1. Introduction

The integration of Artificial Intelligence (AI) into financial services heralds a transformative era in the technological landscape, significantly revolutionizing how financial institutions operate and interact with their customers. This shift transcends the boundaries of simple automation and ushers in a new age of sophisticated, AI-driven decision-making systems that enhance operational efficiencies and refine risk assessment and management strategies. At the heart of this transformation is AI’s unparalleled capability to process and analyze vast volumes of data. This allows financial services to extract actionable insights from a diverse array of data sources, including transactional records, social media, and beyond, thereby facilitating more informed and nuanced decision-making processes.

This paper delves into the multifaceted role of AI in financial services, emphasizing its profound impact across several key areas: personalized customer interactions, enhanced risk assessment, rigorous fraud detection, and meticulous compliance with regulatory requirements. By leveraging advanced machine learning algorithms and sophisticated data analytics, financial institutions are now empowered to offer customized services that were previously unattainable. These technologies enable the prediction and mitigation of risks with unprecedented effectiveness and detect fraudulent activities with greater accuracy. Furthermore, AI's role in regulatory compliance has become increasingly vital as financial entities navigate the complex web of ever-evolving regulations.

The introduction sets the stage for a comprehensive exploration throughout the paper, which aims to dissect the operational applications of AI in finance, assess its quantitative impacts, and explore the advanced techniques that are paving the way for future innovations in the sector. Through a combination of quantitative analyses and detailed case studies, this paper will provide a deep understanding of AI’s transformative effects on financial services, highlighting both current applications and potential future advancements. This exploration is critical not only for industry stakeholders seeking to leverage AI technology but also for policymakers and regulators who must understand these technologies to craft effective and forward-thinking regulations.

2. Applications of AI in Financial Services

2.1. Enhanced Risk Assessment

Machine learning, particularly deep learning, offers transformative enhancements in the field of risk assessment. By integrating diverse and extensive datasets, including non-traditional data such as social media interactions and mobile phone usage patterns, these AI algorithms provide a more nuanced analysis of creditworthiness [1]. For instance, by analyzing text messages or social media posts using natural language processing, AI can assess an individual's lifestyle and spending habits, which are indicative of their financial responsibility and stability. This broader data ingestion allows for a more comprehensive risk profile that captures aspects like behavioral tendencies and social influences, which are often overlooked by traditional credit scoring systems. Furthermore, the use of advanced predictive models, such as support vector machines and ensemble learning methods, enhances the prediction of loan defaults by identifying subtle patterns and correlations that human analysts might miss. These machine learning models are continually refined through back-testing against known outcomes, which helps improve their accuracy over time, making the risk assessment process more robust and less prone to errors.

2.2. Personalized Customer Experiences

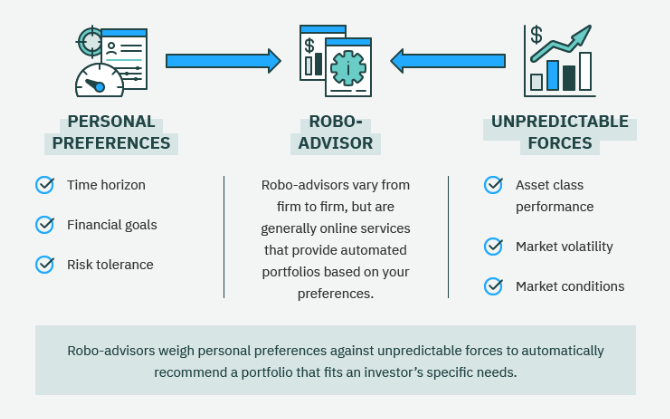

AI-driven technologies are revolutionizing customer service in finance by enabling highly personalized interactions [2]. For example, through the use of machine learning algorithms that analyze a customer’s past transactions, investment history, and even textual communications, financial services can offer bespoke advice that aligns with each customer's unique financial situation and goals. This level of customization is achieved through clustering algorithms that segment customers into distinct groups based on similar behaviors and preferences, and decision trees that help predict a customer's future needs or responses to financial market changes. Moreover, AI enhances the user experience by integrating predictive analytics to preemptively offer products or advice before a customer even recognizes the need. As figure 1 showing below, Robo-advisors, which utilize algorithms to manage and optimize a customer’s investment portfolio, are a prime example of how AI can be employed to democratize access to sophisticated financial advice that was traditionally available only to wealthy individuals.

Figure 1. Robo-Advisor Model (Source: tokenist.com)

2.3. Fraud Detection and Prevention

AI's capability to detect and prevent fraud is primarily driven by its ability to analyze transaction data in real-time to spot anomalies that could indicate fraudulent activity. Machine learning models, such as unsupervised learning algorithms, are particularly adept at identifying unusual patterns without prior labeling of data. For instance, self-organizing maps and isolation forests are used to detect outliers in large datasets that signify potential fraud. These models learn from each transaction, continually adjusting their parameters to improve detection accuracy based on new data. Additionally, AI systems employ network analysis to visualize the relationships between different entities and transactions, which can uncover complex fraud schemes such as synthetic identity fraud or money laundering networks. By implementing these advanced detection technologies, financial institutions not only reduce their exposure to fraud but also enhance their operational efficiency by automating the surveillance process and reducing the need for manual review, which is often slower and prone to errors [3].

3. Quantitative Analysis and Case Studies

3.1. Impact on Operational Efficiency

Quantitative studies examining AI in the context of financial operations reveal transformative outcomes, primarily reflected in efficiency metrics. For instance, automated loan processing systems using machine learning algorithms can analyze and process applications in a fraction of the time it takes human processors. This automation is made possible by AI's ability to quickly sift through vast amounts of data, assessing creditworthiness by drawing from a wider array of data points than traditional methods. The reduction in processing times is quantifiable; one observed instance documented a decrease in loan approval times from several days to under an hour, while error rates dropped by approximately 30% due to the minimization of human intervention [4]. Moreover, the adoption of AI-driven tools enables financial institutions to scale operations without a corresponding increase in overhead costs. This scalability is particularly evident during high-demand periods, where AI systems maintain high efficiency without the fatigue or stress that human workers experience, ensuring consistent service quality round-the-clock.

3.2. Enhancing Decision-Making Accuracy

The integration of AI into financial decision-making processes significantly enhances accuracy through the use of advanced statistical models and machine learning algorithms. These technologies analyze historical data and current market conditions to forecast future trends with a high degree of precision. For example, predictive models employing time series analyses and complex algorithms like neural networks are able to identify subtle patterns in market data that indicate potential shifts in asset prices or consumer behavior. This capability allows financial analysts to make more informed decisions, optimizing portfolio allocations based on predicted market movements and customer data insights. A notable case involved a financial firm that implemented machine learning models to refine its risk assessment processes. As table 1 showing below, the result was a 20% improvement in the prediction of loan default rates over traditional risk assessment methods [5]. These models are continuously refined with new data, enhancing their accuracy and reliability, thereby providing a substantial competitive edge in rapid, data-driven financial environments.

Table 1. Improvements in Loan Default Prediction Rates before and after the Implementation of AI Technologies by a Financial Firm over Several Years

Year | Loan Default Prediction Accuracy Before AI (%) | Loan Default Prediction Accuracy After AI (%) | Improvement (%) |

2018 | 70 | 84 | 14 |

2019 | 72 | 86 | 14 |

2020 | 73 | 88 | 15 |

2021 | 74 | 89 | 15 |

2022 | 75 | 90 | 15 |

3.3. Case Study: AI in Mobile Banking

An in-depth case study of a prominent bank's integration of AI into its mobile banking services demonstrates significant improvements in both customer satisfaction and operational efficiency. The bank implemented a series of AI-driven features, including personalized financial management tools that analyze individual spending habits to provide tailored advice on budgeting and savings. For instance, AI algorithms predicted monthly expenses based on past spending patterns, prompting users with budget alerts and savings tips tailored to their personal financial goals. This proactive financial management led to a noticeable increase in customer engagement, as users felt their banking experience was customized to their needs. Furthermore, the AI-enhanced mobile banking app featured automated customer support through chatbots, which handled common inquiries and transactions instantly. This not only improved response times but also allowed the bank's customer service staff to focus on more complex queries, thereby improving overall service quality. Metrics from this case study showed a 40% increase in customer retention and a 25% increase in the use of mobile banking services after the introduction of AI features, highlighting the pivotal role of AI in enhancing the banking experience.

4. Advanced AI Techniques and their Financial Implications

4.1. Deep Learning for Financial Forecasting

Deep learning has revolutionized financial forecasting by leveraging sophisticated models such as Convolutional Neural Networks (CNNs) and Recurrent Neural Networks (RNNs) to interpret complex patterns in financial data [6]. These models excel at processing time-series data, which is integral to predicting stock prices, economic indicators, and market trends. RNNs, for example, are adept at recognizing sequential patterns, making them ideal for analyzing historical financial data sequences to forecast future market behaviors. They adjust their predictions based on new data, continually improving their accuracy. Similarly, CNNs, typically known for image processing, have been adapted to treat time-series data as one-dimensional 'images' for pattern recognition, enabling them to detect trends and anomalies in stock market data that might elude traditional statistical models [7]. These deep learning techniques are capable of handling the high volatility and non-linear dynamics of financial markets, providing forecasts that are not only more accurate but also more granular in their predictions. This enhanced forecasting capability allows financial analysts to make more informed decisions, potentially leading to higher returns on investment and better risk management.

4.2. Reinforcement Learning for Algorithmic Trading

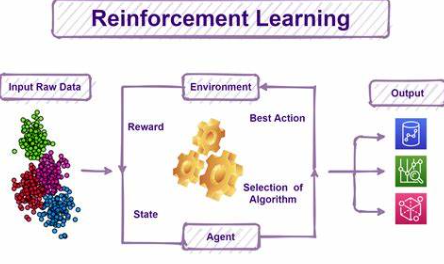

As figure 2 showing below, reinforcement Learning (RL) is redefining the boundaries of algorithmic trading by creating models that adapt and learn from their trading environment in real-time. Unlike traditional models that operate on static pre-coded strategies, RL agents develop their trading strategies by continuously learning from market conditions and outcomes. This is achieved through a system of rewards and penalties, where the algorithm 'learns' the most profitable strategies over time. An RL agent might, for instance, simulate thousands of trading scenarios to learn the subtle cues that predict market movements. This ability to dynamically adjust strategies in response to market conditions allows RL-based trading systems to perform well in environments characterized by high uncertainty and change. Moreover, the implementation of RL in high-frequency trading has shown potential to capture profitable opportunities in milliseconds, much faster than human traders and more traditional automated systems, thus maximizing profit margins and reducing trading costs.

Figure 2. Reinforcement Learning (Source: inwinstack.com)

4.3. Natural Language Processing for Regulatory Compliance

Natural Language Processing (NLP) significantly enhances regulatory compliance by automating the analysis of vast amounts of regulatory text. Financial institutions face the daunting task of staying compliant with an ever-increasing volume of complex regulations, a task that NLP technologies facilitate by extracting actionable insights from regulatory documents quickly and accurately. For example, NLP systems can be trained to identify changes in regulatory documents and flag these changes to compliance teams, ensuring that institutions respond swiftly to new requirements. Additionally, these systems can monitor internal communications, analyzing emails, and messages to detect patterns or keywords that may suggest non-compliant behavior. This proactive approach to compliance helps financial institutions avoid severe penalties and reputational risk associated with regulatory violations. Furthermore, NLP technologies enable better risk management by providing more structured insights into potential compliance risks, thus allowing firms to allocate resources more effectively and enhance their overall compliance strategy.

These advanced AI applications demonstrate not only the potential of AI to transform financial services but also the specific ways in which machine learning and AI technologies can drive significant improvements in forecasting, trading, and compliance.

5. Conclusion

The integration of AI with ESG models provides significant advantages in terms of enhanced analytical capabilities, improved predictive accuracy, and increased operational efficiency. This paper has demonstrated that AI technologies not only facilitate a deeper understanding of ESG factors but also enable businesses to respond more effectively to environmental and social challenges. By addressing the computational and ethical challenges associated with AI implementation, companies can leverage these technologies to foster greater transparency, compliance, and corporate responsibility. The future of corporate sustainability lies in the strategic integration of AI, as it holds the potential to transform traditional ESG assessment methods into dynamic, efficient, and ethically sound decision-making tools. As AI continues to evolve, its application in ESG frameworks is expected to become more nuanced and indispensable, offering a competitive edge to companies committed to sustainable and responsible business practices.

References

[1]. Agrawal, S. S., Rose, N., & PrabhuSahai, K. (2024). THE FINTECH REVOLUTION: AI'S ROLE IN DISRUPTING TRADITIONAL BANKING AND FINANCIAL SERVICES. Decision Making: Applications in Management and Engineering, 7(1), 243-256.

[2]. Yang, P., Duan, S., Liu, B., Song, T., & Wang, C. (2024, March). THE PREDICTION AND OPTIMIZATION OF RISK IN FINANCIAL SERVICES BASED ON AI-DRIVEN TECHNOLOGY. In The 12th International scientific and practical conference “Modern thoughts on the development of science: ideas, technologies and theories”(March 26–29, 2024) Amsterdam, Netherlands. International Science Group. 2024. 336 p. (p. 243).

[3]. Almustafa, E., Assaf, A., & Allahham, M. (2023). Implementation of artificial intelligence for financial process innovation of commercial banks. Revista de Gestão Social e Ambiental, 17(9), e04119-e04119.

[4]. Mogaji, E., Soetan, T. O., & Kieu, T. A. (2020). The implications of artificial intelligence on the digital marketing of financial services to vulnerable customers. Australasian Marketing Journal, j-ausmj.

[5]. Chen, B., Wu, Z., & Zhao, R. (2023). From fiction to fact: the growing role of generative AI in business and finance. Journal of Chinese Economic and Business Studies, 21(4), 471-496.

[6]. Pallathadka, H., Ramirez-Asis, E. H., Loli-Poma, T. P., Kaliyaperumal, K., Ventayen, R. J. M., & Naved, M. (2023). Applications of artificial intelligence in business management, e-commerce and finance. Materials Today: Proceedings, 80, 2610-2613.

[7]. Ali, H., & Aysan, A. F. (2023). What will ChatGPT revolutionize in financial industry?. Available at SSRN 4403372.

Cite this article

Feng,S. (2024). Integrating artificial intelligence in financial services: Enhancements, applications, and future directions. Applied and Computational Engineering,69,19-24.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 6th International Conference on Computing and Data Science

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Agrawal, S. S., Rose, N., & PrabhuSahai, K. (2024). THE FINTECH REVOLUTION: AI'S ROLE IN DISRUPTING TRADITIONAL BANKING AND FINANCIAL SERVICES. Decision Making: Applications in Management and Engineering, 7(1), 243-256.

[2]. Yang, P., Duan, S., Liu, B., Song, T., & Wang, C. (2024, March). THE PREDICTION AND OPTIMIZATION OF RISK IN FINANCIAL SERVICES BASED ON AI-DRIVEN TECHNOLOGY. In The 12th International scientific and practical conference “Modern thoughts on the development of science: ideas, technologies and theories”(March 26–29, 2024) Amsterdam, Netherlands. International Science Group. 2024. 336 p. (p. 243).

[3]. Almustafa, E., Assaf, A., & Allahham, M. (2023). Implementation of artificial intelligence for financial process innovation of commercial banks. Revista de Gestão Social e Ambiental, 17(9), e04119-e04119.

[4]. Mogaji, E., Soetan, T. O., & Kieu, T. A. (2020). The implications of artificial intelligence on the digital marketing of financial services to vulnerable customers. Australasian Marketing Journal, j-ausmj.

[5]. Chen, B., Wu, Z., & Zhao, R. (2023). From fiction to fact: the growing role of generative AI in business and finance. Journal of Chinese Economic and Business Studies, 21(4), 471-496.

[6]. Pallathadka, H., Ramirez-Asis, E. H., Loli-Poma, T. P., Kaliyaperumal, K., Ventayen, R. J. M., & Naved, M. (2023). Applications of artificial intelligence in business management, e-commerce and finance. Materials Today: Proceedings, 80, 2610-2613.

[7]. Ali, H., & Aysan, A. F. (2023). What will ChatGPT revolutionize in financial industry?. Available at SSRN 4403372.