1. Introduction

Due to the global rise in chronic diseases and the intensification of aging, the demand for mechanical therapy is constantly increasing. The medical instrument industry is continuously recovering and thriving. The medical instrument industry has high precision, innovation demand and investment volume, mainly concentrated in developed countries represented by the United States and Germany. At present, the capital market in the US is no longer blindly pursuing investments in the valuation of medical instrument companies. The capital formation gathers and the difference between the strong and the weak becomes apparent. In addition, the development of medical instruments in the European market and the Asia Pacific region has a significant impact on the US market [1]. In this regard, the United States makes changes and improvements in policies and concepts, such as entering overseas markets, expanding cooperations with universities and hospitals, continuously reforming and innovating medical instruments and implementing relevant policies. This provides a more perfect environment for the medical instrument industry [2].

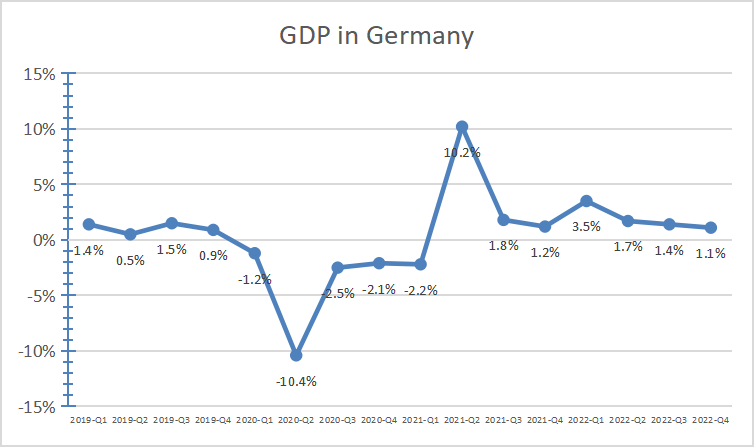

Looking at the European market, expenditure on medical instruments in Germany accounts for approximately 10% of GDP. The government in Germany attaches great importance to the medical instruments [3]. Adequate funding also promotes the innovation in medical instruments and the development of the medical system. However, due to the outbreak of the global epidemic and the continued deterioration of the international economic situation, the economic downturn seriously impacts the medical instrument industry in Germany [3]. The decline in GDP causes tension in medical cost. Hospitals, companies and even the government can’t afford expensive medical equipment and treatment costs. The development of the medical instrument is limited and medical instruments can’t be updated timely. Therefore, medical instruments are unable to cooperate with doctors to treat varied diseases, and then, the operation of the medical system is hindered.

Although Germany has a superior environment in medical instrument, it constantly faces the problem of a single product line. Thus, the government in Germany makes policy improvements. This article takes two leading medical instrument companies in the United States and Germany as examples. Medtronic, as a leading medical instrument company in the United States, has rich experience in expanding overseas businesses, transforming enterprises, making it a good case study. Siemens is a leading global technology company. Siemens contributes to leading the trend of technological development, focusing on bringing benefits to customers through its own technology and promoting sustainable development [4]. The R&D level of Siemens is in the leading position. In addition, Siemens has a comprehensive management system, high product quality and a complete marketing system [5].

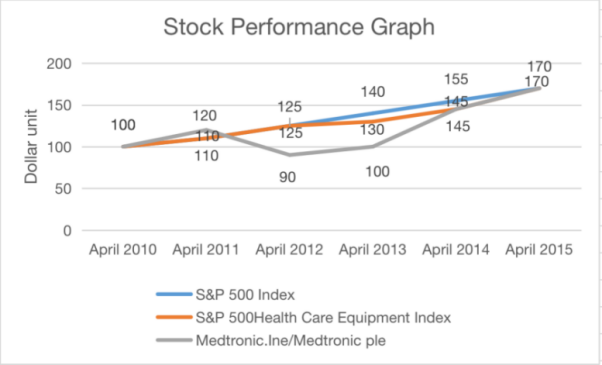

Figure 1: Stock performance.

2. Basic Descriptions

As the largest developing country, China has a huge demand for medical instruments. Medtronic entered the Chinese market in 1989. Medtronic established subsidiaries in Chengdu, China in 2015, which were responsible for multiple sectors, and started production in 2016. Currently, Medtronic holds its leading position in the fields of heart pacemakers and insulin pumps. On July 10, 2021, the US FDA publicly warned Medtronic to recall all the defective insulin infusion pipelines. In 2015, Medtronic took over Covidien to further strengthen its leading position. Thereby, the medical instrument industry in the US continuously maintains product innovation through acquisitions. Siemens operates in a stable economic environment. National policies support the development of medical instruments, and the government attaches great importance to innovation in the medical field. With the development of economic reform, market vitality is further released (seen from Fig. 1).

3. Analysis

3.1. Comparisons of Medical Instrument Market

According to statistics, the US is the country with the most registered medical instrument companies. As of 2022, the US has 6900 medical instrument companies. The revenue of the US medical instrument industry showed an upward trend from 2016 to 2019. Due to the impact of the epidemic, the industry size shrank to 130 billion dollars in 2020. After the recovery of the epidemic in 2021, the revenue returned to 140.71 billion dollars [6].

According to statistics, from 2017 to 2021, health expenditure in Germany was increasing year by year, from 376 billion euros to 466 billion euros. Thus, the German government attaches great importance to people's health and the medical field. The increase in health expenditure provides a financial foundation for medical innovation and the replacement of medical instruments. Advanced medical instruments can identify the cause of the disease more accurately and better cooperate with doctors. It can further promote the operation and development of the medical system.

3.2. Industry Leaders

As an industry leader, Medtronic is a leading global medical technology company. It stands in the strongest field of biomedical engineering by continuously improving the quality of its products. Medtronic earns reasonable profits from its existing business, maintains growth and development of the company, and achieves company goals. It’s expected that Medtronic will become the largest medical technology company by 2028.

Siemens is fully applying artificial intelligence technology to medical practice. Whenever doctors encounter problems that are difficult, time-consuming or inefficient to analyze, AI will provide valuable help to clinical professionals, enabling them to focus on patients and make better use of their expertise.

3.3. Increased Importance of Medical Devices

The United States has strict medical device approval agencies and efficient laws and regulations. The FDA, as the regulatory agency for medical devices in the United States, imposes strict laws and regulations on the industry. For example, on March 1, 2021, FDA issued a recall of Medtronic's HVAD pump implant kit, which are prone to serious medical malpractice, resulting in death and injury [7].

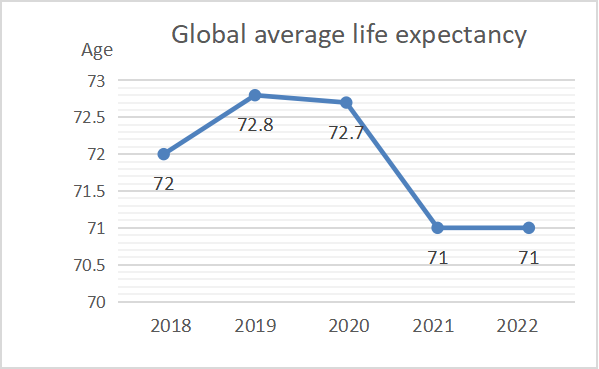

The United States produces a lot of protective medical devices because of strict laws and heavy fines. In 2009, the Centers for Disease Control and Prevention (CDC) estimated that direct medical costs from hospital-acquired infections were $35 billion to $45 billion. It also creates business opportunities [2]. Many medical technology enterprises develop related devices to reduce the infection rate of medical institution. As shown in the Fig. 2, the global average life expectancy rose from 2018 to 2019. However, since 2019, global average life expectancy has plummeted due to the global pandemic. When the global epidemic broke out, people's demand for medical devices increased greatly, resulting in insufficient supply of medical devices. The shortage of medical equipment seriously affects the efficiency and quality of treatment, leading to the aggravation of patients' conditions. The importance of medical devices is self-evident. When the global epidemic abates, global average life expectancy will rise again. The increase in global life expectancy is due to innovations in the medical field. A return to rising life expectancy will require further improvements in medical technology and equipment. It puts forward more urgent demand for the development of medical device industry.

Figure 2: Global average life expectancy.

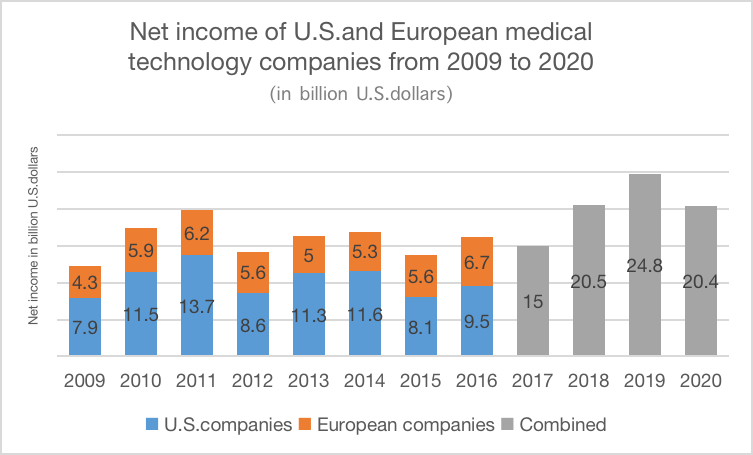

3.4. Expanding Overseas Business

Medtronic established a wholly-owned subsidiary in Chengdu in 2015, responsible for production, product registration and market expansion. It not only opens China's medical device market, but also drives the substantial development of China's medical device industry. In 2015, Medtronic's sales in Greater China only accounted for 7.64% of the global sales. As the world's head medical device company, Medtronic has great space for development. Under the expansion of overseas business, the medical device industry in Europe and America is on the rise (as given in Fig. 3) [8].

Figure 3: Net income of U.S. and European medical technology companies from 2009 to 2020 (in billion U.S. dollars).

Due to the impact of the global epidemic, Germany's GDP continues to be depressed and the economic situation is not optimistic. The squeeze on money has hit Germany's health sector. Moreover, the German medical device industry is characterized by continuous concentration and fierce price competition. This is rooted in growing market share at any price [9]. In the medical device industry, German domestic employment is declining. Some industries are moving abroad to countries with cost advantages, such as China. With the rapid development of Chinese economy and society and the improvement of residents' living standards, the demand for medical instruments has increased rapidly. Population aging and rising incidence of chronic diseases further aggravate this trend [10]. In addition, the new version of the Regulations on the Supervision and Administration of Medical Devices promulgated in 2021 further promoted the development of the medical device industry. Although China has a huge medical device market scale and huge potential growth space, domestic medical device enterprises are still in a state of significantly smaller scale, low technical level, and insufficient competitiveness (as depicted in Fig. 4). The entry of leading German medical device companies such as Siemens into the Chinese market is conducive to the common development of the medical field of China and Germany. The Chinese market provides Siemens with relatively low production cost, wider market, and talent potential in China. Siemens offers advanced technology, brand recognition, market recognition and innovation to the Chinese market.

Figure 4: GDP in Germany.

4. Conclusion

In summary, the medical device industry has excellent development prospects in Germany and the United States. The continuous progress of technology and the continuous expansion of the external market will continue to create the growth of market value. However, the industry also faces great competitive pressure and challenges, such as stricter regulation, lack of strategic cooperation among many enterprises, unbalanced distribution, and lack of large-scale development. Some small enterprises lack of high-tech technology and are difficult to survive in the market. Market environment and pricing pressure will constantly affect the innovation and production of medical device products. Ascirbed to the development of economic globalization, countries should increase the ability of overseas expansion and product innovation in the development of medical device industry, improve the treatment model, and constantly move forward based on the enterprise concept. The government will timely introduce relevant policies to effectively manage the industry. Seen from the turnover of medical resources, the updating speed of medical devices still needs to be improved, and the mutation and transmission speed of the virus is much higher than the controllable range of medical treatment. In the future, one can investigate the compatibility of digital technology and medical device industry, and the recycling and reuse of medical devices is also worth in-depth discussion in the era of resource shortage.

References

[1]. Du, Y.: Development status and Market size analysis of the global medical device industry in 2022 - The United States maintains the leading position in the world, https://www.qianzhan.com/analyst/detail/220/220913-ca754231.html, last accessed 2023/4/13.

[2]. Innomd Homepage, To understand the structure and characteristics of the American medical device industry, https://www.innomd.org/article/630dca060efda1591e194729, last accessed 2023/4/14.

[3]. Fang, H.: Overview of medical device market in major countries and regions: Opportunities and challenges. Chinese medical device information, 15(10), 17-43 (2009).

[4]. Chang, Q., Liu, H.: Scientific and technological innovation management mechanism of world-class enterprises: Based on the case study of Siemens in Germany. China Science and Technology Forum, 312(04), 47-57 (2022).

[5]. Wang, M.: Strategic Analysis of Siemens Medical Devices in China Market. Shanghai Jiao Tong University (2016).

[6]. Siemens Healthineers. Artificial intelligence helps physicians make more informed decisions, https://www.siemens-healthineers.com/innovations#ai, last accessed 2023/4/17.

[7]. Ca, F.: FDA issues alert regarding Medtronic's recall of HVAD Pump Implant Kits due to risk of delayed or failed restart after stop. Chinese Journal of Medicine, 23(03), 194 (2021).

[8]. Li, M.: Medtronic's innovative hemodialysis project has been launched in Chengdu to help patients with kidney disease, http://www.rmzxb.com.cn/c/2014-08-15/363965.shtml, last accessed 2023/4/17.

[9]. Schmitt, J.: Reimbursement and pricing of medical devices in Germany. HEPAC 1, 146–148 (2000).

[10]. Zhang, B., Zhao, S., Zeng, Q., et al.: Research on High Quality Development Measures of Medical Device Industry. China Instrument and Meter 382(01), 31-36 (2023).

Cite this article

Lao,Y.;Zhou,L. (2023). Analysis of the Medical Device Industry in German & US: Evidence from Medtronic and Siemens. Advances in Economics, Management and Political Sciences,35,1-6.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 7th International Conference on Economic Management and Green Development

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Du, Y.: Development status and Market size analysis of the global medical device industry in 2022 - The United States maintains the leading position in the world, https://www.qianzhan.com/analyst/detail/220/220913-ca754231.html, last accessed 2023/4/13.

[2]. Innomd Homepage, To understand the structure and characteristics of the American medical device industry, https://www.innomd.org/article/630dca060efda1591e194729, last accessed 2023/4/14.

[3]. Fang, H.: Overview of medical device market in major countries and regions: Opportunities and challenges. Chinese medical device information, 15(10), 17-43 (2009).

[4]. Chang, Q., Liu, H.: Scientific and technological innovation management mechanism of world-class enterprises: Based on the case study of Siemens in Germany. China Science and Technology Forum, 312(04), 47-57 (2022).

[5]. Wang, M.: Strategic Analysis of Siemens Medical Devices in China Market. Shanghai Jiao Tong University (2016).

[6]. Siemens Healthineers. Artificial intelligence helps physicians make more informed decisions, https://www.siemens-healthineers.com/innovations#ai, last accessed 2023/4/17.

[7]. Ca, F.: FDA issues alert regarding Medtronic's recall of HVAD Pump Implant Kits due to risk of delayed or failed restart after stop. Chinese Journal of Medicine, 23(03), 194 (2021).

[8]. Li, M.: Medtronic's innovative hemodialysis project has been launched in Chengdu to help patients with kidney disease, http://www.rmzxb.com.cn/c/2014-08-15/363965.shtml, last accessed 2023/4/17.

[9]. Schmitt, J.: Reimbursement and pricing of medical devices in Germany. HEPAC 1, 146–148 (2000).

[10]. Zhang, B., Zhao, S., Zeng, Q., et al.: Research on High Quality Development Measures of Medical Device Industry. China Instrument and Meter 382(01), 31-36 (2023).