1. Introduction

The China’s search industry is heating up in competition for the “search+information” model on China’s Internet. 2017, Baidu make search+information as its core strategies, not only achieved the transformation from PC to mobile Internet but also allowed Baidu to sit at the top of China’s search engine market. What’s more, the information flow giant——Today’s headline, marching from the information flow to the search advertising hinterland. In February 2021, it also issued "headline search" and integrated short video content, meeting Baidu on a narrow path through information flow + search, which has also brought enormous pressure to Tencent.

August 3rd 2004, parent company SOHU launched Sogou and it developed very fast. In 2013, SOGO cooperated with Tencent, Tencent invested 448million dollars and became the biggest shareholder. Meanwhile, SOGO received the Tencent Search and QQ Input Method from Tencent. But during the COVID-19, the revenue of SOGO decreased and Search's revenue share was too high, over 90%, had a single structure [1].

July 2020, Tencent made takeover offer for SOGO and SOGO was appreciated for it without any barrier because Tencent has been invested SOGO in 2013, the two are very familiar with each other. In November 2020, China's State Administration of Market Supervision and Administration stepped up anti-monopoly surveillance and did not approve Tencent's acquisition of SOGO until 13 July 2021. on 24 September 2021, SOGO issued an announcement to officially that Tencent merged SOGO at 9 dollar per share and total 350 million dollar.

The purpose of the article is that analyse the importance for Tencent to acquire the SOGO and what to do in the next. The research significance is to explore the AI technology in SOGO can how to help Tencent. First, the article would show some fact about SOGO and why it should be acquired. Second, the article would explain the importance of Tencent acquiring SOGO.

2. SOGO on the Downslope

2.1. Stylized Facts and Why Revenue Decrease

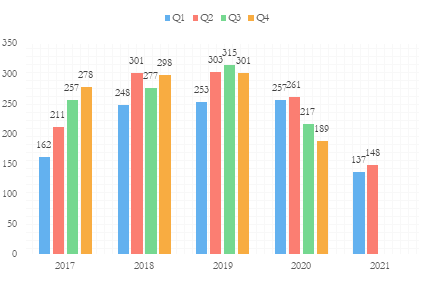

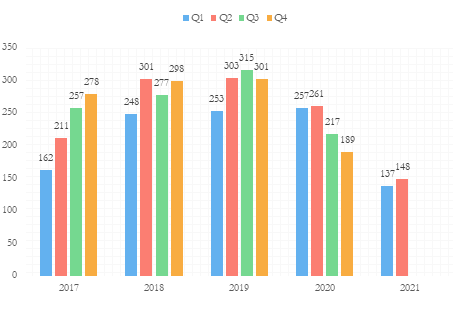

Depend on the financial statement of SOGO, revenue kept a high speed from 2013 to 2018 because Tencent invested 448 million dollars and merged its search engine SOSO, Input Method QQ into the SOGO so that SOGO had asset to expand business. In addition, SOGO got help from Tencent such as QQ and WeChat to get synergy effects. But during the COVID-19, the revenue of SOGO began decrease.

|

Figure 1: SOGO’s revenue from 2017 to 2021. |

Data source: SOGO Financial Statement [2] |

Photo credit: Original |

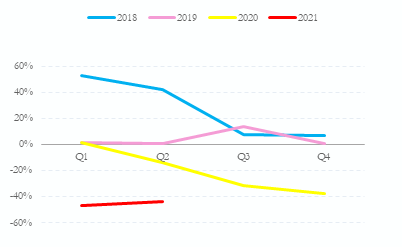

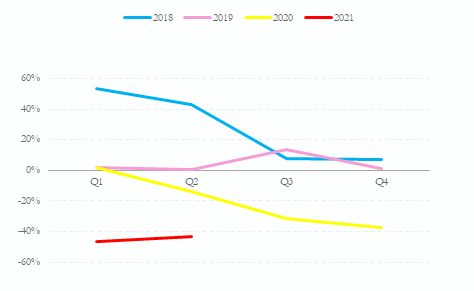

The data in the Figure 1 show that in the 2020 and 2021, the revenue of SOGO persistent, significantly decline though SOGO had achieved above 300million dollars in three of four quarter in 2019. In the second quarter of 2020, just before Tencent made its offer, SOGO's revenue was US$261 million, down 14% year-on-year, and in the four quarters thereafter, revenue was US$217 million, US$180 million, US$137 million and US$148 million, down 31%, 37%, 47% and 44% respectively year-on-year in figure 2.

The main reason why SOGO’s revenue decrease is that the low competition. In the before, SOGO used “Three-stage rocket” model——”Input method-Browser-Search Engine” which users can access the browser through SOGO Input Method and then use SOGO's search engine to search but now input methods, browsers and search engines already run in parallel, and apps are naturally isolated from each other [3, 4]. Mobile input methods do not lead directly to the mobile browser, and users no longer access information through the browser's search engine.

What’s more, there are many other companies competes with SOGO, in 2018, SOGO Input Method also ranked first with a market share at 45.3%, at which time Baidu Input Method ranked second in the industry, holding a market share of 40.5%. 2020 saw Baidu Input Method rank first with a market share of 43.7%, while SOGO Input Method ranked second at 43.6% [5]. In addition, byte jumping launch headline search, Alibaba with Quark search to kill the search field, and small red book, mass review and other vertical field platform has become the entrance of people's information search, SOGO search need to deal with the competition will be more intense.

|

Figure 2: SOGO’s year-on-year revenue growth rate. |

Data source: SOGO Financial Statement [2] |

Photo credit: Original |

2.2. The Single Revenue Structures

In the mobile internet age. The main revenue of SOGO comes from advertisement profit of search and input method. Obviously, this is far from enough. Although SOGO had been tried to expand business, it failed. From 2014-2016, due to the low entry threshold for online lending in China and in the context of an environment of increasing regulation, a large number of irregularly operated platforms were exposed to risk, raising funds by issuing false bids, carrying out false propaganda, exaggerating and distorting the financing channels, nature, purpose and returns, etc. After raising funds to build a pool of funds, the investment of funds is unclear, either to raise funds quickly and then donate to run away, or to use the funds for the associated projects of the platform or the actual controller, or to use the illegal fund-raising to return principal and interest, pay for staff publicity costs, forming a Ponzi scheme. 2017 to December 2018 by the macro liquidity ebb, investor confidence decreased, the P2P industry faced a deep clean-up.

As the country's financial deleveraging continued, liquidity ebbed across the board, credit risk pressure rose, and high overdue rates exacerbated the P2P platform repayment crisis, for which the government launched successive remediation measures. For example, the Notice on Compliance Inspection of P2P Network Lending Institutions, the Guidelines on Information Disclosure on Business Activities of Network Lending Information Intermediaries, the List of P2P Compliance Inspection Questions [5-7]. It had P2P business in 2015 already but banned by government because it Not legally qualified to operate a money lending business, in 2018, SOGO got the qualified and began its P2P business. But in according to the SOGO's financial statement in 2017 and 2018 of table 1, SOGO's third quarterly report showed that SOGO's total revenue for the quarter was US$276.6 million, up 7 percent year-on-year; net profit attributable to SOGO was US$23.9 million, down 23 percent year-on-year. While profits fell, SOGO's general and administrative expenses rose sharply, by 149% to US$15.5 million, or 5.6% of total revenue, compared to US$2.4 in the same quarter last year, SOGO said the increase in the expense was mainly due to a climb in provisions as a result of consumer loans granted by its internet finance platform. SOGO also has been trying in the AI, SOGO launched the Smart Recorder, a smart hardware product which, combined with core AI technology, is capable of achieving a 95% speech-to-text accuracy rate, according to SOGO's external presentation. In addition, SOGO won first place in the Spoken Language Machine Translation Evaluation Competition and the Conversational Machine Reading Comprehension Challenge, beating out prestigious organization such as Alibaba, Microsoft and Stanford. But because of developing AI, SOGO change from profit to loss in 2019.

Table 1: Source of income.

Asset | As of Sep. 30, 2018 | As of Dec. 31, 2017 |

Current asset | ||

Cash and cash equivalents | 230 | 694 |

Short-term investments | 847 | 339 |

Accounts receivable.net | 97 | 70 |

Loan receivables.net | 34 | - |

Prepaid and other current assets | 38 | 15 |

Due from related parties | 2 | 3 |

Unit: Million dollars | ||

Data source: SOGO Financial Statement [2] | ||

3. Strategic Objectives and Implications

3.1. Recent Developments

In 2010, game revenue and membership recharge revenue accounting for over 90% of the company's operating income. It was only after 2011 that Tencent began its extensive and frequent investment and acquisitions activities. This is also evidence that Tencent's managers are aware of and wants to change the problem of relying solely on the game business for revenue. This suggests that the decline in its games business is a result of the increase in its revenue from over 90% to around 50% in 2018. In the process, revenue from the games business itself has grown incrementally. This suggests that the decline in its games business as a percentage of revenue was indeed due to the diversification of its business through acquisitions. In 2017, Tencent bought a 12% stake in Snap Inc. for US$2 billion [8]. Snap Inc. is camera company, but its most important product, Snapchat, is a social software. In February 2020 Roblox closed a US$150 million Series G funding round with Tencent's participation and is the exclusive distributor of Roblox products in China [8]. Tencent invests almost every area in Internet. However, Tencent is still at a disadvantage in the search engine space because it invested SOGO and not developed it. Moreover, though Tencent does not have any particularly outstanding aspects in the field of AI. Tencent's main advantages in the AI field include: 1) Rich data: it has massive data in many fields such as social, games and advertising, providing a basis for AI research and application. 2) Strong technology: it has a team of experts with strong technical strength in natural language processing, computer vision and other areas to continuously promote AI innovation. 3) Perfect ecology: it has a series of platforms and ecologies such as Tencent Cloud, WeChat AI and AI Lab, which can provide good support. 4) Wide range of scenarios: The business is involved in many fields such as social networking, games, advertising, finance and cloud services, with a wide scope of technical applications [9].

3.2. Strategic Objectives

In fact, Tencent had exploited SOSO search to compete at search area in March 2006 but failed in the competition with Baidu and SOGO. In order to avoid vicious competition, Tencent decided to merge SOSO into SOGO in 2013. In retrospect, it may not a good choice to give up search business because there is a lot of recommendation, content and data distribution, and AI technologies behind search, which are extremely important for the information flow business and short video business. Tencent missed the opportunity to build up these technologies when it abandoned its search business. In addition, the competition of search area is very fierce, from providing services in the form of search box + keywords, to relying on a variety of information services to provide search and recommendations in the form of text, sound, image and video content [10]. Quark and Today's Headlines are following suit to grab market share. After acquisition, Tencent can compete with Baidu which has more than 70% market share in search industrial. Not only can Tencent expand its footprint in search, but it can also combine it with AI and leverage SOGO AI technology to compete with those top companies in AI.

3.3. Implications

An important significance of search for Tencent is that it is still a very certain way to obtain traffic in all businesses in the Internet industry, and can help Tencent further strengthen its ability to close the loop - for example, after users search for a product in WeChat, they can jump directly to another app. Another, Tencent acquires SOGO help it go into search and AI market. Finally, the most important thing is that Tencent can combine AI and search engines to develop new skill, trying to catch up with chat GPT.

4. Conclusion

This article is based on a background that in the search field, many parties are wrestling with each other, with Byte Jump and Alibaba competing to enter the game, and perhaps Tencent can cooperate with them to shake Baidu's position; in the AI field, Open AI has launched chat GPT, Baidu has launched ERNIE Bot, and Tencent has fallen behind.

The article analyses why SOGO revenue decrease in recent year and what trouble SOGO faced that Despite trying other businesses, they have largely ended up failing and losing money. SOHU wants to get rid of this liability and SOGO needs capital to develop AI. What’s more, Tencent clearly knows that it is difficult to expand further in the gaming industry and intends to develop in other industries. The purpose of the article is that explaining Tencent's motives for acquiring SOGO and what benefit SOGO can take to Tencent. The core views of the article is which combine AI and search engines bring new opportunities to Tencent, helping Tencent make a bend in the search space and AI. Next, Tencent should ingratiate SOGO business and SOGO search forms healthy competition with WeChat search internally. Besides, leveraging SOGO strengths in AI to grow the business.

References

[1]. China News weekly. (2021). Tencent buys SOGO, Will the search market change? https://baijiahao.baidu.com/s?id=1712586447373924853&wfr=spider&for=pc

[2]. SOGO. (2017). https://caibaoshuo.com/companies/SOGO

[3]. Kaixin567 (2022). The "three-stage rocket" mode assists the search. https://www.wenmi.com/article/pzy0wc04kzly.html

[4]. Financial sector. (2021). Tencent department of input method "internal volume" aggravates Sogou "three stage rocket" stall privatization is not clear, https://baijiahao.baidu.com/s?id=1700325656841969777&wfr=spider&for=pc

[5]. Leading Group for the Special Rectification of P2P Lending Risks. (2018). The Notice on Compliance Inspection of P2P Network Lending Institutions (Net loan regulation letter (2018).

[6]. China Banking Regulatory Commission. (2017). The Guidelines on Information Disclosure on Business Activities of Network Lending Information Intermediaries.

[7]. Leading Group for the Special Rectification of P2P Lending Risks. (2018). The List of P2P Compliance Inspection Questions (2018).

[8]. NFT Chinese Community. (2022). A text to understand Tencent meta - cosmic ecological layouthttps://baijiahao.baidu.com/s?id=1738672357672118235&wfr=spider&for=pc

[9]. The sky Wolf is the hand. (2023). https://weibo.com/1895684102/MAoDvFzbU

[10]. Forward Industry Research Institute. (2020). Why the Internet giants are scrambling to dominate search https://bg.qianzhan.com/report/detail/300/200806-9ee2d700.html

Cite this article

Jiang,L. (2023). AI and Search Give New Impetus to Tencent: The Perspectives Based on Tencent's Acquisition of SOGO. Advances in Economics, Management and Political Sciences,37,19-24.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 7th International Conference on Economic Management and Green Development

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. China News weekly. (2021). Tencent buys SOGO, Will the search market change? https://baijiahao.baidu.com/s?id=1712586447373924853&wfr=spider&for=pc

[2]. SOGO. (2017). https://caibaoshuo.com/companies/SOGO

[3]. Kaixin567 (2022). The "three-stage rocket" mode assists the search. https://www.wenmi.com/article/pzy0wc04kzly.html

[4]. Financial sector. (2021). Tencent department of input method "internal volume" aggravates Sogou "three stage rocket" stall privatization is not clear, https://baijiahao.baidu.com/s?id=1700325656841969777&wfr=spider&for=pc

[5]. Leading Group for the Special Rectification of P2P Lending Risks. (2018). The Notice on Compliance Inspection of P2P Network Lending Institutions (Net loan regulation letter (2018).

[6]. China Banking Regulatory Commission. (2017). The Guidelines on Information Disclosure on Business Activities of Network Lending Information Intermediaries.

[7]. Leading Group for the Special Rectification of P2P Lending Risks. (2018). The List of P2P Compliance Inspection Questions (2018).

[8]. NFT Chinese Community. (2022). A text to understand Tencent meta - cosmic ecological layouthttps://baijiahao.baidu.com/s?id=1738672357672118235&wfr=spider&for=pc

[9]. The sky Wolf is the hand. (2023). https://weibo.com/1895684102/MAoDvFzbU

[10]. Forward Industry Research Institute. (2020). Why the Internet giants are scrambling to dominate search https://bg.qianzhan.com/report/detail/300/200806-9ee2d700.html