1. Introduction

In the booming global digital economy, digital transformation has become the consensus of all walks of life. However, digital transformation involves not only the upgrading of technology but also the adjustment of business management modes, and so on. Under the background of today's complex and changing business environment and increasing customer demand, how to successfully carry out digital management transformation is a difficult problem facing all enterprises. There are corresponding difficulties in research and development, capital and implementation.

Huawei is one of the leaders of domestic high-tech enterprises and has made outstanding contributions in chip technology and 5G technology. Therefore, Huawei's pursuit of management is also higher. Managers have long been aware of the importance of management and the need to change from financial accounting to management accounting and strengthen internal control.

This paper analyzes the advantages and disadvantages of internal control management of Huawei and puts forward relevant suggestions. This paper uses the method of literature research to do research, which is helpful to other enterprises in the same industry and helps to promote the transition from financial accounting to management accounting.

2. Current Status of Huawei's Financial System

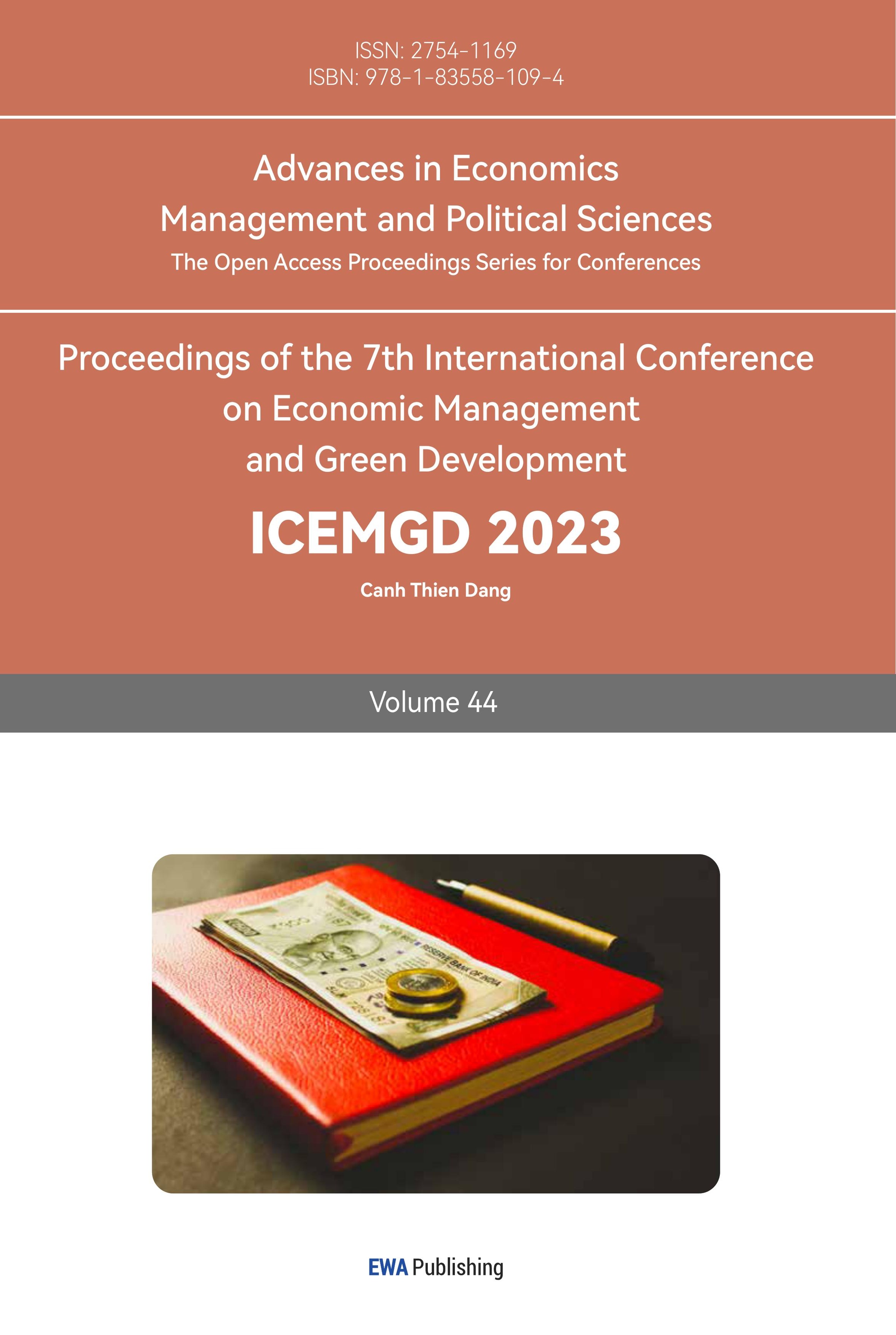

Huawei has an accounting management department that is responsible for global accounting. As can be seen from the chart below, its financial system is divided into three parts: accounting, financial management and audit monitoring. The audit is responsible for supervising and reviewing the accounting. Only when the accounting is accurate, can the financial management give full play to its value and make decisions as correct and trust worthy as possible.

Figure 1: Financial and economic commission structure of Huawei.

According to the figure 1, the graph describe the financial and economic system of Huawei [1].

Huawei now has seven sharing centers around the world. Sharing the resume of the center, on the one hand, can promote the standardization of the processing process and improve the efficiency of financial management; on the other hand, it can also help strengthen the financial control of the company headquarters in global business. At present, Huawei's financial accounting takes full advantage of the time difference in its shared center and has realized the global 7*24 hour circular closing mechanism.The seventh part in the figure above: Huawei Integrated Finance System (IFS) reform includes Huawei's attempt to transform financial accounting into management accounting, which advocates the harmonious unity of expansion and internal control.

Like other domestic enterprises, Huawei also went through a period of extensive growth. With the rapid growth of its business, Huawei's profit margin declined year by year. According to its 2007 annual report, Huawei's operating profit margin dropped from 19% in 2003 to 7% in 2007. Net profit margins fell from 14% to 5%. Zhengfei Ren found that finance was an obstacle to Huawei's growth. At an internal meeting in 2007, he fretted: "We do get a lot of big deals overseas, but I don't even know if they make money." This facilitated Huawei's attempt to shift from financial accounting to management accounting [2].

3. The Necessity of the Transition from Financial Accounting to Management Accounting

3.1. Improve the Defect of Traditional Financial Accounting

Under the background of digital economy era, the shortcomings of traditional financial accounting gradually emerged, which affected the smooth development of financial work to a certain extent. Its shortcomings are mainly reflected in the serious "information island situation", which makes the enterprise's strategic and financial objectives lack unity. Therefore, it is necessary to optimize and innovate the Internet era and explore new management modes and methods [3].

In addition, the increasingly fierce market competition and the diversified development of enterprise business forms have increased the difficulty of enterprise management. A variety of risks make enterprises spend more and more money on the financial level. The rapid development of big data and other information technology and the establishment of financial information platforms gradually marginalized traditional financial accounting personnel. As the main tool of accounting processing, computer can liberate the hands of accountants in the storage of accounting information and data processing, and the focus of management accounting lies in the effective mining and analysis of financial data information [4]. Driven by the development of the Internet era, in order to achieve their own sustainable development, enterprises must constantly accelerate the financial transformation, change the traditional accounting model, and conform to the trend of development.

In this, Huawei is clearly ahead of the industry. Since 2007, Huawei has realized the disadvantages of traditional financial accounting and realized that only by giving full play to the advantages of financial accounting can it be more conducive to the existence and development of enterprises. In order to strengthen internal control, Huawei started the IFS reform with the goal of realizing the "computing- accounting- budgeting" system.

3.2. Management Accounting and Financial Accounting Become Closer

In the future, management accounting and financial accounting will become more and more closely related, and the boundary between them will become more and more blurred. Today, artificial intelligence has been successfully applied in many industries. For example: medicine, financial trade, robot control, law [5].

The application of artificial intelligence in this field has greatly liberated human hands and brains from a series of tedious and repetitive tasks. Most of the work of financial accounting is exactly in line with this feature. Most of the work of financial accounting is repeated, and the daily business of the enterprise is almost repeated every month. It has also been predicted that human labor in financial accounting is likely to be completely replaced when artificial intelligence reaches its extreme maturity [6].

Therefore, the management accounting work related to financial accounting will be revealed to a large extent, and the data and information obtained by artificial intelligence will be summarized and submitted to the information required by the management, which will ultimately achieve the goal of the enterprise, i.e., the maximization of shareholders' wealth.For this point, we can analyze through Huawei founder Mr. Ren Zhengfei's four requirements for Huawei's financial personnel.

First, if a finance do not understand the business, they can only provide low-value accounting services;second, finance must have a desire to progress, desire to grow self-motivation;

third, financial personnel without project management experience can not grow into CFO; Last, a competent CFO should be ready to take over as CEO at any time.

To sum up, finance personnel should be integrated into the business.

For this statement of Mr. Ren Zhengfei, it can be understood that finance is a trinity, the so-called three, that is, understanding finance, management, and business. And this is precisely the position of management accounting. It can be said that Mr. Ren Zhengfei's requirements for Huawei's financial department are exactly within the scope of management accounting. It can be seen that Huawei's requirements for financial personnel have shifted from pure financial accounting to a combination of management accounting and financial accounting.

3.3. Change of Enterprise Financial Management Concept

With the progress of The Times and the improvement of social level, enterprises must learn advanced and innovative ideas of enterprise financial management and change the traditional form of financial management and operation if they want to keep up with social development. Positive financial management concept can promote the transformation of financial accounting to management accounting, help financial personnel to better collect, process, analyze and manage all kinds of data information brought by big data, identify risks, find opportunities, so as to improve the economic benefits of enterprises [7].

4. Difficult Problems that Most Other Enterprises May Meet

4.1. The Concept of Accountants Is Backward

Under the traditional accounting mode, most enterprises' financial management at present has the problem of "paying attention to accounting supervision and neglecting management service" [8]. Enterprise accountants will not stand in the perspective of enterprise managers or development strategy to see the problem, but will themselves be limited to the single model of accounting work and will focus on providing information rather than participating in management, which leads to the economic significance behind financial accounting, which is difficult to conduct in-depth research and cannot create value for the strategic management and internal control of enterprise development.

4.2. Low Information Level

Financial accounting staff need to carry out a large number of repetitive operations in their daily work. At this time, the level of enterprise informatization has become an important factor affecting the organic combination of all aspects of financial accounting.

At present, the level of financial informatization of many enterprises is low, which can only complete the basic data processing, and the coordination with subsequent management and decision-making is low, so it is difficult to realize the integration analysis and accurately reflect the actual business situation of enterprises. The lack of funds and technical personnel to establish an information network structure that can cover the whole enterprise makes it difficult to improve the informatization level of enterprises, which becomes a difficult problem [9].

4.3. Enterprise Attention Is Not Enough

In practical application, only few enterprises attach importance to the development of enterprise management accounting under the background of big data era, and more people even do not know the concept of enterprise management accounting under the background of big data era.

Most enterprises simply attach importance to corporate performance but lack internal operations management. Some enterprises still have a rather preliminary understanding of the role of enterprise management accounting in the context of big data. And in most cases, small and medium-sized enterprises cannot master this technology; if they want to step into this threshold, they need to consume a lot of financial, material, and human resources that are not suitable for the development of applications. So when faced with huge opportunities in the context of enterprise management accounting, they choose to ignore them. In the long run, these enterprises will be easily obsolete.

5. Countermeasures and Suggestions

(Here are two things that other companies can learn from Huawei)

5.1. Comprehensively Improve the Quality of Accounting Talents

In the era of big data, enterprises are facing increasingly fierce competition. For enterprises, they must have excellent management accounting talents so as to have better access to market information and, through reasonable screening and accurate analysis, provide a reasonable basis for the decision-making of enterprise managers. In my opinion, enterprises can start from two aspects: external introduction and internal training [10].

To attract high-quality talents with generous salary and welfare treatment, superior promotion mechanism, improve the proportion of talents. Enterprises can also carry out comprehensive training for existing employees, including quality and skill training, and promote the comprehensive development of employees by inviting experts to teach, exchanging and learning of employees sent abroad, etc. Enterprises should attach importance to the training of personnel in various positions, optimize the existing management accounting training system based on actual needs, strengthen the cultivation of professional theories and practical skills, and encourage management accounting personnel to strengthen self-learning and self-improvement, so as to better promote the common development of personnel and enterprises [11].

In 2017, Peng Qiuen, chief financial officer of Huawei Finance, said to fresh graduates at a Huawei Open Day that Huawei implements differentiated starting salaries without capping them.

Moreover, the total salary of Huawei is composed of basic salary, bonus, welfare security, long-term incentive and international dispatch. Monthly salaries usually start from 12,000 yuan and annual salaries range from 170,000 to 240,000 yuan. Depending on the position and contribution, the annual salary can increase by 210,000 to 290,000 yuan, or even more than 300,000 yuan. At the same time, the company also has various supporting subsidies such as housing to solve some practical problems of life for new people. For the long-term training and development of employees, Huawei also has a sound talent training plan.

5.2. Model Innovation

The traditional four financial statements mainly use the internal financial data of the enterprise as the basis for forecasting and analysis. Not only do the data have limitations, but also a lot of data need to be obtained after closing, so the traditional financial statements can not reflect the financial information of the enterprise in a timely manner. While the digital data of customer group division, activity, consumption preference and so on contained in big data can be obtained in time and reflect the audience group, advantages and disadvantages of the product more intuitively. These numbers can be combined with the existing financial information of the enterprise to form a complete data ecology, which is conducive to the enterprise to make accurate forecasts and decisions in business activities. Some enterprises use big data technology to quantify the value of digital assets and design a fifth statement to reflect and evaluate the Internet information of enterprises. This is more in line with the needs of enterprise internal management [12].

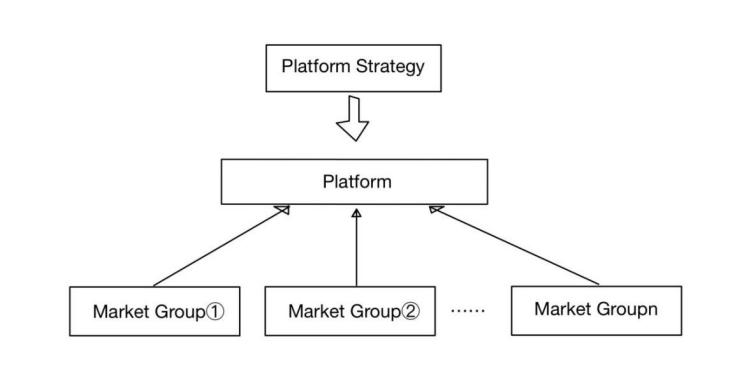

For example, the enterprise can use the platform strategy to build a set of cooperative, open and shared information platform, take the user as the center, make the business subject keep dynamic changes, achieve continuous interactive iteration, so as to provide the enterprise with updated management information. The platform-based innovative management mode can also enable large enterprises and small and micro enterprises to achieve mutual benefit and win-win results, and achieve bilateral prosperity and development.

Figure 2: The platform-based innovation model.

According to the figure 2, the graph shows the visions of future innovation models.

Take Huawei as an example. Huawei has a command and control center for global billing work, and each month, seven shared centers across five time zones accept the command and dispatch here to "sum up" Huawei's hundreds of subsidiaries around the world. Through transaction accounting automation, ERP optimization, data scheduling optimization, data quality monitoring, and improving the performance of the data analysis platform, the system enables Huawei to achieve real-time visibility of global accounting, and the process can be tracked and managed. The data and the technology involved are unique and efficient. The fast processing of financial data also allows Huawei to focus more on other areas such as research and development and products. The excellent financial system has become the most solid backing of Huawei.

6. Conclusion

In conclusion, Huawei, as a leading high-tech enterprise in China, has realized the importance of the transformation from financial accounting to management accounting since the very beginning, and has already begun to try to make some changes. At present, the transformation of Huawei's internal control from financial accounting to management accounting has been relatively mature, because the company attaches great importance to it from top to bottom and has completed the transformation of enterprise financial management concept early. It's also reflected in recruitment. Huawei requires financial management personnel to understand finance and be able to manage. This compound talent is more conducive to the transformation of enterprise management.

On this basis, Huawei can further study how to integrate industry and finance into the platform and integrate on the basis of information standardization and refinement so that the massive management information can provide decision-making support for enterprises more conveniently and quickly. Technological innovation is also difficult; developing and maintaining a multi-dimensional, large-capacity data system is not an easy task.

References

[1]. ZhiHu (Dongao education group), 2022, What is Huawei's financial management model? https://www.zhihu.com/question/270156006

[2]. ZhiHu(Huawei management), 2020, IFS reform: Harmonious unification of expansion and internal control, https://www.shangyexinzhi.com/article/412330.html

[3]. Feng Q.(2020).02 Transition from financial accounting to management Accounting under the background of big Data. China Management Informatization (03),48-49.

[4]. Xue Xilin. (2020). Research on Management Accounting Innovation in the Digital Economy Times. China Township Enterprise Accounting (01), 220-221.

[5]. Xia CH.(2020). The Future of Management Accounting -- data-oriented Management Accounting. The national circulating economy (01), 178-179. The doi: 10.16834 / j.carol carroll nki issn1009-5292.2020.01.086.

[6]. Zhu FW.(2020). On the transformation from financial accounting to management accounting under the background of big data. Contemporary Accounting (02),53-54.

[7]. Zhang QL & Zhang YB.(2020). The Theoretical logic of Enterprise Financial Digital Transformation -- Accounting Function Perspective. Chief Accountants of China (04),39-42.

[8]. Niu XY.(Financial information),2018, Try to describe the challenges and solutions of enterprise management accounting under the background of big data era. https://www.ixueshu.com/document/1662074a158b7fcef264a6352877081f318947a18e7f9386.html

[9]. Wang BX.(2020). Research on the transition from financial accounting to management Accounting under the background of big data. Northern Economy and Trade (01),82-84.

[10]. Yang Jingyi. (2020). In the transition of financial accounting to management accounting under the vision of big data. Business culture (08), 56-59.

[11]. Ye Y. (2020). A preliminary study on the transformation of enterprise financial accounting to management accounting under the background of big data. Industrial Innovation Research (11),116-117.

[12]. Yu L.(2018). Discussion on enterprise management accounting innovation under the background of big data. Modern Marketing (Chuangfu Information)(10),29.

Cite this article

Xie,W. (2023). Research on the Transformation of Enterprise Management from Financial Accounting to Management under the Digital Environment—Take HUAWEI as an Example. Advances in Economics, Management and Political Sciences,44,28-34.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 7th International Conference on Economic Management and Green Development

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. ZhiHu (Dongao education group), 2022, What is Huawei's financial management model? https://www.zhihu.com/question/270156006

[2]. ZhiHu(Huawei management), 2020, IFS reform: Harmonious unification of expansion and internal control, https://www.shangyexinzhi.com/article/412330.html

[3]. Feng Q.(2020).02 Transition from financial accounting to management Accounting under the background of big Data. China Management Informatization (03),48-49.

[4]. Xue Xilin. (2020). Research on Management Accounting Innovation in the Digital Economy Times. China Township Enterprise Accounting (01), 220-221.

[5]. Xia CH.(2020). The Future of Management Accounting -- data-oriented Management Accounting. The national circulating economy (01), 178-179. The doi: 10.16834 / j.carol carroll nki issn1009-5292.2020.01.086.

[6]. Zhu FW.(2020). On the transformation from financial accounting to management accounting under the background of big data. Contemporary Accounting (02),53-54.

[7]. Zhang QL & Zhang YB.(2020). The Theoretical logic of Enterprise Financial Digital Transformation -- Accounting Function Perspective. Chief Accountants of China (04),39-42.

[8]. Niu XY.(Financial information),2018, Try to describe the challenges and solutions of enterprise management accounting under the background of big data era. https://www.ixueshu.com/document/1662074a158b7fcef264a6352877081f318947a18e7f9386.html

[9]. Wang BX.(2020). Research on the transition from financial accounting to management Accounting under the background of big data. Northern Economy and Trade (01),82-84.

[10]. Yang Jingyi. (2020). In the transition of financial accounting to management accounting under the vision of big data. Business culture (08), 56-59.

[11]. Ye Y. (2020). A preliminary study on the transformation of enterprise financial accounting to management accounting under the background of big data. Industrial Innovation Research (11),116-117.

[12]. Yu L.(2018). Discussion on enterprise management accounting innovation under the background of big data. Modern Marketing (Chuangfu Information)(10),29.