1. Introduction

With every arrival of a financial crisis causing bankruptcy or severe financial losses for a large number of investors, finance exists for everyone. There has been a large body of literature examining what factors influence investors' investment psychology, but these studies do not do a good job of linking the influencing factors to a specific context, such as the 2020 severe impact of the new crown epidemic on financial markets [1]. The world landscape is ever-changing, and the crises that investors have to deal with are beginning to be complex, specific, and diverse. This paper collects and analyzes relevant literature to focus on the relationship between specific crisis environments and investor psychology, and divides crisis periods into two categories to illustrate how they affect investors' psychological activities.

2. Periods of crisis

2.1. Financial crisis

Individuals have thematic variability, and in the realm of the options market, Frijns observe the coexistence of fundamentalist and chartist behavior, with chartists becoming more dominant during market panics [2]. This trend was particularly evident around the 2008 financial crisis, as further explored by Li et al. [3]. After the crisis, Hoffmann found that large swings in return expectations indicate a change in investor behavior. In the period following the 2008-2009 financial crisis, global investors also made strategic portfolio adjustments, as highlighted by Vermeulen[4]. These investors increasingly favored less correlated markets, reflecting the intricate relationship between investor sentiment and portfolio strategy. This suggests that the financial crisis has had a profound and lasting impact on market behavior.

Financial crises are characterized by the following: significant currency devaluation in the region as a whole, based on pessimistic expectations of economic development; large losses in the total volume and size of the economy, with a blow to economic growth; large numbers of business closures, with rising unemployment; and widespread economic depression in society, sometimes even accompanied by social unrest or a volatile international political situation. The 2008 financial crisis serves as a prime example of how government intervention may have mitigated the economic downturn. Scholars argue that preemptive measures by the government could have averted the crisis and softened the blow to the economy. However, the lack of preparedness during prosperous times contributed to the subsequent turmoil. Antonides' examination of income fluctuations and their impact on welfare revealed a significant decline in median real income in the United States during periods of economic downturns, resulting in a substantial negative effect on psychological well-being [5].

The financial crisis has greatly stimulated people's fear, making people lose confidence in the expected development of the economy, fear spreads among investors, and the herd mentality also plays an important role in it. The 17th-century Dutch tulip bubble event embodies the terrible consequences of blindly following the herd in investment. When a financial crisis strikes, market information is confusing, investors are not fully informed, and the herd effect grows geometrically when there is a lack of transparency.

2.2. War and Epidemics

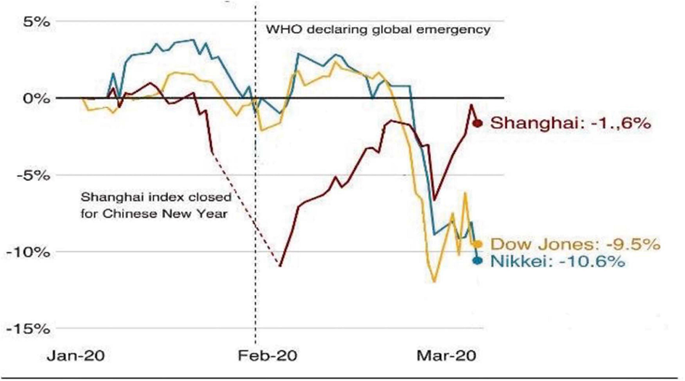

This article refers to crises not only as financial crises, but also as any large-scale event that would impact countries worldwide. An example is the 2019-2022 period of the New Crown Epidemic, a highly transmissible and pathogenic viral infection that can cost people their lives. New Crown epidemics create massive mass anxiety, most notably characterized by mass purchases of daily necessities, even when people do not lack them. It is human's self-love instinct to avoid harm, and due to the sudden outbreak of the epidemic and the potential for illness, as well as the media blitz, people were triggered to reflect on the mass psychiatric disorders [6]. In addition to this, the global stock and financial markets were also significantly affected by the CKP outbreak[7]. Governments ordered people to stay at home, investors received less market information, and investment expectations became unstable. Existing literature shows that investors' mood changes are significantly correlated with contemporary market returns [3]. Pessimism in stock market news also exerts psychological pressure on investors to a great extent and investors become more reluctant to invest during the pandemic, leading to downward pressure on the market [6].

Figure 1: Impact of COVID-19 on stock markets: Source Bloomberg[6].

Figure 1: Impact of COVID-19 on stock markets: Source Bloomberg[6].

There are many types of wars, and this paper focuses on the U.S.-China trade war that broke out in 2018 as an example to illustrate the impact of war on investors' investment psychology. In the countermeasures to deal with the US-China trade war, there is a big difference between the practices of Chinese and American households, most Chinese households, due to a greater fear of loss, have drastically reduced their holdings of risky assets to avoid the risk, which is caused by the economic impact of geopolitical risk on individual behavior [8]. Due to the traditional conservative economic concepts in China, most Chinese investors tend to choose the "capital preservation" investment strategy. When the crisis comes, the psychological pressure of Chinese investors increases, and the fear of loss is more important than the desire to gain, so they are willing to reduce their earnings to preserve their capital, which leads to the downward trend of the stock market.

3. The impact of market volatility on investors

3.1. Differences in application methods

Different investors use different methods of analysis before making investment decisions. According to the study, there is a significant difference in the investment behavior of fundamentalists and chartists, illustrating the different strategies and investment schedules employed by these groups. The study also emphasizes the importance of considering both implied and stochastic volatility to fully grasp market dynamics. Each type of volatility has its unique transition speed that greatly affects how investors react to market changes. Such differences are critical to understanding the different ways in which investors interact with the market, which are influenced by their perspectives and approaches [9]. As Zhang and Li point out, risk aversion among market participants increased significantly after the crisis[10]. Hamilton points out significant changes in the time series behavior of the economy, especially in response to events such as financial crises[11]. Moreover, since 2007, De Bock and de Carvalho Filho have observed more frequent risk aversion events, which lead to sustained currency strength[12]. This comprehensive study highlights the significant impact of crises on investor behavior and market dynamics. The literature on investor behavior in financial markets has extensively explored the impact of unusually negative events on market dynamics. Studies such as Batten et al focus on the impact of volatility on global banks during crises such as the Global Financial Crisis (GFC), the COVID-19 pandemic, and the Russo-Ukrainian War. Boubaker[13], Nguyen, et al investigated the market reaction of the banking sector to the Russo-Ukrainian war, revealing how bank stock prices were affected by the geopolitical conflict[14]. In addition, Hassan et al investigate the heterogeneous impact of border disputes on sectoral returns, providing insights into how particular events lead to different responses across sectors[15]. Furthermore, Ho et al explore the relationship between modern health pandemic crises and global default risk, emphasizing the role of formal and informal institutions in mitigating the negative impact of such crises[16].

Overall, the extent to which different types of investors are affected by market volatility varies, as investigated by Talwar et al, who found that the COVID-19 pandemic led to significant changes in investor behavior. Their study investigated various financial attitudes and found that factors such as financial anxiety, optimism, and interest in financial matters had a positive impact on trading activity. Whereas Smales and Kininmonth found fear, and implied volatility to hurt trading activity in the foreign exchange market[17].

3.2. Overconfidence

Business investment is an important part of production and operation, which can promote business growth and value appreciation, but not all investment behaviors are in line with expectations. Having foresight is a very difficult thing, and judging from the market performance, most enterprises are unable to make the right choices and maintain an efficient level of investment in the face of a large number of investment projects[18]. Therefore, the issue of irrational investment in firms deserves in-depth study. Since managers have a high degree of control over the company's operations, their individual and cognitive differences may directly affect the company's investment decisions, which can lead to irrational investment if the company lacks a sound monitoring mechanism. Based on a sample of 6,485 Chinese A-share listed companies in Shanghai and Shenzhen from 2017-2021, the effect of managers' psychological bias on irrational investment is empirically examined. The higher the managers' confidence, the lower the investment efficiency. The level of irrational investment in listed companies increases with managers' risk tolerance.

Barber and Odean showed that over-frequent trading is detrimental to investment, the development of the Internet has made the process of stock trading simpler, which can worsen the investor's over-confidence, leading to the emergence of the illusion of control, and over-commitment of assets by over-estimating one's control over the environment and the outcome of events in volatile market scenarios, resulting in severe losses[19].

In times of turbulence, fear tends to prevail, leading investors to sell assets, while some business managers, due to their empiricism, have a strong sense of self-confidence, which leads them to invest aggressively during market downturns. Such overconfidence is particularly dangerous in turbulent times and can lead to serious financial losses.

3.3. Other factors

During turbulent times and recessions, investors' psychological factors are influenced by multiple factors, including fear, uncertainty, risk aversion, behavioral finance effects, information overload, mental account adjustments, and optimism bias, in addition to those analyzed above. The first thing to realize is that investors' emotions and psychological changes are important forces that cause market volatility. Herd mentality, fear, and greed are common emotional reactions that may lead to irrational exuberance or panic selling in the market. For example, when the market is in an uptrend, investors may invest heavily for fear of losing profit opportunities, thus pushing asset prices up to unreasonable levels. These psychological changes have a significant impact on investors' decision-making behavior, making market performance more complex and unpredictable[15]. Understanding these psychological factors can help investors make more rational investment decisions during turbulent times.

From the above analysis, it can be seen that investors' mood changes in times of market turbulence are an important factor influencing behavioral choices, and according to research, investor mood can also be regarded as a "weathervane" of the securities market trend or a "thermometer" to measure the degree of market "hotness". According to research, investor sentiment can also be regarded as a "weathervane" or a "thermometer" to measure the degree of "hotness" or "coldness" of the market [20].

Meanwhile, some scholars utilize the closed-end fund discount rate to indirectly measure investor sentiment, such as Zhu & Zhang. However, most of such studies utilize monthly or weekly data to calculate the level of closed-end fund discount rate. Theoretically, the market price of a closed-end fund should be equal to its net asset value per unit, but in the course of investment practice, closed-end funds have been at a discount level (trading at a price significantly lower than the net asset value per unit) for a long period. Currently, the mainstream theory explaining the reason for closed-end fund discounts is the investor sentiment hypothesis. The investor sentiment hypothesis of closed-end fund discount can be traced back to 1946, Wiesenberger pointed out that when the closed-end fund discount is the largest, investors are the most pessimistic; when the discount level is narrowed, investors are optimistic. The fluctuation of investor sentiment affects the fund discount rate, and when investor sentiment is extremely optimistic, the fund will be issued at a premium, and there is a significant negative correlation between the fund discount rate and the index, because the higher the fund discount rate, the lower the institutional investor's sentiment (pessimism), which negatively affects the stock price; on the contrary, it indicates that the higher the institutional investor's sentiment (optimism), which has a positive impact on the stock price.

4. Conclusion

This article aims to identify the factors that influence investors' investment psychology during periods of market turbulence. Based on the analysis of previous literature it can be concluded that different investors make different behavioral choices in times of market turbulence, which are mainly determined by their personal views and approaches.

Based on the obtained conclusions, financial practitioners should consider calmly controlling their emotions when periods of market turbulence arrive, adopting different approaches to assessing risks and making decisions, and not falling into the trap of empiricism and overconfidence that can lead to serious financial losses. Based on the conclusions drawn, financial practitioners should consider controlling their emotions calmly when periods of market turbulence arrive, adopting a different approach to risk assessment and decision-making, and not falling into the trap of empiricism and overconfidence, which can lead to serious financial losses. In short, learning from the experience of previous financial crises, countries are today becoming more effective in their financial risk prevention systems. Unfortunately, prevention cannot be done to avoid harm completely. Especially in developed countries in Europe and the United States, excessive government intervention has triggered strong public opposition and politicians have weakened the ability of the risk mitigation sector to respond to the next crisis by stripping crisis managers of important powers to avoid exercising bailouts in the future. Indeed, these restrictions are all very well-intentioned, but they all have the potential to make the next crisis come faster and get worse, and the resulting financial losses more severe.

The resultant backlash was certain and understandable. While government actions to stem the panic and repair the damaged financial system were ultimately successful, tens of thousands of people suffered as a result of losing their jobs or families. When the next financial crisis erupts, Governments will wish they had a more prepared crisis prevention system and a more capable group of crisis mitigators. One reason the 2008 financial crisis was so devastating was that Governments lacked strong response tools from the start.

To better understand the psychological state of investors in times of market turbulence, future research could further examine how the psychology of investors changes in different contexts or how the investment psychology of different investors in different cultures differs in the face of downward pressure in the market.

References

[1]. Fernando M. PattersonRobert T. Daigler.(2014). The abnormal psychology of investment performance. Review of Financial Economics April 2014

[2]. Frijns, B., Lehnert, T., & Zwinkels, R. C. (2010). Behavioral heterogeneity in the option market. Journal of Economic Dynamics and Control, 34(11), 2273–2287.https:// doi.org/10.1016/j.jedc.2010.05.009

[3]. Lee, W. Y., Jiang, C. X., and Indro, D. C. (2002). Stock market volatility, excess returns, and the role of investor sentiment. J. Bank. Finan. 26, 2277–2299. doi: 10.1016/S0378-4266(01)002023

[4]. Arvid O.I. Hoffmann, Thomas Post, Joost M.E. Pennings(2013),Individual investor perceptions and behavior during the financial crisis,Journal of Banking & Finance,Volume 37, Issue 1,Pages 60-74,ISSN 0378-4266,https://doi.org/10.1016/j.jbankfin.2012.08.007.

[5]. Esther Greenglass,(2014), The financial crisis and its effects: Perspectives from economics and psychology, Volume 50, Pages 10-12

[6]. Sobia Naseem, Muhammad Mohsin, Wang Hui, Geng Liyan, Kun Penglai,(2021), The Investor Psychology and Stock Market Behavior During the Initial Era of COVID-19: A Study of China, Japan, and the United States" Front. Psychol.,10 February 2021,Sec.Organizational Psychology, Volume 12 – 2021

[7]. Yifan Wang, Xiqi You, Yanhang Zhang, Hanfang Yang(2024),Does the risk spillover in global financial markets intensify during major public health emergencies? Evidence from the COVID-19 crisis,Pacific-Basin Finance Journal,Volume 83,102272,ISSN 0927-538X,https://doi.org/10.1016/j.pacfin.2024.102272.

[8]. Xiqian Cai, Zheng quan,Cheng,Dongxu Li ,(2024), Balancing against geopolitical risk: Household investment portfolios during the U.S.-China trade war, Volume 66, 105703

[9]. Wael Dammak, Wajdi Frikha, Mohamed Naceur Souissi(2024), Market turbulence and investor decision-making in currency option market, The Journal of Economic Asymmetries, Dammak 2024 MarketTA, https://api. semanticscholar.org/CorpusID:270772774

[10]. Zhang, Q., & Li, Z. (2021). Time-varying risk attitude and the foreign exchange market behavior. Research in International Business and Finance, 57, Article 101394. https://doi.org/10.1016/j.ribaf.2021.101394

[11]. James D. Hamilton(1990),Analysis of time series subject to changes in regime,Journal of Econometrics,Volume 45, Issues 1–2,Pages 39-70,ISSN 0304-4076,https://doi.org/10.1016/0304-4076(90)90093-9.

[12]. Reinout De Bock, Irineu de Carvalho Filho(2015), The behavior of currencies during risk-off episodes, Journal of International Money and Finance, Volume 53,Pages 218-234,ISSN 0261-5606,https://doi.org/10.1016/j. jimonfin. 2014.12.009.

[13]. Jonathan A.Batten,Sabri Boubaker,Harald Kinateder,Tonmoy Toufic Choudhury and Niklas F. Wagner(2023),Volatility impacts on global banks: Insights from the GFC, COVID-19, and the Russia-Ukraine war,.Journal of Economic Behavior \& Organization,https://api.semanticscholar.org/CorpusID:263248363

[14]. Sabri Boubaker,Ngan Thi Kim Nguyen,Vu Quang Trinh,Thanh Vu,Market reaction to the Russian Ukrainian war: a global analysis of the banking industry,Review of Accounting and Finance, @article Boubaker MarketRT,.https://api.semanticscholar.org/CorpusID:256170665

[15]. M Kabir Hassan, Sabri Boubaker, Vineeta Kumari, Dharen Kumar Pandey(2022),Border disputes and heterogeneous sectoral returns: An event study approach,Finance Research Letters,Volume 50,103277,ISSN 1544-6123,https://doi.org/10.1016/j.frl.2022.103277.

[16]. Kung-Cheng Ho, Hung-Yi Huang, Zikui Pan, Yan Gu(2023).Modern pandemic crises and default risk: Worldwide evidence.Journal of International Financial Management & Accounting: Volume 34, Issue 2.

[17]. Lee A. Smales, Jardee N. Kininmonth(2016).FX Market Returns and Their Relationship to Investor Fear.International Review of Finance: Volume 16, Issue 4.

[18]. Bin Zhong, Wei Ni Soh, Tze San Ong, Haslinah Muhamad, ChunXi He(2024),Analysis of the impact of managers' psychological deviation on information disclosure and irrational overseas investment after IFRS convergence,Finance Research Letters,Volume 64,105446, ISSN 1544-6123, https://doi.org/10.1016/j. frl. 2024. 105446.

[19]. Brad M. Barber,Terrance Odean(2000).Trading Is Hazardous to Your Wealth:The Common Stock Investment Performanceof Individual Investors.The Journal of Finance • VOL. LV, NO. 2 • APRIL

[20]. Dan Zhang, Shiguang Liao.(2012). Research on investor sentiment in China's securities market. School of Economics and Management, Shanghai Jiao Tong University, 200052, Shanghai Stock Exchange Research Center, 200120

Cite this article

Gong,H. (2024). How Market Turmoil Affects Investors' Investment Psychology. Communications in Humanities Research,39,129-135.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of 3rd International Conference on Interdisciplinary Humanities and Communication Studies

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Fernando M. PattersonRobert T. Daigler.(2014). The abnormal psychology of investment performance. Review of Financial Economics April 2014

[2]. Frijns, B., Lehnert, T., & Zwinkels, R. C. (2010). Behavioral heterogeneity in the option market. Journal of Economic Dynamics and Control, 34(11), 2273–2287.https:// doi.org/10.1016/j.jedc.2010.05.009

[3]. Lee, W. Y., Jiang, C. X., and Indro, D. C. (2002). Stock market volatility, excess returns, and the role of investor sentiment. J. Bank. Finan. 26, 2277–2299. doi: 10.1016/S0378-4266(01)002023

[4]. Arvid O.I. Hoffmann, Thomas Post, Joost M.E. Pennings(2013),Individual investor perceptions and behavior during the financial crisis,Journal of Banking & Finance,Volume 37, Issue 1,Pages 60-74,ISSN 0378-4266,https://doi.org/10.1016/j.jbankfin.2012.08.007.

[5]. Esther Greenglass,(2014), The financial crisis and its effects: Perspectives from economics and psychology, Volume 50, Pages 10-12

[6]. Sobia Naseem, Muhammad Mohsin, Wang Hui, Geng Liyan, Kun Penglai,(2021), The Investor Psychology and Stock Market Behavior During the Initial Era of COVID-19: A Study of China, Japan, and the United States" Front. Psychol.,10 February 2021,Sec.Organizational Psychology, Volume 12 – 2021

[7]. Yifan Wang, Xiqi You, Yanhang Zhang, Hanfang Yang(2024),Does the risk spillover in global financial markets intensify during major public health emergencies? Evidence from the COVID-19 crisis,Pacific-Basin Finance Journal,Volume 83,102272,ISSN 0927-538X,https://doi.org/10.1016/j.pacfin.2024.102272.

[8]. Xiqian Cai, Zheng quan,Cheng,Dongxu Li ,(2024), Balancing against geopolitical risk: Household investment portfolios during the U.S.-China trade war, Volume 66, 105703

[9]. Wael Dammak, Wajdi Frikha, Mohamed Naceur Souissi(2024), Market turbulence and investor decision-making in currency option market, The Journal of Economic Asymmetries, Dammak 2024 MarketTA, https://api. semanticscholar.org/CorpusID:270772774

[10]. Zhang, Q., & Li, Z. (2021). Time-varying risk attitude and the foreign exchange market behavior. Research in International Business and Finance, 57, Article 101394. https://doi.org/10.1016/j.ribaf.2021.101394

[11]. James D. Hamilton(1990),Analysis of time series subject to changes in regime,Journal of Econometrics,Volume 45, Issues 1–2,Pages 39-70,ISSN 0304-4076,https://doi.org/10.1016/0304-4076(90)90093-9.

[12]. Reinout De Bock, Irineu de Carvalho Filho(2015), The behavior of currencies during risk-off episodes, Journal of International Money and Finance, Volume 53,Pages 218-234,ISSN 0261-5606,https://doi.org/10.1016/j. jimonfin. 2014.12.009.

[13]. Jonathan A.Batten,Sabri Boubaker,Harald Kinateder,Tonmoy Toufic Choudhury and Niklas F. Wagner(2023),Volatility impacts on global banks: Insights from the GFC, COVID-19, and the Russia-Ukraine war,.Journal of Economic Behavior \& Organization,https://api.semanticscholar.org/CorpusID:263248363

[14]. Sabri Boubaker,Ngan Thi Kim Nguyen,Vu Quang Trinh,Thanh Vu,Market reaction to the Russian Ukrainian war: a global analysis of the banking industry,Review of Accounting and Finance, @article Boubaker MarketRT,.https://api.semanticscholar.org/CorpusID:256170665

[15]. M Kabir Hassan, Sabri Boubaker, Vineeta Kumari, Dharen Kumar Pandey(2022),Border disputes and heterogeneous sectoral returns: An event study approach,Finance Research Letters,Volume 50,103277,ISSN 1544-6123,https://doi.org/10.1016/j.frl.2022.103277.

[16]. Kung-Cheng Ho, Hung-Yi Huang, Zikui Pan, Yan Gu(2023).Modern pandemic crises and default risk: Worldwide evidence.Journal of International Financial Management & Accounting: Volume 34, Issue 2.

[17]. Lee A. Smales, Jardee N. Kininmonth(2016).FX Market Returns and Their Relationship to Investor Fear.International Review of Finance: Volume 16, Issue 4.

[18]. Bin Zhong, Wei Ni Soh, Tze San Ong, Haslinah Muhamad, ChunXi He(2024),Analysis of the impact of managers' psychological deviation on information disclosure and irrational overseas investment after IFRS convergence,Finance Research Letters,Volume 64,105446, ISSN 1544-6123, https://doi.org/10.1016/j. frl. 2024. 105446.

[19]. Brad M. Barber,Terrance Odean(2000).Trading Is Hazardous to Your Wealth:The Common Stock Investment Performanceof Individual Investors.The Journal of Finance • VOL. LV, NO. 2 • APRIL

[20]. Dan Zhang, Shiguang Liao.(2012). Research on investor sentiment in China's securities market. School of Economics and Management, Shanghai Jiao Tong University, 200052, Shanghai Stock Exchange Research Center, 200120