1. Introduction

In the process of business development, mergers and acquisitions of companies are relatively common. However, companies with higher Internet popularity and more attention are usually more cautious about mergers and acquisitions, and it is rare for leaders of companies with higher social influence to announce acquisition plans when the acquisition case is still inconclusive. Researchers investigate whether investors’ surprise emotion, exerts a significant effect on their subsequent decision-making following M&A announcements [1]. Other researchers found the CEO’s social media messages could measure their personalities [2]. This research mainly focuses on the merger and acquisition affection of social platforms. When social media is the target of an acquisition, the original impact on shareholders will be extended to all social media users and feedback will be provided through the users' emotions. As there have been few mergers and acquisitions of social media platforms, a systematic impact analysis has not been conducted. This paper analyzes the impact of social platforms acquired through Musk's merger with Twitter. Case analysis is mainly used in the analysis. The study will make recommendations on whether to publish merger details, which are still under negotiation, and merger developments on social media. Predict the impact on both parties after the completion of the merger.

2. Brief Introduction of Both Parties

2.1. Elon Musk

Elon Musk is an academician of the US National Academy of Engineering and founded SpaceX, a US space exploration technology company, to realize the smooth return of private-owned rockets[3]. In 2004, he became the chairman of Tesla, an American electric vehicle and energy company. Tesla received global attention after making its first profit in 2013, becoming a leading brand of new energy vehicles, and Musk has therefore become a company leader and an investor in the world's attention.

2.2. Twitter

Twitter is an internet company established in 2006 in San Francisco, USA, which mainly promotes micro-blogging and provides social platform services. It has become one of the most widely used social platforms in the world. Many countries have opened official accounts on their platforms for publicity and promotion, which has become an important voice channel and display platform in the new media environment.

2.3. Incident

On April 4, 2022, Elon Musk bought a 9.2% Share of Twitter as a passive stake. On April 5, Twitter CEO post a Twitter "Welcome Musk On Board"; but later on April 10th, Musk refuse the invitation. Then on April 14th, Musk made an offer to buy 100% of Twitter for $44 Billion. The next day, Twitter's board adopted the" poison pill" to defend Musk's offer and showed their attitude. But they accepted the $44 Billion offer on April 25th. The acquisition would be finished in 2022. After that, Twitter will become a private firm, and Musk will hold a 100% stake in it. On July 8, 2022, Musk announced the termination of the acquisition of Twitter. On August 30th, Musk's advisers sent a termination letter to Twitter to formally notify the company of the termination. But Twitter believes the termination letter is invalid and wrong. After the court's decision, on October 27, Musk completed the acquisition of Twitter, and Twitter was delisted on the 28th.

3. The Potential Motivation for Musk's M&A for Telsa

Musk is well-known as the CEO of Tesla, and more attention has been focused on the impact on Tesla in this acquisition. This is divided into the following aspects:

The Potential Motivation of Musk's M&A for Telsa.

3.1. Expand the Business

Tesla's initial vision was to "accelerate the global transition to sustainable energy". Provide every consumer with pure electric vehicles within their consumption capacity. Therefore, its main development goal is to research and develop new cars using pure electric energy. After the development, production, and sales of new energy vehicles were successful, Tesla Motor Company changed its name to Tesla in 2017, proving its determination to expand its business.

With more and more traditional car companies, such as Toyota, Mercedes-Benz, and BMW, joining in the manufacturing of new energy vehicles, market competition has become more intense, and single-car research and development and sales can no longer meet Tesla's needs for business development. As a result, Tesla has to develop more businesses to meet its own development needs and maintain the company's share price.

3.2. Reduce Negative Impacts

Tesla share price reactions are based on Musk's tweet messages, to which market participants respond in response to news [4]. Tesla's original marketing strategy was to attract more attention as the primary method. In the early stage, the celebrity effect was used to attract attention and build credibility. And use social media to narrow the distance between consumers and reduce the communication distance between companies and consumers. This has given Tesla a very generous return for a period of time. When it comes to new energy vehicles, Tesla is the first brand in the hearts of the public. It has even become a synonym for new energy vehicles.

However, things have two sides. Tesla also had a series of adverse events during its operation, such as the hand brake event in 2017, the battery event in 2018, and the rationing event in 2020. In particular, the brake failure event occurred in China in 2021. Car owners received extensive attention after the release of social media, which had a significant negative impact on the Tesla brand and caused a decline in Tesla's share price, resulting in a double loss of reputation and value.

3.3. Increase Attention

The proposal of this merger and acquisition is different from the strict confidentiality details of other mergers and acquisitions. This time, Tesla Chairman Musk made the announcement on his social media and received a reply from senior management of the target company. The process and opinions of both parties on this merger and acquisition are made public in the eyes of all people through social media. This kind of negotiation between you and me has also attracted great attention from both companies. Share prices on both sides were also affected.

In 2016, investors wondered whether Tesla represented a good investment. Its stock price was under $50/share in 2016. Tesla was shown the potential power in 2020, the obvious increase in Figure 1.

Figure. 1 Tesla stock yearly k chart 2022 March-May.

As can be seen from Figure 1, Tesla's stock price rose slightly before the event was noticed, reaching a price high of $1,152.870/share since the beginning of this year on April 5. With Musk's continuous voice on the merger and acquisition, Tesla's stock price is also gradually falling. On April 25th Twitter's board announced that it had reached an agreement on the acquisition. On April 26th Tesla's share price fell by 12.18%, shrinking its market value by more than $120 billion. It fell to its current low of $620.570 per share on May 24. This period of time roughly coincides with the period when Twitter made its voice heard on Twitter about the merger.

Although Tesla's stock price dropped in this incident, it has once again attracted worldwide attention. And covered up the previous negative impact caused by quality problems such as brakes.

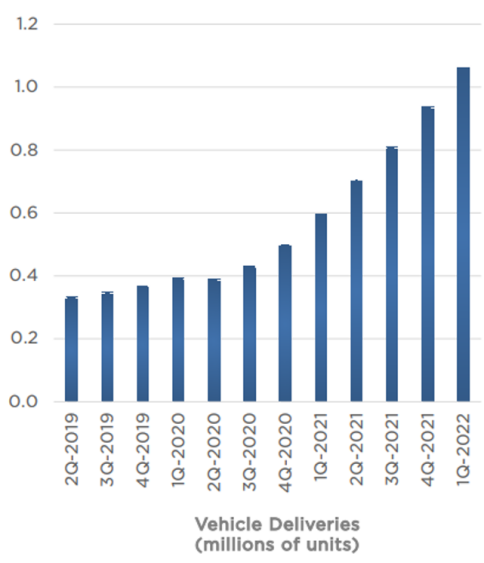

In Q1 2022, Tesla's total revenue reached USD 18.756 billion, a year-on-year increase of 81%. Tesla said that the revenue growth was due to the increase in car delivery, the increase in average selling price, and the growth of other businesses.

In terms of delivery volume, Tesla delivered a total of 310,048 vehicles in Q1 this year, of which 295,324 were delivered by Model 3 and Model Y, and 14,724 were delivered by Model X and Model S.

Figure 2. Tesla’s vehicle deliveries between 2019 Q2-2022 Q1.

Figure 3. Twitter daily k chart 2022 March-May.

At the same time, Twitter's stock price also peaked at $54.570/ share on April 5. Later, when the two sides could not reach an agreement on the merger, the stock prices of both sides were also fluctuating and falling, and the closely watched merger fell into a less favorable cycle. However, it is undeniable that both sides have received extremely high attention in this incident.

3.4. Have a Mature Social Platform

At present, most software regards the development of social attributes as one of the important contents, and social platforms also regard the expansion of users as one of the main contents. The reason is that social attributes are more likely to keep customers on the platform, and having users means more potential customers, which is convenient for the platform to carry out subsequent promotion, publicity, and other business. It is a more cost-effective way to buy and sell social platforms that already have a large user base than to "pull new" new platforms. Twitter is just such a platform.

With the emergence of self-media, social platforms have gradually become platforms for exchanging views.

Judging from the current operation of social platforms, the platforms will block and delete statements that violate laws and regulations, and social ethics; And recommend accounts and tweets that they are more likely to be interested in users through big data filtering and algorithms. The platform also provides services such as paid promotion. Its purpose is to expand its influence and let more people "listen" to its voice and expand its influence. If Musk succeeds in acquiring Twitter and privatizing it, then everyone who uses Twitter may be influenced by his opinion. Musk will also have one of the world's largest social platforms to express his views and provide promotional services for his company.

4. The Possible Impact upon Completion of the Merger and Acquisition

4.1. Provide Publicity Channels for Relevant Companies

If the merger is completed as planned, Twitter will become a private company with Musk as its de facto controller. Tesla, which is also its chairman, has a well-established internet company closely connected to it and a social media platform with a large number of users. This is far more secure than setting up a company of the same type and growing it to the same size. From then on, Tesla will be able to use Twitter's own social advantages to supplement its short promotional board, turning customers for new media promotion into participants for new media promotion. On the one hand, it can reduce publicity expenses, on the other hand, it can also reduce the negative statements and influence on the company and play the role of public relations for the relevant companies, but the cost is lower.

4.2. Distortion of Information Received by Users

It is an indisputable fact that internet companies rely on data filtering and analysis to accurately portray users and push them to their liking. Subtle push may change users' original views and preferences unconsciously. If Twitter is really acquired and privatized by Musk in the future, it is possible that the homepage of Twitter users is full of information Musk wants more people to see, thus changing the users' cognition and thinking direction in the information flow. Different voices are not heard, and the information received by users is distorted, thus becoming victims of artificial screening of information cocoons.

4.3. The Layoff Impaction

Managers will choose to use layoffs as related to the characteristics of the M&A transaction[5]. After completing the merger, Musk announced layoffs for Twitter executives and drastically changed Twitter's original working model. This has kept the merger and the public in high awareness. Large-scale layoffs risk allowing key employees to be invited by other competitors to weaken Twitter's competitiveness in social media.

5. Conclusion

In conclusion, the perceived pattern of alignment between a manager's words and deeds, with special attention to promise-keeping, and espoused and enacted values [6]. This merger, Musk repeatedly talked about the details of the merger on the public platform, which made the public keep attention to this case and also made a tense relationship between the Twitter board of directors and him. It may cause dissatisfaction and even loss of Twitter users, which may weaken or even backfire on the original goal. The post-merger reform measures continue to be released, and the impact on Twitter may deepen in the future.

References

[1]. Wang, Q., & Lau, R. (2019). The Impact of Investors’ Surprise Emotion on Post-M&A Performance: A Social Media Analytics Approach. Association for Information Systems, Munich.

[2]. Gay, E., Ke, B., Qiu, L., & Qu, C. T. (2020). CEOs' social media messages, perceived personality, and M&A decisions.In: 2019 Canadian Academic Accounting Association (CAAA) Annual Conference. Ottawa.

[3]. Gilson, S. C., & Abbott, S. (2017). Tesla Motors (A): Financing Growth. Harvard Business School case study 218-033.

[4]. Strauss, N. and Smith, C.H. (2019), "Buying on rumors: how financial news flows affect the share price of Tesla", Corporate Communications: An International Journal, Vol. 24 No. 4, pp. 593-607.

[5]. O'Shaughnessy, K. C., & Flanagan, D. J. (1998). Determinants of layoff announcements following M&As: An empirical investigation. Strategic management journal, 19(10), 989-999.

[6]. Simons, T. (2002). Behavioral integrity: The perceived alignment between managers' words and deeds as a research focus. Organization Science, 13(1), 18-35.

Cite this article

Zhang,J. (2023). Research on the Motivation and Influence of Musk's Acquisition of Twitter. Advances in Economics, Management and Political Sciences,6,43-48.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 2022 International Conference on Financial Technology and Business Analysis (ICFTBA 2022), Part 2

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Wang, Q., & Lau, R. (2019). The Impact of Investors’ Surprise Emotion on Post-M&A Performance: A Social Media Analytics Approach. Association for Information Systems, Munich.

[2]. Gay, E., Ke, B., Qiu, L., & Qu, C. T. (2020). CEOs' social media messages, perceived personality, and M&A decisions.In: 2019 Canadian Academic Accounting Association (CAAA) Annual Conference. Ottawa.

[3]. Gilson, S. C., & Abbott, S. (2017). Tesla Motors (A): Financing Growth. Harvard Business School case study 218-033.

[4]. Strauss, N. and Smith, C.H. (2019), "Buying on rumors: how financial news flows affect the share price of Tesla", Corporate Communications: An International Journal, Vol. 24 No. 4, pp. 593-607.

[5]. O'Shaughnessy, K. C., & Flanagan, D. J. (1998). Determinants of layoff announcements following M&As: An empirical investigation. Strategic management journal, 19(10), 989-999.

[6]. Simons, T. (2002). Behavioral integrity: The perceived alignment between managers' words and deeds as a research focus. Organization Science, 13(1), 18-35.