1. Introduction

The COVID-19 pandemic has posed unprecedented socioeconomic problems for people living all over the world. As a result, governments have been forced to implement a variety of policy measures to mitigate the pandemic’s socioeconomic effects [1]. By April 2020, 151 countries had already introduced 684 social protection measures and about 500 million people received cash transfers [2]. Of these measures, the Universal Basic Income (UBI) is one potential solution that could satisfy vulnerable populations’ immediate needs and stabilize economies during tumultuous times.

UBI provides every citizen with a regular, unconditional cash transfer from the government — without imposing means testing or other requirements [3]. In recent years, debates around UBI have gained significant attention. On one hand, UBI’s proponents emphasize how this program can serve as a safety net for people who are unemployed, lost income, or experienced financial instability during the pandemic [4]. On the other hand, critics express concerns about UBI’s sustainability and affordability — particularly during periods of economic strain [5]. More specifically, critics call into question whether UBI alone is sufficient to tackle the complex challenges the pandemic presented. Instead, they emphasize the need for comprehensive policy approaches that include addressing job retraining, healthcare access, and social support systems [4].

A UBI cannot resolve all the socioeconomic problems the pandemic has exacerbated, but it could make a meaningful difference for those who receive it. In evaluating how a UBI affects the economy and people’s lives during the COVID-19 pandemic, the Alaska Permanent Fund Dividend offers important insights [6]. Over four decades, guided by astute financial stewardship and bolstered by oil revenues, the Alaska Permanent Fund Corporation (APFC) has presided over the Permanent Fund’s expansion. Indeed, its remarkable growth has exceeded $75.7 billion [6]. Since 1982, the funds earned from the Alaska Permanent Fund have been distributed among Alaskan residents. To qualify for the dividend, each Alaska resident must have lived in the state for at least a year and intend to remain in Alaska [1]. In 2022, each Alaska resident received $3,284 per person [5].

The Alaska Permanent Fund, offering each citizen a consistent, unconditional cash transfer, serves as a valuable model for evaluating a UBI's potential effects during a pandemic. This program’s structure can offer valuable insights into how a broader UBI initiative might function in similar crisis situations [7]. Undeniably, this paper contributes to the universal basic income literature by examining the pandemic’s impact on the economy — employing Alaska as a case study. Hopefully, by analyzing UBI’s merits, policymakers can make more informed decisions about whether this program can be helpful. Ultimately, it considers whether UBI reduces poverty.

This paper is organized as follows: Section 2 provides historical context on Alaska and the Alaska Permanent Fund. Section 3 depicts the data and outlines this investigation’s methodology. Section 4 observes unemployment rate as a socioeconomic factor in Alaska prior to and during the pandemic — analyzing UBI on its merits. Finally, Section 5 evaluates UBI in Alaska’s socioeconomic impact during the pandemic.

2. Policy Context

Alaska became America’s 49th state on January 3, 1959. A decade after Alaska attained statehood, oil was discovered in the North Slope region. This pivotal moment prompted Alaskans to vote to establish a Permanent Fund. This fund strategically invested oil revenues to benefit future generations. The initial contribution to this fund amounted to $734,000. Over four decades, through astute financial stewardship, the Alaska Permanent Fund Corporation (APFC) now manages a sum exceeding $75.7 billion [1].

For more than 40 years, Alaskans have received annual dividends from the state's Permanent Fund. In 2022, they received one of the most substantial payouts in its history with each resident receiving $3,284. Most of these payments were distributed in September and October [5]. To qualify for a payment, each Alaska resident must have lived a full calendar and must intend to remain in Alaska (although there are a few exceptions) [1]. Those with permanent resident status or are refugees can also satisfy the eligibility prerequisites [8]. As a result, the Alaska Permanent Fund offers each individual — regardless of age — a consistent, universal cash transfer [7].

3. Methodology

As mentioned above, an analysis on the Alaska Permanent Fund helps determine how UBI impacted the economy and people’s financial well-being during the pandemic. To assess this, it is important to examine the state’s unemployment rate. More specifically, this analysis compares UBI’s pre-pandemic and pandemic effect on unemployment. The study — conducted in Stockton, California — finds that after receiving a monthly stipend of $500 “over 24 months through a citywide initiative [they found] that full-time employment increased” [9]. Two data sources are utilized in this investigation. First, the study by Jones and Marinescu (2018) are used in the pre-pandemic analysis [10]. Second, an Alaska government website — Department of Labor and Workforce — serves as a valuable resource.

Categorization of Pandemic Timeline:

• Pre-pandemic: January 2004 to February 2020 (i.e., the time between the SARS and COVID-19 pandemics) [11].

• Pandemic: March 2020 to May 2023 (i.e., the month when the World Health Organization officially declared a pandemic to when it concluded COVID-19 was no longer a pandemic) [12]. However, since there is not enough data for 2023 yet, this paper only considers data presented before December 2022.

To analyze the unemployment rate, this paper relies on various secondary sources. I will analyze the unemployment rate by summarizing the factor, unemployment rate, into pre-pandemic and during-pandemic to see the overall impacts of a Universal Basic Income in the event of a pandemic [13].

4. Unemployment Rate

4.1. Observation

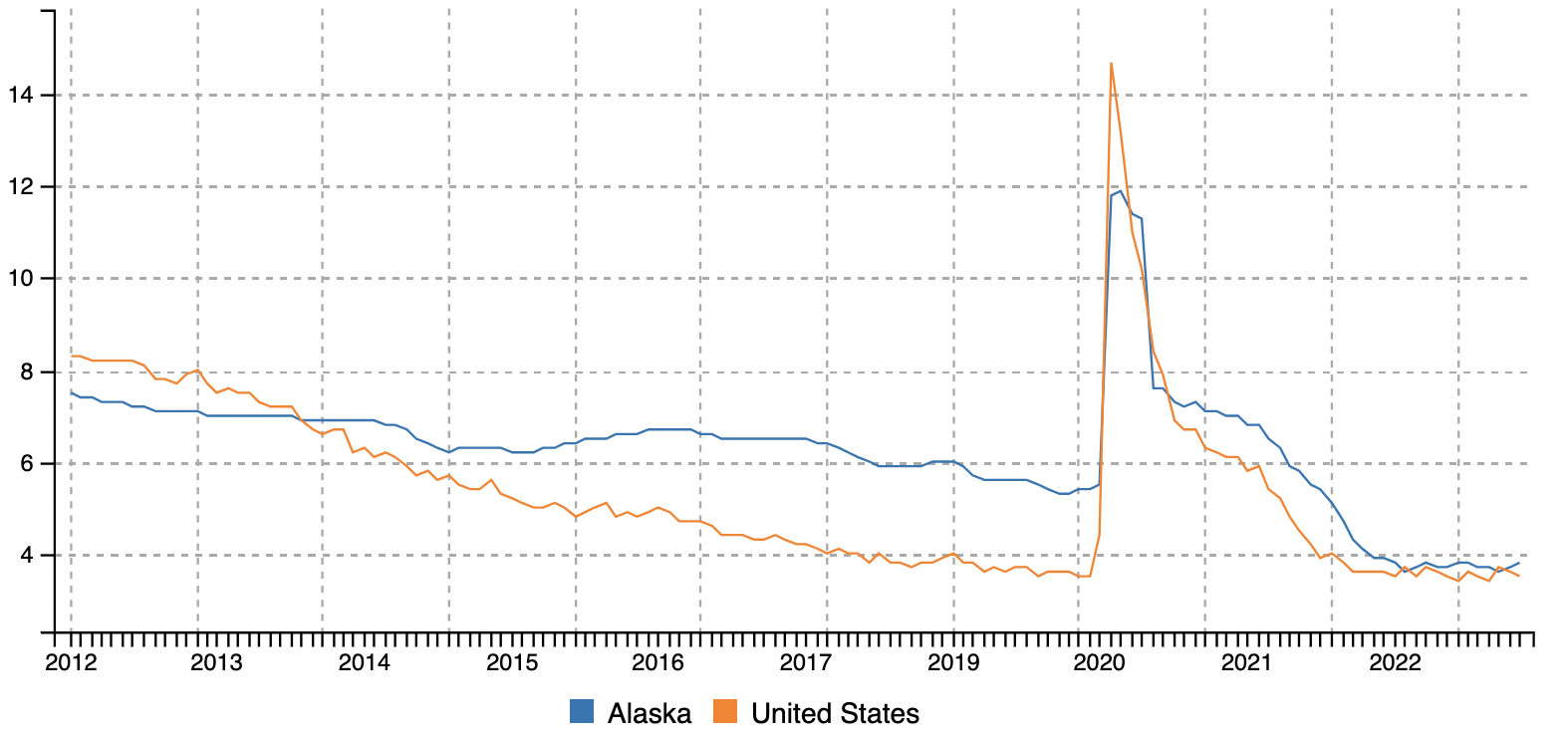

Graph 1 depicts the seasonally adjusted unemployment rates for Alaska and the United States from 2012 to 2023. The blue line is Alaska’s unemployment rate. The orange line represents the national unemployment rate for this period. On the x-axis, this graph tracks the unemployment rate from month-to-month. The y-axis shows the unemployment rate (by percentage) (see Figure 1 below).

Figure 1: Seasonally Adjusted Unemployment Rates for Alaska and United States 2012-2023 [8].

Figure 1: Seasonally Adjusted Unemployment Rates for Alaska and United States 2012-2023 [8].

4.2. Analysis

4.2.1. Pre-Pandemic Analysis

Jones and Marinescu (2018) focus on a long-term analysis of Alaska’s Permanent Fund Dividend. Their central objective is to determine how Alaskans’ working hours and employment rates have changed since the Alaska Permanent Fund’s inception in 1982 [10]. To accomplish this, they employ the synthetic control method — comparing Alaska to other U.S. states to establish a comparative analysis. Their research reveals — that following the introduction of the Alaska Permanent Fund Dividend — Alaska experienced a 1.8 percentage point increase in the part-time employment rate (relative to the synthetic control states) [10]. As figure 1 shows, this increase in the employment rate corresponds to a decrease in the unemployment rate — just before the start of the pandemic. As observed from the figure, the figure slightly fluctuates between 2014 and 2017. By 2020, prior to the pandemic, the unemployment rate was at an all-time low [8].

4.2.2. Pandemic Analysis

As observed in figure 1, after skyrocketing at the pandemic’s outset, Alaska’s unemployment rate has gradually declined. More specifically, the unemployment rate was at its highest in May 2020 and at its lowest in August 2022. Indeed, in August 2022, the unemployment rate fell to 3.6%. When the pandemic began, Alaska’s unemployment rate was 5.5% (March 2020) and reached 11.9% just two months later (May 2020). After May 2020, the unemployment rate decreased to 7.6% by August 2020 and continued to steadily decline [8].

4.2.3. Analytical Comparison Between Pre-Pandemic and Pandemic including Average US State Unemployment Percentage

Overall, as observed in figure 1 (which compares unemployment rates before and during the pandemic), both periods end with the unemployment rate declining. Of course, the pre-pandemic decline was steadier. According to Jones and Marinescu (2018), for the pre-pandemic period: “The unconditional cash transfer thus [had] no significant effect on employment yet increases part-time work.” Nevertheless, they still find a “1.8 percentage point increase in the portion of individuals engaged in part-time employment within the overall population.” This 1.8 percent increase constitutes a decrease in the unemployment rate during the pre-pandemic years [10].

Similarly, during the pandemic, despite the unemployment rate’s rapid surge in May 2020, a rapid decline followed [14]. As observed from figure 1, during this same period, Alaska’s unemployment rate was significantly lower than the average unemployment rate in the U.S., signifying that UBI could mitigate the impacts of unemployment during the pandemic [15]. Despite Alaska having an overall higher unemployment rate than the national average, Alaska achieved a noticeable decrease due to UBI [16]. Moreover, Alaska has a higher unemployment rate than many states due to its location and the seasonal nature of employment [17]. In Alaska, the unemployment rate declines in the summer as employment in construction, fishing, and tourism temporarily increases [18].

5. Evaluation

This research has several strengths. First, by referencing studies conducting similar research in different areas outside Alaska that reach similar conclusions, shows this paper’s conclusions are well-founded. Second, by providing data and statistical charts to represent the unemployment rate fluctuations, this research improves the readers’ understanding of this metric.

On the other hand, this investigation does have some important limitations. The first limitation is that there has been a lack of data and statistical figures for a few years lack data. For those years, then, it was necessary to extract data from a different source. As a result, evaluating how UBI affects the unemployment rate is difficult. Locating data that includes both years and average values would ensure a more reliable interpretation. The second limitation is that there is not enough data to assess UBI’s impact. Furthermore, while our findings suggest a positive association exists between the unemployment rate and the Alaska PFD, causation cannot be established. Further research, perhaps employing longitudinal analyses, could delve deeper into the causal mechanisms underlying this association. The final limitation is that there are not enough socioeconomic factors. After all, the number of socioeconomic factors analyzed can affect overarching conclusions. More specifically, the crime rate, income inequality, and racial inequality should be considered when evaluating UBI.

6. Conclusion

This research’s findings offer insight into the relationship between the unemployment rate and Alaska’s unique Universal Basic Income primarily manifested through the Alaska Permanent Fund Dividend (PFD). Ultimately, the aim was to discern whether a significant association exists between the unemployment rate and the implementation of the Alaska PFD during times of economic uncertainty. Our analysis reveals a positive association between the unemployment rate and the disbursement of the Alaska Permanent Fund Dividend. In other words, as unemployment rates rise, the reliance on the supplementary income provided by the PFD also increases. The PFD, intended to share the state's resource wealth with its residents, seems to act as a stabilizing force during periods of economic downturn — offering a financial safety net for those facing job losses. This economic buffer can potentially reduce the financial strain on individuals and families — mitigating the negative impacts associated with high unemployment rates.

These findings extend beyond the academic realm and into the policy domain. Indeed, policymakers — representing Alaska or anywhere else that is considering enacting similar initiatives — should study UBI’s potential benefits during times of economic instability. More specifically, the Alaska PFD model offers insights into how a direct cash transfer program can act as a counter-cyclical economic tool — especially during periods of increased unemployment.

Finally, this investigation acknowledges that UBI programs would likely differ if they are to be tailored to meet an area’s unique needs. Consequently, from a researcher’s perspective, seeing that there are more advantages to a Universal Basic Income before and during a pandemic in Alaska suggests that broader UBI programs may have merit. Further research should investigate how UBI could impact the US as a whole.

References

[1]. Chen, James. “Alaska Permanent Fund Definition.” Investopedia, September 13, 2022. https://www.investopedia.com/terms/a/alaska-permanent-fund.asp.

[2]. Gentilini, Ugo. “Social Protection and Jobs Responses to COVID-19: A Real-Time Review of Country Measures.” Open Knowledge Repository Data, April 17, 2020. https://openknowledge.worldbank.org/entities/publication/3bc00930-8388-5d60-86a9-a579de8a5b28.

[3]. Van Parijs, Philippe. “The Universal Basic Income: Why Utopian Thinking Matters, and How Sociologists Can Contribute to It.” Politics & Society 41, no. 2 (June 2013): 171–82. https://doi.org/10.1177/0032329213483106.

[4]. Ståhl, Christian, and Ellen MacEachen. “Universal Basic Income as a Policy Response to COVID-19 and Precarious Employment: Potential Impacts on Rehabilitation and Return-to-Work.” Journal of Occupational Rehabilitation 31, no. 1 (March 2021): 3–6. https://doi.org/10.1007/s10926-020-09923-w.

[5]. LaPonsie, Maryalene. “Alaskans Receive Record Dividends of $3,284.” Forbes Advisor, November 10, 2022. https://www.forbes.com/advisor/personal-finance/alaska-dividend-2022/.

[6]. Alaska Permanent Fund Corporation. “History.” n.d. https://apfc.org/history/.

[7]. Gibson, Marcia, Wendy Hearty, and Peter Craig. “The Public Health Effects of Interventions Similar to Basic Income: A Scoping Review.” The Lancet Public Health 5, no. 3 (March 2020): e165–76. https://doi.org/10.1016/S2468-2667(20)30005-0.

[8]. Department of Labor and Workforce Development. “Labor Force Home Analysis and Research.” n.d. https://live.laborstats.alaska.gov/data-pages/labor-force-home.

[9]. Malinsky, Gili. “19% of People Think Universal Basic Income Would Alleviate Work Frustration—Here’s What Experts Say.” CNBC, July 15, 2022. https://www.cnbc.com/2022/07/15/how-likely-universal-basic-income-is-in-the-us.html.

[10]. Jones, Damon, and Ioana Marinescu. “The Labor Market Impacts of Universal and Permanent Cash Transfers: Evidence from the Alaska Permanent Fund.” American Economic Journal: Economic Policy 14, no. 2 (May 1, 2022): 315–40. https://doi.org/10.1257/pol.20190299.

[11]. Hoynes, Hilary, and Jesse Rothstein. “Universal Basic Income in the United States and Advanced Countries.” Annual Review of Economics 11, no. 1 (August 2, 2019): 929–58. https://doi.org/10.1146/annurev-economics-080218-030237.

[12]. CDC. “End of the Federal COVID-19 Public Health Emergency (PHE) Declaration.” September 12, 2023. https://www.cdc.gov/coronavirus/2019-ncov/your-health/end-of-phe.html#print.

[13]. Berman, Matthew. “Resource Rents, Universal Basic Income, and Poverty among Alaska’s Indigenous Peoples.” World Development 106 (June 2018): 161–72. https://doi.org/10.1016/j.worlddev.2018.01.014.

[14]. Patel, Salil B, and Joel Kariel. “Universal Basic Income and Covid-19 Pandemic.” BMJ, January 26, 2021, n193. https://doi.org/10.1136/bmj.n193.

[15]. Weisstanner, David. “COVID-19 and Welfare State Support: The Case of Universal Basic Income.” Policy and Society 41, no. 1 (January 28, 2022): 96–110. https://doi.org/10.1093/polsoc/puab015.

[16]. Ruckert, Arne, Chau Huynh, and Ronald Labonté. “Reducing Health Inequities: Is Universal Basic Income the Way Forward?” Journal of Public Health 40, no. 1 (March 1, 2018): 3–7. https://doi.org/10.1093/pubmed/fdx006.

[17]. Bidadanure, Juliana Uhuru. “The Political Theory of Universal Basic Income.” Annual Review of Political Science 22, no. 1 (May 11, 2019): 481–501. https://doi.org/10.1146/annurev-polisci-050317-070954.

[18]. Ghatak, Maitreesh, and François Maniquet. “Universal Basic Income: Some Theoretical Aspects.” Annual Review of Economics 11, no. 1 (August 2, 2019): 895–928. https://doi.org/10.1146/annurev-economics-080218-030220.

Cite this article

Zhang,J.J. (2024). Investigating the Relationship Between Unemployment Rate and Alaska’s Unique Universal Basic Income. Advances in Economics, Management and Political Sciences,75,11-16.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 3rd International Conference on Business and Policy Studies

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Chen, James. “Alaska Permanent Fund Definition.” Investopedia, September 13, 2022. https://www.investopedia.com/terms/a/alaska-permanent-fund.asp.

[2]. Gentilini, Ugo. “Social Protection and Jobs Responses to COVID-19: A Real-Time Review of Country Measures.” Open Knowledge Repository Data, April 17, 2020. https://openknowledge.worldbank.org/entities/publication/3bc00930-8388-5d60-86a9-a579de8a5b28.

[3]. Van Parijs, Philippe. “The Universal Basic Income: Why Utopian Thinking Matters, and How Sociologists Can Contribute to It.” Politics & Society 41, no. 2 (June 2013): 171–82. https://doi.org/10.1177/0032329213483106.

[4]. Ståhl, Christian, and Ellen MacEachen. “Universal Basic Income as a Policy Response to COVID-19 and Precarious Employment: Potential Impacts on Rehabilitation and Return-to-Work.” Journal of Occupational Rehabilitation 31, no. 1 (March 2021): 3–6. https://doi.org/10.1007/s10926-020-09923-w.

[5]. LaPonsie, Maryalene. “Alaskans Receive Record Dividends of $3,284.” Forbes Advisor, November 10, 2022. https://www.forbes.com/advisor/personal-finance/alaska-dividend-2022/.

[6]. Alaska Permanent Fund Corporation. “History.” n.d. https://apfc.org/history/.

[7]. Gibson, Marcia, Wendy Hearty, and Peter Craig. “The Public Health Effects of Interventions Similar to Basic Income: A Scoping Review.” The Lancet Public Health 5, no. 3 (March 2020): e165–76. https://doi.org/10.1016/S2468-2667(20)30005-0.

[8]. Department of Labor and Workforce Development. “Labor Force Home Analysis and Research.” n.d. https://live.laborstats.alaska.gov/data-pages/labor-force-home.

[9]. Malinsky, Gili. “19% of People Think Universal Basic Income Would Alleviate Work Frustration—Here’s What Experts Say.” CNBC, July 15, 2022. https://www.cnbc.com/2022/07/15/how-likely-universal-basic-income-is-in-the-us.html.

[10]. Jones, Damon, and Ioana Marinescu. “The Labor Market Impacts of Universal and Permanent Cash Transfers: Evidence from the Alaska Permanent Fund.” American Economic Journal: Economic Policy 14, no. 2 (May 1, 2022): 315–40. https://doi.org/10.1257/pol.20190299.

[11]. Hoynes, Hilary, and Jesse Rothstein. “Universal Basic Income in the United States and Advanced Countries.” Annual Review of Economics 11, no. 1 (August 2, 2019): 929–58. https://doi.org/10.1146/annurev-economics-080218-030237.

[12]. CDC. “End of the Federal COVID-19 Public Health Emergency (PHE) Declaration.” September 12, 2023. https://www.cdc.gov/coronavirus/2019-ncov/your-health/end-of-phe.html#print.

[13]. Berman, Matthew. “Resource Rents, Universal Basic Income, and Poverty among Alaska’s Indigenous Peoples.” World Development 106 (June 2018): 161–72. https://doi.org/10.1016/j.worlddev.2018.01.014.

[14]. Patel, Salil B, and Joel Kariel. “Universal Basic Income and Covid-19 Pandemic.” BMJ, January 26, 2021, n193. https://doi.org/10.1136/bmj.n193.

[15]. Weisstanner, David. “COVID-19 and Welfare State Support: The Case of Universal Basic Income.” Policy and Society 41, no. 1 (January 28, 2022): 96–110. https://doi.org/10.1093/polsoc/puab015.

[16]. Ruckert, Arne, Chau Huynh, and Ronald Labonté. “Reducing Health Inequities: Is Universal Basic Income the Way Forward?” Journal of Public Health 40, no. 1 (March 1, 2018): 3–7. https://doi.org/10.1093/pubmed/fdx006.

[17]. Bidadanure, Juliana Uhuru. “The Political Theory of Universal Basic Income.” Annual Review of Political Science 22, no. 1 (May 11, 2019): 481–501. https://doi.org/10.1146/annurev-polisci-050317-070954.

[18]. Ghatak, Maitreesh, and François Maniquet. “Universal Basic Income: Some Theoretical Aspects.” Annual Review of Economics 11, no. 1 (August 2, 2019): 895–928. https://doi.org/10.1146/annurev-economics-080218-030220.