1. Introduction

Microsoft corporation, a famous company which major business is developing personal-computer software systems and applications. Microsoft started as a company to develop software for the Altair 8800, an early personal computer, in 1975, that was formerly known as Traf-O-Data. At the same year, Microsoft released the first product which is called the Altair BASIC. In 1983, Bill Gates first introduced the first version of Microsoft Windows and it is planned to be released 2 years later. In 1986, Microsoft went public, garnering $61 million at a price of $21 per share. In 2001, Microsoft launched Windows XP and the first Xbox. In2005, Microsoft launches the Xbox 360. In 2013, Microsoft launches the Xbox One. In 2020, Microsoft launches the Xbox Series X and Series S [1]. Along the way, Microsoft acquired a number of companies, such as Skype, Nokia LinkedIn and so on, for which it was subject to an antitrust trial by the US Department of Justice.

Activision Blizzard is a developer of interactive entertainment content and services, headquartered in Santa Monica, California, United States. In 1979, Activision was founded. In 2008, Activision merged with Vivendi Games, and then changed its name to Activision Blizzard. Now the company has three separate business units: Activision, Blizzard, and King. Its main business is developing and distributing entertainment services for console, PC, and mobile devices, as well as operating esports leagues. In 2021, Activision Blizzard ranked No. 506 on the "2021 Forbes Global 2000 List of Top Companies."

|

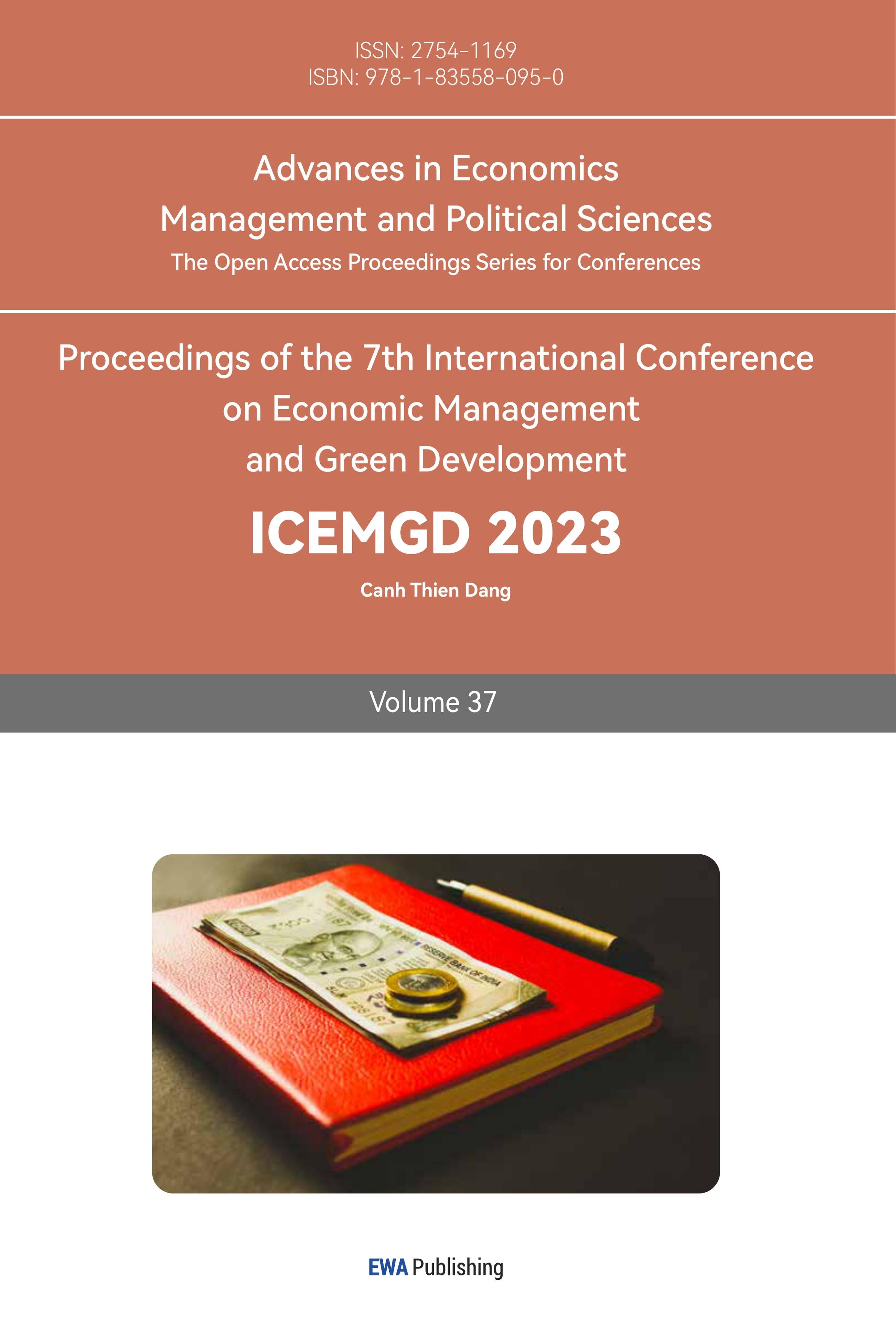

Figure 1: Activision Blizzard revenue from 2017 to 2022. |

Data source: stockanalysis.com [2] |

Photo credit: Original |

As showed in the figure 1, The amount of revenue Blizzard led a downward trend from 8,086 million in 2020 to 7,528 million in 2022, showing that the performance of new games attracts widespread attention and the company management is under great decision-making pressure. From the perspective of the industry, video gaming hit all-time highs in terms of user involvement and investment during the global COVID-19 pandemic's initial outbreak., leading the change of people life’s habit. In 2022, the worldwide video game industry's sales are anticipated to top $200 billion USD for the first time [3].

On January 18, 2022, Microsoft announced that it would acquire Activision Blizzard for $95 per share in a cash-only transaction valued at $68.7 billion, including Activision's net cash. On April 1, U.S. Senators Raise sent a letter to the Federal Trade Commission, concerning over Activision Blizzard acquisition. On August 24, Xbox releases a webpage explaining the advantages of the purchase, including more gaming options, a more equitable market, and increased freedom. On September 1, Call of Duty and Game Pass will still be released on PlayStation. The Competition and Markets Authority (CMA) of the UK expressed alarm on October 12 regarding Xbox's proposed acquisition of Activision Blizzard. Xbox responded by claiming that the worries were unfounded and that PlayStation was too large to collapse. On November 11, Xbox made a 10-year offer to Sony in exchange for keeping Call of Duty on the PlayStation. Activision Blizzard was to be purchased by Xbox, but on December 8 the Federal Trade Commission (FTC) filed a lawsuit to stop it. The UK CMA's inquiry into Xbox's purchase of Activision Blizzard gets extended as of January 5, 2023. The European Union issued a warning to Microsoft for antitrust on February 3. The UK's CMA released a preliminary report of its probe on February 8 that revealed various issues regarding Xbox's intentions to acquire Activision Blizzard. The CMA claims that Microsoft controls 60% to 70% of the market for cloud gaming currently available, and that making Call of Duty an exclusive might "alter the future of gaming." Xbox Signs a 10-Year Deal on February 21 to Bring Call of Duty to Nintendo and Nvidia. Then Nvidia decided to drop concerns about the acquisition and Microsoft cleared at least one significant tech company of objections to the deal [4].

In this article, the main purpose is to analyze the case of Microsoft’s acquisition of Activision Blizzard. Due to the reason that large acquisitions have high research value in general, this paper uses SWTO research methods to analyze the advantages and disadvantages of both Microsoft and Blizzard, as well as the opportunities and threats brought by the acquisition. Microsoft's acquisition of Blizzard has not been completed; the above analysis will have a certain reference to the acquisition results.

2. Strengths and Weaknesses

2.1. Strengths

Microsoft still holds the lion's share of the global market for laaS (Infrastructure as a serve). This includes processing CPU, memory, storage, networks, and other basic computing resources. The management and maintenance of this aspect is large and the computing resources are seriously wasted. The operating system, database and middleware need to consume a large amount of computing resources, and the technology entry barrier is high. As a leading manufacturer of traditional software, Microsoft conforms to the trend of cloud transformation. Due to the high stickiness of the products, Microsoft can smoothly carry over the advantages of products, services and customer relations, and achieve good results in cloud computing.

Microsoft has a comprehensive layout in the game industry chain, including hardware platform, game content production platform, industry distribution channel, cloud platform, etc. This is an integrated industrial chain, so Microsoft can acquire Activision Blizzard to supplement its deficiency in game development, as a supplement to the industrial chain. Starting from the concept of the metacomes, the game industry in the metacomes needs to really put the user experience first. It also provides Microsoft with a cutting-edge technology application scenario. Microsoft launched its "PLAY ANYWHERE" service. (XPA for short), there will be no "exclusives" in the strict sense, and games that support XPA will share games and saves with Win10 PCS.

Activision Blizzard, as a leading game developer, not only has a large number of users, but also has a very complete game product matrix. This paper takes Activision Blizzard's three most famous games Call of Duty, World of Warcraft and Hearthstone as examples. In terms of classic IP, Call of Duty released in the early 20th century is Activision's ace buyout game. Up to now, the Call of Duty series has released 19 console works, with a global cumulative sale of more than 400 million copies. And Call of Duty 19: Modern Warfare II, which was released in November 16, 2022, crossed $1 billion in sales in 10 days, becoming the fastest game in the history of the series to reach that milestone. World of Warcraft (WOW), developed by Blizzard Entertainment, has been the world's most subscribed massively multiplayer online role-playing game (MMORPG) since its release in 2004. It has generated nearly 120 million accounts and generates an estimated $1 billion in annual revenue for Blizzard. According to the MMO POPULATION, World of Warcraft is still in the top three active players of all MMORPGs. Hearthstone is Blizzard's success story in mobile and free-to-play games, currently available on PC, MacOS, and mobile devices. Hearthstone's simple card game mechanics and low barriers to entry fit the fast-paced times.

Activision Blizzard has a complete community business model. The company built its online community around games and formed a mature esports alliance, effectively increasing user engagement that Microsoft lacked. In addition, technical talent is Activision Blizzard's core competitiveness. With 17 game studios, the company will release 36 console and PC games between 2017 and 2022, leading the industry in terms of number of releases. The product development cycle is short, and the game product quality trend is obvious, which brings stable cash flow for the company. Compared with buying commercial engines, such as Unity3D, Activision Blizzard has self-developed engines, which can not only promote game development more freely, but also meet the expectations of players.

Activision Blizzard said in its annual report that more mobile games will be released in the future and all IP addresses are under consideration for IP migration. If the acquisition is successful, it will fill a gap in Microsoft's mobile gaming space.

2.2. Weaknesses

In the console game market where Microsoft, SONY and Nintendo occupy the most market shares, xbox launched by Microsoft is always difficult to stand out. The article uses Nintendo as Microsoft's primary comparison. Focus on console hardware sales, Nintendo's total revenue in FY22 (ended 2022/3/31) was 1,695.3 billion yen. In the same period, SONY's game business revenue was 27,39.8 billion yen, while Microsoft's was 23,64.1 billion yen. Microsoft ranks last among the three with an 18% share of global console hardware sales. Microsoft also has a large PC gaming business, so it doesn't directly reflect its competitive position in the console gaming market. The acquisition of Activision Blizzard, which will bring Blizzard's popular games to the xbox platform, will help boost Xbox hardware sales [5].

Focus on software, software revenue can drive total revenue growth. Compared to roughly 7,000 for PS4 and 5, the official Nintendo Store for Nintendo claims that there are nearly 13,000 Switch games, DLC, and other downloads available. And for the Xbox One and X/S, there are around 6,000 titles that may be downloaded. Game software is the lifeblood of hardware sales and revenue, unfortunately, Microsoft is at a competitive disadvantage when it comes to game software. Microsoft's dominance in gaming has been limited by the software exclusivity of its rivals SONY and Nintendo. As a result, Microsoft's Xbox gaming division has lost nearly 25 percent of its market share in hardware sales, moving from first to third place. Buying Activision Blizzard would improve Microsoft's weakness in games. Blizzard's new game will most likely be released exclusively on the Xbox console, dealing a blow to SONY's PS4 and 5 revenues.

On the whole, the release of excellent head game content has an obvious driving effect on total revenue. For example, Nintendo released the top 2 bestsellers of Switch in the fiscal year of 20th and the end of 20th fiscal year respectively, "Come Together! Animal Mori Youkai", which drove the total revenue of fiscal year of 20th and 21st to 17,589 yen with a year-on-year increase of 34%. PS4 is a great platform for ARPGs. The End of America, The Bloodline Curse, Uncharted, Death Stranded, etc... These excellent games are only available on PS4. Nevertheless, there are fewer Xbox exclusives, except for the Halo series being a hit.

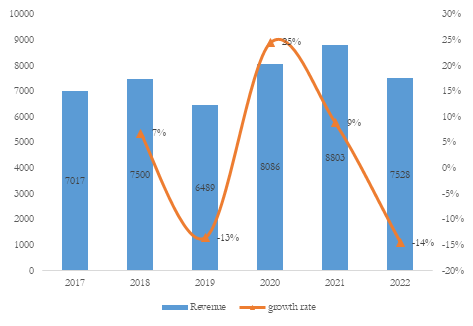

Another weakness for Microsoft is on mobile terminal. According to figure 2&table 1, when the global market shares of all platforms accounted for the majority of the mobile terminal market in 2022, Microsoft announced to give up the mobile operating system, leaving a huge gap in the field of mobile terminal business. There's no question that buying Activision Blizzard would make up for Microsoft's weakness on the mobile side. That's because King's mobile game Candy Crush Saga has long been a big contributor to revenue. It has been the highest-grossing game series in the U.S. App store for 18 consecutive quarters, and mobile accounts for the bulk of Activision Blizzard's revenue.

|

Figure 2: Gaming revenue worldwide 2022, by segment. |

Data source: statista.com [6] |

Photo credit: https://www.statista.com/statistics/292751/mobile-gaming-revenue-worldwide-device/ |

Table 1: Video game market revenue worldwide in 2022, by segment (in billion U.S. dollars).

For the Year Ended December 31 | ||||

Net revenues by platform: | 2022 | 2021 | Increase/(decrease) | %Change |

Console | $1,753 | $2,637 | ($884) | -34% |

PC | 1,653 | 2,323 | -670 | -29 |

Mobile and ancillary | 3,517 | 3,182 | 335 | 11 |

Other | 605 | 661 | -56 | -8 |

Total consolidated net revenues | $7,528 | $8,803 | ($1,275) | ($14) |

Data source: Activision Blizzard 2022 Annual report FORM 10-K [7] | ||||

Several Blizzard games were published in Mainland China thanks to licensing deals Activision Blizzard made with NetEase. These contracts, which made up about 3% of Activision Blizzard's combined net revenues in 2021 and 2022, were set to expire in January 2023. Activision Blizzard will lose that revenue as well as players in China until the alternative way to serve the community in Mainland China is found.

3. Opportunities and Threats

3.1. Opportunities

Merger brings horizontal synergies, namely scale effects. Help Microsoft to expand business, reduce research and development costs, open source and reduce revenue. It is conducive to expanding market share, and software drives the development of hardware. It helped Microsoft to optimize its asset structure. Under the background of the Federal Reserve's interest rate cut, it used cash to acquire high-quality assets such as Activision Blizzard, thus reducing interest rate risks and avoiding tail risks caused by the shrinkage of financial assets such as bonds.

Merger bring vertical synergy, namely the integration of the upper and lower ends of the industrial chain, creates an integrated metauniverse layout from foundation to application.

In 1992, the famous American writer Neal Stephenson mentioned the term Metaverse in his book Snowrash. He described it like this: "By putting on a headset and eyepiece and finding a terminal connecting to it, you can enter a computer-simulated virtual space parallel to the real world in the way of a virtual avatar [8]." [8] In general, the metauniverse is a combination of 6G, Internet of Things, cloud computing and other digital technologies, the network, hardware and software equipment and users in a virtual reality system, forming a mapping to the real world and independent of the virtual world

Interactive technology is to realize the immersion of the meta-universe, interactive experience

The core technology. Video games can be understood as the prototype of the meta-universe, and related technology is one of the key supporting technologies of the meta-universe. At the heart of video game technology is the game engine, which includes things like 3D modeling and graphics rendering [9].

Video game technology is the most intuitive manifestation of the meta-universe. It can not only provide a content creation platform for the meta-universe, but also realize the aggregation of entertainment and social scenes. In game development, the most important thing is the game engine, which is similar to the mother machine tool of making machine tools, which will also be one of the "bottleneck" technologies of large-scale metaverse platforms. The emergence of game engines reduces the difficulty of game designers and developers to build virtual scenes. Its development determines the quality and performance of NPC modeling, real-time scene rendering, user operation and interaction in the meta-universe, so that users can have a closer experience of the real world. It can create a multi-platform integrated game with interactive content such as 3D video games, architectural visualization videos, real-time 3D animation and so on. This kind of development tool is not limited to the game market, has expanded to film production, industrial design and other market fields [10]. Activision Blizzard's IW engine is well known for gaming and can be a gap in Microsoft's research.

3.2. Threats

Liquidity risk. Microsoft paid $68.7 billion for Activision Blizzard, and high valuations are usually a cause for alarm in acquisitions.

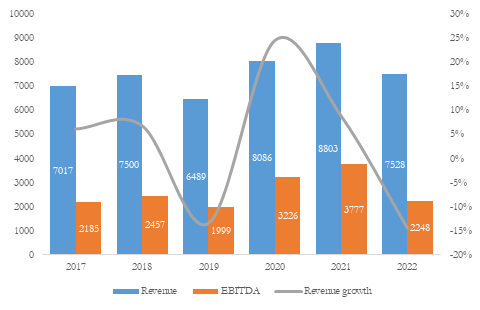

According to the 2022 Activision Blizzard annual report, consolidated net revenues was $8,803 million in 2021 and $7,528 million in 2022 (please see Figure 3). Additionally, compared to consolidated net revenues of $8.8 billion and consolidated operating income of $3.3, the consolidated operating income plummeted 49% to $1.7 billion. The cash flows from operating activities were about $2.2 billion, down 8% from $2.4 billion.

|

Figure 3: Activision Blizzard Profit situation and forecast. |

Data source: stockanalysis.com [2] |

Photo credit: Original |

Microsoft paid $68.7 billion for Activision Blizzard, and high valuations are usually a cause for alarm in acquisitions. Based on conservative estimates, it will take 8 to 10 years for Microsoft to recoup the huge sums it has spent on acquisitions, and synergies could shorten that time.

Microsoft was hit with antitrust sanctions. The UK's Competition and Markets Authority (CMA) said in September 2022 that Microsoft's deal to buy Activision Blizzard could harm competition and required an in-depth investigation. The proposed acquisition of Activision Blizzard by Microsoft was halted on April 26, 2023, by the UK's Competition and Markets Authority (CMA), due to worries that it would damage competition in the fast-expanding cloud gaming business and limit innovation and choice for gamers in the UK for years to come. Microsoft has an extremely strong market position in the cloud gaming services market, with a current 60-70% market share in the global cloud gaming services market, as well as other important advantages such as the console Xbox, the leading PC operating system (Windows), and the global cloud computing infrastructure (Azure and Xbox Cloud Gaming). The evidence suggests that Microsoft's move to acquire Activision Blizzard and make its games exclusive will give its cloud gaming services a commercial advantage. Activision Blizzard's US shares fell 11.45 per cent after the announcement, while Microsoft's rose 7.24 per cent [11].

In order to win the CMA's approval for the acquisition, Microsoft proposed a series of "behavioral compensation" measures to the CMA, including 10-year access agreements to selected platforms. However, the CMA argued that Microsoft's proposal failed to take into account the rapidly growing and evolving nature of cloud gaming and was "materially flawed" given the potential advantages that would result from Microsoft's acquisition of Blizzard. Evidence before the UK Competition and Markets Authority suggests that without a deal, Activision Blizzard would begin offering Overwatch, Call of Duty and other games via the cloud in the foreseeable future. In response to the CMA's decision, Microsoft said it remained committed to pursuing the acquisition and would appeal. A spokesman for Activision Blizzard said the company will continue to work closely with Microsoft on an appeal to reverse the CMA's decision.

On 15 May,2023, Microsoft received regulatory approval from the European Union. Microsoft would eventually have no motivation to impose restrictions on Call of Duty and other Activision-published games, the EU commission further found. In other words, according to the European Commission, Microsoft cannot profit from keeping Call of Duty off of PlayStation systems. This is a definite step in the right direction for Microsoft's takeover bid, which earlier this year suffered a major setback [12].

4. Conclusion

This study found that the combination of Blizzard and Microsoft, two leading players in the industry, will complement Microsoft's industrial chain and make up for its weakness in game development technology and lack of classic game IP. In addition, Microsoft's acquisition of Activision Blizzard made up for the weakness of Xbox in game products, which was conducive to expanding Xbox's share in the global game market and achieving corner overtaking in the competition with Nintendo and SONY. In the long run, the acquisition will help Microsoft develop its cloud gaming platform, build its multicommunal industry chain and complete its online interactive entertainment business blueprint. But the deal has been blocked by the CMA, and Microsoft's rival SONY is pressing ahead with an antitrust appeal that could pose the biggest threat to the deal. As expected, the acquisition is fraught with difficulties, and if it fails, it will be a major blow to both Microsoft and Blizzard.

From the point of view of individual investors, it is worth investing in because the huge synergies and brand benefits brought by the merger are quantified into huge economic effects. From Microsoft's perspective, it should respond aggressively to antitrust investigations, restructure its business and develop some of its game resources, such as extending the contracts of Call of Duty and PlayStation to more than 10 years or making the acquired company no longer independent.

References

[1]. Hall, Mark and Zachary, Gregg Pascal, (2023) "Microsoft Corporation". Encyclopedia Britannica. https://www.britannica.com/topic/Microsoft-Corporation. Accessed 9 May 2023.

[2]. Stock Analysis. Activision Blizzard (ATVI) Financial Statements: Income - Stock Analysis

[3]. J. Clement, (2022). Video gaming worldwide - Statistics & Facts. https://www.statista.com/topics/1680/gaming/#topicOverview

[4]. Matt Kim, (2023). Microsoft's Activison Blizzard Acquisition: The Complete Timeline of the News So Far. Microsoft's Activison Blizzard Acquisition: The Complete Timeline of the News So Far - IGN

[5]. Natallie Wu, X Hu, Y Zhong, J Weng (Haitong International), 2022. Nintendeo: Outstanding Profitability with Unparalleled First Party Content. https://www.djyanbao.com/report/detail?id=3329820&from=undefined

[6]. J. Clement, (2022). Gaming revenue worldwide 2022, by segment. https://www.statista.com/statistics/292751/mobile-gaming-revenue-worldwide-device/

[7]. Activision Blizzard 2022 Annual repport FORM 10-K (2022). Activision Blizzard | Annual Reports

[8]. What is the metaverse of the recent fire? https://baijiahao.baidu.com/s?id=171077674543 7385158&wfr=spider&for=pc

[9]. Y Gou, X Ji, Y Ye, Q Wu, L Lv. (2023). Construction and prospect of metaverse technology system. Journal of University of Electronic Science and Technology (01),74-84.

[10]. W Wang, F Zhou, Y Wan, H Ning. (2022). Meta-universe technology Review. Journalof Engineering Science (04),744-756.

[11]. Y Wu, (2022). Is Microsoft's biggest ever Acquisition Falling Apart? The FTC sued to block the acquisition of Activision Blizzard. https://www.thepaper.cn/newsDetail_forward_21092821

[12]. Hirun Cryer, (2023). Microsoft's Activision Blizzard deal approved by European Union. https://news.yahoo.com/microsofts-activision-blizzard-deal-approved-144632643.html

Cite this article

Tan,H. (2023). Microsoft’s Prospect in Gaming Industry: Strengths, Weaknesses, Opportunities and Threats in Acquisition of Activision Blizzard. Advances in Economics, Management and Political Sciences,37,146-153.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 7th International Conference on Economic Management and Green Development

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Hall, Mark and Zachary, Gregg Pascal, (2023) "Microsoft Corporation". Encyclopedia Britannica. https://www.britannica.com/topic/Microsoft-Corporation. Accessed 9 May 2023.

[2]. Stock Analysis. Activision Blizzard (ATVI) Financial Statements: Income - Stock Analysis

[3]. J. Clement, (2022). Video gaming worldwide - Statistics & Facts. https://www.statista.com/topics/1680/gaming/#topicOverview

[4]. Matt Kim, (2023). Microsoft's Activison Blizzard Acquisition: The Complete Timeline of the News So Far. Microsoft's Activison Blizzard Acquisition: The Complete Timeline of the News So Far - IGN

[5]. Natallie Wu, X Hu, Y Zhong, J Weng (Haitong International), 2022. Nintendeo: Outstanding Profitability with Unparalleled First Party Content. https://www.djyanbao.com/report/detail?id=3329820&from=undefined

[6]. J. Clement, (2022). Gaming revenue worldwide 2022, by segment. https://www.statista.com/statistics/292751/mobile-gaming-revenue-worldwide-device/

[7]. Activision Blizzard 2022 Annual repport FORM 10-K (2022). Activision Blizzard | Annual Reports

[8]. What is the metaverse of the recent fire? https://baijiahao.baidu.com/s?id=171077674543 7385158&wfr=spider&for=pc

[9]. Y Gou, X Ji, Y Ye, Q Wu, L Lv. (2023). Construction and prospect of metaverse technology system. Journal of University of Electronic Science and Technology (01),74-84.

[10]. W Wang, F Zhou, Y Wan, H Ning. (2022). Meta-universe technology Review. Journalof Engineering Science (04),744-756.

[11]. Y Wu, (2022). Is Microsoft's biggest ever Acquisition Falling Apart? The FTC sued to block the acquisition of Activision Blizzard. https://www.thepaper.cn/newsDetail_forward_21092821

[12]. Hirun Cryer, (2023). Microsoft's Activision Blizzard deal approved by European Union. https://news.yahoo.com/microsofts-activision-blizzard-deal-approved-144632643.html