1.Introduction

In the digital age, the finance sector is increasingly driven by data. The effective management of financial data is no longer just a technical necessity but a strategic asset crucial for decision-making and regulatory compliance. This article delves into the multi-dimensional aspects of financial data management, focusing on the paramount importance of data accuracy, integrity, and security within the stringent regulatory framework governing the finance industry. Data accuracy is the linchpin in risk assessment and financial decision-making; even minor inaccuracies can have substantial ripple effects, leading to flawed risk evaluations and misguided investment strategies. The article also addresses the significant challenges financial institutions face in meeting complex reporting requirements dictated by various regulatory bodies. These challenges are compounded by the need for real-time data processing and analysis in an environment characterized by rapid market fluctuations and evolving financial products. The discussion further extends to the transformative impact of emerging technologies such as Artificial Intelligence (AI), machine learning, and blockchain on financial data management. These technologies offer unprecedented opportunities for enhancing data accuracy, ensuring security, and streamlining compliance processes [1]. However, their integration into existing financial systems also poses unique challenges, particularly in safeguarding data privacy and adapting to the continuously evolving regulatory landscape. This introduction sets the context for a detailed exploration of the strategies, technological advancements, and best practices in the realm of financial data management. Through this comprehensive analysis, the article aims to provide financial professionals with insightful perspectives and practical solutions for navigating the complex, ever-changing world of financial data management, emphasizing the critical role data plays in shaping the future of the finance sector.

2.Data Accuracy and Integrity in Financial Decision-Making

2.1.Data Accuracy in Risk Assessment and VaR Calculation

In the realm of financial decision-making, the accuracy of data plays a pivotal role in risk assessment. Precise data allows financial analysts to accurately gauge the risk associated with various investments, leading to more informed decision-making. For instance, when assessing the credit risk of a borrower, data accuracy ensures that the probability of default is correctly estimated. The use of accurate historical default rates, repayment histories, and market conditions, all contribute to a reliable risk assessment model. Furthermore, inaccurate data can lead to miscalculation of Value at Risk (VaR) metrics, often used by financial institutions to measure and control the level of risk exposure. Formula 1 assumes a normal distribution of returns and calculates the maximum loss that will not be exceeded with a specified confidence level (for example, 95% or 99%). The accuracy of data directly impacts the calibration of these models, influencing the allocation of capital reserves to mitigate risk.

\( {VaR_{α}}=μ-{z_{α}}×σ \)(1)

Where:\( {VaR_{α}} \)is the Value at Risk at a certain confidence level\( α \).\( μ is the mean (or expected value)of the portfolio returns.{z_{α}} is the z-score corresponding to the confidence level α , obtained from the standard normal distribution. \)\( σ \)is the standard deviation of the portfolio returns [2].

2.2.Impact of Data Integrity on Investment Strategies

Data integrity, defined as the maintenance and assurance of data consistency and accuracy over its entire lifecycle, is crucial for developing effective investment strategies. Integrity in financial data ensures that the information used for making investment decisions is not only accurate but also reliable and consistent over time. This is particularly vital in the context of long-term investment strategies, where decisions are based on trends and patterns observed over extended periods. For example, inconsistencies in financial reporting or data manipulation can lead to flawed analyses of company performance, affecting decisions related to stock investments. Furthermore, the integrity of data affects the performance of algorithmic trading systems, which rely heavily on consistent and reliable data to execute trades. Inaccurate or manipulated data can lead to significant financial losses and erosion of investor confidence.

2.3.Data Verification Methods and Their Effectiveness

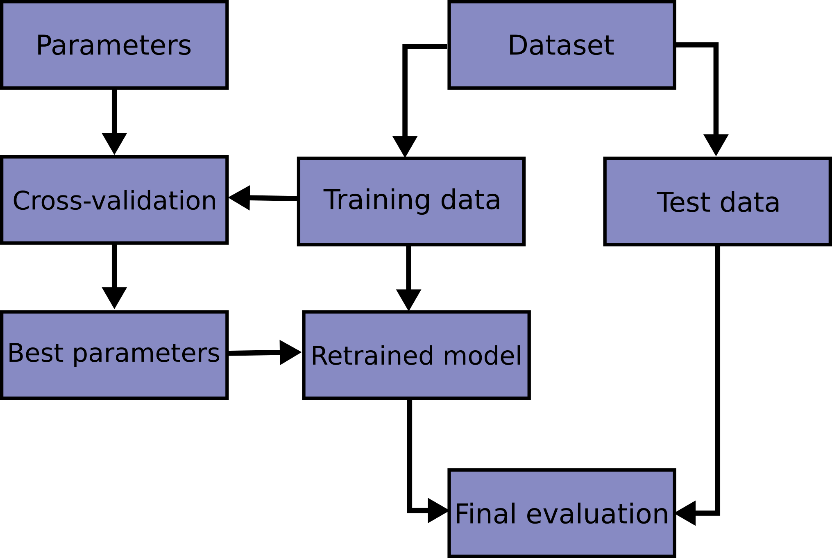

Effective data verification methods are essential to ensure the accuracy and integrity of financial data. One common method is data cross-verification, where financial data is verified against multiple independent sources. Figure 1 shows a data cross-verification process of evaluating estimator performance. For example, a company's reported earnings can be cross-checked with industry benchmarks, audit reports, and market analysis to ascertain its accuracy. Additionally, the implementation of automated data verification tools, utilizing algorithms and machine learning, has gained prominence [3]. These tools can quickly identify inconsistencies or anomalies in large datasets, which might be missed in manual reviews. Another effective method is the use of blockchain technology for data verification, particularly in transactional data. Blockchain’s inherent characteristics of immutability and transparency make it an excellent tool for ensuring the integrity of financial data. However, the effectiveness of these methods largely depends on the quality of the underlying algorithms and the extent of data coverage. Continuous updates and improvements in these verification methodologies are necessary to keep pace with evolving financial practices and technologies.

Figure 1: Cross-validation: evaluating estimator performance.

3.Security Measures in Financial Data Management

3.1.Importance of Data Security in Finance

The imperative of data security in finance cannot be overstated, as the industry deals with sensitive information that has profound implications on economic stability and personal financial wellbeing. Data security in finance encompasses protecting both consumer and corporate data from unauthorized access, breaches, and fraud. The confidentiality, integrity, and availability of data are paramount, given the nature of the financial information being processed, which includes personal identification details, transaction histories, credit scores, and investment strategies. A breach in data security can lead to significant financial losses, erosion of customer trust, regulatory fines, and long-term reputational damage [4]. Furthermore, the financial sector is often a target for cybercriminals due to the lucrative nature of the data, making robust security measures essential.

3.2.Advanced Security Protocols and Compliance

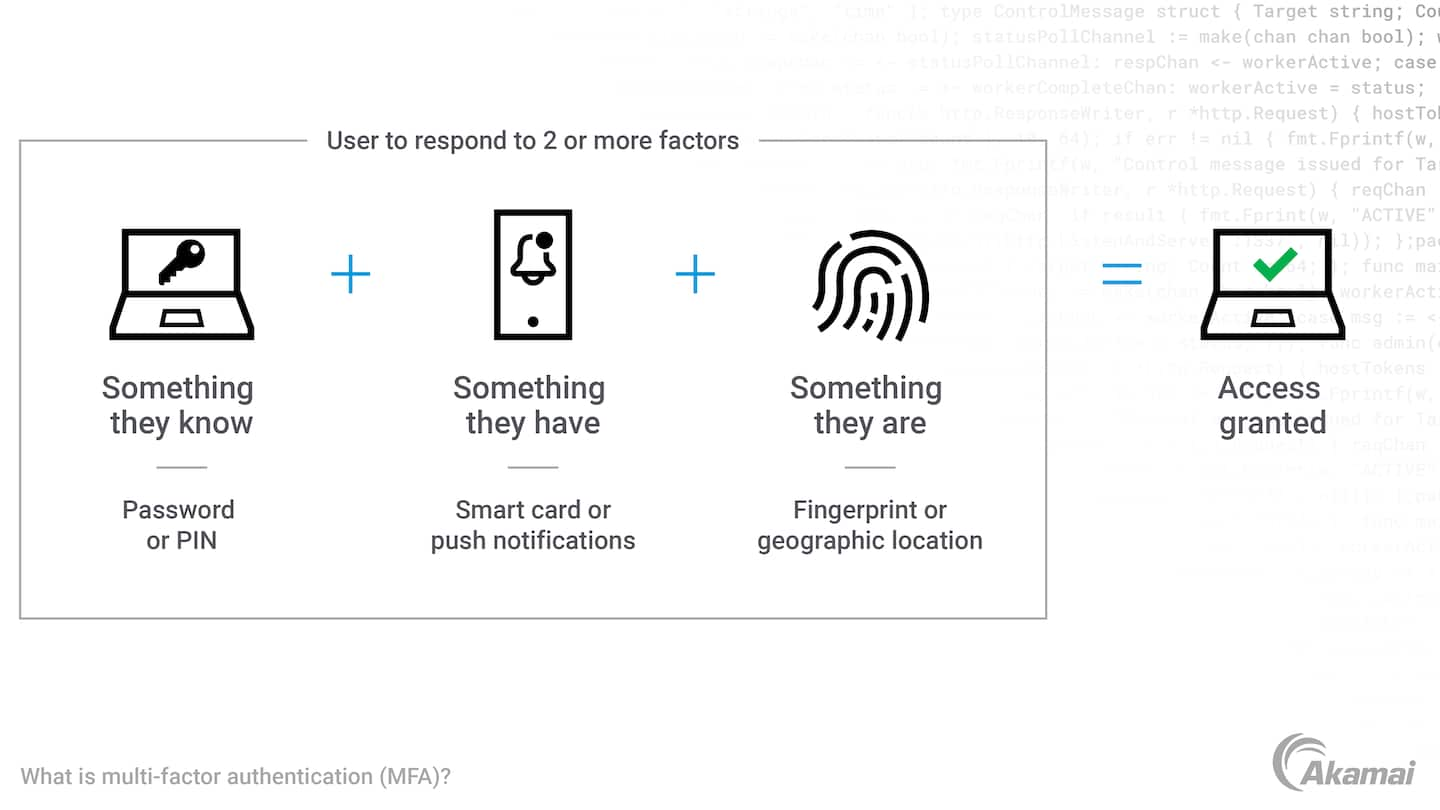

Figure 2: How Multi-Factor Authentication (MFA) works.

In response to the increasing cyber threats, financial institutions have adopted advanced security protocols. These include multi-factor authentication (MFA), end-to-end encryption, and the use of blockchain technology for enhanced security in transactions and data storage. MFA adds an additional layer of security by requiring multiple forms of verification before granting access, significantly reducing the risk of unauthorized access. Figure 2 is a flow chart of how MFA works. End-to-end encryption ensures that data remains encrypted during transmission, safeguarding sensitive information from interception. Blockchain technology offers a decentralized and tamper-evident ledger, ideal for maintaining the integrity of transaction records. Compliance with regulatory standards such as the General Data Protection Regulation (GDPR) in the EU, and the Payment Card Industry Data Security Standard (PCI DSS) globally, is also crucial. These regulations mandate strict data security protocols, including regular audits, compliance reporting, and ensuring that data protection measures are in place to safeguard consumer information.

3.3.Case Studies of Data Breaches and Mitigation Strategies

Examining case studies of data breaches in the financial sector offers valuable insights into potential vulnerabilities and effective mitigation strategies. One notable example is the 2017 Equifax data breach, where personal information of over 147 million consumers was exposed due to an application vulnerability. The aftermath included substantial fines, lawsuits, and a complete overhaul of their security infrastructure. Key mitigation strategies implemented post-breach included the adoption of a more robust security framework, increased investments in cybersecurity, and regular security audits. Another example is the JPMorgan Chase breach in 2014, which affected 76 million households. This breach highlighted the importance of protecting against internal threats and the need for continuous monitoring and updating of security protocols. In response, JPMorgan Chase significantly increased its cybersecurity budget and implemented stricter access controls and monitoring systems. These case studies underscore the need for continuous vigilance, investment in advanced security technologies, and adherence to regulatory standards to prevent and mitigate the impacts of data breaches in the finance sector.

4.Technological Advancements in Data Management

4.1.Emerging Technologies in Financial Data Analysis

The advent of new technologies has revolutionized the way financial data is analyzed and managed. One such breakthrough is the adoption of blockchain technology, which offers a decentralized and transparent way of recording transactions. This technology ensures the immutability and traceability of financial records, mitigating risks associated with data tampering and fraud. In addition, the use of cloud computing in financial data management has provided scalability and flexibility, allowing financial institutions to store and process large volumes of data efficiently and securely. Cloud-based solutions have also facilitated real-time data analysis and reporting, which is crucial for timely decision-making in dynamic financial markets.

4.2.The Role of AI and Machine Learning

Artificial Intelligence (AI) and Machine Learning (ML) are at the forefront of transforming financial data management. AI algorithms are increasingly used for predictive analytics in stock market trading, where they analyze vast datasets to forecast market trends and stock movements. This predictive capability is not limited to trading but extends to areas like fraud detection, where ML algorithms can identify patterns indicative of fraudulent activities [5]. Furthermore, AI-driven chatbots and virtual assistants are enhancing customer service in finance, enabling personalized and efficient client interactions. Machine learning models are also employed in credit scoring, where they analyze a variety of data points to assess a borrower's creditworthiness more accurately than traditional methods.

4.3.Future Trends and Potential Impacts

Looking ahead, the integration of the Internet of Things (IoT) with financial data management is poised to offer even more personalized and efficient services. IoT devices can provide real-time financial data, such as spending patterns and investment preferences, which can be used to tailor financial advice and product offerings. Additionally, the rise of quantum computing presents a potential paradigm shift in data processing capabilities. Its ability to perform complex calculations at unprecedented speeds could revolutionize areas like risk assessment and portfolio optimization. However, these advancements also bring challenges, particularly in data privacy and security. As financial institutions harness these technologies, they must also invest in robust cybersecurity measures and ensure compliance with data protection regulations to safeguard sensitive financial information.

5.Regulatory Compliance and Reporting

5.1.Impact of Regulations on Data Management

Regulatory frameworks such as the General Data Protection Regulation (GDPR) and the Sarbanes-Oxley Act have significantly influenced data management practices in the financial sector. These regulations mandate stringent data handling procedures to ensure accuracy, confidentiality, and integrity of financial information. For instance, GDPR imposes strict guidelines on data privacy, requiring financial institutions to implement comprehensive data governance frameworks. This regulatory environment has compelled organizations to adopt advanced data management systems, focusing on data encryption, audit trails, and secure data storage [6]. Furthermore, regulations like the MiFID II in the European Union emphasize the need for transparent record-keeping and reporting, pushing financial entities to maintain high-quality data that is readily accessible for regulatory scrutiny.

5.2.Challenges in Meeting Reporting Requirements

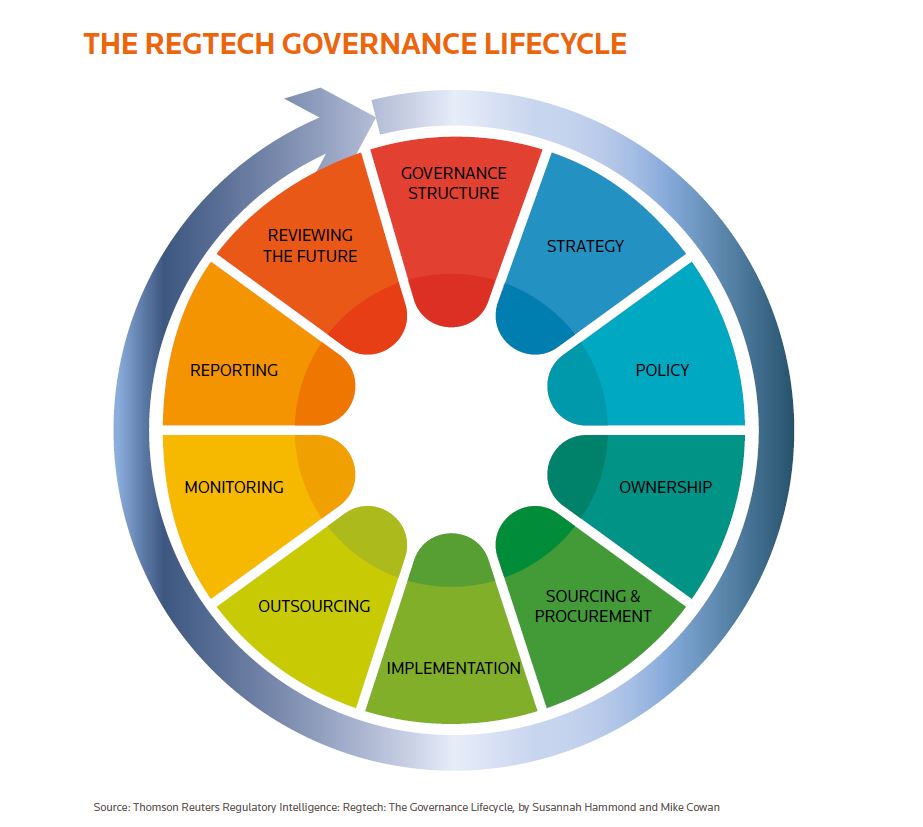

Figure 3: Governance Life Cycle of Regtech.

Financial institutions face multifaceted challenges in adhering to reporting requirements. The complexity of financial data, combined with the need for high accuracy and timeliness in reporting, poses significant operational challenges. For example, the Dodd-Frank Act in the United States requires comprehensive reporting of derivatives transactions, which demands precise and real-time tracking of a vast array of financial instruments. Additionally, cross-border transactions complicate compliance due to varying international regulations, necessitating a global approach to data management and reporting. The dynamic nature of financial markets further exacerbates these challenges, as institutions must constantly adapt their reporting processes to accommodate new products and changing regulatory landscapes [7]. This dynamic requires continuous monitoring and updating of data systems, often leading to increased costs and resource allocation for compliance purposes.

5.3.Best Practices for Regulatory Compliance

To effectively navigate the complexities of regulatory compliance, financial institutions must adopt a proactive and strategic approach to data management. Best practices include implementing robust data governance frameworks that define clear roles, responsibilities, and procedures for data handling. Regular audits and compliance checks are essential to ensure adherence to regulatory standards. Leveraging technology, such as regulatory technology (RegTech) solutions, can streamline compliance processes [8]. Figure 3 is the governance life cycle of RegTech.

6.Conclusion

This article has systematically explored the essential aspects of financial data management, shedding light on the importance of data accuracy, security, and compliance in the finance sector. Through the analysis of risk assessment methodologies, challenges in regulatory reporting, and the adoption of emerging technologies, it becomes evident that managing financial data is a complex yet vital task. The case studies and best practices discussed underscore the need for robust data management strategies to navigate the evolving financial landscape. The integration of advanced technologies like AI, machine learning, and blockchain has emerged as a significant trend, offering new opportunities for efficiency and security in data handling. However, these advancements also bring forth challenges, particularly in the realms of data privacy and cybersecurity. As the financial industry continues to evolve, staying abreast of these developments and adapting to regulatory changes will be crucial for institutions aiming to maintain competitive edge and ensure financial stability. This article serves as a comprehensive resource for professionals in the financial sector, offering insights and guidance on managing data effectively in an increasingly digital and regulated world.

References

[1]. Ahmad, Kashif, et al. "Developing future human-centered smart cities: Critical analysis of smart city security, Data management, and Ethical challenges." Computer Science Review 43 (2022): 100452.

[2]. Hasan, Md Morshadul, József Popp, and Judit Oláh. "Current landscape and influence of big data on finance." Journal of Big Data 7.1 (2020): 1-17.

[3]. Alzamil, Zamil, Deniz Appelbaum, and Robert Nehmer. "An ontological artifact for classifying social media: Text mining analysis for financial data." International Journal of Accounting Information Systems 38 (2020): 100469.

[4]. Lahmiri, Salim, et al. "Performance assessment of ensemble learning systems in financial data classification." Intelligent Systems in Accounting, Finance and Management 27.1 (2020): 3-9.

[5]. Levis, Brooke, et al. "Accuracy of the Edinburgh Postnatal Depression Scale (EPDS) for screening to detect major depression among pregnant and postpartum women: systematic review and meta-analysis of individual participant data." bmj 371 (2020).

[6]. Jiménez-Jiménez, Sergio Iván, et al. "Digital terrain models generated with low-cost UAV photogrammetry: Methodology and accuracy." ISPRS International Journal of Geo-Information 10.5 (2021): 285.

[7]. Erickson, Nick, et al. "Autogluon-tabular: Robust and accurate automl for structured data." arXiv preprint arXiv:2003.06505 (2020).

[8]. Solove, Daniel J., and Paul M. Schwartz. Information privacy law. Aspen Publishing, 2020.

Cite this article

Du,J. (2024). Navigating the Nuances of Financial Data Management: Strategies for Accuracy, Security, and Compliance. Advances in Economics, Management and Political Sciences,79,290-296.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 3rd International Conference on Business and Policy Studies

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Ahmad, Kashif, et al. "Developing future human-centered smart cities: Critical analysis of smart city security, Data management, and Ethical challenges." Computer Science Review 43 (2022): 100452.

[2]. Hasan, Md Morshadul, József Popp, and Judit Oláh. "Current landscape and influence of big data on finance." Journal of Big Data 7.1 (2020): 1-17.

[3]. Alzamil, Zamil, Deniz Appelbaum, and Robert Nehmer. "An ontological artifact for classifying social media: Text mining analysis for financial data." International Journal of Accounting Information Systems 38 (2020): 100469.

[4]. Lahmiri, Salim, et al. "Performance assessment of ensemble learning systems in financial data classification." Intelligent Systems in Accounting, Finance and Management 27.1 (2020): 3-9.

[5]. Levis, Brooke, et al. "Accuracy of the Edinburgh Postnatal Depression Scale (EPDS) for screening to detect major depression among pregnant and postpartum women: systematic review and meta-analysis of individual participant data." bmj 371 (2020).

[6]. Jiménez-Jiménez, Sergio Iván, et al. "Digital terrain models generated with low-cost UAV photogrammetry: Methodology and accuracy." ISPRS International Journal of Geo-Information 10.5 (2021): 285.

[7]. Erickson, Nick, et al. "Autogluon-tabular: Robust and accurate automl for structured data." arXiv preprint arXiv:2003.06505 (2020).

[8]. Solove, Daniel J., and Paul M. Schwartz. Information privacy law. Aspen Publishing, 2020.