1. Introduction

With the rapid development of the Internet, various Internet fields such as online video, online live broadcasting, online shopping, and online social networking have become indispensable parts of people's daily life, bringing new opportunities for the vigorous development of short video platforms. At present, in the fast-paced life, people are no longer satisfied with traditional lengthy videos but are more inclined to brush short and interesting videos in fragmented time. In recent years, China's major short video platforms have seized opportunities under the trend of the times, constantly trying to enter various fields of the Internet and penetrating into the spare life of netizens. Meanwhile, major short video platforms continue to innovate, creating high-quality content to attract the interest of a wide range of user groups, the user base continues to grow, and the competition between platforms is fierce. In 2016, as a new entrant in the short video industry, Douyin developed rapidly after entering the market, leading many competitors in the same industry in just a few years and becoming the head platform in China's short video market. At the same time, with the successful implementation of the overseas strategy, Douyin's overseas version - TikTok - has developed rapidly in the global application market and has now become one of the most successful Chinese brands in internationalization. It is at the top position in the entertainment and short video application market in terms of user scale and usage time, as well as market penetration, and has created tremendous value and economic revenue for its headquarters company ByteDance.

The success of Douyin is inseparable from its unique marketing methods and irreproducible corporate competition strategy. However, due to the relatively concentrated development process and short time of short video platforms, most of the current research on marketing and competition of relevant platforms is still limited to the level of phenomenon description and trend analysis, while there are still gaps in the research on the core strategic model of enterprises. Therefore, based on the review research method, this study will discuss and analyze the marketing methods and corporate competition strategies of Douyin in the context of the short video era through the specific use of the text analysis method, case analysis method, and comparative analysis method. This paper compares and analyzes Douyin with other large short video platforms at home and abroad, aiming to point out the key to the outstanding short video platforms represented by Douyin standing out in the global application market. In addition, this research will explore Douyin's business model in an attempt to point the way for the development of other short video platforms and related companies.

This article will first analyze the competitive environment of the short video market at the launch of Douyin, and then analyze the development status of short video platforms at home and abroad. In this part, Douyin's competition in China and TikTok's competition in the international short video market will be mainly explained. Secondly, this research will conduct an in-depth study of how Douyin competes and operates in a homogeneous market from three aspects: product differentiation, business model and marketing methods. Then, based on the SWOT model, Douyin's enterprise competitive strategy will be analyzed in detail from four aspects: advantages, disadvantages, opportunities, and threats. Finally, this study will summarize the reasons why Douyin is far ahead in the fierce short video competition market and try to provide reference opinions for the development and foothold of short video platforms.

2. Development Status of Short Video Platforms

2.1. The Launch Environment of the Douyin APP

Douyin APP was officially launched in China in September 2016. At that time, China was in the era of rapid popularization of mobile Internet, and the popularity of mobile devices and the improvement of network speed greatly promoted the development of short video applications. However, when it first entered the short video application market, Douyin also faced the threat of many competitors in the same industry. Among them, Kuaishou, as its strongest competitor in China, had already occupied a dominant position in the short video market at that time, with a wider user base and stronger investment. According to Table 1, from January 2016 to January 2017, Kuaishou led the short video market in terms of penetration, far higher than the combined penetration rate of other similar applications [1].

Table 1: Top 5 apps in the vertical short video market penetration rate in January [1].

Top 5 Market Penetration | January 2016 | January 2017 |

Kuaishou | 6.8% | 13.3% |

Meipai | 3.5% | 3.5% |

Xiaoying | 0.7% | 0.9% |

Miaopai | 0.5% | 0.9% |

Xiaokaxiu | 1.2% | 0.7% |

Under the pressure of many powerful industry competitors, Douyin has been hovering in a tepid state since its launch. It was not until March 2017 that Yue Yunpeng posted a short video with a Douyin watermark on Weibo, Douyin suddenly became popular, and the number of daily downloads by users increased rapidly [2]. Driven by this opportunity, Douyin seized the star effect and invited stars such as Zhou Bichang and Yang Di to join, and the Douyin APP became popular.

2.2. The Development Status of the Domestic Short Video Market

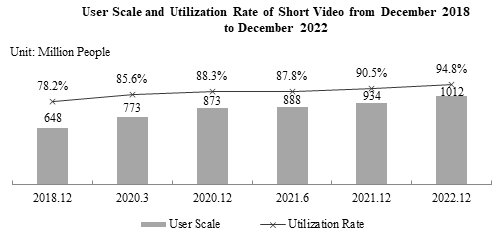

At present, the development of the domestic short video market has entered a climax stage. According to the "51st Statistical Report on Internet Development in China" released by CNNIC, as of December 2022, the scale of short video users in China has reached 1.012 billion, an increase of about 77.7 million over December 2021, accounting for 94.8% of all Internet users (Fig.1) [3].

Figure 1: User scale and utilization rate of short video from december 2018 to december 2022 [3].

In the fierce domestic competitive market, the short video industry has formed a "two strong" pattern dominated by Douyin and Kuaishou [3]. As the leaders of the short video industry, Douyin and Kuaishou far surpass other short video platforms in terms of user scale and the number of active users and stay in the first echelon in the industry, among which Douyin's user scale is even better.

According to the user data of the short video industry in "2022 China Mobile Internet Annual Report" released by QuestMobile, Douyin ranks first among many short video platforms in terms of monthly active user scale and monthly per capita usage time. As is shown in Fig. 2, in December 2022, the number of monthly active users of Douyin was 715 million, with a year-on-year growth rate of 6.4%, and the monthly per capita usage time was 41.4 hours [4]. In contrast, its strongest competitor, Kuaishou, has just 449 million monthly active users with a year-on-year growth rate of 9.2%, and the average monthly usage time was 30.2 hours [4]. In addition, according to the "2022 Douyin Hot Spot Data Report" released by Ocean Insights, the average monthly number of Douyin hot video views exceeded 400 billion in 2022, and the average monthly number of hotspot creators exceeded 700,000 [5]. From the data level, the current Chinese short video platform market has formed a relatively stable competitive situation. Douyin and Kuaishou also have an absolute monopoly in the market (more than 50% of monthly active users).

Figure 2: December 2022 short video industry monthly active user scale top 10 apps and monthly usage time per capita [4].

2.3. The Development Status of the Global Short Video Market

From the perspective of the development status of the global short video market, many short video platforms have stood out in recent years. The scale of users has continued to grow rapidly, and the industry has ushered in a peak period of development. Among the international large-scale short video platforms, TikTok is still in the leading position in the market, driving the growth of global entertainment social platforms in an innovative form. TikTok is considered the third largest traffic pool in the world after Google and Facebook.

According to the Statista Global Statistics Database, TikTok's global downloads reached 672 million in 2022, occupying an absolute leading position among the world's leading entertainment and video streaming applications, more than three times higher than Netflix, which ranks second [6]. In the same year, TikTok's global user scale reached 1.719 billion, and it was launched in more than 150 countries or regions [7][8]. Among them, the United States, as the country with the largest TikTok audience, accounts for 41% of the platform’s application revenue in the global application market in the second quarter of 2022, reaching US$39,400 [9]. According to the "2023 Global Unicorn List" released by the Hurun Research Institute, as of December 31, 2022, TikTok's headquarters company ByteDance continued to be the world's most valuable unicorn company with a market value of 1.38 trillion yuan [10].

3. Douyin's Homogeneous Market Competition Strategy

3.1. Product Differentiation Innovation

3.1.1. Product Design Concept Innovation.

From the perspective of product and APP design, Douyin is a firm practitioner of personalized and refined operations. First of all, from the perspective of content form, high-value influencers, exquisite production, and scene design co-assisted with highly creative script builds, which complement each other to form the main video content of Douyin. Therefore, the above requirements have relatively raised the entry threshold for Douyin. But these requirements also seem to make Douyin's videos occasionally a bit exaggerated. Compared with Douyin, other platforms like Kuaishou are more inclined to help ordinary people record their lives. Therefore, the cost of video production will be relatively controllable. Of course, this will give the audience an ordinary impression. Secondly, from the perspective of social interaction, Douyin is committed to becoming a brand-new social platform. Based on Douyin's slogan "Record a better life" being practiced more and more, an increasing number of people begin to record their daily life and share it with friends or strangers around them, thus, Douyin has become a stage to show themselves. Moreover, in addition to basic functions such as likes, comments, and forwarding, Douyin has also added a variety of new functions, such as interactive topics and challenges, to attract users to share and communicate more actively. Moreover, Douyin is committed to continuous upgrading and innovation in technology. In addition to a powerful intelligent recommendation system, Douyin has launched a series of intelligent video processing technologies such as super-resolution, interpolation, denoising, and deblurring, which effectively improve the overall quality of low-quality videos.

3.1.2. Diversified Business Innovation.

So far, Douyin has ceased to be a platform that focuses solely on entertainment and social networking. Following the rapid development and growth of Douyin Mall in 2022, Douyin began to expand more business. On January 28, 2023, Douyin Supermarket was officially launched. As a new format explored by Douyin, online supermarkets are still in their infancy. In order to reduce the cost of trial and error, Douyin supermarkets focus on FMCG, aiming to gather consumer groups in the short term. As a part of Douyin e-commerce, the entry of Douyin supermarket will have a great impact on the entire e-commerce competition landscape. Immediately afterward, Douyin began to enter the field of food delivery business and is currently piloting in Beijing, Shanghai, and Chengdu. "Retail Circle" magazine believes that for Douyin, which has a significant user traffic and visual display platform, the inbound takeaway has a robust innate advantage [11]. It can be seen that Douyin's diversified business expansion is committed to building it into a "Super APP" that integrates the whole industry chain of daily life.

3.2. Business Model Innovation

3.2.1. Live Monetization.

With the development of the live broadcast business, Douyin has derived a combination monetization model of multiple platforms and creators.

Live Reward. As the most basic monetization method of live broadcasting, the basic operation mode of live reward is that users exchange virtual gifts by recharging Dou coins and giving them to the anchor when watching the live broadcast. The platform converts the value of the virtual gifts and divides between the platform and the anchor according to the agreed proportion. Viewers will continue to consume out of their love for the host or interest in the live content, thus continuously creating value for the platform and the host.

Pure Commission CPS (Cost Per Sale). CPS refers to the conversion of the amount of advertising by the actual number of products sold, which is mainly suitable for live broadcasters who are just starting out. Since Douyin launched the live shopping cart, the Live Broadcast + CPS model has become one of the main monetization methods for Douyin live streaming.

Pit Site Fee + CPS. The platform needs to pay a fixed "pit site fee" to the anchor, and the anchor needs to take a commission according to the sales volume of the goods. The pit site fee is the appearance fee, which is usually proportional to the popularity of the anchor. This kind of monetization is mainly suitable for celebrities or talents with the stable delivery ability or high traffic.

Drainage of Connecting the Mic. Drainage of connecting the mic is a recently emerging form of monetization; that is, merchants or anchors who need traffic can lead traffic to their live broadcast rooms by connecting with high-traffic influencers to increase the attention and flow of live broadcasts.

Overall, Douyin's four live-streaming monetization models provide the most suitable and efficient income methods for influencers with different characteristics and needs and also create huge commercial value for the platform.

3.2.2. Knowledge Drainage.

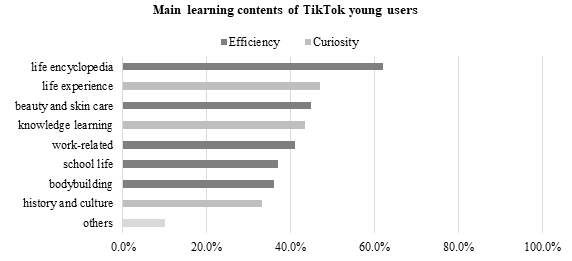

In addition to being a platform for daily entertainment, socializing and shopping, Douyin is committed to becoming a new channel for young people to acquire knowledge. According to Ocean Insights' 2022 TikTok Young People Watch Report, in June 2022, 44.3% of young people have acquired and learned knowledge through Douyin [12]. As the "indigenous residents" of the mobile Internet, the new generation of young people is especially good at efficiently obtaining information from short videos. As shown in Fig. 3, from the life encyclopedia, beauty and fitness, campus life and work related to efficient learning, to life experience, widespread science knowledge, history, and culture that mainly satisfy curiosity are all the main learning content for young users on Douyin. At the same time, Douyin is also used by more and more people as a "search engine". On February 17, 2021, Douyin announced for the first time that the monthly active users of video search exceeded 550 million and stated that it would increase investment in search. TikTok's vision is to become a video encyclopedia of human civilization.

Figure 3:Main learning contents of TikTok young users [12].

3.3. Marketing Methods Innovation

Through the innovative model of "short video + e-commerce", Douyin closely combines traditional sales methods with new marketing methods to provide users with a more personalized, vivid and efficient consumption experience. Compared with conventional e-commerce, Douyin e-commerce has made innovations in marketing models, following the "user-content-goods-service" link, and its core foundation is "good content + good goods + good service".

In order to find a new profit model, Douyin e-commerce actively introduces high-quality partners to promote the brand's marketing culture change in the digital era through innovative advertising forms, multiple scenarios, and traffic solutions. For example, Douyin and the Eleme takeout platform launched in August 2022. Based on the Douyin platform, Eleme uses Mini Programs as the carrier to help takeaway merchants connect with Douyin users. There are also many Internet celebrities on the Douyin platform who use high-traffic capabilities to ignite the products on the shopping platform, causing a consumption boom. The combination of Douyin with takeaway and shopping platforms is the perfect connection between social software and e-commerce. This e-commerce marketing method not only brings considerable economic benefits to Douyin, but also brings new consumption growth points to partners through Douyin's Internet celebrity effect and publicity.

4. Douyin Enterprise Strategy Analysis Based on SWOT Model

The SWOT model is an analytical method used to analyze corporate strategy, that is, to analyze the situation based on the internal and external competitive environment and competitive conditions of the enterprise. This part of the research will analyze the internal and external scenarios of Douyin in detail based on this model so as to discuss the corresponding development strategy and plan of Douyin, and also analyze the corporate threats and potential challenges of it.

4.1. Internal Strengths

4.1.1. Technical Power.

Douyin has powerful audio and video processing technology and a unique intelligent recommendation system. Among them, the implementation of audio and video processing is based on index construction, first frame optimization, image quality optimization, strategy optimization, and other solutions to quickly build the ultimate playback experience. The technologies involved include ultra-low-latency live broadcast technology, video dark scene enhancement technology, and edge computing technology [13]. The intelligent recommendation system conducts an in-depth analysis of user interests and needs through multi-dimensional analysis of user portraits, video quality as well ashot topics. combined with users' geographic location, historical playback records, likes, shares, and other data, and independently generates video playlists to achieve accurate content recommendation, improving user stickiness and retention rate. With the assistance of technical means, users have formed a dependence on software invisibly.

4.1.2. User Base.

Douyin has a huge user base and extremely high user stickiness. The user scale and the number of active users is far ahead in the short video market, which is extremely advantageous for the development of the platform and market competition. The core users of Douyin are young people. According to the Statista Global Statistics Database, starting from the age distribution alone, among TikTok's global users, young people aged 18-34 accounted for 71.3% of the total number of users [14]. This part of the user group is more willing to accept new things and catch up with the trend. From the perspective of geography alone, domestic first-tier, new first-tier, and second-tier cities account for a relatively high proportion of users [12]. Generally, the cultural level and spending power of these users are relatively high. Therefore, the younger and more regionalized user groups make Douyin an important channel for brand marketing.

4.2. Internal Weaknesses

4.2.1. The Low Barrier to Entry Results in Uneven Video Quality.

The Douyin APP is convenient for releasing videos so that all kinds of users can directly participate in the production and dissemination of videos. However, the existence of users with different media literacy and education levels directly causes the phenomenon of uneven video quality and even leads to the adverse consequences of vulgar video content. In addition, there are also some video creators who create videos with the purpose of "catching eyeballs". What these users are pursuing is either greater commercial monetization value or self-satisfaction in gaining widespread attention, which may pose a huge threat to the platform ecology. For example, a Douyin user in Guangxi Province, China, illegally modified his vehicle, drove at excessive speed, edited the video material from the motorcycle recorder, and posted it on his Douyin account for the purpose of obtaining traffic [15]. This behavior not only threatens his own safety but also sets a wrong example for the audience, especially young people, and causes an extremely harmful adverse impact on the platform.

4.2.2. The Serious Homogenization of Video Content.

As the number of Douyin users continues to increase, the problem of homogenization of video content begins to emerge. It is easy to find that when a popular video appears on the Douyin APP, there will inevitably be a large number of users scrambling to imitate it. Coupled with the similar push of Douyin's intelligent recommendation algorithm, after watching a large number of homogeneous videos, the freshness is easily consumed by a significant amount, resulting in aesthetic fatigue. In this case, it is easy to bring a poor experience to some users, resulting in a decline in user traffic. Although this is a common phenomenon in the short video industry, it will cause a broader range of imitations if it is not rectified in time, which will endanger the content ecological environment of the entire platform to a certain extent and restrict the development of the platform.

4.3. External Opportunities

4.3.1. Broad Space for Global Development in the Internet Era.

As a globally popular short video APP, Douyin has huge room for development in domestic and foreign markets. With the continuous innovation of technology and the rapid development of the Internet, Douyin will also usher in more opportunities. At present, in the highly competitive social environment, people's large periods of free time are gradually decreasing while fragmented time is increasing. Douyin's short and entertaining features of videos cater to this social trend. In addition, Douyin's globalization strategy brings more room for development. In overseas markets, Douyin has better integrated into local culture and social habits through localized operation methods, Its brand influence is increasing year by year in the international market, and its development prospects are very optimistic.

4.3.2. A Steady Stream of External Investors and Brand Cooperation.

The continuous development and growth of Douyin have attracted more and more attention from large investment institutions and high-quality brands. A steady stream of external investors has contributed to the continuous expansion of Douyin's funding sources, further enhancing its position in the market. At the same time, a large number of high-quality brands have settled in Douyin Mall, and brand self-broadcasting has become a fundamental breakthrough in the growth of Douyin Live. According to the "2022 Annual Report on Short Video and Live Marketing" released by Feigua Data, the brand self-broadcast GMV continued to grow in 2022, and it is forecast to usher in a comprehensive increase in 2023 [16]. In the future, Douyin will usher in more high-quality cooperation opportunities.

4.4. External Threats

4.4.1. Domestic Competitors Threats.

Although Douyin occupies a leading position in the domestic short video market currently, the threat of its competitors cannot be ignored. First of all, Kuaishou is its strongest competitor, although there is still a certain gap between the number of monthly active users and Douyin. According to the "2022 China Mobile Internet Annual Report" released by QuestMobile, the year-on-year growth rate of Kuaishou’s monthly active users in December 2022 was 2.8% higher than that of Douyin, and the growth momentum was rapid [4]. Secondly, although the entertainment social platforms such as Xiaohongshu and Bilibili do not focus on short video content, the exquisite features of the former with the theme of beauty, fashion and lifestyle, and the unique form of the latter focusing on two-dimensional community make them powerful alternatives to Douyin.

4.4.2. Overseas Market Dilemma.

Although Douyin's overseas strategy has made it a very successful international short video APP, it still faces many difficulties in the process of entering overseas markets. Due to some political and cultural factors, TikTok may be restricted or banned in some countries, which affects Douyin's international market share. After TikTok formed a certain influence in the United States, the US government forcibly acquired TikTok on the grounds of interfering in politics and endangering national security. At the end of 2022, TikTok was banned from the mobile devices of lawmakers and staff of the US House of Representatives, which caused the geopolitical issues between China and the United States to escalate. From this point of view, the overseas expansion of TikTok lies in how ByteDance maintains its relationship with the US government in the context of the Sino-US trade war so as to ensure that the TikTok platform can continue to survive in the United States.

5. Discussion and Suggestions

Based on the data discussed above and the SWOT analysis results, while Douyin is in a period of solid growth, it may also cause potential enterprise development crises due to specific problems and threats. In order to ensure Douyin's domestic and international market dominance, it is necessary to formulate a deeper development strategy based on its own characteristics and internal and external situations. In this regard, this paper intends to put forward the following two suggestions.

The first is to resist the homogenized and badly oriented videos that are still spreading on the platform. To this end, Douyin should strengthen restrictions on the push of such videos and explore and support more videos with high-quality content. Douyin can make full use of its technical advantages, formulate relevant standards, and strengthen the management of algorithm recommendations and traffic exposure. In addition, Douyin should actively guide users to create high-quality video content. For example, the free comprehensive content operation guidance and rule explanation released by the Douyin Creator Center is a beneficial measure, but these tutorials lack effective promotion and fail to attract the attention of the majority of creators. Therefore, Douyin should establish a comprehensive promotion mechanism for creator tutorials to attract users to actively accept guidance in a more novel and interesting form so as to establish a high-quality content ecology.

The second is to attach importance to the issue of information security. Today, information security has become the most sensitive issue for people. In the era of big data, whether the security of users' personal information can be handled appropriately becomes the key to whether enterprises can retain users. In order to win the trust of users, Douyin should place special emphasis on information security issues. Specifically, it should continuously strengthen technical investment and talent training in the entire field of data security. At present, TikTok has established a dedicated US data security management team. Taking this as a starting point, Douyin should strengthen data security in all target markets and set up dedicated teams to ensure its international market share.

6. Conclusion

The reasons why Douyin can occupy a place in the fierce competition in the short video market are inseparable from the support of differentiated product design, innovative business models, and unique marketing methods. Through in-depth research on Douyin's marketing methods and enterprise competition strategies, this paper finds that high-quality video quality, strong technical accumulation, and diversified business development are must-haves for an excellent short video platform. The vision of Douyin is to become the world's leading mobile short video entertainment by exerting the advantages of technology, content, and user base, overcoming the disadvantages of vulgar and homogenization of some video content, seizing the good external development opportunities in the short video era, and taking effective measures to resolve the threat factors from domestic and foreign markets, becoming the world's leading mobile short video entertainment social platform. With the further expansion of the short video application market, Douyin has enormous room for development but also faces more significant challenges. In view of the industry characteristics of Douyin and the current internal and external environment, this paper attempts to put forward some suggestions from the perspectives of internal supervision mechanism and overseas operation strategy, hoping to bring some references to Douyin's corporate development strategy and also point out the direction for the development and foothold of other short video platforms and related industries. The limitation of this paper is that it fails to explore further how China should establish a better overseas operation system to effectively cope with the dilemma of TikTok being restricted or banned in some overseas markets at the national level. In future research, this study suggests that a more comprehensive and systematic corporate strategy could be attempted to summarize by interviewing actual consumers, collecting market feedback, and profoundly analyzing consumer behavior based on empirical data.

References

[1]. Aurora Big Data, afenxi, Short Videos Exploded, Who is in the Wind? —— Vertical short video app industry report, https://www.afenxi.com/42541.html, last accessed 2023-04-19.

[2]. Daxiayizhihua, sunwk, Douyin's Market Segmentation Starting From the Timeline, Analyze the 3 stages of Douyin's development, http://sunwk.cn/xmt/3047.html, last accessed 2023-04-19.

[3]. CNNIC, F.: The 51st Statistical Report on Internet Development in China. Journal (2023).

[4]. QuestMobile Research Institute, questmobile, 2022 China Mobile Internet Annual Report, https://www.questmobile.com.cn/research/report/1627881652360417282, last accessed 2023-04-19.

[5]. Ocean Insights, trendinsight.oceanengine, Spend the Warm End of the Year Together-2022 Douyin Hot Spot Data Report, https://trendinsight.oceanengine.com/arithmetic-report/detail/853, last accessed 2023-04-19.

[6]. Statista, Leading entertainment and video streaming apps worldwide in 2022, by downloads (in millions), https://www.statista.com/statistics/1285024/top-downloaded-entertainment-apps-worldwide/, last accessed 2023-05-01.

[7]. Statista, Number of TikTok users worldwide from 2018 to 2027 (in millions), https://www.statista.com/forecasts/1142687/tiktok-users-worldwide, last accessed 2023-05-01.

[8]. Gu L, F., Gao X, S., Li Y, T.: What drives me to use TikTok: A latent profile analysis of users' motives. Journal 13 (2022).

[9]. Statista, Leading markets based on TikTok iOS revenue in 2nd quarter 2022 (in million U.S. dollars), https://www.statista.com/statistics/1090641/tiktok-ios-revenue-in-leading-markets/, last accessed 2023-05-01.

[10]. Internship and Research for International Students, sohu, ByteDance Catches up SpaceX, First in the World!, https://www.sohu.com/a/671403741_121684947, last accessed 2023-04-30.

[11]. Retail Circles, 36kr, Douyin Supermarket, Coming, https://36kr.com/p/2107245717930112, last accessed 2023-04-29.

[12]. Ocean Insights, trendinsight.oceanengine, Arithmetic says - 2022 Douyin Young People Observation Report, https://trendinsight.oceanengine.com/arithmetic-report/detail/749, last accessed 2023-04-29.

[13]. ByteDance Video Cloud Technical Team, juejin, The Ultimate Experience, Revealing the Audio and Video Technology behind Douyin, https://juejin.cn/post/7088149758812323870, last accessed 2023-04-29.

[14]. Statista, Distribution of TikTok users worldwide as of January 2023, by age and gender, https://www.statista.com/statistics/1299771/tiktok-global-user-age-distribution/, last accessed 2023-05-01.

[15]. Liangguangdadinaxieshier, sohu, In order to Gain Attention, this Netizen "did" these Things on Douyin......, https://www.sohu.com/a/636000025_121106875, last accessed 2023-05-01.

[16]. Feigua Data, dy.feigua, 2022 Short Video and Live Marketing Annual Report, https://dy.feigua.cn/article/detail/849.html, last accessed 2023-05-07.

Cite this article

Wu,T. (2023). Analysis of Douyin's Marketing Methods and Corporate Competitive Strategies in the Era of Short Videos. Advances in Economics, Management and Political Sciences,37,31-41.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 7th International Conference on Economic Management and Green Development

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Aurora Big Data, afenxi, Short Videos Exploded, Who is in the Wind? —— Vertical short video app industry report, https://www.afenxi.com/42541.html, last accessed 2023-04-19.

[2]. Daxiayizhihua, sunwk, Douyin's Market Segmentation Starting From the Timeline, Analyze the 3 stages of Douyin's development, http://sunwk.cn/xmt/3047.html, last accessed 2023-04-19.

[3]. CNNIC, F.: The 51st Statistical Report on Internet Development in China. Journal (2023).

[4]. QuestMobile Research Institute, questmobile, 2022 China Mobile Internet Annual Report, https://www.questmobile.com.cn/research/report/1627881652360417282, last accessed 2023-04-19.

[5]. Ocean Insights, trendinsight.oceanengine, Spend the Warm End of the Year Together-2022 Douyin Hot Spot Data Report, https://trendinsight.oceanengine.com/arithmetic-report/detail/853, last accessed 2023-04-19.

[6]. Statista, Leading entertainment and video streaming apps worldwide in 2022, by downloads (in millions), https://www.statista.com/statistics/1285024/top-downloaded-entertainment-apps-worldwide/, last accessed 2023-05-01.

[7]. Statista, Number of TikTok users worldwide from 2018 to 2027 (in millions), https://www.statista.com/forecasts/1142687/tiktok-users-worldwide, last accessed 2023-05-01.

[8]. Gu L, F., Gao X, S., Li Y, T.: What drives me to use TikTok: A latent profile analysis of users' motives. Journal 13 (2022).

[9]. Statista, Leading markets based on TikTok iOS revenue in 2nd quarter 2022 (in million U.S. dollars), https://www.statista.com/statistics/1090641/tiktok-ios-revenue-in-leading-markets/, last accessed 2023-05-01.

[10]. Internship and Research for International Students, sohu, ByteDance Catches up SpaceX, First in the World!, https://www.sohu.com/a/671403741_121684947, last accessed 2023-04-30.

[11]. Retail Circles, 36kr, Douyin Supermarket, Coming, https://36kr.com/p/2107245717930112, last accessed 2023-04-29.

[12]. Ocean Insights, trendinsight.oceanengine, Arithmetic says - 2022 Douyin Young People Observation Report, https://trendinsight.oceanengine.com/arithmetic-report/detail/749, last accessed 2023-04-29.

[13]. ByteDance Video Cloud Technical Team, juejin, The Ultimate Experience, Revealing the Audio and Video Technology behind Douyin, https://juejin.cn/post/7088149758812323870, last accessed 2023-04-29.

[14]. Statista, Distribution of TikTok users worldwide as of January 2023, by age and gender, https://www.statista.com/statistics/1299771/tiktok-global-user-age-distribution/, last accessed 2023-05-01.

[15]. Liangguangdadinaxieshier, sohu, In order to Gain Attention, this Netizen "did" these Things on Douyin......, https://www.sohu.com/a/636000025_121106875, last accessed 2023-05-01.

[16]. Feigua Data, dy.feigua, 2022 Short Video and Live Marketing Annual Report, https://dy.feigua.cn/article/detail/849.html, last accessed 2023-05-07.