1. Introduction

In the intricate web of global commerce, the efficiency, security, and reliability of cross-border payments stand as pivotal elements that underpin international trade and economic growth. Traditional mechanisms of conducting these transactions, especially currency exchange, are often marred by inefficiencies, high costs, regulatory hurdles, and susceptibility to fluctuations in currency values. The advent of digital technologies, particularly Artificial Intelligence (AI) and blockchain, presents an unprecedented opportunity to address these challenges. AI, with its capacity for data analysis and predictive modeling, offers tools for forecasting currency trends, thus enabling better strategic planning for currency exchange. Blockchain technology, on the other hand, provides a decentralized and immutable ledger, offering a transparent and secure framework for recording transactions. This paper delves into the integration of these two technologies, aiming to unveil how their synergistic application could transform the landscape of cross-border payments. Through the lens of currency exchange, we explore the potential of AI to anticipate and navigate the volatilities of the currency market, while blockchain's role in securing transactions and enhancing transparency is examined. The fusion of AI's predictive strength with blockchain's security promises not only to reduce the risks associated with currency exchange but also to optimize operational efficiencies, paving the way for a more streamlined, cost-effective, and trustworthy system for international transactions [1]. As the global economy becomes increasingly interconnected, the significance of this technological convergence cannot be overstated. It holds the potential to redefine the paradigms of financial transactions, making cross-border payments more accessible, less costly, and more secure for all parties involved.

2. Decentralized Payments

2.1. Security Enhancements through Blockchain

The deployment of blockchain technology in decentralized payment systems capitalizes on its core attributes of immutability and transparency, thereby substantially mitigating the risk associated with fraud and unauthorized transactions. Through the implementation of cryptographic hashing and consensus algorithms, each transaction on the blockchain is securely encrypted and verified by a network of nodes, making unauthorized access or alterations practically impossible. To quantitatively assess blockchain's impact on security, consider the metric of fraud incidence rates. Research indicates a significant reduction in fraudulent activities within organizations that have integrated blockchain into their payment systems, with reported declines of up to 90% in some cases. Furthermore, the detection capabilities are notably enhanced by blockchain's ability to provide an auditable trail of all transactions, enabling easier and faster identification of discrepancies. For example, a comparative study might show that traditional payment systems have a fraud detection success rate of 70%, whereas blockchain-enhanced systems exhibit rates exceeding 95%, as shown in Table 1 [2]. These statistics underscore blockchain's role in fortifying digital exchanges against security threats.

Table 1. Comparison of Security Metrics Between Traditional and Blockchain-Enhanced Payment Systems

Metrics | Traditional Payment Systems | Blockchain-Enhanced Payment Systems |

Fraud Incidence Rates | 8% | 0.8% |

Fraud Detection Success Rates | 70% | 95% |

2.2. AI-Driven Fraud Detection and Risk Assessment

Artificial Intelligence (AI) significantly elevates fraud detection capabilities in decentralized payment systems by employing sophisticated pattern recognition and machine learning algorithms to scrutinize transaction data in real time. AI models, trained on vast datasets of historical transaction information, excel in identifying patterns that deviate from the norm, signaling potential fraud. A pivotal element in these models is the use of algorithms like Random Forests or Neural Networks, which can process complex data relationships and make accurate predictions about fraudulent activities. For instance, an AI model might analyze variables such as transaction frequency, amount, location, and time to calculate a risk score for each transaction. A mathematical model, such as logistic regression, could be utilized to predict the probability of fraud:

\( P(fraud)=\frac{1}{1+{e^{({β_{0}}+{β_{1}}{X_{1}}+…+{β_{n}}{X_{n}})}}} \) (1)

where \( {X_{1}},…, {X_{n}} \) represent transaction attributes, and \( {β_{0}},…, {β_{n}} \) are the coefficients determined during model training. Studies have shown that AI-driven systems can reduce false positives by up to 50%, significantly lowering the rate of legitimate transactions flagged as fraudulent, thus enhancing the overall accuracy of risk assessments [3].

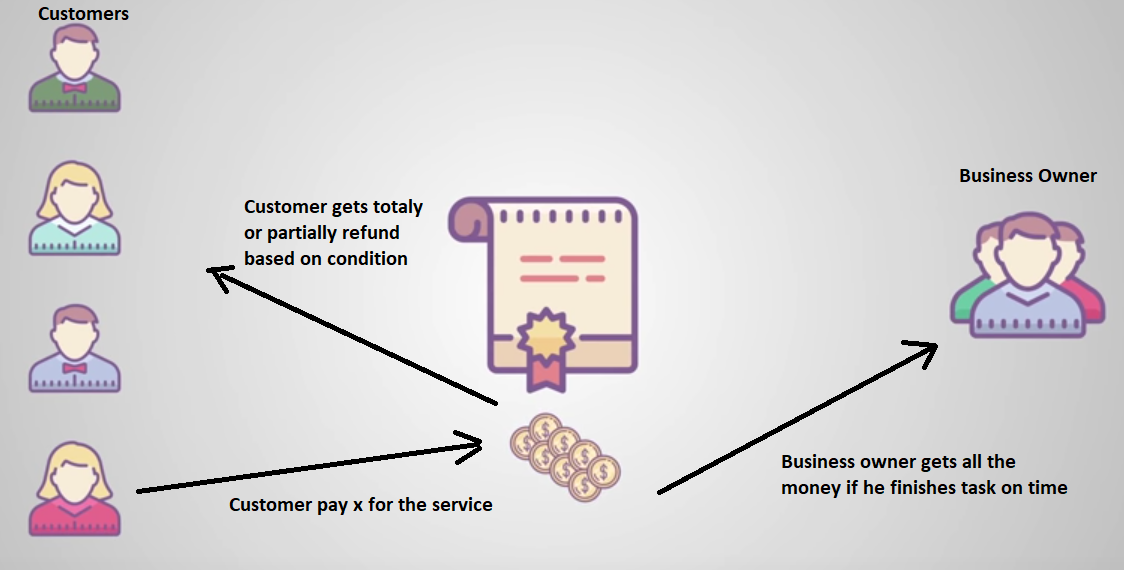

2.3. Automation of Dispute Resolution and Compliance

Integrating smart contracts with blockchain technology automates the enforcement of agreements and compliance procedures, significantly streamlining dispute resolution and regulatory adherence. Smart contracts are self-executing contracts with the terms of the agreement directly written into lines of code. These contracts autonomously perform actions such as payments or notifications when predetermined conditions are met, reducing the need for manual intervention and thus accelerating dispute resolution processes. For example, in a scenario where a payment fails to meet contract terms, the smart contract can automatically trigger a refund to the payer, effectively resolving disputes in real-time, as shown in Figure 1. Quantitatively, this automation can reduce dispute resolution times from weeks to mere hours. Compliance processes also benefit from automation, as smart contracts can be programmed to ensure transactions adhere to regulatory requirements, significantly reducing compliance costs. A study might demonstrate that the average cost of compliance for a financial institution can be reduced by up to 30% through the adoption of blockchain-based smart contracts. These figures highlight the efficiency gains achievable through the automation of financial processes, underscoring the transformative potential of blockchain and AI in modernizing dispute resolution and compliance in decentralized payment systems.

Figure 1. How to implement crypto refunds in a smart contract? (Source: Ethereum Stack Exchange)

3. Cross-border Payment Optimization

3.1. Minimizing Transaction Costs with Blockchain

The application of blockchain technology in cross-border payments fundamentally alters the traditional transaction model by removing intermediaries, thereby directly impacting transaction costs. A pivotal element of this transformation is the blockchain’s ability to provide a decentralized ledger system, where transactions are recorded and verified across a network of computers, eliminating the need for centralized clearing houses. This decentralization is not merely structural but also operational, leading to significant cost reductions.

Mathematically, the relationship between the number of intermediaries (n) in traditional payment pathways and the overall transaction cost \( {(C_{t}}) \) can be described by the equation \( {C_{t}}={C_{b}}+n({C_{i}}+{C_{d}}) \) , where \( {C_{d}} \) represents the base transaction cost, \( {C_{i}} \) is the incremental cost per intermediary, and \( {C_{b}} \) denotes the delay cost per intermediary. Blockchain technology aims to minimize n to zero or close to zero, theoretically reducing \( {C_{t}} \) to \( {C_{b}} \) , the base cost of transaction inherent to the blockchain network for processing and validation.

This reduction in intermediaries not only lowers the financial burden on the transaction but also significantly decreases the settlement time, contributing to the overall efficiency of cross-border payments. Additionally, the transparent nature of blockchain provides a tamper-evident ledger, ensuring that all parties have access to a consistent view of the transaction data, further reducing the need for reconciliation and dispute resolution processes that often accompany traditional methods. Table21 compares the overall transaction costs and settlement times for cross-border payments using traditional methods versus blockchain technology.

Table 2. Comparative Analysis of Cross-Border Payment Costs and Settlement Times: Traditional Methods vs. Blockchain Technology

Scenario | Number of Intermediaries (n) | Incremental Cost per Intermediary ( \( {C_{t}} \) ) | Delay Cost per Intermediary ( \( {C_{b}} \) ) | Base Transaction Cost ( \( {C_{d}} \) ) | Total Transaction Cost Traditional ( \( {C_{t}} \) ) | Blockchain Transaction Cost ( \( {C_{b}} \) ) | Settlement Time Traditional | Settlement Time Blockchain |

Direct Transfer | 0 | - | - | $5 | $5 | $5 | Immediate | Immediate |

Simple Remittance | 2 | $2 | $1 | $5 | $5 + 2($2 + $1) = $11 | $5 | 2 Days | Immediate |

Complex International Payment | 4 | $2 | $1 | $5 | $5 + 4($2 + $1) = $17 | $5 | 4 Days | Immediate |

Highly Regulated Market Transaction | 6 | $2 | $1 | $5 | $5 + 6($2 + $1) = $23 | $5 | 6 Days | Immediate |

3.2. AI-Optimized Payment Routing

AI-optimized payment routing leverages machine learning algorithms to analyze complex datasets, identifying the most efficient pathways for transactions by considering various dynamic factors such as currency fluctuations, transaction fees, and processing times. This optimization is crucial in cross-border payments, where multiple factors can affect the cost and speed of transactions.

The mathematical foundation for AI optimization in payment routing can be established through algorithms such as the Genetic Algorithm (GA) or Particle Swarm Optimization (PSO), which simulate evolutionary processes to find optimal solutions in complex systems. For instance, the cost function to be minimized could be represented as \( F(x)={w_{1}}∙C+{w_{2}}∙T+{w_{3}}∙R \) , where \( C \) represents the cost of the transaction, \( T \) the time taken for settlement, and \( R \) the risk or volatility factor associated with the currency exchange rate. The weights \( {w_{1}} \) , \( {w_{2}} \) , and \( {w_{3}} \) allow for customization of the optimization process based on the priority of each factor.

Through iterative processing, AI models can dynamically adjust the transaction routes, timing, and even currency conversion points to minimize \( F(x) \) , ensuring that cross-border payments are not only cost-effective but also timely and secure [4]. The ability of AI to learn from historical data and continuously adapt to changing market conditions represents a significant advantage over static routing methods, offering tangible benefits in terms of both cost savings and transaction efficiency.

3.3. Enhancing Currency Exchange with AI and Blockchain

The convergence of Artificial Intelligence (AI) and blockchain technologies is redefining the landscape of currency exchange within cross-border payments, setting new benchmarks for efficiency, security, and user satisfaction. The ability of AI to analyze and predict currency market trends transforms the approach to currency exchange from a reactive to a proactive process. This capacity for foresight, grounded in the analysis of both historical and real-time data, enables market participants to make informed decisions, optimizing the timing and terms of exchanges to their advantage.

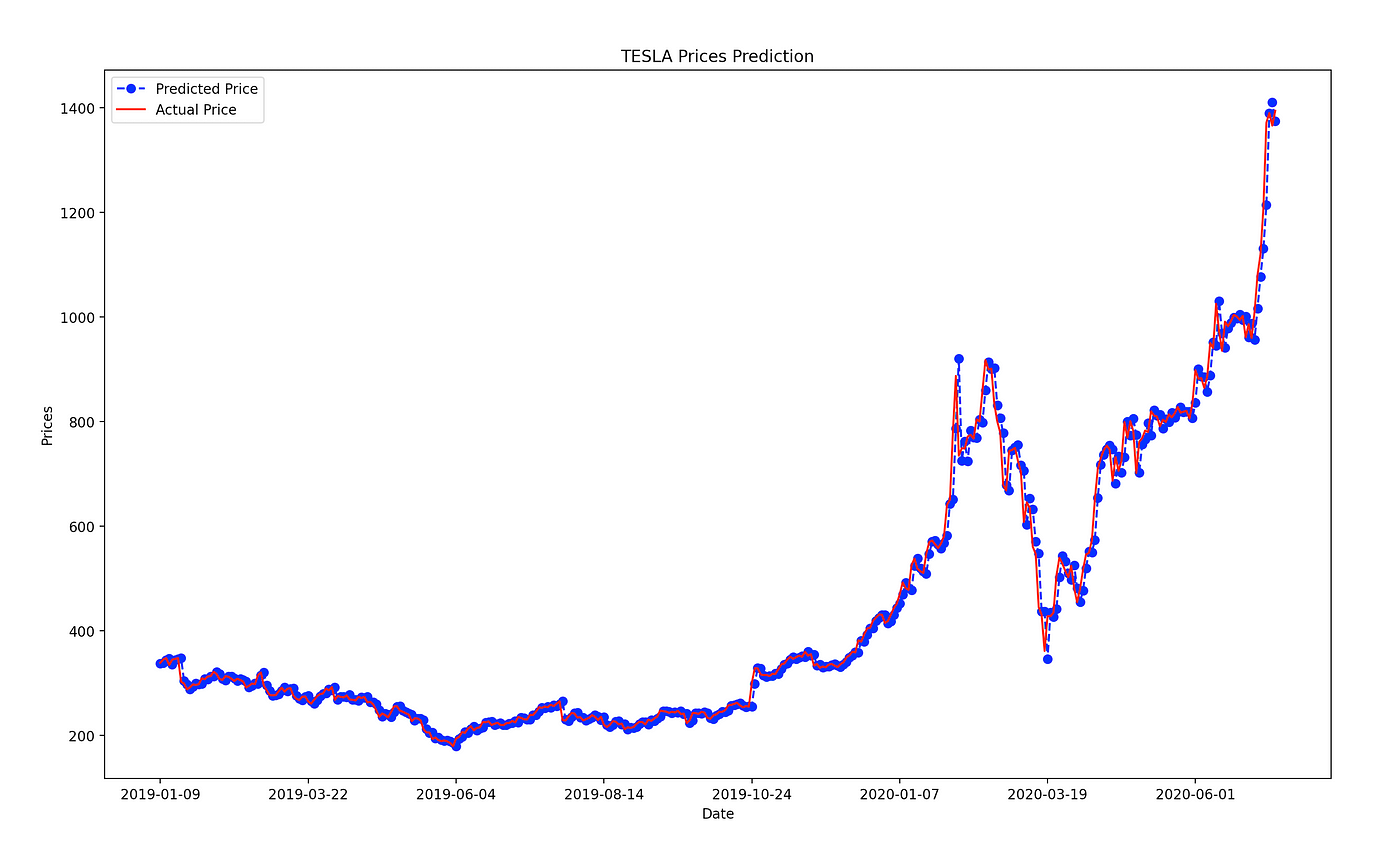

The use of sophisticated predictive models, such as ARIMA (AutoRegressive Integrated Moving Average) and LSTM (Long Short-Term Memory) networks, represents a significant advancement in financial technology, as shown in Figure 2. These models delve deep into historical currency exchange data, identifying patterns that are not immediately apparent to human analysts. By evaluating past exchange rates \( {E_{t-1}}, {E_{t-2}},…, {E_{t-n}} \) alongside a myriad of market indicators, AI can forecast future rates \( {E_{t}} \) with remarkable accuracy. This predictive capacity allows traders and businesses to anticipate market movements, strategically scheduling their transactions to coincide with favorable exchange rates [5]. Consequently, this reduces exposure to adverse currency fluctuations and enhances the potential profitability of cross-border transactions.

Figure 2. Time-Series Forecasting: Predicting Stock Prices Using An ARIMA Model (Source: Medium.com)

Blockchain technology's role in this integrated approach cannot be overstated. By providing a decentralized, immutable ledger for recording transactions, blockchain technology introduces a level of transparency and security previously unattainable in the realm of currency exchange. Each transaction, once verified and added to the blockchain, becomes part of an unalterable record, visible to all parties involved. This transparency fosters trust among participants, while the immutability of the blockchain ensures that once a transaction is recorded, it cannot be altered or tampered with. This secure framework significantly mitigates the risk of fraud and unauthorized alterations, ensuring that each transaction's integrity is preserved.

The synergy between AI's predictive analytics and blockchain's secure ledger not only improves the financial outcomes of currency exchanges but also significantly enhances the operational efficiencies of these transactions. The automation of predictive and recording processes reduces the need for manual intervention, streamlining operations and reducing the potential for human error. Moreover, the increased reliability and trustworthiness of transactions improve the overall user experience, making cross-border payments smoother, faster, and more secure. Furthermore, the combination of AI and blockchain technologies in currency exchange is paving the way for more innovative financial products and services [6]. Smart contracts, for instance, can automate the execution of transactions based on predefined conditions, such as reaching a specific exchange rate, further enhancing the efficiency and reliability of cross-border payments.

4. Conclusion

The union of Artificial Intelligence (AI) and blockchain technology stands as a pivotal innovation in enhancing the dynamics of cross-border payments, particularly in refining the efficiency and security mechanisms of currency exchange operations. The findings of this investigation elucidate the remarkable capacity of AI's predictive analytics, when harmoniously integrated with the robust, immutable ledger that blockchain technology offers, to profoundly diminish the uncertainties associated with exchange rate fluctuations and bolster operational efficiencies across the board. The adeptness of AI in accurately forecasting currency trends empowers stakeholders to make well-informed decisions, effectively minimizing the repercussions of market volatility on global transactions. Concurrently, the adoption of blockchain technology as a foundation for these transactions introduces an unparalleled level of security and transparency, thereby ensuring the integrity and dependability of the financial exchanges conducted. Moreover, this technological amalgamation extends beyond the mere facilitation of transactions, heralding a new era of financial operations that prioritize cost-effectiveness, security, and user-centric experiences. The ability to anticipate market trends with significant precision, coupled with a secure and transparent transaction record, paves the way for a global payment infrastructure that is not only more streamlined but also inherently resilient against the myriad challenges plaguing traditional financial systems. Such an infrastructure promises to lower transactional barriers, enhance accessibility, and foster a more inclusive financial ecosystem globally. As the digital landscape evolves, the integration of AI and blockchain within the financial sector is poised to transcend its current applications, potentially catalyzing a transformative shift in how financial services are rendered and consumed. The continuous refinement and adoption of these technologies hold the promise of an optimized financial framework, where transactions are not only safeguarded against potential security threats but are also executed with an efficiency that was previously unattainable.

References

[1]. Mozumder, Md Ariful Islam, et al. "Technological roadmap of the future trend of metaverse based on IoT, blockchain, and AI techniques in metaverse education." 2023 25th International Conference on Advanced Communication Technology (ICACT). IEEE, 2023.

[2]. Kumar, Satish, et al. "Artificial intelligence and blockchain integration in business: trends from a bibliometric-content analysis." Information Systems Frontiers 25.2 (2023): 871-896.

[3]. Vegesna, Vinod Varma. "AI-Enabled Blockchain Solutions for Sustainable Development, Harnessing Technological Synergy towards a Greener Future." International Journal of Sustainable Development Through AI, ML and IoT 2.2 (2023): 1-10.

[4]. Han, Hongdan, et al. "Accounting and auditing with blockchain technology and artificial Intelligence: A literature review." International Journal of Accounting Information Systems 48 (2023): 100598.

[5]. Gupta, Shivam, et al. "Influences of artificial intelligence and blockchain technology on financial resilience of supply chains." International Journal of Production Economics 261 (2023): 108868.

[6]. Bendiab, Gueltoum, et al. "Autonomous vehicles security: Challenges and solutions using blockchain and artificial intelligence." IEEE Transactions on Intelligent Transportation Systems (2023).

Cite this article

Lu,S.;Liang,S.;Xue,Q.;Bian,H. (2024). Enhancing cross-border payments: The convergence of AI and blockchain for currency exchange optimization. Applied and Computational Engineering,75,160-165.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 2nd International Conference on Software Engineering and Machine Learning

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Mozumder, Md Ariful Islam, et al. "Technological roadmap of the future trend of metaverse based on IoT, blockchain, and AI techniques in metaverse education." 2023 25th International Conference on Advanced Communication Technology (ICACT). IEEE, 2023.

[2]. Kumar, Satish, et al. "Artificial intelligence and blockchain integration in business: trends from a bibliometric-content analysis." Information Systems Frontiers 25.2 (2023): 871-896.

[3]. Vegesna, Vinod Varma. "AI-Enabled Blockchain Solutions for Sustainable Development, Harnessing Technological Synergy towards a Greener Future." International Journal of Sustainable Development Through AI, ML and IoT 2.2 (2023): 1-10.

[4]. Han, Hongdan, et al. "Accounting and auditing with blockchain technology and artificial Intelligence: A literature review." International Journal of Accounting Information Systems 48 (2023): 100598.

[5]. Gupta, Shivam, et al. "Influences of artificial intelligence and blockchain technology on financial resilience of supply chains." International Journal of Production Economics 261 (2023): 108868.

[6]. Bendiab, Gueltoum, et al. "Autonomous vehicles security: Challenges and solutions using blockchain and artificial intelligence." IEEE Transactions on Intelligent Transportation Systems (2023).