1. Introduction

ESG—an evaluation system covering the environmental, social, and governance dimensions—is used to measure a company’s sustainability performance. The concept was first proposed in 2004. Its core objective is to assess a firm’s capacity for long-term value creation in the field of sustainable development and to provide a basis for evaluating risks and opportunities in investment decision-making.

The development of ESG can be roughly divided into three stages. In the initial stage (2004–2009), ESG was largely regarded as a form of moral or ethical investing, and investors began to pay attention to corporate social responsibility. In 2006, the Global Reporting Initiative (GRI) released the first edition of its Sustainability Reporting Guidelines, providing a framework for corporate ESG information disclosure. From 2010 to 2015, as climate change and sustainable development issues came to the fore, ESG entered a growth phase. ESG investing was gradually accepted by mainstream investors, and governments and regulators in many countries began actively promoting ESG-related laws and policies [1].

Meanwhile, rating agencies and research institutions started to develop ESG rating models to support investor decision-making. From 2016 to the present, ESG has entered a maturity phase. ESG investment has grown rapidly worldwide and has become one of the mainstream investment strategies. Investors now look not only at companies’ ESG performance but also demand greater disclosure of related data. Against this backdrop, a large number of ESG rating models and empirical studies have emerged, such as MSCI ESG Ratings, Sustainalytics, and CDP (formerly the Carbon Disclosure Project) [2]. These models and studies help investors gain a deeper understanding of corporate ESG risks and opportunities, thereby further advancing the development of sustainable investing.

2. ESG disclosure and regulation

In the current context where global capital flows and climate risks are accelerating across borders, ESG disclosure has risen to become as important as the balance sheet. Unified, comparable, and verifiable ESG disclosure not only determines whether capital can be priced frictionlessly in cross-border markets, but is also increasingly a core institutional requirement in the competition among countries for comparative advantages in green industries.

At present, ESG disclosure and regulation show significant regional differences.

In the European Union, the ESG assessment system is relatively mature. Through legislative measures, the EU has made ESG standardization and disclosure frameworks mandatory, ensuring that companies with high ESG ratings receive preferential access to “dark green funds.” In addition, the EU has explicitly defined environmentally sustainable economic activities, requiring enterprises to disclose more than 400 data points and raising the environmental weighting in rating models to over 45%. Although these standardization policies have significantly reduced indicator discrepancies among rating agencies, the issue of data accuracy—still highly dependent on third-party verification—remains unresolved [3].

In the United States, ESG assessment is shaped by both market forces and political contestation. The SEC’s new climate disclosure rule requires the reporting of Scope 1–3 carbon emissions, but its implementation has been delayed due to lawsuits filed by 26 states, resulting in only 65% ESG data coverage among U.S. companies. The ESG Disclosure Simplification Act mandates S&P 500 constituent firms to disclose risk, pushing the assessment system toward a focus on governance-related risks. However, frequent policy reversals have forced companies to adjust disclosure strategies reactively, undermining the transparency of rating methodologies [4].

In China, ESG assessment has already developed a relatively comprehensive policy framework, though the standardization of ESG data still requires improvement. China adopts a dual strategy of policy-driven guidance combined with sector-specific differentiation, significantly strengthening mandatory disclosure of environmental data—particularly in heavily polluting industries, where the environmental weighting accounts for as much as 75%. The ESG guidelines issued by the Shanghai and Shenzhen stock exchanges have effectively promoted standardized disclosure in the governance dimension. However, social indicators remain largely voluntary, resulting in lower data comparability relative to international standards. ESG rating models in China tend to be “environment-dominant,” but limited capacity for cross-industry data integration constrains the consistency of rating outcomes [5].

3. ESG composition

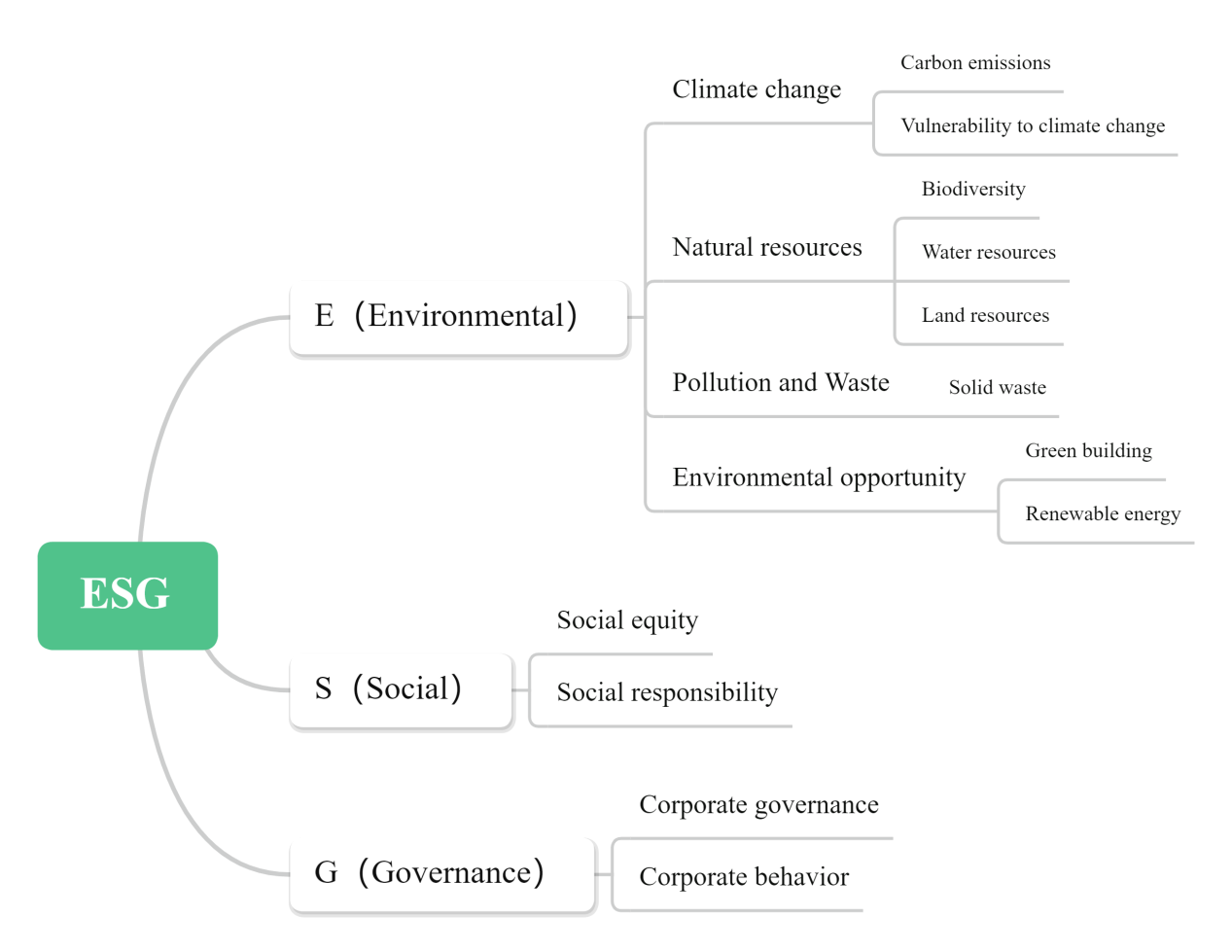

As shown in Figure 1, ESG mainly consists of three dimensions.

3.1. Environmental dimension (E)

The environmental dimension primarily focuses on the impacts that a company has on the ecological environment and its capabilities in resource management. The main components are as follows:

3.1.1. Climate change

(1) Carbon Emissions

Carbon emissions are a key indicator for measuring a company’s impact on climate change. They refer to the total amount of carbon dioxide (CO₂) and other greenhouse gases (such as methane and nitrous oxide) released into the atmosphere during production and operations. Higher carbon emissions indicate a greater contribution to global warming, which may result in more severe climate consequences, such as increased extreme weather events and rising sea levels.

(2) Climate Vulnerability

Climate vulnerability refers to the risks and challenges a company faces due to climate change, including physical risks (e.g., extreme weather events, sea-level rise) and transition risks (e.g., policy changes, shifts in market preferences). Assessing climate vulnerability helps companies identify and manage potential climate-related risks and develop adaptation strategies to mitigate adverse impacts.

3.1.2. Natural resources

(1) Biodiversity

Biodiversity refers to the richness of species, reflecting the diversity and complexity within an ecosystem. It is an important indicator of ecosystem health and stability. Loss of biodiversity can lead to ecosystem function degradation, affecting ecosystem stability and service provision, negatively impacting productivity and resilience, and ultimately impairing the normal functioning of environmental systems.

(2) Water Resources

Water resources encompass the total water used by a company, including surface water, groundwater, and reclaimed water. Effective management of water resources is crucial for sustainable operations, as it reflects a company’s efficiency and sustainability in water usage. Proper water management can reduce waste and pollution, lower operational costs, and ensure the long-term availability of water resources.

(3) Land Resources

Land resources refer to the land utilized by a company, including land area, land use types, and land quality. This indicator reflects the sustainability of land use. Proper land management helps optimize land-use efficiency, reduce land degradation, and prevent ecological damage.

3.1.3. Pollution and waste

(1) Solid Waste

Solid waste includes all solid materials generated during production and operations, such as industrial residues, construction debris, and municipal waste. Effective waste management strategies are crucial for minimizing negative environmental impacts and enhancing resource recycling. Core aspects of solid waste management include setting emission standards, optimizing resource utilization efficiency, establishing environmental management systems, and applying innovative technologies. Inadequate handling may adversely affect environmental performance and regulatory compliance.

3.1.4. Environmental opportunities

(1) Green Buildings

Green buildings are designed, constructed, and operated to minimize negative environmental impacts while maximizing energy and resource efficiency. This includes the use of eco-friendly materials, energy-saving equipment, and intelligent management systems. Green buildings help reduce carbon emissions and resource consumption in the construction sector, improving overall environmental performance.

(2) Renewable Energy

Renewable energy refers to energy sources that can naturally regenerate, such as solar, wind, hydro, and biomass energy. Utilizing renewable energy helps reduce reliance on fossil fuels, lower carbon emissions, and facilitate the energy transition. It directly reduces lifecycle greenhouse gas emissions and ecological footprints, serving as a core metric for quantifying the strength of a company–Earth system negative feedback within the environmental dimension.

3.2. Social dimension (S)

The social dimension focuses on a company’s relationships with stakeholders and its fulfillment of social responsibilities, primarily encompassing social equity and corporate responsibility. Deficiencies in the social dimension may lead to strained stakeholder relations, social conflicts, and public pressure, thereby affecting a company’s social reputation and market competitiveness. These factors ultimately influence a company’s capacity for sustainable development and indirectly affect its environmental investments and performance. For example, if a company faces difficulties arising from social dimension issues, it may neglect environmental responsibilities, resulting in weaker environmental management, increased resource waste, higher pollution emissions, and ultimately compromised environmental sustainability.

3.3. Governance dimension (G)

The governance dimension measures a company’s decision-making mechanisms and risk management capabilities, including corporate governance structures and corporate behavior. Weaknesses in governance can lead to poor decision-making, internal management disorder, and inadequate risk control, which negatively affect operational efficiency and long-term development. These deficiencies also indirectly impact environmental management investments and outcomes. A lack of effective governance mechanisms—such as insufficient board independence, unreasonable executive compensation, inadequate anti-corruption systems, or poor protection of shareholder rights—may result in short-sighted management decisions, inefficient resource allocation, and lack of internal oversight. Such issues not only compromise operational efficiency and market competitiveness but can also reduce a company’s commitment to environmental management, leading to insufficient implementation and poor environmental performance.

4. Challenges and opportunities in the environmental dimension

The development of the environmental dimension is at a critical stage, evolving from mere “carbon emissions disclosure” toward “full life-cycle management.” The social and governance dimensions can provide strong support and effective extension for this development through mechanisms, resource allocation, and risk governance.

4.1. Interactions and linkages between the environmental and social dimensions

The relationship between the environmental and social dimensions is not a simple trade-off between environmental protection and human rights; rather, it exhibits a significant nonlinear connection. Advancements in the environmental dimension often trigger new social issues, while the capability and inclusiveness of the social dimension directly determine whether environmental goals can be effectively implemented and sustained without generating negative consequences. Improvements in environmental governance can reduce community health risks, enhance social reputation, lower operational costs, and create virtuous feedback loops. Conversely, environmental risk events may trigger chain reactions by worsening community relations. The higher the inclusiveness of the social dimension, the more fully the potential of environmental technologies can be realized. Ignoring the social dimension, however, can cause exponential increases in transition costs and social friction, ultimately undermining the achievement of environmental objectives.

4.2. Interactions and linkages between the environmental and governance dimensions

The relationship between the environmental and governance dimensions is not a simple “supervision–execution” dynamic but rather a dynamic feedback system. The environmental dimension is not only a core risk that governance must manage but also serves as a catalyst for reshaping governance structures, processes, and incentive mechanisms. Governance frameworks act as carriers for environmental strategies while simultaneously mitigating associated risks. Currently, environmental performance has become a key metric for institutional investors assessing governance quality, and the robustness of governance structures directly affects the implementation of environmental policies and the quality of ESG disclosure. Only when governance fully integrates the environmental dimension into fiduciary responsibility, resource allocation, and incentive mechanisms can environmental protection evolve from an external issue into an internal driver of corporate growth.

4.3. Interactions and linkages between the social and governance dimensions

The relationship between the social and governance dimensions is not a one-way “service” relationship but a process of bilateral renegotiation between social contracts and governance structures. The social dimension, as the demand side of governance for environmental matters, continually introduces new rights, demands, and risk scenarios, forcing governance to adjust power distribution, disclosure practices, and incentive contracts. Conversely, governance institutional design directly determines whether social demands are recognized, appropriately valued, and ultimately realized.

As shown in Figure 2, the three ESG dimensions influence and reinforce one another, forming a “boundary–baseline–mechanism” closed loop. The environmental dimension establishes ecological boundaries, the social dimension sets the baseline for societal behavior, and the governance dimension provides continuously iterating governance mechanisms. Together, they form the core framework for corporate sustainable development. Ultimately, through governance rules and social resilience, the social and governance dimensions transform environmental risk burdens into contemporary equity and intergenerational shared value, achieving a substantive conversion of “green” initiatives into economic growth.

5. Opportunities and challenges

With the widespread adoption of sustainable development concepts, ESG development shows tremendous potential. First, the institutional advantages of relevant policies and standards are being increasingly realized. Global regulatory frameworks are gradually converging, mandatory disclosure systems are being implemented, and standards continue to improve. Regional policy innovations and local incentives are also developing, leading to explosive growth in both ESG-related talent demand and job supply. Second, corporate sustainability and financial performance are increasingly central to capital markets. Creating sustainable value not only reduces operating costs but also improves financial indicators, lowering financing costs, enhancing corporate valuation and market capitalization, strengthening supply chain access advantages, and ensuring long-term financial stability.

However, ESG development faces multiple challenges. Conflicts between long-term sustainability strategies and short-term economic gains can hinder sustainable development, damage the environment, and weaken investor confidence. Slow returns on environmental technology investments and high-carbon asset risks can drag down corporate finances and threaten ecosystems, affecting capital markets. Small- and medium-sized enterprises (SMEs), due to tight cash flow, may neglect sustainability, reducing their capacity to manage environmental risks and potentially facing rising compliance costs, compressed profits, and decreased investment attractiveness. Insufficient policy incentives and poor policy coordination make it difficult for companies to convert environmental investments into economic returns, and a lack of data for investors hampers efficient capital allocation to green industries. Gaps in industry experience, organizational and cultural conflicts, imperfect data governance, and a shortage of skilled professionals limit innovation in environmental technology and the accurate assessment of environmental risks, affecting investors’ ability to evaluate environment-related financial risks. Short-term profit-seeking at the expense of environmental responsibility can lead to environmental degradation that backfires on financial health and market reputation, undermining recognition of long-term investment value.

6. Conclusion

Since its inception in 2004, ESG has evolved from a moral investment tool into a globally mainstream investment strategy and now serves as a core framework for assessing corporate long-term sustainable value and guiding investment decisions. ESG disclosure and regulation, through laws, standards, and market mechanisms, compel or guide companies to disclose and verify key information, aiming to create a system that is comparable across markets, risk-controllable, and efficient in allocating green resources. Currently, regional differences remain evident. The environmental dimension focuses on a company’s impact on ecological boundaries and opportunities, covering carbon emissions, climate vulnerability, water resources, biodiversity, waste management, green buildings, and renewable energy across the full lifecycle. The social and governance dimensions set the baseline for social behavior and provide continuously iterating governance mechanisms. The social dimension evaluates stakeholder relations and corporate responsibility, while the governance dimension supervises decision-making, risk management, and fiduciary duties. Together, they transform external risks into internal growth drivers. The environmental dimension is transitioning from “carbon disclosure” to “full life-cycle management” but faces challenges in data governance and technological barriers. When social inclusiveness and governance mechanisms are upgraded in parallel, ecological risks can be transformed into green growth dividends. Short-term cash flow pressures, interdisciplinary talent bottlenecks, and high-carbon asset impairment risks hinder ESG implementation. However, unified regulation generates institutional benefits, sustainability premiums reduce financing costs, and talent demand is rising—gradually converting green constraints into growth momentum. When regional institutional advantages, green capital valuation premiums, and interdisciplinary talent supply are released simultaneously, ESG can overcome cash flow and data barriers, fusing ecological boundaries, social baselines, and governance mechanisms into the next-generation global growth engine.

References

[1]. Annesi, N., Battaglia, M., Ceglia, I., & Mercuri, F. (2025). Navigating paradoxes: Building a sustainable strategy for an integrated ESG corporate governance.Management Decision, 63(2), 531–559.

[2]. Zhang, M., & Chang, Y. (2024). ESG studies the impact on enterprise investment and financing decisions. Journal of Economics,Finance and Accounting Studies, 6(3), 121-131.

[3]. Stamelos, C. (2022). Corporate sustainability and ESG factors in Greece and Cyprus: Compliance, laws and business practices, towards a holistic approach. InterEULawEast: Journal for the International and European Law,Economics and Market Integrations, 9(2), 289-313.

[4]. Xu, Z., Wang, Z., & Su, Y. (2022). Analysis on the path for enterprises to improve ESG under the background of digital economy.Frontiers in Humanities and Social Sciences, 2(5), 95-102.

[5]. Hu, J., Zhang, H., Guo, W., et al. (2024). ESG practice and development in China's enabling industry: Analysis of ESG report by industry and construction of rating index matrix.Chinese Sustainable Development Review, 3(1), 17-32.

Cite this article

Su,Y. (2025). Construction of ESG models and comparative analysis of ratings. Advances in Engineering Innovation,16(8),169-174.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Journal:Advances in Engineering Innovation

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Annesi, N., Battaglia, M., Ceglia, I., & Mercuri, F. (2025). Navigating paradoxes: Building a sustainable strategy for an integrated ESG corporate governance.Management Decision, 63(2), 531–559.

[2]. Zhang, M., & Chang, Y. (2024). ESG studies the impact on enterprise investment and financing decisions. Journal of Economics,Finance and Accounting Studies, 6(3), 121-131.

[3]. Stamelos, C. (2022). Corporate sustainability and ESG factors in Greece and Cyprus: Compliance, laws and business practices, towards a holistic approach. InterEULawEast: Journal for the International and European Law,Economics and Market Integrations, 9(2), 289-313.

[4]. Xu, Z., Wang, Z., & Su, Y. (2022). Analysis on the path for enterprises to improve ESG under the background of digital economy.Frontiers in Humanities and Social Sciences, 2(5), 95-102.

[5]. Hu, J., Zhang, H., Guo, W., et al. (2024). ESG practice and development in China's enabling industry: Analysis of ESG report by industry and construction of rating index matrix.Chinese Sustainable Development Review, 3(1), 17-32.