1.Introduction

As a long-standing media and film powerhouse, Disney has undergone numerous transformations to establish a business model centered around four key pillars: media, theme parks, film and television, and derivatives. Among these pillars, the streaming media sector serves as a distribution channel that emerged in response to the digital entertainment landscape in recent years, fundamentally revolutionizing Disney's operational approach[1]. While it may not yield immediate substantial profits, the user remains at the core of this venture. In light of the digital shift transferring users directly to distribution endpoints and emphasizing direct-to-consumer strategies, seizing opportunities for business transformation becomes imperative.

2.Background of digital reform

2.1.Internal causes

2.1.1.Capped traditional business and poor profitability

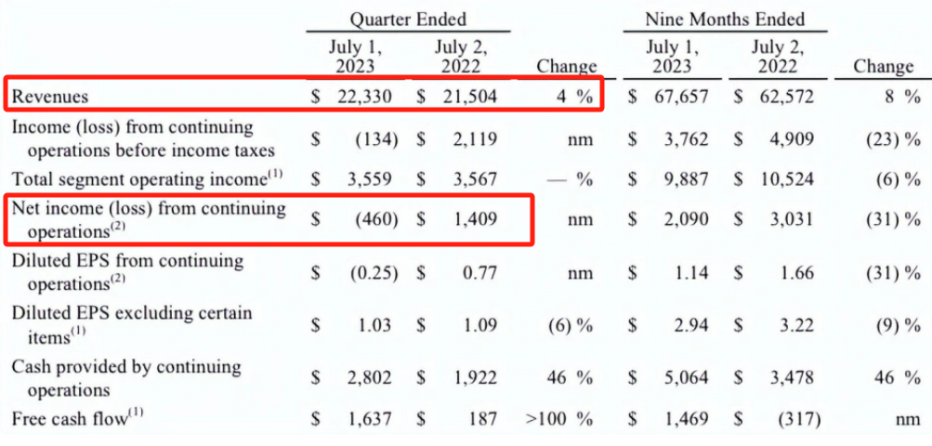

According to Disney's third quarter results report of the fiscal year 2023, it revealed a lot of "cold" : revenue of $22.33 billion, an increase of only 4%, lower than the market expectation of $22.51 billion; The net loss attributable to the parent was $460 million, compared with net income of $1.409 billion in the same period last year, a rare quarterly net loss. Traditional cable TV networks and theme park businesses have faced growth ceilings, and Disney's next operational focus will be mainly streaming media.

Figure 1: Financial statements of 2023Q3

2.1.2.The failure of quantity over quality

2023 will be Disney's 100th birthday, but it will also be the first year without a top three global box office and a superhero movie as spectacular as the past. Since 2019, with the "Avengers" and "Star Wars" series ending, Disney has not produced a multi-billion dollar box office miracle, especially last year, the latest movie and TV content fell short of expectations. IP(Intellectual Property) performance recession harms its roots, the company's strategy needs to change.

2.2.External causes

2.2.1.The failure of distribution channels

Digital streaming media era has come, online video streaming media service with its real-time, interactive, convenience and other advantages, gradually meet the audience's growing entertainment needs. According to the Mordor Intelligence2023 report, the media streaming market size is expected to grow from $119.01 billion in 2023 to $173.73 billion in 2028, with a CAGR(Compound Annual Growth Rate) of 7.86% over the forecast period (2023-2028). Traditional television is on the decline as more consumers spend their attention and money on streaming and cancel their cable subscriptions.

According to Nielsen data, the share of time spent by TV subscribers on cable video channels continued to decline last year. In the medium and long term, the advertising revenue of cable TV will continue to be under pressure, and the profit margin will be gradually weakened in the future, and the revenue situation of Disney's cable network business in recent years can also be seen that users have a trend of migration from cable TV to streaming media.

In the context of the failure of traditional TV channel advantages and the monopoly of new media distribution channels, according to Ken Wilber's four-quadrant theory analysis of Internet social characteristics, it is found that the construction of a contact platform with user viscosity (that is, contact interface) is a key move for us to re-connect with users on social relationship channels [2]. Major traditional media have recognized the importance of homemade DTC (Direct To Customer) platform.

2.2.2.The catfish effect of market entrants

As a competitive market, the film and television entertainment industry, especially the digital media industry, relies on creative drive and business model innovation, so it is a highly competitive free entry market without technical barrier.After the transformation of Netflix, the status of the established content giants, set off the wind of change.

Psychology has found that joining competitors will significantly promote the efficiency of individual action, and this social promotion effect is called the "catfish effect", which is also applicable in corporate behavior. The success of Netflix and the entry of old content companies have stimulated traditional media and film companies to make new innovations, forming a positive market competition.

3.Analysis of Disney industry behavior around streaming media reform

3.1.Organizational behavior: merger and reorganization, matrix attack

Under the impact of domestic and foreign troubles, Disney has consolidated its position as a content giant by acquiring Pixar, Marvel and Lucas film, and opened a new round of large-scale mergers and acquisitions; At the same time, adjust the internal organizational structure to adapt to the new situation. All have laid a solid foundation for the digital reform in its century-old revolution.

Platform development is inseparable from the need for technology, Disney's entry into streaming media began with the acquisition of BAMTech in 2017. In April 2018, Disney embedded ESPN+ in ESPN, in April 2019, Disney acquired the official control of Hulu, and in November 2019, Disney+ landed in North America, and successively launched in Europe and the Asia-Pacific region. In 2020, the company will deeply integrate its Hulu operations and improve its streaming matrix.

To expand new business, the internal organizational structure needs to keep up. In order to better cope with digital changes, Disney has made three major strategic restructuring of its internal structure in recent years.

•First recognizing the importance of direct-to-consumer, Disney conducted its first business restructuring in 2018, forming a "direct-to-consumer and international" division;

•Later, under the impact of the epidemic in 2020, "direct-to-consumer service" began to become a separate major business activity independent of cable TV and content sales and licensing;

•In February 2023, Disney officially announced its third strategic reorganization. The company is organized into three core business segments: the Disney Entertainment segment, which includes most of its distribution media and media businesses; the ESPN segment, which includes Television Networks and ESPN+; and the Parks, Experiences and Products segment.

The further independence of the streaming entertainment business highlights its importance to Disney's future development.

The latest business restructuring is also complemented by performance changes in the company's "new financial structure". Three strategic reorganizations, three parts of the assessment and management of the business, have brought more cost efficiency to Disney's operations and a more coordinated and streamlined management model.

3.1.1.Analysis of Fox acquisition from the perspective of streaming media reform

Disney's digital DTC transformation is a major event is the acquisition of Fox at a high price. In March 2019, the merger of Disney and Fox's 20th Century Fox officially went into effect, and since then, Fox's major assets including Hulu, Star India, 20th Century Fox Film and Television Company, Fox Television Group, and National Geographic have come under Disney's ownership. The acquisition not only enriches Disney's content, expands its international visibility, but also strengthens the layout of the streaming media platform.

Table 1: Comparable business Fox and Disney operating profit comparison

|

Operating Margin %-FOX |

2018 |

2017 |

2016 |

|

Cable Network Programming |

32.4% |

32.6% |

32.2% |

|

Television |

4.9% |

13.8% |

12.3% |

|

Filmed Entertainment |

10.0% |

11.8% |

11.8% |

|

Total |

21.2% |

23.2% |

22.2% |

|

Operating Margin %-DlS |

2018 |

2017 |

2016 |

|

Media Networks |

27.0% |

29.4% |

32.7% |

|

Parks and Resorts |

22.0% |

20.5% |

19.4% |

|

Studio Entertainment |

29.8% |

28.1% |

28.6% |

|

Consumer products and interactive media |

36.1% |

35.5% |

35.1% |

As a Hollywood film and television company, the acquisition of Fox is a typical horizontal merger. But comparing similar businesses, it is not difficult to find that 21st Century Fox's profitability is limited. Disney's $71.3 billion price to beat Comcast, the largest cable operator in the United States, to persist in the acquisition, indicating its determination to develop streaming media in the future.

The gains include Disney taking a majority stake in hulu, a streaming platform based in North America; It also brought Star India and its VOD platform Hotstar, which originated in Hong Kong and took root in India after the spin-off. STAR launched as a Disney+ subchannel, while Hotstar became Disney+Hotstar continued to offer its service in Southeast Asia, and its paying subscribers were added to Disney+ subscribers. Since then, Disney has officially formed a full-service streaming matrix of sports-centric ESPN +, family-friendly streaming service Disney+, and hulu, which is mainly aimed at adult audiences.Among them, the core Disney+ currently includes Walt Disney Studio, Pixar, Marvel, star Wars, National Geographic and STAR six channels, comprehensively covering all ages and different cultural target groups, rich product content.

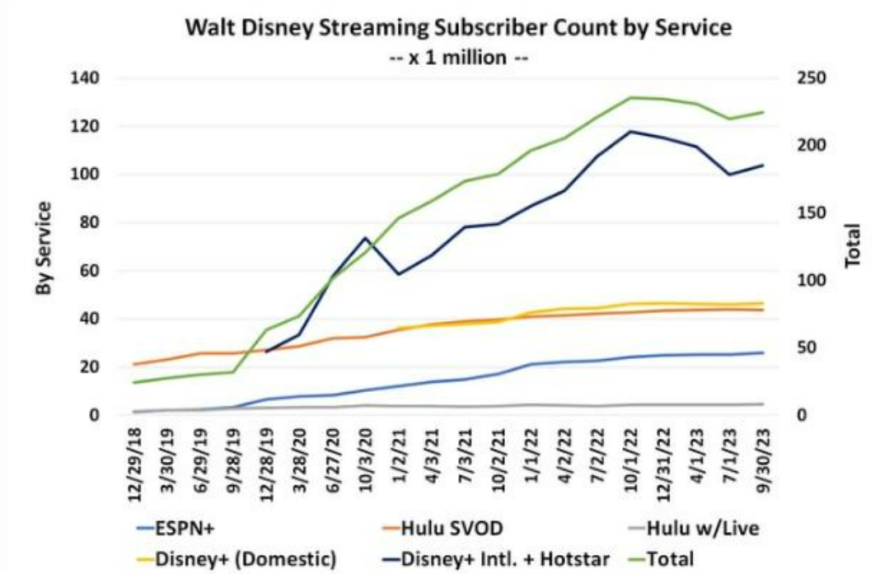

Figure 2: Number of Disney subscribers by streaming platform(Data source statista)

As of the third quarter of 2023, Disney+ streaming subscribers have exceeded 100 million, Hulu more than 40 million, ESPN+ more than 20 million, as can be seen from the figure above, even in the overall market share is huge. Through streaming media products with different positioning, increase consumer touch points, continuously seize market share, establish Disney's streaming media scale effect, and create a closed-loop ecology. The streaming product matrix also makes it possible for Disney's unique acquisition strategies, such as bundling, to reduce content costs.

Overall, the acquisition of the horizontal merger of Fox assets to enable Disney's streaming layout, in the long run to accelerate its internationalization and digitalization process. but the high acquisition fees and initial investment costs of streaming media in the short term drag down earnings, testing streaming profitability.

3.2.Price strategy: bundle and plunder at low prices

Due to the scale advantage of the streaming media platform product matrix, Disney has long adopted a low-price strategy based on bundled services to quickly seize market share, which is to bundle Disney+, Hulu and ESPN+ three platform membership portfolios to sell under more cost-effective conditions. In terms of profit model, Disney mainly adopts the form of SVOD (Subscription Video On Demand), which is similar to the domestic video website membership, and users can consume all the content of the platform after paying for a fixed period (month or year). Hulu also supports consuming content by watching ads. In recent years, more and more model innovations have been faced, such as Comcast Peacock adopting FAST (Free Ad-Supported Streaming TV) model[3]. Film and television companies are constantly adapting to explore new profit realization channels.

However, in the long run, the low-price strategy of Disney+ and other products is difficult to balance the high cost of content, and the streaming media sector is facing the challenge of "living beyond its means". At present, the company takes profit as a stage goal, trying to reduce content investment and return to positive cash flow. Over the past four years, Disney+ has increased its price two or three times a year.

4.Current situation and development suggestions

In the view of Disney's legendary CEO Iger, "achieving significant and sustained profitability in the streaming media business" is the first of the four keys to the success of Disney's future reform. Competition monopoly, weak growth, profit worries, the digital era streaming media competition has entered a new stage, in need of a new strategy adjustment.

4.1.A new situation of competition and monopoly

The United States is the source of the development of streaming media industry, which is dominated by Netflix. The layout of all streaming media in the United States is almost completed in 2021, and has entered a stage of stable growth spurred by the epidemic and industry competition. This paper is based on the market share data of major streaming media platforms such as Disney and Netflix in North America in the third quarter of 2021[4]. The concentration of the North American streaming market will be assessed based on the Herfindahl-Hirschman Index (HHI), reflecting the overall structure of today's streaming market.

\( HHI=\sum _{i=1}^{N}{(\frac{{x_{i}}}{X})^{2}}=\sum _{i=1}^{N}S_{i}^{2} \)(1)

Where,\( N \)represents the total number of streaming media platforms,\( X \)represents the market share of the first streaming media,\( S \)represents the total size of the North American streaming media market, represents the market share of the first streaming media platform. According to the formula, HHI is equal to the sum of the squares of the market share of all enterprises in a certain industry, and its value is between 0 and 1, which is usually multiplied by 10000 to enlarge for convenient research. According to the market share in the third quarter of 2021, the HHI value here is calculated to be 1736, and according to the classification method based on HHI. So it is concluded that the market structure of streaming media in North America is low-oligopoly type I, close to oligopoly.

With the continuous development of streaming media, based on the scale economy of the demand side of digital platforms and the role of network effects, the market is easy to continue to form the Matthew effect of "the strong are stronger". In the Internet environment with low barriers to free entry, the market structure of "competitive monopoly" with dynamic competition and monopoly is reached[5], In line with the general digital media ultimate market structure development trend.

Figure 3: Market share of major streaming platforms in North America in Q3 2021

4.2.Suggestions

Tracing Cause and effect, breaking through one by one. By combing and reviewing Disney's causal experience in market behavior, this paper proposes the following directions in view of the current predicament. The road is long, Disney reform traditional film and television industry has dawn.

Innovate the old and welcome the new.

The core of enhancing user engagement lies in the content value, with the end of the series of movies, the creation of new IP, the expansion of the theme is essential. Although Disney has invested a lot in content, it is not in quantity but in quality, and the audience is prone to aesthetic fatigue for Disney's time-tested heroic plot, which has been repeatedly failed at the box office in recent years.

Specifically, we can consider the new investment focus, improve the plot to avoid routine, rather than excessive, and consolidate the complementary advantages of the copyright market; For the films that have been shot and stored, slow down the release schedule and reasonably allocate the cost of advertising marketing and production to avoid excessive publicity.

Adapt to local conditions and explore the international market.

From the market structure, it is easy to judge that the streaming media market in Europe and Latin America is relatively mature and has entered a stable growth period, and the growth rate of users has gradually slowed down. Disney+ 's overseas expansion began in Europe, rapidly expanding from the Netherlands to major countries such as the United Kingdom, France, Germany and Spain.[6]

However, In other overseas regions, mainly in Asia, the streaming media market is still in a period of rapid expansion, and the expansion of emerging markets has a greater impact on today's streaming media stock pool pattern. for example, Last year, Disney lost the bidding for the streaming rights of the Indian Premier League (IPL), which directly led to a sharp drop in subscribers and a significant fluctuation in earnings. Therefore, the decision to expand the growth of the international market is urgent.

Horizontal and vertical integration to speed up integrated operation.

In addition to horizontal mergers and acquisitions to enhance the competitiveness of similar products, we also need to pay attention to the parallel competitive impact of short video products, such as the strong sweep of Tik Tok in the United States. Short video products have the characteristics of fragmented entertainment, dividing consumers' limited attention and time, but appropriate cooperation and reasonable use can also be used by us. Such as second creation, high-energy segment publicity, etc., increase the creation and coverage of derivative content of long videos, and try to generate gathering force.

5.Conclusion

Create opportunities in crisis, and capitalize new ones in change. In the complex and evolving landscape of enterprise transformation, media giants, led by Disney, are strategically adjusting their operations through mergers and reorganizations to compete for market dominance. During the era of stock innovation and competition monopolies, it becomes imperative to adopt a collaborative and innovative approach in order to transform losses into profits. As traditional media ventures into the realm of the Internet, it will inevitably drive profound adjustments in industry structure, giving rise to a new breed of media conglomerates that integrate content, channels, audiences, users, and intelligent technologies.

The future of global entertainment media industry will continue to be shaped by fierce competition between old and new media across multiple platforms. Disney's path towards positive reform and innovative channels serves as an invaluable source of inspiration for practitioners within the media sector.

References

[1]. Richard A. Gershon, Digital Media and Innovation: Communication Management and Design Strategies, translated by Xie Yi, Tsinghua University Press, 2018, pp. 63-65

[2]. YU Guoming, Yi Lijia, Liang Xiao. Crack the media dilemma of "channel failure" : A detailed explanation of "relationship Law" -- and discuss the path and key of traditional media transformation [J]. Modern Communication (Journal of Communication University of China),2015,37(11):1-4.

[3]. Chen Rong. An overview and analysis of the development status of American traditional media industry [J]. China Radio and Television Journal,2023(11):77-80.

[4]. Yin Yiyi. On the Changes of Film and Entertainment Industry in the Age of Digital Media [J]. Contemporary Film,2022(03):39-45.

[5]. Jin Xuetao. Research on market structure characteristics of Chinese media Industry based on Industry Convergence [J]. Journal of modern transmission (communication university of China), 2011 (03) : 106-110. The DOI: 10.19997 / j.carol carroll nki XDCB. 2011.03.021.

[6]. ZHANG Jianzhong. Shift to streaming media: Disney's Digital Transformation and Innovation [J]. China Television,2021(07):101-104.

Cite this article

Jiang,X. (2024). Research on Disney's Streaming Media Industry Behavior under the Digital Transformation. Advances in Economics, Management and Political Sciences,80,330-336.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 3rd International Conference on Business and Policy Studies

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Richard A. Gershon, Digital Media and Innovation: Communication Management and Design Strategies, translated by Xie Yi, Tsinghua University Press, 2018, pp. 63-65

[2]. YU Guoming, Yi Lijia, Liang Xiao. Crack the media dilemma of "channel failure" : A detailed explanation of "relationship Law" -- and discuss the path and key of traditional media transformation [J]. Modern Communication (Journal of Communication University of China),2015,37(11):1-4.

[3]. Chen Rong. An overview and analysis of the development status of American traditional media industry [J]. China Radio and Television Journal,2023(11):77-80.

[4]. Yin Yiyi. On the Changes of Film and Entertainment Industry in the Age of Digital Media [J]. Contemporary Film,2022(03):39-45.

[5]. Jin Xuetao. Research on market structure characteristics of Chinese media Industry based on Industry Convergence [J]. Journal of modern transmission (communication university of China), 2011 (03) : 106-110. The DOI: 10.19997 / j.carol carroll nki XDCB. 2011.03.021.

[6]. ZHANG Jianzhong. Shift to streaming media: Disney's Digital Transformation and Innovation [J]. China Television,2021(07):101-104.