1. Introduction

The financial sector has undergone significant transformations with the advent of artificial intelligence (AI), which has introduced new paradigms in risk management. Traditional risk management methods, reliant on historical data and static models, often fall short in capturing the complexities of modern financial markets. AI-driven systems, on the other hand, offer dynamic and adaptive solutions by leveraging machine learning algorithms and vast datasets. These systems enhance the accuracy of risk predictions, provide real-time insights, and automate decision-making processes, thereby improving the overall efficiency and effectiveness of financial risk management. AI's application in financial risk management encompasses several key areas, including credit risk assessment, market risk analysis, operational risk management, and regulatory compliance. In credit risk assessment, AI algorithms analyze a wide range of data sources, such as social media activity and transaction history, to identify patterns and correlations that traditional methods might overlook. This leads to more accurate risk predictions and better management of loan defaults. Similarly, in market risk analysis, AI systems continuously monitor and analyze real-time data, enabling financial institutions to detect emerging trends and respond proactively to market fluctuations. Operational risk management also benefits from AI's capabilities, particularly through process automation and anomaly detection. AI-driven systems can continuously monitor operational data to identify potential risks and suggest preventive measures, reducing the likelihood of costly incidents. Moreover, AI's role in regulatory compliance is increasingly critical as financial institutions navigate complex regulatory landscapes. Automated compliance monitoring and regulatory change management ensure timely and accurate adherence to regulatory requirements [1]. This paper delves into the various applications of AI in financial risk management, highlighting the transformative impact of these technologies. By examining the benefits and challenges associated with AI-driven systems, we aim to provide a comprehensive understanding of how AI is reshaping financial risk management practices and enhancing the resilience of financial institutions.

2. Discussion

2.1. AI in Credit Risk Assessment

Credit risk assessment is a critical component of financial risk management, involving the evaluation of a borrower's ability to repay loans. Traditional methods primarily rely on credit scores and financial statements, which may not capture the full risk profile of a borrower. AI-driven systems enhance credit risk assessment by utilizing machine learning algorithms that analyze vast datasets, including non-traditional data sources such as social media activity and transaction history. These algorithms identify patterns and correlations that human analysts might overlook, leading to more accurate risk predictions. Moreover, AI systems continuously learn and adapt to new data, improving their predictive accuracy over time. This dynamic capability enables financial institutions to respond more effectively to changing market conditions and borrower behaviors, ultimately reducing the incidence of loan defaults and enhancing portfolio quality.

2.2. Enhanced Data Analytics

AI-driven financial risk management systems leverage enhanced data analytics to process and analyze large volumes of structured and unstructured data. Traditional risk assessment methods are often constrained by their reliance on historical financial data and static models, which may not capture the full spectrum of risk factors. AI systems, on the other hand, can incorporate diverse data sources such as social media activity, transaction history, and macroeconomic indicators, providing a more comprehensive view of potential risks [2]. Machine learning algorithms identify complex patterns and relationships within the data, enabling more accurate and timely risk predictions. This enhanced data analytics capability allows financial institutions to make more informed decisions, optimize risk mitigation strategies, and ultimately improve their overall risk management outcomes.

2.3. Predictive Modeling

Predictive modeling is a core component of AI-driven financial risk management systems, utilizing advanced machine learning techniques to forecast potential risks and identify early warning signals. These models can capture non-linear relationships and dynamic interactions among various risk factors, unlike traditional models that rely on linear assumptions and historical averages. Mathematically, the predictive model can be represented as

\( {Y_{t}}={β_{0}}+{β_{1}}{X_{t-1}}+{β_{2}}{X_{t-2}}+⋯+{β_{n}}{X_{t-n}}+{ϵ_{t}} \) (1)

where Yt is the target variable at time t, such as asset price or credit risk score, and Xt is a vector of predictor variables including market data, economic trends, and geopolitical events. The coefficients β are estimated using machine learning algorithms, which analyze real-time data to adjust the model and improve predictive accuracy continuously. This allows financial institutions to proactively manage risks by forecasting fluctuations in asset prices and potential credit defaults, thereby adjusting their exposure to volatile assets and implementing preemptive measures to mitigate potential losses.

These models utilize advanced machine learning techniques to forecast potential risks and identify early warning signals. Unlike traditional models, which often rely on linear assumptions and historical averages, AI-based predictive models can capture non-linear relationships and dynamic interactions among various risk factors. For instance, AI algorithms can analyze real-time market data, economic trends, and geopolitical events to predict fluctuations in asset prices and potential credit defaults. This predictive capability enables financial institutions to proactively manage risks, adjust their exposure to volatile assets, and implement preemptive measures to mitigate potential losses.

2.4. Automated Decision-Making

AI-driven systems facilitate automated decision-making in financial risk management by providing real-time insights and recommendations. These systems utilize machine learning algorithms to analyze complex datasets, identify risk patterns, and generate actionable insights. For example, AI-powered platforms can automatically assess the creditworthiness of loan applicants, detect fraudulent transactions, and monitor compliance with regulatory requirements [3]. By automating routine decision-making processes, financial institutions can reduce operational costs, minimize human errors, and enhance the efficiency and accuracy of their risk management practices. Additionally, AI-driven automation allows risk managers to focus on more strategic and high-value tasks, such as developing innovative risk mitigation strategies and addressing emerging threats.

3. AI in Market Risk Analysis

Market risk analysis involves assessing the potential impact of market fluctuations on a financial institution's portfolio. AI technologies offer significant advantages in this area by enabling real-time data analysis and predictive modeling. Traditional market risk models, such as Value at Risk (VaR), often rely on historical data and assumptions of normal market behavior, which can be insufficient in volatile markets. AI-driven systems, however, can analyze a wide range of market data, including price movements, trading volumes, and news sentiment, to identify emerging trends and potential risks. Machine learning algorithms can also simulate various market scenarios, providing financial institutions with a more comprehensive understanding of potential risks and their implications. This enhanced market risk analysis capability enables institutions to make more informed investment decisions and implement effective risk mitigation strategies [4].

3.1. Real-Time Data Analysis

AI-driven market risk analysis systems leverage real-time data analysis to provide financial institutions with up-to-date insights into market conditions. Traditional risk assessment methods often rely on historical data and periodic updates, which can lead to delayed responses to market changes. AI systems, on the other hand, continuously monitor and analyze real-time market data, such as stock prices, trading volumes, and news sentiment. This real-time analysis capability enables financial institutions to detect emerging market trends, identify potential risks, and respond proactively to market fluctuations. By providing timely and accurate insights, AI-driven systems enhance the institution's ability to manage market risks and optimize their investment strategies. Table 1 demonstrates how real-time data on stock prices, trading volumes, and news sentiment can be analyzed to determine market trends.

Table 1. Real-Time Data Analysis Table

Time | Stock Price | Trading Volume | News Sentiment | Market Trend |

9:00 | 150.25 | 1200 | 0.5 | Stable |

9:05 | 151 | 1300 | 0.6 | Positive |

9:10 | 150.75 | 1250 | 0.4 | Stable |

9:15 | 150.5 | 1220 | 0.3 | Negative |

9:20 | 151.25 | 1350 | 0.7 | Positive |

9:25 | 151.75 | 1400 | 0.8 | Positive |

9:30 | 152 | 1380 | 0.9 | Positive |

9:35 | 151.5 | 1370 | 0.6 | Stable |

9:40 | 151.75 | 1360 | 0.7 | Positive |

9:45 | 152.25 | 1390 | 0.8 | Positive |

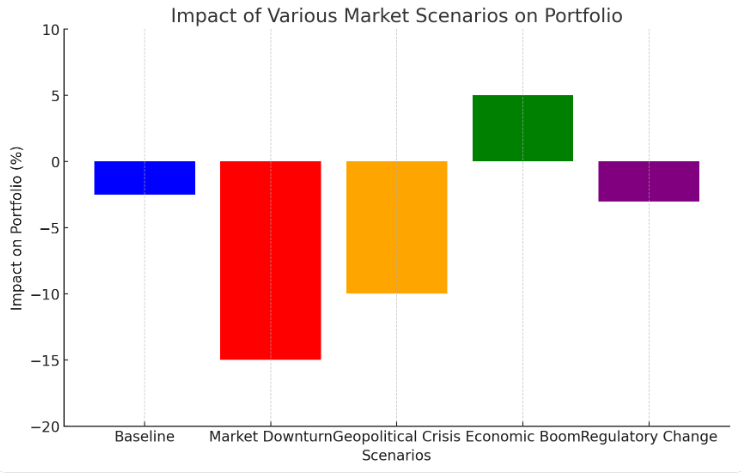

3.2. Scenario Simulation

Scenario simulation is a critical component of AI-driven market risk analysis. Machine learning algorithms can simulate various market scenarios, taking into account a wide range of factors such as economic indicators, geopolitical events, and historical price movements. These simulations provide financial institutions with a comprehensive understanding of potential market risks and their implications. For example, AI-driven systems can simulate the impact of a sudden market downturn or a geopolitical crisis on the institution's portfolio. By analyzing the potential outcomes of different scenarios, financial institutions can develop robust risk mitigation strategies and adjust their exposure to volatile assets. This scenario simulation capability enables institutions to prepare for potential market disruptions and minimize their impact on the portfolio. Figure 1 illustrates the impact of various market scenarios on a financial portfolio [5]. The chart demonstrates how different scenarios, such as a market downturn, geopolitical crisis, economic boom, and regulatory change, can affect the portfolio's performance, highlighting the importance of scenario simulation in AI-driven market risk analysis.

Figure 1. Impact Of Various Market Scenarios On Portfolio

Figure 1. Impact Of Various Market Scenarios On Portfolio

3.3. Sentiment Analysis

Sentiment analysis is an advanced AI technique used in market risk analysis to gauge the market sentiment based on news articles, social media posts, and other textual data. Machine learning algorithms analyze the sentiment expressed in these texts, identifying positive, negative, or neutral trends. This analysis provides financial institutions with insights into market participants' perceptions and expectations, which can significantly influence market movements. For instance, a surge in negative sentiment towards a particular industry or company may indicate potential risks and prompt financial institutions to adjust their investment strategies. By incorporating sentiment analysis into their market risk analysis framework, institutions can gain a more holistic understanding of market dynamics and enhance their ability to manage risks effectively [6].

4. AI in Operational Risk Management

4.1. Anomaly Detection

Anomaly detection is a key application of AI in operational risk management. Machine learning algorithms analyze operational data to identify patterns and detect anomalies that may indicate potential risks or failures. For example, AI-driven systems can monitor transaction logs, employee activities, and system performance to detect unusual patterns or deviations from normal behavior. By identifying anomalies in real-time, financial institutions can promptly investigate and address potential issues, minimizing the impact of operational failures. This anomaly detection capability enhances the institution's ability to manage operational risks and maintain the integrity and reliability of their systems and processes.

4.2. Process Automation

AI-driven process automation significantly enhances operational risk management by streamlining routine tasks and reducing the likelihood of human errors. Automated systems can handle tasks such as data entry, transaction processing, and compliance monitoring, freeing up human resources for more strategic activities. For instance, AI-powered platforms can automatically reconcile transactions, monitor compliance with regulatory requirements, and generate risk reports. This automation reduces the operational workload, minimizes the risk of errors, and ensures consistency and accuracy in risk management processes. By leveraging AI-driven process automation, financial institutions can enhance their operational efficiency and reduce the overall risk exposure.

4.3. Predictive Maintenance

Predictive maintenance is an advanced application of AI in operational risk management, aimed at preventing system failures and reducing downtime. Machine learning algorithms analyze historical maintenance data, equipment performance metrics, and environmental factors to predict potential failures and suggest preventive measures. For example, AI-driven systems can monitor the performance of critical infrastructure such as servers, network equipment, and software applications, identifying signs of wear and potential issues before they lead to failures. By implementing predictive maintenance strategies, financial institutions can reduce the frequency and impact of operational disruptions, enhance system reliability, and optimize maintenance costs. This proactive approach to maintenance ensures the continuous and efficient operation of critical systems, minimizing the institution's operational risk.

5. AI in Regulatory Compliance

5.1. Automated Compliance Monitoring

Automated compliance monitoring is a key application of AI in regulatory compliance. AI-driven systems continuously monitor and analyze operational data to ensure compliance with regulatory requirements. For example, machine learning algorithms can track transactions, customer activities, and employee behavior to detect potential violations of anti-money laundering (AML) regulations, know-your-customer (KYC) requirements, and other compliance standards. By automating compliance monitoring, financial institutions can reduce the operational burden of manual compliance checks, enhance the accuracy and consistency of their compliance processes, and respond more promptly to potential issues. This automated approach to compliance monitoring ensures that institutions remain compliant with regulatory requirements and mitigate the risk of penalties and reputational damage.

5.2. Regulatory Change Management

Regulatory change management is a critical aspect of regulatory compliance, involving the identification, assessment, and implementation of changes in regulatory requirements. AI-driven systems can significantly enhance regulatory change management by analyzing regulatory updates, assessing their impact on the institution's operations, and suggesting necessary adjustments. For example, machine learning algorithms can analyze new regulatory guidelines, interpret their implications for the institution's processes and controls, and generate recommendations for compliance adjustments. This proactive approach to regulatory change management ensures that financial institutions remain compliant with evolving regulatory requirements, reduce the risk of non-compliance, and maintain their operational efficiency.

5.3. Compliance Reporting

Compliance reporting is an essential component of regulatory compliance, involving the generation and submission of reports to regulatory authorities. AI-driven systems can automate the compliance reporting process, ensuring timely and accurate submission of required reports. Machine learning algorithms can analyze operational data, generate compliance reports, and identify potential discrepancies or violations. By automating compliance reporting, financial institutions can reduce the operational burden of manual report generation, enhance the accuracy and consistency of their reports, and ensure compliance with regulatory requirements. This automated approach to compliance reporting enables institutions to maintain transparency, demonstrate regulatory compliance, and mitigate the risk of penalties and reputational damage.

6. Conclusion

AI-driven financial risk management systems represent a significant advancement in the ability of financial institutions to manage and mitigate risks. By utilizing machine learning algorithms and real-time data analysis, these systems offer enhanced predictive capabilities and dynamic responses to evolving market conditions. The integration of AI in credit risk assessment, market risk analysis, operational risk management, and regulatory compliance not only improves accuracy and efficiency but also enables proactive risk management and strategic decision-making. As financial institutions continue to adopt and refine AI-driven technologies, they will be better equipped to navigate the complexities of modern financial markets, reduce the incidence of loan defaults, and maintain regulatory compliance. The future of financial risk management lies in the continuous evolution and integration of AI, driving innovation and resilience across the industry.

References

[1]. El Hajj, Mohammad, and Jamil Hammoud. "Unveiling the influence of artificial intelligence and machine learning on financial markets: A comprehensive analysis of AI applications in trading, risk management, and financial operations." Journal of Risk and Financial Management 16.10 (2023): 434.

[2]. Odejide, Opeyemi Abayomi, and Tolulope Esther Edunjobi. "AI in project management: exploring theoretical models for decision-making and risk management." Engineering Science & Technology Journal 5.3 (2024): 1072-1085.

[3]. Ahmadi, Sina. "A Comprehensive Study on Integration of Big Data and AI in Financial Industry and its Effect on Present and Future Opportunities." International Journal of Current Science Research and Review 7.01 (2024): 66-74.

[4]. Apsilyam, N. M., L. R. Shamsudinova, and R. E. Yakhshiboyev. "THE APPLICATION OF ARTIFICIAL INTELLIGENCE IN THE ECONOMIC SECTOR." CENTRAL ASIAN JOURNAL OF EDUCATION AND COMPUTER SCIENCES (CAJECS) 3.1 (2024): 1-12.

[5]. Weber, Patrick, K. Valerie Carl, and Oliver Hinz. "Applications of explainable artificial intelligence in finance—a systematic review of finance, information systems, and computer science literature." Management Review Quarterly 74.2 (2024): 867-907.

[6]. Devi, K., and Devadutta Indoria. "The Critical Analysis on The Impact of Artificial Intelligence on Strategic Financial Management Using Regression Analysis." Res Militaris 13.2 (2023): 7093-7102.

Cite this article

Shen,Q. (2024). AI-driven financial risk management systems: Enhancing predictive capabilities and operational efficiency. Applied and Computational Engineering,69,134-139.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 6th International Conference on Computing and Data Science

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. El Hajj, Mohammad, and Jamil Hammoud. "Unveiling the influence of artificial intelligence and machine learning on financial markets: A comprehensive analysis of AI applications in trading, risk management, and financial operations." Journal of Risk and Financial Management 16.10 (2023): 434.

[2]. Odejide, Opeyemi Abayomi, and Tolulope Esther Edunjobi. "AI in project management: exploring theoretical models for decision-making and risk management." Engineering Science & Technology Journal 5.3 (2024): 1072-1085.

[3]. Ahmadi, Sina. "A Comprehensive Study on Integration of Big Data and AI in Financial Industry and its Effect on Present and Future Opportunities." International Journal of Current Science Research and Review 7.01 (2024): 66-74.

[4]. Apsilyam, N. M., L. R. Shamsudinova, and R. E. Yakhshiboyev. "THE APPLICATION OF ARTIFICIAL INTELLIGENCE IN THE ECONOMIC SECTOR." CENTRAL ASIAN JOURNAL OF EDUCATION AND COMPUTER SCIENCES (CAJECS) 3.1 (2024): 1-12.

[5]. Weber, Patrick, K. Valerie Carl, and Oliver Hinz. "Applications of explainable artificial intelligence in finance—a systematic review of finance, information systems, and computer science literature." Management Review Quarterly 74.2 (2024): 867-907.

[6]. Devi, K., and Devadutta Indoria. "The Critical Analysis on The Impact of Artificial Intelligence on Strategic Financial Management Using Regression Analysis." Res Militaris 13.2 (2023): 7093-7102.