1. Introduction

The Efficient Market Hypothesis (EMH) stands as the bedrock of contemporary financial theory. Eugene Fama, in his seminal work titled "Efficient Capital Markets: A Review of Theoretical and Empirical Research," published in the Journal of Finance in 1970, underscored that in a legally robust, efficient, transparent, and completely competitive stock market, all pertinent information should be promptly, accurately, and comprehensively reflected in stock price movements. This includes information concerning both the present and future valuations of enterprises. The effectiveness of the securities market holds direct sway over the investment philosophies and strategies of investors, consequently exerting a substantial influence on the macroeconomic landscape, particularly in the realm of currency dynamics.

China's stock market exhibits disparities in regulatory oversight, regulatory levels, and the proportion of retail investors. The pronounced focus of the 14th Five-Year Plan and the 2022 CPC National Congress on bolstering the intrinsic strength of China's economy and the development of an advanced Socialist market economy system has engendered the standardization of China's financial markets.

The 14th Five-Year Plan, spanning from 2021 to 2025, coincided with a phase during which the Chinese market experienced a scenario characterized by a diminutive scale of social financing. A substantial portion of funds remained locked within the banking system and in long-term fixed deposits. In response to this, the People's Bank of China resorted to measures such as reducing reserve requirements, while financial institutions, especially banks, found themselves relatively detached from enterprises and markedly influenced by monetary policy. An undeniable causal relationship emerges from this context, where the product market and monetary policy bear direct consequences on the stock market. In light of this, it becomes imperative to deliberate upon how the effectiveness of China's capital market, with a notable emphasis on the A-share market, balances the dynamics of supply and demand in the product market through the circulation of capital.

2. Factors Influencing Market Efficiency

2.1. Lack of Liquidity

Robert J. Shiller and George A. Akerlof have repeatedly emphasized the profound impact of liquidity constraints on market behavior. They assert that "liquidity significantly constrains market behavior. When stock prices hit their limits, trading grinds to a halt, and price adjustments become impossible. In the event of a panic, where shares are dumped in large volumes without takers, an oversupply and liquidity stagnation ensue, leading to substantial deviations of share prices from their fair values."[2] In such instances, the stock market ceases to be a realm of fair competition, with market efficiency gravely imperiled.

China's A-share market is encumbered with stringent regulations. For instance, the current daily trading limit for the main board market stands at 10 percent, while the Growth Enterprise Board and the Science and Technology Innovation Board permit a 20 percent daily limit. When a particular stock hits its daily limit, trading grinds to a halt. This often coincides with the erroneous anticipation of "chasing gains and cutting losses," prompting an influx of retail investors, often driven by impulsive speculation. Rational investors, having secured their interests, subsequently withdraw their funds. Companies possessing intrinsic values exceeding their stock prices also face the risk of surging solely due to price limits. The restricted prices typically do not align precisely with fair values, thereby failing to maximize investor "investment surplus" and severely curtailing enterprise financing opportunities within the secondary market.

Upon reaching its daily limit, a stock typically triggers an overreaction within the market. As individuals pursue their economic interests, they undergo a sequence of emotions, as articulated by John Maynard Keynes: "people experience firsthand threats to themselves and their values -- first fear, then risk aversion, a complex animal spirit that is crucial to forecasting and reflects people's ambivalence about taking risks."[3] When a stock experiences a limit-down, trading is suspended for the day. The limit price fails to reflect the equilibrium price within the stock supply market. Consequently, a majority of shareholders experience panic, pondering the possibility of imminent declines and, consequently, opt for short-term liquidation to achieve "timely stop-loss." While daily limits may curb potential losses for investors, the resulting liquidity constraints erode market confidence in the stock. The ensuing price action typically resembles a buyer-seller game, with demand-side participants seeking to acquire stocks at the lowest prices while existing stockholders often entertain hopes of a swift recovery in the face of modest declines. This high correlation with stock price limits often engenders a "stampede" effect, exerting negative repercussions on the broader market.

2.2. Investors’ Irrational Behavior

The classical economic assumption of the rational individual has perpetuated an excessive idealization within traditional economic research models. However, as articulated by Ben Shalom Bernanke, former Chairman of the Federal Reserve, "we didn't expect bad news in one segment of the housing market to produce what economist Gary Gorton called the E. coli effect." This phenomenon, known as the E. coli effect, mirrors a situation where rumors about contamination in a few hamburgers led consumers to reject all meat products, rather than attempting to discern which meat was tainted in specific stores and regions [4]. In the context of a market downturn, the conduct of most retail investors contradicts the principles of a "rational investor."

By the year 2023, nearly 70 percent of participants in China's A-share market will consist of retail investors, accounting for 25 percent of the market's total capitalization. Retail investors often respond to market information in a relatively disorganized fashion, resulting in information asymmetry and subsequent overreactions to news. Institutional investors, in contrast, wield substantial capital resources and typically boast professional training and extensive investment experience. When compared to the speculative inclinations of retail investors, institutions tend to operate on longer investment horizons, thus reducing the proportion of readily available short-term funds relative to retail investors. If one were to liken the stock market to a body of water, institutional investors would resemble a concentrated waterfall – potent and with forceful impact but minimal splashing. Conversely, retail investors take on the semblance of scattered raindrops – each possessing less force individually but contributing to larger ripples that interact with one another. Particularly when the actions of institutional investors are conspicuous, retail investors often exhibit either active or subconscious inclinations to invest in specific stocks or sectors.

Consider, for instance, the case of the 2021 hot sectors, where price-to-earnings ratios significantly deviated from stock prices. Driven by institutional endorsements, retail investors indiscriminately entered the market only to experience a sharp downturn once the supply reached saturation. Institutions, however, frequently enjoy access to information across various sectors, encompassing research, risk management, and quantitative analysis, which minimizes their investment costs. When contrasted with retail investors, especially in the context of a weak market, marked by inefficiency and a profusion of opaque or concealed information, institutions are better positioned to acquire information conveniently and swiftly. Consequently, stock prices often react in a manner exceeding expectations, relegating retail investors to a relatively passive role in the market.

2.3. Insufficient Market Competition**

In Chapter 19 of the Outline of the 14th Five-Year Plan, specifically in Section 1, titled "Accelerating the Optimization of the Distribution and Structural Adjustment of the State-Owned Economy," there is a resounding call to "accelerate the optimization of the distribution, structural adjustment, and strategic reorganization of the state-owned economy." This directive underscores the imperative of enhancing the competitiveness, innovation, control, influence, and resilience of the state-owned economy. It emphasizes the vital role that Chinese enterprises occupy within the fabric of China's economic development [5].

However, it is evident that the management and systems governing the state-owned economy are far from perfect. There is a conspicuous absence of a rational and effective oversight and restraint mechanism, leading to a proliferation of corruption, bribery, misappropriation of state-owned assets, and the hollowing out of state-owned enterprises. These issues are symptomatic of personal gain through the abuse of power and the misappropriation of state-owned assets, perpetuating a climate of relative severity concerning corruption. Furthermore, distortions exist in the listing of stocks and the allocation of bank credit, with investment decisions often proving misguided, resulting in suboptimal investment efficiency and meager economic benefits. This situation highlights that in the backdrop of an economic framework where "public ownership is predominant," the realization of an ideal state characterized by an efficient market marked by full competition becomes a formidable challenge.

Additionally, the visible hand of government intervention retains significant influence. Faced with substantial market volatility, government-led investments or market rescue policies tend to remain the preferred recourse. Simultaneously, the current practice of active or passive favoritism toward financial institutions exacerbates the "too big to fail" predicament and nurtures a complacent mindset among major enterprises. This situation finds resonance in Hayek's "The Road to Serfdom," where he contends, "The efficiency of big business has not been proven... Centralization is an extremely clumsy, primitive, and narrow way of solving economic problems."

According to reports from China Economic Net, it is projected that by 2023, state-owned enterprises will command a market value share of 43.62%, while private enterprises will account for 44.00%. The number of registered private enterprises is set to exceed 4,200, constituting over 99% of the total number of Chinese enterprises. This discrepancy in market value ratios signifies a significant impediment to private enterprises. It manifests chiefly in difficulties encountered in securing financing and navigating regulatory policies. The Cobb-Douglas production function underscores the pivotal role of capital. When the equilibrium price of production factors in the market is expressed in monetary or correlational terms, it underscores the role of capital as the direct driver of enterprise production. Enterprises exhibiting weakened competitiveness often struggle to secure a foothold in the production factor market, thereby perpetuating a vicious cycle marked by diminishing output, income, and reproduction.

3. Reforms and Measures for Market Efficiency

3.1. The Registration System Promotes Market Standardization and Liquidity

Chapter 21 of the Outline (Establishing a Modern Fiscal, Tax, and Financial System), specifically Section 3 (Deepening Supply-Side Structural Reform), posits: "Comprehensively implement the registration system of stock issuance, establish a regular delisting mechanism, and improve the quality of listed companies. [5]" This move marks a significant milestone in China's financial modernization journey. In April 2023, the main board trading system successfully completed its transformation into a "registration system." In the five days preceding a main board listing, trading is no longer subject to price limits. Instead, a new "price cage" system has been introduced. This system includes a requirement for a 2% effective declaration of the price range, coupled with 10 declaration units for the lowest price change.

The reform and optimization of the registration system have had a profound impact, particularly on ST shares. In the initial stages, the listing review process was arduous and protracted. Consequently, many enterprises resorted to "shell listings" or "backdoor listings" using ST shares as a means of achieving their listings. Such a strategy also aligned with the speculative tendencies of individual investors in the secondary market. When stocks showed the potential for future gains, speculators would opt to buy low and sell high. Even if market valuations significantly diverged from actual values, speculators would pursue risk in pursuit of short-term profits. The full registration system streamlines the process of going public for enterprises, enabling them to quickly secure funds within the secondary market. Importantly, it is no longer constrained by price fluctuations in the five days leading up to the listing. This has significantly bolstered liquidity and the potential for equity prices to evolve, granting investors more alternatives and furnishing high-potential enterprises with a robust financing channel. Consequently, trading volumes have surged, enticing new investors and fostering a virtuous cycle that befits efficient markets.

Drawing upon the wisdom of Joseph Alois Schumpeter, it becomes apparent that "I would consider the alternative possibility that if Keynes's analysis were divorced from any of these ideas, we would not be impressed by the most reasonable development of the present doctrine. Liquidity preference has to stand out to impress us. [6]" While the realization of liquidity and further marketization of the stock market necessitates an extended "trial period," it is unequivocal that the current trajectory of stock market reform underscores the imperative of cultivating a more efficient market. Such an environment is essential to balancing the allocation of capital and serving the real economy. Innovation and productivity are both critically reliant on the force of capital, which encapsulates the core purpose of the capital market – to enhance overall societal production and utility through the efficient allocation of capital. Whether evaluated through tangible data or the visionary outlook of development plans, China's A-share market remains steadfast in its pursuit of enhanced efficacy, poised to continue attracting increased financing and investors.

3.2. Increasing the Proportion of Institutional Investors

Chapter 21 (Establishing a Modern Fiscal, Taxation, and Financial System), Section 3 (Deepening Supply-Side Structural Reform) underscores the imperative to "Improve the multi-tiered capital market system, vigorously develop institutional investors, and increase the proportion of direct financing, especially equity financing. [5]" It is an arduous endeavor to fully realize the behavioral rationality of a market. Current critiques and analyses within behavioral economics/finance have yet to establish a definitive criterion for "rational investors." Traditional economic research's rational man hypothesis is confined to the realm of "self-interest," asserting that individuals act in pursuit of gains and the avoidance of losses. In this paradigm of "perfect rationality," each individual optimizes their choices by weighing costs and benefits or adhering to principles that maximize advantages while minimizing disadvantages.

Yet, the concept of risk introduces an element of future uncertainty that transcends our limited cognitive capacities, rendering it challenging to make fully rational judgments. In such an environment, the focus should shift towards enhancing the investment literacy of market participants. Key factors contributing to this literacy include professional training, investment experience, and the ability to access and react to information comprehensively. As analyzed earlier, based on logical deduction, the average institutional investor possesses a stronger ability in these regards than the majority of retail investors. Effective markets, first and foremost, hinge on information transparency. In situations where complete transparency cannot be achieved, institutional investors often employ research departments to compensate, thereby improving their information acquisition capabilities while information transparency remains unchanged.

Secondly, the correctness of information utilization is paramount. A significant portion of retail investors are "short-term" traders, which tends to exacerbate market volatility and speculative behavior. In contrast, institutional investors, even when pursuing short investment cycles, typically retain a substantial portion of their funds within the stock market system to mitigate significant declines in overall trading volume. Consequently, increasing the proportion of institutional investors aligns with the exigency for efficient markets to foster a conducive financial environment. As Robert J. Shiller and George A. Akerlof posited, "If everyone cooperates, the group benefits the most. [2]"

3.3. Restoring Market Order

Following the 20th National Congress of the Communist Party of China, Yi Gang, the Governor of the People's Bank of China, reiterated the primary responsibility of financial institutions and shareholders. In his report, he emphasized that "'Self-rescue' should become the primary approach to managing financial risks both in the present and the future... We will enhance incentive and restraint mechanisms, respect the autonomy of financial institutions, and reduce administrative interference in their operations. [7]"

This underscores the resolve to address the issue of "too big to fail," particularly in financial firms. Individuals should be responsible for their own choices, which limits their propensity for engaging in risky activities. This does not imply that the government will disregard large-scale financial crises but rather signifies that the socialist market economy, which strives to balance supply and demand in the market, will gain strength. This shift signifies the gradual fading of the "visible hand" in the economy, thereby fostering full and equitable competition.

Additionally, Chapter 19 (Accelerating the Optimization of the Distribution and Structural Adjustment of the State-owned Economy), Section 1, underlines the need to consolidate and develop the state-owned economy, with an emphasis on enhancing its competitiveness, innovation, control power, influence, and risk resistance. However, the management system for state-owned enterprises is not perfect, lacking a rational and effective supervision and restraint mechanism. State-owned enterprises have skewed stock listings and bank credit in their favor, leading to significant errors in investment decisions and low economic efficiency. A comprehensive analysis and in-depth reform of state-owned enterprises are required to create a conducive environment for capital investment.

Furthermore, the second chapter of the Outline of the 14th Five-Year Plan underscores the importance of high-quality development, deepening supply-side structural reform, and innovation as fundamental driving forces. It emphasizes the need to balance development with security, accelerate the establishment of a new development pattern, and modernize the country's governance system and capacity.

In today's rapidly changing world, characterized by a new scientific and technological revolution and industrial transformation, a robust and efficient capital market plays a pivotal role in facilitating industrial upgrading and economic structural transformation. Capital markets are essential for balancing the allocation of capital to achieve optimal levels of total social production.

Finally, the Reform Plan for Party and State Institutions, issued by the CPC Central Committee and The State Council in March 2023, established the Financial Commission of the CPC Central Committee as a decision-making and coordination body. Its core mission is to enhance the rationality of government institution establishment and functional allocation, improve government operational efficiency and management capacity, and contribute to building a modern national governance system.

These developments collectively signal China's commitment to regulating, increasing transparency, and fully fostering competition in its capital market, ultimately progressing towards a semi-strong or even strong efficient market.

4. Macro Data Analysis

4.1. Autoregressive Model

The autoregressive model is an essential component of financial analysis, particularly in the evaluation of stock market behavior. It is expressed as follows:

\( {R_{t}}={b_{0}}+{b_{1}}*{R_{t-1}}+u \)

\( {R_{t}}=\frac{{P_{t}}-{P_{t-1}}}{{P_{t-1}}} \)

Where:

\( {R_{t}} \) represents the yield at time \( t \) ,

\( {P_{t}} \) denotes the ending stock price at time \( t \) ,

\( {P_{t-1}} \) signifies the stock price of the previous period,

\( u \) represents the error term.

Eugene F. Fama's work on the Efficient Capital Market, as presented in "A Review of Theory and Empirical Work"[1], establishes that in a weak efficient market where there is no hysteresis effect in the rate of return, the random error term \( u \) is uncorrelated and akin to white noise.

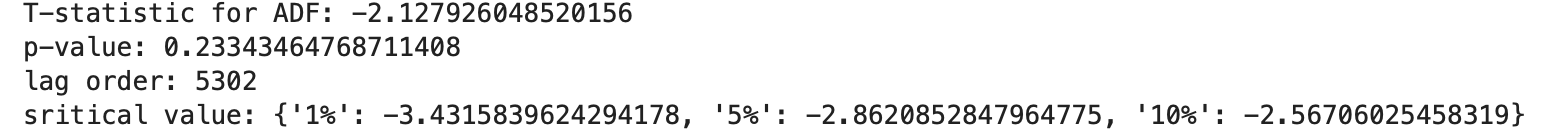

1. Augmented Dickey-Fuller (ADF) Test

The ADF test is instrumental in assessing whether unit roots exist in time series data. It is typically represented as:

\( {y_{t}}=∂+{y_{t-1}}+{ε_{t}} \) (t=1,2,3…,n)

Where:

\( {ε_{t}} \) is a random term with E () = 0, and Var () = \( {σ^{2}} \) ,

\( ∂ \) is a constant term.

When \( ∂ \) = 0, it is referred to as a random walk model with zero drift; when \( ∂ \) ≠ 0, it is termed a random walk model with drift.

2. The ADF test further extends to the equation:

\( {y_{t}}=α+βt+ρ{y_{t-1}}+{ε_{t}} \) (t=1,2,3…,n)

In this equation, if \( ρ \) = 1, it implies the presence of unit roots, rendering the sequence non-stationary.

The ADF test, proposed by American scholars David A. Dickey and Wayne A. Fuller, hinges on constructing statistics \( {∅_{2}} \) and \( {∅_{3}} \) .

3. Other ADF test equations are:

\( {y_{t}}-{y_{t-1}}={a_{0}}+βt+{a_{1}}{y_{t-1}}+{ε_{t}} \)

\( {y_{t}}-{y_{t-1}}={a_{0}}+βt+{a_{2}}({y_{t-1}}-{y_{t-2}})+{ε_{t}} \)

\( {y_{t}}-{y_{t-1}}=βt+{a_{2}}({y_{t-1}}-{y_{t-2}})+{ε_{t}} \)

Where:

\( y \) signifies the yield,

\( {a_{i}} \) denotes the intercept, and

\( β \) is the coefficient.

Ordinary Least Squares (OLS) estimation is employed to estimate Equations 1-5, yielding residual sums of squares for each \( i \) = 0, 1, 2, 3.

\( {∅_{2}}=\frac{{RSS_{3}}-{RSS_{1}}}{\frac{{3RSS_{1}}}{n-4}} \)

\( {∅_{3}}=\frac{{RSS_{2}}-{RSS_{1}}}{\frac{{2RSS_{1}}}{n-4}} \)

If \( ∅ \lt \dot{∅} \) , the sequence conforms to the "zero-drift random walk model"; if \( ∅ \lt \dot{∅} \) , the sequence adheres to the "non-zero drift random walk model."

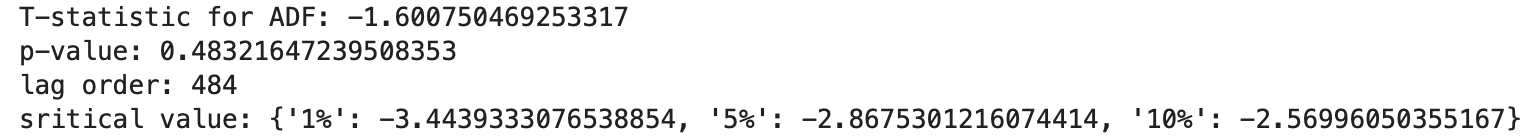

In this paper, a 5% significance level is employed, and the T value of the time series is compared with critical values. If the T value is less than the critical value, it signifies a weak efficient market.

It is pertinent to note that, for enhanced precision and convenience, this paper utilized machine calculations (Python) during data import and experimentation. The data source was Zhongcai.com.

Table. 1: China's macro data in April 2023.

Years | GDP (RMB 100 million) | Gross National Income (RMB 100 million) | Employment Number (10,000) |

2000 | 100280.14 | 7942.07 | 72085 |

2001 | 110863.12 | 8716.68 | 72797 |

2002 | 121717.42 | 9506.2 | 73280 |

2003 | 137422.03 | 10666 | 73736 |

2004 | 161840.16 | 12487 | 74214 |

2005 | 187318.9 | 14368 | 74647 |

2006 | 219438.47 | 16738 | 74978 |

2007 | 270092.32 | 20494 | 75321 |

2008 | 319244.61 | 24100 | 75564 |

2009 | 348517.74 | 26180 | 75828 |

2010 | 412119.26 | 30808 | 76105 |

2011 | 487940.18 | 36277 | 76196 |

2012 | 538579.95 | 39771 | 76254 |

2013 | 592963.23 | 43497 | 76301 |

2014 | 643563.1 | 46912 | 76349 |

2015 | 688858.22 | 49922 | 76320 |

2016 | 746395.06 | 53783 | 76245 |

2017 | 832035.95 | 59592 | 76058 |

2018 | 919281.13 | 65534 | 75782 |

2019 | 986515.2 | 70078 | 75447 |

2020 | 1013567 | 71828 | 75064 |

2021 | 1149237 | 81370 | 74652 |

2022 | 1210207.2 | 85734 | 74900 |

(Source: National Bureau of Statistics of China)

Analysis: Table 1 presents China's macroeconomic data as of April 2023, sourced from the National Bureau of Statistics of China.

It is evident from the table that there is a high degree of correlation between Gross National Income (GNI) and Gross Domestic Product (GDP). Both indicators have exhibited an upward trajectory over the years. However, it's worth noting that the presence of inflationary factors has not been entirely optimistic, especially considering the gradual slowdown in growth rates after 2015.

Presently, China's macroeconomic indicators have entered a phase of slow growth, with a significant decline in employment rates since 2015. This indicates that in order to propel the Chinese economy into a second phase of substantial growth, the first critical step is to address the issue of unemployment. Strategies such as leveraging new industries to stimulate total demand or enhancing the government's role in stimulating the economy, as discussed in the context of the new Kondratiev wave, may be essential.

(Data source: Office for China’s Statistics)

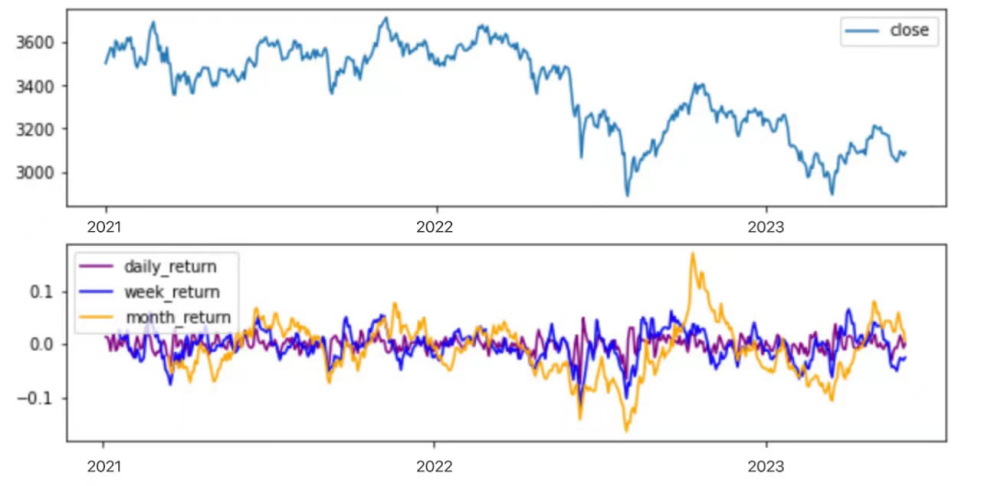

The 14th Five-Year Plan (2021-2023)

Figure 1: A line chart depicting the closing price yield of the A-share CSI 300 index for the period 2021-2023.4.

Analysis: Figure captions are conventionally placed below the illustration. Brief captions are centered, while more extensive ones are justified, with formatting automatically applied using the macro button.

During the analysis, T-values consistently fell within the acceptance domain, indicative of a market exhibiting weak efficiency. Throughout this period, the T-values remained significantly distant from critical values, underscoring a further weakening of market efficiency. As of April 2023, the A-share market continues to grapple with the ramifications of the ongoing epidemic. The stock market has demonstrated heightened sensitivity due to the compounding effects of reduced aggregate demand stemming from the COVID-19 pandemic, production disruptions, and an accommodative monetary policy.

Nevertheless, with a continual refinement of policies, including the forthcoming implementation of a registration system stipulated in the 14th Five-Year Plan and the encouraging directives outlined in the 20th economic report, China's A-share market is poised for gradual stabilization during the latter half of 2022.

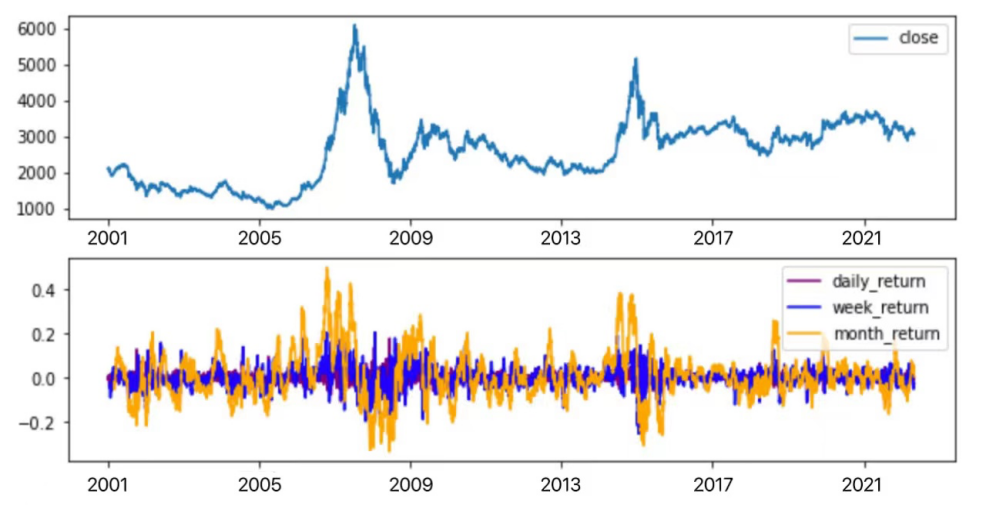

The Tenth Five-Year Plan to the 14th Five-Year Plan (2001-2023.4)

Figure 2: A line chart illustrating the closing price yield of the A-share CSI 300 index for the period 2001-2023.

Analysis: As customary, figure captions are positioned beneath the illustration. Brief captions are centered, while more elaborate ones are justified, with proper formatting applied automatically through the macro button.

The results of our analysis indicate that T-values have consistently fallen within the acceptance domain from 2001 to April 2023, signifying that China's A-share market has consistently retained characteristics of a weak efficient market. Notably, there is an emerging trend towards a transition into a semi-strong efficient market. The period closest to reaching the critical value is the 13th Five-Year Plan period, indicating strong market efficiency during this timeframe. As the 14th Five-Year Plan is yet to conclude, limited data makes it challenging to definitively assess market efficiency during this period.

Reflecting on China's A-share market over recent years, a discernible trend towards increased efficiency is evident. In the near future, China stands poised to potentially evolve into a semi-strong efficient market, thereby serving the interests of inclusive finance and the macroeconomy. It is worth noting that the capital market has exerted a substantial influence on government policies, particularly monetary policies, and has played a pivotal role in shaping international capital flows, including exchange rates, across various periods.

5. Conclusion

In the discourse on China's A-share market and the Efficient Market Hypothesis within the framework of the 14th Five-Year Plan, two key conclusions emerge:

1. Building an Effective Capital Market for Chinese Characteristics

China's pursuit of an effective capital market is grounded in the imperative to align with the demands of a new developmental stage. This involves enhancing the adaptability, competitiveness, and inclusivity of a modern financial system. The goal is to bolster the foundational institutions of the capital market and establish mechanisms that support the real economy. While the journey toward an efficient market draws inspiration from global developed markets, it must be imbued with the spirit of "Socialism with Chinese Characteristics." This guiding concept should underscore the entire process, serving as a wellspring of development. Amid the pursuit of an efficient market, the emphasis remains on crafting a financial development path tailored to China's unique circumstances. This path should address practical macroeconomic development issues and promote international economic cooperation.

2. Incremental Progress Toward Capital Market Efficiency

The ongoing enhancement of capital market efficiency throughout the 14th Five-Year Plan period aligns with China's need to seize new opportunities and confront emerging challenges as it enters a new developmental phase. Realizing a genuinely efficient market is a long-term endeavor and is not expected to be fully achieved within the confines of the 14th Five-Year Plan. Nevertheless, the 14th Five-Year Plan's framework lays essential groundwork and sets the stage for an efficient market. China has a clear trajectory toward market efficiency and promising prospects. Constructing an effective market that harmonizes with China's national context necessitates adopting a broader perspective and a more comprehensive outlook. The focus should center on optimizing resource allocation, maintaining market stability, and ensuring the nation's long-term peace and prosperity, rather than prioritizing the interests of any single entity. The goal is to fully leverage the pivotal role of finance in the macroeconomy, enhance its capacity to serve the real economy, and cultivate a financial environment that aligns with the requisites of high-quality development.

In summary, China's journey toward an effective capital market represents a dynamic process rooted in the nation's unique context and guided by its distinctive developmental path. While the goal of market efficiency remains steadfast, it is ultimately oriented toward serving broader societal objectives and enhancing China's position in the global economic landscape.

References

[1]. Fama, E. F. (1970). Efficient Capital Markets: A Review of Theory and Empirical Work. Journal of Finance, 25(3), 283-417.

[2]. Shiller, R. J., & Akerlof, G. A. (2009). Animal Spirits. Citic Press. DOI

[3]. Greenspan, A. (2014). The Age of Turbulence.

[4]. Bernanke, B. S., Geithner, T., & Paulson, H. M. Jr. (2019). Fire Fighting: The Financial Crisis and Its Lessons Described the 2008 Stock Market. Citic Press. DOI

[5]. National Development and Reform Commission of China (Ed.). (2021). The Outline of the 14th Five-Year Plan. [Online]. Available at: http://www.gov.cn/xinwen/2021-03/13/content_5592681.htm.

[6]. Schumpeter, J. A. (1926). Theory of Economic Development (Volume III). The Commercial Press. DOI

[7]. Yi Gang, People's Bank of China (Ed.). (2022). Building a Modern Central Banking System (Seriously Studying, Propagating and Implementing the Party's Twenty Great Spirits). [Online]. Available at: http://www.gov.cn/xinwen/2022-11/04/content_5724235.htm.

Cite this article

Zheng,Y. (2023). An Analysis of the Validity of the Chinese A-share Market During the 14th Five-year Plan Period. Advances in Economics, Management and Political Sciences,39,68-78.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 7th International Conference on Economic Management and Green Development

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Fama, E. F. (1970). Efficient Capital Markets: A Review of Theory and Empirical Work. Journal of Finance, 25(3), 283-417.

[2]. Shiller, R. J., & Akerlof, G. A. (2009). Animal Spirits. Citic Press. DOI

[3]. Greenspan, A. (2014). The Age of Turbulence.

[4]. Bernanke, B. S., Geithner, T., & Paulson, H. M. Jr. (2019). Fire Fighting: The Financial Crisis and Its Lessons Described the 2008 Stock Market. Citic Press. DOI

[5]. National Development and Reform Commission of China (Ed.). (2021). The Outline of the 14th Five-Year Plan. [Online]. Available at: http://www.gov.cn/xinwen/2021-03/13/content_5592681.htm.

[6]. Schumpeter, J. A. (1926). Theory of Economic Development (Volume III). The Commercial Press. DOI

[7]. Yi Gang, People's Bank of China (Ed.). (2022). Building a Modern Central Banking System (Seriously Studying, Propagating and Implementing the Party's Twenty Great Spirits). [Online]. Available at: http://www.gov.cn/xinwen/2022-11/04/content_5724235.htm.