1. Introduction

The literature that is now available emphasizes how the Russia-Ukraine war and the COVID-19 outbreak have affected the economy. Comprehensive research utilizing the IS-PC-MR model to examine the ECB's policy reactions is, nevertheless, lacking. This discrepancy allows for the examination of the efficacy and consequences of these policies on the economy of the Eurozone. This study uses the IS-PC-MR model to analyze the monetary policies of the European Central Bank (ECB) and to examine the economic effects of the COVID-19 epidemic and the Russia-Ukraine war on the Eurozone. The specific issue under discussion is how well the monetary policies of the European Central Bank (ECB) mitigate the economic shocks brought on by these crises while maintaining economic development and stability. The ECB's policy reactions are analyzed in this study using the IS-PC-MR model. To support the analysis, data is gathered from the World Bank, European Commission, European Central Bank, and other pertinent sources. This study forecasts future economic patterns, sheds light on the efficacy of the ECB's policies, and makes recommendations for improving policy measures to deal with comparable economic shocks in the future.

2. The Economic Shock of COVID-19 and the Conflict between Russia &Ukraine on the Eurozone

2.1. The Economic Shock of COVID-19 on the Eurozone

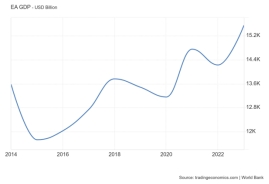

At the end of 2019, the COVID-19 pandemic broke out worldwide, which had a great impact on the world and development. In January 2020, the worldwide COVID-19 epidemic reached Europe, which became one of the worst affected regions later.. The COVID-19 epidemic caused the Eurozone to experience an unparalleled economic shock that severely disrupted a number of industries. The first effects included a severe loss in economic activity as a result of supply chain interruptions, lockdown measures, and a precipitous drop in corporate and consumer confidence on both investment and consumption, which would have a further deflationary impact on the Eurozone economy. In the Figure 1, which is from Word Bank, it is obvious that since 2019, the GDP of the euro area began to decline due to the impact of the epidemic, reaching the lowest point in 2020 that is only 13.2k USD billions [1].

Figure 1: Euro Area GDP [2]

More severely, the Eurozone's GDP contracted by 6.6% in 2020, marking the deepest recession since World War II according to the European Central Bank [2]. The economic depression caused by the epidemic was made worse by a precipitous drop in industrial production, especially in the manufacturing and automotive sectors, which are vital to the Eurozone economy. Furthermore, travel restrictions and social distancing measures caused serious setbacks for the services industry, particularly for the tourist and hospitality industries.

As businesses shuttered or reduced their operations, unemployment rates increased dramatically.

The European Commission stated in the 2020 Annual Report that in spite of the important measures adopted, unemployment in the EU was still rising from 7.5% in 2019 to 8.6% in 2020, and there is a significant risk of widening economic and social disparities between and within the Member States [3]. The surge in unemployment exacerbated the economic crisis by lowering household incomes and consumer spending. In nations like Spain and Italy that heavily depend on tourism, the labor market disruptions were more noticeable, with job losses being more severe and less hope for an economic recovery.

Disruptions in the supply chain were also a major factor in the Eurozone's economic shock. The epidemic significantly impacted industrial and production processes throughout the region by causing delays and shortages in the supply of intermediate goods and raw materials. Prices for products and services were impacted as a result of lower output and higher production expenses. The automobile sector saw significant production halts as a result of critical component shortages, underscoring the susceptibility of global supply chains. The Eurozone's experience during the COVID-19 crisis underscored the fragility of interconnected economies and highlighted the need for robust policy frameworks to navigate such unprecedented shocks effectively.

2.2. The Economic Shock of Russia & Ukraine Conflict on the Eurozone

The conflict between Russia and Ukraine, which escalated since February 2022, has caused a major economic shock to the Eurozone, which is showing up in a number of ways, including oil costs, trade disruptions, and volatility in the financial markets. Energy prices have been among the most direct and serious effects. Natural gas from Russia is a major source of energy for the Eurozone, and the conflict has caused significant disruptions in supplies. Natural gas prices have reached all-time highs as a result of the energy crisis, which has had an impact on the economies of the Eurozone. Inflationary pressures have resulted from rising energy costs, which have also raised living expenses for consumers and increased production costs for firms. According to the European Investment Bank, the war will exacerbate firms’ vulnerability through three channels: (1) a reduction in exports, (2) lower profit due to higher energy prices, and (3) difficulty finding funding as banks avoid risk [4].

The economic effects of the conflict have also been significantly impacted by trade interruptions. Russia and Ukraine's trade relations with the Eurozone have suffered greatly, especially in important areas like agriculture and raw minerals. Major wheat exporters, Russia and Ukraine, are suffering from shortages and higher pricing of agricultural items as a result of the conflict, which is making food inflation in the Eurozone worse. The fighting has caused supply chain disruptions, which have increased prices and caused delays for raw materials used by a number of businesses, including machinery and the automobile industry.

The turmoil brought on by the battle has not spared the financial markets. The prolonged battle has raised risk and uncertainty, which has caused financial market volatility to rise. This has caused stock prices to drop and bond risk premiums to rise, making it harder for governments and companies to get funding. Risks to the banking industry have also grown due to possible loan defaults from companies that have been directly impacted by the conflict. As Sharma and his colleagues presented, the conflict presents a dilemma for monetary policymakers as it contributes to inflation while weakening growth and undermining consumer and business confidence, already strained by COVID-induced price hikes [5].

3. The Policies that ECB should Adopt Corresponding to the Shocks

3.1. The Policies ECB should Adopt to Solve the Shocks Caused by COVID-19

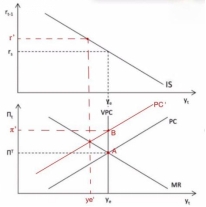

In order to mitigate the economic impact of the COVID-19 outbreak, the European Central Bank can use the IS-MR-PC model to analyze a series of policies that should be adopted to restore economic stability and growth. The IS-PC-MR mode is a macroeconomic framework for analyzing the relationships between the labor market, the products market, and monetary policy. The Investment-Savings curve, the Phillips Curve (PC), and the Monetary Rule (MR) are its three main components that are integrated. According to the inventors of this model, the IS diagram should be placed vertically above the Phillips diagram, with the monetary rule shown in the latter along with the Phillips curves [6].

Figure 2: The impact of the COVID-19 on the IS-PC-MR model

As Figure 2 shows, consumption and investment fell as a result of the pandemic's severe impact on company and consumer confidence. Lockdown procedures, uncertainty, and a severe decline in economic activity were the causes of this. There would be a shift to the left in the IS curve, which depicts the equilibrium in the goods market where total production equals total spending. This change suggests a decline in aggregate demand, which could result in higher unemployment rates and a lower level of output at equilibrium. As a result, the IS curve should be shifted to the right by the ECB's expansionary monetary policies, which will increase aggregate demand. This can be accomplished by lowering interest rates, which will cut the cost of borrowing for firms and consumers and promote consumption and investment. A revival of the economy would require increased investment and spending, which would be made possible by lower interest rates.

Additionally, in order to add liquidity to the financial system and avoid the Zero-Lower Bound (ZLB) of the short-term interest rate, the ECB should also purchase corporate and government bonds through quantitative easing (QE). From the description from the Bank of England, quantitative easing (QE) is an unconventional monetary policy action where a central bank purchases predetermined amounts of government bonds or other financial assets in order to bring down longer-term interest rates on savings and loans; and to stimulate economic activity [7]. QE could not only help increase the money supply in the market, but also lower the long-term interest rate. The equation for calculating the long-term interest rate is:

\( i_{t}^{n}=\frac{{i_{t}}+ {E_{{t^{i}}t+1}}+..+{E_{{t^{i}}t+n-1}}}{n} + θ_{t}^{n} \) (1)

Once people’s expectations of future inflation fall due to the ECB’s forward guidance promising to maintain accommodative policies until economic conditions improve, long-term interest rates naturally fall as well. The ECB enhances demand for these securities by purchasing them, which drives up their prices and down their yields. By lowering the total cost of borrowing, this procedure facilitates consumers' and enterprises' ability to finance expenses. Also, QE conveys the ECB's dedication to bolstering the economy, a move that may boost investor confidence and stabilize financial conditions.

3.2. The Policies ECB should Adopt to Solve the Shocks Caused by Russia & Ukraine Conflict

As a major supplier of energy to the whole of Europe, the surge in energy prices and inflation caused by the war between Russia and Ukraine would shift the PC curve to the left, from the PC to the PC’, which would lead to higher inflation and less output in the Eurozone, as shown in Figure 3. For the purpose of keeping inflation under control and preventing a recession, the ECB must carefully balance its monetary policy. To show that it is committed to reining in inflation, the first thing the ECB ought to think about is a modest rate increase. By making borrowing more expensive, rising interest rates can help lower demand-pull inflation by reducing excessive expenditure. But the ECB should refrain from making hasty rate increases that would choke off economic expansion, especially during a time of unrest in the geopolitical arena.

Figure 3: The impact of the Russia-Ukraine Conflict on the IS-PC-MR model

Instead of increasing the interest rate, the ECB needs to consider adjusting and phasing out the QE policies that were used to stimulate the economic recovery within Europe after the pandemic in order to control the inflation rate. Reducing the rate of asset purchases keeps inflation within the European Central Bank's target range of close to but below 2% and helps protect the economy from overheating as inflationary pressures increase and economic conditions improve. Furthermore, large-scale asset acquisitions on a continuous basis have the potential to skew financial markets and create imbalances like asset bubbles. By letting market forces have a bigger say in how asset values are determined, tapering quantitative easing (QE) helps reduce these risks and fosters stronger, more stable financial markets. Allen et al. agreed that prompt and timely moves to reduce the mismatch by reducing the duration of assets and increasing that of liabilities will limit both the financial risks to the central bank and the risk of disruption to bond markets [8].

Besides, the ECB should back structural changes and energy infrastructure investments in order to alleviate the particular supply-side shock in the energy markets. Promoting investments in energy efficiency and renewable energy sources can lessen the Eurozone's reliance on fossil fuels from unstable regions, averting supply problems in the future. Long-term energy price stabilization and the Eurozone's green transformation would both be aided by these investments.

4. The Actual Polices EU Adopted Facing COVID-19 and Russia-Ukraine Conflict

In order to counteract the economic shocks brought on by COVID-19 and the crisis between Russia and Ukraine, the European Central Bank (ECB) really implemented a number of important actions. The objectives of these actions were to control inflationary pressures, maintain financial markets, and stabilize the economy. Key policies include the Pandemic Emergency Purchase Programme (PEPP), the Recovery and Resilience Facility (RRF), the tapering of QE and so on.

To begin with, in response to the unprecedented challenges posed by COVID-19, the ECB introduced the PEPP in March 2020. The PEPP is a temporary asset purchase program covering private and public sector securities [9]. This temporary asset purchase program was created to address the serious threats to the transmission mechanism of monetary policy and the outlook for the economy. It started with an initial budget of €750 billion and eventually extended to €1.85 trillion. Flexible purchases across asset classes and jurisdictions were made possible by the PEPP, which helped the ECB maintain the seamless implementation of monetary policy and react quickly to market disturbances. This adaptability was essential for keeping attractive financing circumstances, supporting sovereign debt markets, and stabilizing financial markets.

The EU RECOVERY AND RESILIENCE FACILITY (RRF) is a crucial part of the EU's larger response to the economic effects of COVID-19, even if it is not an ECB policy directly. The RRF offers grants and loans to member states in support of investments and reforms meant to promote a sustainable recovery. It is financed by the NextGenerationEU recovery plan. The RRF's fiscal assistance was supplemented by the ECB's accommodating monetary policies, which made sure there was enough liquidity to fund recovery initiatives. According to Watzka and Watt, and in direct consequence of the increased GDP, the RRF will lead to lower public debt ratios-between 2.0% and 4.4% below baseline for southern European countries in 2023 [10].

In the face of the conflict between Russia and Ukraine, the ECB quickly adjusted its fiscal and monetary policies. Firstly, from July 2022, ECB started the interest rate hike that it raised the deposit faculty rate (DFR) by 50 bps, which was increased 8 times throughout the year, eventually reaching 4.00% in September 2023 [11].

What’s more, the ECB started to reduce its quantitative easing (QE) programs, such as PEPP, as inflationary pressures started to rise and economic circumstances started to improve. In order to minimize the risks of inflation and keep the economy from overheating, tapering entailed progressively slowing down the rate of asset purchases. On March 10th of this year, the ECB shocked the market on by announcing an early end to its tapering program and ending up with asset purchases sooner than expected. Based on its assessment that the economy was starting to recover and that extraordinary monetary support could be reduced without endangering financial stability, the ECB decided to taper.

Last but not least, to solve the energy supply crisis caused by the conflict, the ECB also highlighted the importance of fiscal measures and structural reforms. In order to get rid of energy dependence on Russia, European countries and the European Council promoted the implementation of a series of policies, such as strengthening international trade, seeking new energy exporters, energy types, accelerating research and development of new energy, and so on. According to Papunen, EU dependency on Russian energy, especially for gas, has fallen significantly. Moreover, the value of exports to Russia fell by 62% between February 2022 and September 2023, while imports from Russia fell by 81% in this period [12].

5. Conclusion

The analysis highlights the serious economic effects of the COVID-19 epidemic and the Russia-Ukraine conflict on the Eurozone, emphasizing notable interruptions in important industries and high rates of inflation. The paper critically assesses the ECB's monetary policy responses to these crises using the IS-PC-MR model. The results show that although the expansionary policies of the European Central Bank (ECB), like quantitative easing and interest rate decreases, were important in reducing the economic shock caused by the pandemic, the ensuing inflationary pressures required a deliberate relaxing of these policies. The report also highlights how important it is for the ECB to strike a balance between controlling inflation and promoting economic growth, particularly in light of geopolitical concerns like the conflict between Russia and Ukraine. The ECB's structural reforms and energy infrastructure investments are pivotal in reducing dependency on volatile regions and ensuring long-term economic stability. Moreover, the study shows that the ECB is using both short-term monetary measures and long-term strategic planning to manage the economic effects of the conflict between Russia and Ukraine. To lessen the impact of energy price volatility on the Eurozone economy, this involves improving energy security and diversifying energy sources. Achieving economic resilience also emphasizes the significance of coordinated fiscal measures among Eurozone member states and international cooperation. This study presents insightful suggestions for future policy frameworks to more effectively manage economic shocks, in addition to a thorough examination of previous policy actions. The research holds importance as it provides insights into the dynamics of monetary policy during times of crisis and can help shape more robust economic approaches for the Eurozone. By investigating the long-term consequences of these measures and looking at other possible crisis scenarios, future research could build on this work and provide a stronger framework for economic policy inside the Eurozone.

References

[1]. European Central Bank. (2021). Annual report 2020, April 14. https://www.ecb.europa.eu/press/annual-reports-financial-statements/annual/html/ar2020~4960fb81ae.en.html

[2]. World Bank. (2023) Euro Area GDP. https://tradingeconomics.com/euro-area/gdp

[3]. European Union. (2020). 2020 SPC Annual Review of the Social Protection Performance Monitor (SPPM) and Developments in Social Protection Policies. EU Publications, Nov 09. https://doi.org/10.2767/700431

[4]. European Investment Bank. (2022a). How bad is the Ukraine war for the European recovery? ECONOMICS – THEMATIC STUDIES. https://doi.org/10.2867/945503

[5]. Sharma, K., Mittal, K., & Kondle, R. (2024). THE RUSSIA-UKRAINE CONFLICT: IMPLICATIONS FOR GLOBAL FOOD SECURITY, TRADE, AND ECONOMIC STABILITY. https://doi.org/10.26480/faer.02.2024.39.45

[6]. Carlin, W., Soskice, D. (2005). The 3-equation new Keynesian Model --- a graphical exposition. [J] Topics in Macroeconomics, 5(1). https://doi.org/10.2202/1534-6005.1299

[7]. Bank of England. (2024). Quantitative easing, May 10. https://www.bankofengland.co.uk/monetary-policy/quantitative-easing

[8]. Allen, W. A. (2021). Quantitative tightening: Protecting monetary policy from fiscal encroachment. [J] SSRN Electronic Journal. https://doi.org/10.2139/ssrn.3895541

[9]. European Central Bank. (2024). Pandemic emergency purchase programme, July 3. https://www.ecb.europa.eu/mopo/implement/pepp/html/index.en.html

[10]. Watzka, S., & Watt, A. (2020). THE MACROECONOMIC EFFECTS OF THE EU RECOVERY AND RESILIENCE FACILITY. Macroeconomic Policy Institute Policy Brief, No. 98

[11]. Lane, P.R. (2024), “The 2021-2022 inflationsurges and monetary policy in the euro area", in English, B., Forbes, k. and Ubide, Á.(eds.), Monetary Policy Responses to the Post-Pandemic Inflation, CEPR Press,February, pp. 65-95.

[12]. Papunen, A. (2024). Economic Impact of Russia’s War on Ukraine: European Council Response. European Parliament

Cite this article

Li,J. (2024). The Economic Impact of the COVID-19 and the Russia-Ukraine Conflict on the Eurozone and the Central Bank's Corresponding Policies. Lecture Notes in Education Psychology and Public Media,63,100-106.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 2nd International Conference on Global Politics and Socio-Humanities

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. European Central Bank. (2021). Annual report 2020, April 14. https://www.ecb.europa.eu/press/annual-reports-financial-statements/annual/html/ar2020~4960fb81ae.en.html

[2]. World Bank. (2023) Euro Area GDP. https://tradingeconomics.com/euro-area/gdp

[3]. European Union. (2020). 2020 SPC Annual Review of the Social Protection Performance Monitor (SPPM) and Developments in Social Protection Policies. EU Publications, Nov 09. https://doi.org/10.2767/700431

[4]. European Investment Bank. (2022a). How bad is the Ukraine war for the European recovery? ECONOMICS – THEMATIC STUDIES. https://doi.org/10.2867/945503

[5]. Sharma, K., Mittal, K., & Kondle, R. (2024). THE RUSSIA-UKRAINE CONFLICT: IMPLICATIONS FOR GLOBAL FOOD SECURITY, TRADE, AND ECONOMIC STABILITY. https://doi.org/10.26480/faer.02.2024.39.45

[6]. Carlin, W., Soskice, D. (2005). The 3-equation new Keynesian Model --- a graphical exposition. [J] Topics in Macroeconomics, 5(1). https://doi.org/10.2202/1534-6005.1299

[7]. Bank of England. (2024). Quantitative easing, May 10. https://www.bankofengland.co.uk/monetary-policy/quantitative-easing

[8]. Allen, W. A. (2021). Quantitative tightening: Protecting monetary policy from fiscal encroachment. [J] SSRN Electronic Journal. https://doi.org/10.2139/ssrn.3895541

[9]. European Central Bank. (2024). Pandemic emergency purchase programme, July 3. https://www.ecb.europa.eu/mopo/implement/pepp/html/index.en.html

[10]. Watzka, S., & Watt, A. (2020). THE MACROECONOMIC EFFECTS OF THE EU RECOVERY AND RESILIENCE FACILITY. Macroeconomic Policy Institute Policy Brief, No. 98

[11]. Lane, P.R. (2024), “The 2021-2022 inflationsurges and monetary policy in the euro area", in English, B., Forbes, k. and Ubide, Á.(eds.), Monetary Policy Responses to the Post-Pandemic Inflation, CEPR Press,February, pp. 65-95.

[12]. Papunen, A. (2024). Economic Impact of Russia’s War on Ukraine: European Council Response. European Parliament