1. Introduction

By November 2023, China's high-speed railway mileage will reach 43,700 kilometres. It has an important role to play in the development of various societies. Firstly, high-speed rail itself has low carbon emissions, which can reduce the pollution produced by enterprises in the production process [1]. At the same time, high-speed rail also has a green spillover effect [2]. In other words, the opening of high-speed rail in order to promote the technological upgrading of enterprises is also conducive to the exercise of the right of supervision by various external actors. Secondly, the opening of high-speed rail increases the fairness between enterprise management and ordinary employees [3]. In addition, the opening of high-speed railway strengthens the connection between enterprises and customers and protects the rights and interests of customers. Finally, the opening of high-speed rail makes the cost and difficulty of shareholder monitoring will be greatly reduced, alleviating possible agency problems and improving internal corporate governance [4]. Therefore, this study selects Chinese listed companies for empirical testing. It is found that the opening of high-speed railway improves firms' ESG performance. In addition, we find that market attention also affects the impact relationship. Our study also shows that the greater the firm's own financing constraints, the smaller the impact of the opening of a high-speed railway on the firm's ESG performance.

This paper has some contributions. First, ESG is affected by various aspects such as politics, culture [5-6], and fundamental firm characteristics [7-8]. However, fewer scholars have examined the influence of HSR on environmental, social and governance (ESG) performance, and our study enriches existing research. Secondly, many scholars have explored the impact of high-speed rail opening on firms' cost, performance and innovation with the new economic geography theory and signalling theory [9-10], but there is a lack of exploring firms' ESG performance, and this study expands the application of related theories to a certain extent.

2. Data and Summary Statistics

2.1. Data and Sample

We selected Chinese listed companies from 2010 to 2021 for this study. The ESG score data in this study is from Bloomberg database, and the HSR station data and other data are from China Research Data Service Platform (CNRDS), which makes the data of this study more reliable. In addition, in order to make the sample selected for this study more representative, listed companies in the financial and real estate industries as well as companies in risk warning status were excluded from this study. After the downsizing process, the present study finally obtains 11,413 observations.

In order to control the influence of other factors on this study, financial leverage, firm size, board size, firm growth, firm age, Tobin's Q and book-to-market ratio are selected as control variables in this study, controlling for industry and year. As shown in Table 1.

Table 1: Variable definitions.

Variables | Description |

ESG | Bloomberg ESG Rating Score |

HSR | The value is 0 before the opening of the high-speed railway and 1 after the opening of the high-speed railway |

Size | Logarithm of total assets at the end of the period |

Board | Board of Directors |

Growth | Operating income growth/year-earlier operating income |

LEV | Total liabilities/total assets |

Age | Statistical year-opening year+1 |

TB | TB Tobin's Q |

BK | BK Shareholders' Equity/Market Capitalization |

Time | Year Dummy variable |

Industry | Industry Dummy Variable |

2.2. Summary Statistics

Table 2 aggregates the summary statistics and correlation matrix of the main variables in our study. Panel A shows the quantitative characteristics of the sample.. We can find that the standard deviation of ESG scores of listed companies is 8.81, which tentatively suggests that the ESG performance of Chinese listed companies is mixed and there is much room for improvement. Panel B of Table 2 reports the results of the Pearson correlation test. It can be tentatively concluded that the opening of high-speed railways is positively correlated with firms' ESG scores. This result tentatively supports our conjecture.

Table 2: Summary statistics.

Panel A: Summary statistics of variables | |||||||||

Variables | N | Mean | SD | Min | Median | Max | |||

ESG | 11413 | 28.15 | 8.810 | 11.72 | 27.28 | 55.30 | |||

HSR | 11413 | 0.890 | 0.320 | 0 | 1 | 1 | |||

LEV | 11413 | 0.480 | 0.200 | 0.0700 | 0.490 | 0.900 | |||

Size | 11413 | 23.19 | 1.330 | 20.45 | 23.07 | 26.97 | |||

Board | 11413 | 9 | 1.860 | 5 | 9 | 15 | |||

TB | 11413 | 2.180 | 1.600 | 0.850 | 1.620 | 10.01 | |||

Bk | 11413 | 0.670 | 0.270 | 0.110 | 0.670 | 1.220 | |||

Age | 11413 | 13.02 | 7.270 | 0 | 13 | 27 | |||

Growth | 11413 | 0.180 | 0.400 | -0.510 | 0.110 | 2.610 | |||

Panel B: Correlation matrix | |||||||||

Variables | ESG | HSR | LEV | Size | Board | TB | Bk | Age | Growth |

ESG | 1 | 0.207 | 0.073 | 0.457 | 0.02 | -0.027 | 0.129 | 0.193 | 0.016 |

3. Main Results

3.1. High-speed rail opening and corporate ESG performance

This subsection examines how the opening of high-speed rail affects firms' ESG performance. We first introduce our empirical model and then provide the estimation results.

In order to examine the link between high speed rail turn-up (HSR) and firms' ESG performance, we developed the following model:

\( {ESG_{i,t}}={α_{0}}+{α_{1}}{HSR_{i,t}}{+\sum Controls_{i,t}}+{\sum Industry_{i,t}}+{\sum Time_{i,t}}+{ε_{i,t}} \) (1)

where i and t represent sample, and time, respectively. We also include time-industry fixed effects. In line with other scholars, we cluster firm-level standard errors in order to eliminate serial correlation.

The estimation of the hypotheses is shown in Table 3. We find that the impact coefficient of the opening of the HSR is 1.032, which is significantly at the 1 per cent level. We also conducted an additional empirical analysis of the sub-scores. The column 2-4 shows the results of our further estimation. We can observed that the coefficients of HSR opening on environmental score, social score and governance score are 1.194, 0.779 and 1.384 respectively, which further proves that the opening of high-speed railway can promote the performance of listed companies in many ways, and therefore improve the rating agencies' scores of the companies.

Table 3: The Impact of High Speed Rail Opening on Corporate ESG Performance.

Variables | (1) | (2) | (3) | (4) |

ESG | E | S | G | |

HSR | 1.032*** | 1.194** | 0.779** | 1.384*** |

(3.49) | (2.65) | (2.21) | (3.22) | |

Observations | 11,413 | 11,413 | 11,413 | 11,413 |

R-squared | 0.566 | 0.566 | 0.315 | 0.165 |

Control variables | YES | |||

Industry fixed effects | YES | |||

Time fixed effects | YES | |||

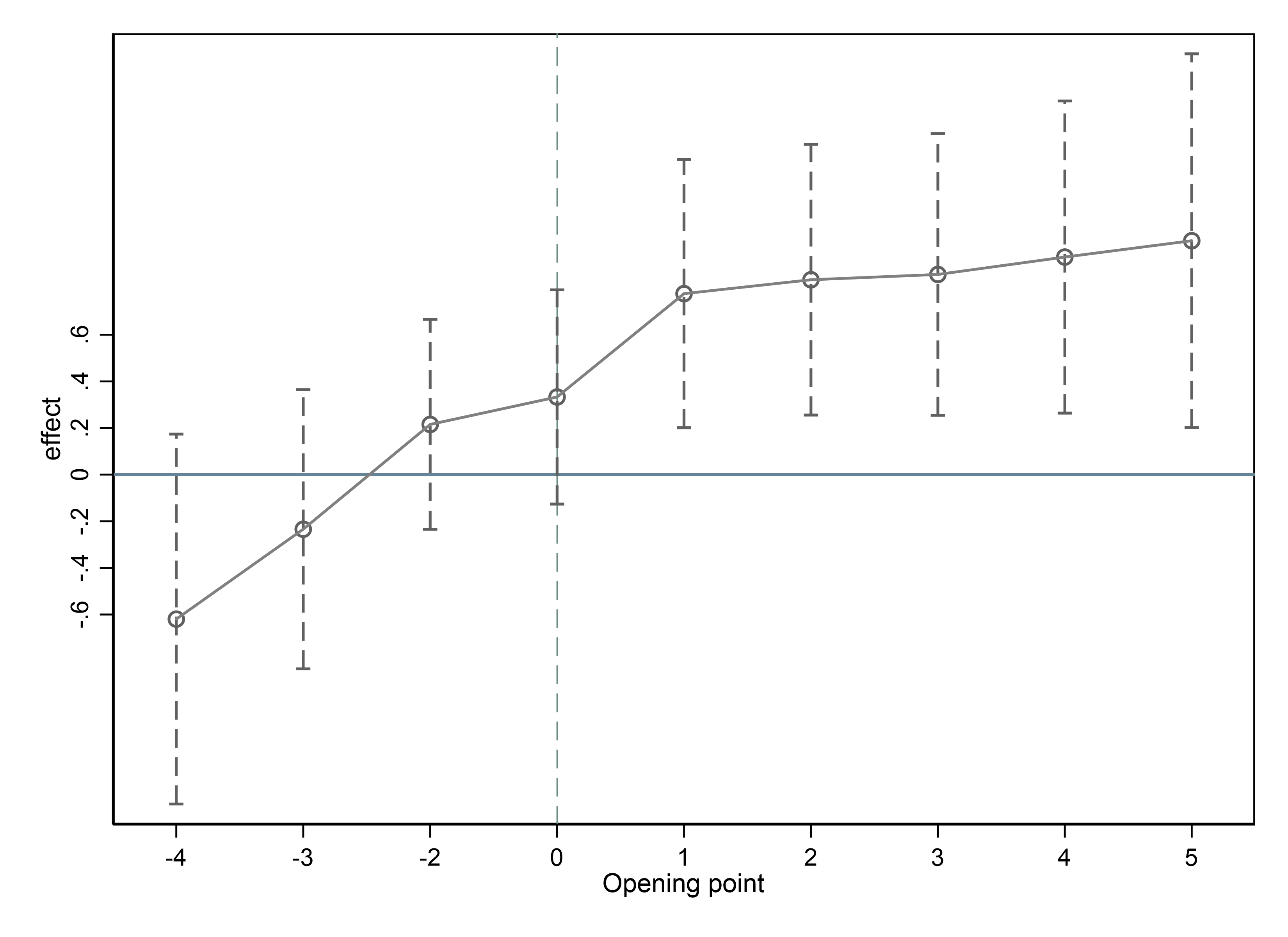

3.2. Comparing trends before and after the opening of the HSR

Using a multi-period DID model to detect policy effects does not allow for direct inferences about whether the results are affected by factors such as time [11]. To avoid possible errors, we tested for parallel trends.

We can find the results of the parallel trend test in Figure 1. When the opening point is "-4" to "-2", the confidence interval for the significance of the data contains 0, i.e., the coefficients are not significant. On the contrary, the coefficients of the data with opening points from "1" to "5" are significant. This means that our estimates pass the parallel trend test. We also note that ESG performance is significantly positive 1-5 years after the opening of the HSR, further supporting our hypothesis.

Figure 1: parallel trend test.

3.3. propensity score matching

Existing research suggests that propensity score matching hair can mitigate endogeneity in econometrics [12]. Therefore, this study conducted 1-to-2 matching of control variables to obtain matched samples for regression analyses. We can notice from Table 4 that there is no endogeneity problem in this study.

Table 4: Estimates after propensity score matching.

Variables | (1) | (2) |

ESG | ESG | |

HSR | 1.027*** | 0.960*** |

(3.57) | (3.07) | |

Observations | 11,367 | 11,367 |

R-squared | 0.460 | 0.566 |

Control variables | NO | YES |

Industry fixed effects | YES | |

Time fixed effects | YES | |

3.4. Replacement of ESG measurement

In addition to Bloomberg's ratings of ESG performance, there are also numerous domestic institutions that rate ESG, such as the Huazheng ESG Index launched in 2018, which adopts the retrospective method to rate ESG by quarter, and is recognised by many scholars in China. In other Chinese scholars' studies, year-end values and annual averages were used to measure firms' ESG performance, respectively [13]. Therefore, this study also uses these two methods to replace ESG rating data to further demonstrate the robustness of this study.

The estimates after replacing the ESG measure are shown in Table 5. Column (1) shows the results using the yearly average value of the huazheng ESG index, and column (2) shows the results using the year-end value of the huazheng ESG index, and it can be found that the coefficients of the impact of the opening of the high-speed railway on the ESG performance of the firms are 0.08 and 0.07, respectively, indicating that the results are robust.

Table 5: Using the Huazheng ESG Index as an ESG measure.

Variables | (1) | (2) |

ESG(Annual average) | ESG(value at end of year) | |

HSR | 0.080*** | 0.070** |

(2.69) | (2.21) | |

Observations | 37,562 | 35,746 |

R-squared | 0.204 | 0.221 |

Control variables | YES | |

Industry fixed effects | YES | |

Time fixed effects | YES | |

4. Additional analysis

4.1. Heteroskedasticity analysis

In this subsection, we further investigate whether the external characteristics of a firm's location mitigate or exaggerate the impact of the opening of high-speed rail on a firm's ESG performance. One study found that analyst attention is an important indicator of capital market attention to firms [14]. Therefore, we use market attention as a proxy for external characteristics and group them by median. Table 6 shows the estimation results. We observe that firms with a high market focus (Coverage = 1) are more affected.

Table 6: Heterogeneity of external concerns.

Variables | (1) ESG | (2) ESG |

Coverage=1 | Coverage=0 | |

HSR | 1.410*** | 0.608* |

(3.54) | (1.75) | |

Observations | 5,350 | 6,063 |

R-squared | 0.611 | 0.539 |

Control variables | YES | |

Industry fixed effects | YES | |

Time fixed effects | YES | |

4.2. The moderating role of financing constraint

In our previous analyses, we found that the availability of high-speed rail affects firms' ESG performance. In this section, we explore whether financing constraints have an impact on this relationship.

The main reason why financing constraints arise is because of information differences between firms and lending institutions [15]. In layman's terms, financing constraints refer to the difficulty of obtaining financing for a firm. When corporate financing constraints are high, firms are more willing to invest their funds in financial or physical assets with fast returns and high yields so that firms can recover their funds quickly [16]. Good environmental, social and governance performance cannot be achieved without corporate investment in projects for environmental protection and charitable donations. However, these investments do not generate profits in the short term. Therefore, enterprises with lower financing constraints can optimise their production structure and improve their ESG performance by obtaining more financial support [17] , for example, by increasing the number of energy-saving equipment purchases and strengthening technological transformation.

In order to empirically investigate the above possible moderating effects, we collected data on the financing constraints of each firm from the Chinese CSMAR database. We built the following regression model to study the above channels:

\( {ESG_{i,t}}={β_{0}}+{β_{1}}{HSR_{i,t}}{+{β_{2}}{HSR_{i,t}}*{SA_{i,t}}+\sum Controls_{i,t}}+{\sum Industry_{i,t}}+{\sum Time_{i,t}}+{ε_{i,t}} \) (2)

where \( {SA_{i,t}} \) is the firm's financing constraint, in which t denotes the year and i denotes the firm. All regressions include year-industry fixed effects. Control variables are consistent with equation (1).

Table 7 reports the estimation results. The coefficient of high speed rail opening (HSR) is significant at 10.569, while the cross-multiplier term is significant at -2.531, which supports our hypothesis with the results. It suggests that financing constraints have a negative moderating effect on the relationship between HSR opening and firms' ESG performance.

Table 7: The moderating role of financing constraints.

Variables | ESG |

HSR | 10.569** |

(2.14) | |

HSR*SA | -2.531* |

(-1.92) | |

Control variables | YES |

Observations | 11,413 |

R-squared | 0.568 |

Industry fixed effects | YES |

Time fixed effects | YES |

5. Conclusion

We select China, where high-speed railway construction and ESG ratings are developing rapidly, as the study area, and select a sample of listed companies over an 11-year period to empirically investigate the relationship between the opening of high-speed railways and firms' ESG performance. We find that high-speed rail can positively affect firms' ESG through resource and capital flows. Meanwhile, our study also shows that we also conduct a heterogeneity analysis and find that the opening of high-speed rail has a greater impact on firms with a higher level of concern. In addition, when firms' financing constraints are high, firms can only rely on existing accumulation to overcome negative market externalities, which leads to the negative moderating effect of financing constraints on the opening of high-speed rail on firms' ESG performance.

Our findings provide a better understanding of the micro impacts of the opening of HSR. It also reveals the additional benefits of accelerated high-speed railway construction, informing policymakers in China and other countries that are making significant efforts to develop high-speed railways. This study also has limitations. Firstly, the data in this study also lacks time span in the time dimension, which is mainly due to the late start of ESG ratings in China. Second, this study does not consider possible intermediation mechanisms, the possible channels of which can be explored in a further study.

References

[1]. Schmutzler A. The hidden benefits of high-speed rail[J]. Nature Climate Change, 2021,11(11):902-903.

[2]. Gao Y, Song S, Sun J, et al. (2020) Does High‐Speed Rail Connection Really Promote Local Economy? Evidence from China's Yangtze River Delta[J]. Economic Growth eJournal.

[3]. Li, X.Z., JI, X.l., Zhou, L.L. (2017) Can high-speed rail improve enterprise resource allocation? --Micro evidence from China's industrial enterprise database and high-speed rail geographic data[J]. Economic Review, 3-21.

[4]. GUO, Z.R., H, J. (2021) The time-space compression effect of high-speed rail and corporate cost of equity capital--empirical evidence from A-share listed companies[J]. Financial Research, 190-206.

[5]. Ioannou I, Serafeim G. (2012) What drives corporate social performance? The role of nation-level institutions[J]. Journal of International Business Studies, 834-864.

[6]. Cai Y, Pan C H, Statman M. (2016) Why do countries matter so much in corporate social performance?[J]. Journal of Corporate Finance, 591-609.

[7]. Baraibar-Diez E, D. Odriozola M. (2019) CSR Committees and Their Effect on ESG Performance in UK, France, Germany, and Spain[J]. Sustainability.

[8]. Dempere J M, Abdalla S. (2023) The Impact of Women’s Empowerment on the Corporate Environmental, Social, and Governance (ESG) Disclosure[J]. Sustainability

[9]. Fritsch M, Slavtchev V. (2011) Determinants of the Efficiency of Regional Innovation Systems[J]. Regional studies,905-918.

[10]. Ye. D.Z., P, S., L, Z.X. (2020) Can the opening of high-speed rail reduce corporate agency costs - based on the perspective of off-site independent directors[J]. Financial Regulation Research,51-68.

[11]. BECK, T., LEVINE, R. and LEVKOV, A. (2010), Big Bad Banks? The Winners and Losers from Bank Deregulation in the United States. The Journal of Finance, 65 (5): 1637–67.

[12]. Hamilton, B. H., & Nickerson, J. A. (2003). Correcting for endogeneity in strategic management research. Strategic Organization, 1(1), 51-78.

[13]. Wang, Y. C , Yang, (2023) R .Y , He, K, et al. Can Digital Transformation Enhance Corporate ESG Performance? --A study based on legitimacy theory and information asymmetry theory[J]. Securities Market Herald, 4-25.

[14]. Zhang, C., Lu, W. (2007) Information Disclosure, Market Concerns and Financing Constraints[J]. Accounting Research,32-38.

[15]. Bae J, Yang X, Kim M. (2021) ESG and Stock Price Crash Risk: Role of Financial Constraints*[J]. Asia-Pacific Journal of Financial Studies,556-581.

[16]. Zhao, S. K., Zou, R. (2023) Management equity incentives, financing constraints and corporate financialisation[J]. Friends of Accounting,92-98.

[17]. Zhao C, Ban Y., LI H.B., et al. (2023) Digital transformation of enterprises and labour income share[J]. Financial Research, 49-63.

Cite this article

Tang,M.;Li,X. (2024). Can the Opening of High Speed Rail Boost Corporate ESG? - Empirical Evidence from China. Advances in Economics, Management and Political Sciences,75,37-43.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 3rd International Conference on Business and Policy Studies

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Schmutzler A. The hidden benefits of high-speed rail[J]. Nature Climate Change, 2021,11(11):902-903.

[2]. Gao Y, Song S, Sun J, et al. (2020) Does High‐Speed Rail Connection Really Promote Local Economy? Evidence from China's Yangtze River Delta[J]. Economic Growth eJournal.

[3]. Li, X.Z., JI, X.l., Zhou, L.L. (2017) Can high-speed rail improve enterprise resource allocation? --Micro evidence from China's industrial enterprise database and high-speed rail geographic data[J]. Economic Review, 3-21.

[4]. GUO, Z.R., H, J. (2021) The time-space compression effect of high-speed rail and corporate cost of equity capital--empirical evidence from A-share listed companies[J]. Financial Research, 190-206.

[5]. Ioannou I, Serafeim G. (2012) What drives corporate social performance? The role of nation-level institutions[J]. Journal of International Business Studies, 834-864.

[6]. Cai Y, Pan C H, Statman M. (2016) Why do countries matter so much in corporate social performance?[J]. Journal of Corporate Finance, 591-609.

[7]. Baraibar-Diez E, D. Odriozola M. (2019) CSR Committees and Their Effect on ESG Performance in UK, France, Germany, and Spain[J]. Sustainability.

[8]. Dempere J M, Abdalla S. (2023) The Impact of Women’s Empowerment on the Corporate Environmental, Social, and Governance (ESG) Disclosure[J]. Sustainability

[9]. Fritsch M, Slavtchev V. (2011) Determinants of the Efficiency of Regional Innovation Systems[J]. Regional studies,905-918.

[10]. Ye. D.Z., P, S., L, Z.X. (2020) Can the opening of high-speed rail reduce corporate agency costs - based on the perspective of off-site independent directors[J]. Financial Regulation Research,51-68.

[11]. BECK, T., LEVINE, R. and LEVKOV, A. (2010), Big Bad Banks? The Winners and Losers from Bank Deregulation in the United States. The Journal of Finance, 65 (5): 1637–67.

[12]. Hamilton, B. H., & Nickerson, J. A. (2003). Correcting for endogeneity in strategic management research. Strategic Organization, 1(1), 51-78.

[13]. Wang, Y. C , Yang, (2023) R .Y , He, K, et al. Can Digital Transformation Enhance Corporate ESG Performance? --A study based on legitimacy theory and information asymmetry theory[J]. Securities Market Herald, 4-25.

[14]. Zhang, C., Lu, W. (2007) Information Disclosure, Market Concerns and Financing Constraints[J]. Accounting Research,32-38.

[15]. Bae J, Yang X, Kim M. (2021) ESG and Stock Price Crash Risk: Role of Financial Constraints*[J]. Asia-Pacific Journal of Financial Studies,556-581.

[16]. Zhao, S. K., Zou, R. (2023) Management equity incentives, financing constraints and corporate financialisation[J]. Friends of Accounting,92-98.

[17]. Zhao C, Ban Y., LI H.B., et al. (2023) Digital transformation of enterprises and labour income share[J]. Financial Research, 49-63.