Hainan Airlines chose to abandon the perpetual debt, thereby prolonging the survival time of the company. However, Hu Yiwen found that giving up the redemption of perpetual bonds could not fundamentally solve the financial problems of enterprises. Enterprises must make judgments based on their own development conditions and long-term goals. In addition, after research, it was found that there are certain problems in the internal management of Hainan Airlines [2]. Chen Shizhong believes that the bankruptcy and reorganization of Hainan Airlines was mainly caused by the failure of the company's management and management, which led to the break of the capital chain [4]. At the same time, due to changes in leasing standards, Wang Haoyu found that the application of the new leasing standards would have an adverse impact on the financial status of Hainan Airlines, and he really proposed to change the financing method to reduce corporate risks [5]. Although this article has a big disadvantage: there are few references on domestic and foreign websites, especially English literature. So inevitably there will be aspects that are not thoroughly researched. There are still more experiments that should be done to make the results more accurate.

3. Case Description

On the evening of January 29, 2021, the Higher People's Court of Hainan Province issued a "Notice" to HNA Group, which read: The relevant creditors applied to the court for bankruptcy and reorganization of HNA Group due to the group's inability to pay off due debts [6]. The news exploded in the aviation field. The three listed companies of HNA Holdings, HNA Foundation, HNA Holdings and Supply and Marketing Daji, respectively issued major risk warnings, and even have the risk of delisting. The amount involved by the three listed companies exceeded 100 billion yuan. If finally accepted by the court, this will be the largest bankruptcy reorganization case among Chinese enterprises.

Hainan Airlines used to be the second largest private enterprise in China, but its development process was indeed bumpy. The founders had the problem of insufficient funds in the early days of their business. However, he changed HNA into a joint-stock company and raised funds abroad, making HNA the first Sino-foreign joint venture airline. After 2000, China's aviation industry ushered in an industry reshuffle. Ten airlines directly under the Civil Aviation Administration of China were merged into three major groups: Air China, China Southern Airlines, and China Eastern Airlines. HNA began larger-scale borrowing and financing, borrowing money, developing routes and merging companies to expand its own scale. And by 2017, HNA's asset scale was more than three times that of the other three aviation groups. Unfortunately, in 2020, the outbreak of the new crown epidemic has plunged the global aviation industry into a depression. This time the balance of fate is not in favor of HNA. Since the relevant creditors of Hainan Airlines applied to the court for bankruptcy and reorganization of the group because the group could not pay off the due debts. It marks the official bankruptcy and reorganization of HNA. HNA's bankruptcy reorganization is not bankruptcy, but new strategic investment will enter and inject a brand new HNA. HNA's core business will not be affected and will continue to be on the right track.

4. Analysis on the Problems

4.1. Impact of COVID-19 on Hainan Airlines

The COVID-19 outbreak in 2020 is not only a health crisis, but also an economic, social and humanitarian crisis. To contain the outbreak and protect people's health, governments around the world have imposed full or partial lockdowns, closed borders, imposed strict travel restrictions and issued advisories to avoid non-essential travel around the world. Aviation has been one of the hardest-hit sectors as the measures have led to an unprecedented plunge in demand for air travel. The sharp decline in air traffic has created a severe liquidity crunch for the airline industry, putting its financial viability at risk and endangering the millions of jobs that depend on it. All those involved in the aviation industry face challenges to their business continuity and even their survival. The latest ICAO analysis of the economic impact of COVID-19 on civil aviation shows that in 2020, global passenger traffic dropped sharply by about 60% [7]. Total airline revenue plummeted by $370 billion as passenger traffic fell off a cliff; airports and air navigation service providers lost $115 billion and $13 billion in revenue, respectively.

For Hainan Airlines, which is already heavily indebted, the continuous reduction in passenger flow has led to a decline in its profits. Negative operating profits mean that operating profits cannot even cover costs, and it is even more difficult to repay debt interest and principal. Table 1 and Table 2 are the composition of HNA's 2020 operating income and operating costs [8]. It can be seen that passenger revenue has dropped sharply due to the impact of the epidemic, while cargo revenue has remained stable. However, the cost of freight revenue is too high, resulting in a negative total operating profit. The sharp decline in operating income has made HNA's cash flow difficult, and the necessity of operating costs has further exacerbated this difficulty. In the past, HNA used to use short-term financing to restore normal operating conditions. However, due to the negative operating profit of the group and the insufficient realizable ability of the book current assets, there is a phenomenon of insufficient liquidity, which makes it difficult to repay the bonds when they mature. This has also caused Hainan Airlines to struggle with sluggish demand for a long time, which has become the fuse of its bond default. As a potential deterioration in the future economic viability of the aviation industry could affect the balance of the aviation ecosystem, the knock-on effect could be profound across all levels of the wider economy.

Table 1: Composition of HNA's 2020 operating income.

Operating income | Increase or decrease of operating income compared with the previous year (%) | |

Air passenger revenue | 22,810,519 | -64.68 |

Air Cargo and Excess Baggage Revenue | 2,475,466 | 0.00 |

Refund fee income | 1,203,102 | -38.61 |

Table 2: Composition of HNA's 2020 operating costs.

Cost Component | Current Amount | Proportion of current period to total cost (%) | Amount of the same period last year | Proportion of total cost in the same period of last year (%) | The change ratio of the amount in the current period compared with the same period of the previous year (%) |

Passenger transport | 35,629,072 | 85.87 | 62,204,735 | 92.82 | -42.72 |

Cargo and Excess Luggage | 3,890,807 | 9.38 | 2,393,410 | 3.57 | 62.5 |

Other operating costs | 1,973,790 | 4.76 | 2,419,400 | 3.61 | -18.42 |

4.2. Increased Competition in the Industry

With the continuous improvement of people's living standards, the air transport industry, as a cyclical industry with selective consumption attributes, its development is largely restricted by the macroeconomic cycle and its own consumption attributes. In recent years, with the growth of the national economy and the improvement of residents' income, the total turnover of China's air transport and passenger turnover have maintained growth, and the growth trend is generally positively correlated with the GDP growth trend. The total revenue of China's civil aviation industry is the second in the world, while the gap with the world's first is constantly decreasing. But compared with the international air transportation market, the proportion of air transportation in my country's transportation market is still relatively small. For Hainan Airlines, its competitors are the remaining three airlines in China: Air China, China Eastern Airlines and China Southern Airlines. At the same time, it is also agreed to be affected by the diversion of other transportation methods such as high-speed rail. At present, China's high-speed rail is cheap, convenient to transport, and has a larger territory, which has great competitive advantages for the air transport industry. According to statistics, from 2014 to 2019, high-speed rail operating mileage, passenger volume, and passenger turnover maintained a relatively high growth rate, significantly higher than the growth rate of air transport. Finally, there is no denying that the airline industry is less profitable. Even with the rapid development of China's air transport industry and the continuous growth of industry revenue, the total profit fluctuates greatly. During the same period, the average level of international companies showed a fluctuating upward trend, reaching a phased high in 2016-2018, much higher than that of the domestic air transport industry [9]. Overall, the profitability of the domestic air transport industry is low, and there is a big gap with international air transport companies. For domestic airlines, in addition to weaker operating profitability at home than abroad, fluctuations in oil prices and RMB exchange rates have affected the profitability of Chinese airlines, and many external risks have led to lower overall profitability of the domestic air transport industry.

4.3. Internal Control Issues

The bankruptcy and reorganization of Hainan Airlines was mainly caused by a broken capital chain. The rupture of the capital chain is largely due to problems in the internal management of the enterprise.

Due to the non-diversified expansion of HNA Group: it refers to the strategy of the enterprise to enter new industries or new fields that have no connection with existing products or services in terms of technology and market [10]. While effective expansion can help companies spread risk, new products or new markets can protect companies when existing products and markets fail. And it is easier to obtain financing from the capital market. However, HNA Group adopted a more radical strategy, expanding wildly and establishing subsidiaries in the early stage of entrepreneurship. This cost it a huge amount of money and had a huge impact on the company's operating cash flow. And due to the ultra-fast expansion, many assets of the company have been lost, and there is a situation of insolvency.

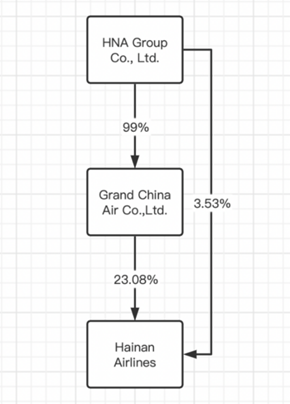

Figure 1: Property rights and control relationship of Hainan Airlines.

At the same time, it is due to the failure of internal control brought about by personal control of power. The high degree of centralization of the chairman of HNA Group has led to the opacity of Hainan Airlines' capital flow. As shown in Figure 1, Hainan Airlines is affiliated to Grand China Air Co., Ltd., and the latter's important controlling shareholder is HNA Group [11]. As of the end of 2020, the shareholder control rights of Hainan Airlines have gradually become unbalanced, and there are great differences. Therefore, the internal management of Hainan Airlines was disordered, which eventually broke its capital chain and led to bankruptcy and reorganization.

5. Suggestions

5.1. Enhance corporate operational capabilities

The lack of profitability of Hainan Airlines is one of the important reasons for its bond default. Therefore, an important measure to solve the debt problem is to improve operating capabilities. In terms of profitability, the air transport industry must ensure the steady growth of the main passenger and cargo business.

Appropriately expand new business according to the actual situation, carry out cooperation at home and abroad, increase business income, reduce the company's operating costs, and increase profit margins. In terms of operational capabilities, improve service quality, increase sales revenue, enhance capital flow, and improve the efficiency of capital use. In terms of cash flow management, it is necessary to maintain a stable cash flow and ensure sufficient liquidity. For the cash spent on investment, it is necessary to make investment plans and calculate the payback period. For the expenses that need to be paid to repay bonds, it is necessary to plan the repayment plan in advance, manage the interest payable well, and avoid falling into financial difficulties due to temporary insufficient liquidity.

5.2. Diversified financing, optimized debt structure

Reasonable financial leverage for the air transport industry can increase the value of the enterprise. A reasonable debt structure can reduce the cost of debt financing on the one hand and maintain the stable operation of the company on the other hand. Enterprises should determine the appropriate capital structure and debt structure based on their own profitability and cash flow and should not blindly pursue the improvement of company value and the reduction of financing costs [12]. Airlines should adopt diversified financing methods and choose financing methods according to the investment cycle of the project or the purpose of financing. Internal financing can be through targeted allotment of shares or the use of retained earnings. External financing should pay attention to the combination of long-term and short-term bonds, moderate borrowing, ensure a reasonable debt structure, and avoid maturity mismatches; in addition, innovate financing tools by issuing perpetual bonds and convertible bonds , redeemable bonds and other bonds, flexibly adjust the capital structure, issue preferred shares, additional shares, etc. to conduct external equity financing; the cost of debt can also be reduced through third guarantees or credit enhancement institutions.

5.3. Improve the internal control of the enterprise

As a highly debt-operated industry, the air transport industry generally has a long investment project construction cycle and a relatively large investment scale, and there is almost no cash flow inflow during the investment cycle. Once the investment fails, the previous expenditures will drag down the company’s cash flow. Therefore, It is necessary to formulate investment strategies scientifically. On the one hand, to accurately assess the company's risks, it is necessary to determine the investment direction based on the economic situation, industry prospects and national policies; Improving the profitability of an enterprise is not to conduct acquisitions and mergers simply for the sake of seeking perfection, but to truly digest and absorb investment projects and transform them into profitability. In addition, it is recommended to introduce third-party supervision, give full play to the governance role of external directors, and prevent management from ignoring investment risks in order to blindly pursue performance.

6. Conclusion

In conclusion, through the above research, it can be concluded that the new crown epidemic is not the main factor leading to the bankruptcy and reorganization of Hainan Airlines. It is a combination of the accumulation of hidden dangers accumulated by various factors, including the economic downturn in the macro environment and the emergency of the new crown epidemic, as well as the blind expansion of the company's strategy and the pressure of debt management, accompanied by the shortage of cash flow at the company's financial level, Insufficient operating capacity and low profitability. The successive bond defaults not only made the company's cash flow continue to be tight, but also affected the company's follow-up operations, reducing the reputation of Hainan Airlines and causing a great impact. At the same time, the strategy and internal control of an enterprise are also of great significance to the internal operation of the enterprise. When there are already problems in the internal operation of the enterprise, a blind expansion will only be counterproductive. And the internal control problem of the enterprise will drag down the development of the enterprise step by step, and eventually produce serious consequences. Now that Hainan Airlines has completed its reorganization, the operation of the company has gradually entered the right track. The incident also sounded the alarm to other private companies in China, and more and more companies began to pay attention to the company's bond structure and internal control. The relevant analysis of Hainan Airlines' bond default, profit and cost data is based on the current public information, and this information is second-hand information, so its authenticity needs to be considered. If the authenticity is insufficient, the research conclusion of this article Pending verification. If there is an opportunity to combine more samples for analysis in the future, the suggestion may be more comprehensive and appropriate.

References

[1]. Jinhao Jiao.: Research on Financial Risk Control Issues and Countermeasures under the Diversified Operation Strategy of Hainan Airlines. Tianjin University of Finance and Economics (2020).

[2]. Yiwen Hu.: A study on the economic consequences of Hainan Airlines giving up redemption of perpetual bonds. Jiangxi Normal University (2021).

[3]. Qinyue Zheng.: Research on the Causes and Countermeasures of Hainan Airlines’ Bond Default. Beijing Jiaotong University (2021).

[4]. Shizhong Chen.: Why is the myth of Hainan Airlines shattered? -- Talking about the internal control of enterprises. Accounting of Township Enterprises in China (2022).

[5]. Haoyu Wang.: Study on the Influence of the Change of Leasing Accounting Standards on the Financial Affairs of Hainan Airlines. Tianjin University of Commerce (2021).

[6]. Case Analysis of Bond Default of Hainan Airlines, Xinpin Xie, Hebei University of Finance and Economics (2022).

[7]. ICAO.: Economic Impacts of COVID-19 on Civil Aviation. ICAO (2021). www.icao.int/sustainability/Pages/Economic-Impacts-of-COVID-19.aspx.

[8]. 2020 Annual Report of Hainan Airlines Holding Co., Ltd., PricewaterhouseCoopers Zhongtian (2021).

[9]. Liu Yanghui, Chen Hong, Liu Guofan.: Research on the Motivation and Economic Consequences of Hainan Airlines' Perpetual Bond Financing. Journal of Tianjin Business Vocational College (2021).

[10]. Maoshu Wen.: Study on The Motivation and Economic Consequences of Controlling Shareholder’s Tunneling--Taking HNA Group’s Tunneling of Hainan Airlines as An Example,Sichuan Normal University (2022).

[11]. Yi Li. Financing Structure Analysis -- Taking Hainan Airlines as an Example. The 15th (2022) Proceedings of China Construction Accounting Society 2022

[12]. Nan Du. Research on Financial Risk Management of Hainan Airlines under Diversified Business Strategy, Northeast Petroleum University (2022).

Cite this article

Zhang,X. (2023). The Decline and Reorganization of Hainan Airlines. Advances in Economics, Management and Political Sciences,34,52-58.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 7th International Conference on Economic Management and Green Development

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Jinhao Jiao.: Research on Financial Risk Control Issues and Countermeasures under the Diversified Operation Strategy of Hainan Airlines. Tianjin University of Finance and Economics (2020).

[2]. Yiwen Hu.: A study on the economic consequences of Hainan Airlines giving up redemption of perpetual bonds. Jiangxi Normal University (2021).

[3]. Qinyue Zheng.: Research on the Causes and Countermeasures of Hainan Airlines’ Bond Default. Beijing Jiaotong University (2021).

[4]. Shizhong Chen.: Why is the myth of Hainan Airlines shattered? -- Talking about the internal control of enterprises. Accounting of Township Enterprises in China (2022).

[5]. Haoyu Wang.: Study on the Influence of the Change of Leasing Accounting Standards on the Financial Affairs of Hainan Airlines. Tianjin University of Commerce (2021).

[6]. Case Analysis of Bond Default of Hainan Airlines, Xinpin Xie, Hebei University of Finance and Economics (2022).

[7]. ICAO.: Economic Impacts of COVID-19 on Civil Aviation. ICAO (2021). www.icao.int/sustainability/Pages/Economic-Impacts-of-COVID-19.aspx.

[8]. 2020 Annual Report of Hainan Airlines Holding Co., Ltd., PricewaterhouseCoopers Zhongtian (2021).

[9]. Liu Yanghui, Chen Hong, Liu Guofan.: Research on the Motivation and Economic Consequences of Hainan Airlines' Perpetual Bond Financing. Journal of Tianjin Business Vocational College (2021).

[10]. Maoshu Wen.: Study on The Motivation and Economic Consequences of Controlling Shareholder’s Tunneling--Taking HNA Group’s Tunneling of Hainan Airlines as An Example,Sichuan Normal University (2022).

[11]. Yi Li. Financing Structure Analysis -- Taking Hainan Airlines as an Example. The 15th (2022) Proceedings of China Construction Accounting Society 2022

[12]. Nan Du. Research on Financial Risk Management of Hainan Airlines under Diversified Business Strategy, Northeast Petroleum University (2022).