1 Introduction

The real estate sector in China, considered a foundational industry of the economy, holds significant influence in driving economic growth due to the swift advancement of the nation's economy and the hastened process of urbanization. [18] However, the development of the real estate industry in the past few decades has also brought a series of problems and challenges. Therefore, it is of great practical significance to study the influence of the real estate industry on the economic growth of our country. This paper will explore the impact of the real estate industry on China's economic growth.

This paper mainly discusses the impact of the real estate industry on China's economy from four aspects. The relationship between real estate and economic expansion in China is the initial focus. Subsequently, the policy evolution of the Chinese real estate sector's growth is examined. Lastly, difficulties that exist in the advancement of the Chinese real estate industry are addressed. Fourth, future development countermeasure of real estate industry of our country.

Firstly, we clarify the core concepts studied in this paper. The real estate industry refers to a series of economic activities involving real estate development, sales, leasing, and related services [25]. The term economic growth pertains to the increase in the overall economy of a country within a specific timeframe, typically evaluated through the rise in gross domestic product (GDP) [25]; The average growth rate is an index that measures the average growth rate of an index over a certain period.

This paper will take data analysis and literature review of statistical data as the main research methods, and combine the conclusions drawn from the literature with data analysis, so as to obtain an objective evaluation of the impact of the real estate industry on China's economic growth. The structure of my paper consists of five sections. To elaborate, the introductory section delves into the background, content, and scope of the research, elucidates the methodology and aims of the study, and outlines the organization of the paper. The subsequent section will delve into the review of relevant research findings, as well as recapitulate the current theoretical frameworks and empirical approaches. In the discussion part, I will discuss the contribution of the real estate industry to China's economic growth through the analysis of statistical data, and analyze the impact of the promulgation of policies on the real estate industry by reviewing the policies of previous years. Summarizing the research results, proposing pertinent proposals and anticipating the future growth trend - this is the conclusion.

2 Research Review

2.1 The Related Theory of the Real Estate Industry and Economic Growth

2.1.1 Industry-Related Theories

Industry to some extent can refer to the production of materials to form an industry, such as manufacturing, agriculture, industry, etc. Industry is broad, it includes different industrial structures, and although the division of labour between different industries, the mode of operation is not the same, but they are all around their core products. In a broad sense, when the input of one industry leads to the output of another, the relationship between input and output is expressed quantitatively, that is, a conceptual understanding of the industrial structure. Industrial structure is a complex network of relationships, which is the key to the healthy and orderly development of the economy. China's industrial structure, generally, refers to the composition and different proportions of various industries that promote economic growth. According to the traditional economic growth theory, economic growth is mainly due to the huge capital, labor force, and advanced technology [24].

Economic growth is achieved through the continuous development of various closely related industries, and various complex relationships generated in the process of economic development can also be called industrial association. The real estate sector plays a crucial role in driving economic growth in China and holds a firm position in the country's economic advancement. Its growth not only offers housing for residents, but also supplies essential amenities and technology support to various industries. In the process of national economic development, various departments are closely related to each other, and no department can operate alone without contacting other departments. Industries such as real estate, which are developing rapidly and contributing greatly to the economy, will also inevitably have economic linkages with many sectors. The real estate industry can provide business places and infrastructure for other industries, as well as a good development environment for other industries. In addition, the rapid development of other industries will generate a continuous demand for the real estate industry, thus promoting the development of the real estate industry. Therefore, it can be considered that the real estate industry and other industries are a relationship of mutual promotion and influence. The real estate industry can achieve the purpose of influencing economic growth by promoting the development of other industries.

2.1.2 Economic Growth Theory

The most common definition of economic growth is the rate of change of per capital national income measured at constant prices [10]. The early economic pioneers began their focus on national income with taxes, which they sought to determine by calculating the level and distribution conditions of national income at static points in time. Mercantilism was the original economic theory of the bourgeoisie, coinciding with the Renaissance. Its main point of view is that precious metals are the only standard to measure wealth, and it is necessary to maintain a surplus in foreign trade. Unlike the mercantilist school, agronomists believe that exchange is an equivalent act and that circulation cannot increase wealth. Khounnai represented the interests of agricultural capitalists, such as leasehold farmers. Under Kunnai, the understanding of French economic growth was very important in the history of economic science. The realization of a nation's wealth is generated from this, rather than the circulation of products in the field of circulation.

Classical political economy is the title of a large number of economic works and documents published by Marx in Britain and continental European countries in the 17th and 18th centuries [10]. Classical political economists were in the stage of the formation and development of the capitalist production model and did a lot of theoretical research for the establishment of the capitalist system. According to Adam Smith the main way to increase the wealth of the country and promote economic growth is to increase the number of workers, increase capital input, strengthen the division of labor, and improve machinery to increase productivity. [25] At the same time, he also believes that all these factors can be solved by the market itself without much state intervention.

For more than 200 years, Smith's basic economic thought has become an important economic theory to promote the development of capitalism. According to David Ricardo, profit is the driving force of economic growth and social progress, while distribution is the subject of study in economics [25]. According to him, the main means to promote profit growth or economic growth is to increase labour productivity, shorten the necessary labour working hours, and reduce wages. Marx was one of those early economists who used mathematical tools to analyze economic theory. Marx's analyses of labor value, surplus value, capital accumulation, capitalist reproduction, and the total amount of social capital's reproduction and circulation all focus on economic growth matters.

At the beginning of the nineteenth century, capitalism gained a solid foothold in Europe and North America, and neoclassical economics theoretically studied and explored the limiting factors and conditions of economic growth under capitalism. The advancement of the information revolution and progress in science and technology, along with the restructuring of international organizations, have facilitated the growth of economic, trade, political, and cultural interactions between countries globally [25]. The new growth theory attaches great importance to the study of knowledge spillovers, investment in human capital, R&D, increasing income, division of labor and specialization, learning by doing, open economy, and monopoly.

New growth theories attach great importance to the role of institutional arrangements, government, and policies in economic growth. The new institutional economists present the most comprehensive and authoritative study of economic growth presented by Max Weber in the 1920s: "Economic growth depends on capitalist accumulation, and capitalism depends on the capitalist entrepreneur class, But entrepreneurs can only be active if there are proper religious values and civic virtues." North, the founder of new institutional economics, once pointed out that efficient economic organization is the key to economic growth, and the key factor of economic growth is institutions and their innovation. [10]

2.2 Positive Impact of Real Estate on Economic Growth

Lu Kuan [14] asserts that the rapid advancement of the real estate sector has significantly boosted the overall economic progress of the nation, with real estate development emerging as a key cornerstone in enhancing the quality of life and fostering stable growth of the societal economy. The real estate industry and the national economy share a strong interconnectedness as they mutually support and reinforce one another.

The real estate sector, a critical element of China's macro economy, is situated at the midpoint of the national economic chain. This sector is responsible for investing, producing and consuming three development requirements for related industries, which in turn leads to an upsurge in upstream and downstream production, thereby stimulating the macro economy [8]. Additionally, the real estate industry-related tax rate is increasing and its overall proportion is also on the rise [9].

The real estate economy has a beneficial impact on the national economic growth, such as altering urban investment structures, stimulating the growth of related industries, augmenting labor and employment opportunities, and enhancing the scientific character of urban construction land. The expansion of the real estate industry in a region will spur the expansion of enterprise output throughout the entire industrial chain, or the effect of the real estate industry's spillover [11]. For example, the development and sales of real estate will correspondingly have a strong driving effect on the tertiary industry such as logistics finance [20]. The prosperity of China's real estate market is propelled by the ongoing expansion of its economy (Real Estate Network Database of State Information Center, 2002; 2015). Real estate development investment is conducive to stimulating real estate production, and real estate production serves real estate, and the upgrading of consumer real estate promotes new real estate development investment. The land transfer fee required for real estate is the main component of government-managed funds and the credit endorsement of local governments (Li et al., 2004).

When local governments relax land supply, the number of land available for development increases, and the investment in residential housing will increase accordingly, leading to the improvement of the overall production level of the society [4]. Expanding residential land availability can help ease the conflict between supply and demand while also fostering the robust growth of the real estate sector [2]. Simultaneously, effectively managing the possible hazards in the progression of the real estate industry necessitates a precise comprehension of the correlation between real estate market growth, real estate risks, and economic advancement (Pi et al.)., 2004).

2.3 The Negative Impact of the Real Estate Industry

After a brief period of rapid growth, the economic growth is detrimentally impacted by real estate investment lag items [3]. Specifically, the real estate economy will have an impact on the national economy, regional coordinated development and non- real estate sector. For the national economy: the decline in real estate-related consumption will lead to the decline in the overall consumption level of residents [6]. The negative effects of the real estate economy on the development of the national economy include: bringing about the problem of housing price bubble, hindering the industrial development, and affecting the market order (Lu, 2022). However, if the housing price rises too fast, it will have an inhibitory effect on household consumption through the "mortgage slave effect", "wealth effect" and "mortgage effect" [25]. In terms of the regional coordinated development: due to the uneven level of intermediary services and the uneven development of the real estate industry, which affects the coordinated development of regional services (Li et al., 2004).According to the Research Group of the National Bureau of Statistics in 2005, the real estate sector will crowd out the development of non-real estate industries in the national economy, leading to a lack of financial support for other economic sectors, hindering innovation within enterprises, and ultimately impacting long-term economic growth., 2015).

2.4 Relevant Regulation and Control Policies of the Real Estate Industry

The government has implemented certain regulations to regulate the real estate sector, in an effort to maximize its value and foster economic expansion. As Luo Peng and other scholars believe, moderate real estate regulation has the optimal effect on promoting the total factor productivity of local enterprises [15]. Here, I would like to mainly discuss the specific types and functions of relevant policies. First of all, the specific functions of the policy are as follows: 1. The implementation of the restriction policy can restrain the price of housing by increasing the cost of housing ownership and transfer, and with the flow of funds between cities [7,27]. Property tax is also an effective means to restrain housing price rises from the demand side [22]. 3.[19] 4. The housing demand inhibition in lower prices at the same time also will reduce social output, so the land supply regulation is a good real estate regulation policy [29] 5. Restricted, loans, restricted policy by limiting purchase qualification, financing channels and cash channels to reduce commercial housing sales, maintain the relevant market stability.[6] 6. Using scientific and reasonable credit, tax and other policies, Reduce the heat of property speculation in the real estate market, This can effectively reduce the economic risk of the real estate industry, Reflect the residential value of real estate (Lu, etc., 2022) 7.The real estate market must be tightened in time to address the issues of oversupply and supply and demand inclusion, while avoiding blind investment which could lead to a contradiction between supply and demand(Lu et al.)., 2022) In addition, Dai Jinping and other scholars believe that the policies of purchase restriction, loan restriction and sale restriction adopted by the government in order to stabilize the real estate market will have a negative effect on the macro economy.[6] 2. Conclusion that the real estate regulation policies on the demand side and the supply side have a heterogeneous impact on the macro economy. [6]

3 Discussion/ Development

3.1 The Interaction between China's Real Estate Industry and Economic Growth

Over the past decade, property has been on the rise. Due to mainly rely on housing reform, GDP growth, loose monetary policy, rapid urbanization and local government highly dependent on land finance, lead to rapid growth in real estate margins (no industry like the real estate industry can afford more than 20% interest rate of financing costs), far more than the average profit level of other industries. In the next 10 years, the profit level of the real estate industry will gradually return to the average profit level of all industries in the market, that is, about 8%~ 10%, and the era of excessive profits will no longer exist.

3.2 The Development Scale of China's Real Estate Industry

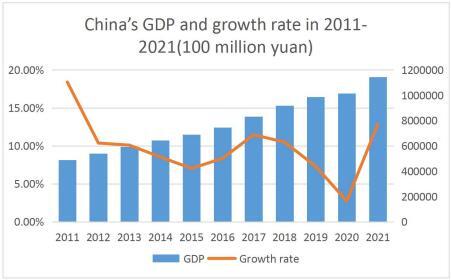

Table 1. China's GDP and growth rate in 2011-2021 (100 million yuan)

Time |

GDP |

Growth rate |

2011 |

487940.2 |

18.40% |

2012 |

538580.0 |

10.38% |

2013 |

592963.2 |

10. 10% |

2014 |

643563. 1 |

8.53% |

2015 |

688858.2 |

7.04% |

2016 |

746395. 1 |

8.35% |

2017 |

832035.9 |

11.47% |

2018 |

919281. 1 |

10.49% |

2019 |

986515.2 |

7.31% |

2020 |

1013567.0 |

2.74% |

2021 |

1143669.7 |

12.84% |

Figure 1. China’s GDP and growth rate in 2011-2021 Data Source: National Bureau of Statistics

In comparison to the decade prior, China's GDP growth rate has decreased in the past ten years; however, it still remains at a medium-high velocity. In particular, in 2017, China's GDP growth rate reached a staggering 11.47%. It is not easy for such a huge economy to maintain a growth rate of 6-9%. The reasons for such rapid economic development can be attributed to the following points. First, a stable political and social environment has provided a solid foundation for economic development. China has an excellent national cultural tradition and attaches great importance to education, which provides good talent and cultural support for economic development. Second, China's huge population size determines the imagination of its economic growth potential. On the one hand, driven by science and technology, the average production efficiency of the society is constantly improving, coupled with the huge population base, making a significant contribution to GDP. On the other hand, the large population also determines the vastness of the consumer market, and domestic demand has become an important part of the considerable proportion of China's total GDP. From 2011 to 2017, China's GDP growth rate remained relatively stable, fluctuating at around 10.61%. However, due to the outbreak of COVID-19, China's GDP growth has slowed down in the past four years but still maintained positive growth. In short, although China's GDP growth has declined relatively in the past decade, it still maintains a medium-high level.

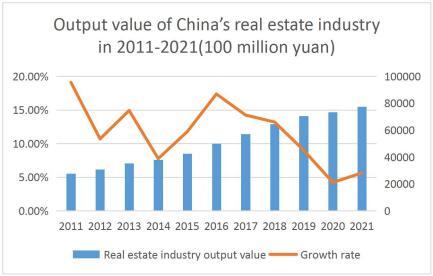

Table 2. Output value of China's real estate industry in 2011-2021 (100 million yuan)

Time |

Real estate industry output value |

Growth rate |

2011 |

27780.7 |

19.09% |

2012 |

30751.9 |

10.70% |

2013 |

35340.4 |

14.92% |

2014 |

38086.4 |

7.77% |

2015 |

42573.8 |

11.78% |

2016 |

49969.4 |

17.37% |

2017 |

57086.0 |

14.24% |

2018 |

64623.0 |

13.20% |

2019 |

70444.8 |

9.01% |

2020 |

73425.3 |

4.23% |

2021 |

77560.8 |

5.63% |

Figure 2. Output value of China’s real estate industry in 2011-2021 Data Source: National Bureau of Statistics

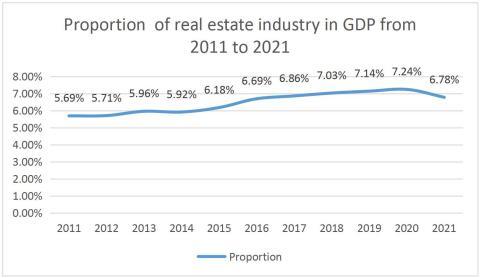

Figure 3. Proportion of real estate industry in GDP from 2011 to 2021 Data Source: National Bureau of Statistics

The data show that the growth rate of the output value of China's real estate industry shows different trends in different periods. From 2011 to 2014, the industry growth rate fluctuated, mainly due to the state's strict regulation and control policy on the real estate industry. However, as can be seen from the chart, from 2015 to 2016, the growth rate of real estate industry output value has picked up. However, affected by the economic situation and the epidemic, the growth rate of the real estate industry from 2017 to 2020 has shown a continuous downward trend. However, in the subsequent 2021, the growth rate of the real estate industry showed a slow recovery trend. Nevertheless, by 2021, the total output value of the real estate industry has reached 7.7 trillion yuan. On the whole, the real estate industry is still in a sustained growth stage, and the growth of the real estate industry may start to pick up in the next few years. This is because the epidemic is gradually under control, the overall economic situation is gradually recovering, and market demand and investment confidence are expected to gradually rise, thus promoting the real estate industry to return to the growth track.

Based on the data in Figure 3, I draw the following conclusions and suggestions: Observing the chart, we can see that the contribution of China's real estate industry to the economy is increasing year by year. This phenomenon is due to the acceleration of urbanization in recent years, a large number of people pour into the city, the rapid expansion of housing demand, and then promote the prosperity of the real estate market. At the same time, because the real estate industry chain is long, covering construction, home furnishing, finance and other industries, its rapid development has driven the prosperity of related industries, forming a positive industry chain effect. To guarantee the economic growth's sustainability, I believe the Government should bolster its backing for the real estate sector. At the same time, it is worth noting that the share of real estate in GDP declined slightly in 2020 after reaching a peak. This can be influenced by a number of factors, including the global economic environment and policy regulation. The outbreak of the epidemic in recent years has caused a lack of clarity for the national economy, and certain state control measures on the real estate market may cause some investors to decrease or abandon their investment, thus having an adverse effect on the growth of the real estate sector. In general, however, the real estate industry has been beneficial in advancing China's economic development.

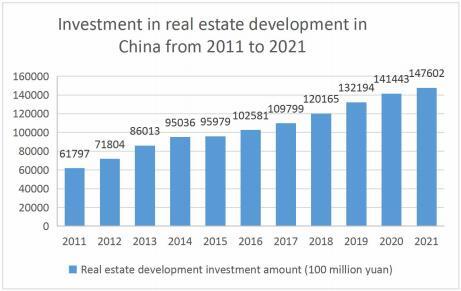

3.3 Investment and Sales of China's Real Estate Development

Figure 4. Investment in real estate development in China from 2011 to 2021

Data source: National Bureau of Statistics, China Economic and Industry Research Institute

Through the bar chart, we can draw a conclusion. From 2011 to 2021, investment in real estate development has been increasing year by year. The continuous heating up of real estate investment activities reveals the market's strong demand and firm confidence in the real estate industry. It can be concluded from the calculation that from 2011 to 2021, the average growth rate of the real estate industry (defined as the ratio between the growth rate of a certain indicator and the initial value in a specific period of time, which is used to measure the growth rate or change degree of the phenomenon or indicator over a period of time, and can be used to analyze the economic growth of enterprises, industries, regions and even countries) is about 9.23%. The result shows that the real estate industry has maintained a relatively stable growth trend in the past ten years, and has a certain market attraction and potential. It is likely that real estate investment will keep on increasing, and its contribution to the national economy will remain substantial in the future.

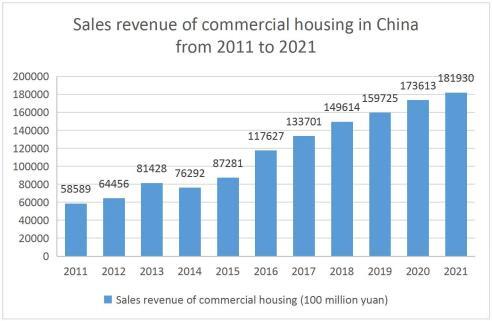

Figure 5. Sales revenue of commercial housing in China from 2011 to 2021

Data source: National Bureau of Statistics, China Economic and Industry Research Institute

For the decade spanning 2011 to 2021, China's real estate market has displayed a steady expansion, demonstrating its powerful growth momentum and immense market potential. The average annual rate of growth in total sales is 12.43%, indicating that the industry is experiencing strong growth. In general, China's real estate market has been growing in the past ten years, and the market size has been expanding, with great market potential gradually. We have reason to predict that in the coming period of time, under the dual role of government guidance and market regulation, China's real estate market will continue to grow and inject vitality into the sustainable development of the national economy.

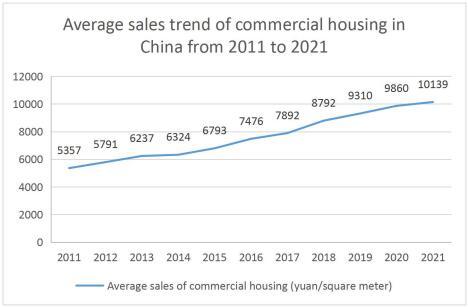

Figure 6. Average sales trend of commercial housing in China from 2011 to 2021

Data source: National Bureau of Statistics, China Economic and Industry Research Institute

From 2011 to 2021, the average price of real estate in our country a trend of rising year by year, this phenomenon reveals that the real estate market prices are rising steadily, highlighting the contradiction between the demand and supply shortage. Average growth rate is to show us the housing average selling price changes. During this period, the average growth rate of about 6.90%, this means that the property line Industry in the past ten years maintained a relatively stable growth, but growth differences between each year should not be ignored, especially the lower growth in 2014 and 2019, this phenomenon is mainly due to our country, policy and strengthen the purchase, the limit of credit, to curb the momentum of house prices from rising too fast, led to economic growth is slowing, Market expectations have changed, and buyers have a strong wait-and-see mood, resulting in poor real estate sales. In conclusion, our country's real estate market has made considerable progress in the past ten years.

However, every coin has two sides, and in the past ten years, the development of the real estate market has contributed to the growth of our country's GDP to some extent. However, at the same time, the excessively rapid rise in housing prices has also brought pressure on the majority of home buyers, squeezed the consumption potential, and to a certain extent produced inflation, which may have a negative effect on the country's economic growth if not controlled in time. Moving forward, it is imperative for the government to enhance oversight of the real estate sector in order to maintain a stable and robust market that supports the growth of the national economy and fosters social cohesion and stability.

3.4 The Disparity between the Expansion of Real Estate and Economic Growth in China Is Regional

6

Figure 7. Data from the National Bureau of Statistics and the China Economic and Industry Research Institute reveals the distribution of real estate development investment in various regions of China in 2021.

It can be seen from the data that in the real estate development investment of all regions in China, the western region ranks first with 22.64%. This phenomenon may be due to the policy support and resource advantages in the region, which attract many investors. This is mainly due to the great potential of the western region in the process of economic development and urbanization. In contrast, the central and eastern regions accounted for 21.The real estate development investment in the western region is only slightly higher, at 22.64%, compared to the 11% invested elsewhere. This may be due to the relatively developed economy and strong market demand in the central and eastern regions, which provide a good soil for real estate development and investment.In contrast, the northeast region has the least amount of investment in real estate development among the four regions, comprising a mere 3.64%. This may stem from the fact that the region has faced challenges such as economic transformation and population loss in recent years and has invested relatively little in real estate development. The northeast region has been plagued by structural problems and industrial transformation in recent years, resulting in a relatively weak real estate market. To sum up, there are significant differences in real estate development and investment in different regions of our country: the western region has attracted a lot of investment by virtue of policy support and resource advantages; The level of investment in real estate development in the central and eastern regions is similar; However, in the Northeast, challenges such as economic transformation and population loss have resulted in relatively low investment in real estate development.

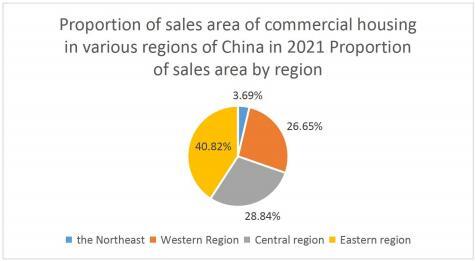

Figure 8. Proportion of sales area of commercial housing in various regions of China in 2021 Proportion of sales area by region Data source: National Bureau of Statistics, China Economic and Industry Research Institute

The data show that there are some differences in the performance of the real estate market in various regions of China. First of all, the eastern region has performed well in real estate sales by virtue of its advantages of developed economy and mature urbanization process. Statistics show that the eastern region has been a major draw for housing demand and investment, accounting for 40.82% of all real estate sales in the area. Secondly, the central region is gradually rising in the process of economic development and urbanization, and the real estate sales area accounts for 28.84%, indicating that the central region is attracting a certain amount of housing demand and investment. In contrast to the central region, the western area's real estate sales area is slightly less than 26.65%, potentially due to economic conditions and population mobility. Still, the West has its place in the housing market. The northeast region's real estate sales area share remains the lowest, at a mere 3.69%.

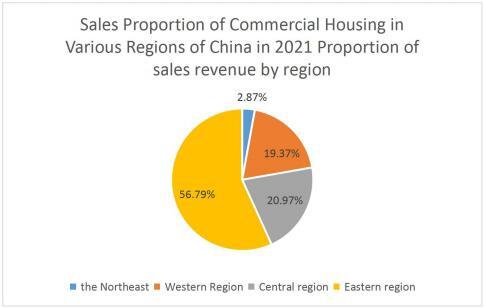

Figure 9. Sales Proportion of Commercial Housing in Various Regions of China in 2021 Proportion of sales revenue by region

Data source: National Bureau of Statistics, China Economic and Industry Research Institute

Real estate sales in the eastern region dominated, accounting for 56.79%. This data reveals the active level of the real estate market in the eastern region, attracting a large number of housing demand and investment. Thanks to the rapid economic development and mature urbanization process in the eastern region, the performance of real estate sales is outstanding. This was followed by the Central region, which accounted for 20.97 per cent of property sales. The central region has achieved remarkable results in the process of economic development and urbanization, so it has also attracted a certain scale of housing demand and investment. Compared with the central region, the proportion of property sales in the western region was slightly lower at 19.37 percent. This may be influenced by factors such as economic conditions and population movements, making property sales in the western region relatively weak. The northeast region has the lowest share of property sales at just 2.87 percent. This may be due to the difficulties of economic transition and the lack of housing demand caused by population loss, which in turn makes real estate sales depressed.

In short, the distribution of real estate development investment and sales in various regions shows obvious differences. By virtue of its economic advantages, the eastern region has attracted more housing demand and investment; The central region followed; The western region is slightly inferior; However, the northeast region faces challenges such as economic transformation and population loss, and the proportion of real estate sales is relatively low.

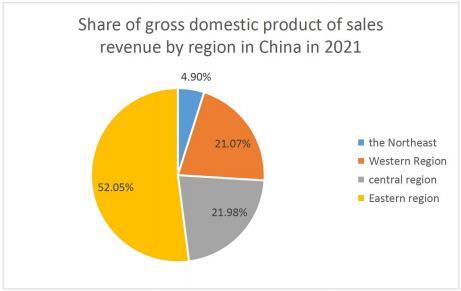

Figure 10. Share of gross domestic product of sales revenue by region in China in 2021 Data Source: National Bureau of Statistics

In 2021, the eastern region's GDP was 5.92 trillion yuan, a growth of 8.1% over the year prior and representing 52.05% of China's total output value. The central area saw an increase of 8.7%, with 2.5 trillion yuan, making up 21.98%. The western region had a 7.4% rise in GDP, to 2.4 trillion yuan, which made up 21.07% of the total output; and the northeast region's GDP was 0.56 trillion yuan, rising 6%. 1%, accounting for 4.90% of the country. It can be seen that China's eastern region maintains a leading economic development, the central region is developing rapidly, the western region is constantly increasing its efforts to undertake industrial transfer, and the economy of the northeast region is recovering steadily. The regional real estate industry's development trend is in harmony with the region's economic expansion, a result that demonstrates its significant part in the growth of the area. This is evidenced by the prior analysis. (Year-on-year growth data from China Bureau of Statistics, 2022)

3.5 Policy Evolution of the Development of China's Real Estate Industry

After the reform and liberalization, the policy development of the real estate sector in our nation has shifted from a planned economy to a market-oriented approach, and from focusing on supply to focusing on demand. In the early days of reform and opening up, the real estate market was relatively closed, and the allocation of housing was mainly controlled by the state planned economy department. Nevertheless, as the market economy system was implemented and enhanced, the government began to acknowledge the crucial importance of the real estate sector in driving economic growth and maintaining social stability, leading to the implementation of a series of pertinent policies.

The initiation of the pilot program for reforming the urban housing system in 1998 signified a significant advancement in the progression of China's real estate sector. [12] The program relazes the restrictions on housing conditions, allows people to purchase commercial housing voluntarily, and introduces loans from commercial banks. The surge in housing demand among residents resulted in an increase in the availability of commercial housing units, setting the stage for future market-driven development. The year 2002 saw the official enforcement of the Provisional Regulations on Urban Land Use Right Transfer, signaling the initiation of market-driven reforms in land use rights. Accordingly, land use rights can be transferred through auction, competitive negotiation, etc., with a clear transfer period. This policy makes the transfer of land use rights more flexible and expands the space for real estate development.

However, in 2008, there was a serious bubble in China's real estate market, which attracted great attention from the government. In response to the rapid rise in housing prices and speculation, the government has implemented a series of regulatory policies, including restrictions on purchases, loans and sales. These measures have effectively curbed the excessively rapid rise in housing prices and brought the market back to rationality.

In 2016, the Implementation Plan on Promoting the Reform of the Housing System was released, which put forward the development strategy of "both renting and purchasing". The Plan advocates meeting residents' housing needs through multiple channels, promoting the development of the housing rental market, and clearly proposes to build a long-term mechanism to guarantee people's basic housing needs. In recent years, the Chinese government has stepped up supervision of the real estate market, emphasizing on stabilizing market expectations and preventing financial risks. At the same time, in the process of urbanization, the government emphasizes the promotion of new urbanization and the reform of population mobility management system, so as to achieve sustainable urban development.

China's real estate industry has undergone a dramatic shift from the planned economy to marketization and supply-led to demand-driven policy evolution. The government is attempting to reconcile the market supply/demand balance, guarantee basic housing requirements for citizens, and foster healthy and stable growth in the sector through various policies and measures.

3.6 Problems Existing in the Development of China's Real Estate Industry

The rapid advancement of China's social economy has led to the emergence and growth of various new industries. Following the implementation of reforms and opening up, the real estate sector has become a key driver in the country's economic growth, playing a role in advancing the sustainable development of China's social economy. “However, there are also some problems in the current real estate industry, which have caused a series of adverse effects on the national economic growth and people's lives.”said by Yan Hao in 2021. Below we combine the current situation of the development of China's real estate industry, for its future development trend of analysis.

3.6.1 Imperfect Development Model of Real Estate

The real estate industry in China has seen a steady rise, which has been beneficial to economic growth; however, this is accompanied by a plethora of issues. Observe the current housing price situation in some big cities in China, the housing price in most cities is growing very fast, and even conflicts with people's purchasing power. There is a serious imbalance between people's actual ability to pay and high housing prices. At present, the land resources in many cities are increasingly scarce, and the competition among developers is becoming increasingly fierce, which directly leads to the coexistence of low and too high housing prices.

In response to this situation, in order to promote the rapid growth of the urban economy, many cities choose to sell land at low prices to attract developers to conduct construction, thus stimulating economic growth. This strategy makes many developers start to turn to the second and third-tier cities. However, because the economy of these cities has not been fully developed and the migrant population is small, the housing demand of most residents is not urgent, therefore, the phenomenon of oversupply occurs, which finally makes the housing prices in these cities tend to be relatively balanced.

3.6.2 Most Land Resources are not Fully Utilized

From the perspective of the characteristics of land resources in China, it can be summarized as "one more than three less", that is, the total amount is abundant, but the per capita arable land, high- quality cultivated land and exploitable reserve resources are relatively small. With the continuous advancement of the urbanization process, the state has issued a series of policies to promote the development of urbanization, which brings the pressure on the resources and the environment to a large extent.After the housing reform, China's real estate sector has experienced significant growth, particularly in the development and construction of commercial properties, resulting in the utilization of extensive farmland. As a consequence, numerous major developers have engaged in land hoarding, anticipating the escalation of land prices for profit maximization, thereby distorting the market equilibrium. Related results show that from January to September 2015, the land area purchased by real estate developers decreased by 33.8 percent year on year.(Kang Shu, 2023)As a key regulated industry in China, the real estate industry, on the basis of steady improvement, should solve the current high land consumption and high waste from various aspects.

3.6.3 Differences in Local Land Prices Have an Impact on Housing Prices

The economic success of the real estate sector is intertwined with the overall national economy, with the level of demand in the market being largely influenced by the appeal of cities to residents. The economic and social advancement of cities plays a crucial role in drawing in people. In big cities, with the rapid development of social economy, a large number of migrants pour in, which not only promotes the rapid growth of local economy, but also directly leads to the situation of real estate in short supply, making the living needs of a large number of populations cannot be met.

However, for the second and third-tier cities, the slow development of local public service resources and industries, which determines the slow growth of the local resident population. As a result, growth in demand for home ownership is very limited, including is the enthusiasm for real estate investment. Part of the demand for entrepreneurship and employment has a diversion effect on social capital, making it difficult for the real estate market demand to achieve rapid growth in the short term. On the whole, the real estate market is developing more slowly, with a large amount of inventory appearing.

3.7 Future of China's Real Estate Development Countermeasures and Suggestions

The Chinese government, enterprises and residents must collaborate in the future of real estate development to ensure a scientific outlook on growth is adhered to, while also driving the industry towards stability and sustainability. This will result in an improved quality of life for all citizens.

The government can augment the real estate market's supply and reconcile the disparity between supply and demand by boosting land availability and utilizing rural areas near cities. To further enhance housing security, we should persist in advancing the building of such a system, intensify the development of public rental dwellings, and fulfill the housing requirements of middle- and low-income individuals.

At the same time, developers are encouraged to build affordable housing and talent apartments suitable for different income groups. Attention should be paid to cultivating rational consumption concepts among residents and avoiding blind investment in purchasing houses. Through educational publicity, financial supervision and other means, residents are guided to diversify their funds and invest in multiple fields, and reduce their over-dependence on the real estate market. It is imperative to enhance oversight of the real estate market in order to mitigate the risk of a real estate bubble.

The government can take measures such as restricting the purchase, loans and sales to stabilize housing prices and curb speculation. The government should encourage real estate enterprises to carry out innovative research and development, and promote the application of intelligent and green building technology. At the same time, we will increase support for rural revitalization and urbanization, and promote the orderly development of rural land circulation and urban expansion. We shall persist in refining the financial system, offering varied funding pathways, stimulating banks and other banking organizations to augment credit backing for real estate businesses, and directing the capital market to partake in the investment in the real estate sector. Finally, actively participate in international economic cooperation and absorb advanced experience and ideas. Fostering the advancement of China's real estate sector through collaboration and interactions with various nations and regions to ensure superior quality development.

4 Conclusion

This study aims to analyze the strength of the real estate sector's impact on China's economic growth. After a thorough examination of both domestic and international literature, along with an assessment of statistical information, we can come to the following conclusions: Primarily, the real estate sector is indispensable in our nation's economic expansion. Real estate investment accounts for a large proportion of fixed asset investment, and its contribution to economic growth cannot be underestimated. The real estate sector's growth rate is in direct correlation with GDP's; the power of this market can generate jobs, bring prosperity to its related industries, and ultimately bolster the whole economy.

However, the risks of housing bubbles and high leverage cannot be ignored. Over-reliance on the real estate sector can lead to financial risks and fiscal stress, and even trigger a recession. Over the past few years, the Chinese authorities have implemented stricter controls on the real estate sector in order to manage market dynamics and mitigate potential risks.

Looking ahead to future research, the following directions are worth further exploration: First, in-depth research on the correlation between real estate investment and other economic indicators, such as consumption, employment, and financial markets. It further explores the extent to which the real estate sector influences job creation and the development of related industrial chains, as well as the contribution of these influences to overall economic growth.

Second, we can look at how the real estate sector affects economic growth in different countries and regions, which in turn provides a more complete picture of the role of the real estate sector globally. Through comparison, we can find out the similarities and differences of the real estate industry in various countries or regions, and provide reference for policy making. Furthermore, it is essential to examine how government regulations affect the real estate sector and economic development. Look at the effect of regulatory policies in balancing market demand and preventing risks, and seek a more precise and sustainable regulatory approach.

The real estate industry is a critical factor in China's economic expansion, to put it simply. However, we should also be alert to related risks and formulate reasonable regulatory policies. Further investigation should delve into these matters and offer more specific advice for decision makers to reach a harmonious relationship between real estate and economic expansion.

References

[1]. Bass. (2011). A study of the problem of Xi'an real estate tax collection (Master's thesis, Northwestern University). https://kns.cnki.net/kcms2/article/abstract?v=j6HAoO1nZAyXbCRLjlyGNFGigHdI74d1x9QmberwOM8NqRF2HszwuGQxcN0WNZDOFOatJjVvAL8ZQM1x1RKjSQSSb9FK0kilMy4z3077ahxPQP8qd7tsJTY4N0q3L-21

[2]. Chen, B. K., & Yang, R. D. (2013). Land supply, housing prices and the savings of Chinese urban residents. Economic Research, (01), 110-122. https://kns.cnki.net/kcms2/article/abstract?v=j6HAoO1nZAzxSp3GH37WRhfdltLzZQz-4SIPvJcEDOwmqL2vkdDdmiybgYUXE7KBhyEdDV_yVbIs2KUw72MsK4NMPADfVa2FwJZHHcQ9hbGj_trHm_FGhkXnDswWsdX1zv8HD_Ts7A=

[3]. Cheng, W. A., Zhao, J. D., & Zheng, Y. (2022). Research on the impact of Chinese real estate investment on economic growth: Based on a quantitative perspective. Proceedings of Zhongzhou University, (03), 31-36. https://doi.org/10.13783/j.cnki.cn41-1275/g4.2022.03.006

[4]. Chen, Z., & Shen, Y. (2021). The spatial spillover of the purchase restriction policy and the efficiency of land resource allocation. Economic Research, (06), 93-109. https://kns.cnki.net/kcms2/article/abstract?v=j6HAoO1nZAwUQUoLQP94yD4ENYfdr0VvwSeT8Rfd8GyDH2ciqiWz2D_c5quxHbpTVGbeQJjm3BG4Cay4O1pTJpgD4UAs4lo1LMtoDa9zTVNMeammK2X3jez7sSzGSVBiDIR0G3z2M=

[5]. China Statistical Yearbook. (2011). China Statistics, (11), 2. https://kns.cnki.net/kcms2/article/abstract?v=GARc9QQj0GXPB-0PX-SEhaDrpmXN3SWa8wAx7h1g1hA_tyC9HOTi4yyde5-_ngmyfJwuWIYGvhO_z-GGOCsY_obPj3gLQeGnbHPvtK7bIlrdOA49We1Y50r12BtPVeGM

[6]. Dai, J. P., Fan, M., & Li, B. W. (2022). Research on the economic growth effect of real estate regulation: The asymmetry of demand-side and supply-side regulation. Fujian Forum (Humanities and Social Sciences Edition), (08), 48-64. https://kns.cnki.net/kcms2/article/abstract?v=j6HAoO1nZAz8M80JlQJ4lTGQCGtAtE10FQHhJPkHm72clPtccdRjSblkN14ec8CFuSXMa81C1K6GtLAVT49DqqKyuV9GR2i1pi05bREMtpbY4eDPQaODv7Sjb-jLmTnU8PKz6zEQQ=

[7]. Huang, X., Dong, X., & Ping, X. Q. (2018). Evaluation of the effect of local government real estate purchase restriction and loan restriction policy. Reform, (05), 107-118. https://kns.cnki.net/kcms2/article/abstract?v=j6HAoO1nZAwtub0lwmWWAmwCxcd9b2B9YG3Ww6G7ba8gi4bSlgcEWXg2mALf7FMEtXB6yoy4GCMwQaE23YdqgfsPcH6sanSdh3ZCXpWdbuwrXDXpvhgcFStpezP8adf1WibPKj3Vq9k=

[8]. Lai, H. R., & Dai, S. X. (2020). We will improve the fiscal system that gives full play to the initiative of both the central and local governments. Journal of Fujian Normal University (Philosophy and Social Sciences Edition), (03), 1-8. https://kns.cnki.net/kcms2/article/abstract?v=j6HAoO1nZAwHvL2SlpGmKyjur1u0TxVYGxkAj_3MOJ4l_fTZAUGHMwQ7qiJKF2IFw1rZf0TveTL5lYrxkKicIZcmfchnzMcs8Y5Tbohf1niNimopl41C0mcSisbCZtXQ54b55jeS24g=

[9]. Lei, Z. Y. (2022). Analysis of the macroeconomic impact of the real estate industry on China. Small and Medium Management and Technology, (20), 122-124. https://kns.cnki.net/kcms2/article/abstract?v=j6HAoO1nZAztc_01eRKoYov3NR2qKxH8Zw1JDkf7yjeJUOWskxZdTx7PUZJwe14cdGjGwukbdRB9UE64Yk8zHbAroWwTnFMeBBg8ogYiQj8oP6So-KD1nMRT7tSxAQ4pDFca8-xRyq8=

[10]. Liang, Z. T., & Zhai, S. M. (2004). Research on the theoretical history of economic growth (Part 1). Economic Problems, (03), 2-7. https://doi.org/10.16011/j.cnki.jjwt.2004.03.001

[11]. Liu, J., & Chen, B. K. (2021). Did rising house prices widen consumer inequality in China?. Economics (Quarterly), (04), 1253-1274. https://doi.org/10.13821/j.cnki.ceq.2021.04.07

[12]. Liu, X. (2013). China's urban housing system reform since the 1990s (Master's thesis, Jilin University). https://kns.cnki.net/kcms2/article/abstract?v=GARc9QQj0GXMBeOUZZPjzVdQvtnjYVu1AgnYeC88IV9zP88tNAPSBfaExATAe0xh_hDhVW9lYa2HNFp503-vsnPrsuyHmibSbWFJ5zPq2Xy_89yOZ5mJ0fAnM5R_qp57_ZxYwz7fcMI=

[13]. Lu, J. H. (2022). Analysis of the influence of real estate economy on our national economy growth. Residential and Real Estate, (Z1), 57-61. https://kns.cnki.net/kcms2/article/abstract?v=j6HAoO1nZAyhUAyunaC2gTEruhQ1evWP4kRBRdYS7Udq20aLHg_w0WMlQNaWs2rF5jxr5NziJoNY4m4M90JL8hoYOb8n2Q3nZNBj5gNcViiwrPg4dA2Rc28F-XDi8IE43ECwpF24Do8=

[14]. Lu, K. (2022). Study on the role of real estate economy on national economic growth. Real Estate World, (17), 18-20. https://kns.cnki.net/kcms2/article/abstract?v=j6HAoO1nZAwOa9LJ0TDwYNOSRexPY9ZHwo6wnLNZ6zZQA2AQw20fGAT-SB46dLsCgaSOuhV5gZ9vs-eUECqQLqtU6vlyJKP7VFLp0rT5BLf9aIqFFnoORXtBpb3GHGPF-G3GC1l-M0=

[15]. Luo, P., Ni, L. B., Chen, Y. G., & Yu, J. Y. (2020). Real estate regulation and total factor productivity: "Twice the result with half the effort" or "counterproductive". The Southern Economy, (11), 47-61. https://doi.org/10.19592/j.cnki.scje.371729

[16]. Main Consumer Price data for July 2021. (2021). China Statistics, (08), 80. Available at: https://kns.cnki.net/kcms2/article/abstract?v=GARc9QQj0GXUn7aabQWXUBkkacTHg-34WPVMc_DydGNpcetiTi441AsCsVHIiLj0wt21u04dIHu3lJfxeJgMmNH_ggO_MxybTT4jOadDlRK7QlCsNCBvTBqf3Ku0NDGlUKPjAH0ThDw=&uniplatform=NZKPT&flag=copy (Accessed: July 12, 2023).

[17]. Mei, D. Z., Cui, X. Y., & Wu, Y. (2018). Housing price changes, land finance and China's economic fluctuations. Economic Research, (01), 35-49. Available at: https://kns.cnki.net/kcms2/article/abstract?v=j6HAoO1nZAyGuaTLja2UOo1QpvCBdRj54ePN8XYJgHzXQ9LQ8AMFVQBIpn0hhEDNVV0IUiWiz2Dnp6Dme2QSmau6cy6FwInh48lEqTud_o7Znp0HXgMA2oYfKHUR-jbt6GOi1ap285I=&uniplatform=NZKPT&flag=copy (Accessed: July 6, 2023).

[18]. Wang, Y. (2011). How local debt is changing China. China Economic Weekly, (46). Available at: https://kns.cnki.net/kcms2/article/abstract?v=j6HAoO1nZAynsvHxFIv7l2bO5BzJrVMZdG2zjx1SS9Vip_1afOtxeA8btmujlwFDe7CK4A1ktrxKRAmMkr7C6aRoi3_52S3qPZuXQolHD-ms88qQ7N4b6VfjlmPIT-G&uniplatform=NZKPT&flag=copy (Accessed: July 3, 2023).

[19]. Wu, J. G., & He, Y. Z. (2012). Empirical analysis of the impact of the government's macro-control on the economy in the real estate industry. Financial Research, (12), 25-29. https://doi.org/10.19477/j.cnki.11-1077/f.2012.12.007. Available at: https://kns.cnki.net/kcms2/article/abstract?v=j6HAoO1nZAxVtCpFgEnXFeswQipubvyk32zd0bO9j-lm3aMgwOsip4IBaFU-gyDm6Ej3Ns1rPgm1M1kx4WKch2VnCXAmat2GNFdk0OHaLB1XqcZY49bu9Kdyaf2dZ2iT&uniplatform=NZKPT&flag=copy (Accessed: July 6, 2023).

[20]. Xu, X. C., Jia, H., Li, J., & Li, J. B. (2015). Study on the effect of real estate economy on China's national economic growth. Chinese Social Sciences, (01), 84-101 + 204. Available at: https://kns.cnki.net/kcms2/article/abstract?v=j6HAoO1nZAxobKcq2wE1ehdKAJIpq4t1TdvcjT70A2X7-ldpq8FBiOjNJH0pBWQ2nNHEBTaHNHfuJeu02fEtY8dBRMGpgqR3AWvUot7qg7Qhomqd-WBVnXHCcxYptH912VeVJinUnw=&uniplatform=NZKPT&flag=copy (Accessed: July 6, 2023).

[21]. Yan, H. (2023). Research on single SPV commercial real estate mortgage backed notes — Taking Yangguang City CMBN project as an example [D]. Shanghai: Shanghai University of Finance and Economics. Available at: https://d.wanfangdata.com.cn/thesis/D02961936 (Accessed: July 6, 2023).

[22]. Yan, H., & Hong, B. (2018). Effects of house-sale restrictions in China: A difference-in-difference approach. Applied Economics Letters, (15). https://doi.org/10.1080/13504851.2017.1394968. Available at: https://kns.cnki.net/kcms2/article/abstract?v=ohXIcpZjJKwk4BlfZzlE_7OmLPdgn7cgm7wI_7haRgHkQ6ngf52aLfDVMhSWRorVaCXPGNVUBCD21DfNIKdsr7lsMHiHoSe_Pn7SU94_it8XWld8UdnTe1sUJi-aWSm2M3cpnF9PSPXPR2P2DDNMLxcH8vS&uniplatform=NZKPT&flag=copy (Accessed: July 6, 2023).

[23]. Yuan, D. S. (2018). Current situation and future development of China's real estate economy. Northern Economy and Trade, (06), 131-132. Available at: https://kns.cnki.net/kcms2/article/abstract?v=j6HAoO1nZAzfXYtRbpNS-w_jz-4YMxGx2pt2OQlJoAOqCyNUlV82SmmEXwEC0R-KAg4kRt5O9v1Ye2539066Cf_Um64WpgBOLH8JtHV1dDp8S2BoVi4BKtOJd0PRuO57i32PbboRyyY=&uniplatform=NZKPT&flag=copy (Accessed: July 6, 2023).

[24]. Zeng, M., & Xiang, R. K. (2019). An empirical analysis of the relationship between the upgrading of industrial structure and economic growth in Guangxi. Journal of Liaoning Executive College of Economics and Management, (05), 13-15 + 103. Available at: https://kns.cnki.net/kcms2/article/abstract?v=j6HAoO1nZAw2B3bOorN6V2FoQrVGPmzOOd5ZGHQ28DsjUSATmqYb5JDWwT30bpSOQXmuZ3eCkWOP5QZcyOTKc4ylUIj4w_h6KPswtW_o6wdkPz5mnbXsyIsdkgKy7Pw3AomSDjNPZY=&uniplatform=NZKPT&flag=copy (Accessed: July 3, 2023).

[25]. Zhang, J., Yang, L. X., & Xin, F. (2016). Is real estate hindering innovation in China? Interpretation based on the loan term structure of the financial system. Manage the World, (05), 64-80. https://doi.org/10.19744/j.cnki.11-1235/f.2016.05.007. Available at: https://kns.cnki.net/kcms2/article/abstract?v=j6HAoO1nZAyAIs6SDpQgbbptpVc6Vwd9ss4Kqpfxvh5fXBO8PLqSWw5YaFXDN1OObEzRcJIONGDFPJ2urEScmp6azD4cgrALxYLr4YD060yK_FDZ6Oi8sK6hkTzLspqWJIvTz1Vz4=&uniplatform=NZKPT&flag=copy (Accessed: July 6, 2023).

[26]. Zhang, Y. (2010). Foreign capital dependence and China's economic growth from the perspective of spatial economy. Economics (Quarterly), (4), 1211-1238. https://doi.org/10.13821/j.cnki.ceq.2010.04.012. Available at: https://kns.cnki.net/kcms2/article/abstract?v=j6HAoO1nZAyTasnriVreW8WKcdynxPGwdNRI5JkUhYelsAeGmPtvmhsXeC7YodOfe9SzYA6tlVuR9E96l_kED87DrsNWm6FU7U30dEIK_glg7KsIyVCaiYdM_dN0EhE0&uniplatform=NZKPT&flag=copy (Accessed: July 6, 2023).

[27]. Zhu, H. R., Li, P., & Xie, Z. F. (2019). Effectiveness and externality evaluation of the real estate purchase restriction policy. Finance and Trade Economy, (02), 147-160. Available at: https://kns.cnki.net/kcms2/article/abstract?v=j6HAoO1nZAzy781CZ8m_fu7OZV0z9PwdaakVz46wFFfPi6Eo9Ej9fUHMwJP7JwNT02EoQQbPv2VmCFmDpyCg_tXZdZZBfcSH6gH_hTqxCi_7EUVRWXkSM124048AHsW_-tU-BExRaw=&uniplatform=NZKPT&flag=copy (Accessed: July 6, 2023).

[28]. Zhou, W. W., Liu, C., & Li, J. (2017). Research on the influence of real estate policy regulation on housing prices — Analysis based on ARDL model. Price Theory and Practice, (11), 70-73. https://doi.org/10.19851/j.cnki.cn11-1010/f.2017.11.018. Available at: https://kns.cnki.net/kcms2/article/abstract?v=j6HAoO1nZAxX_k64ucAlZ6Ys87tmimdJko6BwLCAsMJyaUCcvv6VJ-foWT_xvjXcLZzAfpU58lWcTcCOt1kQwgmOWzF1_1WYsbqmUcpja6ifDWEwSBj0wEb4gQ9J2TzzVlq5yhdllBw=&uniplatform=NZKPT&flag=copy (Accessed: July 13, 2023).

[29]. Zou, L. H., & Zhong, C. P. (2022). An empirical analysis of land transfer and housing price data in cities above the prefecture level. Finance and Trade Economy, (03), 82-97. https://doi.org/10.19795/j.cnki.cn11-1166/f.20220307.009. Available at: https://kns.cnki.net/kcms2/article/abstract?v=j6HAoO1nZAyk_dmsWfTN7PnXWQ0Uo-PtK7FM-pYJZx2MwKZg7OD_2R2ujBO7q6mPBG_Gt-v7jCI7enTstXbpV1mnKpLnI5ZvxcSm3AaMGqtY631CT03nHjfc-TUUTIn6xy1DJAmG6No=&uniplatform=NZKPT&flag=copy (Accessed: July 6, 2023).

Cite this article

Huang,G. (2024). To What Extent Has the Real Estate Industry Affected China's Economic Growth?. Journal of Applied Economics and Policy Studies,10,38-52.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Journal:Journal of Applied Economics and Policy Studies

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Bass. (2011). A study of the problem of Xi'an real estate tax collection (Master's thesis, Northwestern University). https://kns.cnki.net/kcms2/article/abstract?v=j6HAoO1nZAyXbCRLjlyGNFGigHdI74d1x9QmberwOM8NqRF2HszwuGQxcN0WNZDOFOatJjVvAL8ZQM1x1RKjSQSSb9FK0kilMy4z3077ahxPQP8qd7tsJTY4N0q3L-21

[2]. Chen, B. K., & Yang, R. D. (2013). Land supply, housing prices and the savings of Chinese urban residents. Economic Research, (01), 110-122. https://kns.cnki.net/kcms2/article/abstract?v=j6HAoO1nZAzxSp3GH37WRhfdltLzZQz-4SIPvJcEDOwmqL2vkdDdmiybgYUXE7KBhyEdDV_yVbIs2KUw72MsK4NMPADfVa2FwJZHHcQ9hbGj_trHm_FGhkXnDswWsdX1zv8HD_Ts7A=

[3]. Cheng, W. A., Zhao, J. D., & Zheng, Y. (2022). Research on the impact of Chinese real estate investment on economic growth: Based on a quantitative perspective. Proceedings of Zhongzhou University, (03), 31-36. https://doi.org/10.13783/j.cnki.cn41-1275/g4.2022.03.006

[4]. Chen, Z., & Shen, Y. (2021). The spatial spillover of the purchase restriction policy and the efficiency of land resource allocation. Economic Research, (06), 93-109. https://kns.cnki.net/kcms2/article/abstract?v=j6HAoO1nZAwUQUoLQP94yD4ENYfdr0VvwSeT8Rfd8GyDH2ciqiWz2D_c5quxHbpTVGbeQJjm3BG4Cay4O1pTJpgD4UAs4lo1LMtoDa9zTVNMeammK2X3jez7sSzGSVBiDIR0G3z2M=

[5]. China Statistical Yearbook. (2011). China Statistics, (11), 2. https://kns.cnki.net/kcms2/article/abstract?v=GARc9QQj0GXPB-0PX-SEhaDrpmXN3SWa8wAx7h1g1hA_tyC9HOTi4yyde5-_ngmyfJwuWIYGvhO_z-GGOCsY_obPj3gLQeGnbHPvtK7bIlrdOA49We1Y50r12BtPVeGM

[6]. Dai, J. P., Fan, M., & Li, B. W. (2022). Research on the economic growth effect of real estate regulation: The asymmetry of demand-side and supply-side regulation. Fujian Forum (Humanities and Social Sciences Edition), (08), 48-64. https://kns.cnki.net/kcms2/article/abstract?v=j6HAoO1nZAz8M80JlQJ4lTGQCGtAtE10FQHhJPkHm72clPtccdRjSblkN14ec8CFuSXMa81C1K6GtLAVT49DqqKyuV9GR2i1pi05bREMtpbY4eDPQaODv7Sjb-jLmTnU8PKz6zEQQ=

[7]. Huang, X., Dong, X., & Ping, X. Q. (2018). Evaluation of the effect of local government real estate purchase restriction and loan restriction policy. Reform, (05), 107-118. https://kns.cnki.net/kcms2/article/abstract?v=j6HAoO1nZAwtub0lwmWWAmwCxcd9b2B9YG3Ww6G7ba8gi4bSlgcEWXg2mALf7FMEtXB6yoy4GCMwQaE23YdqgfsPcH6sanSdh3ZCXpWdbuwrXDXpvhgcFStpezP8adf1WibPKj3Vq9k=

[8]. Lai, H. R., & Dai, S. X. (2020). We will improve the fiscal system that gives full play to the initiative of both the central and local governments. Journal of Fujian Normal University (Philosophy and Social Sciences Edition), (03), 1-8. https://kns.cnki.net/kcms2/article/abstract?v=j6HAoO1nZAwHvL2SlpGmKyjur1u0TxVYGxkAj_3MOJ4l_fTZAUGHMwQ7qiJKF2IFw1rZf0TveTL5lYrxkKicIZcmfchnzMcs8Y5Tbohf1niNimopl41C0mcSisbCZtXQ54b55jeS24g=

[9]. Lei, Z. Y. (2022). Analysis of the macroeconomic impact of the real estate industry on China. Small and Medium Management and Technology, (20), 122-124. https://kns.cnki.net/kcms2/article/abstract?v=j6HAoO1nZAztc_01eRKoYov3NR2qKxH8Zw1JDkf7yjeJUOWskxZdTx7PUZJwe14cdGjGwukbdRB9UE64Yk8zHbAroWwTnFMeBBg8ogYiQj8oP6So-KD1nMRT7tSxAQ4pDFca8-xRyq8=

[10]. Liang, Z. T., & Zhai, S. M. (2004). Research on the theoretical history of economic growth (Part 1). Economic Problems, (03), 2-7. https://doi.org/10.16011/j.cnki.jjwt.2004.03.001

[11]. Liu, J., & Chen, B. K. (2021). Did rising house prices widen consumer inequality in China?. Economics (Quarterly), (04), 1253-1274. https://doi.org/10.13821/j.cnki.ceq.2021.04.07

[12]. Liu, X. (2013). China's urban housing system reform since the 1990s (Master's thesis, Jilin University). https://kns.cnki.net/kcms2/article/abstract?v=GARc9QQj0GXMBeOUZZPjzVdQvtnjYVu1AgnYeC88IV9zP88tNAPSBfaExATAe0xh_hDhVW9lYa2HNFp503-vsnPrsuyHmibSbWFJ5zPq2Xy_89yOZ5mJ0fAnM5R_qp57_ZxYwz7fcMI=

[13]. Lu, J. H. (2022). Analysis of the influence of real estate economy on our national economy growth. Residential and Real Estate, (Z1), 57-61. https://kns.cnki.net/kcms2/article/abstract?v=j6HAoO1nZAyhUAyunaC2gTEruhQ1evWP4kRBRdYS7Udq20aLHg_w0WMlQNaWs2rF5jxr5NziJoNY4m4M90JL8hoYOb8n2Q3nZNBj5gNcViiwrPg4dA2Rc28F-XDi8IE43ECwpF24Do8=

[14]. Lu, K. (2022). Study on the role of real estate economy on national economic growth. Real Estate World, (17), 18-20. https://kns.cnki.net/kcms2/article/abstract?v=j6HAoO1nZAwOa9LJ0TDwYNOSRexPY9ZHwo6wnLNZ6zZQA2AQw20fGAT-SB46dLsCgaSOuhV5gZ9vs-eUECqQLqtU6vlyJKP7VFLp0rT5BLf9aIqFFnoORXtBpb3GHGPF-G3GC1l-M0=

[15]. Luo, P., Ni, L. B., Chen, Y. G., & Yu, J. Y. (2020). Real estate regulation and total factor productivity: "Twice the result with half the effort" or "counterproductive". The Southern Economy, (11), 47-61. https://doi.org/10.19592/j.cnki.scje.371729

[16]. Main Consumer Price data for July 2021. (2021). China Statistics, (08), 80. Available at: https://kns.cnki.net/kcms2/article/abstract?v=GARc9QQj0GXUn7aabQWXUBkkacTHg-34WPVMc_DydGNpcetiTi441AsCsVHIiLj0wt21u04dIHu3lJfxeJgMmNH_ggO_MxybTT4jOadDlRK7QlCsNCBvTBqf3Ku0NDGlUKPjAH0ThDw=&uniplatform=NZKPT&flag=copy (Accessed: July 12, 2023).

[17]. Mei, D. Z., Cui, X. Y., & Wu, Y. (2018). Housing price changes, land finance and China's economic fluctuations. Economic Research, (01), 35-49. Available at: https://kns.cnki.net/kcms2/article/abstract?v=j6HAoO1nZAyGuaTLja2UOo1QpvCBdRj54ePN8XYJgHzXQ9LQ8AMFVQBIpn0hhEDNVV0IUiWiz2Dnp6Dme2QSmau6cy6FwInh48lEqTud_o7Znp0HXgMA2oYfKHUR-jbt6GOi1ap285I=&uniplatform=NZKPT&flag=copy (Accessed: July 6, 2023).

[18]. Wang, Y. (2011). How local debt is changing China. China Economic Weekly, (46). Available at: https://kns.cnki.net/kcms2/article/abstract?v=j6HAoO1nZAynsvHxFIv7l2bO5BzJrVMZdG2zjx1SS9Vip_1afOtxeA8btmujlwFDe7CK4A1ktrxKRAmMkr7C6aRoi3_52S3qPZuXQolHD-ms88qQ7N4b6VfjlmPIT-G&uniplatform=NZKPT&flag=copy (Accessed: July 3, 2023).

[19]. Wu, J. G., & He, Y. Z. (2012). Empirical analysis of the impact of the government's macro-control on the economy in the real estate industry. Financial Research, (12), 25-29. https://doi.org/10.19477/j.cnki.11-1077/f.2012.12.007. Available at: https://kns.cnki.net/kcms2/article/abstract?v=j6HAoO1nZAxVtCpFgEnXFeswQipubvyk32zd0bO9j-lm3aMgwOsip4IBaFU-gyDm6Ej3Ns1rPgm1M1kx4WKch2VnCXAmat2GNFdk0OHaLB1XqcZY49bu9Kdyaf2dZ2iT&uniplatform=NZKPT&flag=copy (Accessed: July 6, 2023).

[20]. Xu, X. C., Jia, H., Li, J., & Li, J. B. (2015). Study on the effect of real estate economy on China's national economic growth. Chinese Social Sciences, (01), 84-101 + 204. Available at: https://kns.cnki.net/kcms2/article/abstract?v=j6HAoO1nZAxobKcq2wE1ehdKAJIpq4t1TdvcjT70A2X7-ldpq8FBiOjNJH0pBWQ2nNHEBTaHNHfuJeu02fEtY8dBRMGpgqR3AWvUot7qg7Qhomqd-WBVnXHCcxYptH912VeVJinUnw=&uniplatform=NZKPT&flag=copy (Accessed: July 6, 2023).

[21]. Yan, H. (2023). Research on single SPV commercial real estate mortgage backed notes — Taking Yangguang City CMBN project as an example [D]. Shanghai: Shanghai University of Finance and Economics. Available at: https://d.wanfangdata.com.cn/thesis/D02961936 (Accessed: July 6, 2023).

[22]. Yan, H., & Hong, B. (2018). Effects of house-sale restrictions in China: A difference-in-difference approach. Applied Economics Letters, (15). https://doi.org/10.1080/13504851.2017.1394968. Available at: https://kns.cnki.net/kcms2/article/abstract?v=ohXIcpZjJKwk4BlfZzlE_7OmLPdgn7cgm7wI_7haRgHkQ6ngf52aLfDVMhSWRorVaCXPGNVUBCD21DfNIKdsr7lsMHiHoSe_Pn7SU94_it8XWld8UdnTe1sUJi-aWSm2M3cpnF9PSPXPR2P2DDNMLxcH8vS&uniplatform=NZKPT&flag=copy (Accessed: July 6, 2023).

[23]. Yuan, D. S. (2018). Current situation and future development of China's real estate economy. Northern Economy and Trade, (06), 131-132. Available at: https://kns.cnki.net/kcms2/article/abstract?v=j6HAoO1nZAzfXYtRbpNS-w_jz-4YMxGx2pt2OQlJoAOqCyNUlV82SmmEXwEC0R-KAg4kRt5O9v1Ye2539066Cf_Um64WpgBOLH8JtHV1dDp8S2BoVi4BKtOJd0PRuO57i32PbboRyyY=&uniplatform=NZKPT&flag=copy (Accessed: July 6, 2023).

[24]. Zeng, M., & Xiang, R. K. (2019). An empirical analysis of the relationship between the upgrading of industrial structure and economic growth in Guangxi. Journal of Liaoning Executive College of Economics and Management, (05), 13-15 + 103. Available at: https://kns.cnki.net/kcms2/article/abstract?v=j6HAoO1nZAw2B3bOorN6V2FoQrVGPmzOOd5ZGHQ28DsjUSATmqYb5JDWwT30bpSOQXmuZ3eCkWOP5QZcyOTKc4ylUIj4w_h6KPswtW_o6wdkPz5mnbXsyIsdkgKy7Pw3AomSDjNPZY=&uniplatform=NZKPT&flag=copy (Accessed: July 3, 2023).

[25]. Zhang, J., Yang, L. X., & Xin, F. (2016). Is real estate hindering innovation in China? Interpretation based on the loan term structure of the financial system. Manage the World, (05), 64-80. https://doi.org/10.19744/j.cnki.11-1235/f.2016.05.007. Available at: https://kns.cnki.net/kcms2/article/abstract?v=j6HAoO1nZAyAIs6SDpQgbbptpVc6Vwd9ss4Kqpfxvh5fXBO8PLqSWw5YaFXDN1OObEzRcJIONGDFPJ2urEScmp6azD4cgrALxYLr4YD060yK_FDZ6Oi8sK6hkTzLspqWJIvTz1Vz4=&uniplatform=NZKPT&flag=copy (Accessed: July 6, 2023).

[26]. Zhang, Y. (2010). Foreign capital dependence and China's economic growth from the perspective of spatial economy. Economics (Quarterly), (4), 1211-1238. https://doi.org/10.13821/j.cnki.ceq.2010.04.012. Available at: https://kns.cnki.net/kcms2/article/abstract?v=j6HAoO1nZAyTasnriVreW8WKcdynxPGwdNRI5JkUhYelsAeGmPtvmhsXeC7YodOfe9SzYA6tlVuR9E96l_kED87DrsNWm6FU7U30dEIK_glg7KsIyVCaiYdM_dN0EhE0&uniplatform=NZKPT&flag=copy (Accessed: July 6, 2023).

[27]. Zhu, H. R., Li, P., & Xie, Z. F. (2019). Effectiveness and externality evaluation of the real estate purchase restriction policy. Finance and Trade Economy, (02), 147-160. Available at: https://kns.cnki.net/kcms2/article/abstract?v=j6HAoO1nZAzy781CZ8m_fu7OZV0z9PwdaakVz46wFFfPi6Eo9Ej9fUHMwJP7JwNT02EoQQbPv2VmCFmDpyCg_tXZdZZBfcSH6gH_hTqxCi_7EUVRWXkSM124048AHsW_-tU-BExRaw=&uniplatform=NZKPT&flag=copy (Accessed: July 6, 2023).

[28]. Zhou, W. W., Liu, C., & Li, J. (2017). Research on the influence of real estate policy regulation on housing prices — Analysis based on ARDL model. Price Theory and Practice, (11), 70-73. https://doi.org/10.19851/j.cnki.cn11-1010/f.2017.11.018. Available at: https://kns.cnki.net/kcms2/article/abstract?v=j6HAoO1nZAxX_k64ucAlZ6Ys87tmimdJko6BwLCAsMJyaUCcvv6VJ-foWT_xvjXcLZzAfpU58lWcTcCOt1kQwgmOWzF1_1WYsbqmUcpja6ifDWEwSBj0wEb4gQ9J2TzzVlq5yhdllBw=&uniplatform=NZKPT&flag=copy (Accessed: July 13, 2023).

[29]. Zou, L. H., & Zhong, C. P. (2022). An empirical analysis of land transfer and housing price data in cities above the prefecture level. Finance and Trade Economy, (03), 82-97. https://doi.org/10.19795/j.cnki.cn11-1166/f.20220307.009. Available at: https://kns.cnki.net/kcms2/article/abstract?v=j6HAoO1nZAyk_dmsWfTN7PnXWQ0Uo-PtK7FM-pYJZx2MwKZg7OD_2R2ujBO7q6mPBG_Gt-v7jCI7enTstXbpV1mnKpLnI5ZvxcSm3AaMGqtY631CT03nHjfc-TUUTIn6xy1DJAmG6No=&uniplatform=NZKPT&flag=copy (Accessed: July 6, 2023).