1. Introduction

Romer continues to use the equilibrium and optimum methodologies of neoclassical economics. In growth models, they seek to eliminate decreasing returns and endogenous technological processes. This is an expansion and improvement of the traditional neoclassical theory of growth, also known as endogenous growth theory [1]. One of the most pressing issues of endogenous growth theory is to explain the possibility of continuous economic growth and the causes for disparities in economic growth rates [2]. Although the neoclassical economic growth theory offered exogenous technological progress and population growth rate to explain sustained economic development, exogenous technological progress rate and population growth rate did not conceptually solve the problem of sustained economic growth.

The endogenous growth hypothesis is based on the neoclassical economic growth model[3]. In a way, the neoclassical growth theory's assumptions are relaxed and linked variables are endogenized in the endogenous economic growth theory. According to the Ramsey model, the long-term growth rate is tied to the exogenous value x of the pace of technological advancement. Long-term, a greater propensity to save or a rise in technology results in larger levels of capital or more efficient worker productivity but has no effect on the growth rate per capita. Consider immigration and emigration for economic opportunity first. This procedure modifies the population and labor force for a particular birth and death rate. Second, it introduces birth rate alternatives. This is another means by which population and labor can be determined endogenously[4]. The endogeneity of labor supply in a growth paradigm also includes migration and labor/leisure selection, in which population and labor are no longer equal.

2. Model Dynamics and Economic Implications

2.1. Theoretical Framework and Mathematical Foundations

\( u(c)=\frac{{c^{1-θ}}-1}{1-θ} \) (1)

Thus,

\( \frac{\dot{c}}{c}=\frac{1}{θ}(r-ρ) \) (2)

In the model, lower intertemporal substitution elasticity would lead to a weaker willingness to substitute consumption between periods.

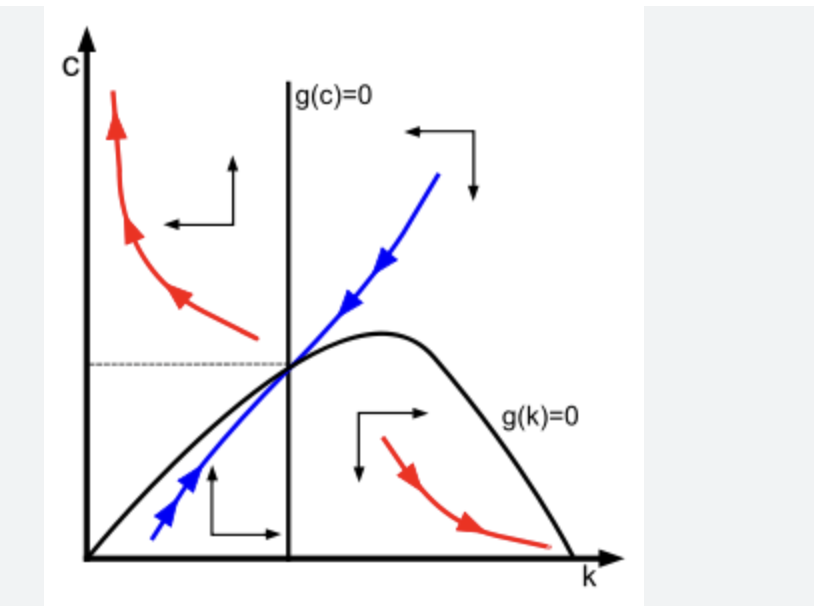

Figure 1: Trajectory Analysis in Ramsey Model

Observing the trajectory requires determining k(0) and discussing the transfer dynamics of c(0) at various points. Alternatively, we determine c(0) and explore the transfer dynamics of k(0) at various places. Using this strategy, it is possible to conclude that c(0) is unique at a particular critical point. This merely causes the economy to gravitate to its equilibrium position (steady state point). Other paths are not conceivable, and the path to the saddle point is an equilibrium path. In other words, this path is the sole path that leads to competitive equilibrium. This route is also known as the ideal growth route.

2.2. Endogenous Growth Perspectives

The Ramsey model is a dynamic economic model that attempts to describe how economies grow through time. In this concept, growth is endogenous, as opposed to exogenous influences such as technological advancements or government regulations. To induce endogenous growth in the Ramsey model, several requirements must be met. The first requirement is a steady return to manufacturing scale. This indicates that an increase in production inputs, will result in an increase in output that is proportional to the increase in inputs. If there are increasing returns to scale, larger firms will be dominant and stifling competition, which can limit growth [5]. Second, information development must have a positive spillover effect. This implies that the knowledge created by one enterprise or household can be utilized by others in the economy, resulting in a cycle of innovation and economic progress. In the Ramsey model, this spillover effect is reflected by the assumption that knowledge is a non-rivalrous good, meaning that multiple individuals in the economy can use it without diminishing its availability to others.[5] Thirdly, a system for reaping the advantages of knowledge creation is required. This is made possible by intellectual property rights, such as patents and copyrights, which enable companies to reap the rewards on their efforts in invention. Without these mechanisms, enterprises may underinvest in knowledge development, resulting in lower growth rates. Finally, there must be a mechanism for saving and investment.

2.3. Policy Implications and Growth Projections

In the context of the Ramsey model, public policy has the potential to have a significant bearing on long-term growth. The model sheds light on both the short-term and the long-term consequences that a variety of policy initiatives have on economic growth. In this response, we will focus on some of the most significant policy actions that can have an impact on the Ramsey model's projections of long-run economic growth. The funding of research and development is an essential component of any sound policy (R&D). In the Ramsey model, the production of new knowledge is an essential factor in endogenous growth, as was mentioned earlier. Investing in research and development (R&D) is one way for governments to contribute to the creation of new knowledge. This investment may take the form of grants to educational institutions or subsidies to for-profit businesses engaged in research and development. Another essential intervention on the part of policymakers is the provision of public goods like as infrastructure and education. The production of private businesses and families as well as the dissemination of knowledge can both benefit from the provision of public goods. For example, investing in transportation infrastructure can lower the cost of transporting goods, increasing economic growth and company competitiveness. Investing in education, on the other hand, can increase human capital as well as productivity, both of which can lead to better growth rates in the long run. The tax system is the third essential policy measure. According to the Ramsey model, the structure of the tax system has the potential to have an impact on the total quantity of money that is saved and invested. If capital income taxes are high, then households and firms may invest less in both physical and human capital, which will result in slower rates of growth over the long term. On the other hand, if taxes on labor income are high, households might decide to work less, which would result in lower output and growth rates.

3. The Impact of Brexit and COVID-19 on Consumption and Capital Dynamics in the Ramsey Model

3.1. Theoretical Framework and Mathematical Foundations

\( \dot{\hat{k}}=f(\hat{k})-\hat{c}-(x+n+δ)\hat{k} \) (3)

So,

\( {f^{ \prime }}(\hat{k})=δ+ρ+θx \)

\( ⇒\dot{\hat{c}}=0 locu \) (4)

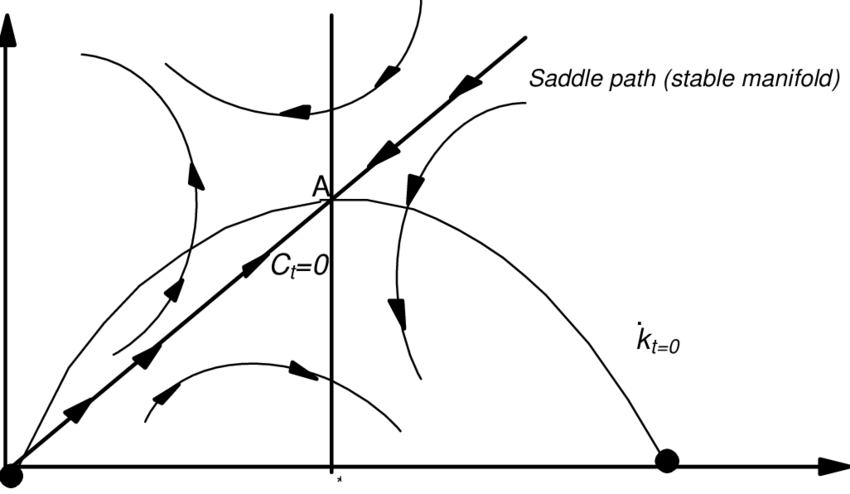

Figure 2: Capital and Consumption Dynamics in Ramsey Model

There must be some k^, which makes the dynamic growth rate of consumption zero. Hence a vertical line. Since f'(k(t)) is a single-decreasing function, in the area to the left of the vertical line, the growth rate of consumption is positive, otherwise it is negative.

3.2. Economic Implications of Brexit and COVID-19 pandemic

Under the framework of the Ramsey model, the Brexit, or the United Kingdom's decision to leave the European Union, has had substantial ramifications for the country's long-term growth prospects. Brexit could have a huge influence on trade, which is one of its many potential consequences. Because it was a member of the European Union (EU), the United Kingdom enjoyed access to a sizable market in which there were few obstacles to commerce. For this reason, the profits from trade may be reduced, which may in turn lead to lower levels of output and investment and limit the possibility for endogenous growth. Likewise, the United Kingdom's capacity to recruit and keep talented people from all over the world could be hampered by Brexit. This could restrict the possibility for knowledge spillovers and the rewards from innovation, both of which are essential for endogenous growth.

The COVID-19 pandemic has had a significant impact on the economy of the world, particularly with regard to the potential effects it may have on long-term growth when viewed within the context of the Ramsey model. The lockdown measures that have been imposed by governments in an effort to restrict the propagation of the virus have had both direct and indirect effects on the conditions that are necessary for endogenous growth. As a direct consequence of the lockdown measures, there has been a reduction in economic activity. Output and investment have decreased as a result of the closure of non-essential businesses and travel restrictions. The conditions necessary for endogenous growth have also been indirectly impacted by the lockdown measures. For example, the pandemic has produced disruptions in global supply chains. On the other hand, it is not impossible that the pandemic could result in changes to the environment that are beneficial and necessary for endogenous growth. For instance, the pandemic has resulted in a greater reliance on distant labor and digital technology, both of which have the potential to generate additional chances for the dissemination of knowledge and the development of new ideas.

The UK's GDP growth has been volatile over the past decade. It has experienced periods of strong growth, followed by periods of contraction, and this trend has continued even after the Brexit referendum in 2016. However, the COVID-19 pandemic has had a significant negative impact on the UK's economy, with GDP contracting by a record 9.9% in 2020. To analyze the impact of these events on long-run growth within the context of the Ramsey model, we can look at the components of GDP that drive long-run growth, namely capital accumulation and technological progress. Capital accumulation refers to the investment in physical and human capital, while technological progress refers to the development of new technologies and innovations.

3.3. Comparative Perspectives: Policy, Innovation, and Long-Term Growth

There is a chance that Brexit will have an effect on the United Kingdom's capacity to invest in research and development. The United Kingdom receives a significant portion of its funding for scientific investigation from the European Union (EU), and the impending departure from the EU may result in a reduction in the total amount of money devoted to research and development. This might put a damper on the potential for knowledge generation and innovation, both of which are essential for continued economic expansion over the long term. On the other side, the United Kingdom will have a larger degree of autonomy over its own internal regulatory environment, giving it the opportunity to pursue policies that are possibly more beneficial to economic growth and innovation. As a result, the effects of Brexit on Ramsey's model of long-term economic growth are complex and unpredictable [1]. Even though Brexit might make it more difficult for the conditions that are necessary for endogenous growth to occur, it is also possible that the United Kingdom will pursue policies that are more conducive to growth in the event that it is no longer a member of the European Union. In the end, the impact that Brexit will have on growth in the long run will rely on a variety of factors, such as the policies that are pursued by the government of the United Kingdom (UK) and the extent of trade frictions with the European Union (EU) and other trading partners.

The epidemic has also brought to light the importance of investing in public health infrastructure, which, over the longer run, may lead to improvements in both health and productivity. In addition, the steps taken by the government in response to the outbreak may have a significant effect on long-term growth. However, if these policies are not well targeted, they could result in higher levels of debt and inflation, so restricting the prospect of long-term growth. This would be the case since higher levels of debt and inflation would make it more difficult to service debt. As a consequence of this, the implications of the COVID-19 lockout on long-term growth in the Ramsey model are complex and unexpected. The longer-term consequences of the pandemic on growth will depend on a variety of different variables, including the effectiveness of government measures and the capacity of firms to adapt to the changing economic climate.

4. Conclusion

This essay analyzes the Ramsey model of endogenous economic growth and how public policy and exogenous events, such as Brexit and the COVID-19 pandemic, might affect long-term growth. The Ramsey model necessitates constant returns to scale, positive spillovers from knowledge development, means for capturing the benefits of knowledge creation, and a mechanism for saving and investment to provide endogenous growth. Brexit could restrict trade, knowledge transfer, and financing for research and development, whereas the COVID-19 pandemic has limited economic activity and investment but may result in advancements to public health infrastructure and digital technology. Public policy, such as sponsoring research and development, providing public goods, and developing a tax structure that encourages saving and investment, can also affect long-term growth.

References

[1]. Romer, P. M. (1990). Endogenous technological change. Journal of political Economy, 98(5, Part 2), S71-S102.

[2]. Guerrini, L. (2010). The Ramsey model with AK technology and a bounded population growth rate. Journal of Macroeconomics, 32(4), 1178-1183.

[3]. Piętak, Ł. (2014). Review of theories and models of economic growth. Comparative Economic Research. Central and Eastern Europe, 17(1), 45-60.

[4]. Accinelli, E., & Brida, J. G. (2007). The dynamics of the Ramsey economic growth model with the von Bertalanffy population growth law. Applied Mathematical Sciences, 1(1-4), 109-118.

[5]. Cerqueti, R., & Coppier, R. (2011). Economic growth, corruption and tax evasion. Economic Modelling, 28(1-2), 489-500.

Cite this article

Huang,Y. (2024). The Ramsey Model's Insight on Long-Term Growth Amidst Brexit and the COVID-19 Pandemic. Advances in Economics, Management and Political Sciences,77,172-176.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 3rd International Conference on Business and Policy Studies

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Romer, P. M. (1990). Endogenous technological change. Journal of political Economy, 98(5, Part 2), S71-S102.

[2]. Guerrini, L. (2010). The Ramsey model with AK technology and a bounded population growth rate. Journal of Macroeconomics, 32(4), 1178-1183.

[3]. Piętak, Ł. (2014). Review of theories and models of economic growth. Comparative Economic Research. Central and Eastern Europe, 17(1), 45-60.

[4]. Accinelli, E., & Brida, J. G. (2007). The dynamics of the Ramsey economic growth model with the von Bertalanffy population growth law. Applied Mathematical Sciences, 1(1-4), 109-118.

[5]. Cerqueti, R., & Coppier, R. (2011). Economic growth, corruption and tax evasion. Economic Modelling, 28(1-2), 489-500.