Volume 202

Published on July 2025Volume title: Proceedings of the 3rd International Conference on Financial Technology and Business Analysis

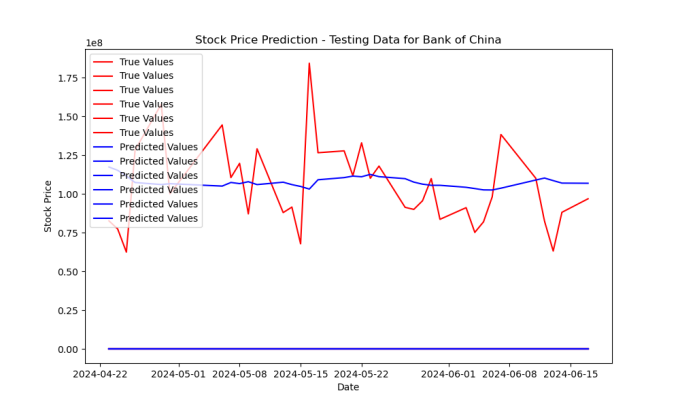

Stock price prediction in the volatile and evolving China A-share market faces both a challenge and an opportunity. In this paper, an attempt is going to be made to implement Long Short-Term Memory (LSTM) neural networks in predicting stock price movements of several large banks in China. The database comprises daily information on stocks of eight banks, split into training and testing sets. Development and Optimization of an LSTM Model Using MSE and the Adam Optimizer. The model exhibited quite good predictive capability over the training data but weak generalization over the unseen data. However, the study found that LSTM-based predictions could support profitable trading strategies, thus providing valuable insight for investors and policymakers. This could be further investigated by enhancing the robustness of the model and deploying across different markets and time frames.

View pdf

View pdf

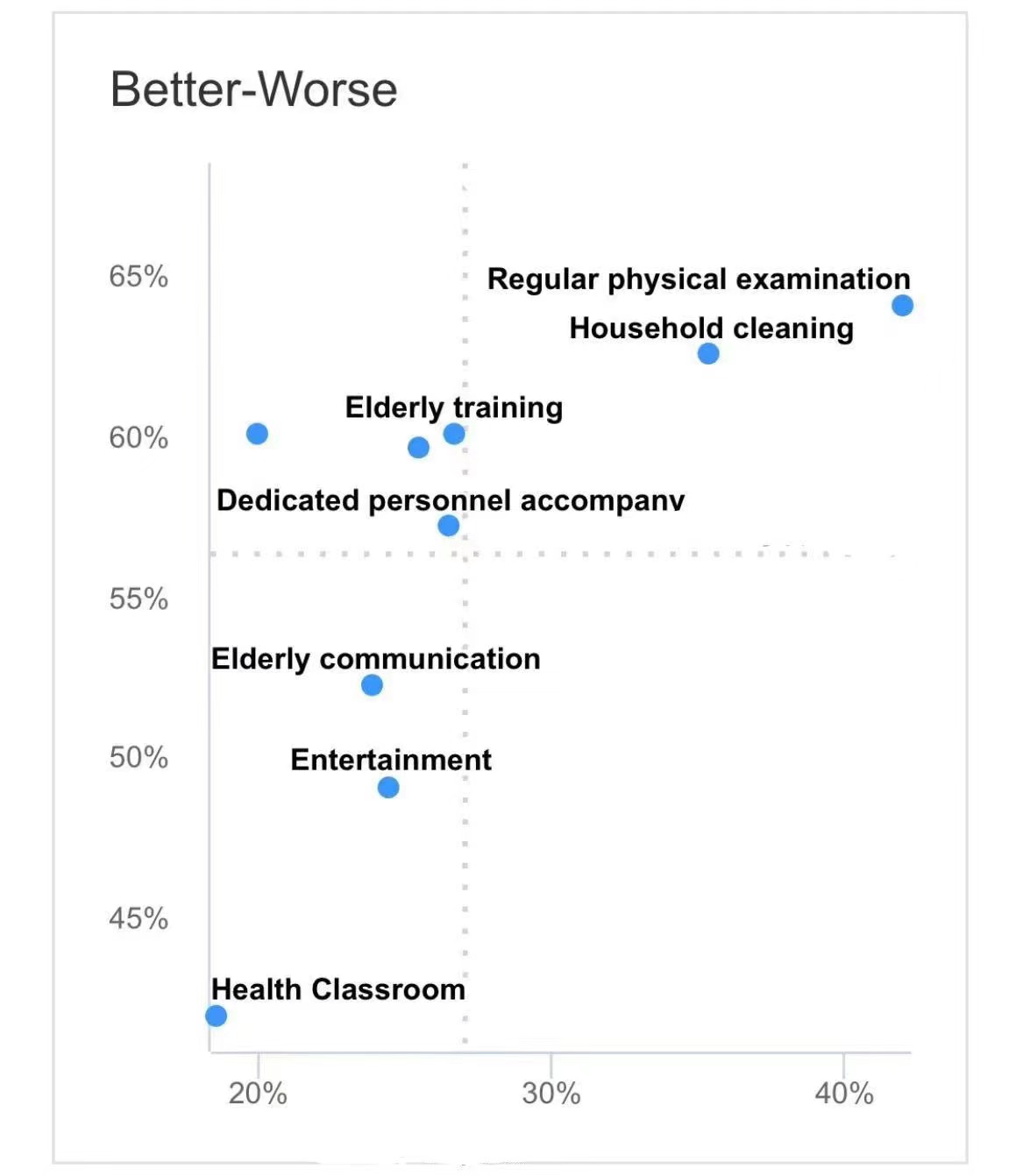

At present, the trend of aging in China is constantly intensifying, and the growth of the elderly care service industry urgently needs to be expanded and updated. Among them, the popularization and popularization of the family care form are faced with more urgent innovation and the reshaping of the traditional format. This study based on the existing research, through interviews and surveys, combined with the advantages of community family care service, for the smart family care platform construction, to serve the elderly population more mature development model, promote the innovation of family care service, provide new development ideas for China's pension industry.

View pdf

View pdf

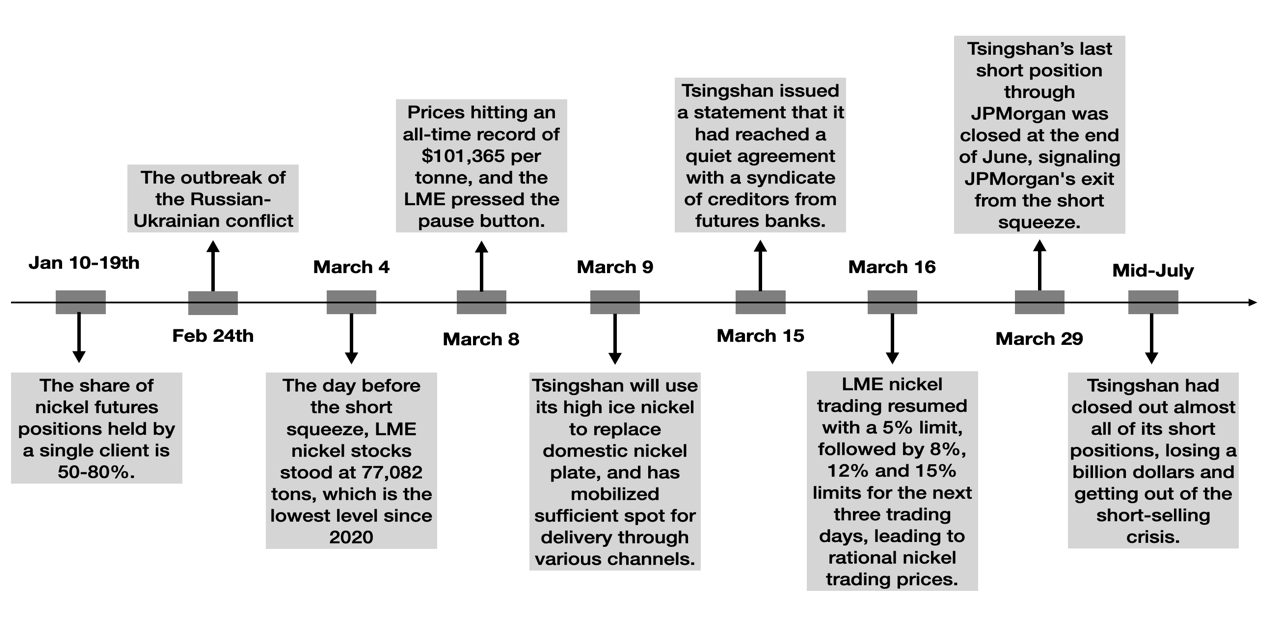

This paper aims to explore what hedgers can do in the futures market to gain profits through a case study of Tsingshan Company's LME short nickel sale in 2022. The primary findings encompass an examination of the risks and hurdles related to Tsingshan's OTC trading, the purity divergence of nickel in the exchange market, and an assessment of Tsingshan's margin requirements during the short squeeze. Additionally, the paper scrutinizes the functions of the London Metal Exchange and the Chinese government within this context. The conclusions underscore the significance of risk management and suitable hedging tactics, cautioning against speculative ventures devoid of meticulous risk assessment that can result in significant financial setbacks. Employing indirect and rolling hedge strategies in tandem and with precision may aid firms in evading or mitigating losses. The absence of price limit regulations by the LME clearinghouse amplified market volatility and liquidity risks, with Tsingshan's survival predominantly attributed to the Chinese government's intervention, albeit such interventions are infrequent. Future investigations may concentrate on refining effective hedging approaches and enhancing market regulations.

View pdf

View pdf

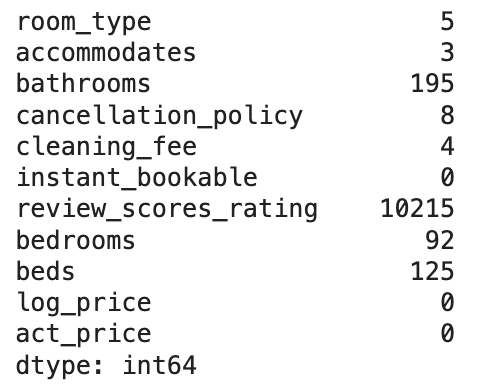

To study the different factors affecting Airbnb housing prices, this research uses the data from the Airbnb platform and evaluates key determinants influencing listing prices on the Airbnb website. The study employs exploratory data analysis (EDA) and linear regression analysis to analyze the impact of these variables on Airbnb housing prices. The research finding reveals that accommodations, bedrooms, and beds have a significant correlation with housing prices. Insights coming out of this research are able to provide valuable perspectives to Airbnb hosts and its housing rental business. It is suggested that focusing on these factors will enhance Airbnb’s pricing strategies and its overall market performance.

View pdf

View pdf

We study effective measures to avoid speculative risks by corporations. We analyze “AVIC Oil Incident” (The company CAO (a physical purchaser of jet fuel and a supplier of imported jet fuel to China's civil aviation industry.) suffered a huge loss of about $550 million in 2004 for speculative trading.), its background and the development process of the incident. We then analyze the reasons for the huge loss of CAO, including lack of internal control and external supervision, weak risk management system, over-confidence of the CEO and ineffective information disclosure. After analysis of speculative risks, we propose the effective measures could have been taken to reduce the loss of AVIC. After that, we suggest solutions, including implementing risk hedge, improving internal communication and supervision mechanism and strengthening external regulation. At the end, we make a conclusion of the exposure of the whole financial incident of AVIC and also make an exception for the exploring aspects of future researches which include dynamic evolution, influencing factors and new characteristics and trends of speculative behavior.

View pdf

View pdf

Reciprocity in the labor market has always sparked an intense debate in society. In this study, we explore the complex role of reciprocity in the labor market, in particular its interaction with extrinsic and intrinsic motivation, and the phenomenon of the "crowding-out effect". The research is based on economic and psychological theories and aims to elucidate how various factors affect work effort. We conducted extensive investigations in multiple regions of China, using a controlled experimental design to isolate specific effects. Through regression analysis, our results show that intrinsic motivation has a more significant impact on work effort than extrinsic motivation, while excessive reliance on extrinsic rewards weakens intrinsic motivation. These insights are critical to designing balanced incentive structures to optimize employee performance and efficiency.

View pdf

View pdf

We analyzed the competition between China's leading food delivery platforms, Meituan and Ele.me, and focused on exploring how pricing strategies and network effects affect the competitive dynamics between platforms. Firstly, we reviewed the overall development history of the food delivery industry and elaborated on the competitive history of the two platforms. We explored the economic value of multi-platform operation in this competitive context and the role of subsidy strategies in promoting the migration of businesses and consumers between multiple platforms. Through analyzing pricing games and multi platform operation strategies, we found that both Meituan and Ele.me face the dilemma of profit compression in fierce price competition, which damages the interests of both platforms. We believe that the government should intervene through anti-monopoly regulatory measures to promote a healthier market competition environment. This study not only provides in-depth insights into the platform economy for the academic community but also provides practical references for policymakers and market participants.

View pdf

View pdf

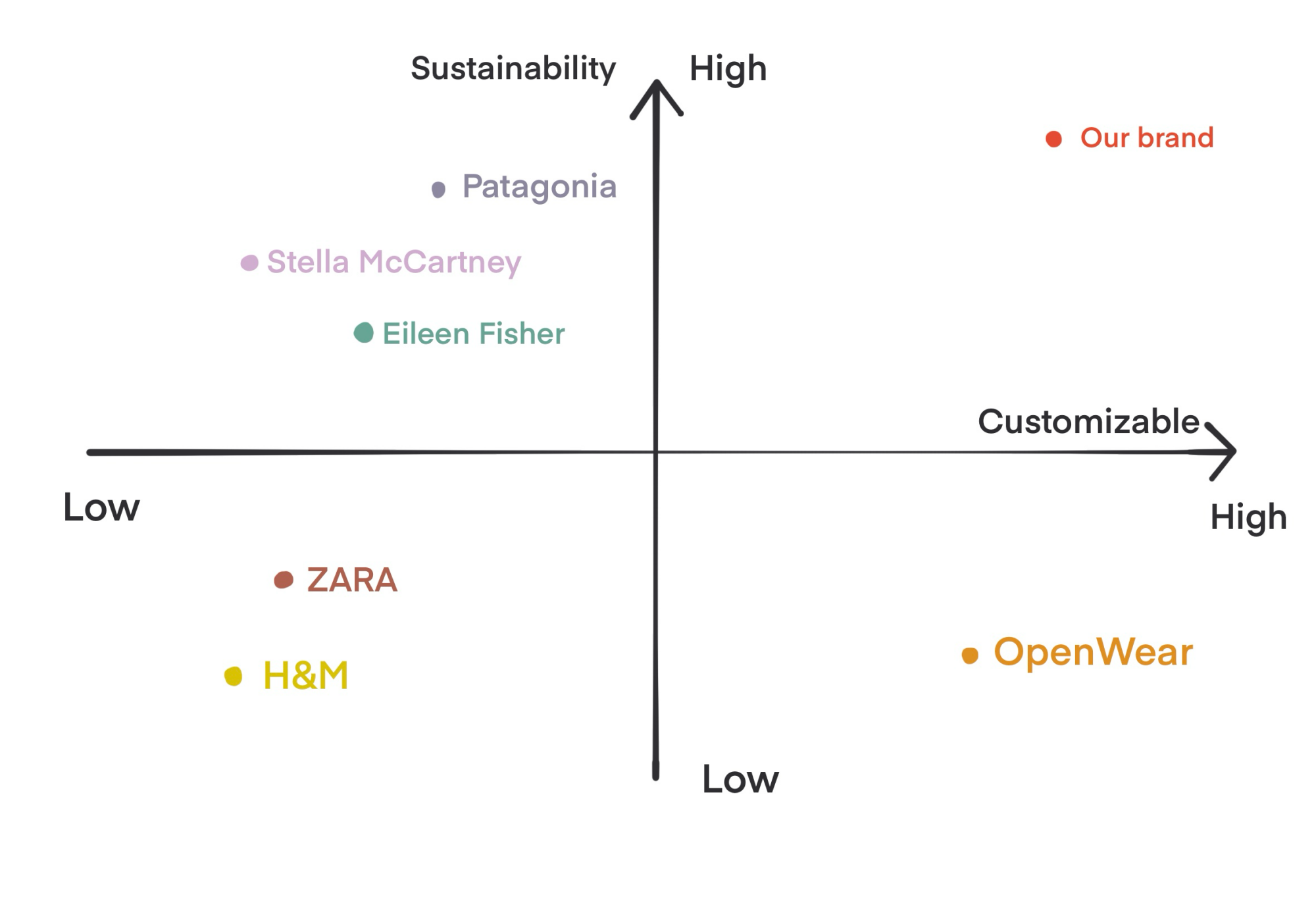

In today's era, more and more consumers are beginning to pay attention to the environmental protection of products. Through the form of a questionnaire, this paper determines the patchwork clothing as the research object. Patchwork clothing recycles old fabrics and freely arranges and combines cloth pieces of different patterns, colors, shapes, and sizes to make different styles of clothing. After purchasing spliced clothing, consumers can also increase or decrease the number of pieces to make the size of the clothes more suitable for them. At the same time, consumers can also, through the free combination of clothing items, have different styles of clothing so as to reduce the frequency of consumers buying new clothes to achieve environmental protection. Therefore, the following discussion of this article will focus on patchwork clothing

View pdf

View pdf

This paper explores the complex challenge China faces in balancing economic growth with national strategic interests, particularly in the context of managing Foreign Direct Investment (FDI) policies. Tracing the historical development of China's economic transformation, it examines key reforms such as the Household Responsibility System and the rise of Township and Village Enterprises (TVEs), which played crucial roles in transitioning from a command economy to a market-oriented system. The paper also delves into the privatization wave of the 1990s and the legitimization of the market economy under Deng Xiaoping's leadership. This paper discusses the policy paradox presented by the 2013 Third Plenum, which advocates for market forces in resource allocation while maintaining state dominance. Under Xi Jinping's strategic imperatives, China selectively liberalizes sectors to attract high-quality FDI while safeguarding national security. By discussing the challenges of creating a stable regulatory environment, fostering domestic innovation, and ensuring economic resilience, this paper emphasizes the need for a balanced approach to sustain economic growth and safeguard national interests.

View pdf

View pdf

Subscription, with a long history, is a popular business model that has been creating revenue for lots of companies. There are subscription methods with different features in markets nowadays. However, there is no clear evidence of how the merchandise associated with the subscription would affect consumer behavior. In this research, we focus on two popular features of subscriptions, removing advertisements and providing better services. Then explore the relevance of different merchandise and consumer behavior through the survey. Based on descriptive statistical methods to analyze consumer subscription consumption preferences, this article quantitatively analyzes the factors influencing the loss rate of subscriptions using econometric models. We find that advertising can reduce subscriber churn rates, leading to increased revenue and user loyalty with effective ad strategies. This suggests that consumers may be more averse to losing existing features (ad-free viewing) than gaining additional ones. Loss aversion might potentially play a role in consumer preference.

View pdf

View pdf