1. Introduction

Within finance, the futures market stands out for its vital role in managing risks and uncertainties. Hedging, a key strategy within this market, empowers participants to shield themselves from adverse price shifts. The 2022 LME short nickel selling by Tsingshan Group highlights the dangers of straying from hedging and indulging in speculation, emphasizing the crucial disparity between the two.

The futures market acts as a platform for trading financial contracts that bind the buyer to purchase or the seller to sell an asset at a predetermined future date and price, aiding market players in mitigating price risks and stabilizing business functions. Hedging serves as a tactic to counter adverse price movements by assuming an offsetting position in a correlated asset or derivative.

The Tsingshan Nickel Incident holds immense significance for its profound impact on the global futures market and related industries' stability. Triggered by various factors like supply disruptions post the Russia-Ukraine conflict, speculative trading, and lax regulatory oversight by the LME, it led to a sudden surge in nickel prices, creating a highly volatile trading atmosphere.

This paper aims to analyze Tsingshan's activities in the OTC and exchange markets, scrutinize their futures selling process, and explore the involvement of other entities like the London Metal Exchange and the Chinese Government. Key questions to be addressed include the reasons behind Tsingshan's losses in the futures market and the risks and challenges linked to their OTC trading. How did the difference in nickel purity impact Tsingshan's trading in the exchange market? What were the actions taken by the London Metal Exchange and what was its role in this incident? Why did the Chinese Government intervene, and what was its significance? Did the Chinese Government bail out the firm?

Through this analysis, the paper seeks to provide insights into risk management strategies and offer suggestions to prevent similar crises in the future.

1.1. Timeline

In the world of finance, the futures market is crucial for managing risks and uncertainties, and hedge is essential for market participants to protect against adverse price movements. However, the LME short nickel sale by Tsingshan Group in Feb - March 2022 serves as a reminder of the dangers of deviating from the hedge and engaging in speculation.

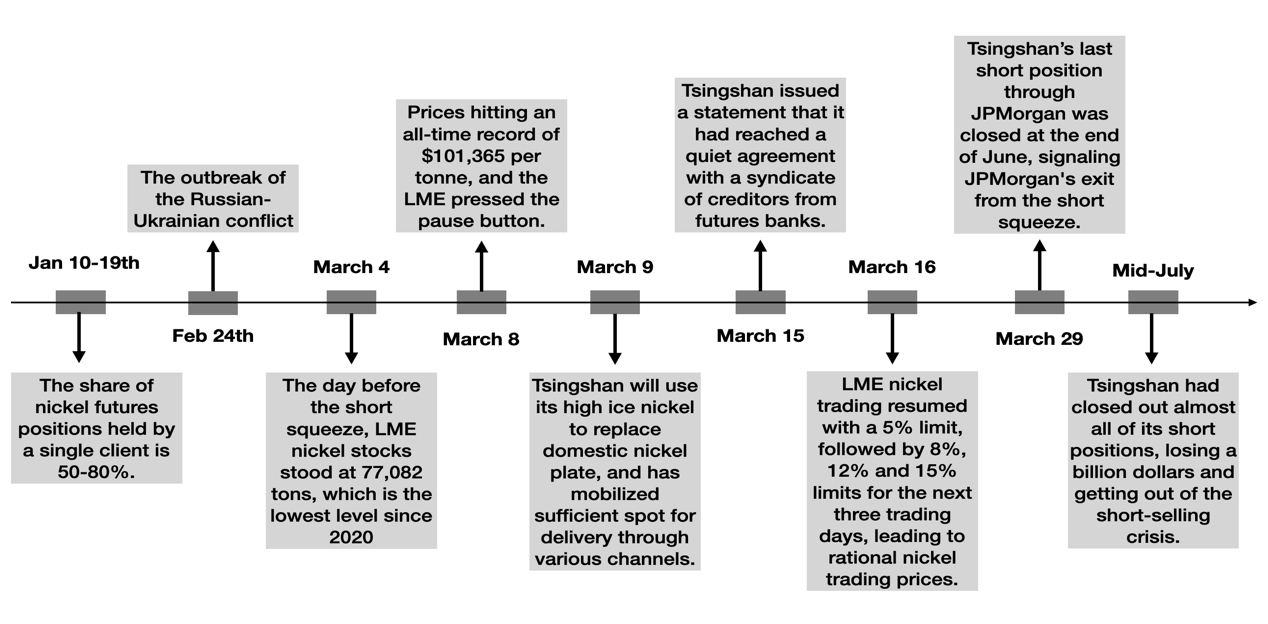

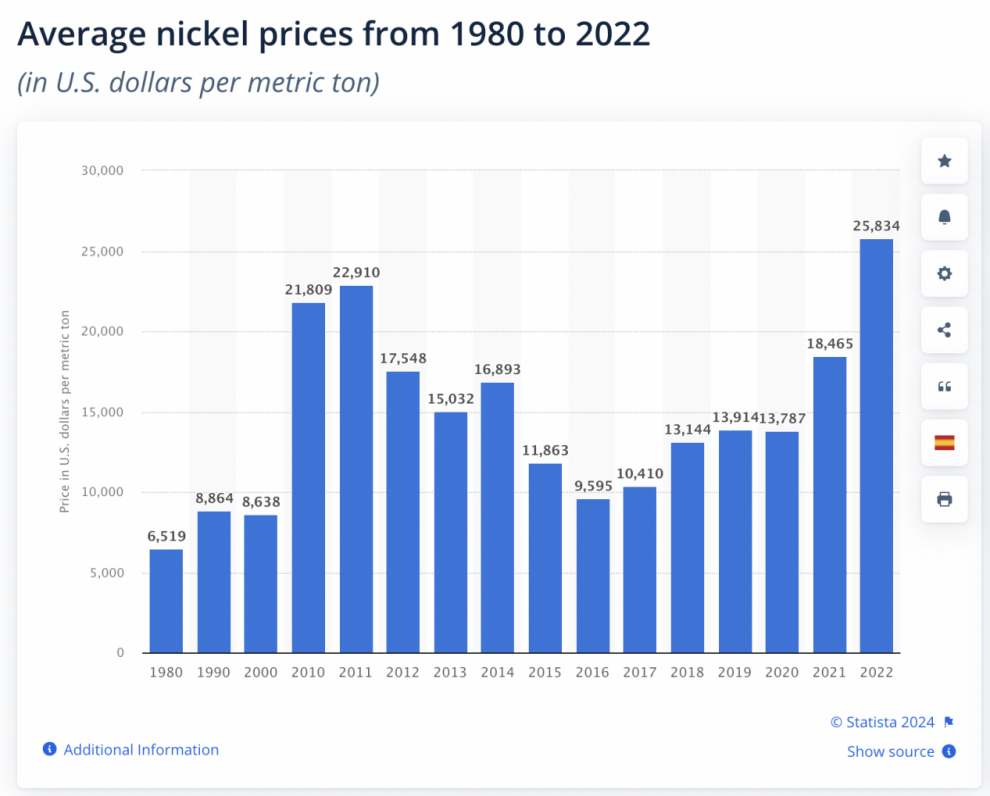

Based on the Figure 1, Tsingshan Holding Group Co., Ltd., a major player in the nickel industry established in 2003 and headquartered in Wenzhou, Zhejiang Province, is a significant producer and trader in the global nickel market, focusing on nickel mining, smelting, and the production and trading of nickel-based products. The London nickel short squeeze crisis occurred in March 2022, triggered by multiple factors, including supply disruptions due to sanctions on Russia after the conflict with Ukraine, speculative trading by financial institutions and hedge funds, and insufficient regulatory oversight by the LME. This resulted in a sudden and unparalleled surge in nickel prices, fostering a highly volatile trading atmosphere.

The surge in nickel prices was primarily driven by the decrease in global nickel supply, a consequence of Russia's significant role as a major producer and the uncertainties in supply stemming from the conflict. Speculative trading also drove up prices, and the lack of regulation allowed for excessive leverage and risky strategies in the nickel futures market. As of March 4, 2022, the LME nickel inventory was low, and Tsingshan was suspected to hold a large number of short positions. In mid-July 2022, Tsingshan reportedly closed most of its short positions, incurring a loss of one billion US dollars.

Despite the challenges and ongoing discussions around this topic, such as the role of speculators and the effectiveness of regulatory measures, we want to contribute by offering some possible hedge strategies and suggestions.

2. Analysis of Tsingshan’s trading in OTC market

2.1. Details of OTC trading

In the context of the London Nickel Incident, Tsingshan engaged in OTC trading for nickel futures. This involved bilateral agreements directly with counterparties, potentially offering advantages in terms of pricing, possibility of delivery and privacy compared to exchange-traded contracts.

Although Tsingshan Group has a large amount of nickel products, these products cannot be registered for storage in the delivery warehouses of the futures market. The reason is that the purities of nickel produced by Tsingshan and those required by the LME are different. The purity of its production was less than 98%, which did not meet the 99.5% purity requirement of the LME. The delivery link is crucial for futures hedging as it enables price regression and unification between the spot and futures markets. However, the listed varieties in domestic and foreign futures markets are limited, and the regulations on deliverables are strict, making many products in the industrial chain ineligible for delivery. [1]

2.2. Analysis of risks in OTC trading

OTC trading carries several risks, such as counterparty risk (the risk of default by the other party), less transparency compared to exchange-traded prices, and potentially higher costs due to lower liquidity and non-standardized terms.

In the case of the restrictions and risks in on-exchange trading, OTC trading provides conveniences for Tsingshan's non-standard hedging. However, there are also difficulties. For instance, after investment institutions sign OTC agreements with non-standard hedging enterprises, they might not trade the hedging volume in the on-exchange market, and the relevant information may lack transparency and supervision.

2.2.1. Parties involved in trading with Tsingshan

During the incident, Tsingshan traded with various counterparties in the OTC market, including JPMorgan and some Chinese and foreign banks and brokers such as Banque Nationale de Paris Paribas, Standard Chartered Bank, China Construction Bank International Holdings Limited were also embroiled [2].

2.2.2. Trading volume of Tsingshan's OTC transactions

Tsingshan conducted transactions in the OTC market involving substantial amounts and volumes of nickel futures. However specific figures may vary depending on the stage of the incident.

In the Tsingshan nickel incident, about 50,000 tons of 150,000 tons of nickel short positions were OTC trading positions [2].

2.2.3. Motivation for OTC trading

The main reason Tsingshan chose over the counter (OTC) trading is that the nickel products it produces are not qualified deliverables in domestic and foreign futures markets and belong to non-standard hedging products. The capacity to directly negotiate terms with counterparties, potentially securing more favorable pricing or tailored contract terms unavailable on exchanges, along with the discretion and confidentiality provided by OTC trading, further bolster this preference.

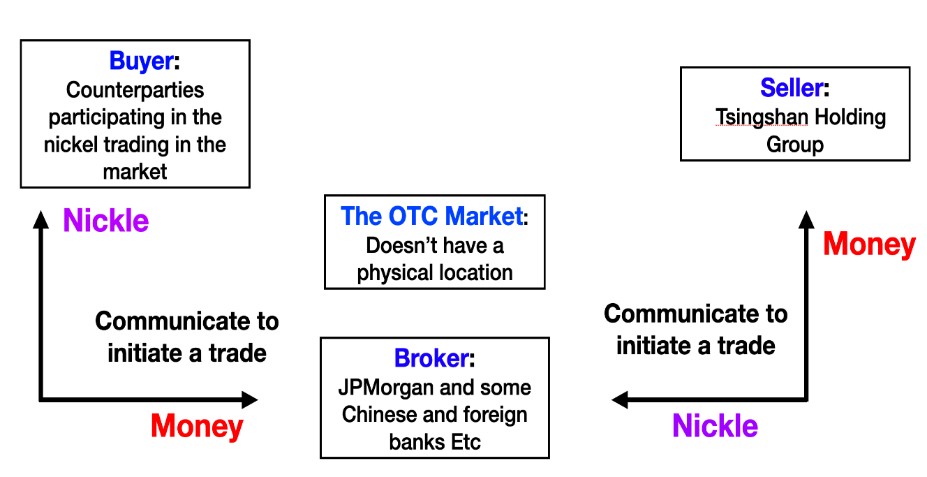

2.2.4. Comparison between OTC and exchange trading

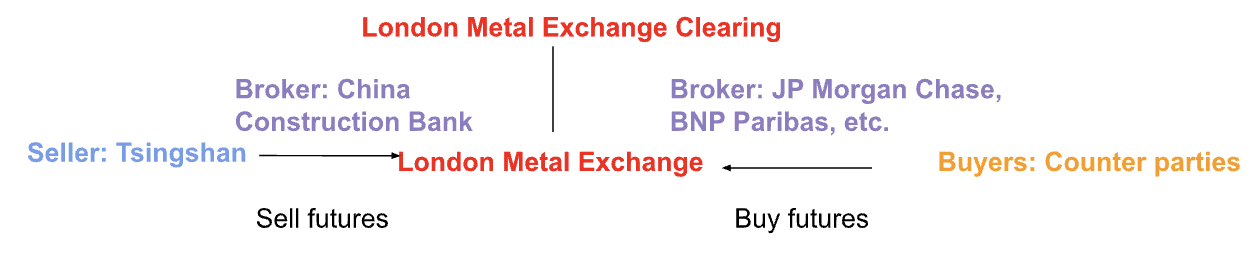

As seen in Figure 2 which is the trading process of the OTC market, OTC trading stands primarily apart from exchange trading due to its customization, flexibility, and counterparty risk. Exchanges offer standardized contracts, enhanced pricing transparency, and clearing services that help alleviate counterparty risk in contrast to OTC markets. In essence, Tsingshan's participation in OTC trading amid the London Nickel Incident showcases a deliberate decision to leverage the perks of direct negotiation and contract flexibility in futures, despite the inherent risks tied to these dealings.

In summary, Tsingshan's involvement in OTC trading during the London Nickel Incident illustrates a strategic choice to take advantage of the benefits of direct negotiation and flexibility in futures contracts, despite inherent risks associated with such transactions.

2.3. Costs and benefit of using OTC derivatives

The involvement of Tsingshan in OTC derivatives trading during the LME nickel incident vividly displayed the intricate balance between costs and benefits.

On the positive side, OTC derivatives held the promise of tailored risk management for Tsingshan. This potential customization could have enabled them to hedge business and financial risks more closely, potentially leading to favorable accounting treatment. These instruments might have also boosted market liquidity, facilitated personalized diversification of the investment portfolio, improved market price accuracy, and offered broader risk diversification compared to conventional instruments.

However, the costs and risks were undeniably substantial. The lack of transparency in OTC derivatives was glaringly evident, resulting in market uncertainties that made it exceedingly difficult for both Tsingshan and regulatory bodies to gauge counterparty credit risks and market concentrations. This opacity triggered a host of issues, including fostering distrust among market participants and creating liquidity shortages. With excessive leverage and minimal capital requirements, OTC trading could have heightened market volatility and systemic risks. For Tsingshan, this transaction might have negatively impacted its cash flow and exchange markets, weakened the bank's monitoring incentives, and imposed elevated accounting costs and complexities.

Overall, while OTC derivatives could have offered Tsingshan certain advantages, the potential pitfalls necessitated meticulous regulation and management to safeguard financial stability and mitigate possible adverse outcomes. The LME nickel incident acts as a cautionary tale, underscoring the imperative of a comprehensive understanding and effective management of the intricate costs and risks associated with OTC derivatives trading.

2.4. Regulating the invisible risk

2.4.1. Regulation of institutional market participants

The regulation of institutional market participants emerges as a critical factor. The regulatory landscape surrounding OTC derivative markets is intricate. Traditionally, institutional players like banks and insurance firms face stringent regulations. However, notable entities such as hedge funds often operate with minimal oversight, potentially creating regulatory loopholes that could have impacted Tsingshan's OTC dealings. It's crucial to distinguish between overseeing individual participants and regulating the overall market structure, as lax monitoring of specific actors may have enabled risky OTC practices to proceed unchecked.

The classification of financial products also plays a pivotal role in regulatory oversight. In the instance of Tsingshan's OTC derivatives within the nickel market, how these products were categorized significantly influenced the level of regulation. The Commodity Futures Modernization Act (CFMA) has had a profound effect by introducing numerous exclusions and exemptions, thereby reducing oversight by the SEC and CFTC. This diminished regulatory scrutiny may have fostered an environment where certain OTC derivative transactions, like those of Tsingshan, faced less rigorous regulatory supervision.

The introduction of clearing organizations for OTC derivatives by the CFMA and the regulatory oversight provisions have evoked mixed reactions. The design of regulations and policies, exemplified by the actions of the CFTC, carries substantial implications for market structure. The CFMA's stipulations, including the federal preemption of state laws concerning OTC derivatives, have provided legal clarity while also sparking debates about regulatory effectiveness and the necessity for prudent reform. In essence, the current regulatory framework surrounding OTC derivatives, characterized by complexity and hurdles, underscores the urgency for comprehensive and well-considered reforms to avert similar incidents and uphold market stability, as underscored in the LME nickel event involving Tsingshan.

2.4.2. International framework of cooperation

In the LME nickel incident involving Tsingshan's OTC trading, the international framework of cooperation is demonstrated through the following aspects within the described scenario:

In the aftermath of the financial crisis, the necessity for a new macro-prudential framework to manage systemic risks, with derivatives playing a pivotal role, has been underscored. In this occurrence, efforts such as the establishment of emerging international regulatory bodies like the OTC Derivatives Regulators' Forum (DRF) signify endeavors towards international collaboration in the regulatory sphere. However, during the LME nickel event, the evident fractures in the transatlantic approach to reform underscore the intricacies and obstacles of international cooperation. Tsingshan's OTC trading was impacted by this evolving global regulatory landscape, which has inherent gaps and inefficiencies.

Regarding local and global regulatory challenges, when incidents like the Tsingshan situation occur, local regulators encounter difficulties in regulating the inherently global financial market of nickel derivatives. The international cooperation framework is still in the process of being constructed and improved. In the case of Tsingshan's OTC trading, problems such as the localization of markets create difficulties that require international cooperation. Additionally, the transaction costs associated with coordinating international government solutions were also evident during the handling of this event.

Although there are private organizations such as the International Swaps and Derivatives Association (ISDA), which have certain advantages in implementing global coordination through private contracting mechanisms, in the LME nickel event, the coordination and interaction between these private and public sectors within the international framework in handling the situation of Tsingshan and the market turmoil were not seamless. The model of public-private governance partnerships for regulating the global OTC derivative markets is still in the process of being explored and refined in practice.

3. Analysis of Tsingshan’s trading in exchange

3.1. The difference in nickel purity

A fundamental factor in the Tsingshan incident was the nickel difference between Tsingshan’s products and LME’s future requirements. According to the LME nickel future contract, the delivery standard in LME is 99.80% nickel . However, Tsingshan produced nickel pig iron and nickel matte which have lower purity and cannot traded in LME. This led Tsingshan Group's role in this futures transaction to shift from a hedger to a speculator.

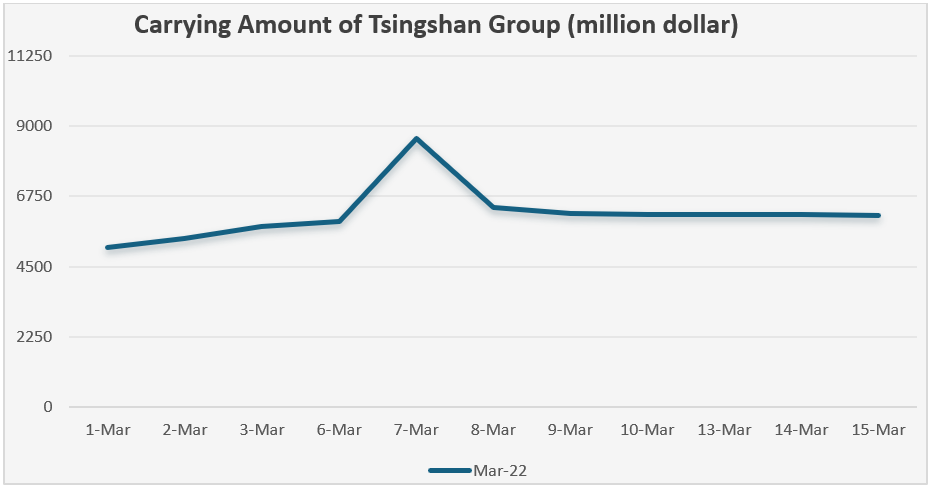

3.2. Evaluation of Tsingshan’s margin calls in short squeeze

The following is for the evaluation of the total margin requirement needed for liquidation once the short squeeze happened. Tsingshan Group held a short position of about 200,000 tons of nickel metal on the LME. On March 8, 2022, as the nickel price on the LME surpassed $100,000 per ton, Guangda Xiang, the owner of Tsingshan Group, faced the darkest hour of his life [2]. Tsingshan did not have any precautionary risk management structure in place.

The unrealized loss of Tsingshan equals to the nickel position held in the LME multiplies by the difference between the purchased price and the closing price of nickel. The equation is shown as below

Equation 1 The Margin Call

From Figure 3, it indicates that the unrealized loss was extremely high and spiked to the highest unrealized loss on March 8th. This is unpredictable, and it was not the expectation of Guangda Xiang. Lacking a risk management system and futures expertise, speculative futures trading can lead to severe risks, including potential bankruptcy.

3.3. Russian nickel production impacts LME nickel futures

Russia's nickel supply ranks in the top five globally, making it an important producer and exporter of nickel. Its export volume of nickel slabs is the highest in the world, and it is also the main deliverable variety accepted by the LME. Consequently, if the supply of nickel from Russia is disrupted, the futures prices related to nickel ore on the LME are bound to rise.

According to Reuters, due to the COVID-19 pandemic, the production of nickel in Russia dropped. As a result, the price of the nickel produced in Russia rose. In the first quarter of the year 2021, nickel production was 51 thousand tons, a decrease of 7% compared to the same period last year; copper production was 115 thousand tons, with a 9% decrease year-over-year; the production of palladium was 17 tons, which was a 29% decrease compared to the previous year; and the production of platinum was 4.67 tons, reflecting a 26% reduction.

From Figure 4, starting from January 2021, the price per ton of nickel produced in Russia has continued to increase significantly. Based on the futures pricing theory, the price of nickel futures in the LME is also likely to rise accordingly.

Furthermore, the Russian-Ukraine War has impacted the export of nickel produced in Russia, causing an increase in nickel spot prices.

With the ongoing Russia-Ukraine conflict, international sanctions against Russia are intensifying, increasing the uncertainty in the trading and transportation of Russian nickel slabs. As of March 4, 2022, the day before the short squeeze, the LME's nickel inventory was only 77,082 tons, dropping to a new low since 2020 [1]. Making it difficult for Tsingshan to buy the same amount of nickel by the same money.

The pandemic and the war are unforeseeable events, and Tsingshan could not have responded to it in a timely manner due to the lack of the risk management plan.

4. Futures selling process of Tsingshan

The futures market is where financial products can be delivered and bought on a future date, which the buyers have locked in in advance [3]. Figure 5 is the futures selling process of Tsingshan in our case study. Tsingshan is the seller in LME and its sale is through brokers, e.g. China Construction Bank, JP Morgan, etc. And some counterparties buy futures in LME. LME clearinghouse is the intermediary for sellers and buyers. Simply, there are four major characters in the whole process, Tsingshan, LME, LME clearinghouse, and counterparties.

4.1. The cause of the loss of Tsingshan: the ambition without an accurate analysis of risk from the CEO

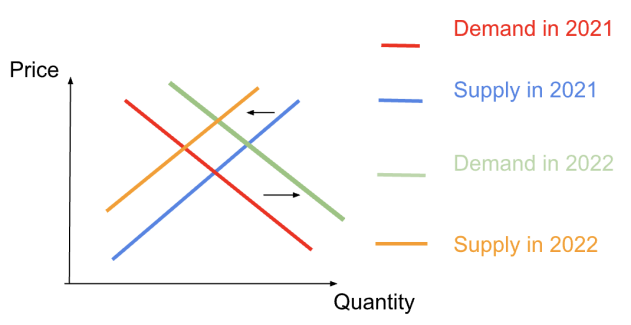

The main cause of the loss is the risky strategy and non-accurate prediction from Guangda Xiang who is the owner of the company. In 2022, economics warmed up after the effect of the pandemic, nickel market attracted the attention of investors, and later, this increased the demand for nickel. At the same time, the supply also increased due to the manufacturers starting again after the pandemic. But later Russia-Ukraine military conflict happened which decreased the supply of Russian nickel. Even though Russia and the UK does not have direct trade [4], the market price of nickel still be influenced. Figure 6 simulates the nickel change in supply and demand between 2021 and 2022, showing the demand curve shifts to the right and the supply curve shifts to the left. Therefore, the price of nickel increased. Based on the demand curve, demand decreases when the price increases, which may lower Tsingshan's revenue.

Guangda Xiang wanted to gain profits by selling futures in the LME market; however, his knowledge of the whole market was limited. He used a risky strategy, speculation rather than hedge. First, speculation is about using price fluctuations to realize profits [5]. While a hedge is a strategy that uses a new investment to cover the loss in the previous investment [6]. Since there was no publicized information that Tsingshan had a loss in its nickel trading and Guangda Xiang had after noticing the price of nickel increased in 2021, we assume the main purpose of the sale of futures in LME was speculation rather than hedge. Second, the reasons why speculation is risky have two main reasons. On the one hand, speculation is highly influenced by the unpredicted and unstable market, so more invested capital, more profits or even losses; on the other hand, speculation requires more capital to buy futures and causes shortages in other accounts in Tsingshan.

Guangda Xiang locked into a higher price to gain profits. In the beginning, the price of nickel in LME followed his expectations, so he would sell futures at the highest price he expected. However, a Russia-Ukraine military conflict broke out. Since Russia is the third-largest nickel producer in the world, the military conflict was highly likely to decline sanctions of nickel in Russia and later influence the supply. These global supply concerns raised the price of nickel again. The subsequent increase in nickel price broke Guangda Xiang's prediction. Thus, Tsingshan faced the urgent issue of paying a great number of margins and it owed an estimated $15 billion, even though this issue was quelled by the Chinese government.

5. The analysis of other parties

5.1. The role of the London metal exchange

LME plays an important role in facilitating future transactions. However, it also directly caused the loss of Tsingshan by the non-existent price limit.

5.1.1. The action taken by London metal exchange clearing

The unestablished price limit regulation is the dereliction of LME clearinghouse. LME clearinghouse is not only the intermediary between buyers and sellers for setting contracts, ensuring required obligations (e.g. margin payments) to satisfy; but also stabilizes the market.

On March 8th, 2022, the price rose from $48,078/ metric tonne (mt) to $101,365/mt in intra-day trading [2]. This is a manifestation of market instability. Thus, LME urgently announced to suspension of all nickel trading attempting to stabilize the market after the failed attempt to significantly increase the margin rate to curb the speculative buying sentiment in the market. On March 15, 2022, LME published a 22/064 notice to set the price limit to protect its market. It declares that “for Nickel, at least 5% having previously guided 10%, and will keep under review in light of market conditions”. This indicates that LME realized its failure in monitoring and its limitations in controlling prices and the market.

The delayed price limit regulation caused price fluctuations and the instability of the nickel market, which later produced liquidity risk. This could cause many companies to face limited free cash flow and even liquidation. This happens to the LME clearinghouse as well because they cannot receive margins and pay profits to the buyers. The unstable futures market also influences human society, including rising unemployment, higher interest rates, panic emotions, country construction, etc. In other words, the influences of the unstable futures market are not only limited to the economic market but to the whole society. When the issue expands to a level that related companies cannot control, countries will be involved in maintaining the stability of the society.

Moreover, because an LME clearinghouse is an institution that connects different sides of the transaction, it could be harmed by market participants if they do not manage risks properly [7]. Because of the default risk brought by Tsingshan, the LME clearinghouse was under pressure to control nickel prices and stabilize the market.

5.1.2. The purpose of the suspension of the nickel transaction on LME

The suspension of the nickel transaction on LME is a way to protect the company itself. Due to the significant price fluctuation, Tsingshan owed LME about $15 billion [2]. However, when Tsingshan owed money to LME, LME also owed money to the other side of the relationship, which is the counterparties. Counterparties involved in the nickel futures market also wanted to gain profits from the price change. Therefore, they desired to receive money for transactions they made from LME. Due to the large capital Tsingshan owed and the counterparties that needed to receive it, LME faced the problem of paying the bill. In order to protect its own company, LME decided to suspend nickel trading [2]. Even though this decision is unfair and against the regulations, this ensures the normal future operation of LME and indirectly survives Tsingshan.

5.1.3. The influence of Tsingshan’s loss in the global futures market

The transaction of Tsingshan in LME drew our attention to regulations in different future exchanges. This reflects the limitation of LME’s protection in the future market. For example, in Shanghai Futures Exchange, there is a clear price limit in the Shanghai Futures Exchange Nonferrous Metals Futures Price Index Compilation Program 2023: for every metal future, the price range is 8%~15% [8]. And in the Chicago Mercantile Exchange (CME), it uses circuit breakers to control the price of metal futures “can move is reset continuously on a rolling 60-minute lookback window. If markets move +/- 10% in that time, a 2-minute halt is initiated”. These two futures exchanges have regulations to protect the market and prevent the short squeeze in the market. The failed transaction in the LME indirectly warns other exchanges to reexamine their regulations to ensure it still fits in the market.

Besides, the instability of the LME could break the confidence of investors in the global futures market. Due to the great number of contracts Tsingshan owned, LME cannot pay profits to counterparties. Thus, investors in the global futures market might have less interest in buying futures, which will lower the number of transactions and later even slow and narrow the futures market. Additionally, investors may not rely on the exchange offices but do over-the-counter transactions. This will make the transactions less controllable for clearinghouses to stabilize the market. Sellers and buyers are likely to cooperate to gain profits by adjusting prices since the total amount of owned contracts is big enough to control the market. In other words, Tsingshan’s transaction in LME might stop the investments in other futures markets in order to protect investors themselves.

5.2. The role of the Chinese government: the main cause of the survival of Tsingshan

From the previous content, the survival of Tsingshan Company is with the help of the Chinese government. The practical bargain between the Chinese government and LME is unknown; however, this type of support is very less common and this is based on the contribution of Tsingshan to Chinese economics, trade, and city construction.

First, Tsingshan Company produces nickel and steel, which are the main materials for infrastructure, food preparation, and energy supply [9]. Most importantly, Tsingshan is one of the biggest nickel producers in the world, which gives China a reputation that spreads far and wide in the nickel market; for example, it has business in Indonesia. This promotes the trading and relationship between the Chinese government and other governments in the world. More specifically, the expansion of the company helps to lower the unemployment rate and build a good impression in the world. Additionally, it could help the Chinese government improve the construction of China and make it a more modern country. This creates greater government revenue through enterprise taxes since the company generates more profits. In other words, the Chinese government needs Tsingshan Company to support the Chinese GDP from the past to the future. Therefore, the Chinese government was involved in the problem of loss in the future sight of the country.

However, this involvement is rare. For example, Shanghai Wusheng Semiconductor announced bankruptcy and was liquidated in 2023. This company is the “maker of OLED display drivers, microcontrollers, and CMOS image sensors” [10]. Its products are in the technology market, which is also a focus of the Chinese government. Moreover, the failure of its investment is $2.48 billion [10] which is much smaller than Tsingshan’s. However, the Chinese government did not help the company to avoid bankruptcy during its investment in techniques. From this, the survival of the Tsingshan Company is almost hard to copy and even a fluke.

6. The best practice of risk management strategies

Rolling hedge and indirect hedge serve as strategic instruments for corporations aiming to mitigate financial losses, yet they are distinguished by their underlying objectives and the contexts in which they are optimally deployed.

Indirect hedging is primarily targeted at attenuating or nullifying market risks within an investment portfolio, becoming particularly instrumental in scenarios where direct hedging opportunities are unattainable. Conversely, the rolling hedge is designed to ensure the seamless continuity of a hedging strategy, circumventing the risk exposure that might arise upon the expiration of extant contracts. These methodologies reflect a sophisticated approach to risk management, tailored to navigate the intricacies of financial markets with foresight and precision.

6.1. Aim

The failure of Tsingshan’s short indicates that speculation was not advised to its situation, but hedging is more feasible to avoid the loss. In the following research, the aim is to find the most proper hedge strategy for Tsingshan to avoid the most loss and realize the maximum amount of the hedge.

6.2. Theories

6.2.1. Indirect hedge

Indirect hedge is a risk management strategy, which refers to the situation where export companies, facing an incomplete market and unable to hedge directly through financial derivatives, can achieve actual hedging by adjusting the number of the contract bought for certain portfolio.

6.2.2. Rolling hedge

Rolling hedge is a strategy for managing currency risk that involves using forward contracts with different maturities to continuously hedge currency exposure. This approach allows companies to spread their hedge positions across different maturities instead of hedging their entire exposure at once, thereby reducing the impact of market volatility on the hedging plan and providing flexibility. Although the LME’s future usually lasts for three months, it can be a part of the overall hedge, in case Tsingshan find the proper amount of the LME’s future they can buy.

Indirect hedge and rolling hedge are two hedging methods that can be combined to supplement each other. Indirect hedge indicates that the method of hedging is to use a commodity that has an inverse relationship with the rise and fall of the company's main business operations for hedging. A rolling hedge means that the quantity of the indirect hedge must be regularly recalculated according to market changes, and the quantity of the hedging products must be adjusted accordingly.

6.3. Analysis of risk management strategy in the future

For the risk management strategy in the future, Tsingshan Group could have employed an indirect hedging strategy and change the variables using the rolling hedge to rebalance in each period. The nickel of LME is the futures underlying Tsingshan Group chosen for hedging, and the nickel Tsingshan Group produced found the data of the market volatility and the prices of the two kinds of nickel in the most recent period, calculate the betas, find out the contract amount needed for hedge. The Nf that best matches the actual amount of the contract should be bought in the coming period.

Follow these hedge strategies to rebalance the contract amount could help to hedge the nickel price risk in the future. Tsingshan can make an effective risk management.

Even though the application of Formula 1 could provide useful information for Tsingshan to avoid risk, it still has limitations. The data of each variable in Formula 1 is from historical data and thus it has the issue of limited time-sensitivity. Fluctuations in market conditions could potentially compromise the precision, and relevance of the Beta coefficient. As a result, business decisions will adjust accordingly. So, risk managers are required to gather more information to ensure the hedge successfully proceeds and then protect entrepreneurs.

6.4. Suggestions for risk management

(1) Timing of position establishment and liquidation in futures and options markets are very important. Tsingshan should avoid hasty short position entries during trading, monitor the market closely, and establish positions swiftly upon confirming an upward inflection point. For liquidation, promptly close positions when observing adverse price reversals in the futures market without waiting for the commodity's physical delivery. It could be one of the best practices for risk management.

(2) Maintaining ample margins to mitigate unforeseen risks in the volatile derivatives market can better establish a stable risk management system for Tsingshan. But for the LME’s future, Tsingshan hadn’t prepared any margin. When the LME asked for a margin, the Tsingshan took no action.

(3) The most important point is to avoid turning hedging into speculation. The CEO must not let overconfidence in trend analysis lead to speculative positions in futures or options markets that mirror the hedged commodity. Such actions contravene the principles of hedging and can amplify risks upon trend reversals, a critical error in risk management.

(4) Effective hedging requires futures with high liquidity, in case the closing can’t be done in time. In this incident, Tsingshan carried too much LME’s future which has little liquidity. Thus resulting in a unavoidable paper loss.

7. Conclusion

In conclusion, the Tsingshan Nickel Incident stands as a pivotal case study in the futures market, underlining the critical significance of risk management and appropriate hedging strategies. This event exposes the perils of speculation without a thorough risk analysis, as evidenced by Tsingshan's substantial losses.

The collapse of Tsingshan's investment underscores the imperative for firms to meticulously evaluate market conditions and implement effective risk mitigation measures. Utilizing indirect and rolling hedge strategies in tandem can potentially assist companies in averting or reducing losses. Nonetheless, it is essential to acknowledge the limitations of these approaches, such as their reliance on historical data and susceptibility to market fluctuations impacting the accuracy of the Beta coefficient.

The involvement of the London Metal Exchange in this incident is also notable. The absence of a defined price limit regulation by the LME clearinghouse amplified the volatility of the nickel market and the ensuing liquidity risk. The suspension of nickel transactions, aimed at safeguarding the exchange and indirectly aiding Tsingshan, raised concerns regarding fairness and regulatory adherence. This episode underscores the necessity for robust and efficient regulations within futures exchanges to ensure market stability and integrity.

Tsingshan's survival was largely attributed to the intervention of the Chinese government, underscoring the significance of governmental support in certain scenarios. However, such interventions are relatively rare and contingent on various factors, including the company's economic contributions, trade impact, and urban development initiatives.

Overall, this case study imparts valuable insights for market participants, regulators, and researchers, stressing the importance of grasping market dynamics, effective risk management, and the roles of diverse stakeholders in the futures market. Subsequent research avenues could delve into refining hedging strategies, enhancing market regulations, and bolstering the resilience of companies and markets in response to unforeseen events.

Acknowledgement

Yunyi Qian and Haoyan Li contributed equally to this work and should be considered co-first authors.

References

[1]. Zhou Yuming. (2023). The "Nickel Squeeze" Incident on the London Metal Exchange: Enlightenment for Futures Risk Management of Bulk Commodity Enterprises in China. Modern marketing: Volume one (3), 52-54.

[2]. Jones, Alexander. (2022). “The Nickel Short Squeeze: What Happened?” International Banker, 26 Apr.

[3]. Chen, James. (2022). “How the Futures Market Works.” Investopedia.

[4]. Office for Budget Responsibility. (2022). “How Does the Russian Invasion of Ukraine Affect the UK Economy?”. Office for Budget Responsibility.

[5]. Chen, James. (2023). “Speculation: Trading with High Risks, High Potential Rewards.” Investopedia.

[6]. Reiff, Nathan. (2021). “Hedge Definition: What It Is and How It Works in Investing.” Investopedia.

[7]. Robert Dukich. (2022). Liquidity Management in Central Clearing: How the Default Waterfall Can Be Improved, NYU Stern School of Business.

[8]. Shanghai Futures Exchange. (2023). Shanghai Futures Exchange Nonferrous Metals Futures Price Index Compilation Program. Shanghai Futures Exchange.

[9]. Minerals Make Life. (2015). “The Importance of Nickel in Everyday Life - Minerals Make Life.” Minerals Make Life.

[10]. Shilov, Anton. (2024). “Major Chinese Semiconductor Company Goes Bankrupt — 23 Others Recently Withdrew IPO Applications.” Tom’s Hardware.

Cite this article

Qian,Y.;Li,H. (2025). How Can Hedgers Thrive in the Futures Market? A Case Study of Tsingshan’s Nickel Short Squeeze. Advances in Economics, Management and Political Sciences,202,23-36.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 3rd International Conference on Financial Technology and Business Analysis

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Zhou Yuming. (2023). The "Nickel Squeeze" Incident on the London Metal Exchange: Enlightenment for Futures Risk Management of Bulk Commodity Enterprises in China. Modern marketing: Volume one (3), 52-54.

[2]. Jones, Alexander. (2022). “The Nickel Short Squeeze: What Happened?” International Banker, 26 Apr.

[3]. Chen, James. (2022). “How the Futures Market Works.” Investopedia.

[4]. Office for Budget Responsibility. (2022). “How Does the Russian Invasion of Ukraine Affect the UK Economy?”. Office for Budget Responsibility.

[5]. Chen, James. (2023). “Speculation: Trading with High Risks, High Potential Rewards.” Investopedia.

[6]. Reiff, Nathan. (2021). “Hedge Definition: What It Is and How It Works in Investing.” Investopedia.

[7]. Robert Dukich. (2022). Liquidity Management in Central Clearing: How the Default Waterfall Can Be Improved, NYU Stern School of Business.

[8]. Shanghai Futures Exchange. (2023). Shanghai Futures Exchange Nonferrous Metals Futures Price Index Compilation Program. Shanghai Futures Exchange.

[9]. Minerals Make Life. (2015). “The Importance of Nickel in Everyday Life - Minerals Make Life.” Minerals Make Life.

[10]. Shilov, Anton. (2024). “Major Chinese Semiconductor Company Goes Bankrupt — 23 Others Recently Withdrew IPO Applications.” Tom’s Hardware.