1. Introduction

1.1. Background

1.1.1. Oil market conditions

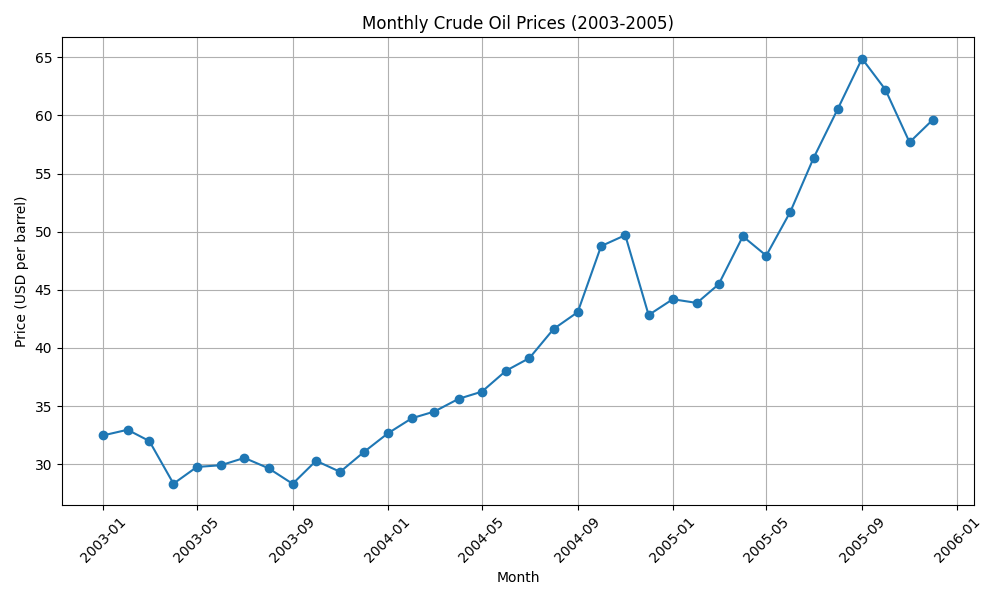

Figure 1 shows that due to global economic recovery and supply disruptions caused by geopolitical tensions, international crude oil prices experienced a continuous rise from 2003 to 2004 (from around $33 per barrel at the beginning of 2003 to nearly $55 per barrel by the end of 2004).

1.1.2. Background analysis of AVIC

AVIC (Aviation Industry Corporation of China) established in 1951, is a large state-owned enterprise in China, primarily engaged in the aviation industry. It is one of the world's largest aerospace and defense companies, with a comprehensive range of activities that include the development, production, and sale of military and civil aircraft, as well as various aerospace products. Over the decades, AVIC has diversified its interests into various sectors, including real estate, finance, and oil trading, making it a significant player in multiple industries.

CAO is a key subsidiary of the China Aviation Oil Group, which operates under the umbrella of AVIC. The relationship between AVIC and CAO is a classic parent-subsidiary dynamic, where CAO ’s operations are strategically aligned with AVIC ’s broader goals and objectives.

1.1.3. Background analysis of CAO singapore

CAO is the largest physical purchaser of jet fuel in the Asia-Pacific region and a major supplier of imported jet fuel to China's civil aviation industry. It supplies jet fuel to major international airports in China, including Beijing Capital International Airport, Shanghai Pudong International Airport and Guangzhou Baiyun International Airport. In order to increase the scale of the company's business, CAO ’s also supplies diesel oil, fuel oil and aviation gasoline (aviation gas), but no investment business is involved.

Initially, CAO traded over-the-counter (OTC) swaps and exchange-traded futures as hedging instruments to manage the risk in its oil procurement business. The company conducted relatively riskless back-to-back option positions on behalf of client airlines. CAO earned fee income from the bid/ask spread on these trades without exposing itself to any volatility in the oil markets.

At the end of the third quarter in 2003, CAO started conducting speculative option trades to profit from favorable market movements in oil-related commodities. It traded them based on the expectation that oil prices would increase. The trading strategy involved the simultaneous purchase of call options and the sale of put options in September 2003.This effectively created a synthetic long position in oil without the need to purchase the commodity outright. As oil prices increased, the calls that were purchased were exercised at a profit. The puts that were sold were not exercised, and CAO profited from the premiums collected when these options were sold. However, these trading strategies had not been reviewed or approved by the Board of Directors before trading began, and there was no risk committee in place to review these transactions on an ongoing basis.

1.1.4. CAO board’s members’ s background

During the critical period of the AVIC Oil Incident, the CAO board had members with significant expertise in engineering, legal, and operational fields. However, the board lacked members with strong financial backgrounds, particularly in derivatives and speculative trading. Chen Jiulin, the CEO, graduated from the Oriental Studies Department of Peking University and holds a Master's Degree in International Judicial Studies from China University of Political Science and Law. Additionally, he earned an MBA from the National University of Singapore and a PhD in Civil and Commercial Law from Tsinghua University. Chen Jiulin's extensive academic background equipped him with knowledge in law and business management but did not provide him with the specialized financial expertise needed for high-risk trading activities. This gap in expertise played a significant role in the oversight failures that led to the AVIC Oil Incident.

1.1.5. Development of the CAO incident

Timeline of Events is showed in Figure 2:

January 2003: International crude oil prices began rising from around $33 per barrel. This upward trend set the stage for increased speculative activity in the oil markets.

June 2003: Starting in June 2003, CAO Singapore employed high-risk speculative strategies involving the purchase of call options, the sale of put options, and leveraging to create synthetic long positions in the oil market.

March 2004: As shown in Table 1, as international oil prices fluctuated and quickly approached the historical high of $39 per barrel, Chen Jiulin judged that there was limited room for further increases. This was due to the stabilization of the Iraq war and the restoration of oil exports to pre-war levels. The historical highs for oil prices before the Iraq war can be traced back to the 1980s. During the Iran-Iraq War and other geopolitical tensions in the Middle East, oil prices experienced significant spikes. In 1980, the peak of oil price was $39.00 per barrel.

Consequently, CAO began to short the paper oil market by selling large quantities of call options, anticipating that oil prices would fall in the future.

|

Year |

Average ($) |

Low ($) |

High ($) |

Causes |

|

1970 |

2.96 |

Regulated prices |

||

|

1971 |

3.17 |

|||

|

1972 |

3.22 |

|||

|

1973 |

4.08 |

|||

|

1974 |

12.52 |

9.59 |

13.06 |

OPEC oil embargo ended |

|

1975 |

13.95 |

12.77 |

15.04 |

Stagflation |

|

1976 |

13.48 |

13.26 |

13.71 |

Economy recovered |

|

1977 |

14.53 |

14.11 |

14.76 |

Fed raised and lowered rates |

|

1978 |

14.57 |

14.4 |

14.94 |

Fed raised and lowered rates |

|

1979 |

21.57 |

15.5 |

28.91 |

Iran-Iraq War, fed rate 20% |

|

1980 |

33.86 |

30.75 |

35.63 |

Iran oil embargo |

|

1981 |

37.1 |

35.43 |

39 |

Reagan cut taxes |

|

1982 |

33.57 |

32.78 |

35.54 |

Recession ends inflation |

|

1983 |

29.31 |

27.95 |

31.4 |

|

|

1984 |

28.88 |

28.02 |

29.26 |

|

|

1985 |

26.99 |

26.21 |

27.6 |

|

|

1986 |

13.93 |

10.91 |

24.93 |

|

|

1987 |

18.14 |

16.45 |

19.32 |

OPEC added to supply |

|

1988 |

14.6 |

12.66 |

15.93 |

|

|

1989 |

18.07 |

16.04 |

20.05 |

|

|

1990 |

21.73 |

15.15 |

32.88 |

Gulf War |

|

1991 |

18.73 |

17.17 |

22.3 |

SPR released oil |

|

1992 |

18.21 |

16 |

19.83 |

|

|

1993 |

16.13 |

12.56 |

18.35 |

|

|

1994 |

15.54 |

12.9 |

17.52 |

NAFTA allowed cheap oil from Mexico |

|

1995 |

17.14 |

16.29 |

18.7 |

|

|

1996 |

20.62 |

17.48 |

23.22 |

|

|

1997 |

18.49 |

15.95 |

23.02 |

|

|

1998 |

12.07 |

9.39 |

14.33 |

|

|

1999 |

17.27 |

10.16 |

24.35 |

Prices doubled |

|

2000 |

27.72 |

24.29 |

30.56 |

|

|

2001 |

21.99 |

15.95 |

24.97 |

Recession and 9/11 |

|

2002 |

23.71 |

17.04 |

27.14 |

Afghanistan War |

|

2003 |

27.73 |

24.48 |

32.23 |

|

|

2004 |

35.89 |

30.11 |

45.36 |

|

|

2005 |

48.89 |

37.56 |

58.79 |

Hurricane Katrina |

July 2004: By July 2004, crude oil prices had broken through the 44 dollars per barrel mark, far exceeding the expectations of CAO Singapore's speculative strategies. The companies speculative positions, which were highly leveraged, began to generate substantial floating losses.

November 24, 2004: CAO Singapore announced a loss of $550 million and applied for bankruptcy protection. This public disclosure marked the official recognition of the financial crisis.

Late November 2004: Management changes occurred, with Chen Jiulin and other executives being suspended and investigated. These changes were part of the initial response to address the crisis and restore stakeholder confidence.

December 1, 2004: The Singapore Exchange (SGX) launched an investigation and suspended stock trading of CAO Singapore. This regulatory intervention aimed to prevent further market disruption and protect investors.

December 8, 2004: Singapore police arrested Chen Jiulin, charging him with fraud and falsifying financial reports. This legal action underscored the severity of the misconduct and the commitment to holding those responsible accountable.

January 2005: Chen Jiulin was sentenced, and CAO Singapore underwent restructuring and debt reorganization. These steps were necessary to stabilize the company’s operations and address the financial fallout from the crisis.

1.1.6. CAO trading amount and losses

During the period leading up to the AVIC Oil Incident, CAO Singapore engaged in large-scale trading activities. The exact trading volumes are not publicly detailed in most reports.

By November 2004, CAO Singapore announced that it had incurred a total realized loss of approximately USD 550 million from its speculative trading activities.

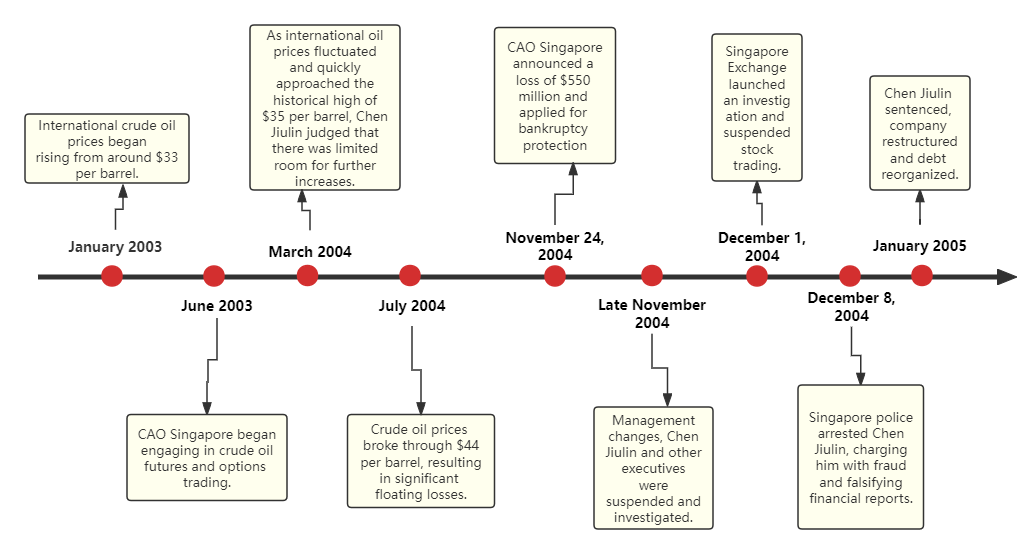

1.2. Motivation of paper

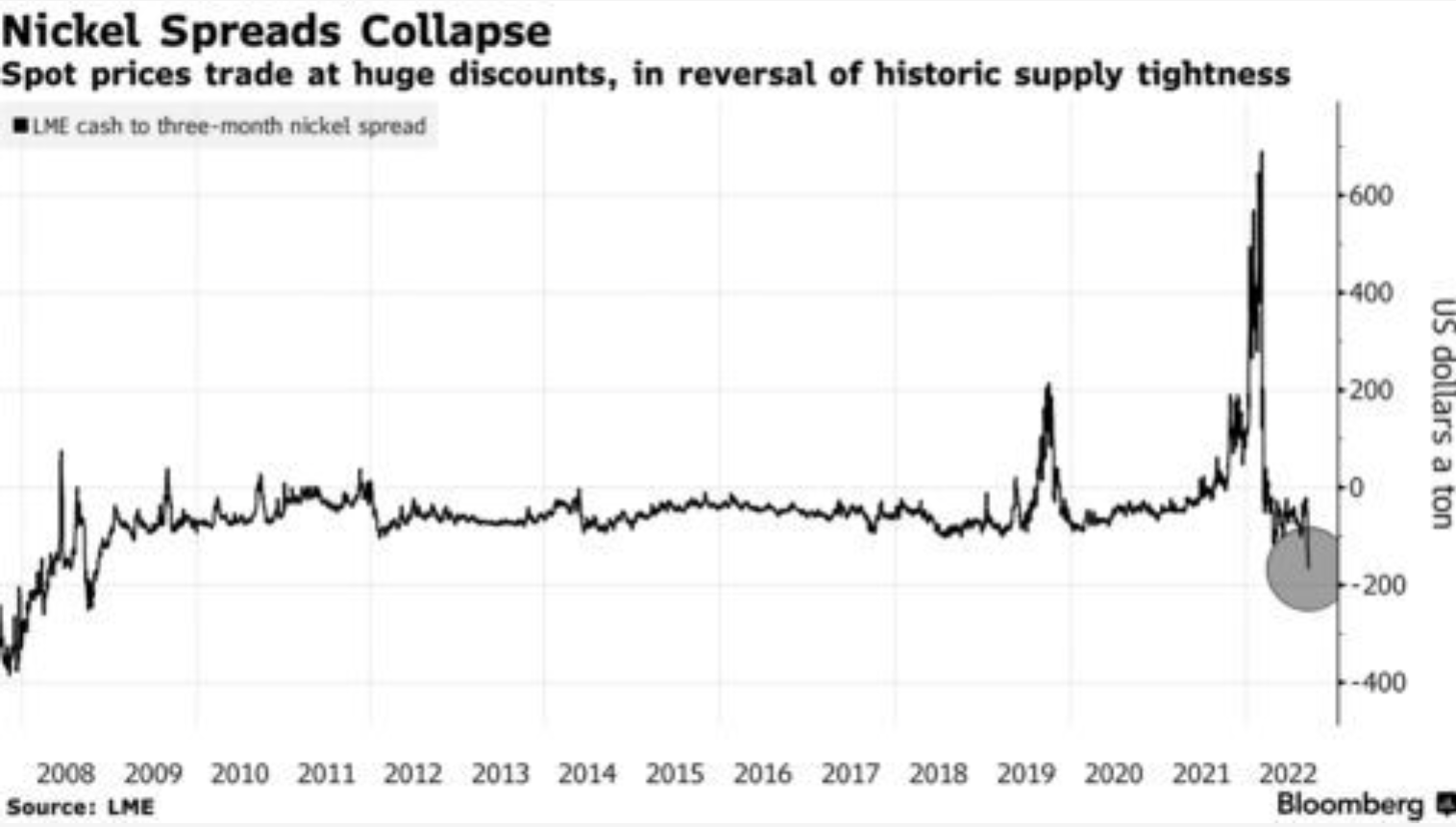

With the development of China's modernization drive, China's futures market has also leapt ahead and played an increasingly important role in recent years. For example, the market scale has been expanding with futures market growing steadily, and the trading volume and turnover rank among the world's top. Additionally, continuous enrichment of product varieties contributes to the improvement of financial product system. China's futures market also continues to improve its trading system by increasing trading efficiency, strengthening risk control, and providing investors with a safer and more efficient trading platform. However, there are still many problems and challenges. As a result of intense competition in the market, in order to gain higher profit, some companies have turned to high-risk speculative trading. There are numerous typical examples of companies that face a huge loss because of their speculation behaviors, including Black Swan Event for WTI Crude Oil (2020, Offshore Futures Contract Trading was pushed short), Tsingshan (2022, Nickel trade was pushed short)(as shown in Figure 3, Pice of three-month nickel forwards on the London Metal Exchange in 2022 topped $26,897 a metric ton, Figure 4, Price of Nickel collapse in 2022) and so on.

In response to the CAO incident, CAO which serve as a company supplying oil should never speculate on futures to pursue high-risk profits. To prevent companies like fuel suppliers from high-risk speculation, the study of the speculative behavior in the futures market is very necessary to understand the motivation of companies’ speculative behavior and then propose targeted solution.

1.3. Literature review

The following are some existing studies and analyses on the AVIC Oil Incident:

1. Risk management perspective: The AVIC Oil incident was comprehensively analyzed from the perspective of risk management, including moral risk, market risk and operational risk. And a risk cycle model was constructed to analyze the risk evolution process of the incident. In addition, the Value-at-Risk (VaR) technique is applied to empirically estimate the market risk [1].

2. Behavioral finance perspective: The basic theories of behavioral finance are applied to analyze the beginning and end of the AVIC Oil incident. Take into account factors such as confirmation bias and cognitive dissonance caused by the limited rationality of the decision makers [2].

3. Application for bankruptcy protection: On November 29, 2004, AVIC Oil had to apply for bankruptcy protection due to a loss of US$550 million from speculative trading in oil options [3].

4. Case Study on Financial Derivative Trading: It analyses the circumstances when AVIC began trading oil options in the second half of 2003. Then, the subsequent series of events are analyzed [4].

5. Failure of external regulation by international consortiums: The study examines the failure of external regulation and the "hunting" behavior of international consortiums in the AVIC Oil incident, as well as the details of the incident [5].

To sum up, in the research of control of futures speculation like AVIC Oil Incident, most studies focus on risk management, behavioral finance, case reflections and regulatory issues, and lack of study on risk hedging measures and corporate risk management system.

2. Cause analysis

The failure of Singapore-listed China Aviation Oil (CAO) has been caused by factors on almost every level, from internal control and complex bureaucracy to external supervision.

2.1. Lack for internal control and risk management

In an overview of the CAO scandal, [6] points out that multiple issues exist concerning internal control and risk management. CAO has repeatedly made wrong predictions about global oil price changes and implemented risky investment strategies. It has neither done sufficient research into the risky and rapidly changing market nor prepared to implement precautious measures to hedge risks or avoid losses, yet it has taken gambling actions to bet on the decrease of oil prices. The bets were extremely dangerous considering the lack for background knowledge of the senior management team.

Even though there were safeguard systems against misconducts in derivatives trading, including senior traders that supervise the other traders, the risk-control committee, and the internal auditing department, all these systems failed to function properly, reflecting a poor level of corporate governance, especially among the top management [7]. For intance, the The CEO, Chen Jiulin, actually took charge of some internal auditing teams, which made it impossible to challenge his decisions.

2.2. Disadvantages of the centralized control of state-owned companies

As a state-owned enterprise, CAO has many shortcomings in the bureaucracy and organizational structure. For one thing, the power was highly centralized. The CEO of CAO, Chen Jiulin, had almost unrestricted power in the operation of CAO and violated many rules set by the head of the company. He was also able to hide the actual losses of CAO from the Chinese authorities, and even the board members, for long. This is because, in such a centralized system, accurate and timely reporting of the actual financial situation is lacking. The corporate culture even celebrates secrecy, which blocks information disclosure to a more considerable extent.

2.3. Over-confidence of the CEO

After the scandal was revealed, many investigative reports and media releases have pointed out that the CEO's first and foremost responsibility lies with him [8]. Chen, Wu and Zhang also highlight the less-perfect or bounded rationality in the failure of CAO. The CEO, Chen Jiulin, has shown overconfidence and high loss aversion in the decision-making process. As he wanted to cover the small losses, he insisted on enlarging investment with increasing risks. These risky gambles finally led to a huge collapse.

2.4. Issues in information disclosure

The main business of CAO Singapore is over-the-counter (OTC) operations trading. All the trading parties are exposed to higher risks than other derivatives on the exchange market. However, the competitors of CAO, which were experienced international organizations, have obvious advantages in gathering and analyzing market information, as well as making predictions about how the price would go in a short time period over CAO. More importantly, they had learned from past scandals and knew how to deal with these scandals. They certainly took these advantages, especially the monopoly of inside information, and transferred risks on the shoulders of CAO Singapore. There were some findings that were more shocking to investors. Almost all the traders hired by CAO Singapore are foreigners, who clearly broke the moral standards and sold the inside secrets to the competitors of CAO Singapore, leading to an even worse and more serious information imbalance and putting CAO Singapore in a more disadvantaged position in the market. CAO Singapore had no knowledge of the misconduct of its traders, nor did it understand the advantages and disadvantages of the company itself and its international competitors well. In a sense, the huge loss is a result of both internal and external factors. From the inside, its negligence in market changes, lack of requirements for professional ethics and employee conduct, and arrogance about its operation and capacity all contributed to its huge fall. On the outside, the competitors were more experienced with the market and obtained CAO's internal information through illegal and improper means.

2.5. The lack of external supervision

Back then, there was no direct, strict supervision of the state-owned companies. It was not until 2008 that the formal regulatory force, the State-owned Assets Supervision and Administration Commission, was established under the Notice on the Institutional Establishment of the State Council [9]. The central government did not fully fulfill the investors’ responsibilities or supervise or manage the country's assets properly. Neither did the local authorities of Singapore identify the problems of CAO early. Additionally, third-party auditors, such as Ernst & Young, have not helped prevent the risky movements of CAO. The US Securities and Exchange Commission (SEC) also once charged Ernst & Young with improper professional conduct that violates auditor independence rules [10].

3. In-depth analysis of speculative risk

3.1. Overview of the CAO incident

In response to the CAO incident, AVIC (Aviation Industry Corporation of China) as a parent company or related party could have taken a series of measures to mitigate risks. The CAO incident serves as a profound lesson in the financial industry, highlighting the potential risks that uncontrolled speculative activities in the futures market can bring. Initially, the company viewed futures trading as a strategic measure to hedge against fluctuations in aviation fuel prices. However, with excessive participation in speculative futures activities and inadequate risk management, the company ultimately suffered significant economic losses and market turmoil.

3.2. Detailed identification of speculative risks

In the CAO incident, speculative risks were particularly evident. Firstly, there was market risk, as the volatile prices of aviation fuel futures could lead to significant losses when market trends went against the company's expectations.

Secondly, there was liquidity risk, which refers to the difficulty of quickly buying or selling assets without significantly affecting market prices. In the CAO case, as the company's speculative positions grew, it became increasingly vulnerable to liquidity issues. Under extreme market conditions, when prices moved rapidly against the company's positions, it faced challenges in quickly liquidating futures contracts or increasing margin to maintain its positions. This lack of liquidity further exacerbated the company's losses.

Additionally, operational risk also existed in the CAO incident, stemming from the company's own operational errors or system failures that could lead to decision-making mistakes, improper trade execution, or system crashes.

3.3. Analysis of measures AVIC could have taken in CAO

Firstly, for oil price locking, AVIC could have hedged against future oil price fluctuations by entering into futures contracts equal to its expected future purchases. This way, regardless of future market price movements, AVIC could purchase the required oil at a predetermined price, avoiding the risks associated with price volatility.

Apart from futures market price locking, AVIC could also consider using other oil-related products as hedging instruments, such as purchasing other oil derivatives or related assets that are highly correlated with aviation fuel prices. These hedging tools could provide some protection against oil price fluctuations.

However, in the CAO incident, the company chose to speculate rather than lock in prices to mitigate risks. This may have been due to an overly optimistic market judgment within the company or a lack of attention to risk management. While speculative activities may bring short-term profits, they can also lead to significant losses once market trends go against the company's expectations. Therefore, AVIC should strengthen its risk management awareness, exercise caution in speculative activities, and adopt more stable measures such as price locking to mitigate risks.

3.4. Lack of optimal risk management practices

The lack of optimal risk management practices was a significant contributing factor to the substantial losses suffered by the company in the CAO incident. If the company had established an effective risk management system, strengthened internal controls and risk management training, and promptly identified and responded to various risks, it may have been able to avoid or reduce its losses. Therefore, AVIC should seriously learn from the lessons of the CAO incident, enhance its risk management awareness, improve its risk management capabilities, and ensure the stable development of the company.

4. Solution analysis

As China's largest oil import monopoly, China Aviation Oil (CAO) faces the risk of rising oil prices increasing procurement costs. It should choose the appropriate hedging strategy, by going long the 30-year Treasury, and close positions at the right time to stop losses and avoid further damage. In addition, CAO lacked a robust internal control mechanism. The CEO has supreme power, is not supervised by the board of directors, and lacks effective restriction mechanism. The Audit Committee has insufficient oversight of the financial reporting process and internal control activities. CAO used to send party secretaries and financial managers, but they were either isolated from the company's business or transferred to subordinate companies by Chen for various reasons. The party secretary, who had been in Singapore for more than two years, did not know that Chen Jiulin was engaged in over-the-counter futures speculation. As a manager, Chen Jiulin has the functions of authorization, execution, inspection and supervision at the same time, which proves that CAO has serious problems in the division of functions.

4.1. Hedging options with financial products

It may be possible to consider using some financial products that are not directly linked to crude oil prices but are traded in the same market. This approach can mitigate the risk of counterparty default due to fluctuations in crude oil prices. By going long the 30-year Treasury, it can hedge its exposure to short call options and reduce CAO's losses due to misjudgment of oil prices [11].

4.2. Establish effective communication mechanisms

Effective communication is a fundamental skill for any manager. In the aftermath of the China Aviation Oil incident, inadequate communication among the management, board of directors, and the parent company led to irreparable losses. According to current international financial accounting standards based on the accrual principle, the potential profits and losses of financial derivatives transactions are not reflected in current financial statements due to their transaction characteristics, resulting in structural information opacity. This opacity prevented market stakeholders from promptly discovering the massive losses China Aviation Oil Company incurred in option trading. Consequently, the management, aware of the truth, attempted to compensate for the losses through time and space transfers.

1. The Company should establish clear communication policies and guidelines, specifying the methods, timing, locations, and languages for communication to ensure that employees understand how to communicate effectively with superiors, colleagues, and others.

2. Provide diverse communication platforms such as face-to-face meetings, phone calls, emails, instant messaging tools, and employee forums, allowing employees to choose the most suitable method for their needs.

3. Encourage employees to actively communicate and provide feedback, including suggestions and opinions to superiors, as well as exchanges and sharing among colleagues. Implement a reward system to motivate employees to offer valuable suggestions and opinions.

4. Establish a shared information platform so departments can easily access and share information via internal websites, shared folders, or collaboration tools, ensuring visibility and accessibility for all relevant parties and promoting better communication and collaboration.

5. Organize regular cross-departmental meetings, workshops, or team-building activities to foster face-to-face communication and cooperation among different departments, enhancing understanding, communication, and efficiency.

6. Appoint a coordinator or contact person when necessary to organize, coordinate, and facilitate cross-departmental communication and collaboration, acting as a bridge to promote information transmission, problem-solving, and collaborative project management.

4.3. Establish an effective separation of powers and supervision mechanisms

As a risk-preferring individual, Chen Jiulin’s authority overshadowed that of regulatory bodies, rendering the company’s risk control systems ineffective despite their comprehensive appearance. This allowed Chen to manipulate funds freely and engage in continuous speculative trading. A robust internal control mechanism requires departments to mutually restrict each other, each fulfilling their respective roles, with the president's power limited to prevent abuse. In the CAO incident, Chen Jiulin’s excessive personal power triggered the losses. Effective internal controls could have enabled CAO to close positions in time, preserving at least part of the capital and avoiding significant losses.

1. The approval, recording, and handling of business activities and property custody should be as independent as possible, with each task assigned to dedicated personnel. Clearly define the work content, responsibilities and authority of each department or post, and report to the board of directors and internal control agency for supervision, to ensure the effectiveness and reliability of internal control.

2. Strengthen internal audits, inspections, and assessments. Ensure that the risk management committee operates independently of senior management and can perform its duties independently and conscientiously. The committee should directly, promptly, and unimpededly report material information to the board of directors and senior management to maintain close communication.

4.4. Effective risk management

1. Conduct regular risk assessments to identify potential business and financial risks. Key risks are identified based on their probability of occurrence and impact. Develop risk response strategies, including risk avoidance, mitigation, transfer, and acceptance.

2. Establish a real-time monitoring system to track key risk indicators (KRIs). Regularly generate risk reports to inform management of the current risk status and the implementation of response measures.

3. Enhance employees' risk awareness and risk management skills through training and awareness programs. Encourage all employees to participate in risk management, and establish a risk reporting mechanism to enable timely reporting of potential risks.

4. Calculate the return on investment (ROI) to show managers the profitability of investment projects. The higher the ROI, the greater the return and the lower the risk. Calculate the return on invested capital (ROIC) to assess the profitability and risk level of a project. Conduct sensitivity analysis to evaluate investment returns and risks under different scenarios.

5. Regularly review risk management processes and policies to ensure their effectiveness and adaptability. Continuously improve the risk management system in response to changes in the internal and external environment of the enterprise.

4.5. Example of risk management structure

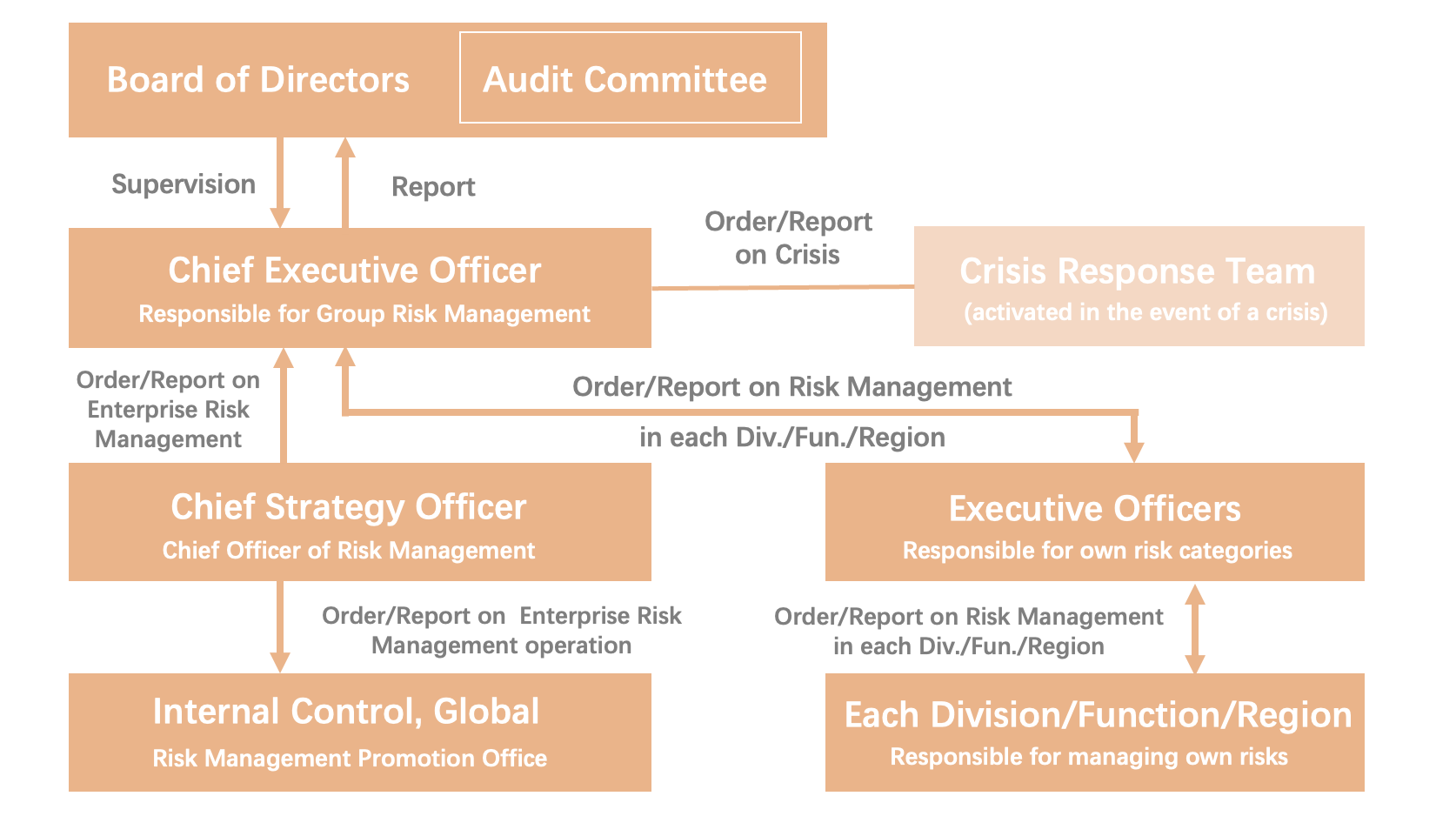

Figure 5 shows that the Board of Directors is the highest decision-making body of the company, with the Audit Committee responsible for overseeing the company’s financial matters and compliance. The Chief Executive Officer (CEO) reports regularly to the Board of Directors and is responsible for the day-to-day operations and strategic planning of the company. Under the CEO's leadership, the Head of Group Risk Management oversees the risk management for the entire group, ensuring the formulation and implementation of effective risk management strategies.

The Chief Risk Management Officer (CRO), reporting to the Head of Group Risk Management, is responsible for managing specific risk categories. The Risk Management Promotion Office serves as the emergency agency tasked with initiating risk management measures during emergencies. The crisis response team, composed of senior executives, is responsible for rapid response and handling of crisis situations. The Chief Strategy Officer (CSO) is responsible for the company's strategic development and must consider potential risks during the strategic planning process, intersecting with risk management activities. Executives in each department or region are accountable for the specific operations of the company while also participating in risk management.

Overall, the corporate governance structure ensures the effective implementation of risk management and internal control through a clear hierarchy and division of responsibilities, extending from the Board of Directors to senior executives at all levels. Each level has distinct responsibilities and reporting relationships, forming a governance system characterized by mutual supervision and support.

Japan's second-largest financial group, Sumitomo Mitsui Financial Group (SMFG), adopts a "business unit + management unit" model similar to that of major international financial groups, while also incorporating its own innovations. It has introduced a matrix management system composed of group business divisions, a CxO system, and subsidiaries. The CxO system includes eight functional departments: Financial Management, Strategy Consulting, Risk Management, Compliance, Human Resources, Information, Digital Innovation, and Internal Audit.

To support this organizational structure, SMFG has appointed eight Chief Executive Officers (CxOs) under the Group CEO (President of Sumitomo Mitsui Financial Group), each responsible for one of these eight areas. An Internal Control Committee has been established to manage and supervise daily internal control affairs, reporting to the management. This ensures strict institutional and managerial oversight, integrating internal control concepts into employee training and ensuring effective control across the system, execution, and personnel levels.

Through robust internal auditing, SMFG ensures the proper implementation of internal controls. The company’s comprehensive evaluation system periodically checks the internal control status of its subsidiaries to guarantee process standardization and operational compliance. This system aims to enhance the group management capabilities centered on the holding company. The management framework provides valuable experiences; the group’s departments have established a complete Chief Executive Officer system, offering experiences that large groups can learn from.

4.6. Improvement measures for CSRC's regulation of speculative behavior of companies

The system of futures trading regulations on companies must be further improved. This includes, but is not limited to, clearly defining the legal definition of speculative behavior, and clarifying the illegality of speculative behavior and the standards of penalties to be imposed. Through legislative behaviors, the regulatory authorities are provided with a solid legal basis to ensure the legal enforcement and regulation of regulatory actions. The authority should also adopt legislation to define clear responsibilities of third-party auditors like Ernst & Young and impose strict penalties for irresponsible and improper professional conduct by accounting firms.

Market supervision should be intensified. An efficient early warning mechanism for monitoring speculative behavior should also be constructed. Through the use of advanced information technology means, the government is able to achieve real-time monitoring of the company, detect the risk in time and deal with these abnormal trading behavior. At the same time, by the establishment of reward mechanism of reporting speculative behavior, government could encourage market participants to actively report speculative behavior, which benefits the formation of a good atmosphere of supervision in the whole society.

The supervision of futures companies should be strengthened. Futures companies are required to establish an effective internal risk management system and strictly carry out risk control standards to prevent excessive speculative behavior. Futures companies that operate in violation of the law should be publicly exposed as a warning to others and punished seriously in accordance with the law.

5. Conclusion

It has been twenty years since the CAO Incident raised concerns of the whole financial markets in 2004. The research of many scholars at home and abroad provide this paper with support. Based on our study, this paper’s conclusions are as follows:

The whole incident of CAO is not only related to the fact that his unsound internal control system, but also due to the top management seriously overstepped their authority and violated the rules, and the company's internal supervision and review mechanism did not play its due role. Therefore, combining the case, we find that any unilateral risk control measures cannot effectively reduce the risk of transactions, so it is essential to monitor the risk of instruments in advance, establish an effective risk hedging mechanisms, establish a comprehensive and effective internal control mechanism, and then strengthen the government's external supervision and regulatory measures, which benefits the normal operation of the financial derivatives market.

In future research, the dynamic evolution and influencing factors of speculative behavior in the futures market can be further explored. It may help provide more comprehensive and in-depth theoretical guidance and practical solutions for market regulation and investor when making decisions. At the same time, as the market environment and regulatory policies continue to change, speculative behavior may also show new characteristics and trends, which require continuous attention and research.

Acknowledgement

Chengxiao Ye, Siying Wu, Jiacheng Ping, Zhixin Yuan and Jiahua Wang contributed equally to this work and should be considered co-first authors.

We would like to express our sincerest gratitude to all those who have given us help and support. We hope that future research will continue to receive your attention and support.

References

[1]. Li et al., 2007. Analyzing AVIC Oil from a Risk Management Perspective. 27.1: 23-32.

[2]. Lu et al., 2007. Reflection on "CAO" Incident Using the Behavioral Finance Theory.https: //www.semanticscholar.org/paper/Reflection-on-%22CAO%22-Incident-Using-the-Behavioral-Ai-ping/7011017d43c7ccd7d34bab5496e9f7a33a42f750#related-papers

[3]. Gong, 2015. Case Study of the AVIC Oil Incident.https: //xueshu.baidu.com/usercenter/paper/show?paperid=675520ed9637c3d1ed99a188ce0c8e47& site=xueshu-se& hitarticle=1

[4]. ChinaEconomyWebsite, 2005.https: //finance.ce.cn/stock/gsgdbd/202005/04/t20200504-34834012.shtml

[5]. Sina Finance, 2009. https: //finance.sina.com.cn/futuremarket

[6]. Jackson, K. T. (2009). The China Aviation Oil Scandal. In Matulich, S. & Currie, D. M. (Eds), Handbook of Frauds, Sacams and Swindles (1st Edition). Routledge.

[7]. Cao, D. (Dec 23, 2004). Costly lessons from the CAO scandal. China Daily, https: //www.chinadaily.com.cn/english/doc/2004-12/23/content_402605.htm

[8]. Burton, J. (Jun 3, 2005). CAO 'failed at every level, report concludes. Financial Times, https: //www.ft.com/content/05f6336c-d455-11d9-9db0-00000e2511c8

[9]. SASAC. (2018). What We Do. http: //en.sasac.gov.cn/2018/07/17/c_9258.htm

[10]. SEC. (2021). SEC Charges Ernst & Young, Three Audit Partners, and Former Public Company CAO with Audit Independence Misconduct, https: //www.sec.gov/news/press-release/2021-144

[11]. Wu, Y. (2018). Master's Degree (Dissertation, Harbin University of Commerce). https: //link.cnki.net/doi/10.27787/d.cnki.ghrbs.2018.000001doi: 10.27787/d.cnki.ghrbs.2018.000001

Cite this article

Ye,C.;Yuan,Z.;Wang,J.;Ping,J.;Wu,S. (2025). Risk Analysis and Risk Avoidance for Speculative Behavior in Futures Markets--Based on the AVIC Oil Incident and Related Case Studies. Advances in Economics, Management and Political Sciences,202,50-63.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 3rd International Conference on Financial Technology and Business Analysis

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Li et al., 2007. Analyzing AVIC Oil from a Risk Management Perspective. 27.1: 23-32.

[2]. Lu et al., 2007. Reflection on "CAO" Incident Using the Behavioral Finance Theory.https: //www.semanticscholar.org/paper/Reflection-on-%22CAO%22-Incident-Using-the-Behavioral-Ai-ping/7011017d43c7ccd7d34bab5496e9f7a33a42f750#related-papers

[3]. Gong, 2015. Case Study of the AVIC Oil Incident.https: //xueshu.baidu.com/usercenter/paper/show?paperid=675520ed9637c3d1ed99a188ce0c8e47& site=xueshu-se& hitarticle=1

[4]. ChinaEconomyWebsite, 2005.https: //finance.ce.cn/stock/gsgdbd/202005/04/t20200504-34834012.shtml

[5]. Sina Finance, 2009. https: //finance.sina.com.cn/futuremarket

[6]. Jackson, K. T. (2009). The China Aviation Oil Scandal. In Matulich, S. & Currie, D. M. (Eds), Handbook of Frauds, Sacams and Swindles (1st Edition). Routledge.

[7]. Cao, D. (Dec 23, 2004). Costly lessons from the CAO scandal. China Daily, https: //www.chinadaily.com.cn/english/doc/2004-12/23/content_402605.htm

[8]. Burton, J. (Jun 3, 2005). CAO 'failed at every level, report concludes. Financial Times, https: //www.ft.com/content/05f6336c-d455-11d9-9db0-00000e2511c8

[9]. SASAC. (2018). What We Do. http: //en.sasac.gov.cn/2018/07/17/c_9258.htm

[10]. SEC. (2021). SEC Charges Ernst & Young, Three Audit Partners, and Former Public Company CAO with Audit Independence Misconduct, https: //www.sec.gov/news/press-release/2021-144

[11]. Wu, Y. (2018). Master's Degree (Dissertation, Harbin University of Commerce). https: //link.cnki.net/doi/10.27787/d.cnki.ghrbs.2018.000001doi: 10.27787/d.cnki.ghrbs.2018.000001