1. Introduction

As per the Federal Reserve (Fed), the central bank of the United States, monetary policy encompasses actions taken by central banks and finance ministries to fortify the economy and mitigate cyclical fluctuations. This is achieved through manipulation of the availability and cost of credit, implementation of budget and tax policies, and consideration of other financial factors. The Federal Reserve wields control over three tools for monetary policy: reserve requirements, the discount rate, and open market operations. Oversight of open market operations falls under the purview of the Federal Open Market Committee (FOMC). Through the utilization of these three tools, the Federal Reserve shapes the supply of and demand for balances held by depository institutions, resulting in changes to the federal funds rate. The federal funds rate denotes the interest rate in the U.S. interbank lending market, with the overnight lending rate being the most significant [1].

In 1980, U.S. inflation shot up to the highest amount in history: 14.6 percent. To control inflation, the Fed set a target of 14 percent for the funds rate over the next decade in January 1980. When officials wrapped up a conference on December 5, 1980, they raised the target range to 19-20 percent, the highest point ever recorded [2]. Over the next four decades, the Fed has implemented interest rate hikes several times in response to the economy. The current rate hike cycle began in March 2022. At its July 2023 meeting, the FOMC raised interest rates to 5.25%-5.50%, which is the eleventh rate hike this cycle intended to combat excessive inflation. The FOMC held its most recent policy meeting from October 31 to November 1, when interest rates remained at 5.25% to 5.50%. The next meeting will be held from December 12 to 13, and the interest rates are forecasted to remain unchanged by investors and analysts. Hayes advocates that continuous high rates may have a negative effect on the banking industry, trade market, and stock market. Therefore, if rates were to rise once more before the year ends, experts only anticipate a slight increase of 25 basis points (bps), or 0.25%. According to interest rate futures as of November 1, 2023, the market is pricing in a 17.5% chance of a 0.25% increase in December. The Fed is keeping an eye on credit conditions, financial markets, and international events, and the Fed will make a final decision on interest rates based on economic statistics, including productivity, employment, and inflation indexes in the upcoming weeks [3].

With the Fed raising the federal funds rate, economic interest rates usually rise as a result, which appeals to international investors looking for more tremendous profits on interest-rate and bond products. Foreign investors exchange their native currency-denominated investments for those denominated in the U.S. dollar, which results in a greater exchange rate benefiting the U.S. dollar [4]. However, according to S&P Global Market Intelligence, the U.S. dollar index declined from November 2022 to February 2023 and from March to May 2023. During that time, the Fed has implemented rate hikes several times [1, 5]. Hence, an unequivocal connection between the funds rate and the exchange rate does not exist, making it a subject worthy of exploration. This manuscript aims to scrutinize the effects of interest rate hikes by the Fed on the U.S. dollar exchange rate, drawing insights from both historical data and theoretical principles.

2. Theoretical Basis

The following sections demonstrate some theories and factors related to the influence of the Fed’s interest rate hikes.

2.1. The Interest Rate Effect

The interest rate effect is the impact on demand due to changes in the interest rate set by the central bank. When the central bank raises the interest rates it lends to other banks, those banks increase the interest rates they lend to consumers. Consumers eventually reduce their demand for consumption because of the higher cost of borrowing [6]. This theory shows that when the Fed raises interest rates, the demand for money by banks, businesses, and consumers subsequently reduces. The Fed thus achieves the goals of reducing the currency supply in the short term, curbing inflation, and increasing the value of the U.S. dollar.

2.2. Capital Flow Theory

Capital flow is essential to the national and global economy. It is the process in which capital transforms from monetary form to commodity form, and after flowing, it changes back to currency [7]. The process by which the Federal Reserve Bank lends to other banks is a capital flow. When the federal funds rate is lower, other banks will borrow less from the Fed because borrowing costs are higher, and therefore there is less liquidity. On the contrary, greater liquidity indicates a larger currency supply from the Fed, which is likely to cause inflation. It is when the Fed might consider raising interest rates. In addition, Ogawa et al. analyze that the Fed’s interest rate hike has increased capital outflows from emerging market countries [8]. It follows that capital flows and the federal funds rate are mutually reinforcing.

2.3. Stock Market

Changes in interest rates by central banks, such as the Fed, have an impact on the stock markets in diverse ways. When interest rates rise, it becomes more expensive for a company to borrow money from banks, which increases its debts and harms its ability to raise funds. If a company has trouble raising capital, its short-term earnings and prospects will be negatively affected. More debt and less profit will send the company's share price down. If the stock prices of an enormous number of companies decrease, many vital indexes, such as the S&P 500, will go down, resulting in a downturn in the whole stock market [9].

2.4. Investor Sentiment

According to Guo et al., investor sentiment can refer to their beliefs on the valuation of assets. Before the Federal Open Market Committee holds the scheduled meeting, investors always forecast the Fed’s decision on the federal funds rate. After the conference ends and the interest rate adjustment is announced, investors start to analyze its effect on the economy and stock market. Throughout the process, investors are anxious and fearful because there is uncertainty about the changes in the valuation of their assets [10]. Once the FOMC announces a rate hike, investors are likely to divest from stocks and shift to more defensive investments rather than waiting for the convoluted and protracted process of higher interest rates to permeate the whole economy [11].

3. Empirical Research

3.1. Historical Data

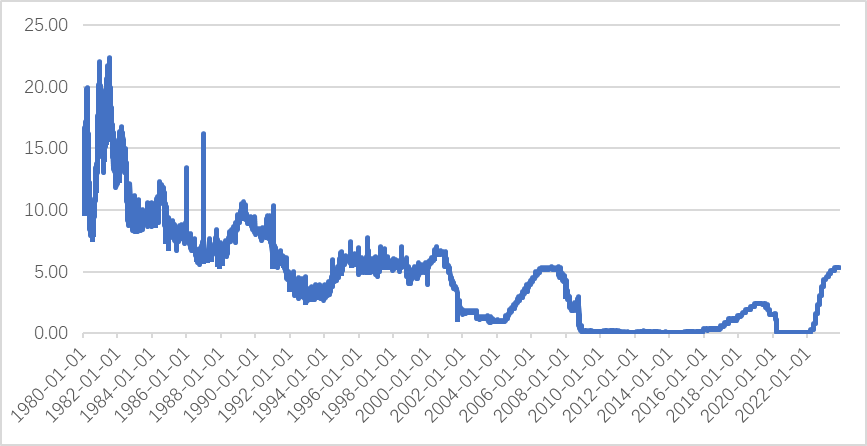

Figure 1: Federal Funds Effective Rate (Picture credit: Original).

Figure 1 shows the data on the federal funds rate since 1980. In the 1980s, the Fed unprecedentedly made the enormous interest rate hikes, reaching 22.36 on July 22, 1981, the highest rate ever. As a result, the dollar experienced its sharpest appreciation ever in the mid-1980s, rising 77 percent on a trade-weighted basis from 1980’s trough to 1985. It also allowed the United States to reach a super-high trade deficit of $107 billion in 1984 [2, 12].

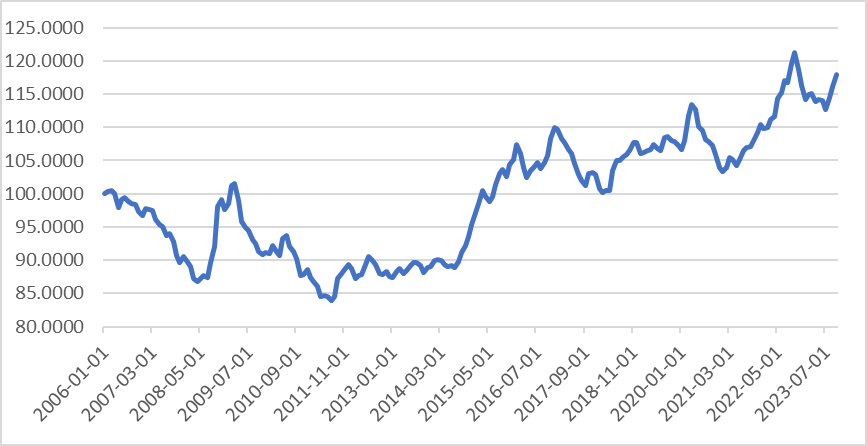

Figure 2: Real Board Dollar Index (Picture credit: Original).

Figure 2 shows the U.S. dollar index from 2006 (Jan 2006=100). The two charts indicate no absolute correlation between the two factors, but there are several periods in which there is a clear state of mutual influence. From September 2007 to April 2008, the funds rate significantly decreased by over 250 basis points, and the dollar also showed an apparent downward trend. After seven years of low funds rates, it rose continuously from 2016 to 2019. During this period, except for a short decline in 2017, the dollar has been upward overall. After funds rates began to fall in September 2019, the dollar followed suit in mid-2020. In the current cycle of rate hikes, starting in March 2022, the dollar has reached its highest level since 2006 in November.

3.2. Empirical Evidence

Research from different aspects has been done on the correlation between the federal funds rate and the U.S. dollar exchange rate.

Kang used the Leading Economic Index (LEI) to analyze the dollar exchange rate. It is a Conference Board’s measure of the U.S. economic cycle. When country A's LEI goes up and country B's goes down, the yield margins move toward A, which causes the B/A exchange rate to rise. According to the data from the Conference Board, the U.S.’s LEI declined by 3.0% from February to August 2022, followed by another 3.6% from August 2022 to February 2023, finally reaching 110.0 (2016=100). Theory suggests that the decrease in LEI means the dollar's exchange rate has risen relative to other countries' currencies. Kang advocates that it makes sense since the rise in interest rates attracts international investors to the U.S. market, increasing demand for U.S. dollars, and thereby resulting in the dollar’s appreciation [13].

Tarver holds a similar view. He argues that when the U.S. economy is strong, wages rise, which increases people's desire to spend [14]. More spending spurs prices to increase, causing higher inflation. At this time, the Fed raises interest rates, which increases the interest rate for other banks to borrow from the central bank, and commercial banks will increase the lending rate and deposit interest to the public to increase their income. As a result, people are more willing to put their money in the bank, which not only reduces people's spending but also reduces the money supply of the bank, thus causing the dollar to appreciate.

However, it has also happened that the U.S. dollar depreciated after the Fed raised interest rates. According to Figure 2, the dollar index fell by approximately 7 percent from October 2022 to July 2023. During this period, the Fed has implemented interest rate hikes by 225 basis points. Scheid claims that the reason is the Fed has slowed down rate hikes. The Fed raised rates by 50 basis points after every meeting from May 2022 to November 2023. Since then, the Fed has only increased by 25 basis points at a time or even left it unchanged. Scheid also notes that the dollar's decline has much to do with persistently high inflation and the tight labor market [1, 5].

It can be concluded that when the Fed raises rates, the U.S. dollar exchange rate usually rises overall, but their relationship is only relative.

4. Discussion

The appreciation or depreciation of the dollar is not entirely dependent on the Fed's rate hike. Twin lists five other factors that influence exchange rates: inflation, terms of trade, current account deficits, public debt, and economic performance. Countries with persistently low inflation rates typically see their currencies stronger. When the inflation rate is low, the price of commodities is low. Therefore, people's purchasing power will rise, which promotes long-term economic development and forms a virtuous circle.

Terms of trade denote the relationship between export prices and import prices. When a nation experiences a favorable terms of trade, meaning that its export prices increase at a greater rate than its import prices, the consequence is that the country can trade a reduced amount of export goods for a greater quantity of imports. This results in an upsurge in the country's export income, leading to an augmented demand for its currency, consequently causing the currency to appreciate.

The current account is defined as the trade balance between two countries. When a country’s current account deficit, its expenditure is higher than income in trade. Meanwhile, the government must borrow from others to cover the deficit, which will cause an increase in demand for foreign currencies and decrease the exchange rate of its currency. Public debt is the debt a country owes to other countries for financing. Foreign investment will decrease when a country’s public debt outpaces its economic growth. Some countries will also print more money to pay off their debt. Both of these factors will lead the country's inflation rate to rise and its currency to depreciate.

Finally, a country’s economic performance also affects the investments from other countries. Investors usually prefer countries with stable economies instead of those with high risks in economy and politics [15].

5. Conclusion

In summary, the research undertaken emphasizes that the Federal Reserve's decision to increase interest rates is poised to exert a notable impact on the U.S. dollar exchange rate. The investigation delves into various dimensions, considering the interest rate effect, capital flow theory, investor sentiment, and stock market dynamics. The study offers a comprehensive analysis by scrutinizing historical data dating back to 1980 and considering diverse perspectives. One significant finding is that a surge in the federal funds rate can lead to increased costs for borrowing, rendering it more profitable to deposit funds. This, in turn, stimulates a shift towards saving, prompting a reduction in consumption and currency liquidity. Consequently, the dollar supply from the Federal Reserve diminishes, setting the stage for strengthening the U.S. dollar.

While acknowledging the existence of fluctuations in the U.S. dollar exchange rate following Federal Reserve interest rate hikes, the study underscores the inevitability of such fluctuations. Moreover, the research acknowledges the multitude of factors influencing the dollar and highlights the potential for future interest rate increases if inflation in the United States escalates. This multifaceted analysis contributes to a nuanced understanding of the intricate relationship between Fed interest rate policy and the U.S. dollar exchange rate dynamics.

References

[1]. Federal Reserve System. (2023). About the FOMC. https://www.federalreserve.gov/monetarypolicy/fomc.htm

[2]. Foster, S. (2023). Fed’s interest rate history: The federal funds rate from 1981 to the present. Bankrate. https://www.bankrate.com/banking/federal-reserve/history-of-federal-funds-rate/

[3]. Hayes, A. (2023). Next Fed Meeting: When It Is in December and What To Expect. https://www.investopedia.com/next-fed-meeting-7551561

[4]. Sami, M., Eldomiaty, T. I., & Kamal, M. (2020). How do fund rates affect the U.S. firms? A threshold estimation. Central Bank Review, 20(2), 75–84.

[5]. Scheid, B. (2023). US dollar falls as biggest Fed rate hikes have likely passed. S&P Global Market Intelligence. https://www.spglobal.com/marketintelligence/en/news-insights/latest-news-headlines/us-dollar-falls-as-biggest-fed-rate-hikes-have-likely-passed-76311089

[6]. Seidmann, D. J. (1987). The impact of interest rates on price and supply. Canadian Journal of Economics/Revue Canadienne D’économique, 20(3), 625-633.

[7]. Caballero, R. J., & Simsek, A. (2020). A Model of Fickle Capital Flows and Retrenchment. Journal of Political Economy, 128(6), 2288–2328.

[8]. Ogawa, E., Shimizu, J., & Luo, P. (2019). Effects of US Interest Rate Hikes and Global Risk on Daily Capital Flows in Emerging Market Countries. RIETI Discussion Paper Series 19-E-019.

[9]. Kim, J. (2023). Stock market reaction to US interest rate hike: evidence from an emerging market. Heliyon, 9(5), e15758.

[10]. Guo, H., Hung, C. D., & Kontonikas, A. (2022). The Fed and the stock market: A tale of sentiment states. Journal of International Money and Finance, 128, 102707.

[11]. Hoek, J., Kamin, S., & Yoldas, E. (2022). Are higher U.S. interest rates always bad news for emerging markets? Journal of International Economics, 137, 103585.

[12]. Kaminsky, G., & Peruga, R. (1991). Credibility crises: the dollar in the early 1980s. Journal of International Money and Finance, 10(2), 170–192.

[13]. Kang, J. (2023). The Impact of the Fed's Interest Rate Hike on the Financial Industry: Focusing on the Exchange Market and Capital Market. Highlights in Business, Economics and Management, 15.

[14]. Tarver, E. (2022). How Moves in the Fed Funds Rate Affect the US Dollar. https://www.investopedia.com/articles/investing/101215/how-fed-fund-rate-hikes-affect-us-dollar.asp

[15]. Twin, A. (2023). 6 Factors That Influence Exchange Rates. https://www.investopedia.com/trading/factors-influence-exchange-rates/#toc-determinants-of-exchange-rates

Cite this article

Tian,M. (2024). Impact of the Federal Reserve Interest Rate Hikes on the U.S. Dollar Exchange Rate. Advances in Economics, Management and Political Sciences,78,67-72.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 3rd International Conference on Business and Policy Studies

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Federal Reserve System. (2023). About the FOMC. https://www.federalreserve.gov/monetarypolicy/fomc.htm

[2]. Foster, S. (2023). Fed’s interest rate history: The federal funds rate from 1981 to the present. Bankrate. https://www.bankrate.com/banking/federal-reserve/history-of-federal-funds-rate/

[3]. Hayes, A. (2023). Next Fed Meeting: When It Is in December and What To Expect. https://www.investopedia.com/next-fed-meeting-7551561

[4]. Sami, M., Eldomiaty, T. I., & Kamal, M. (2020). How do fund rates affect the U.S. firms? A threshold estimation. Central Bank Review, 20(2), 75–84.

[5]. Scheid, B. (2023). US dollar falls as biggest Fed rate hikes have likely passed. S&P Global Market Intelligence. https://www.spglobal.com/marketintelligence/en/news-insights/latest-news-headlines/us-dollar-falls-as-biggest-fed-rate-hikes-have-likely-passed-76311089

[6]. Seidmann, D. J. (1987). The impact of interest rates on price and supply. Canadian Journal of Economics/Revue Canadienne D’économique, 20(3), 625-633.

[7]. Caballero, R. J., & Simsek, A. (2020). A Model of Fickle Capital Flows and Retrenchment. Journal of Political Economy, 128(6), 2288–2328.

[8]. Ogawa, E., Shimizu, J., & Luo, P. (2019). Effects of US Interest Rate Hikes and Global Risk on Daily Capital Flows in Emerging Market Countries. RIETI Discussion Paper Series 19-E-019.

[9]. Kim, J. (2023). Stock market reaction to US interest rate hike: evidence from an emerging market. Heliyon, 9(5), e15758.

[10]. Guo, H., Hung, C. D., & Kontonikas, A. (2022). The Fed and the stock market: A tale of sentiment states. Journal of International Money and Finance, 128, 102707.

[11]. Hoek, J., Kamin, S., & Yoldas, E. (2022). Are higher U.S. interest rates always bad news for emerging markets? Journal of International Economics, 137, 103585.

[12]. Kaminsky, G., & Peruga, R. (1991). Credibility crises: the dollar in the early 1980s. Journal of International Money and Finance, 10(2), 170–192.

[13]. Kang, J. (2023). The Impact of the Fed's Interest Rate Hike on the Financial Industry: Focusing on the Exchange Market and Capital Market. Highlights in Business, Economics and Management, 15.

[14]. Tarver, E. (2022). How Moves in the Fed Funds Rate Affect the US Dollar. https://www.investopedia.com/articles/investing/101215/how-fed-fund-rate-hikes-affect-us-dollar.asp

[15]. Twin, A. (2023). 6 Factors That Influence Exchange Rates. https://www.investopedia.com/trading/factors-influence-exchange-rates/#toc-determinants-of-exchange-rates