1. Introduction

Counterstrike: Global Offensive, a first-person shooter developed by VALVE and Hidden Path Entertainment and published by Valve Software, was officially released in Europe and the United States on August 21, 2012 [1]. After years of development since its launch, it has become one of the three main competitive games in the world, along with DOTA2 and LOL. One of its peculiarities is that by opening the weapon case that the game drops while playing, players can get different skins, including the primary weapon, the knife, the gloves, and stickers that can be attached to the main gun. On some domestic platforms, such as NetEase Buff and YoYoYouPin, and foreign platforms, such as CS. Money and skins can be traded between players using real-world currencies such as RMB and dollars, causing price fluctuations. This article analyzes the factors affecting the overall market trend, including online player numbers, purchasing power, game adjustments and updates, skin output adjustments, game tournaments, and team collective actions.

2. Theoretical Basis

2.1. Efficient Market Hypothesis

The efficient market hypothesis in The Economics of Money, Banking, and Financial Markets states that in a healthy financial market, all information is fully open and transparent, and investors can use this information to make rational decisions [2]. The efficient market hypothesis states that prices in the market already reflect all available data, and therefore, investors cannot make excessive profits based on information.

In CS: GO, each skin has its corresponding price, which is acceptable to all players in the market. If the price of a particular skin is higher than the market average, there is not enough supply for that skin, and the demand is higher than the supply.

Therefore, the theory of efficient market hypothesis in-game trading can be expressed as follows: each skin has its corresponding price, which is acceptable for all players in the market.

2.2. Pareto efficiency

Pareto efficiency, mentioned in the Manual of Political Economy, means that in each scheme of resource allocation, there is no change scheme in which the utility of at least one person is greater than that of the others [3]. In-game trading, Pareto efficiency can be reflected in the fact that each player can obtain the skin he needs at the lowest price and that no player can get a higher profit by changing his trading strategy.

Therefore, this article analyzes the trading market of CS: GO and examines the influence of six factors: player numbers, player purchasing power, game adjustments and updates, skin output adjustments, game tournaments, and team collective actions the evolution of the market price of CS: GO skins to test the validity of the efficient market hypothesis and the theory of Pareto efficiency in the game trading market.

3. Analysis of Influencing Factors

3.1. Online Player Numbers

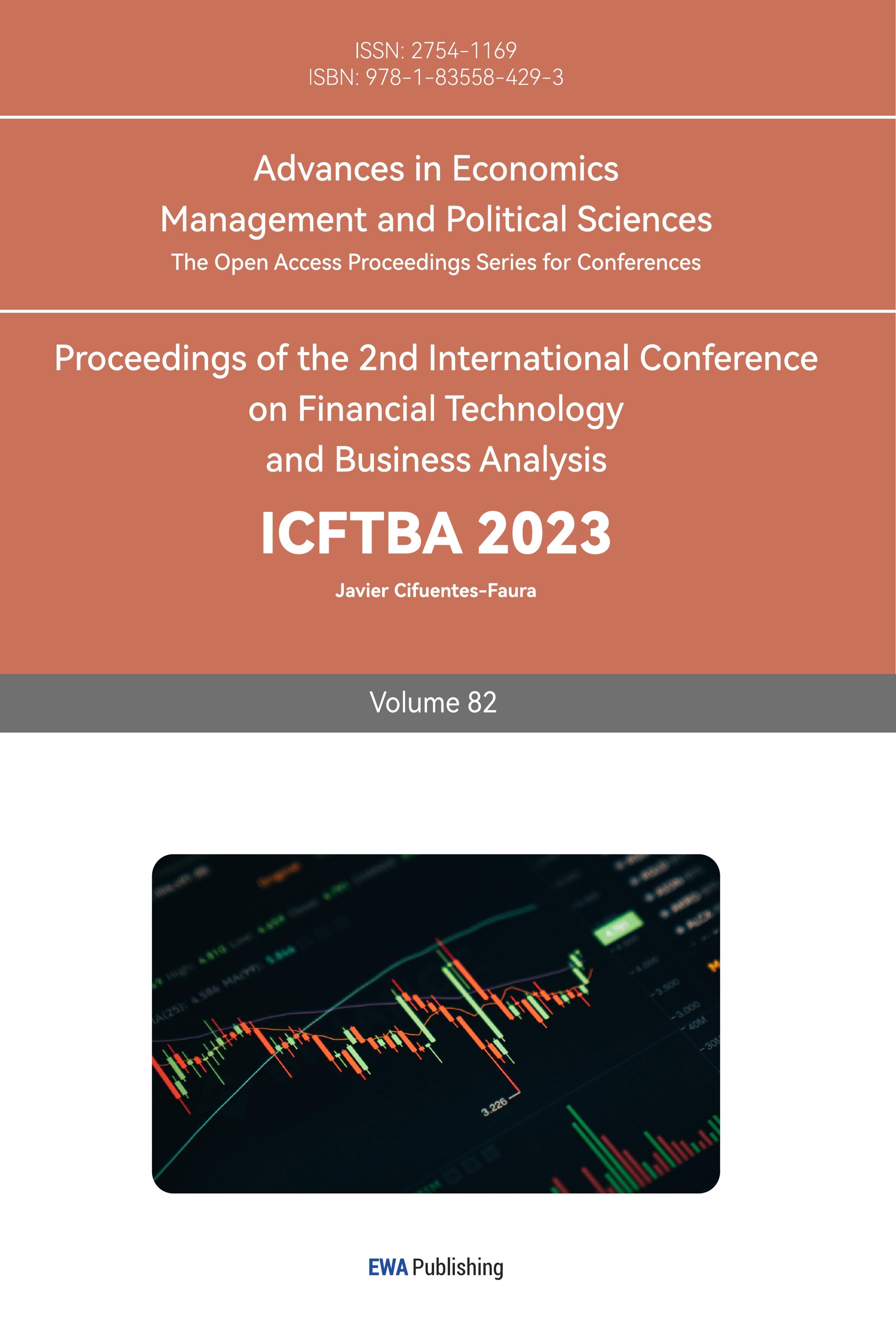

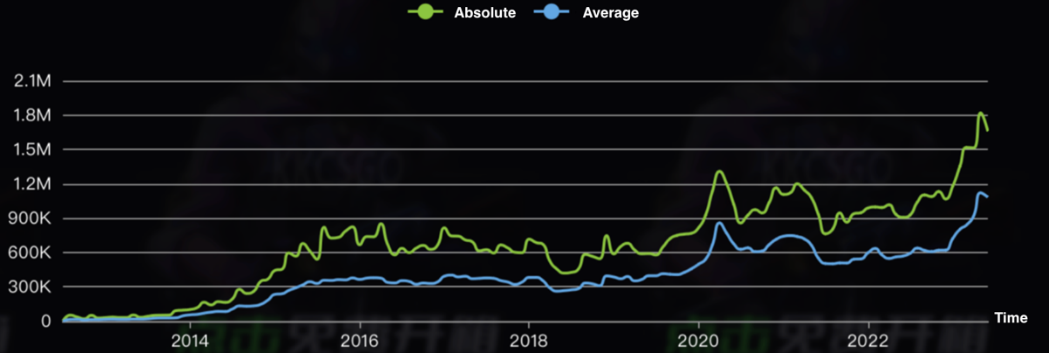

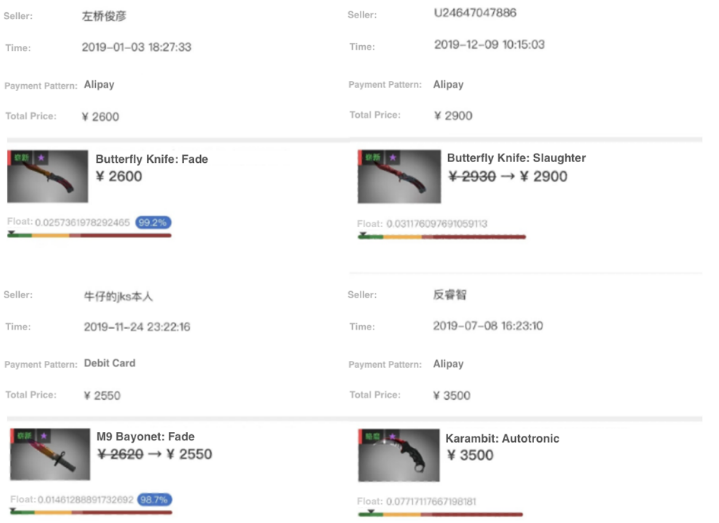

One of the factors influencing the market is the number of online players, which in a sense, can be understood as the game's popularity. Figure 1 shows the online number of CS: GO has demonstrated a linear upward trend since 2014 [4]. In December 2019, the peak number of CS: GO online is 767,683, and the prices of four random skins-Butterfly Knife Fade, Butterfly Knife Slaughter, M9 Bayonet Fade, and Karambit Autotronic-are 2600 RMB, 2900 RMB, 2550 RMB, and 3500 RMB (Figure 2) [5]. In May 2023, the number of CS: GO online reached an all-time high; the maximum number of players online was 1818773, and compared to 2019, it increased almost 2.5 times. The prices for the same four skins are 24800 RMB, 12920 RMB, 15200 RMB, and 11499.5 RMB (Figure 3) [5]. The same skin has increased in price by at least 23-85% compared to 2019. It is noted that the costs of the skins have increased by different amounts compared to the merits of 2019, but the price increase is a general phenomenon. Since there is no significant update from 2019 to 2023, and the biggest change is the number of online players, it can be concluded that the number of online players reflects the game's popularity, and the higher the popularity of the game, the higher the price of skins.

Figure 1: CS: GO All-time Online Players Stats, data from Steam

Figure 2: Prices of Four Skins in 2019, data from NetEase Buff

Figure 3: Prices of Four Skins in 2023, data from NetEase Buff

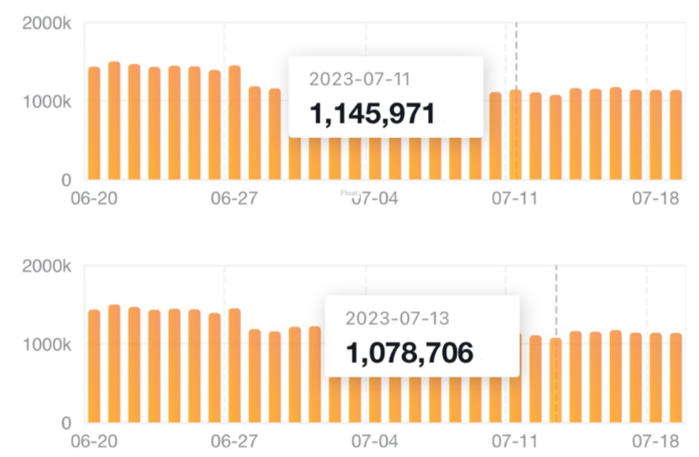

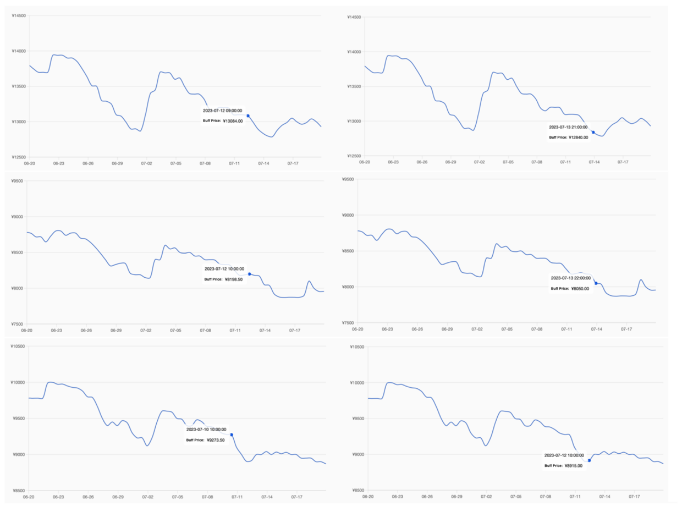

Another piece of evidence can also demonstrate the relationship between online player numbers and market trends. VALORANT is a free-to-play multiplayer first-person shooter developed by Riot Games. The game resembles CS: GO, as both are FPS games. The game was launched for international service on June 2, 2020, but not until July 12, 2023, for Chinese service. The game's launch impacted CS: GO online player numbers. According to Steam statistics, the peak online player numbers was 1,145,971 on July 11, 2023, and 1,078,706 on July 13 (Figure 4) [4]. The launch of VALORANT Chinese service on July 12 resulted in 67,265 fewer players online in CS: GO. Select three representative skins: Butterfly Knife without color, Karambit without color, and M9 Bayonet without color. Figure 5 shows that the price of Butterfly Knife without color decreased by 244 RMB from July 12 to July 13, the cost of Karambit without color fell by 148.5 RMB from July 12 to July 13, and the price of M9 Bayonet without color decreased by 358.5 RMB from July 10 to July 12 [5]. It can be found that the costs of the three skins show a highly steep downward trend from July 12 to July 13. This proves that the decrease in CS: GO online player numbers caused by the launch of VALORANT on July 12 has affected the overall price of the CS: GO skin market. The CS: GO skin market price is therefore, inextricably linked to the number of online players: the more players, the higher the market price; the fewer players, the lower the market price.

Figure 4: Comparison of CS: GO Online Player Numbers on July 11 and July 13, data from Steam.

Figure 5: Price Comparison of Three Skins around July 12, data from NetEase Buff

3.2. Player Purchasing Power

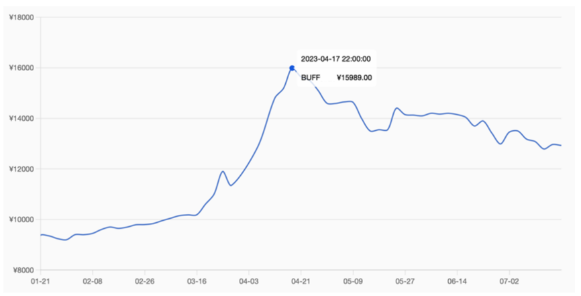

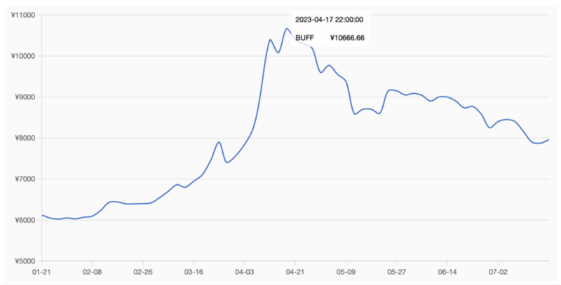

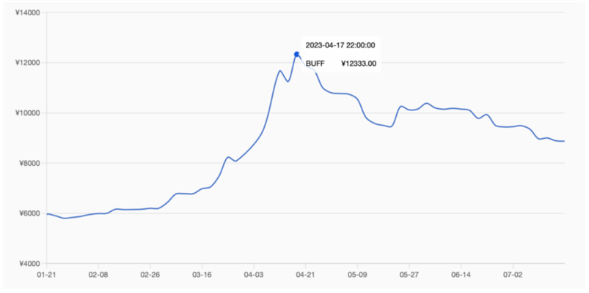

The primary function of CS: GO is still a game for entertainment and relaxation, not a tool to earn money. Therefore, the game's players are the skins' leading consumer group. If the market price exceeds the acceptance of the players, the market price will naturally decrease. The key to forming a market for CS: GO is that regardless of the cost, there will always be sellers and buyers. However, if the price is so high that no buyers are willing to buy, the seller will have to lower the cost to sell the item quickly. If a seller sees a lower price than what he is selling at, he will lower the price even further to ensure he is the first to sell. As a result, the market price will trend downward. When some market participants observe a downward trend in the skin market, they will lose confidence and compete to be the first to sell the skin, resulting in a sharp drop in market prices. For example, the Butterfly Knife without color, the Karambit without shade, and the M9 Bayonet without color. The prices of the three skins peaked on April 17, respectively 15989 RMB, 10666.66 RMB, and 12333 RMB (Figure 6) [5]. This means that on April 17, the prices of skins reached the price that most players cannot withstand with their purchasing power, so to sell, sellers started to pressure each other, eventually leading to the market showing a downward trend.

Figure 6: Prices Trend of Three Skins on April 17, data from NetEase Buff

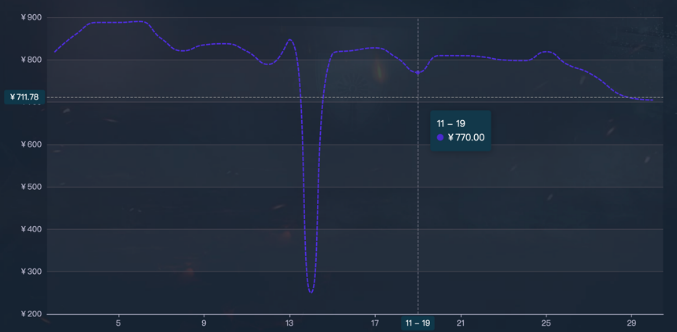

3.3. Game Adjustments and Updates

Since skins depend on the game, the market will inevitably react when the game company makes some updates or adjustments. On November 19, 2022, Valve's CS: GO project team announced an adjustment to M4A1-S that reduces its long-range damage. Three skins of M4A1-S are randomly selected: Printstream, Blue Phosphor, and Golden Coil. Observing the price trend before and after November 19, 2022, as shown in Figure 7, it can be found that there was a downward trend on November 19 [6]. Even though there was a regression afterward, it can still be concluded that the price of M4A1-S is affected by the game company's adjustment. In CS: GO, players can choose either M4A1-S or M4A4. Therefore, the weakening of M4A1-S means that more players will choose M4A4 instead. Three M4A4 skins were randomly selected: Asiimov, Royal Paladin, and The Emperor. By observing their price trend around November 19, 2022, it can be found that all three skins show an upward trend after November 19 (Figure 8) [6]. So, the price of M4A4 was also influenced by the adjustments made by the game company to M4A1-S. The logic behind this is that the game company's adjustments to the weapon affect player demand for the gun, and the change in direction leads to a change in price. In this case, the decrease in player demand for the M4A1-S has led to a price decrease, while the increase for the M4A4 has led to a price increase.

Figure 7: Prices Trend of Three Skins of M4A1-S on November 19, 2022, data from IGXE

Figure 8: Prices Trend of Three Skins of M4A4 on November 19, 2022, data from IGXE

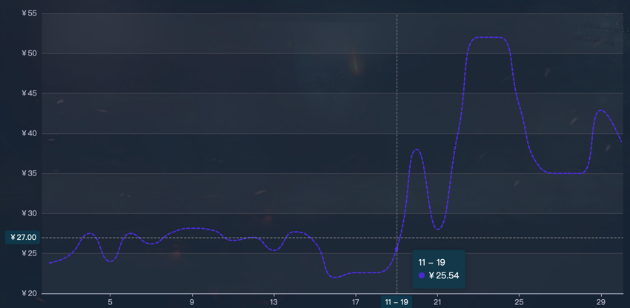

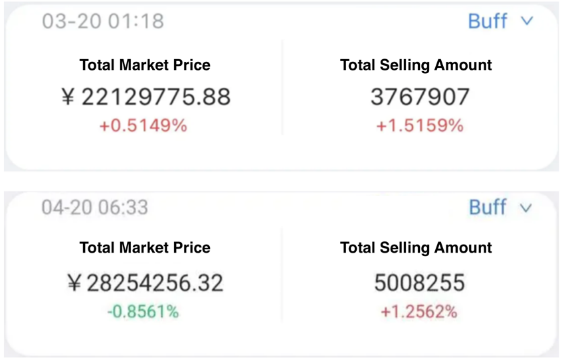

The game company's adjustments to individual skins can bring small market fluctuations, but game updates usually cause significant changes in the overall skin market. On March 23, 2023, the game company announced the upcoming release of CS2, a major update based on the new game engine Origins II. The new game engine has many effects, such as smoother gameplay, more realistic physics reactions, and more detailed map engraving. But there is no more critical update for the skin market than improving map lighting and shadows. With the new Origins II game engine, some skins like Doppler, Fade, and Marble Fade will have better gameplay performance. Randomly select three particularly effective skins: Flip Knife Doppler Sapphire, Karambit Doppler Ruby, and Butterfly Knife Doppler Ruby. Observing their price trend, as shown in Figure 9, it can be found that the price has increased sharply since March 23, and the increase continued for almost a month [5]. Since most of the skins from CS: GO were affected by Origins II and received an effect boost, the impact of this game update on the market was far-reaching. In just two months, from March 20, 2023, to April 20, 2023, the total market price increased from 22129775.88 RMB to 28254256.32 RMB, an increase of about 30%, according to NetEase Buff (Figure 10) [5]. It can be concluded that the game update will bring a wide range of fluctuations to the CS: GO skin market. The adjustments of the game and the updates are both CS: GO skin market influencing factors.

Figure 9: Prices Trend of Three Skins around March 22, data from NetEase Buff

Figure 10: Comparison of March 20 and April 20 Total Market Price, data from NetEase Buff

3.4. Skin Output Adjustments

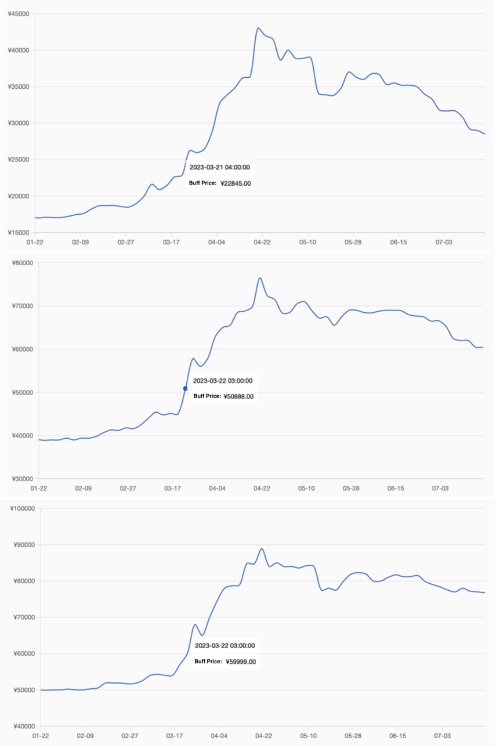

Rarity is one of the most critical factors affecting the price of skins. The higher the monster, the higher the price because they are harder to obtain. So, when the game company adjusts the output of certain skins, their rarity changes, leading to a price change. On November 19, 2022, Valve's CS: GO project team announced adjustments to the service map set. At Paris Major 2023, "Anubis" will be added to the service map set and "Dust II" will be removed. This change means that Dust II will no longer appear in professional tournaments, and as a direct result, the Dust II package will no longer be available. As a result, AK -47 Gold Arabesque, a skin produced by the Dust II package, will also become obsolete.

As shown in Figure 11, the price of AK -47 Gold Arabesque was 9800 RMB on November 18, 2022, and 13885 RMB on November 21, 2022 [6]. The price has increased by 4,085 RMB in just three days, more than 40%. This is the direct effect of the announcement of this change by the game company.

Moreover, this change also has a substantial subsequent impact. Looking at Figure 12, the AK -47 Gold Arabesque price increased since March 23 and reached the highest point of 51149 RMB on April 21 [6]. The prices have increased more than 420% since November 18, 2022. This shows that the cessation of AK -47 Gold Arabesque output has a vast potential for price increase. Even if the price subsequently drops to 29998 RMB, it is still far higher than the price on November 18, 2022, which is three times higher than the price on that date. It can be concluded that the skins' output and the skins' price are inseparable, and the change of rarity directly affects the cost of the skins. The higher the monster, the higher the price of the skins; the lower the anomaly, the lower the price.

Figure 11: Prices Trend of AK -47 Gold Arabesque around November 19, 2022, data from IGXE

Figure 12: Prices Trend of AK -47 Gold Arabesque in 2023, data from IGXE

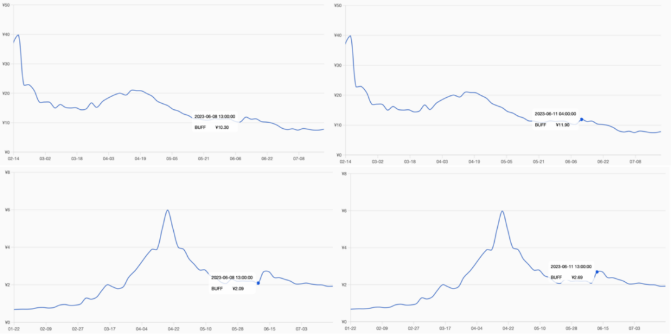

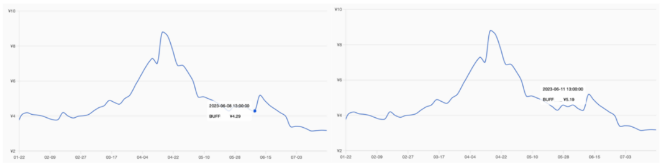

In addition to adjusting the output of the individual skins, the game company is also likely to change the production of the skins. On June 10, 2023, CS: GO officially announced adjustments to how weapon cases drop, which is the output of all skins. Under the new rules, weapon cases will be much more difficult to obtain, with the number of points available and the chances of getting them greatly affected. Three weapon cases are randomly selected: the Revolution Case, the Snakebite Case, and the Recoil Case. Looking at Figure 13, it can be seen that from June 8th to June 11th, the prices of all three weapon cases have risen. The Revolution Case rose from 10.3 RMB to 11.9 RMB, an increase of about 15.5%; the Snakebite Case rose from 2.09 RMB to 2.69 RMB, an increase of approximately 28.7%; the Recoil Case rose from 4.29 RMB to 5.19 RMB, an increase of about 21% [5]. It can be concluded that the adjustment of the weapon case drop mechanism directly and strongly impacts the price of weapon cases. The rise in the price of weapon cases will affect the prices of its output, skins because an increase in the price of weapon cases represents an increase in the cost of obtaining skins. However, this process requires time to settle, and the impact cannot be observed quickly. Therefore, it can be concluded that the adjustment of skin output directly and indirectly impacts the CS: GO skin market.

Figure 13: Price Comparison of Three Weapon Cases around June 10, data from NetEase Buff

3.5. Game Tournaments

CS: GO, as the most popular competitive game, has plenty of professional competitions. It mainly consists of three tournaments, namely Major, ESL and Blast. Major, hosted by Valve, is the only official tournament with the most attention and influence, which can be interpreted as the World Cup. IEM and EPL, hosted by ESL, are divided into Challenge and Master groups and Championships. A complete league system can be interpreted as La Liga, Premier League, Bundesliga, etc. Blast organizes spring and autumn tournaments and the World Finals. There is a complete league system that is on the same level as ESL. Such a variety of tournaments attracts professional teams and players, naturally bringing countless followers. Professional players representing the highest level of the game often perform impressive maneuvers in tournaments. If an experienced player uses a specific skin to serve well in a highly publicized game, players will most likely seek that skin, thus driving up the price. A typical example of this is Desert Eagle Blaze.

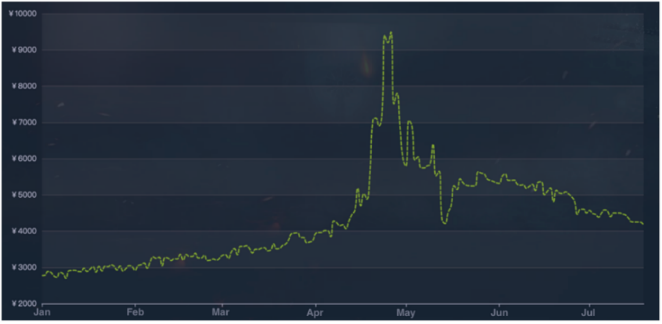

In the 2015 Dreamhack London Open final, Envyus vs TSM. The game progressed to map 2 Inferno. Round 18 as Envyus had gone to a loss in the previous round, so this round was all pistols. On the other side, TSM was fully armed and had an overwhelming advantage in weapons. When TSM wanted to win the game, Envyus's player Happy took a Desert Eagle and guarded the road alone, taking five kills to win this round with beautiful operations. His Desert Eagle's skin was Blaze. Happy's operation is not only the most classic scene of Desert Eagle Blaze, but also a legendary classic in the history of CSGO gaming. Since then, the price of Desert Eagle Blaze began to skyrocket. In the subsequent professional competitions, more and more experienced players use Blaze to play excellent operations, making its price higher and higher. By observing its price trend in 2023, as shown in Figure 14, its extremely high volatility proves its high attention. At the highest point, the price is close to 10000 RMB, up nearly 153% compared to before March 23 [6]. Desert Eagle Blaze is also one of the skins most affected by the overall market trend in April, and its high level of attention is inseparable from the beautiful operations achieved by professional players. Therefore, it can be concluded that the game tournaments influence the price of some skins. This influence has a great relationship with the experienced players, so it is generally more random and unpredictable.

Figure 14: Prices Trend of Desert Eagle Blaze in 2023, data from IGXE

3.6. Team collective actions

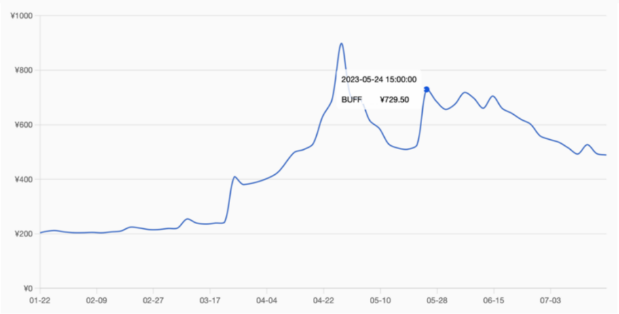

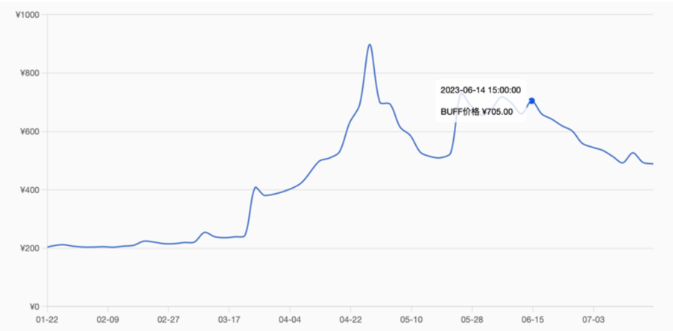

While most buyers in CS: GO skin market are players, teams also exist. These teams will gather several people to buy large quantities of a particular skin. Since the skin market tends to sort from low to high prices, and a skin can have different prices simultaneously. When all low prices of a particular skin are bought, only high prices remain, causing the price to increase for a short period. On May 23, 2023, a team in China decided to purchase a considerable amount of Desert Eagle Golden Koi collectively. Observing Figure 15, due to the team's collective action, the price of Desert Eagle Golden Koi directly increased from 526.78 RMB to 729.5 RMB, an increase of about 38.4% [5]. On June 16, 2023, the team leader operated to bring the price to 800 RMB and announced the start of selling. However, due to the lack of unity in the team and the vast amount of selling simultaneously, team members were pressuring each other's prices. Observing Figure 16, since June 16th, Desert Eagle Golden Koi has gone all the way down, falling to near the bottom [5]. Thus, it can be concluded that the collective action of the team will indeed cause the price of some skins to be inconsistent with the overall market trend. This type of operation is also the mainstream means of making profits through CS: GO skins in China. However, this method often requires an extremely high degree of cooperation. Otherwise, mutual pressure will be on each other, lowering prices.

Figure 15: Price Comparison of Desert Eagle Golden Koi from May 21 to 24, data from NetEase Buff

Figure 16: Price Trend of Desert Eagle Golden Koi around June 14, data from NetEase Buff

4. Conclusion

For Counterstrike: Global Offensive, as the most popular competitive game with a unique skin output method, characteristic of skin tradable, extremely high degree of commodity circulation, the stability of the trading platform, the joint effect of these factors provides the possibility of the existence of CS: GO skin market. To some extent, CS: GO skin market is related to the financial market, and some of its fundamental theories can be generalized and share the exact characteristics of uncertainty as the financial market. So, if all CS: GO skin market participants think it will go up or down at a particular time, this will not happen because it violates uncertainty. By analyzing the historical data, this article summarizes six main influencing factors: online player numbers, player purchasing power, game adjustments and updates, skin output adjustments, game tournaments, and joint actions of teams. According to the preliminary research in this article, the Pareto efficiency and efficient market hypothesis are also valid in CS: GO skin market. If the market is further analyzed using these six dimensions, the pattern of fluctuations in the CS: GO skin market will likely be discovered and thus, future trends can be predicted.

References

[1]. Manninen T. Virtual Team Interactions in Networked Multimedia Games Case: "Counter-Strike" - Multiplayer 3D Action Game[J]. Presence Teleoperators & Virtual Environments, 2001.

[2]. Mishkin, Frederic S. (2019) The Economics of Money, Banking, and Financial Markets. Pearson, Toronto.

[3]. Pareto, V. (2020) MANUAL of POLITICAL ECONOMY: A Critical and Variorum Edition. Oxford Univ Press, S.L.

[4]. Liu Y, Zhang W, Pinnavaia T J. Steam‐Stable MSU‐S Aluminosilicate Mesostructures Assembled from Zeolite ZSM‐5 and Zeolite Beta Seeds[J].Angewandte Chemie International Edition, 2001, 40(7):1255.DOI:10.1002/1521-3773(20010401)40:73.0.CO;2-U.

[5]. Corley D A, Kerlikowske K, Verma R, et al.Protective association of aspirin/NSAIDs and esophageal cancer: a systematic review and meta-analysis.[J].Gastroenterology, 2003, 124(1):47-56.DOI:10.1053/gast.2003.50008.

[6]. Mendes,José Vicente Santos.THE SEMANTICS-PRAGMATICS OF ROUTE DIRECTIONS[J].Vdm Verlag Dr.mller Aktiengesellschaft & Co.kg, 2005.

Cite this article

Yuan,M. (2024). CS: GO Skins Market Impact Factors Analysis. Advances in Economics, Management and Political Sciences,82,1-11.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 2nd International Conference on Financial Technology and Business Analysis

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Manninen T. Virtual Team Interactions in Networked Multimedia Games Case: "Counter-Strike" - Multiplayer 3D Action Game[J]. Presence Teleoperators & Virtual Environments, 2001.

[2]. Mishkin, Frederic S. (2019) The Economics of Money, Banking, and Financial Markets. Pearson, Toronto.

[3]. Pareto, V. (2020) MANUAL of POLITICAL ECONOMY: A Critical and Variorum Edition. Oxford Univ Press, S.L.

[4]. Liu Y, Zhang W, Pinnavaia T J. Steam‐Stable MSU‐S Aluminosilicate Mesostructures Assembled from Zeolite ZSM‐5 and Zeolite Beta Seeds[J].Angewandte Chemie International Edition, 2001, 40(7):1255.DOI:10.1002/1521-3773(20010401)40:73.0.CO;2-U.

[5]. Corley D A, Kerlikowske K, Verma R, et al.Protective association of aspirin/NSAIDs and esophageal cancer: a systematic review and meta-analysis.[J].Gastroenterology, 2003, 124(1):47-56.DOI:10.1053/gast.2003.50008.

[6]. Mendes,José Vicente Santos.THE SEMANTICS-PRAGMATICS OF ROUTE DIRECTIONS[J].Vdm Verlag Dr.mller Aktiengesellschaft & Co.kg, 2005.