1. Introduction

In 2023.1.25, US short-seller Hindenburg accused Adani Group of covering its corporate liabilities while expanding its capital and committing financial fraud, stock market manipulation, and money laundering [1].

The Adani Group is a prominent Indian multinational conglomerate with an extensive portfolio of interests across various sectors, including resources, logistics, energy, and agriculture. There are seven principal subsidiaries in the group. They are Adani Enterprises Limited (AEL), Adani Ports and Special Economic Zone Limited (APSEZ), Adani Power Limited (APL), Adani Green Energy Limited (AGEL), Adani Transmission Limited (ATL), Adani Gas Limited (AGL) and Adani Wilmar Limited (AWL)

Hindenburg Research is an investment research firm focusing on activist short-selling founded by Nathan Anderson in 2017 [2].

2. Methodology

2.1. Event study

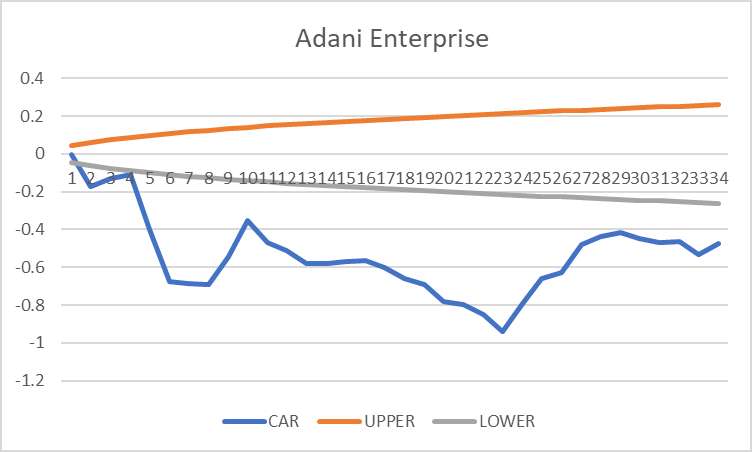

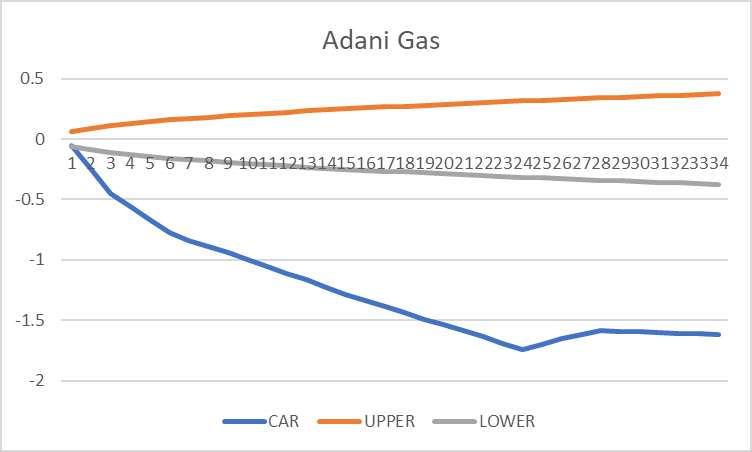

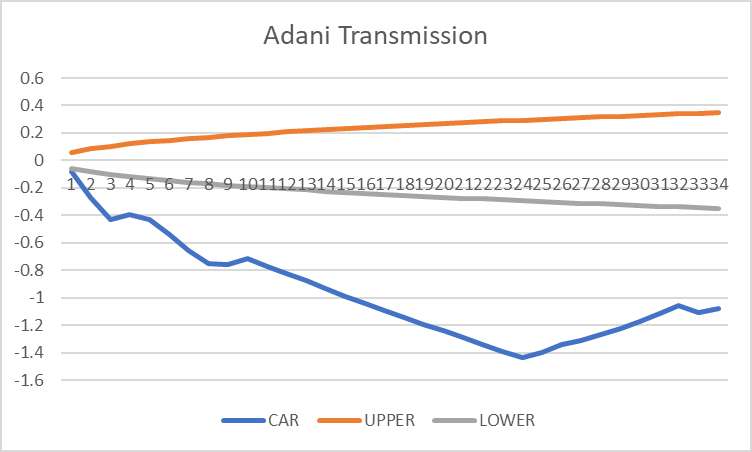

Our estimated window is from 2021.1.1 to 2023.1.15. (Adani Wilmar starts on 2022.2.9) The report was released on 2023.1.25, and we took a 10-day quarantine. The event window ended on 2023.3.15 with 34 days in total.

Based on return rates in the estimation window, we get expected return E(R) and plot a graph according to linear regression. We then used the actual rate of returns R real minus the predicted rate of returns which is the abnormal return (AR). Then we get the cumulative abnormal return (CAR) and sketch the diagrams with the upper boundary (UB) and lower boundary (LB). If CAR exceeds the upper limit, the event benefits the stock. Otherwise, the store will be adversely affected by the event.

\( E(R)={α+β*R_{market}}+ϵ \)

\( AR={R_{real}}-E(R) ; CAR=\sum _{t=1}^{34}({AR_{t}}) \)

\( UB=1.96σ\sqrt[]{T} ; LB=-1.96σ\sqrt[]{T} \)

R: stock return

α: risk-free return

β: slope/ unknown coefficient

ϵ: a normally distributed mean zero random variable

2.2. Correlation

Correlation expresses the extent to which two variables are linearly related. We use Excel to make a 7*7 correlation matrix using the stock return from seven companies and aiming to check whether the event had a lasting impact on the performance of the relationship between Adani stocks.

2.3. Sharp ratio

The Sharpe Ratio measures the performance of an asset or a group of assets relative to their assumed risk. The higher a fund's Sharpe ratio, the better its returns have been close to the amount of investment risk taken.

E= expected value

R1= stock return

R2= risk-free return

𝑆ℎ𝑎𝑟𝑝𝑒 𝑅𝑎𝑡𝑖𝑜 \( =\frac{[R1-R2]}{σ} \)

σ= standard deviation of the stock excess return.

3. Data

3.1. Correlation and market share

Adani Enterprise has the maximum transaction volume and market share. Adani transmission ranks second (16%), while Adani Power is smaller (8.6%), and Wilmar is the most minor (6.1%) [3,4]. Most correlation values remain at about 0.5, showing they do not have strong relationships in stock performance. Enterprise and Ports & SEZ have a high correlation at 0.75 before and 0.79 after. They can be considered as close stocks with similar return trends in portfolios. Gas Transmission and Green Energy have extremely high correlations, all greater than 0.80. To conclude, Investors can consider stocks with high coefficients as the same type when making their portfolios. (Data was collected on 2023.3.25)

Table 1: Weighted index.

Company | Weighted Index |

Adani Ports & SEG | 15.97% |

Adani Transmission | 14.58% |

Adani Enterprise | 23.02% |

Adani Green Energy | 18.86% |

Adani Gas | 12.84% |

Adani Power | 8.60% |

Adani Wilmar | 6.13% |

Table 2: Correlation for the event window.

vent window | Power | Wilmar | Gas | Enterprise | Green Energy | Transmission | Ports & SEZ |

Power | 1 | ||||||

Wilmar | 0.61 | 1 | |||||

Gas | 0.64 | 0.49 | 1 | ||||

Enterprise | 0.44 | 0.57 | 0.39 | 1 | |||

Green Energy | 0.64 | 0.54 | 0.86 | 0.41 | 1 | ||

Transmission | 0.61 | 0.53 | 0.83 | 0.48 | 0.86 | 1 | |

Ports & SEZ | 0.35 | 0.41 | 0.42 | 0.79 | 0.38 | 0.37 | 1 |

Table 3: Correlation for estimate window.

Estimate window | Power | Wilmar | Gas | Enterprise | Green Energy | Transmission | Ports & SEZ |

Power | 1 | ||||||

Wilmar | 0.70 | 1 | |||||

Gas | 0.35 | 0.41 | 1 | ||||

Enterprise | 0.39 | 0.46 | 0.51 | 1 | |||

Green Energy | 0.35 | 0.39 | 0.37 | 0.35 | 1 | ||

Transmission | 0.33 | 0.34 | 0.64 | 0.44 | 0.44 | 1 | |

Ports & SEZ | 0.45 | 0.47 | 0.42 | 0.75 | 0.36 | 0.41 | 1 |

Figure 1: Adani Enterprise.

Figure 2: Adani Gas.

Figure 3: Adani Transmission.

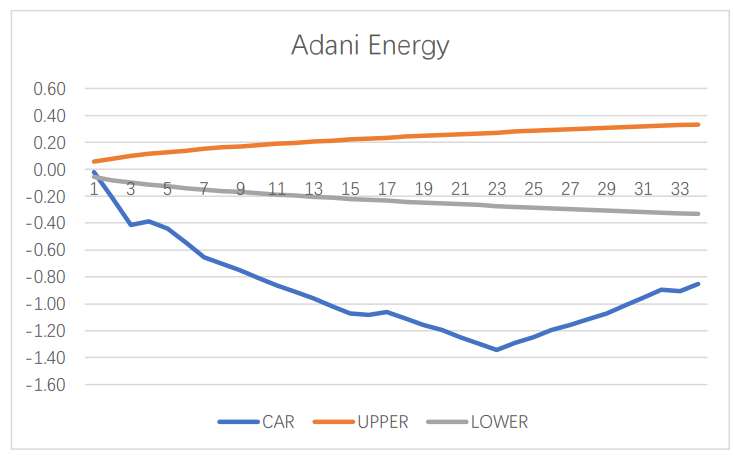

Figure 4: Adani Energy.

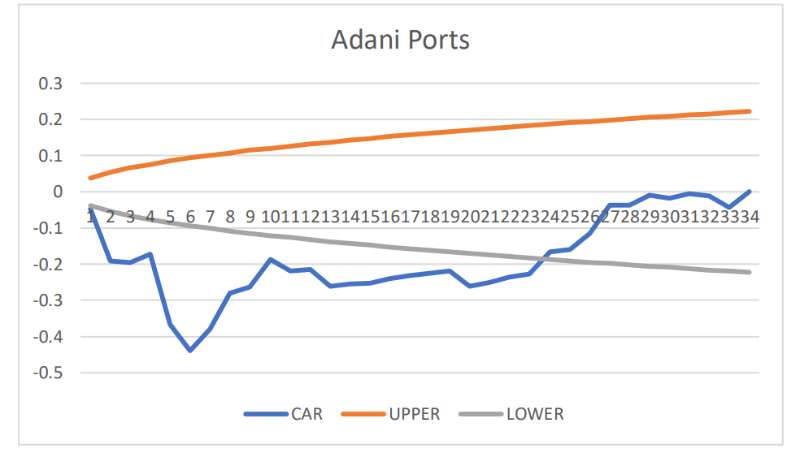

Figure 5: Adani Ports.

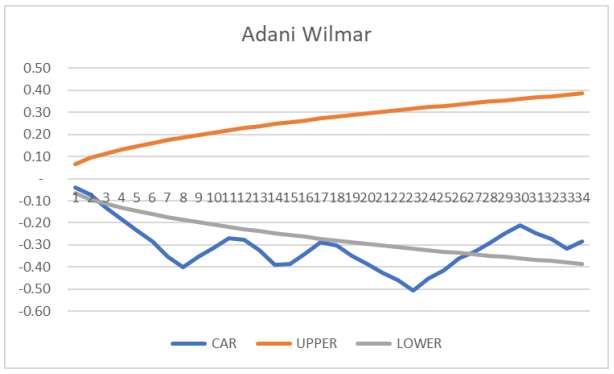

Figure 6: Adani Wilmar.

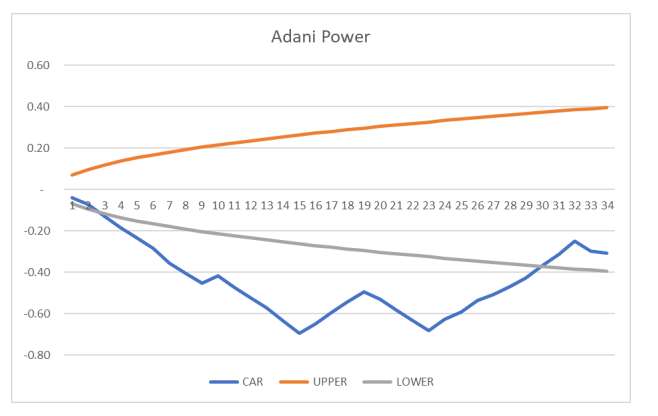

Figure 7: Adani Power.

It is evident that all seven stocks instantly exceeded the lower bound of the confidence interval, which means the event hurt the Adani group. Judging from the seven pictures, Adani's gas dropped the most after the incident.

Adani Enterprises, Adani Gas, Adani Transmission, and Adani Energy (the first four pictures) didn't return to their confidence interval after the event. However, the other three (Adani Power, Adani Wilmar, and Adani Ports) returned to the confidence interval.

4. Analysis

Speculations of reasons why three companies return to their confidence intervals.

4.1. Adani Power

There are three potential factors we can find:

(1) Increasing electricity demand in India

Firstly, India's power sector has been experiencing a continued growth in electricity demand, driven by increased economic activity and weather-related factors. The Ministry of Power anticipates a record surge in power usage during the summer months, necessitating the maximization of output from imported coal-based power plants. The government has invoked an emergency law to ensure this output, marking the second time in two years that such measures have been implemented. This growing demand may have contributed to the resurgence of Adani Power's CAR.

(2) Adani Power's decision to cancel coal-fired power plant acquisitions.

Meanwhile, Adani Power canceled its plans to acquire a coal-fired power plant project in central India. The cancellation of this $850 million acquisition deal with DB Power Ltd. allowed Adani Power to defer capital expenditure, subsequently garnering the favor of investors.

(3) Gautam Adani's financing initiatives.

Gautam Adani has sought to address investor concerns about leverage by pledging shares to repay loans early, improving the port unit's debt ratio, and engaging in a roadshow to sell shares in four companies to GQGP Partners. These actions have likely contributed to the improvement in Adani Power's CAR and overall investor sentiment.

4.2. Adani Wilmar

1. Adani Wilmar is the first market leader in Edible Oil. Its industry is not as essential as that of Adani Power and Adani Gas, which are energy-related. Stock buyers, therefore, lose less confidence in it and may restore their trust sooner.

2. As shown above, it fell relatively less in market cap, with the second least proportion, and did not have a bad Sharpe Ratio among ADANI Group. Although all Sharpe ratios turned out to be negative after the event, that of Adani Wilmar is -0.15, which is relatively more optimistic. This could be another reason to restore confidence to speculators.

Table 4: Sharp ratio (Data for the month before 3.30).

Power | -0.03 |

Wilmar | -0.15 |

Gas | -0.23 |

Enterprise | -0.23 |

Green energy | -0.41 |

Transmission | -0.52 |

Port &SEZ | -0.71 |

4.3. Adani ports

The need for ports in India and the corporations with the Asian country

India had ensured infrastructure projects, including the Northern Sri Lanka wind power project, and apart from the renewable energy projects in northern Sri Lanka, the Adani Group is also involved in the development of the U.S. $700-million West Container Terminal (WCT) project at the Colombo Port.

Adani has shelved plans to bid for a stake in power trader PTC India. SYDNEY, March 8 (Reuters) - GQG Partners would likely expand its investment in the Adani group, the fund firm's founder Rajiv Jain said on Wednesday, a week after its $1.9 billion infusion into the embattled Indian conglomerate. GQG Partners, co-founded by Jain in 2016, bought shares worth $1.87 billion in four Adani group companies, marking the first significant investment in the Indian conglomerate since a short-sellers critical report in January sparked a stock rout. It does help recover investors’ confidence in them and gets them through [5].

5. Proposals

5.1. Buy it and hold It

After considering the Political, Economy, International Relations, and Opportunity Dimensions, we think buying and holding a stock can be the best choice for investors to earn money.

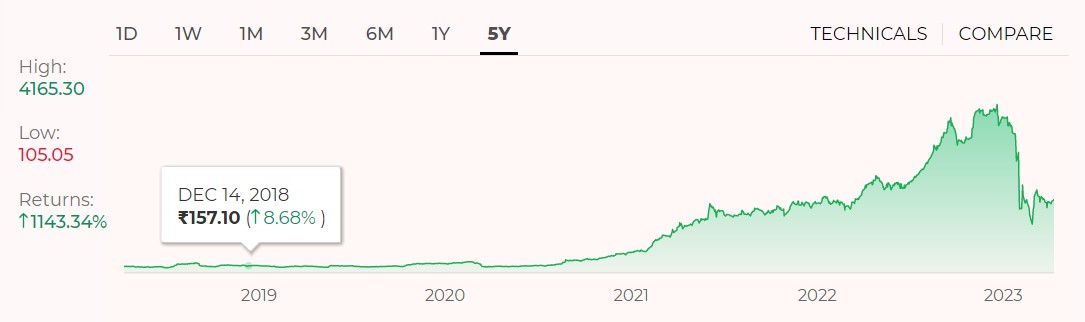

Figure 8: Stock price of Adani Enterprise.

Of course, we can short-sell the stock of Adani company. However, from the picture above (Adani Enterprises), the company's share price has remained relatively high and fluctuated. Short-selling it now may not be a good choice for retail investors.

5.2. Political

Modi government has a tight relationship with Adani companies. Adani's development is inseparable from the support of the government. Mr. Modi's "rising India" ambitions and infrastructure-heavy economic model are why he fostered Adani. In one of the world's worst business environments, India is inefficient and rife with occasional bribes and rip-offs by officials. Such risky investments and runaway riches are impossible without backing from the top; Adani is deeply bound to Modi.

One of the pieces of evidence is that in these five years, the Indian economy has experienced covid-19, the energy crisis, but the share price of Adani has constantly been rising. With this relationship, the Modi government will still support Adani company and make it quickly recover from this shock. This will also give strong confidence to investors.

5.3. International relationship

The reason for Hindenburg’s short selling of India’s Adani also reflects the US sanctions against India to a certain extent. At present, no more information is conducive to Adani, so the impact on Adani is slowly calming down.

5.4. Economy

Adani Group is an Indian multinational conglomerate group whose businesses today include port management, power generation, transmission, renewable energy, mining, airport management, natural gas, food processing, and public works. All kinds of production and infrastructure in India are inseparable from Adani, so Adani still plays a pivotal role. Adani's share price is also bound to recover due to high demand.

5.5. Opportunity

To sum it up, the chances of capitalizing on the Adani share price recovery to make money are much more significant than shorting it, so buying is a good bet.

6. Conclusions

In conclusion, this study has provided an in-depth analysis of the impact of Hindenburg's report on the Adani Group's share prices. The event study results demonstrated that the information negatively affected all seven Adani stocks. Some of the subsidiaries in the Adani group have recovered sooner than others. Specifically, Adani Power, Adani Wilmar, and Adani Ports returned to their confidence intervals, possibly due to increasing electricity demand, industry leadership, and strong political and international support.

The correlation analysis revealed that some Adani stocks have stronger relationships in their return performance, which can be valuable information for investors when constructing their portfolios. Additionally, the Sharpe Ratio and weighted index analysis indicated that some Adani companies, such as Adani Wilmar, experienced relatively minor market capitalization declines and maintained rather better risk-adjusted returns.

Based on the political, economic, international relations, and opportunity dimensions, we recommend that retail investors consider buying and holding Adani stocks as a long-term investment strategy. The strong relationship between the Adani Group and the Indian government, the company's crucial role in India's economy, and the lack of further detrimental information following Hindenburg's report suggest that the Adani Group is likely to recover from the negative impact of the accusations.

Overall, the study contributes to the understanding of the effects of short-selling reports on stock prices and provides valuable insights for investors seeking to make informed decisions in the face of such events.

References

[1]. Sumathi Bala(2023)India’s Supreme Court sets up panel to investigate Adani allegations https://www.cnbc.com/2023/03/03/indias-supreme-court-orders-probe-into-adani- allegations-.html?&qsearchterm=adani%20power

[2]. https://en.wikipedia.org/wiki/Adani_Group

[3]. https://cn.investing.com/

[4]. https://finance.yahoo.com/

[5]. Praveen Menon Lewis Jackson (2023) GQG Partners likely to step up investment in Adani group, says founder https://www.reuters.com/business/gqg-partners-likely-grow-adani-investment-says- founder-2023-03-08/

Cite this article

Hu,X.;Chen,F.;Liu,Y.;Lu,Z. (2023). Thoughts on Hindenburg’s Report on Adani Share Price. Advances in Economics, Management and Political Sciences,39,79-86.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 7th International Conference on Economic Management and Green Development

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Sumathi Bala(2023)India’s Supreme Court sets up panel to investigate Adani allegations https://www.cnbc.com/2023/03/03/indias-supreme-court-orders-probe-into-adani- allegations-.html?&qsearchterm=adani%20power

[2]. https://en.wikipedia.org/wiki/Adani_Group

[3]. https://cn.investing.com/

[4]. https://finance.yahoo.com/

[5]. Praveen Menon Lewis Jackson (2023) GQG Partners likely to step up investment in Adani group, says founder https://www.reuters.com/business/gqg-partners-likely-grow-adani-investment-says- founder-2023-03-08/