1. Introduction

Geely was founded by Eric Li (Li Shufu) in Taizhou City, Zhejiang Province in 1986. It entered the automotive industry in 1997 and is now a global innovative technology conglomerate that includes automobile, powertrain and key components design, research and development, production, sales and service, as well as mobility services, digital technology, financial services, education and other businesses. Geely Group produces passenger cars, commercial vehicles, and new energy vehicles. It has total assets of over 510 billion yuan and employs more than 140,000 people. Geely Group is one of the top 10 automotive brands in China and one of the top 10 companies in the world in terms of global automotive brand portfolio value. The company holds a significant position in the Chinese market, as well as in the new energy vehicle market and other fields. Geely is an international market-oriented multinational automobile company with world-class modern automobile and powertrain manufacturing plants in China, the United States, the United Kingdom, Sweden, Belgium, and Malaysia. The company has also established styling design and engineering R&D centers in Shanghai, Hangzhou, Ningbo, Gothenburg, Coventry, California, and Frankfurt, Germany. With over 30,000 R&D and design personnel, more than 4,000 sales outlets, and exports to over 100 countries, Geely Holding Group is a leading player in the global automobile industry [1]. The company has a global sales and service network. In the first half of 2023, the company sold a total of 694,000 units, a 13.1% increase from the previous year. The operating income was 73.18 billion yuan, a 25.8% increase from the previous year. The average unit sales revenue increased by 6.8% year-on-year. The company's cash level remained stable at RMB33.64 billion, and the operating cash flow increased by 9.1% to RMB10. In the first half of this year, R&D investment in intelligent electrification increased by 62.8% year-on-year to RMB5.91 billion. Geely, the company, has several subsidiaries and partners around the world, including internationally renowned car brands such as Volvo Cars and Lynk & Co, and is driving the development of its brands worldwide [2]. Geely is known for its continuous and technological innovation. In response to the trend of digitalization, Geely Group has partnered with Sensors Data to accelerate digital transformation. Together, they aim to build a global journey data operation platform, explore the full life cycle value of users, achieve multi-channel user growth and refined operations, and empower performance growth with an excellent digital experience. In this regard, this essay follows up with some analyses of Geely's external and internal environments, risk management,and so on.

2. External Environment of Geely

In recent years, the automobile manufacturing industry has become an important part of the world's civil industrial system, driving a series of upstream and downstream industrial chains, and automobiles are Geely's main sales products. As a leading company in China's automobile manufacturing industry, Geely faces many competitors at home and abroad. The gradual opening of the international automobile market has increased the pressure on Geely's international competition, while the increase in the variety of Chinese domestic automobiles has also compressed Geely's share in the Chinese market. In the domestic market, competitors such as SAIC Group, BYD Auto, Changan Automobile, and Guangzhou Automobile have shown impressive competitiveness. SAIC, for example, is one of China's largest automakers, with a strong market share and a diversified product line that packs a powerful punch in both the joint venture and independent brand segments. SAIC's large scale and broad product portfolio pose a huge competitive challenge to Geely Group in the market. Meanwhile, with the rapid development of the new energy vehicle market, BYD Auto's leading position in the electric vehicle segment provides it with a significant competitive advantage. Its innovation in electric vehicles and hybrid technology has been highly successful, giving BYD a strong market share and brand influence in this field. This makes Geely Group have to face fierce competitive pressure in the new energy vehicle market. In the international market, Volkswagen Group, Toyota Motor Corporation, Honda Motor Company, Ford Motor Company, and other established international companies have a huge market population and perfect industrial system. Volkswagen Group,one of the largest manufacturers of automobiles in the world, owns famous brands under it such as Volkswagen, Audi, Porsche, etc. It has a strong competitiveness in terms of rich products and global strategies. Toyota is known for its quality and hybrid power, and its strong brand image period makes it a competitor of Geely in several market segments.

At the same time, as people become more environmentally aware, the government's mention of new energy sources and the growing sharing economy and smart cities may make public transport and shared mobility services an alternative option. For example, in areas such as Manchester in the UK, China stated in its 20th National Congress report that it would create livable, resilient, and smart cities. The creation of smart cities may not only improve the efficiency of traffic in terms of intelligent transport, but may also lead to fewer people choosing to travel by private car. At the same time as the era of technological progress, people are full of curiosity and fantasy about future technological products, emerging transport vehicles, and technologies, just like self-driving cars, aircraft, etc., some of these vehicles may have a certain impact on the use of personal vehicles. Thirdly, with the advent of data, the integration of automobiles and technology is becoming particularly important, which could see companies like tech giants such as Apple and, Google emerge as new competitors. These companies have advanced technology and innovation capabilities and may introduce highly intelligent automotive products to capture Geely's market share, among others. Lastly, Geely Group as an automobile manufacturer involves numerous raw materials, components, etc. that require the support of multiple supply chains such as steel, rubber plastics, glass, electronic components, battery production, etc. from multiple suppliers. However, Geely Group, as one of the world's leading automobile manufacturers, has a huge production scale, Geely company in China, the United States, the United Kingdom, Sweden, Belgium, and Malaysia has world-class modern vehicle and powertrain manufacturing plants, with all kinds of sales outlets more than 4,000, product sales and service network around the world [1]. At the same time, with the intensification of competition in the automotive industry, consumers' personalized needs have begun to influence automotive research and development and production, Geely Automobile's intelligent manufacturing strategy implementation plan, mainly using the "three lines" interoperability mode, the strategy to open up the product research and development line, the product delivery line (including the supply chain) and the production line of the manufacturing line data, and the IOT platform as a data center. IoT platform as a data center.

With the IOT platform as the data center, BI, micro-service development, AI algorithms, and other technologies are applied to empower the data application, and application systems such as intelligent management cockpit, IOT micro-service group, lean scheduling mathematical model, advanced scheduling, and process management platform are deployed to generate "knowledge ubiquity" effect from business management to business analysis, and from lean production to agile response. It provides technical support for the brand value of glamour quality, lean management, timely delivery, and agile development [3]. The use of supply chain OTWB integrated logistics information platform, specifically including the OMS order management system, TMS scheduling management system, WMS warehouse management system, and BMS billing management system, is the digital supply chain system framework that is widely used by the logistics industry. In the past two years, Geely has independently developed an OTWB platform [4].

The use of the ESG management model for personnel stipulates the requirements for suppliers in terms of the working environment and human rights, health and safety, business ethics, environmental protection, etc., making the sustainability assessment of suppliers more standardized [5]. The writing method effectively controls costs and enhances the competitiveness of the company. As for consumers, Geely Automobile caters to a wide range of consumer groups, including individual consumers, families, and corporate car-buying needs. The company's product line covers a wide range of segments from small cars to SUVs and luxury vehicles. Since 2013, Geely acquired Manganese Bronze Holding (MBH), Emerald Automotive, acquired 49.9% of Proton Holdings and 51% of the British luxury sports car brand Lotus Group, Terrafugia, 51.5% equity of Saxo Bank. After this series of mergers and acquisitions, Geely has perfected the direction of each of its brands. It covers the low-end, mid-end and high-end markets, and opens up the global market. This multi-level competitive landscape allows Geely to play to its strengths in different market segments and meet the needs of different consumer groups [6].

Currently, Geely's brands cover a wide range of needs from mass to high-end markets. Geely Geometry, Geely China Star, and Geely Galaxy series, which are positioned in the mass market, focus on the price range of 100,000-200,000 yuan; Link, which is priced at 200,000-300,000 yuan, is positioned in the mid-range and high-end, and is an important part of Geely's electrification, high-end and globalization; and Extreme Krypton is an intelligent pure electric vehicle positioned in the luxury of 300,000 yuan or more.

3. Internal Environment of Geely

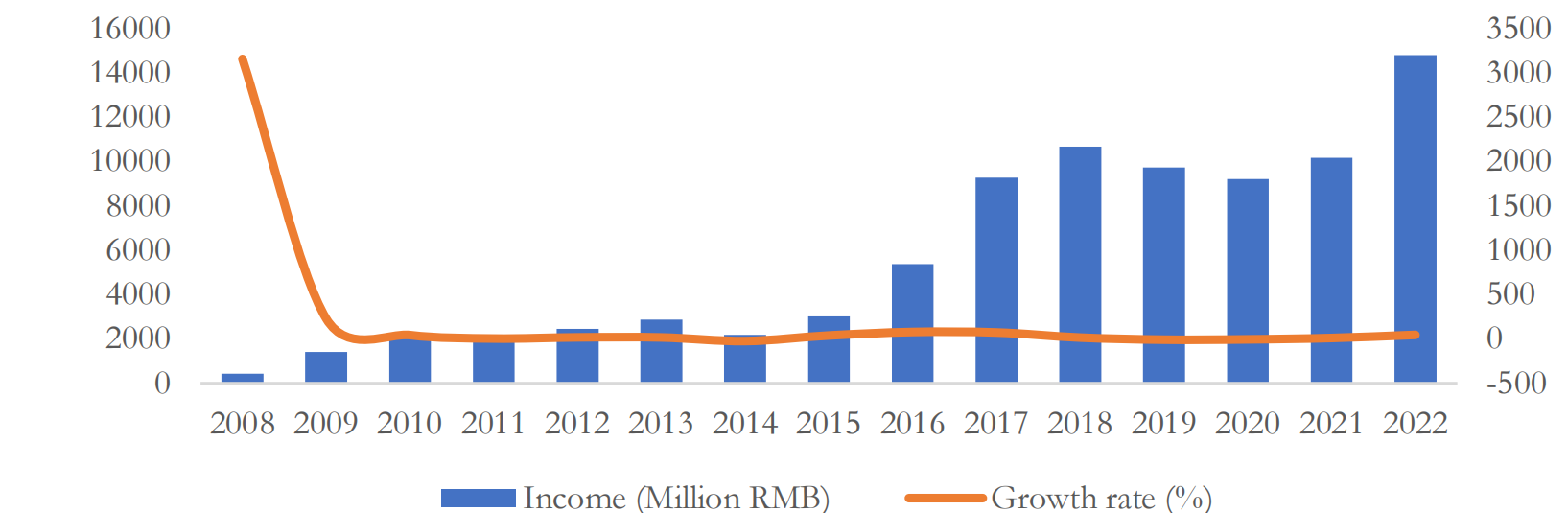

Geely has been able to flourish in the fierce automotive industry, Geely Group from 2007 to implemented a multi-brand to date, Geely transformation and upgrading to seize the development opportunities in overseas and domestic markets. For 08 years Geely deployed three major sub-brands all off the line, and ten years income Volvo 100% shares.

Figure 1: Income and Growth Rate of Geely [7].

As can be seen from Figure 1, before 2018 Geely's operating income showed a steady increase. In 2018, affected by the COVID-19, from 2018 to 2020, the total operating income of the enterprise showed a continuous downward trend, from 106.595 billion yuan to 92.114 billion yuan. From the viewpoint of driving factors, the company's operating income is directly related to its car sales, and the decline in corporate revenue in 2018-2019 is mainly due to the fact that the company's product life cycle is already in the maturity period, and compared with the new energy car new forces in the industry, the market competitiveness of the enterprise has been diluted to a large extent, and in 2020, it will be hit by the severe impact of the COVID-19 epidemic, and the automobile consumer market will be in the doldrums, at the same time, due to the stoppage of production and the impact of overseas input recession, enterprise auto parts and industry chain operating costs have risen, the company's operating income further, by 2020, Geely foreign sales revenue decreased, and then Geely with 2021 with the normalisation of the epidemic, and the company's investment in online channels, the brand market puts a significant rise in the interval from 2021 to 2022 to sales volume continued to rise, and by 2022, Geely Automobile Group's cumulative sales of 1.43 million units, a record high in sales volume (see Table 1).

Table 1: Geely’s net profit and gross profit, 2013 Q1–2022 Q2 [8].

Date | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 |

Net income | 9.28 | 6.58 | 7.50 | 9.52 | 11.46 | 11.78 | 8.41 | 6.01 | 4.77 | 3.56 |

Gross profit | 20.08 | 18.23 | 18.15 | 18.32 | 19.38 | 20.18 | 17.37 | 16.00 | 17.14 | 14.12 |

But in 2022 sales increased at the same time, the company's foreign investment costs also gradually rose, Geely's overall net profit margin gradually declined, Geely Automobile began to energy change started late, and in the new energy vehicle research and development period, the growth costs rose sharply, reducing operating profits, the company's overall profit is a declining curve. The overall gross profit margin declined, and the performance of the profit side was much weaker than the market expectation. As the profitability of new energy vehicles is much lower than that of fuel vehicles, Geely Automobile's gross profit margin level in 2022 was only 14.1%, down 3 percentage points from the same period in 2021. In terms of sub-brands, the Extreme Krypton brand suffered a significant loss of 2.04 billion yuan, and Link Automotive's net profit was only 7.222 million yuan, a decline of nearly 99 percent from the same period last year (700 million yuan) [9]. Looking at the longer-term cycle, Geely Auto's gross profit margin on sales has been in a year-on-year decline since 2018, which has led to the company's profit-end performance falling far short of market expectations. From the point of view of the index of net profit from attribution, Geely Auto's net profit from attribution in 2022 will be 5.123 billion yuan, which is still less than half of the level of the same period in 2018 (12.553 billion yuan) [10]. Geely Automobile started the energy change late, and during the research and development of new energy vehicles, growth costs rose significantly, reducing operating profit. Rising costs of raw materials such as batteries also reduced Geely's gross profit.

Table 2: Geely’s Trailing Twelve Months, 2013Q1–2022Q2 [11].

Date | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 |

TTM | 9.66 | 12.11 | 13.41 | 11.6 | 19.71 | 8.87 | 15.39 | 39.76 | 36.22 | 20.43 |

As of June 2023, Geely's diluted EPS for the past six months was $0.02, and Geely's diluted EPS for the last 12 months was $0.07. The going concern P/E ratio is derived by dividing the current share price by the company's going concern EPS. Over the past ten years, Geely's going concern P/E ratio has a maximum value of 53.46 and a minimum value of 6.6 with a median of 17.05 [10]. Table 2 also illustrates that Geely has not escaped from the impact of the epidemic on the industry, and has been affected by the incentives of the external competition, which has also had a huge impact on Geely's internal business. Geely in the process of the past ten years, Geely established a high brand awareness and a perfect supply chain, 2023 Geely car sales of more than 1.6 million units, and Geely new energy vehicles cumulative sales of 487,461 units, a year-on-year strong increase of more than 48%; year-on-year growth of about 36 [12]. It can be reflected in the Geely good operating policy and excellent brand image, while the new market adaptability, Geely gradually get rid of the impact of the epidemic on the company. At the same time from the strategic level, Geely has also launched partnerships with several international and Chinese domestic, actively carrying out research and cooperation in the field of automotive design, powertrain, intelligent manufacturing, and other areas, and continues to launch new products to meet market demand.

At the same time, Geely also focuses on co-operation with internationally renowned automobile manufacturers to introduce advanced production technology and management experience to enhance its core competitiveness. Facing the world, Geely adopts the company to gradually grow its market share by continuously optimizing its product structure, expanding its sales channels, and enhancing its brand awareness. At the same time, the company also actively promotes its internationalization strategy and increases the development and layout of overseas markets, which has made certain achievements. This also reflects the strength of Geely's internal technology and its value concept. In the field of ecology, Geely has integrated the concept of sustainability into the entire value chain of the vehicle's life cycle, promoting the integration and symbiosis between the enterprise and the environment. The Krypton 009 uses environmentally friendly materials throughout the entire vehicle, achieving a 30% share of plant-based raw materials; the Geometry E model uses plastic materials made from plant straw and recycled PET fibers. The entire vehicle of the Lutus pure-electric supercar SUV Eletre can be reused at a rate of more than 89%. In the manufacturing process, the manufacturing bases in China have achieved an industrial wastewater and exhaust gas discharge rate of 100 %; the Wuhan intelligent factory of Lutece Technology has achieved rainwater reuse and is planning to save 35,000 cubic meters of water throughout the year; the LEVC base in the United Kingdom has set up a special hibernation area for amphibians and reptiles; and the Lutece Hethel factory in the United Kingdom has created several eco-insect hotels by using wooden pallets from the logistics center. Insect hotels. Geely is gradually transforming into a nature-beneficial business model through life-cycle resource conservation, closed-loop production, and nature-related risk and opportunity management [13].

4. Risk Assessment

Nowadays, automobiles, as an important part of the global economic economy, are faced with many aspects of market risk, firstly, facing the global market economic downturn by the macroeconomic impact of the consumer's desire to buy, the ability to buy and the heart may be subject to a series of impacts. Take the epidemic period to illustrate, in early 2020, the COVID-19 epidemic outbreak led to the implementation of embargoes and restrictions in several countries, affecting people's lifestyles and economic activities. This situation raised the risk of demand volatility in the automotive sector. As a result of the blockades and social distance measures, many people postponed or canceled their car purchasing plans. Automakers faced a sudden drop in demand for their sales, and production lines had to adjust to market changes. Some carmakers had to reduce production capacity, suspend production lines, or even lay off staff to cope with the sharp drop in demand. At the same time, the auto parts supply chain has also been hit, as global transport restrictions and production disruptions have led to supply chain tensions. Secondly, technological changes may also create market risks for the automotive industry, which has suffered capacity bottlenecks since the outbreak of the COVID-19 epidemic, due to multiple uncertainties such as upstream supply shortages and changes in the international situation.

At the same time, the transformation of energy power from fuel to electrification and the intelligent upgrading of autonomous driving and Telematics have brought IT and Internet companies into deeper intersection with the automotive industry, further driving the dramatic changes in the global landscape of the automotive industry. Geely itself, is also facing many challenges, first of all, the new energy segment has still not formed a planning effect, at present, the market scale of new energy vehicles under Geely Group and the total share of the Group's business is 22.9 percent, and the traditional automotive products are still the main force of the Geely Group, however, Geely Group's investment in the research and development of new energy-related technologies has far exceeded that of the traditional automotive segment. With Geely Group's layout in the new energy industry chain ecosystem, the contradiction between huge investment and reporting cycle will bring great pressure on Geely's future development. Additionally, the fact with the industry inputs don't match the tempo of end-to-end conversions. Established in 2016, Yigatong, as a car technology operating system for Geely, and expanding its R&D business to autonomous driving as well as cockpit chips, is an important node of Geely's industrial chain strategy in the transformation of commercial applications, but by the end of 2022, the enterprise had not achieved good performance and market reputation. As one of Geely's main products, the Extreme Krypton series is equipped with a car system that is quite criticized by the market. Meanwhile, unlike the intelligent assisted driving system, Geely's autonomous driving, a future strategic high point in the new energy vehicle sector, has still not made much progress.

5. Conclusion

To sum up, through in-depth investigation and analysis of Geely as the research object. This article analyses Geely and discusses the issues Geely is facing under the transformationalisation of automotive energy and data, as well as the internal and external industry environment of Geely Automobile, and the risks facing the automotive industry today. It reflects Geely's continued investment in technology and new energy and the profound impact it has had in the wake of the COVID-19 epidemic. Looking back at the present, Geely is still relying on its strong brand influence and strength to gradually recover from the epidemic and return to the normal path. Looking to the future, Geely continues to adopt ESG, a blueprint for advancing sustainable development with ESG, and integrates environmental, social and governance (ESG) principles into the corporate governance structure and business operations management of the entire Group. By establishing and improving the ESG governance structure, the long-term resilience of business development is guaranteed. At the same time, we focus on globalization, technological innovation and social responsibility at the strategic level. Together, these factors have shaped Geely's image as a leading automotive company, but they also require the company to remain flexible and constantly adapt its strategy to changes in the industry.

References

[1]. Wang, B. X. (2023). Long-term Synergies of Geely Automobile's Acquisition of Volvo. Journal of Tongling Vocational and Technical College, 22(03), 39-45.

[2]. Lu, Y. D., & Chen, J. Y. (2023). The Impact of Financial Strategy on Corporate Performance: A Case Study of Geely Automobile. Modern Business, (15), 108-111.

[3]. Li, R. F., Zhou, J., Zhang, Y., et al. (2021). Implementation of Geely Automobile's Smart Manufacturing Strategy. Automobile Technologist, (06), 59-64.

[4]. Sun, L. P. (2023). Analysis of Geely's Acquisition of Volvo Based on Enterprise Mergers and Acquisitions Theory. National Circulation Economy, (12), 120-123.

[5]. Geely Auto 2022 Financial results released. (2023). https://global.geely.com/en/news/2023/geely-auto-financial-results-2022

[6]. Wen, L., Liu, R. Y., & Ye, Y. (2024). Analyzing Geely’s acquisition of Volvo in terms of motivation, risk and competitive markets. Advances in Economics Management and Political Sciences, 69(1), 1–10.

[7]. Zhao, H. K. (2023). Analysis of Synergies in Geely's Acquisition of Volvo, Jilin University.

[8]. Li, X. (2023). Study on the Strategic Transformation and Financial Performance of Volvo Car Group, Yunnan Normal University.

[9]. Deng, N. J., Chen, D. A., & Li, X. M. (2023). Research on Internationalization Strategy of the Automobile Manufacturing Industry: A Case Study of Geely Automobile. Foreign Trade and Economic Cooperation, (04), 17-20.

[10]. Cao, Y. N. (2023). Insights from "David vs. Goliath" Type Enterprise Mergers and Acquisitions: A Case Study of Geely's Acquisition of Volvo. China Storage and Transportation, (04), 98.

[11]. Chen, C. (2023). Performance Analysis of Geely's Acquisition of Volvo. Cooperation Economy and Technology, (03), 128-129.

[12]. Chen, Y. A., Wang, X. J., & Young, M. N. (2015). Geely automotive's acquisition of Volvo. Asian Case Research Journal, 19(01), 183-202.

[13]. Lopacinska, K. (2016). The merger of Geely automobile and Volvo car corporation as an example of the expansion of Chinese capital in the automotive sector. International Journal of Business and Administrative Studies, 2(6), 162.

Cite this article

Xiao,S. (2024). A Company Analysis on Geely Based on Its External and Internal Environment. Advances in Economics, Management and Political Sciences,79,283-289.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 3rd International Conference on Business and Policy Studies

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Wang, B. X. (2023). Long-term Synergies of Geely Automobile's Acquisition of Volvo. Journal of Tongling Vocational and Technical College, 22(03), 39-45.

[2]. Lu, Y. D., & Chen, J. Y. (2023). The Impact of Financial Strategy on Corporate Performance: A Case Study of Geely Automobile. Modern Business, (15), 108-111.

[3]. Li, R. F., Zhou, J., Zhang, Y., et al. (2021). Implementation of Geely Automobile's Smart Manufacturing Strategy. Automobile Technologist, (06), 59-64.

[4]. Sun, L. P. (2023). Analysis of Geely's Acquisition of Volvo Based on Enterprise Mergers and Acquisitions Theory. National Circulation Economy, (12), 120-123.

[5]. Geely Auto 2022 Financial results released. (2023). https://global.geely.com/en/news/2023/geely-auto-financial-results-2022

[6]. Wen, L., Liu, R. Y., & Ye, Y. (2024). Analyzing Geely’s acquisition of Volvo in terms of motivation, risk and competitive markets. Advances in Economics Management and Political Sciences, 69(1), 1–10.

[7]. Zhao, H. K. (2023). Analysis of Synergies in Geely's Acquisition of Volvo, Jilin University.

[8]. Li, X. (2023). Study on the Strategic Transformation and Financial Performance of Volvo Car Group, Yunnan Normal University.

[9]. Deng, N. J., Chen, D. A., & Li, X. M. (2023). Research on Internationalization Strategy of the Automobile Manufacturing Industry: A Case Study of Geely Automobile. Foreign Trade and Economic Cooperation, (04), 17-20.

[10]. Cao, Y. N. (2023). Insights from "David vs. Goliath" Type Enterprise Mergers and Acquisitions: A Case Study of Geely's Acquisition of Volvo. China Storage and Transportation, (04), 98.

[11]. Chen, C. (2023). Performance Analysis of Geely's Acquisition of Volvo. Cooperation Economy and Technology, (03), 128-129.

[12]. Chen, Y. A., Wang, X. J., & Young, M. N. (2015). Geely automotive's acquisition of Volvo. Asian Case Research Journal, 19(01), 183-202.

[13]. Lopacinska, K. (2016). The merger of Geely automobile and Volvo car corporation as an example of the expansion of Chinese capital in the automotive sector. International Journal of Business and Administrative Studies, 2(6), 162.