1. Introduction

On January 18th, 2022, Microsoft blazoned its intent to acquire Activision Blizzard for $68.7 billion in an each-cash deal, or roughly$ 95 per share [1]. The background of the two companies in the accession case should be introduced first before agitating the impact of the accession.

Microsoft Corporation (Nasdaq MSFT) holds the position of the largest software manufacturer globally, recognized for its popular products such as the Microsoft Windows operating system, the Microsoft Office suite, and video game consoles, particularly the Xbox, which is part of its hardware gaming line. Microsoft's gaming business has evolved significantly over the years. The release of the original Xbox in 2001 marked the beginning, followed by the Xbox 360 in 2005 and the Xbox One in 2013. In addition to hardware, Microsoft has also developed a robust gaming software platform, Xbox Live, which allows gamers to connect, play, and purchase games online. Microsoft's acquisition of game studios such as Mojang (creator of Minecraft) and Bethesda Softworks has also helped to expand its game library. More recently, Microsoft has introduced the subscription service for Xbox Game Pass, which provides access to a wide range of games for a monthly fee. The company's gaming business continues to grow and evolve with the launch of new hardware and services. While they are pioneers in internet technology, Microsoft lags behind Sony and Nintendo in terms of market share. In fact, when it comes to overall gaming revenue, Tencent, Sony, and Nintendo rank higher than Microsoft.

Activision Blizzard, Inc. (Nasdaq ATVI) operates differently from Microsoft, as its primary focus lies in the production and distribution of games.The company is structured into three main segments: Activision, which oversees the development and publishing of games created by its associated companies; Blizzard Entertainment, which handles the development and publishing of Blizzard's games; and also hosts esports events. King Studio is primarily concentrated on the growing mobile gaming request. At present, Activision Blizzard owns Watch Vanguard, Candy Legend etc. well- known IP. Despite this, Activision Blizzard has faced unsatisfactory business performance over the past two years, with major game development facing difficulties. As a result, the company's shares declined from a peak of $103.81 in February to $57.28 in December 2021. However, upon announcement of the acquisition, shares of Activision Blizzard surged by $25.88, rising from $65.39 to $82.31. By comparison, the purchase price of $68.7 billion, converted to Activision Blizzard's equity, equates to a stock price of $95 per share [2].

For this accession, the assiduity generally believes that Microsoft and Activision Blizzard stand to mutually benefit from the acquisition, with the addition of numerous popular IPs placing a significant load on Microsoft's XGP. With Microsoft's assistance, Activision Blizzard's games will have stable channels, reducing request costs and potentially lowering development and labor expenses. This report discusses Microsoft's proposed accession of Activision Blizzard, including some implicit impacts on being product requests, labour requests and on product requests that don't presently live but may develop in the future.

2. Strengths

2.1. Brand Value

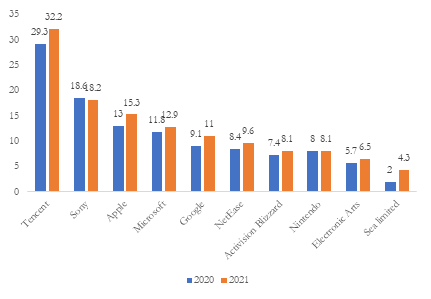

Microsoft is a well-known multinational technology company, and Activision Blizzard is one of the largest gaming firms in the world [3, 4]. Fig 1 depicts the revenue of the top ten listed gaming firms in the world in 2020 and 2021, demonstrating that Microsoft wishes to win a place in the gaming market. In 2022, Microsoft acquired Activision Blizzard, which greatly increased Microsoft's recognition and trust in the gaming market, and also made Microsoft the third largest global gaming company after Tencent Games and Sony Interactive Entertainment [5]. Activision Blizzard has a great brand effect due to its outstanding reputation in the gaming industry for product quality and originality. Activision game titles were visited by 111 million monthly active users in the fourth quarter of 2022 [6]. Their games, such as World of Warcraft, Overwatch, and others, are well-known and adored by the majority of people, therefore they have a strong dedicated fan base, and Activision Blizzard users will have high stickiness. Following Microsoft's acquisition of Blizzard, its corporate value advantage will be reflected in its enormous and devoted user base, as well as Blizzard's own brand influence, which will significantly increase Microsoft's brand value.

|

Figure 1: Top 10 public firms in terms of game revenue (in billion) in 2020 and 2021. |

Data source: Games Industry.biz |

Photo credit: Original |

2.2. Resources

Activision Blizzard focuses on the development and distribution of well-known games, with many well-known game brands, such as Overwatch, World of Warcraft and so on. Therefore, Activision Blizzard had an experienced game development team and advanced technology platforms. Not only is technology important, but the player base is also vital. Overwatch will appeal to those who prefer multiplayer shooting games, particularly those who appreciate teamwork and assuming various heroic characters [7]. According to public sources, the previous game Overwatch was launched internationally in May 2016 [8]. It became Blizzard's eighth game with more than $1 billion in revenue in less than a year, with more than 30 million players and 41 million monthly active users [8]. The overall number of Overwatch players has reached 60 million by 2021 [8]. On the other hand, World of Warcraft will attract to gamers who prefer large-scale multiplayer online role-playing games as well as those who enjoy experimenting with social elements [9]. In terms of aggregate server and player population, World of Warcraft ranks first out of 138 recorded MMOs [10]. The overall number of players or subscriptions in World of Warcraft is projected to be 125,744,978 [10]. World of Warcraft is expected to have 1,194,577 gamers every day [10]. Therefore, user loyalty may also be used to boost its revenue which might be quite beneficial to Microsoft. In addition, Microsoft can obtain these resources to strengthen its Xbox platform and cloud gaming business, which not only enhances Microsoft's competitiveness in the gaming industry, but also attracts more users and increases revenue. Based on these resources, it may have a natural edge in producing new metaverse-related products and competing in the market. At the moment, the metaverse is a developing field that has yet to be completely explored and utilised. Product quality, user experience, security, sociability, ecosystem, and innovation are critical aspects in establishing a footing in the metaverse industry. They must also constantly develop and innovate in order to meet market expectations. Because of Activision Blizzard possesses all of these critical elements. Therefore, Microsoft, who has bought Activision Blizzard, has a stronger chance of acquiring market share and user loyalty in the metaverse market.

3. Weaknesses

3.1. Management

After Microsoft's acquisition of Activision Blizzard, management will confront substantial problems. Activision Blizzard's toxic work culture has resulted in litigation, large-scale layoffs, and a big decline in stock prices, thus Microsoft will still have to deal with Activision's internal issues [11]. Therefore, Microsoft needs to address and correct these internal concerns as soon as possible in order to guarantee that Activision Blizzard can be controlled and operated successfully. As a result, Microsoft had to commit much more additional labour, material resources, and time to overhaul Activision Blizzard's management [11]. Given the size of Blizzard, this will be a difficult undertaking. Microsoft must assess whether Blizzard's current management structure is reasonable and identify which areas need to be changed, such as employing new talent or providing new training and guidance to existing employees, so that they can adopt new working culture and become more proactive and motivated.

3.2. Acquisition Costs

Microsoft acquired Activision Blizzard for $68.7 billion, which is an extremely high cost [12]. What’s more, it's also an all-cash acquisition transaction [12]. Except the acquisition cost, there are also included the $3 billion in probable separation fees and legal fees [13]. Despite the fact that Microsoft has $131.6 billion in cash and short-term investments on its balance sheet, which it will easily pay, it may still have an impact on its future cash flows [13]. In 2022, Microsoft's total revenue was $0.19827 billion and total expenses was $0.114887 billion, resulting in a net profit of $83.383 million [13]. It is roughly estimated that Microsoft will need 824 years to recover the cost of its acquisition of Activision Blizzard. This is an unlikely return time to achieve, as too long a return time will lead to increased risk, as well as a decrease in the value of funds due to inflation and other economic factors.

4. Opportunities

4.1. Metaverse

With the development of the gaming industry becoming increasingly mature, its application technology has spread to multiple industrial fields. Metaverse, by definition, is a generalized cyberspace. On the basis of covering physical space, social space, cyberspace and thinking space, it integrates a variety of digital technologies, integrates networks, hardware and software devices and users into a virtual reality system, and forms a virtual world that is both reflected in and independent of the real world [14]. Metaverse is a new form of network that will bring new markets, products, and customers and yet received a lot of attentions lately. Therefore, business tycoons like Microsoft must prepare for the potential opportunities. The basic technologies for constructing and supporting the Metaverse include artificial intelligence, extended reality, blockchain, electronic communication, digital twins, edge computing, cloud computing, etc, which are very similar to the technology applied in the gaming field. Microsoft is already a significant player in the gaming industry through its Xbox console and the accompanying game development studios. The Metaverse provides opportunities, such as expanding the gaming experience, creating a new gaming platform, providing tools for game developers, etc. that could redefine the way people interact with games to enable Microsoft to occupy market share. Many gaming companies are also exploring the potential of the Metaverse and developing their strategies to take advantage of this emerging platform. Epic Games, the creator of the Fortnite, has already announced plans to create a Metaverse-like platform called the "Epic Universe" that will be a "real-time 3D social ecosystem. “Epic Games has also acquired several companies, including 3D graphics company Capturing Reality,to strengthen its position in the Metaverse. As one of the largest gaming companies in the world, Tencent is also investing in the Metaverse. The company has invested in several companies, including Roblox and Epic Games, and is developing its Metaverse platform called "TiMi Planet" [15]. Therefore, Microsoft wants to consolidate its position in the gaming industry by acquiring Activision Blizzard and prepared for future competition with other gaming companies in the metaverse.

4.2. Potential for innovation

Microsoft has a diverse user base in the gaming industry, but mainly are Xbox players. Microsoft’s Xbox brand has been a staple of the gaming industry for years. However, Microsoft’s Xbox sales declined by 13 percent while the gaming system’s content and services saw a 12 percent drop in revenue in 2022.According to Microsoft, the decrease in revenue from Xbox content and services was primarily caused by a comparison to a strong prior year, as well as declines in revenue from first-party content and lower monetization of third-party content. However, this revenue decline was partially offset by an increase in the number of subscribers to the Xbox Game Pass.[16]. In order to reverse this situation, Microsoft must improve its game development capabilities, launch game works that can compete with competitors, and regain the favor of consumers. Finding another way out in the growing mobile gaming industry is also a way to regain market share, but Microsoft has historically struggled to break into the mobile gaming space. Not only did the acquisition of Activision Blizzard provides a wide range of users but the technology of game producing and talents as well. Activision Blizzard also has a significant presence in mobile gaming, which will give Microsoft access to this growing market. For instance, creating cross-platform experiences and bring more mobile gamers into the Xbox ecosystem.

5. Threats

5.1. Competitors in Gaming Industry

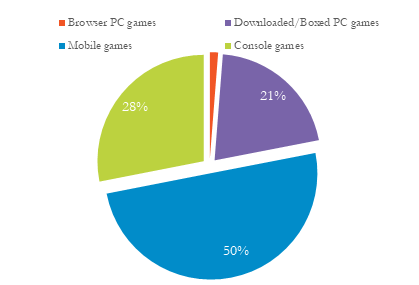

2022 has been the biggest year ever in gaming with record deal activity of over $127 Billion. As for console game, Sony had the lion's share of the console market at 45%. Nintendo commanded 27.7%, while Microsoft controlled 27.3% [17]. Sony's PlayStation consoles have been in direct competition with Microsoft's Xbox consoles since the launch of the original Xbox in 2001. The most recent generation of consoles, the PlayStation 5 and Xbox Series X/S, were both released in late 2020 and are direct competitors in terms of hardware and software offerings.

|

Figure 2: 2022 Global games market. |

Data source: Newzoo.com |

Photo credit: Original |

Nintendo, while offering a different approach to gaming with its family-friendly and innovative game designs, also competes with Microsoft and Sony in the console gaming market. The Nintendo Switch, released in 2017, has been a strong competitor in the market, with its unique hybrid design allowing players to switch between playing on a TV and in handheld mode.

The difference between these three companies is very obvious. Sony's PlayStation consoles have a strong track record of delivering high-quality exclusives and third-party games such as the Uncharted and God of War series, Nintendo, on the other hand, offers a unique approach to gaming with its family-friendly and innovative game designs. One of the key features of the Xbox games that sets it apart is the emphasis on online multiplayer gaming. Xbox Live, Microsoft's online gaming service, has been a central part of the Xbox experience since the launch of the original Xbox console.

One of the threats Microsoft faces from these two companies is its lack of brand loyalty. Sony’s PlayStation brand has a strong and dedicated fan base that has been built over the years through the success of its console hardware and exclusive game offerings. Nintendo has a very loyal fan base as well, which is built on its long history in the gaming industry and its unique approach to game design. Microsoft, on the other hand, has a relatively younger fan base, as its first console, the original Xbox, was released in 2001, several years after the PlayStation and Nintendo consoles.

Overall, in order to continue to gain a foothold in this market, Microsoft needs to focus more on creating an outstanding online multiplayer gaming experience and build its own brand loyalty.

5.2. Corporate Culture Is Highly Controversial

One major factor is the company's handling of allegations of sexual harassment and discrimination against women in the workplace, alleging that the company had created a "frat boy" culture that led to a pattern of harassment and discrimination against female employees [18]. In a Bloomberg report, the prosecution documents were also exposed, detailing the sexual harassment and unequal pay of female employees within Blizzard. The lawsuit prompted widespread criticism and calls for accountability from the public, employees, and industry leaders. In response, Activision Blizzard issued a statement acknowledging the allegations and committing to making changes to its culture and policies. However, some critics argue that the company's response has been inadequate, and that its brand value has been tarnished as a result. What’s more, in April 2021, it was reported that Blizzard Entertainment, the video game developer behind popular titles such as World of Warcraft, had ended its partnership with Chinese tech giant NetEase. However, according to NetEase's 2021 and 2022 financial reports, the profits obtained by NetEase acting on behalf of Blizzard National Service are extremely low, and the reason for the disagreement is that Blizzard hopes to further increase its share, NetEase’s research and development of other Blizzard mobile games in the world can only receive revenue share from China and requires payment of a deposit, and Blizzard has put forward binding clauses that cannot be promised in response to domestic version issues [19].This has led to a sharp decline in the reputation of Blizzard's brand in China and will result in a significant loss of loyal Chinese users.

6. Conclusion

As the internet and information technology continue to advance at a rapid pace, it is possible that the internet industry and virtual reality (VR) technology could eventually replace certain facets of everyday life for people. A major corporation such as Microsoft recognizes the potential for creating new social trends in this era and is therefore taking advantage of the opportunity. This study explores the rationale and potential outcomes of Microsoft's acquisition of Activision Blizzard, utilizing the horizontal merger theory and SWOT analysis to draw conclusions. It is clear that the game industry and the internet industry are closely interconnected. In the near future, the acquisition of Activision Blizzard by Microsoft will provide the company with a significant boost in competitive gaming value. In the long run, Microsoft can utilize its technological resources to expand into a broader market.

However, it is crucial to align the production model of Activision Blizzard's with Microsoft's business model post-merger. Furthermore, it is important to confirm the scope of Microsoft's management of Activision Blizzard's game production, particularly regarding the issue of IP exclusivity, which is also a concern for many individuals.

Furthermore, according to the analysis, if Microsoft intends to include the Metaverse in its development objectives, the concept's risk and feasibility should be evaluated based on its eventual development and progress. In addition to the fact that the key technology of the current project has not yet been developed, how should Microsoft maintain its advantages over competitors in the game industry, and its corporate culture is extremely controversial? Solving these problems may develop more exclusive games to attract more players, establish better communication channels, and gain recognition from the outside world.

Authors Contribution

All the authors contributed equally and their names were listed in alphabetical order.

References

[1]. Microsoft News Center. (2022). “Microsoft to Acquire Activision Blizzard to Bring the Joy and Community of Gaming to Everyone, Across Every Device,” Microsoft, January 18, 2022, at https://news.microsoft.com/2022/01/18/microsoft-toacquire-activision-blizzard-to-bring-the-joy-and-community-of-gaming-to-everyone-across-every-device/.

[2]. In depth interpretation: Is it worthwhile for Microsoft to invest 68.7 billion dollars to acquire Activision Blizzard? (2022). https://baijiahao.baidu.com/s?id=1722393300491418892&wfr=spider&for=pc

[3]. Chan, L.Y. (2014) Corporate social responsibility of multinational corporations, UW Tacoma Digital Commons. Available at: https://digitalcommons.tacoma.uw.edu/gh_theses/18 (Accessed: April 20, 2023).

[4]. Subrat Patnaik, S.M. (2022). Microsoft to gobble up Activision in $69 billion metaverse bet, Reuters. Thomson Reuters. Available at: https://www.reuters.com/technology/microsoft-buy-activision-blizzard-deal-687-billion-2022-01-18/ (Accessed: April 20, 2023).

[5]. Microsoft to acquire Activision Blizzard to bring the joy and community of gaming to everyone, across every device (2022). Stories. Available at: https://news.microsoft.com/2022/01/18/microsoft-to-acquire-activision-blizzard-to-bring-the-joy-and-community-of-gaming-to-everyone-across-every-device/ (Accessed: April 20, 2023).

[6]. Clement, J. (2023). Activision number of monthly active users 2022, Statista. Available at: https://www.statista.com/statistics/1234240/activision-quarterly-mau/ (Accessed: April 24, 2023).

[7]. Overwatch. (2016). Metacritic. Available at: https://www.metacritic.com/game/pc/overwatch (Accessed: April 20, 2023).

[8]. Zheng, R. and Han, X. (2022) “Player loss ‘Overwatch 2’ word-of-mouth diving ‘return’. Beijing Business Daily,” Beijing Business Daily, 7 November.

[9]. World of warcraft. (2004). Metacritic. Available at: https://www.metacritic.com/game/pc/world-of-warcraft (Accessed: April 20, 2023).

[10]. Server population & player count MMO Populations. Available at: https://mmo-population.com/r/wow.

[11]. Sharma, R. (2022). Analysing Microsoft's (MSFT) acquisition of Activision Blizzard (ATVI), Investopedia. Investopedia. Available at: https://www.investopedia.com/analyzing-microsoft-activision-blizzard-acquisition-5216323 (Accessed: April 20, 2023).

[12]. Proposed acquisition of Activision Blizzard by Microsoft. (2023). Wikipedia. Wikimedia Foundation. Available at: https://en.wikipedia.org/wiki/Proposed_acquisition_of_Activision_Blizzard_by_Microsoft (Accessed: April 20, 2023).

[13]. Microsoft's all cash acquisition of Activision Blizzard is a good use of its cash. Yahoo! Finance. Yahoo! Available at: https://finance.yahoo.com/news/microsoft-cash-acquisition-activision-blizzard-154921509.html (Accessed: April 20, 2023).

[14]. Wang Wenxi, Zhou Fang, Wan Yueyue, et al. (2022). A Review of Metaverse Technology. Journal of Engineering Science,2022,44(04):744-756.

[15]. Global Data, Leading gaming companies in the metaverse theme. (2022). https://www.verdict.co.uk/top-ranked-gaming-companies-in-metaverse/

[16]. J. Clara Chan, Xbox Sales Drop as Microsoft’s Gaming Division Declines in Revenue (2023). https://www.hollywoodreporter.com/business/digital/xbox-microsoft-gaming-earnings-1235309158/

[17]. Jeffrey Rousseau, Ampere Analysis: Console market dipped to $56.2bn in 2022. (2023). https://www.gamesindustry.biz/ampere-analysis-console-market-dipped-to-562bn-in-2022.

[18]. Kellen Browning, Activision Blizzard Is Sued by California Over Workplace Culture. (2021). https://www.nytimes.com/2021/07/21/business/activision-blizzard-california-lawsuit.html

[19]. Li Mingzi, Blizzard and NetEase Divorce: It's all about money. (2022). https://baijiahao.baidu.com/s?id=1750249389933430405&wfr=spider&for=pc

Cite this article

Hu,Y.;Li,F.;Mao,L. (2023). Microsoft's Acquisition of Activision Blizzard: SWOT and Prospect Analysis. Advances in Economics, Management and Political Sciences,36,85-92.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 7th International Conference on Economic Management and Green Development

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Microsoft News Center. (2022). “Microsoft to Acquire Activision Blizzard to Bring the Joy and Community of Gaming to Everyone, Across Every Device,” Microsoft, January 18, 2022, at https://news.microsoft.com/2022/01/18/microsoft-toacquire-activision-blizzard-to-bring-the-joy-and-community-of-gaming-to-everyone-across-every-device/.

[2]. In depth interpretation: Is it worthwhile for Microsoft to invest 68.7 billion dollars to acquire Activision Blizzard? (2022). https://baijiahao.baidu.com/s?id=1722393300491418892&wfr=spider&for=pc

[3]. Chan, L.Y. (2014) Corporate social responsibility of multinational corporations, UW Tacoma Digital Commons. Available at: https://digitalcommons.tacoma.uw.edu/gh_theses/18 (Accessed: April 20, 2023).

[4]. Subrat Patnaik, S.M. (2022). Microsoft to gobble up Activision in $69 billion metaverse bet, Reuters. Thomson Reuters. Available at: https://www.reuters.com/technology/microsoft-buy-activision-blizzard-deal-687-billion-2022-01-18/ (Accessed: April 20, 2023).

[5]. Microsoft to acquire Activision Blizzard to bring the joy and community of gaming to everyone, across every device (2022). Stories. Available at: https://news.microsoft.com/2022/01/18/microsoft-to-acquire-activision-blizzard-to-bring-the-joy-and-community-of-gaming-to-everyone-across-every-device/ (Accessed: April 20, 2023).

[6]. Clement, J. (2023). Activision number of monthly active users 2022, Statista. Available at: https://www.statista.com/statistics/1234240/activision-quarterly-mau/ (Accessed: April 24, 2023).

[7]. Overwatch. (2016). Metacritic. Available at: https://www.metacritic.com/game/pc/overwatch (Accessed: April 20, 2023).

[8]. Zheng, R. and Han, X. (2022) “Player loss ‘Overwatch 2’ word-of-mouth diving ‘return’. Beijing Business Daily,” Beijing Business Daily, 7 November.

[9]. World of warcraft. (2004). Metacritic. Available at: https://www.metacritic.com/game/pc/world-of-warcraft (Accessed: April 20, 2023).

[10]. Server population & player count MMO Populations. Available at: https://mmo-population.com/r/wow.

[11]. Sharma, R. (2022). Analysing Microsoft's (MSFT) acquisition of Activision Blizzard (ATVI), Investopedia. Investopedia. Available at: https://www.investopedia.com/analyzing-microsoft-activision-blizzard-acquisition-5216323 (Accessed: April 20, 2023).

[12]. Proposed acquisition of Activision Blizzard by Microsoft. (2023). Wikipedia. Wikimedia Foundation. Available at: https://en.wikipedia.org/wiki/Proposed_acquisition_of_Activision_Blizzard_by_Microsoft (Accessed: April 20, 2023).

[13]. Microsoft's all cash acquisition of Activision Blizzard is a good use of its cash. Yahoo! Finance. Yahoo! Available at: https://finance.yahoo.com/news/microsoft-cash-acquisition-activision-blizzard-154921509.html (Accessed: April 20, 2023).

[14]. Wang Wenxi, Zhou Fang, Wan Yueyue, et al. (2022). A Review of Metaverse Technology. Journal of Engineering Science,2022,44(04):744-756.

[15]. Global Data, Leading gaming companies in the metaverse theme. (2022). https://www.verdict.co.uk/top-ranked-gaming-companies-in-metaverse/

[16]. J. Clara Chan, Xbox Sales Drop as Microsoft’s Gaming Division Declines in Revenue (2023). https://www.hollywoodreporter.com/business/digital/xbox-microsoft-gaming-earnings-1235309158/

[17]. Jeffrey Rousseau, Ampere Analysis: Console market dipped to $56.2bn in 2022. (2023). https://www.gamesindustry.biz/ampere-analysis-console-market-dipped-to-562bn-in-2022.

[18]. Kellen Browning, Activision Blizzard Is Sued by California Over Workplace Culture. (2021). https://www.nytimes.com/2021/07/21/business/activision-blizzard-california-lawsuit.html

[19]. Li Mingzi, Blizzard and NetEase Divorce: It's all about money. (2022). https://baijiahao.baidu.com/s?id=1750249389933430405&wfr=spider&for=pc