1. Introduction

Globally, grain, energy, and fresh water are vital strategic materials for national economies and people's livelihoods, with grain price fluctuations impacting consumer prices and macroeconomic stability [1-3]. Consequently, nations prioritize stabilizing grain prices through various measures like storage, price control, and tariffs. Recent global challenges, including geopolitical conflicts, trade disputes, and public health emergencies, have complicated the international environment, affecting grain price volatility [4-8]. Understanding the influence of global economic policy uncertainties on grain prices is crucial for global grain security and market stability.

Traditional research on agricultural price fluctuations focuses on supply-demand, cost, international markets, and financial factors. The Nerlove model and others analyze supply responses and demand influences [9-13]. Studies also examine cost factors across the agricultural supply chain and the impact of external shocks like petroleum prices [14-15]. International market research considers spillover effects, trade barriers, and climate change impacts [16-20], while financial studies look at macroeconomics and monetary factors [21-25].

With increasing global economic integration and uncertainties, research on economic policy uncertainty has grown. Economic policy uncertainty, as defined by Tian Qingsong et al., relates to unpredictable governmental decision-making risks [26]. Baker et al.'s Economic Policy Uncertainty Index (EPU) has been crucial for quantifying this uncertainty [27].

Existing research has begun to look at the impact of economic policy uncertainty on agricultural prices. Some studies preliminarily prove the necessity of further research on the impact of economic policy uncertainties on the volatility of agricultural prices [28-29]. Various methods, including Johansen co-integration test, Granger causality test, and different models (BEKK-GARCH, SVAR, GARCH, VAR), are used to explore these relationships [7, 30-34]. However, most researchers often focuses on national impacts, with fewer global perspectives. Meanwhile, These studies mainly adopt the Granger causality test and VAR model, but the former focuses on the analysis of variable correlation. And the latter does not consider the time-varying characteristics of variables.

Based on the shortcomings of existing studies, this study mainly focuses on the price fluctuations in the international market of the four main grains of beans, maize, rice, and wheat, and constructs the Global Economic Uncertainty (GEPU) Index by using the Economic Uncertainty Index (EPU) created by Baker. Based on the TVP-VAR-SV model, the time-varying effect of global economic policy uncertainty on grain price volatility was measured, the mechanism of economic policy uncertainty on grain price was analyzed, and its policy implications were discussed according to the research conclusions.

2. Methods

2.1. Methods

Given the GEPU index's distinct fluctuations at specific times and its variable impact on grain prices at different time, this study uses the TVP-VAR-SV model. This model enhances the traditional VAR model by transforming static parameters into dynamic, fluctuating ones, capturing the variable relationships between different variables over time.

The VAR model, developed by Sims, is extensively used and has evolved over time. Primiceri integrated it with a time-varying analysis framework, and Nakajima further refined it into the TVP-VAR-SV model [35-37]. This approach considers a basic structural VAR model:

\( A{y_{t}}={Β_{1}}{y_{t-1}}+{Β_{2}}{y_{t-2}}+...+{Β_{s}}{y_{t-s}}+{μ_{t}} \) (1)

In the above-mentioned model, \( {y_{t}} \) represents the variable vector to be examined; t=s+1,... n, t represents time, s is the number of lag periods; yt is a variable vector that is composed of the whole economic policy uncertainty, and the global prices of beans, maize, rice, and wheat, \( A \) , \( {Β_{1}},...,{B_{s}} \) is the parameter matrix of \( k×k \) order; The random disturbance term \( {μ_{t}} \) represents a \( k×1 \) structural shock of one order, while assuming \( {μ_{t}}~N(0,∑∑) \) that:

\( ∑=(\begin{matrix}{σ_{1}} & 0 & ... & 0 \\ 0 & {σ_{2}} & ... & 0 \\ ... & ... & ... & ... \\ 0 & 0 & ... & {σ_{k}} \\ \end{matrix}) \) (2)

Here, the interrelation of structural shocks can be determined by recursive identification and the assumption is as follows:

\( A=(\begin{matrix}1 & 0 & ... & 0 \\ {a_{21}} & 1 & ... & 0 \\ ... & ... & ... & ... \\ {a_{k1}} & {a_{k2}} & ... & 1 \\ \end{matrix}) \) (3)

The VAR model form of formula (1) is simplified as follows:

\( {y_{t}}={Φ_{1}}{y_{t-1}}+{Φ_{2}}{y_{t-2}}+...+{Φ_{s}}{y_{t-s}}+{A^{-1}}∑{ε_{t}} \) (4)

where, \( {Φ_{i}}={A^{-1}}{Β_{i}}, i=1,2,...,s \) ; converts the row element of \( {Φ_{i}} \) to form \( β(vector of order {k^{2}}s×1 \) ) and defines \( {X_{t}}={I_{k}}⊗(y_{t-1}^{ \prime },...,y_{t-s}^{ \prime }) \) , where \( ⊗ \) is the Kronecker product. At this point, the model can be expressed as follows:

\( {y_{t}}={X_{t}}β+{A^{-1}}∑{ε_{t}} \) (5)

It should be noted that the parameters in equation (5) are time-invariant. To equip the parameters with time-varying characteristics, a TVP-VAR model can be constructed. The TVP-VAR model with random volatility, i.e., the TVP-VAR-SV model, is as follows:

\( {y_{t}}={X_{t}}{β_{t}}+A_{t}^{-1}{∑_{t}}{ε_{t}} \) (6)

Where, \( {β_{t}} \) , \( {A_{t}} \) , and \( {∑_{t}} \) are variable model estimation parameters. Such time-varying parameters can be used to model related processes in a variety of ways. According to Primiceri (2005), let \( {a_{t}}=({a_{21}},{a_{31}},{a_{32}},{a_{41}},...,{a_{k,k-1}}{)^{ \prime }} \) be one of the lower triangular element vectors, and \( {h_{t}}=({h_{1t}},{h_{2t}},...,{h_{kt}}{)^{ \prime }}, {h_{jt}}=Lnσ_{jt}^{2} \) , \( j=1,2,...,k, t=s+1,...,n \) . Meanwhile, the model parameters in hypothesis (6) obey the random walk process, namely:

\( {β_{t+1}}={β_{t}}+{μ_{{β_{t}}}} \) (7)

\( {a_{t+1}}={a_{t}}+{μ_{{a_{t}}}} \) (8)

\( {h_{t+1}}={h_{t}}+{μ_{{h_{t}}}} \) (9)

and:

\( (\begin{matrix}{ε_{t}} \\ {μ_{{β_{t}}}} \\ {μ_{{a_{t}}}} \\ {μ_{{h_{t}}}} \\ \end{matrix})~N(0,(\begin{matrix}I & 0 & 0 & 0 \\ 0 & {∑_{β}} & 0 & 0 \\ 0 & 0 & {∑_{a}} & 0 \\ 0 & 0 & 0 & {∑_{h}} \\ \end{matrix})) \) (10)

Where, \( {β_{s+1}}~N({μ_{{β_{0}}}},{∑_{{β_{0}}}}) \) , \( {a_{s+1}}~N({μ_{{a_{0}}}},{∑_{{a_{0}}}}) \) , \( {h_{s+1}}~N({μ_{{h_{0}}}},{∑_{{h_{0}}}}) \) .

Due to its excessive estimated parameters, this study employs the Markov Chain Monte Carlo (MCMC) simulation method for estimation, aiming to achieve more precise and effective estimation results to avoid over-fitting issues caused by a small sample size and to reduce the complexity of handling the likelihood function under random fluctuations.

2.2. Data Sources

This study investigates the impact of global economic uncertainty on the price fluctuations of major staple grains, focusing on beans, maize, rice, and wheat. Data from January 2011 to June 2023, with an actual sample period T of 150 periods, are chosen to ensure model stability and accurate variable relationships. The research uses monthly data, adjusted for seasonality with the Census X-12 method via Eviews12.0, and applies logarithmic transformations for stationarity and unit root test compliance.

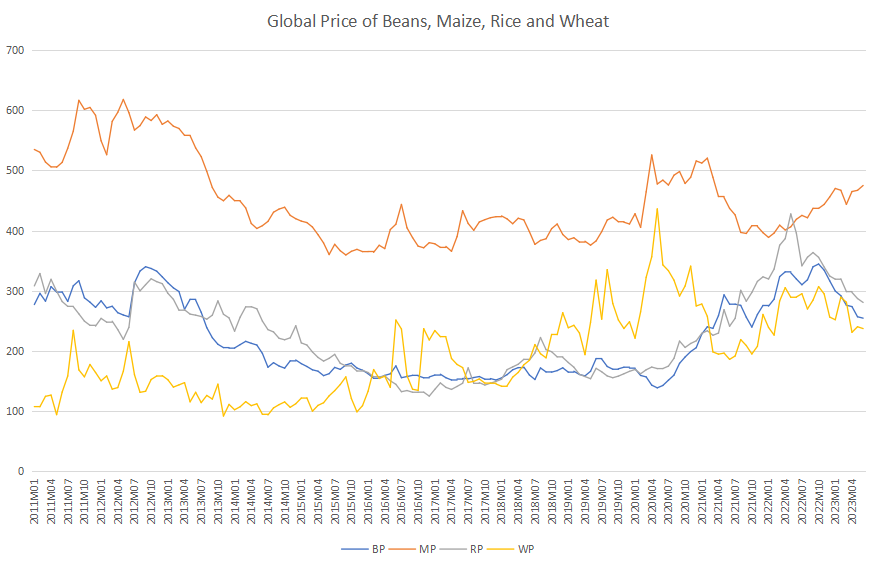

Data of Global Grain Price. This study focuses on beans, maize, rice, and wheat, the four major grains globally, which are pivotal for human sustenance and comprise over half of the world's grain sources [38-39]. The monthly price data, sourced from the International Monetary Fund, reflects average nominal U.S. dollar prices per ton for these grains. Figure 1 reveals distinct price variations among these grains and a strong correlation with the GEPU Index, indicating that their price fluctuations vary with different GEPU Index levels, exhibit time-varying characteristics.

Figure 1: Global Price of Beans, Maize, Rice and Wheat

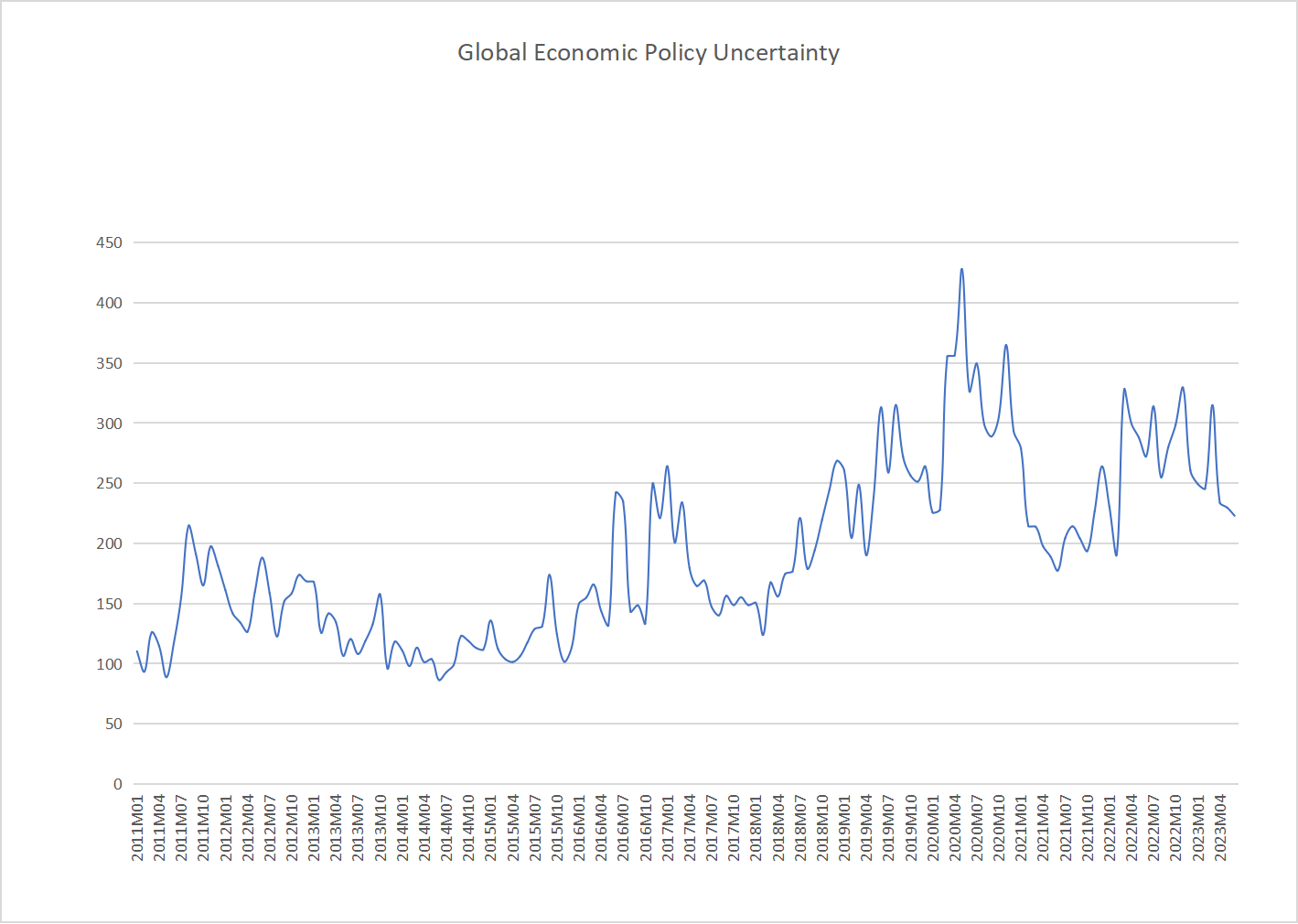

Data of GEPU. This study utilizes the GEPU Index, developed by Baker et al. using text-mining techniques, to assess global economic policy uncertainty. The index aggregates the uncertainty indices from 21 countries, including China, Brazil, the U.S., France, Germany, and Japan, based on their global GDP share. Data is sourced from the Economic Policy Uncertainty Database (http://www.policyuncertainty.com/). The GEPU Index comprises three components: economic, policy, and uncertainty measures. The economic aspect is gauged through a news index, tallying uncertain economic policy-related news in newspapers. The policy change dimension is tracked via a tax code expiration index, counting the number of tax codes expiring annually. Lastly, the uncertainty measure involves a fiscal forecast discrepancy index, based on variances in fiscal forecasts by different agencies, focusing on indicators like the CPI and government fiscal expenditure.

Figure 2 shows the global economic policy uncertainty trend from January 2011 to June 2023, highlighting key events. The trend generally indicates increasing and irregularly cyclical changes in economic policy uncertainty. Notably, after April 2016, the index becomes more volatile, suggesting a grain market increasingly affected by economic policy uncertainties. Peaks in the GEPU Index, occurring in October 2011, January 2017, July 2019, May 2020, and April 2022, correspond to major global events like the European debt crisis, Brexit, U.S. elections, China-U.S. trade friction, the COVID-19 pandemic, and the Russia-Ukraine war. This chart reflects public concerns about economic policy uncertainty and its effects on the global economy.

Figure 2: Global Economic Policy Uncertainty

3. Discussion and Results

3.1. Unit Root Test and Determination of Optimal Lag Order

In this study, time series data are monitored for stationarity using the Augmented Dickey-Fuller (ADF) test to avoid spurious regression. Time series stability means its statistical properties remain consistent over time. Without it, even unrelated variables can show significant T-statistics, leading to incorrect estimations. Table 1 shows ADF test results for the international prices of four major grains and global economic policy uncertainty series. The first-order difference series of these five indicators all pass the ADF test at the 5% level, confirming they are free from unit roots and suitable for constructing the TVP-VAR-SV model.

Table 1: Results of the Augmented Dickey-Fuller test

Variable | Test Type | ADF Value | 5% Critical Value | P-value | Conclusion |

D(BeanPrice) | (C,T,0) | -9.826543 | -2.880987 | 0.0000 | Stable |

D(MaizePrice) | (C,T,0) | -9.961793 | -2.880987 | 0.0000 | Stable |

D(RicePrice) | (C,T,0) | -10.74654 | -2.880987 | 0.0000 | Stable |

D(WheatPrice) | (C,T,0) | -12.34559 | -2.880987 | 0.0000 | Stable |

D(GEPU) | (C,T,0) | -10.27194 | -2.881260 | 0.0000 | Stable |

Note: In (C, T, K), C stands for including intercept, T for including trend, K for lag order, and 0 denotes no intercept or trend. D( ) indicates the series after first-order differencing.

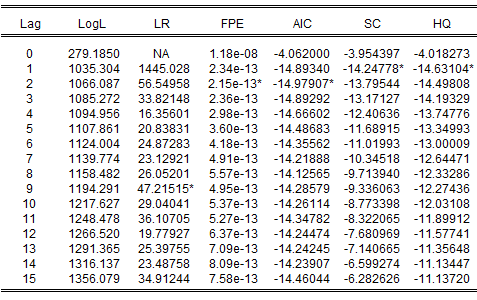

In addition, before constructing the model, it is also necessary to determine the optimal lag order for the variables in the model. Table 2 shows Likelihood Ratio (LR), Final Prediction Error (FPE), Akaike Information Criterion (AIC), Schwarz Criterion (SC), and Hannan-Quinn Criterion (HQ) values for different lags. The most asterisks appear at lag orders 1 and 2. Ivanov and Kilian's research [40] suggests AIC is most accurate for monthly series analysis. Thus, following common practice in similar studies, the optimal lag order is chosen based on the minimum AIC value, which is 2.

Table 2: Results of the optimal lag period selection

Note: * indicates the optimal lag order selected by the respective criterion.

3.2. Model Estimation Results and Diagnosis

This study employs the Monte Carlo method (MCMC) to estimate model parameters with 100,000 samples, discarding the first 1,000 to ensure stability. The TVP-VAR-SV model's estimation results in Table 3 show all posterior means within the 95% confidence interval. The Geweke values, used for convergence diagnostics, are all below the 5% critical value of 1.96, indicating appropriate parameter convergence and selection. The model's maximum inefficiency factor is 57.55, satisfying posterior inference requirements. Overall, the parameter estimation is valid and suitable for further impulse response analysis.

Table 3: Estimation and diagnosis results of the model

.ESTIMATION RESULT | ||||||

Parameter | Mean | Stdev | 95%L | 95%U | Geweke | Inef. |

Sb1 | 0.0226 | 0.0026 | 0.0183 | 0.0283 | 0.104 | 9.07 |

Sb2 | 0.0226 | 0.0026 | 0.0183 | 0.0283 | 0.290 | 8.09 |

Sa1 | 0.0716 | 0.0248 | 0.0395 | 0.1335 | 0.744 | 57.55 |

Sa2 | 0.0681 | 0.0210 | 0.0393 | 0.1200 | 0.004 | 50.12 |

Sh1 | 0.3084 | 0.0568 | 0.2190 | 0.4397 | 0.084 | 55.90 |

Sh2 | 0.3747 | 0.0493 | 0.2912 | 0.4840 | 0.124 | 47.68 |

3.3. Results and Discussion

3.3.1. Equal Interval Impulse Response Analysis

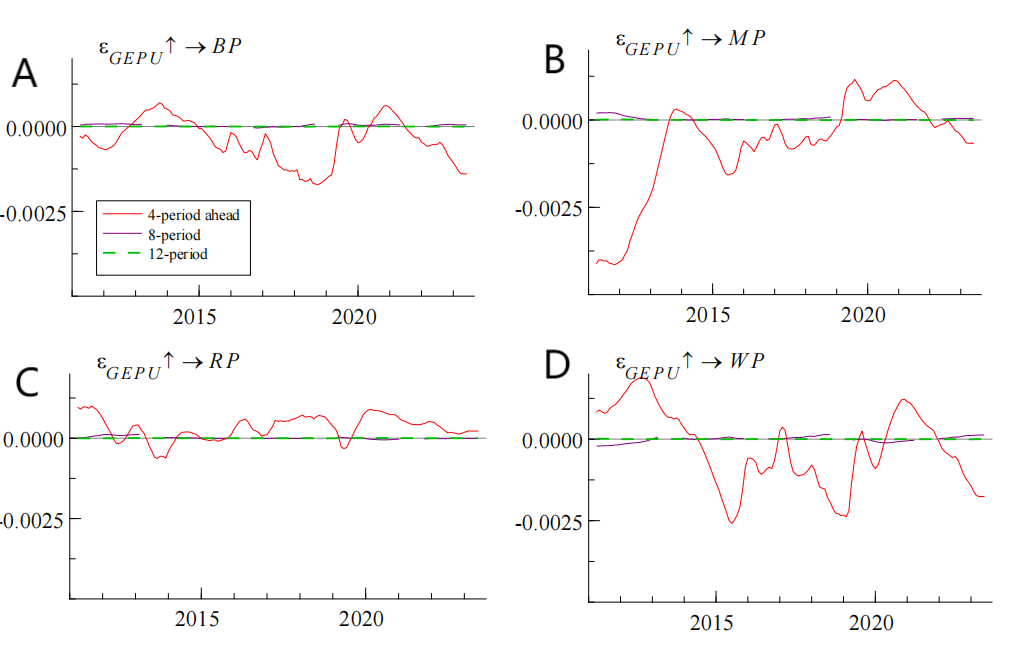

The TVP-VAR model's impulse response function includes equal interval and specific time point impulse responses. Equal interval responses assess the dependent variable's reaction to the independent variable over different lead times within a set period. In this study, we examine short-term (4 months), medium-term (8 months), and long-term (12 months) stages using different lags to analyze the impact of global economic policy uncertainty on the global prices of the four grains. Figure 3 shows these impulse responses, revealing a fluctuating pattern with time-varying structural characteristics, oscillating between positive and negative values around the zero axis.

Figure 3: Equal Interval Impulse Response of Global Prices of Beans, Maize, Rice, and Wheat to Economic Policy Uncertainty

3A: Equal Interval Impulse Response of Global Prices of Beans to Economic Policy Uncertainty

3B: Equal Interval Impulse Response of Global Prices of Maize to Economic Policy Uncertainty

3C: Equal Interval Impulse Response of Global Prices of Rice to Economic Policy Uncertainty

3D: Equal Interval Impulse Response of Global Prices of Wheat to Economic Policy Uncertainty

First, from the perspective of the impulse response effects under different lag periods, the strength of the impulse response weakens as the number of lag periods increases. The greatest impact on global grain prices occurs at a 4-period lag, with a notably intense impulse response. At an 8-period lag, the response weakens considerably but still remains evident. By a 12-period lag, the response significantly diminishes, becoming almost negligible. This pattern suggests that grain price fluctuations due to global political uncertainties are primarily short-term, substantially weaken in the medium term, and are minimal in the long term. This trend is likely due to two factors. First, global uncertain events increase the index of global economic policy uncertainty, creating market instability and altering short-term expectations among producers and consumers, thus impacting grain prices. Over time, rational thinking prevails, and prices stabilize. Second, agriculture's strategic importance prompts swift government interventions in significant grain market fluctuations, stabilizing prices through economic policies. Therefore, the study primarily focuses on the grain price response at a 4-period lag to illustrate its short-term impulse response characteristics.

From the perspective of changes in the short-term impulse response cycle, the impact of the GEPU shock on global grain prices has shown a continuous driving force since 2011, with all four grains displaying similar cyclical patterns. The first cycle spans from 2011 to 2016; the second cycle is from 2016 to 2019; and the third cycle runs from 2019 up to the present. Based on the experiences of the previous cycles, it is assessed that the GEPU shock has not yet descended from its declining phase to the trough of its cyclical fluctuation. Overall, the influence of the GEPU shock presents itself in three distinct cycles, with the effects predominantly manifesting as a driving force on market prices. This indicates that global economic policy uncertainty plays a significant role in the cyclical fluctuations of grain market prices, and is a pivotal factor propelling the global price volatility of grains.

From the perspective of the short-term impulse response direction, using a 4-period lag as an example, the prices of the four grains studied in this study show an alternating positive and negative trend. The global prices of beans, maize and wheat mainly exhibit a negative response, while the price of rice predominantly shows a positive response. This indicates that for the global markets of beans, maize, and wheat, when GEPU is on an upward trend, its impact is primarily manifested as a shock on the demand side, subsequently leading to a decrease in the prices of these commodities. Conversely, in the rice market, when GEPU is trending upwards, its influence is primarily seen as a supply-side shock, which then results in a price increase for the product.

From the perspective of short-term impulse response time, rice and wheat prices react faster to economic policy uncertainty than beans and maize. Beans and maize, primarily used as feed grain, show a delayed price response compared to rice and wheat, which are staple grains. This delay is evident in graphs, where beans and maize reach peak and trough values later than rice and wheat. This quicker response in staple grains is due to several factors. Firstly, the inelastic demand for staple grains, as basic necessities, means people continue to buy them even at higher prices, unlike feed grains where demand is more elastic and substitutions or production adjustments are possible. Secondly, the staple grain market reacts faster as these grains are purchased more frequently, leading to quicker price changes at the retail level. On the other hand, the feed grain industry involves upstream investment decisions and production cycles, resulting in longer market response time. Furthermore, governments often prioritize stabilizing staple grain prices due to their direct impact on public welfare. In times of increasing economic policy uncertainty, government interventions in staple grain markets are likely more prompt, resulting in swifter price adjustments.governments might intervene more actively in the staple grain markets, leading to swifter price reactions.

From the perspective of the intensity of short-term impulse responses, the intensity of global rice price reaction to changes in GEPU is noticeably weaker than that of the other three grains. Compared to the other three grains, the intensity of impulse response of the global rice market price to global economic policy uncertainty is significantly muted. The reason could be that rice has a lower export proportion in its production, and the primary exporting countries are predominantly smaller nations. Specifically, when economic policy uncertainty rises, it might affect international trade, monetary policies, and the investment climate, thus influencing the prices of different commodities to varying extents. Goods with a lower export proportion are less affected, and this can be explained from several perspectives: First, from the demand side, goods with a smaller export proportion largely rely on domestic markets. In an environment of heightened economic policy uncertainty, these commodities are more influenced by domestic demand rather than changes in the international market. Second, in terms of external shocks, these types of goods are relatively insulated from direct impacts of international economic policies or the global economic environment since their sales predominantly hinge on domestic markets. Next is the supply chain. The supply chain for such goods relies more on domestic suppliers, making them less susceptible to fluctuations in the international supply chain. Lastly, in terms of exchange rate volatility, since they mainly rely on domestic markets, the prices of these goods are less affected by currency fluctuations.

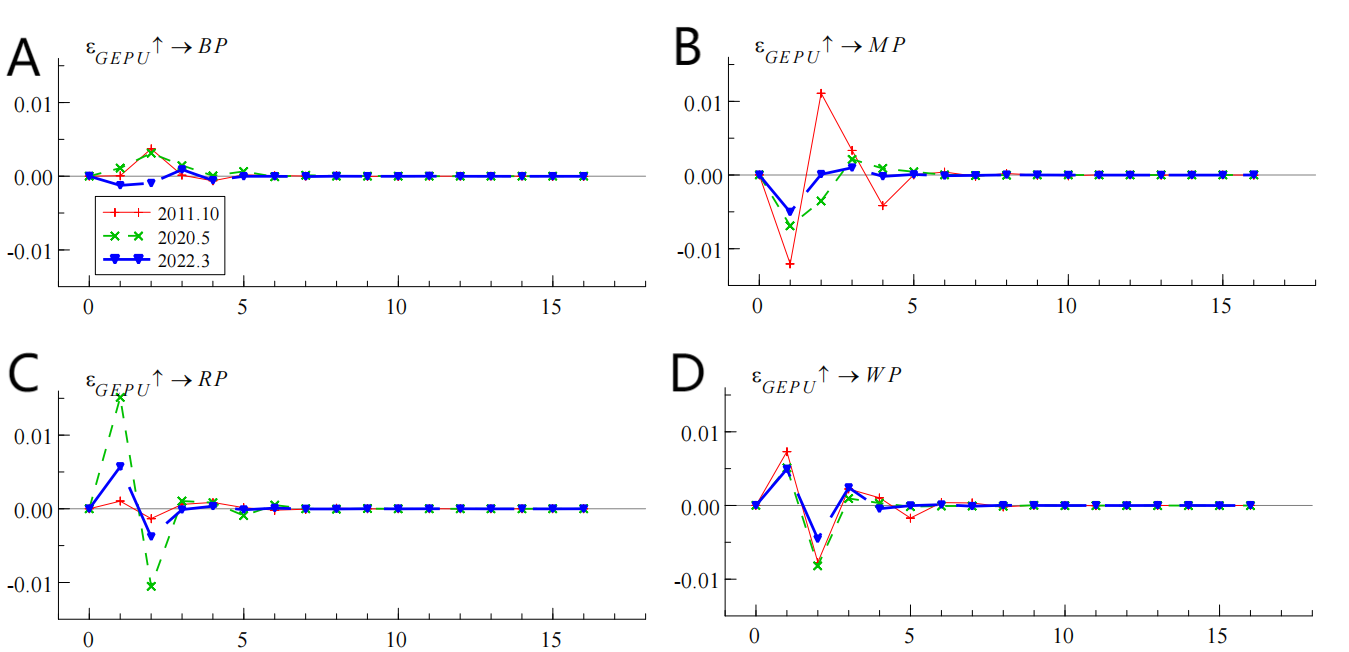

3.3.2. Point-in-Time Impulse Response Analysis

The point-in-time analysis refers to selecting a few economic policy events with high uncertainty indices in various sudden incidents and comparing the impact of different economic policy shocks on the price fluctuations of the four major grains. This study selected the Eurozone crisis in October 2011 (t=9), the COVID-19 pandemic situation in May 2020 (t=112) and the Russia-Ukraine war in March 2023 (t=134), representing financial, public health emergency, and political categories of major uncertainty events, respectively. By simulating the global economic policy uncertainty shocks at these three points on the global prices of beans, maize, rice and wheat, the results are shown in Figure 4.

Figure 4: Point-in-Time Impulse Response of Global Prices of Beans, Maize, Rice and Wheat to Economic Policy Uncertainty

4A: Point-in-Time Impulse Response of Global Prices of Beans to Economic Policy Uncertainty

4B: Point-in-Time Impulse Response of Global Prices of Maize to Economic Policy Uncertainty

4C: Point-in-Time Impulse Response of Global Prices of Rice to Economic Policy Uncertainty

4D: Point-in-Time Impulse Response of Global Prices of Wheat to Economic Policy Uncertainty

From the perspective of the speed of the impulse response, the time points corresponding to the peak of the economic policy uncertainty index and the maximum impulse response level of grain prices are not consistent. This indicates that the impact of economic policy uncertainty events on grain prices is delayed. In this study, the time points corresponding to the highest values of the Economic Policy Uncertainty Index during the three major events were selected (when there were multiple peaks with no significant difference within the period, the earliest peak was selected in this study). However, the response magnitudes of the four grain prices did not reach their maximum in the first period. Only the prices of rice and wheat, which are staple grains, peaked in the first period, while the prices of beans and maize, which are feed grains, lagged by one period. This confirms that the response of feed grains to economic policy uncertainty events is lagged compared to staple grains, which is consistent with the results of the equidistant impulse response.

From the perspective of the duration of impulse response, the impulse effects of the European debt crisis, the COVID-19 pandemic and the Russia-Ukraine war on the prices of the four grains all ended around the 6th period. This suggests that financial, environmental, and political events, which lead to elevated economic policy uncertainty, mainly have short-term impacts on grain price fluctuations, consistent with the results from the equidistant impulse response.

From the intensity of the impulse response, on average, beans were the least affected among the three selected time points. The COVID-19 pandemic had the most significant impact on the prices of the four grains. During the 2011 European debt crisis, the uncertainty of economic policies had the most substantial impact on maize prices and the least on rice prices. During the 2020 COVID-19 pandemic, the uncertainty had the most significant impact on rice and the least on beans. During the Russia-Ukraine war in 2022, economic policy uncertainty had the weakest impact on beans prices, with similar impacts on the other three grains. The emergence of these phenomena relates to the nature, scope, and level of impact of different events. The 2011 European debt crisis, a financial-economic event, mainly caused changes in exchange rates, subsequently affecting grain prices. Maize, as a feed grain with large import and export volume, was more susceptible to financial uncertainties. Conversely, rice, a staple grain with smaller import and export volumes and primarily reliant on domestic production, was less affected. The COVID-19 pandemic in 2020, a public heath emergency, directly influenced grain production and consumption, disrupting the balance of supply and demand, leading to direct impacts on grain prices. Of the three types of uncertainty events, public health emergency has the most severe effects on grain prices and should be paid great attention. In terms of the supply chain, with governments implementing prevention and control measures against COVID-19, transportation restrictions increased the costs of grain production, transportation, and consumption, disrupting distribution channels and causing supply chain interruptions. Consumers, due to reduced outdoor activities and panic during the pandemic, changed their consumption habits to stockpiling, leading to short-term surges in grain demand. Primarily, consumers stockpiled staple grains like rice rather than feed grains with longer storage periods. Therefore, during the pandemic, the impact on staple grains was more significant than on feed grains. The Russia-Ukraine war in 2022, a geopolitical event, mainly affected global trade routes, increasing grain transportation cost and causing grain price fluctuations. The largest exporter of beans is in the southern hemisphere, while the other three grains' primary exporters are in the northern hemisphere. Therefore, when airspace restrictions were imposed over Russia and Ukraine, the transportation routes for the other three grains changed, increasing transportation cost and having a more significant impact on their prices compared to beans.

4. Policy Implications

Given the increasing openness of the international grain market and global economic uncertainties, it is essential for countries to consider grain security issues from a global perspective. Countries can avoid the risks of global grain price fluctuations and ensure grain security by establishing international grain security organizations and improving the institutional design of grain security. Therefore, the following policy suggestions are proposed:

Governments need to enhance information disclosure and transparency to alleviate market uncertainty caused by unstable economic policies, aiming to construct a smoothly operating grain market. Empirical studies show that grain prices are affected by policy uncertainty to varying degrees. To mitigate this impact, it's vital to reduce information transmission costs and accelerate information dissemination rates. A transparent and open market environment results in faster information dissemination, helping to alleviate abrupt short-term fluctuations in grain prices due to policy uncertainty. Such a measure strengthens the role of government entities in macroeconomic regulation while conveying the latest policy information to consumers and producers, addressing the information asymmetry between these parties, guiding businesses to form reasonable expectations about economic policy changes, and mitigating the impact of such uncertainty on the global grain market.

International organizations should play a key role in monitoring the international grain market and provide timely alerts. Regular updates on countries' monetary policies, trade policies, grain policies and other global economic policy uncertainty events are crucial. Moreover, focus on exchanging and sharing grain market information among nations and building information sharing platforms. When global economic policy uncertainty heightens, international organizations should issue warnings to countries globally. International grain aid should be offered to nations facing grain shortages. Countries should rapidly issue alerts for agricultural supply chains, assisting in pre-emptive adjustments in production and supply. This will help countries introduce robust policies to maintain the stability of international agricultural product prices and supply chains.

Particular attention should be paid to the direct short-term effects of economic policy uncertainty on wheat and rice price volatility. When faced with global economic policy uncertainties, the magnitude and trajectory of the responses of different international grain products vary. The effects on wheat and rice prices are most pronounced in the short term and are the most responsive to economic policy uncertainty. Thus, in mitigating the effects of global economic policy uncertainty on grain prices, differentiated economic policies should be implemented in terms of pricing and circulation for different grains to ensure policy effectiveness. Given the strong and immediate short-term price fluctuations of wheat and rice, timely policies should be implemented to stabilize their supply chains and prices when global economic policy uncertainties occur. In addition, the establishment of grain storage mechanisms and price stability mechanisms can enhance the risk resilience of the global staple grain market.

Different countermeasures should be formulated and implemented based on the unique characteristics of different events. Governments should formulate targeted strategies based on three broad categories of economic policy uncertainty events (financial, emergent public events, political) and the two types of grains (staple grains and feed grains). In the face of economic policy uncertainty, governments should not only provide early warning, but also actively design and implement price control policies. This "two-handed strategy" combines the "invisible hand" of the market with the "visible hand" of the government to maintain grain price stability more effectively. In addition, supervision of the grain futures market should be strengthened to prevent speculators from maliciously manipulating grain futures prices during periods of heightened economic policy uncertainty. Finally, improving import-export regulatory capacity and effectively utilizing grain trading methods, combined with domestic and international grain market conditions, will help establish a comprehensive grain import-export monitoring and warning system.

5. Conclusion

The article is based on the monthly data of the GEPU Index and the global prices of beans, maize, rice and wheat from January 2011 to June 2023. It uses the TVP-VAR-SV model to study the time-varying effects of global economic policy uncertainty on global grain price fluctuations and analyzes the mechanism of economic policy uncertainty on grain prices. The following conclusions are drawn:

In the equidistant impulse response, as the number of lag periods increases, the impulse response of grain prices to economic policy uncertainty gradually weakens. This indicates that grain price fluctuations have time-varying characteristics and mainly manifest as short-term impacts.

The impact of GEPU presents three distinct cycles, with the impact more often manifesting as a driving force in market prices. This demonstrates that the shock of global economic policy uncertainty plays a vital role in the cyclical fluctuations of beans market prices, making it an essential factor driving the price fluctuations of the four major grains globally.

The price response of beans and maize to the rise in economic policy uncertainty lags behind that of rice and wheat. When beans and maize prices are affected by economic policy uncertainty, they reach peak and trough values later than rice and wheat. Beans and maize are primarily used as feed grains, while rice and wheat are used as staple grains. This indicates that, under typical circumstances, the price reaction of staple grains to the rise in economic policy uncertainty is usually faster and more direct.

In the point impulse response, the impact of economic policy uncertainty events on grain prices has a lagged characteristic. The effects of economic policy uncertainty on grain prices show significant differences during the three periods of the 2011 European debt crisis, the COVID-19 pandemic in 2020, and the Russia-Ukraine war in 2022, with the pandemic having the most significant impact on grain prices. The emergence of these phenomena relates to the nature, scope, and level of impact of different events.

References

[1]. Liu Ximing. International Grain Price Fluctuation,s Impacts on China,s Economy . Zhejiang University, 2009. (in Chinese)

[2]. Wu Ting. Research on the influencing factors and regulation policies of agricultural product price fluctuations.Yangzhou University,2014. (in Chinese)

[3]. Chen Yufeng, Xue Xiaofan, Xu Zhenyu. The impact transmission mechanism of international oil price fluctuations on domestic agricultural product prices: based on the LSTAR model. Chinese Rural Economy,2012( 9) : 74 - 87 (in Chinese)

[4]. Fang Su, Yu Liu, Shao-Jian Chen, Shah Fahad, Towards the impact of economic policy uncertainty on food security: Introducing a comprehensive heterogeneous framework for assessment, Journal of Cleaner Production, Volume 386, 2023, 135792, ISSN 0959-6526

[5]. Ting-Ting Sun, Chi-Wei Su, Nawazish Mirza, Muhammad Umar. How does trade policy uncertainty affect agriculture commodity prices, Pacific-Basin Finance Journal, Volume 66, 2021, 101514, ISSN 0927-538X

[6]. WEI Zhongjun. ZHANG Bingbing. The Shock of Global Economic Policy Uncertainty and International Grain Price Fluctuation:Theoretical and Empirical Analysis. Economic Problem, 2018,(03):90-95. (in Chinese)

[7]. Pan Qunxing. Chen Xu. Research on the Impact of Economic Policy Uncertainty on the Prices of Agricultural Products in China. jiangsu agricultural sciences, 2019,47(15):335-338. (in Chinese)

[8]. Qing Yuqian. Guo Fenglong. Economic Policy Uncertainty, International Crude Oil Price Changes, and China's Agricultural Product Futures Prices: An Analysis Based on the TVP-SV-VAR Model. Financial Economy,2022,(12):79-93. (in Chinese)

[9]. NERLOVE M. Estimates of Elasticities of Supply of Selected Agricultural Commodities [J]. Journal of Farm Economics,1956 (38):496-509.

[10]. FOX K A. A Spatial Equilibrium Model of the Livestock Feed Economy in the United States[J].Economitrica,1953(41):547- 566.

[11]. Xie, H.; Wang, B. An empirical analysis of the impact of agricultural product price fluctuations on China’s grain yield. Sustainability 2017, 9, 906.

[12]. TROSTLE R. Global Agricultural Supply and Demand:Factors Contributing to the Recent Increase in Food Commodity Prices, USDA,2008.

[13]. Rezitis, A.N.; Pachis, D.N. Investigating the price volatility transmission mechanisms of selected fresh vegetable chains in Greece. J. Agribusiness Dev. Emerg. Econ. 2020, 10, 587–611.

[14]. Liu Chunmei, Bao Wen.Price Fluctuation of Agricultural Products and Its Control Countermeasures.Agricultural Technology and Equipment,2021,(01):41-42+45. (in Chinese)

[15]. Xiao Hao. Liu Shu. Yang Cuihong. Analysis of Supply Factors in the Rise of Agricultural Product Prices: From the Perspective of Cost Transmission Capability. Agricultural Technology Economy,2014,(06):80-91. (in Chinese)

[16]. LI Guangsi. WANG Li. XIE Jingjing. ZHONG Yu. Research on Grain Price Fluctuation and Transmission Effect In the Background of Import Growth. Agricultural Economic Issues,2018,(02):94-103. (in Chinese)

[17]. Gu Guoda. Fang Chenliang. Analysis of the Fluctuation Characteristics of Agricultural Product Prices in China: A Situation Transfer Model Based on International Market Factors. Rural Economy in China,2010,(06):67-76. (in Chinese)

[18]. Jiang Y, Wang Y. Is China’s domestic agricultural market influenced by price fluctuations of the world agricultural commodities in the short-run?[J]. Agricultural Economics, 2013, 59(12): 578-589.

[19]. Kym Anderson, Signe Nelgen. Trade Barrier Volatility and Agricultural Price Stabilization, World Development, Volume 40, Issue 1,2012,Pages 36-48

[20]. Liu Decai. Bao Wen. Climate intelligent agriculture is a strategic choice to ensure food security in the context of climate change . Gansu Science and Technology Review,2016,45(3):91-93. (in Chinese)

[21]. PINDYCK R S,JULIO J,ROTEMBERG. The Excess Comove ment of Commodity Prices [J]. Economic Journal,1990,100 (403):1173-1189.

[22]. LAPP J S,SMIT H V H. Aggregate Sources of Relative Price Variability Among Agricultural Commodities [J]. American Journal of Agricultural Economics. 1992,74(1):1-9

[23]. DING Cun zhen. XIAO Hai feng. Dynamic pass-through effects of RMB exchange rate on China’s agricultural products price:Based on TVP-VAR model.CHINA AGRICULTURAL UNIVERSITY, 2018,23( 12) : 176 - 186.(in Chinese)

[24]. Gong Xinshu. Zhang Jingru. Empirical study on the relationship between money supply and agricultural product prices in China based on VAR model . Jiangsu Agricultural Science,2014,42( 10) : 398 - 4 (in Chinese)

[25]. Johnson Gale, Guoqing Song. Inflation and the Real Price of Grain in China, Food Security and Economic Reform-The Challenges Facing Chinas Grain Marketing System[M].London: Macmillan Press, 1999.

[26]. TIAN Qingsong. XIAO Xiaoyong. LI Chongguang. Influence of economic policy uncertainty on the price fluctuation of China’s grain futures . Journal of China Agricultural University,2018,23(2):204-212. (in Chinese)

[27]. Scott R. Baker, Nicholas Bloom, Steven J. Davis. Measuring Economic Policy Uncertainty. The Quarterly Journal Of Economics, 2016, 131:1593-1636.

[28]. TAN Ying. HU Hongtao. LI Dasheng. The Impact of Economic Uncertainty on the Price of Agricultural Products from Perspective of Industrial Chain. Agricultural Technology Economy, 2018, (7): 80-92. (in Chinese)

[29]. XL Zhai, XG Xu, ZX Tan. Financialization of agricultural product: concept, formative mechanism and effects on agricultural product price[J]. Chinese Rural Economy, 2013(34):120-125.

[30]. Shi Zizhong. Wang Mingli. Nonlinear Relationship Between Beef and Mutton Price in China. ournal of Huazhong Agricultural University (Social Sciences Edition), 2015(06) : 19-28. 2015. 06. 003. (in Chinese)

[31]. Tian Q, Xiao X , Chongguang LI . Influence of economic policy uncertainty on the price fluctuation of China's grain futures[J]. Journal of China Agricultural University, 2018(21):167-181

[32]. Frimpong S, Gyamfi E N, Ishaq Z, et al. Can global economic policy uncertainty drive the interdependence of agricultural commodity prices? Evidence from partial wavelet coherence analysis[J]. Complexity, 2021, 2021: 1-13.

[33]. Jiang Bo. Study on Influence of Epu on The Price of Agricultural Products. Jiangxi University of Finance and Economics, 2022. (in Chinese)

[34]. ZHANG Junhua. HUA Junguo. TANG Huacang. WU Yiping. Economic Policy Uncertainty and Price Fluctuation of Agricultural Products. Agricultural Technology Economy, 2019, (05): 110-122. (in Chinese)

[35]. Nakajima J. Time-varying parameter VAR model with stochastic volatility: An overview of methodology and empirical applications. Monetary and Economic Studies, 2011, 29: 107-142.

[36]. Primiceri G E. Time varying structural vector autoregressions and monetary policy. Review of Economic Studies, 2005, 72 (3): 821-852.

[37]. Sims C A. Macroeconomics and reality. Econometrica, 1980, 48: 1-48.

[38]. Haile, M.G., Kalkuhl, M. and von Braun, J. (2014), Inter- and intra-seasonal crop acreage response to international food prices and implications of volatility. Agricultural Economics, 45: 693-710.

[39]. Roberts, M.J. and Schlenker, W. (2009), World Supply and Demand of Food Commodity Calories. American Journal of Agricultural Economics, 91: 1235-1242.

[40]. Ivanov V, Kilian L. A practitioner's guide to lag order selection for VAR impulse response analysis[J]. Studies in Nonlinear Dynamics & Econometrics, 2005, 9(1): 1-34.

Cite this article

Chen,R. (2024). The Impact of Global Economic Policy Uncertainty on Global Grain Prices --Based on the TVP-VAR-SV Model. Advances in Economics, Management and Political Sciences,74,275-287.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 3rd International Conference on Business and Policy Studies

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Liu Ximing. International Grain Price Fluctuation,s Impacts on China,s Economy . Zhejiang University, 2009. (in Chinese)

[2]. Wu Ting. Research on the influencing factors and regulation policies of agricultural product price fluctuations.Yangzhou University,2014. (in Chinese)

[3]. Chen Yufeng, Xue Xiaofan, Xu Zhenyu. The impact transmission mechanism of international oil price fluctuations on domestic agricultural product prices: based on the LSTAR model. Chinese Rural Economy,2012( 9) : 74 - 87 (in Chinese)

[4]. Fang Su, Yu Liu, Shao-Jian Chen, Shah Fahad, Towards the impact of economic policy uncertainty on food security: Introducing a comprehensive heterogeneous framework for assessment, Journal of Cleaner Production, Volume 386, 2023, 135792, ISSN 0959-6526

[5]. Ting-Ting Sun, Chi-Wei Su, Nawazish Mirza, Muhammad Umar. How does trade policy uncertainty affect agriculture commodity prices, Pacific-Basin Finance Journal, Volume 66, 2021, 101514, ISSN 0927-538X

[6]. WEI Zhongjun. ZHANG Bingbing. The Shock of Global Economic Policy Uncertainty and International Grain Price Fluctuation:Theoretical and Empirical Analysis. Economic Problem, 2018,(03):90-95. (in Chinese)

[7]. Pan Qunxing. Chen Xu. Research on the Impact of Economic Policy Uncertainty on the Prices of Agricultural Products in China. jiangsu agricultural sciences, 2019,47(15):335-338. (in Chinese)

[8]. Qing Yuqian. Guo Fenglong. Economic Policy Uncertainty, International Crude Oil Price Changes, and China's Agricultural Product Futures Prices: An Analysis Based on the TVP-SV-VAR Model. Financial Economy,2022,(12):79-93. (in Chinese)

[9]. NERLOVE M. Estimates of Elasticities of Supply of Selected Agricultural Commodities [J]. Journal of Farm Economics,1956 (38):496-509.

[10]. FOX K A. A Spatial Equilibrium Model of the Livestock Feed Economy in the United States[J].Economitrica,1953(41):547- 566.

[11]. Xie, H.; Wang, B. An empirical analysis of the impact of agricultural product price fluctuations on China’s grain yield. Sustainability 2017, 9, 906.

[12]. TROSTLE R. Global Agricultural Supply and Demand:Factors Contributing to the Recent Increase in Food Commodity Prices, USDA,2008.

[13]. Rezitis, A.N.; Pachis, D.N. Investigating the price volatility transmission mechanisms of selected fresh vegetable chains in Greece. J. Agribusiness Dev. Emerg. Econ. 2020, 10, 587–611.

[14]. Liu Chunmei, Bao Wen.Price Fluctuation of Agricultural Products and Its Control Countermeasures.Agricultural Technology and Equipment,2021,(01):41-42+45. (in Chinese)

[15]. Xiao Hao. Liu Shu. Yang Cuihong. Analysis of Supply Factors in the Rise of Agricultural Product Prices: From the Perspective of Cost Transmission Capability. Agricultural Technology Economy,2014,(06):80-91. (in Chinese)

[16]. LI Guangsi. WANG Li. XIE Jingjing. ZHONG Yu. Research on Grain Price Fluctuation and Transmission Effect In the Background of Import Growth. Agricultural Economic Issues,2018,(02):94-103. (in Chinese)

[17]. Gu Guoda. Fang Chenliang. Analysis of the Fluctuation Characteristics of Agricultural Product Prices in China: A Situation Transfer Model Based on International Market Factors. Rural Economy in China,2010,(06):67-76. (in Chinese)

[18]. Jiang Y, Wang Y. Is China’s domestic agricultural market influenced by price fluctuations of the world agricultural commodities in the short-run?[J]. Agricultural Economics, 2013, 59(12): 578-589.

[19]. Kym Anderson, Signe Nelgen. Trade Barrier Volatility and Agricultural Price Stabilization, World Development, Volume 40, Issue 1,2012,Pages 36-48

[20]. Liu Decai. Bao Wen. Climate intelligent agriculture is a strategic choice to ensure food security in the context of climate change . Gansu Science and Technology Review,2016,45(3):91-93. (in Chinese)

[21]. PINDYCK R S,JULIO J,ROTEMBERG. The Excess Comove ment of Commodity Prices [J]. Economic Journal,1990,100 (403):1173-1189.

[22]. LAPP J S,SMIT H V H. Aggregate Sources of Relative Price Variability Among Agricultural Commodities [J]. American Journal of Agricultural Economics. 1992,74(1):1-9

[23]. DING Cun zhen. XIAO Hai feng. Dynamic pass-through effects of RMB exchange rate on China’s agricultural products price:Based on TVP-VAR model.CHINA AGRICULTURAL UNIVERSITY, 2018,23( 12) : 176 - 186.(in Chinese)

[24]. Gong Xinshu. Zhang Jingru. Empirical study on the relationship between money supply and agricultural product prices in China based on VAR model . Jiangsu Agricultural Science,2014,42( 10) : 398 - 4 (in Chinese)

[25]. Johnson Gale, Guoqing Song. Inflation and the Real Price of Grain in China, Food Security and Economic Reform-The Challenges Facing Chinas Grain Marketing System[M].London: Macmillan Press, 1999.

[26]. TIAN Qingsong. XIAO Xiaoyong. LI Chongguang. Influence of economic policy uncertainty on the price fluctuation of China’s grain futures . Journal of China Agricultural University,2018,23(2):204-212. (in Chinese)

[27]. Scott R. Baker, Nicholas Bloom, Steven J. Davis. Measuring Economic Policy Uncertainty. The Quarterly Journal Of Economics, 2016, 131:1593-1636.

[28]. TAN Ying. HU Hongtao. LI Dasheng. The Impact of Economic Uncertainty on the Price of Agricultural Products from Perspective of Industrial Chain. Agricultural Technology Economy, 2018, (7): 80-92. (in Chinese)

[29]. XL Zhai, XG Xu, ZX Tan. Financialization of agricultural product: concept, formative mechanism and effects on agricultural product price[J]. Chinese Rural Economy, 2013(34):120-125.

[30]. Shi Zizhong. Wang Mingli. Nonlinear Relationship Between Beef and Mutton Price in China. ournal of Huazhong Agricultural University (Social Sciences Edition), 2015(06) : 19-28. 2015. 06. 003. (in Chinese)

[31]. Tian Q, Xiao X , Chongguang LI . Influence of economic policy uncertainty on the price fluctuation of China's grain futures[J]. Journal of China Agricultural University, 2018(21):167-181

[32]. Frimpong S, Gyamfi E N, Ishaq Z, et al. Can global economic policy uncertainty drive the interdependence of agricultural commodity prices? Evidence from partial wavelet coherence analysis[J]. Complexity, 2021, 2021: 1-13.

[33]. Jiang Bo. Study on Influence of Epu on The Price of Agricultural Products. Jiangxi University of Finance and Economics, 2022. (in Chinese)

[34]. ZHANG Junhua. HUA Junguo. TANG Huacang. WU Yiping. Economic Policy Uncertainty and Price Fluctuation of Agricultural Products. Agricultural Technology Economy, 2019, (05): 110-122. (in Chinese)

[35]. Nakajima J. Time-varying parameter VAR model with stochastic volatility: An overview of methodology and empirical applications. Monetary and Economic Studies, 2011, 29: 107-142.

[36]. Primiceri G E. Time varying structural vector autoregressions and monetary policy. Review of Economic Studies, 2005, 72 (3): 821-852.

[37]. Sims C A. Macroeconomics and reality. Econometrica, 1980, 48: 1-48.

[38]. Haile, M.G., Kalkuhl, M. and von Braun, J. (2014), Inter- and intra-seasonal crop acreage response to international food prices and implications of volatility. Agricultural Economics, 45: 693-710.

[39]. Roberts, M.J. and Schlenker, W. (2009), World Supply and Demand of Food Commodity Calories. American Journal of Agricultural Economics, 91: 1235-1242.

[40]. Ivanov V, Kilian L. A practitioner's guide to lag order selection for VAR impulse response analysis[J]. Studies in Nonlinear Dynamics & Econometrics, 2005, 9(1): 1-34.