1. Introduction

The wave of big data has profoundly reshaped the operational logic and management paradigm of enterprises, driving the transformation of management accounting from traditional accounting supervision to strategic value creation through deep business integration [1]. Massive, high-speed, and diverse data provide unprecedented insights for management accounting, but also expose pain points such as information lag, high financial barriers, and weak decision support under traditional models [2]. The intensification of market competition, accelerated technological iteration, and stricter regulatory requirements collectively constitute the core external driving force for promoting the integration of management accounting and finance. Related studies have pointed out that enterprises urgently need to rely on data resources to connect business flow, capital flow, and information flow, and achieve real-time dynamic value insights and risk warnings. This is the key path to enhancing core competitiveness [3]. The "14th Five Year Plan for Accounting Reform and Development" issued by the Ministry of Finance also emphasizes the need to "promote the internal expansion of accounting functions", and the integration of business and finance has become the core proposition of modernizing management accounting.

Scientific and quantitative classification of the transformation stage of business finance integration has significant practical guidance and evaluation optimization value. It provides a clear "transformation positioning instrument" for enterprises, enabling them to accurately identify their own stage and formulate matching resource allocation and promotion strategies, avoiding blind investment in a "one size fits all" approach [4]. This classification constructs an objective evaluation scale, enabling enterprises to horizontally benchmark industry benchmarks, vertically track their own progress, scientifically evaluate the effectiveness of integration, and identify bottleneck links. At the same time, the classification framework reveals key features, technical requirements, and capability gaps at different stages, providing clear guidance for targeted capacity building and resource allocation, greatly improving the efficiency and success rate of transformation. Quantitative classification concretizes and standardizes the process of abstract transformation, and is a key bridge driving the integration of industry and finance from concept to implementation [5].

Machine learning algorithms play a core role as intelligent engines in the classification of business and finance integration stages. Faced with massive amounts of heterogeneous financial and business data, machine learning can efficiently mine the hidden patterns and correlations within them. Unsupervised learning can automatically identify the similarity of enterprise groups in indicators such as data integration, analysis dimension richness, and prediction accuracy, achieving natural grouping; Supervised learning models can train high-precision classifiers based on expert annotated stage samples, automatically making stage judgments on new enterprise data. Algorithms not only provide static classification, but also dynamically monitor indicator changes, warn of stage transitions or stagnation risks, provide real-time basis for management intervention, upgrade stage classification from "snapshot" to "dynamic dashboard", and endow the process of business finance integration with continuous intelligent navigation capabilities. This article quantitatively classifies the degree of business finance integration transformation based on improved machine learning algorithms, providing a quantitative comparison method for business finance integration transformation [6].

2. Data sources

In the quantitative classification research of business finance integration transformation, this article selects indicators from four dimensions: technology application, organizational capability, management support, and resource investment, and determines evaluation indicators such as big data, cloud computing, automation level, data quality, talent structure, cross departmental collaboration, management support, process standardization, and IT infrastructure investment for the quantitative classification research of business finance integration transformation.

This dataset contains the management accounting and financial integration transformation of 692 enterprises under the background of big data, including 10 key independent variables and 1 categorical predictor variable. The independent variables cover four dimensions: technological applications (big data, cloud computing, automation level), organizational capabilities (data quality, talent structure, cross departmental collaboration), management support (management support, process standardization), and resource investment (IT infrastructure investment), while considering historical transformation success rates as reference indicators. The predictive variable 'transformation stage of business finance integration' divides the process of enterprise transformation into three categories: the initial stage, the implementation stage, and the mature stage [7]. The dataset reflects the complex relationship between the key driving factors and transformation stages of enterprise digital transformation, and is suitable for machine learning classification model training and analysis of transformation key factors. Select some data for display, as shown in Table 1.

|

Analytics talent ratio |

Automation level |

Big data application |

Data quality |

It investment |

Management support |

Past success rate |

Process standardization |

Integration stage |

|

10.42 |

4 |

4 |

80.69 |

5.5 |

1 |

45.44 |

2 |

Mature stage |

|

10.74 |

1 |

5 |

80.89 |

22.2 |

5 |

49.71 |

3 |

Mature stage |

|

17.21 |

1 |

3 |

58.33 |

22.6 |

4 |

81.19 |

4 |

Implementation phase |

|

21.90 |

2 |

5 |

83.39 |

12.8 |

5 |

57.97 |

3 |

Implementation phase |

|

18.56 |

4 |

5 |

98.76 |

22.9 |

4 |

84.13 |

2 |

Mature stage |

3. Method

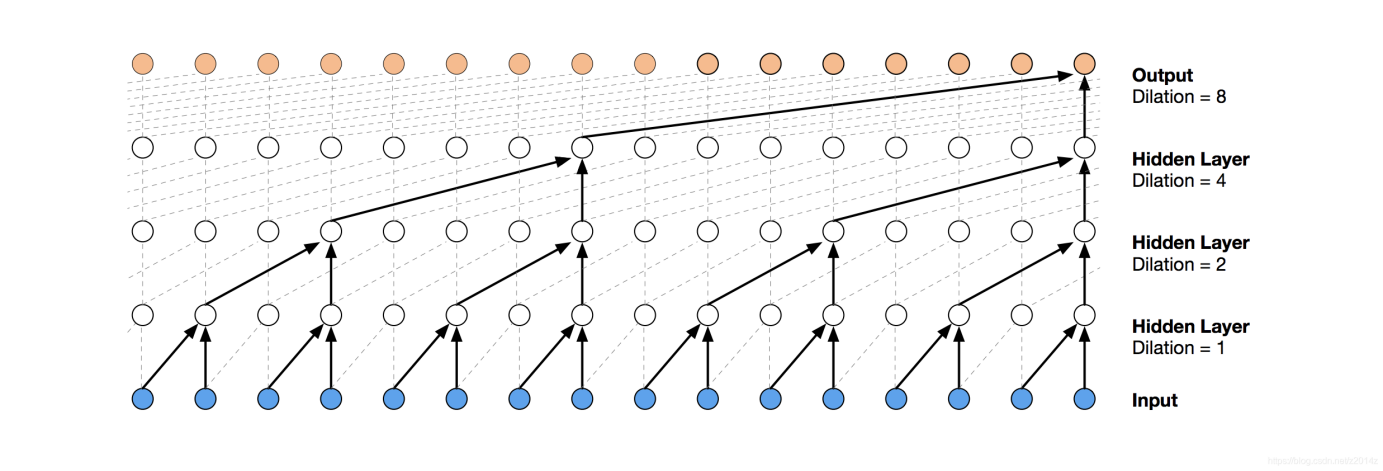

3.1. Time Convolutional Network

The core principle of Time Convolutional Networks (TCNs) is to modify standard one-dimensional Convolutional Neural Networks (CNNs) specifically for the characteristics of time series data, enabling them to efficiently capture long-term dependencies while overcoming the limitations of traditional Recurrent Neural Networks (RNNs) in terms of training efficiency and gradient propagation. Traditional CNN performs well in image processing, but faces two major challenges when directly applied to sequential data: first, standard convolution utilizes both past and future contextual information, which is unacceptable in many scenarios that require strict temporal prediction; Secondly, as the sequence length increases, effectively capturing long-range dependencies requires extremely deep networks or huge convolution kernels, leading to parameter explosion and optimization difficulties. TCN addresses these issues by introducing two key techniques, causal convolution and dilated convolution, to construct an architecture that can handle sequences of arbitrary length, maintain temporal causality, and efficiently model long-term dependencies [8]. The network structure of the time convolutional network is shown in Figure 1.

The core principle of TCN is to ensure strict causality in temporal prediction through causal convolution; Using dilated convolution to exponentially expand the receptive field and efficiently capture long-range dependencies; Stable training of deep networks using residual connections. This architecture endows TCN with the ability to rival or even surpass RNN in sequence modeling tasks, while possessing higher training efficiency, more stable gradient propagation, and clearer interpretability [9].

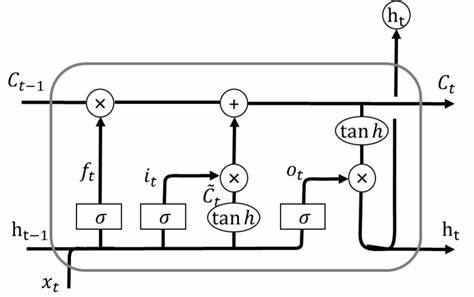

3.2. Long Short Term Memory network

Recurrent neural networks (RNNs) face core challenges in processing time-series data, making it difficult to effectively learn long-term dependencies. Traditional RNNs transmit historical information through hidden states, but they are prone to gradient vanishing or exploding during the training process. The disappearance of gradients makes it difficult for the network to adjust the weights of early time steps, making it unable to "remember" key information from a long time ago, resulting in a "short-term memory" bottleneck. Gradient explosion makes training unstable. Long Short Term Memory (LSTM) networks are designed to overcome this fundamental flaw, with the core being the introduction of a sophisticated "gating mechanism" and a unique "cellular state" structure, significantly enhancing the network's ability to capture and utilize long-range dependency information [10]. The network structure of the long short-term memory network model is shown in Figure 2.

The core of LSTM unit is the cellular state, which is like a "highway" that runs through time, mainly responsible for carrying and transmitting long-term memory information. LSTM regulates cell state through three precise "gate" structures: the forget gate determines which old information in the cell state needs to be discarded. It reads the current input and the hidden state of the previous moment, outputs a vector between 0 and 1 through the Sigmoid function, and applies it to the cell state. The input gate determines which new information needs to be stored in the cell state at the current moment. It consists of two parts, one Sigmoid layer determines which values to update; A Tanh layer generates candidate new information vectors. The product of the two is added to the cellular state. The output gate determines what hidden state to output based on the current cell state. A Sigmoid layer determines which parts of the cell state will output, and then the cell state is activated by Tanh and multiplied with the Sigmoid output to obtain the final current hidden state.

3.3. Long Short-Term Memory network optimized based on time convolutional network

Long Short Term Memory (LSTM) networks have shown significant advantages in capturing long-range dependencies of time series due to their precise gating mechanism. However, when faced with ultra long sequences, LSTM still faces two core challenges: first, the gradient propagation dilemma. Although LSTM alleviates the gradient explosion/disappearance problem of ordinary RNNs through gate structures, when dealing with extremely long sequences, information still needs to be transmitted layer by layer through long time steps.

To address the above bottlenecks, a Time Convolutional Network (TCN) is introduced to optimize LSTM, forming a TCN-LSTM hybrid architecture. Its core principle lies in the synergistic effect of hierarchical feature extraction and deep dependency modeling. This architecture typically places TCN at the front end: TCN utilizes causal convolution to ensure that the output only depends on current and historical inputs, strictly maintaining temporal causality; Its unique dilated convolution structure exponentially increases the hole rate, allowing high-level features to cover an extremely wide historical window, thereby efficiently capturing deep dependency patterns spanning ultra long distances. At the same time, the hierarchical stacking structure of TCN naturally possesses strong local feature extraction capabilities, which can effectively identify local morphology, trends, and periods in sequences. The sequence processed by TCN is transformed into optimized feature vectors containing rich long and short range information, and then input into the LSTM layer. At this point, LSTM no longer needs to struggle to directly learn all dependencies from raw data, but instead focuses on higher-level temporal dynamic modeling and final prediction based on the "refined" features provided by TCN.

4. Result

The hardware adopts NVIDIA RTX 3090, 128GB memory, and NVMe SSD; The software environment is Matlab R2024a; The input sequence length of the model is T=128, the feature D=64, the TCN part contains 3 layers of dilated convolutions, and the LSTM part has a hidden layer of 128 units/2 layers dropout=0.3, The classification header is a double fully connected layer; Train using AdamW optimizer, batch size 64, maximum 100 rounds, with a loss function of cross entropy; The dataset is divided into training and testing sets in a 7:3 ratio, and the performance of the model is evaluated using accuracy, precision, recall, and F1 score.

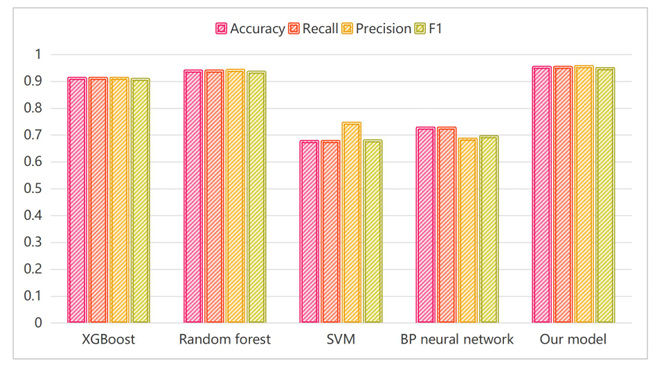

In terms of comparison models, this article uses XGBoost, Random Forest, SVM, and BP neural network. Firstly, the classification results of each model compared to the model proposed in this article are output, as shown in Table 2. The comparison results of the indicators of each model are shown in Figure 3.

|

Model |

Accuracy |

Recall |

Precision |

F1 |

|

XGBoost |

0.911 |

0.911 |

0.912 |

0.907 |

|

Random forest |

0.938 |

0.938 |

0.941 |

0.934 |

|

SVM |

0.676 |

0.676 |

0.744 |

0.678 |

|

BP neural network |

0.726 |

0.726 |

0.685 |

0.694 |

|

Our model |

0.952 |

0.952 |

0.955 |

0.948 |

According to the classification results, it can be seen that in the quantitative classification experiment of the transformation of business finance integration, the random forest model has the highest classification accuracy on the comparison model, reaching 93.8%. The Precision, Recall, and F1 scores of this model are also the highest. Our proposed model has a 1.4% higher accuracy than random forests, and its Precision, Recall, and F1 scores are all higher than random forests. Prove that the model proposed in this article can be used for quantitative classification analysis of business finance integration transformation, and has good classification accuracy.

5. Conclusion

This study focuses on the quantitative classification of the degree of transformation of enterprise business finance integration, innovatively introducing and improving machine learning algorithms, aiming to provide an objective and comparable quantitative analysis framework for this complex management change process. In the process of model construction and validation, we systematically selected current mainstream classification models as benchmark comparison objects, including gradient boosting trees, random forests, support vector machines, and BP Neural Networks. The empirical analysis results clearly show that in the quantitative classification task of business finance integration transformation, the random forest model performs the most outstandingly in the benchmark model, with a classification accuracy of 93.8%. At the same time, it leads other comparative models in precision, recall, and comprehensive evaluation index F1 score. However, the improved model proposed in this study achieved further significant improvements in performance: its classification accuracy surpassed the best performing random forest model by 1.4 percentage points, reaching 95.2%, and achieved comprehensive surpassing in key performance indicators such as accuracy, recall, and F1 score. The superior results of this series of comparative experiments fully demonstrate that the improved machine learning model proposed in this paper has excellent classification performance, and can stably, efficiently, and accurately complete the quantitative identification and classification analysis tasks of the degree of transformation of business finance integration.

This study not only successfully verified the high-precision applicability of the proposed improved model in the quantitative classification of business finance integration, but its deeper significance lies in providing a powerful quantitative tool and methodological support for enterprises to evaluate and manage the process of business finance integration.

Acknowledgment

This project has received funding from the following funds:

1.Research on Management Accounting Based on the Integration of Business and Finance under the Background of Big Data (H202210), Foshan Polytechnic University-Level Advantageous Horizontal Supporting Project Fund.

2.Ideological and Political Team for the 2023 Big Data and Accounting Professional Curriculum,Foshan Polytechnic.

References

[1]. Guo, Mengdi. "Research on Financial Business Integration and Financial Management Function Transformation Based on Thermal Power Plants." IOP Conference Series: Earth and Environmental Science. Vol. 252. No. 3. IOP Publishing, 2019.

[2]. Mohsen, Sara Ebrahim, Allam Hamdan, and Haneen Mohammad Shoaib. "Digital transformation and integration of artificial intelligence in financial institutions." Journal of Financial Reporting and Accounting 23.2 (2025): 680-699.

[3]. Zhao, Rongxiu, and Duochang Tang. "The integration of financial business and the transformation of financial management functions based on internal control optimization algorithm." Informatica 48.10 (2024).

[4]. Trad, Antoine. "The business transformation framework and enterprise architecture framework for managers in business innovation: An applied holistic mathematical model." International Journal of Service Science, Management, Engineering, and Technology (IJSSMET) 12.1 (2021): 142-181.

[5]. Hensen, Joris, and Brigitte Kötting. "From open banking to embedded finance: the essential factors for a successful digital transformation." Journal of Digital Banking 6.4 (2022): 308-318.

[6]. Alt, Rainer, Roman Beck, and Martin T. Smits. "FinTech and the transformation of the financial industry." Electronic markets 28 (2018): 235-243.

[7]. Olanrewaju, Omowonuola Ireoluwapo Kehinde, Gideon Oluseyi Daramola, and Olusile Akinyele Babayeju. "Transforming business models with ESG integration: A strategic framework for financial professionals." World Journal of Advanced Research and Reviews 22.3 (2024): 554-563.

[8]. Amoozad Mahdiraji, Hannan, Khalid Hafeez, and Seyyed Hossein Razavi Hajiagha. "Business process transformation in financial market: A hybrid BPM‐ELECTRE TRI for redesigning a securities company in the Iranian stock market." Knowledge and Process Management 27.3 (2020): 211-224.

[9]. El Ardeliya, Vina, Joshua Taylor, and Julia Wolfson. "Exploration of artificial intelligence in creative fields: Generative art, music, and design." International Journal of Cyber and IT Service Management 4.1 (2024): 40-46.

[10]. Yonghong, Li, et al. "The impact of enterprise digital transformation on financial performance—Evidence from Mainland China manufacturing firms." Managerial and decision economics 44.4 (2023): 2110-2124.

Cite this article

Li,J.;Liu,J.;Wang,L.;Huang,P. (2025). Quantitative Classification Model for the Degree of Transformation of Enterprise Business Finance Integration Based on Machine Learning Algorithms. Applied and Computational Engineering,163,106-112.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 3rd International Conference on Software Engineering and Machine Learning

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Guo, Mengdi. "Research on Financial Business Integration and Financial Management Function Transformation Based on Thermal Power Plants." IOP Conference Series: Earth and Environmental Science. Vol. 252. No. 3. IOP Publishing, 2019.

[2]. Mohsen, Sara Ebrahim, Allam Hamdan, and Haneen Mohammad Shoaib. "Digital transformation and integration of artificial intelligence in financial institutions." Journal of Financial Reporting and Accounting 23.2 (2025): 680-699.

[3]. Zhao, Rongxiu, and Duochang Tang. "The integration of financial business and the transformation of financial management functions based on internal control optimization algorithm." Informatica 48.10 (2024).

[4]. Trad, Antoine. "The business transformation framework and enterprise architecture framework for managers in business innovation: An applied holistic mathematical model." International Journal of Service Science, Management, Engineering, and Technology (IJSSMET) 12.1 (2021): 142-181.

[5]. Hensen, Joris, and Brigitte Kötting. "From open banking to embedded finance: the essential factors for a successful digital transformation." Journal of Digital Banking 6.4 (2022): 308-318.

[6]. Alt, Rainer, Roman Beck, and Martin T. Smits. "FinTech and the transformation of the financial industry." Electronic markets 28 (2018): 235-243.

[7]. Olanrewaju, Omowonuola Ireoluwapo Kehinde, Gideon Oluseyi Daramola, and Olusile Akinyele Babayeju. "Transforming business models with ESG integration: A strategic framework for financial professionals." World Journal of Advanced Research and Reviews 22.3 (2024): 554-563.

[8]. Amoozad Mahdiraji, Hannan, Khalid Hafeez, and Seyyed Hossein Razavi Hajiagha. "Business process transformation in financial market: A hybrid BPM‐ELECTRE TRI for redesigning a securities company in the Iranian stock market." Knowledge and Process Management 27.3 (2020): 211-224.

[9]. El Ardeliya, Vina, Joshua Taylor, and Julia Wolfson. "Exploration of artificial intelligence in creative fields: Generative art, music, and design." International Journal of Cyber and IT Service Management 4.1 (2024): 40-46.

[10]. Yonghong, Li, et al. "The impact of enterprise digital transformation on financial performance—Evidence from Mainland China manufacturing firms." Managerial and decision economics 44.4 (2023): 2110-2124.