1. Introduction

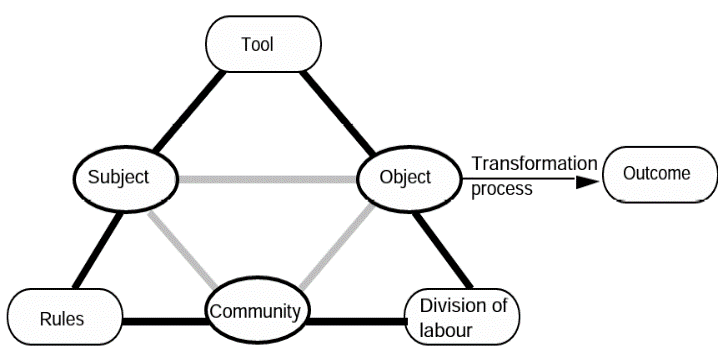

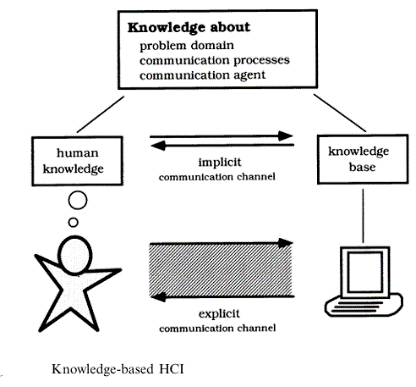

The field of financial decision-making has seen significant progress with the integration of human-computer interaction (HCI) because of its potential to enhance user experience and improve investment performance. Since the decision support system (DSS) was proposed in the 1970s, DSS has developed greatly, and it has played a huge role in promoting the use of computer-aided solutions to semi-structured and unstructured problems [1-4]. In an era of rapid technological advancement, collaboration between human expertise and machine intelligence is also becoming increasingly important in the financial industry. Decision support system [5] is the combination of information system and decision-making technology. Visual human-computer interaction decision-making is a key technology in decision support systems [6]. With the development of database technology [7], visual human-computer interaction technology and database based on business operation environment and platform can no longer meet people’s needs in analysis and decision-making. By deeply exploring various human-computer interaction technologies and their application in the field of financial decision-making, related research has provided valuable insights into the influence of financial institutions, investors, and users [8-10]. This study highlights the potential of human-computer interaction in the financial sector to enhance user experience, provide key decisions and help users gain benefits by providing personalized financial services, intuitive user interfaces, and real-time feedback. Furthermore, it demonstrates how the integration of human expertise [11] and machine intelligence can improve investment performance, risk management, and decision support in financial activities. However, the synergy of human-computer interaction in finance also brings challenges that must be addressed [12]. Privacy concerns, data security [13], and establishing appropriate regulatory and ethical guidelines [14] are key issues that need to be carefully managed. How to improve the corresponding measures and rationally apply human-computer interaction is imminent. This study contributes to a deeper understanding of the synergy of human-computer interaction in the financial decision-making process [15], emphasizing the importance of a balanced approach that leverages the strengths of humans and machines. The implications of this research will be very valuable to financial institutions, policy makers, and researchers seeking to enhance user experience [16] and improve investment outcomes in the financial sector [17]. In the remainder of this paper, we delve into the theoretical framework, empirical analysis, and discussion underpinning the exploration of the synergistic effects of HCI in financial decision-making. By examining the potential benefits, challenges, and implications of this integration [18], this study aims to provide valuable insights and contribute to the advancement of the field. The paper shows us the internal logic of the human-computer interaction operation (see Figure 1) [19]. It shows us the role of the user in human-computer interaction (see Figure 20) [20].

Figure 1. Activity theory as a potential framework for human-computer interaction research.

Figure 2. User modeling in human-computer interaction.

2. Financial Decisions and Their Forward-Looking Views

2.1. Operation of financial decision-making

Financial decision-making involves key decision-making processes in the financial domain, with important impacts on individuals, businesses and the economy as a whole. Among them, it is necessary to comprehensively consider market intelligence, economic indicators and risk management, covering investment, financing, asset allocation and other decisions. Formulating a reasonable financial plan requires consideration of multiple factors such as market, economy, risk, and policy, in order to achieve optimal returns and risk control under different conditions and meet the needs of all parties [21]. Decision makers should conduct in-depth market and economic environment analysis, rational decision-making and controllable risk management, with the help of quantitative models and risk assessment methods, and customize financial solutions for individual needs [22]. Behavioral finance reveals the biases and limitations in the human decision-making process [23], and more informed decisions are needed. The key to successful financial decision-making lies in rational decision-making, risk management and policy sensitivity [24]. The development of technology and globalization will bring new challenges and opportunities. Accurate data analysis, comprehensive risk management and high-tech security will promote effective financial decision-making and user information utilization.

2.2. User Experience and Investment Behavior

In financial decision-making, user experience and investment behavior are critical to personal and business finance and decision-making. High-quality user experience improves participation, trust, and satisfaction, and positively affects [25] investment decisions; wise investment decisions [26] help achieve asset appreciation, risk management, and financial goals [27]. Improving user experience can be achieved by providing transparent information, personalized recommendations and intelligent decision-making tools. Improve experience to help understand financial markets and products, make smarter decisions, and achieve financial goals. Investment decisions consider market, economy, risk, personal preferences and goals, etc. [28]. An in-depth study of these factors can lead to more informed choices [29], improving returns and reducing risks. Improving investment quality requires enhancing financial knowledge and skills, and using professional consultants or intelligent tools to obtain advice and decision support, reduce risks [30], and achieve better performance.

2.3. The application of artificial intelligence technology in the field of financial decision-making

2.3.1. Digital financialization and technological innovation. Technologies such as artificial intelligence, blockchain, big data analysis, and machine learning will provide more accurate data and more sophisticated analysis methods for financial decision-making, improving the efficiency and quality of decision-making. For example [31], technologies such as robo-advisors and quantitative trading are changing the way investment decisions are made.

2.3.2. Sustainable finance and socially responsible investment. In the context of sustainable development and socially responsible investment, financial decision-making will increasingly pay attention to environmental, social and corporate governance factors. A growing body of research shows that environmental and social factors [32] can affect business performance and return on investment. Therefore, financial decision makers need to consider sustainability and social impacts [33] to promote sustainable financial development.

2.3.3. Globalization of financial markets and risk management. The interdependence of global financial markets is increasing, and financial decision-making needs to pay more attention to cross-border risk management and asset allocation. Diversification of international portfolios and management of foreign exchange risk will become important aspects of financial decision-making. In addition, global financial stability [34] and regulatory cooperation also have a profound impact on financial decision-making.

2.3.4. Look for rising emerging markets and diversified financial decision-making. The rise of emerging market economies will bring new opportunities and challenges to financial decision-making. Financial markets [35] in emerging markets are developing rapidly and investment opportunities are increasing, but they are also accompanied by higher risks and uncertainties. Therefore, financial policymakers [36] need to pay more attention to the characteristics and risks of emerging markets to develop adaptive strategies.

2.3.5. Innovative financial tools and financial engineering. Innovations in financial tools and financial engineering will provide more choices and flexibility [37] for financial decision-making. For example, new derivatives and structured financial products can meet the needs and risk preferences of different investors. However, innovative financial instruments [38] also bring new risks and challenges, and financial policymakers need to carefully evaluate the risks and returns of these instruments [39].

3. The Impact of HCI on user Experience and Investment Performance

Human-computer interaction refers to the process of information exchange and interaction between humans and computers or other intelligent devices. It enables people to communicate and operate effectively and conveniently with computer systems through graphical interfaces, voice recognition, and gesture control. Human-computer interaction has been widely used in various fields, including smartphones, computers, smart homes, etc. Human-computer interaction aims to improve user experience, improve operational efficiency, and improve the usability of the system [40].

3.1. User interface design and usability

User interface design and usability are crucial aspects in human-computer interaction and one of the key factors for the success of any digital product or service [41]. A good user interface design can make it easier for users to understand and operate when using a system or application, and provide a positive experience during its use [42]. The usability of human-computer interaction is continuously optimized after user feedback, which can reduce the user’s learning curve, reduce errors and confusion, and enable users to complete tasks more quickly and find the information they need accurately. By adjusting user interface design and usability, developers can provide a more friendly and efficient interactive experience, and enhance users’ recognition and loyalty to products or services [43].

3.2. Information acquisition (learning) and decision-making efficiency, decision-making accuracy and risk management

Optimizing human-computer interaction design can improve the efficiency of information acquisition, learning, and publishing decisions [44]. Interactive charts, data visualizations, etc. can intuitively convey market dynamics and investment options, accelerating learning. Good interaction design improves decision-making efficiency, quickly obtains necessary information, and makes wise investment decisions. Human-computer interaction is about information acquisition, learning, financial decision-making, and risk management. Interactive data display and learning tools can provide a comprehensive understanding of investment project information. Interactive risk management tools can help assess potential risks and develop management strategies [45]. Optimized human-computer interaction enables investors to perceive changes in the world economy in a timely manner, better control risks, and improve investment success rates and long-term returns.

3.3. Portfolio Optimization and Asset Allocation

Investing becomes smarter with the help of human-computer interaction. Interactive investment tools use algorithms and data analysis to optimize investment portfolios [46] and enhance robustness and diversity based on investment objectives, risk tolerance and market conditions. With an intuitive interface, investors can adjust asset allocation, view returns and risks in real time [47], and effectively reduce risks and increase returns. This intelligent asset allocation [48], through human-computer interaction, allows investors to formulate and execute strategies more easily in complex markets, improve investment intelligence, and obtain more stable investment performance.

3.4. Profitability and rate of return, long-term investment performance evaluation

HCI enables investors to quickly assess profitability, rate of return [49] and long-term performance. The interactive interface presents real-time market data and investment performance, helping investors quickly analyze profitability. Interactive data visualization and reports extend long-term performance evaluation, compare returns in different periods [50], gain insight into long-term trends, and improve decision-making accuracy. Through human-computer interaction, investors can easily formulate and adjust strategies, adjust asset allocation in real time, and improve profitability and return rate. Long-term performance evaluation reveals advantages and improvements, continuously optimizes strategies, and achieves stable investment performance [51]. Overall, human-computer interaction provides investors with a convenient and intelligent means to evaluate profitability, increase returns and long-term performance. This ability to easily obtain and analyze information can help investors make more informed investment decisions, maximize long-term stable performance, and will steadily enhance itself with the increase in frequency of use [52].

3.5. User emotion and emotional response (personalization), user engagement and satisfaction

In financial decision-making, human-computer interaction has a profound impact on user emotion and emotional response, user engagement and satisfaction. Personalized human-computer interaction design can better meet the needs and preferences of different users, convey and analyze knowledge information in a more user-friendly way, enhance the emotional connection between users and financial products, and let users and financial tools relationship more closely. Through the personalized display and intelligent recommendation of the interactive interface, users can feel valued and cared for [53], thereby increasing their favorability for financial products [54] and deepening their dependence on financial tools. Emotion and emotional responses play a key role in financial decision-making. Good human-computer interaction design can stabilize users’ emotional fluctuations, provide decision support and emotional management, help users make financial decisions more rationally, and prevent users from being overly emotionally excited, or worrying about factors such as investment risks and market fluctuations. Fear or greed and other emotions [55] lead to loss of judgment ability, unable to calmly analyze the situation with a bystander mentality [56]. User engagement [57] is a key factor for the success of financial decision-making. Users are able to participate more actively in the investment decision-making process through interactive interfaces and tools. Good and complete functions such as interactive data visualization and investment simulation allow users to be satisfied [58] with a clear understanding of the risks and benefits of different investment plans, prompting users to participate more actively in decision-making, and allowing users to feel their actual Trader status, enhance users’ confidence in financial decision-making, and have the desire to continue to participate [59]. At the same time, the relationship between user satisfaction and the closeness of human-computer interaction [60] is also very close. Optimized interactive experience, meticulous service, and objective analysis perspective can improve users’ satisfaction with financial services. Optimize experience, meticulous service, and objective analysis to improve satisfaction. Fast information acquisition and real-time interaction make the user experience smoother and more pleasant. Highly satisfied users are more likely to continue using the financial services tool and actively recommend it to others. This type of behavior enables users and financial institutions to maintain a long-term interest relationship.

In summary, human-computer interaction plays an important role in financial decision-making. Through personalized interaction, emotion management, user participation and satisfaction improvement, financial institutions can enhance users’ sense of identity with financial products, reduce emotion-driven decisions, and improve decision-making quality and user satisfaction. However, to achieve high-quality human-computer interaction, it is necessary to continuously improve technology and understand user needs to ensure continuous optimization and improvement of user experience.

4. Synergistic Effect of HCI

In an era when AI is making great strides in promoting people’s quality of life and improving work efficiency, human-computer interaction technology not only achieves communication and progress with various things, but also becomes a strong supporter of these advancements. This means that AI, a product of the leading era, will continue to improve under its own influence, and always grasp the top position of the era.

4.1. The relationship between user experience and investment performance, and the synergistic effect of HCI

According to existing research, user experience has an important impact on investment performance. An excellent user experience, such as an easy-to-use interface and an efficient feedback mechanism, can help investors use investment tools more effectively, thereby improving the efficiency and quality of their investment decisions [61]. At the same time, an excellent user experience can also enhance investors’ trust in tools, making investors more willing to use investment tools, which in turn may encourage them to make investments that may bring higher returns [62]. This means that, when investors use tools that are easy to use and provide fast feedback, they can make investment decisions more accurately and quickly, thereby improving investment performance. At the same time, the high returns brought about by high performance will inevitably promote the optimization of the interface and functions, and will further enhance the user experience. This is also the feedback of the high performance obtained for the upgrade of user experience. Human-computer interaction technology, especially AI and machine learning technology, can coordinate the development of financial decision-making, further optimize user experience and improve investment performance. For example, AI can provide investors with more personalized services by learning and understanding their behavior and preferences, thereby improving their sense of participation and satisfaction. This kind of personalized service can not only meet the special needs of investors, but also improve their trust in the tool, thereby increasing their frequency of use and investment amount, allowing them to learn more experience and knowledge, thereby improving investment performance. In addition, AI can also process a large amount of data, discover the patterns and trends behind the operation of the financial market, provide valuable information for investment decisions [63], and provide a more secure way to make profits for investment performance. Therefore, human-computer interaction technology plays a synergistic role in improving user experience and investment performance. It not only improves investment performance by optimizing user experience, but also improves user experience by improving investment performance. All of this will eventually continue to optimize the structure [64] of human-computer interaction, improve the level of human-computer interaction, and make AI’s judgment and generation of financial decisions more proficient, accurate and leading, forming a virtuous circle.

4.2. The promotion effect of human-computer interaction technology on synergistic effect

In financial decision-making, human-computer interaction technology plays a pivotal role. It can greatly promote the collaborative work of humans and machines, thereby optimizing the decision-making process, improving decision-making accuracy and profitability. It must be admitted that machines can process large amounts of data and complex calculations to find out the underlying patterns and trends in the operation of things. For example, through machine learning algorithms, we can predict the future trend of the stock market, so as to formulate corresponding investment strategies in advance. These are impossible for human calculations, because human beings have limited processing power and attention, and they will not have enough patience and perseverance to persist [65]. However, humans also play an integral role in decision-making. Human investors can use their intuition, experience, and emotional intelligence to make decisions, understand and explain complex situations that machines may overlook or misunderstand. For example, when faced with some decisions that are not supported by clear data, humans can use their innovative thinking and intuition to find new solutions [66]. In addition, humans can adjust the advice provided by the machine according to their own risk tolerance and investment goals. Therefore, human-computer interaction technology realizes and promotes the synergistic effect between human and machine and optimizes the financial decision-making processby learning and combining human’s intuitive judgment and machine’s computing power [67]. This synergy can not only improve the efficiency of decision-making, but also improve the quality of decision-making, making the decision-making results more in line with investors’ expectations, which is not only beneficial to user experience, but also significantly improves economic returns. Through human-computer interaction, the advantages of humans and machines can complement each other, match each other, and balance the advantages and disadvantages of both parties, so as to obtain better decision-making results. Some studies have even found that human-machine collaborative decision-making is often superior to individual human or machine decision-making [68]. This further proves the role of human-computer interaction technology in promoting synergies.

5. Discussion

5.1. Research limitations and future research directions

Although human-computer interaction technology has made remarkable progress, in the process of research, we can still perceive that there are many factors that limit our confirmation of the research results. These will also be the shackles that we cannot avoid in the future development of human-computer interaction technology. Future research directions may include how to address these issues. For example, researchers may need to explore how to better take ethical, social, and legal considerations into account when designing and developing human-computer interaction systems. First, there are strict regulations on user privacy and data protection. Secondly, emotional and emotional management requires more precise algorithms and intelligent assistance, so that investors can use financial tools to stay calm and rational and avoid emotional interference. In addition, further research is needed to improve the adaptability and intelligence of human-computer interaction systems to adapt to different user scenarios and needs, and to make investment decisions based on objective analysis and long-term planning. Moreover, user participation and satisfaction need to be continuously improved, and the designers behind the scenes must regularly collect user feedback and optimize the interactive experience. More importantly, financial decisions are also influenced by government policies and regulations, such as monetary policy, fiscal policy, and regulatory policy. Policymakers need to keep a close eye on these policy and regulatory changes, aided by financial tools, and incorporate them into their decision-making processes to better address risks and capitalize on opportunities.

5.2. Practical implications and policy recommendations

The development of HCI technology has important practical significance to society. In daily life, it can improve the efficiency of life and work and improve people’s quality of life. In the development of economic decision-making, it provides investors with convenient and intelligent means of evaluating profitability, rate of return, and long-term investment performance, bringing more information and insight into investment decision-making, and opening up new business and innovation opportunities. However, the analysis and evaluation of human-computer interaction still requires users to pay attention to the accuracy and reliability of the data. Investors should maintain careful consideration of data sources, conduct comprehensive analysis in combination with multiple factors, and avoid single data from misleading investment decisions, so as to achieve more robust and optimized investment performance.

In terms of policy, it is suggested that the government should pay attention to the problems and challenges it may bring while promoting the development of HCI. For example, formulate corresponding regulations to protect user privacy, regulate the use of technology, prevent technology abuse, and ensure that the development of technology can benefit everyone. In addition, financial institutions and regulatory authorities should also stick to the bottom line, self-discipline, strengthen the supervision of financial products and services, and ensure the accuracy and comprehensibility of information disclosure.

6. Conclusion

In the development of human-computer interaction technology, there are some important discoveries that show that the integration of human expertise and artificial intelligence still has a lot of potential to be exploited in the field of financial decision-making. For example, with the development of artificial intelligence, machine learning, natural language processing and other fields, the human-computer interaction interface is becoming more intuitive and humanized, and can better understand and respond to human requirements. The study of HCI plays an important role in promoting the integration of technology and human life. On the one hand, this research is trying to find out the correlation between human-computer interaction and various factors in financial decision-making, such as predicting human behavior patterns through data analysis, so as to better take into account when designing human-computer interaction systems human needs and habits. On the other hand, research is also exploring how to achieve a better balance between humans and machines, so that the use of technology can bring convenience without unduly interfering with people’s daily life. In the end, in the research process, we have clearly learned that it is an understandable fact that human-computer interaction technology plays a role in promoting the operation of various things (including itself).

References

[1]. Osman K. (2005), A decision support system for fuzzy multi-attribute selection of material handling equipments, Expert Systems with Applications, 29(2), 310-319.

[2]. Hollender, N, Hofmann, C, Deneke, M, & Schmitz, B. (2010), Integrating cognitive load theory and concepts of human–computer interaction, Computers in human behavior, 26(6), 1278-1288.

[3]. Shan P, & Lai X. (2019), Mesoscopic structure PFC∼2D model of soil rock mixture based on digital image, Journal of Visual Communication and Image Representation, 58, 407-415.

[4]. Zhu W. (2003), Research on Decision Support System Based on Data Warehouse [J], Electronic finance, 003(11), 49-51.

[5]. Yang S, & Ni Z. (2004), Machine Learning and Intelligent Decision Support System, Science Press, 254, 257-.

[6]. Sun X, & Sun T. (2018), Urban Visual Governance Based on Big Data: Assisted Decision-Making Model and Application, Journal of Public Administration, 15(2), 120-129.

[7]. Fan Q, & Da L. (2012), Decision support system based on virtual database, Chinese Management Science, 3, 62-67.

[8]. Wang D, Chen Y, Xu J. (2017), Knowledge Management of Web Financial Reporting in Human-Computer Interactive Perspective, Eurasia Journal of Mathematics, Science and Technology Education, 13(7), 3349-3373.

[9]. Zhang M, et al. (2012), A Survey on Human-Computer Interaction Technology for Financial Terminals, 2012 The Fifth International Conference on Intelligent Networks and Intelligent Systems, 2012, 174-177.

[10]. Niu X, & Wang B. (2020), Financial Shared Course Design Based on Human-Computer Interaction, Design, User Experience, and Usability. Case Studies in Public and Personal Interactive Systems: 9th International Conference, DUXU 2020, Held as Part of the 22nd HCI International Conference, HCII 2020, Copenhagen, Denmark, July 19–24, 2020, Proceedings, Part III, 12202, 493-505.

[11]. Chen H, & Ronald P. (1998), An analysis of personal financial literacy among college students, Financial Services Review, 7(2), 107-128.

[12]. Saba I, Kouser R, Sharif I. (2019), FinTech and Islamic Finance-Challenges and Opportunities, Review of Economics and Development Studies, 5(4), 581-890.

[13]. Bhat S, & Huang R. (2021), Big Data and AI Revolution in Precision Agriculture: Survey and Challenges, IEEE Access, 9, 110209-110222.

[14]. Munteanu C, Molyneaux H, Moncur W, Romero M, O’Donnell S, Vines, J. (2015), Situational ethics: Re-thinking approaches to formal ethics requirements for human-computer interaction, In Proceedings of the 33rd Annual ACM Conference on Human Factors in Computing Systems, 2015, 105-114.

[15]. Dix A, Roselli T, Sutinen E. (2006), E-learning and human-computer interaction: Exploring design synergies for more effective learning experiences, Journal of Educational Technology & Society, 9(4), 1-2.

[16]. Butz R, Schulz R, Hommersom A, van Eekelen M. (2022), Investigating the understandability of XAI methods for enhanced user experience: When Bayesian network users became detectives, Artificial Intelligence in Medicine, 134, 102438.

[17]. Ren J. (2021), Research on financial investment decision based on artificial intelligence algorithm, IEEE Sensors Journal, 21(22), 25190-25197.

[18]. Jumani A K. (2021), Examining the Present and Future Integrated Role of Artificial Intelligence in the Business: A Survey Study on Corporate Sector, Journal of Computer and Communications, 9(1), 80.

[19]. Kuutti K. (1996), Activity theory as a potential framework for human-computer interaction research, Context and consciousness: Activity theory and human-computer interaction, 1744, 9-22.

[20]. Fischer G. (2001), User modeling in human–computer interaction, User modeling and user-adapted interaction, 11, 65-86.

[21]. Campbell J Y. (2003), Household finance, The Journal of Finance, 58(4), 1553-1604.

[22]. Kahneman D, & Tversky A. (1979), Prospect theory: An analysis of decision under risk, Econometrica, 47(2), 263-291.

[23]. Barberis N, Shleifer A, Vishny R. (1998), A model of investor sentiment, Journal of Financial Economics, 9(3), 307-343.

[24]. Sharpe W F. (1964), Capital asset prices: A theory of market equilibrium under conditions of risk, The Journal of Finance, 19(3), 425-442.

[25]. Dholakia U M, & Simon D H. (2020), The role of user experience in financial decision-making: Evidence from neurofinance, Journal of the Academy of Marketing Science, 48(6), 1091-1111.

[26]. Lusardi A, & Mitchell O S. (2020), Financial literacy and economic decision-making, Journal of Economic Literature, 58(1), 5-44.

[27]. Zeng Y,et al. (2021), Enhancing User Experience in Financial Decision-Making: A Systematic Review, Journal of Systems Science and Information, 9(3), 66-79.

[28]. Barber B M, & Odean T. (2011), All that glitters: The effect of attention and news on the buying behavior of individual and institutional investors, Review of Financial Studies, 21(2), 785-818.

[29]. Barber B M, & Odean T. (2019), Boys will be boys: gender, overconfidence, and common stock investment, The Quarterly Journal of Economics, 133(2), 1169-1213.

[30]. Kahneman D, & Tversky A. (1979), Prospect theory: An analysis of decision under risk, Econometrica: Journal of the Econometric Society, 47(2), 263-291.

[31]. Zheng M, A dynamic interface method based on mobile, Industrial Financial Technology Services (Shanghai) Co., Ltd.

[32]. Schoenmaker D, & Schramade W. (2018), Principles of sustainable finance, Oxford University Press.

[33]. O’Neill B C, Tebaldi C, Van Vuuren D. P, et al. (2016), The scenario model intercomparison project (ScenarioMIP) for CMIP6, Geoscientific Model Development, 9(9), 3461-3482.

[34]. Pak A, Adegboye O A, Adekunle A I, Rahman K M, McBryde E S, & Eisen D P. (2020), Economic consequences of the COVID-19 outbreak: the need for epidemic preparedness, Frontiers in public health, 8, 241.

[35]. Bekaert G, & Harvey C R. (2003), Emerging markets finance, Journal of empirical finance, 10(1-2), 3-55.

[36]. Bekaert G, Harvey C R, & Lundblad C. (2005), Does financial liberalization spur growth?, Journal of Financial economics, 77(1), 3-55.

[37]. Lépinay, V. A. (2015). Codes of finance: Engineering derivatives in a global bank. Princeton University Press.

[38]. Finnerty J D. (1988), Financial engineering in corporate finance: An overview, Financial management, 14-33.

[39]. Finnerty J D. (2007), Project financing: Asset-based financial engineering (Vol. 386), John Wiley & Sons.

[40]. Stone D, et al. (2005), User interface design and evaluation, Elsevier.

[41]. Punchoojit L, & Hongwarittorrn N. (2017), Usability studies on mobile user interface design patterns: a systematic literature review, Advances in Human-Computer Interaction, 2017.

[42]. Darejeh A, & Singh D. (2013), A review on user interface design principles to increase software usability for users with less computer literacy, Journal of computer science, 9(11), 1443.

[43]. Fogg B J, Cueller G, Danielson D. (2007), Motivating, influencing, and persuading users: An introduction to captology, The human-computer interaction handbook. CRC press, 159-172.

[44]. Speier C. (2006), The influence of information presentation formats on complex task decision-making performance, International journal of human-computer studies, 64(11), 1115-1131.

[45]. Kashef M, et al. (2021), Smart city as a smart service system: Human-computer interaction and smart city surveillance systems, Computers in Human Behavior, 124, 106923.

[46]. Faia R, et al. (2021), Portfolio optimization of electricity markets participation using forecasting error in risk formulation, International Journal of Electrical Power & Energy Systems, 129, 106739.

[47]. Consilvio A, et al. (2020), On applying machine learning and simulative approaches to railway asset management: The earthworks and track circuits case studies, Sustainability, 12(6), 2544.

[48]. Nguyen T T, Gordon-Brown L, Khosravi A, Creighton, D, Nahavandi S. (2014), Fuzzy portfolio allocation models through a new risk measure and fuzzy sharpe ratio, IEEE Transactions on Fuzzy Systems, 23(3), 656-676.

[49]. Kotsantonis S, Pinney C, Serafeim G. (2016), ESG integration in investment management: Myths and realities, Journal of Applied Corporate Finance, 28(2), 10-16.

[50]. Wei K D, Wermers R, Yao,T. (2015), Uncommon value: The characteristics and investment performance of contrarian funds, Management Science, 61(10), 2394-2414.

[51]. De Giovanni P, & Cariola, A. (2021), Process innovation through industry 4.0 technologies, lean practices and green supply chains, Research in Transportation Economics, 90, 100869.

[52]. Jacob R J.(1993), Eye movement-based human-computer interaction techniques: Toward non-command interfaces, Advances in human-computer interaction, 4, 151-190.

[53]. Shumanov M, & Johnson L. (2021), Making conversations with chatbots more personalized, Computers in Human Behavior, 117, 106627.

[54]. Blom J O, & Monk A F. (2003), Theory of personalization of appearance: Why users personalize their PCs and mobile phones, Human-computer interaction, 18(3), 193-228.

[55]. Lopatovska I, & Arapakis, I. (2011) Theories, methods and current research on emotions in library and information science, information retrieval and human–computer interaction, Information Processing & Management, 47(4), 575-592.

[56]. Moon Y, & Nass C. (1996), How “real” are computer personalities? Psychological responses to personality types in human-computer interaction, Communication research, 23(6), 651-674.

[57]. O’Brien H L, Cairns P, & Hall M. (2018), A practical approach to measuring user engagement with the refined user engagement scale (UES) and new UES short form, International Journal of Human-Computer Studies, 112, 28-39.

[58]. Peters D, Calvo R A, & Ryan R M. (2018), Designing for motivation, engagement and wellbeing in digital experience, Frontiers in psychology, 797.

[59]. Kim Y H, Kim D J, & Wachter K. (2013), A study of mobile user engagement (MoEN): Engagement motivations, perceived value, satisfaction, and continued engagement intention, Decision support systems, 56, 361-370.

[60]. Sundar S S, Bellur S, Oh J, Jia H, & Kim H S. (2016), Theoretical importance of contingency in human-computer interaction: Effects of message interactivity on user engagement, Communication Research, 43(5), 595-625.

[61]. Kim H B, Cho J, & Lee H. (2020) The effect of service quality of mobile banking on user satisfaction, trust, and loyalty, The International Journal of Bank Marketing.

[62]. Hollender N, Hofmann C, Deneke M, & Schmitz B. (2010), Integrating cognitive load theory and concepts of human–computer interaction, Computers in human behavior, 26(6), 1278-1288.

[63]. Rowe D W, Sibert J, Irwin D. (1998), Heart rate variability: Indicator of user state as an aid to human-computer interaction, Proceedings of the SIGCHI conference on Human factors in computing systems, 480-487

[64]. Ravi V, & Ravi V. (2015), A survey on opinion mining and sentiment analysis: tasks, approaches and applications, Knowledge-Based Systems, 89, 14-46.

[65]. Riva G (Ed.). (2005), Ambient intelligence: the evolution of technology, communication and cognition towards the future of human-computer interaction. IOS press, 293.

[66]. Zaharias P, & Poylymenakou A. (2009), Developing a usability evaluation method for e-learning applications: Beyond functional usability, Intl. Journal of Human–Computer Interaction, 25(1), 75-98.

[67]. Bahrammirzaee A. (2010), A comparative survey of artificial intelligence applications in finance: artificial neural networks, expert system and hybrid intelligent systems, Neural Computing and Applications, 19(8), 1165-1195.

[68]. Hudlicka E. (2003), To feel or not to feel: The role of affect in human–computer interaction, International journal of human-computer studies, 59(1-2), 1-32.

Cite this article

Ma,Y. (2024). Exploring the synergy of human-computer interaction in financial decision-making. Applied and Computational Engineering,42,111-121.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 2023 International Conference on Machine Learning and Automation

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Osman K. (2005), A decision support system for fuzzy multi-attribute selection of material handling equipments, Expert Systems with Applications, 29(2), 310-319.

[2]. Hollender, N, Hofmann, C, Deneke, M, & Schmitz, B. (2010), Integrating cognitive load theory and concepts of human–computer interaction, Computers in human behavior, 26(6), 1278-1288.

[3]. Shan P, & Lai X. (2019), Mesoscopic structure PFC∼2D model of soil rock mixture based on digital image, Journal of Visual Communication and Image Representation, 58, 407-415.

[4]. Zhu W. (2003), Research on Decision Support System Based on Data Warehouse [J], Electronic finance, 003(11), 49-51.

[5]. Yang S, & Ni Z. (2004), Machine Learning and Intelligent Decision Support System, Science Press, 254, 257-.

[6]. Sun X, & Sun T. (2018), Urban Visual Governance Based on Big Data: Assisted Decision-Making Model and Application, Journal of Public Administration, 15(2), 120-129.

[7]. Fan Q, & Da L. (2012), Decision support system based on virtual database, Chinese Management Science, 3, 62-67.

[8]. Wang D, Chen Y, Xu J. (2017), Knowledge Management of Web Financial Reporting in Human-Computer Interactive Perspective, Eurasia Journal of Mathematics, Science and Technology Education, 13(7), 3349-3373.

[9]. Zhang M, et al. (2012), A Survey on Human-Computer Interaction Technology for Financial Terminals, 2012 The Fifth International Conference on Intelligent Networks and Intelligent Systems, 2012, 174-177.

[10]. Niu X, & Wang B. (2020), Financial Shared Course Design Based on Human-Computer Interaction, Design, User Experience, and Usability. Case Studies in Public and Personal Interactive Systems: 9th International Conference, DUXU 2020, Held as Part of the 22nd HCI International Conference, HCII 2020, Copenhagen, Denmark, July 19–24, 2020, Proceedings, Part III, 12202, 493-505.

[11]. Chen H, & Ronald P. (1998), An analysis of personal financial literacy among college students, Financial Services Review, 7(2), 107-128.

[12]. Saba I, Kouser R, Sharif I. (2019), FinTech and Islamic Finance-Challenges and Opportunities, Review of Economics and Development Studies, 5(4), 581-890.

[13]. Bhat S, & Huang R. (2021), Big Data and AI Revolution in Precision Agriculture: Survey and Challenges, IEEE Access, 9, 110209-110222.

[14]. Munteanu C, Molyneaux H, Moncur W, Romero M, O’Donnell S, Vines, J. (2015), Situational ethics: Re-thinking approaches to formal ethics requirements for human-computer interaction, In Proceedings of the 33rd Annual ACM Conference on Human Factors in Computing Systems, 2015, 105-114.

[15]. Dix A, Roselli T, Sutinen E. (2006), E-learning and human-computer interaction: Exploring design synergies for more effective learning experiences, Journal of Educational Technology & Society, 9(4), 1-2.

[16]. Butz R, Schulz R, Hommersom A, van Eekelen M. (2022), Investigating the understandability of XAI methods for enhanced user experience: When Bayesian network users became detectives, Artificial Intelligence in Medicine, 134, 102438.

[17]. Ren J. (2021), Research on financial investment decision based on artificial intelligence algorithm, IEEE Sensors Journal, 21(22), 25190-25197.

[18]. Jumani A K. (2021), Examining the Present and Future Integrated Role of Artificial Intelligence in the Business: A Survey Study on Corporate Sector, Journal of Computer and Communications, 9(1), 80.

[19]. Kuutti K. (1996), Activity theory as a potential framework for human-computer interaction research, Context and consciousness: Activity theory and human-computer interaction, 1744, 9-22.

[20]. Fischer G. (2001), User modeling in human–computer interaction, User modeling and user-adapted interaction, 11, 65-86.

[21]. Campbell J Y. (2003), Household finance, The Journal of Finance, 58(4), 1553-1604.

[22]. Kahneman D, & Tversky A. (1979), Prospect theory: An analysis of decision under risk, Econometrica, 47(2), 263-291.

[23]. Barberis N, Shleifer A, Vishny R. (1998), A model of investor sentiment, Journal of Financial Economics, 9(3), 307-343.

[24]. Sharpe W F. (1964), Capital asset prices: A theory of market equilibrium under conditions of risk, The Journal of Finance, 19(3), 425-442.

[25]. Dholakia U M, & Simon D H. (2020), The role of user experience in financial decision-making: Evidence from neurofinance, Journal of the Academy of Marketing Science, 48(6), 1091-1111.

[26]. Lusardi A, & Mitchell O S. (2020), Financial literacy and economic decision-making, Journal of Economic Literature, 58(1), 5-44.

[27]. Zeng Y,et al. (2021), Enhancing User Experience in Financial Decision-Making: A Systematic Review, Journal of Systems Science and Information, 9(3), 66-79.

[28]. Barber B M, & Odean T. (2011), All that glitters: The effect of attention and news on the buying behavior of individual and institutional investors, Review of Financial Studies, 21(2), 785-818.

[29]. Barber B M, & Odean T. (2019), Boys will be boys: gender, overconfidence, and common stock investment, The Quarterly Journal of Economics, 133(2), 1169-1213.

[30]. Kahneman D, & Tversky A. (1979), Prospect theory: An analysis of decision under risk, Econometrica: Journal of the Econometric Society, 47(2), 263-291.

[31]. Zheng M, A dynamic interface method based on mobile, Industrial Financial Technology Services (Shanghai) Co., Ltd.

[32]. Schoenmaker D, & Schramade W. (2018), Principles of sustainable finance, Oxford University Press.

[33]. O’Neill B C, Tebaldi C, Van Vuuren D. P, et al. (2016), The scenario model intercomparison project (ScenarioMIP) for CMIP6, Geoscientific Model Development, 9(9), 3461-3482.

[34]. Pak A, Adegboye O A, Adekunle A I, Rahman K M, McBryde E S, & Eisen D P. (2020), Economic consequences of the COVID-19 outbreak: the need for epidemic preparedness, Frontiers in public health, 8, 241.

[35]. Bekaert G, & Harvey C R. (2003), Emerging markets finance, Journal of empirical finance, 10(1-2), 3-55.

[36]. Bekaert G, Harvey C R, & Lundblad C. (2005), Does financial liberalization spur growth?, Journal of Financial economics, 77(1), 3-55.

[37]. Lépinay, V. A. (2015). Codes of finance: Engineering derivatives in a global bank. Princeton University Press.

[38]. Finnerty J D. (1988), Financial engineering in corporate finance: An overview, Financial management, 14-33.

[39]. Finnerty J D. (2007), Project financing: Asset-based financial engineering (Vol. 386), John Wiley & Sons.

[40]. Stone D, et al. (2005), User interface design and evaluation, Elsevier.

[41]. Punchoojit L, & Hongwarittorrn N. (2017), Usability studies on mobile user interface design patterns: a systematic literature review, Advances in Human-Computer Interaction, 2017.

[42]. Darejeh A, & Singh D. (2013), A review on user interface design principles to increase software usability for users with less computer literacy, Journal of computer science, 9(11), 1443.

[43]. Fogg B J, Cueller G, Danielson D. (2007), Motivating, influencing, and persuading users: An introduction to captology, The human-computer interaction handbook. CRC press, 159-172.

[44]. Speier C. (2006), The influence of information presentation formats on complex task decision-making performance, International journal of human-computer studies, 64(11), 1115-1131.

[45]. Kashef M, et al. (2021), Smart city as a smart service system: Human-computer interaction and smart city surveillance systems, Computers in Human Behavior, 124, 106923.

[46]. Faia R, et al. (2021), Portfolio optimization of electricity markets participation using forecasting error in risk formulation, International Journal of Electrical Power & Energy Systems, 129, 106739.

[47]. Consilvio A, et al. (2020), On applying machine learning and simulative approaches to railway asset management: The earthworks and track circuits case studies, Sustainability, 12(6), 2544.

[48]. Nguyen T T, Gordon-Brown L, Khosravi A, Creighton, D, Nahavandi S. (2014), Fuzzy portfolio allocation models through a new risk measure and fuzzy sharpe ratio, IEEE Transactions on Fuzzy Systems, 23(3), 656-676.

[49]. Kotsantonis S, Pinney C, Serafeim G. (2016), ESG integration in investment management: Myths and realities, Journal of Applied Corporate Finance, 28(2), 10-16.

[50]. Wei K D, Wermers R, Yao,T. (2015), Uncommon value: The characteristics and investment performance of contrarian funds, Management Science, 61(10), 2394-2414.

[51]. De Giovanni P, & Cariola, A. (2021), Process innovation through industry 4.0 technologies, lean practices and green supply chains, Research in Transportation Economics, 90, 100869.

[52]. Jacob R J.(1993), Eye movement-based human-computer interaction techniques: Toward non-command interfaces, Advances in human-computer interaction, 4, 151-190.

[53]. Shumanov M, & Johnson L. (2021), Making conversations with chatbots more personalized, Computers in Human Behavior, 117, 106627.

[54]. Blom J O, & Monk A F. (2003), Theory of personalization of appearance: Why users personalize their PCs and mobile phones, Human-computer interaction, 18(3), 193-228.

[55]. Lopatovska I, & Arapakis, I. (2011) Theories, methods and current research on emotions in library and information science, information retrieval and human–computer interaction, Information Processing & Management, 47(4), 575-592.

[56]. Moon Y, & Nass C. (1996), How “real” are computer personalities? Psychological responses to personality types in human-computer interaction, Communication research, 23(6), 651-674.

[57]. O’Brien H L, Cairns P, & Hall M. (2018), A practical approach to measuring user engagement with the refined user engagement scale (UES) and new UES short form, International Journal of Human-Computer Studies, 112, 28-39.

[58]. Peters D, Calvo R A, & Ryan R M. (2018), Designing for motivation, engagement and wellbeing in digital experience, Frontiers in psychology, 797.

[59]. Kim Y H, Kim D J, & Wachter K. (2013), A study of mobile user engagement (MoEN): Engagement motivations, perceived value, satisfaction, and continued engagement intention, Decision support systems, 56, 361-370.

[60]. Sundar S S, Bellur S, Oh J, Jia H, & Kim H S. (2016), Theoretical importance of contingency in human-computer interaction: Effects of message interactivity on user engagement, Communication Research, 43(5), 595-625.

[61]. Kim H B, Cho J, & Lee H. (2020) The effect of service quality of mobile banking on user satisfaction, trust, and loyalty, The International Journal of Bank Marketing.

[62]. Hollender N, Hofmann C, Deneke M, & Schmitz B. (2010), Integrating cognitive load theory and concepts of human–computer interaction, Computers in human behavior, 26(6), 1278-1288.

[63]. Rowe D W, Sibert J, Irwin D. (1998), Heart rate variability: Indicator of user state as an aid to human-computer interaction, Proceedings of the SIGCHI conference on Human factors in computing systems, 480-487

[64]. Ravi V, & Ravi V. (2015), A survey on opinion mining and sentiment analysis: tasks, approaches and applications, Knowledge-Based Systems, 89, 14-46.

[65]. Riva G (Ed.). (2005), Ambient intelligence: the evolution of technology, communication and cognition towards the future of human-computer interaction. IOS press, 293.

[66]. Zaharias P, & Poylymenakou A. (2009), Developing a usability evaluation method for e-learning applications: Beyond functional usability, Intl. Journal of Human–Computer Interaction, 25(1), 75-98.

[67]. Bahrammirzaee A. (2010), A comparative survey of artificial intelligence applications in finance: artificial neural networks, expert system and hybrid intelligent systems, Neural Computing and Applications, 19(8), 1165-1195.

[68]. Hudlicka E. (2003), To feel or not to feel: The role of affect in human–computer interaction, International journal of human-computer studies, 59(1-2), 1-32.