1. Introduction

Shadow Banking in China refers to informal financial institutions that engage in financial intermediation and financing activities within China, but are not directly regulated or regulated by the People's Bank of China (the central bank) and the Banking and Insurance Regulatory Commission (the banking and insurance regulator).[1]According to the definition and research analysis of shadow banking by many scholars at home and abroad, the author finds that securitization is the key word often used by foreign scholars in the study of shadow banking, which indicates that foreign shadow banking is often accompanied by banking financial business, while Chinese shadow banking is generally regarded as a kind of non-bank financial institution. Therefore, Chinese scholars are more willing to use "the shadow of traditional commercial banks" to define Chinese shadow banking. Other scholars have pointed out that the main components of the Chinese-style shadow banking system are trust loans, entrusted loans and direct lending between enterprises without the involvement of financial intermediaries. In recent years, with the flourishing of fintech, China's shadow banking has also been developing rapidly. However, there is still a big gap between domestic shadow banking and foreign developed countries.

2. The Shadow Banking in China

2.1. Feature of Shadow Banking in China

1. Informality: Shadow banking does not comply with the monitoring and regulatory norms of traditional banks, and its mode of operation and institutional arrangements do not meet the requirements of traditional financial institutions. 2. High risk: Due to the lack of supervision, the risk of shadow banking is high. These risks include credit risk, liquidity risk and leverage risk.3. High profitability: Shadow banking can provide a higher interest rate and return on investment, attracting some enterprises and individuals to invest.4. Liquidity of funds: Shadow banks manage liquidity of funds through means that are not legally regulated, such as disguised lending and fund transfer.5. Private financing: Shadow banking mainly provides financing services for small and medium-sized enterprises and self-employed people, filling the financing needs that traditional bank cannot meet.6. Financial innovation: In order to explore and meet the financial needs of the market, shadow banking carries out financial innovation and launches a series of new financial products and services.[1]

In general, China's shadow banking is a non-traditional financial institution with certain risks, but it also meets the financing needs of some markets and becomes a non-negligible part of China's financial system.

2.2. Development Trend

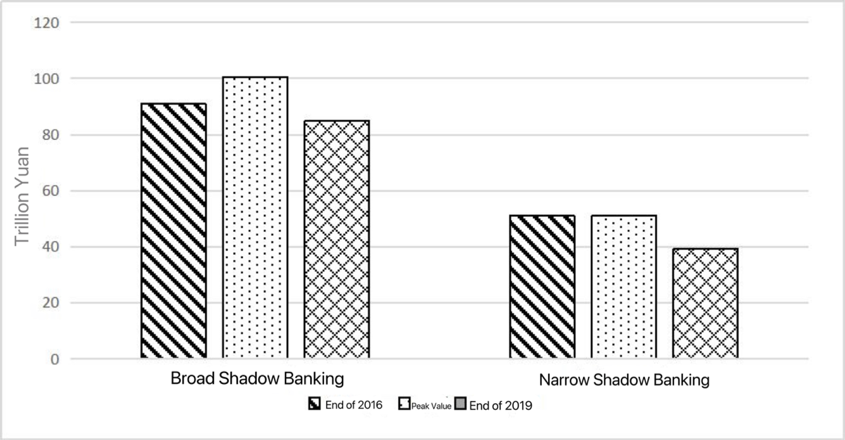

In response to the 2008 financial crisis, China adopted a moderately loose monetary policy and no longer imposed a rigid scale requirement on the credit business of financial institutions, which stimulated the rapid accumulation of real estate bubbles and the intensification of risks of local financing platforms, and further led the government to tighten monetary policy and credit management policies. Under such circumstances, financial institutions began to transfer risky assets to off-balance sheet in order to evade supervision, and shadow banking showed a trend of rapid growth. During this period, shadow banking mainly took the form of bank channel business, and most of the investment targets were non-standard creditor's rights. In 2013, the CBRC began to regulate the related work of commercial banks' wealth management business, and the form of shadow banking changed, manifested as diversification of on-balance sheet interbank business. Under the role of moderately loose monetary policy, the scale of shadow banking in China reached its peak in 2017. As shown in Figure 1, the scale of shadow banking is huge and developing rapidly, and there are many irregular phenomena, which seriously endanger the stability of the financial system. Since 2017, in order to maintain the stability and healthy development of the financial system, the regulatory authorities have carried out strict governance actions against shadow banking, and the scale of shadow banking in China has been gradually reduced. As shown in the figure, by the end of 2019, the broad shadow scale was reduced to 84.80 trillion yuan, nearly 16 trillion yuan less than the peak scale in early 2017; The narrow shadow scale shrank to 39.14 trillion yuan, down 11.87 trillion yuan from the high in 2016. The latest data show that by the end of the first half of 2021, the quasi-credit shadow banking business has decreased by more than 2.3 trillion yuan compared with the peak in 2017, 22 and the governance has achieved remarkable results. After three years of rectification, the illegal financial business of shadow banking has been significantly reduced, market order has been restored, the stock risks of the financial system have been reduced, and incremental risks have been contained in a timely manner, which has further improved the level of risk resistance of China's financial system and created favorable conditions for China's economic development in the post-epidemic era.[2]

Figure 1: The Market Capitalization of Shadow Banking in China.

2.3. The classifications

The first category is the bank's off-balance sheet business, including bank wealth management products, entrusted loans. The bills accepted by the bank and not discounted are not included in the scope of shadow banking because of the provision of risk assets. Compared with traditional deposit and loan business, off-balance sheet business usually has higher risk. For example, securities investment is affected by market fluctuations and investor sentiment, and the risk is greater. The derivative risk of derivative products is high, which may lead to arbitrage risk. The income of financial products is closely related to market fluctuations. However, high risk also means high returns, and banks can earn higher returns through off-balance sheet operations. The second category is non-bank financial institutions, including trust companies, small loan companies, underwriting companies, financial leasing companies and pawn shops.t is characterized by professional business, high risk management requirements, dependence on the market environment, high innovation and flexibility, and strict policy supervision and management. In addition, it should be noted that the business characteristics of different types of non-bank financial institutions are slightly different, and the specific analysis needs to be combined with specific types of in-depth research. In addition, non-bank financial institutions also have a certain business crossover with banks, and they have a competitive and cooperative relationship in some business fields.

2.4. Major issues of Shadow Banking System in China

With the deepening of financial innovation and the continuous development of financial market, shadow banking is developing rapidly in China, its scale is growing, and its forms are becoming more complex and diversified. However, the transparency of shadow banking in China is low, and shadow banking is intertwined with the traditional business of commercial banks, which may become an important driving force causing financial risks. Moreover, under the special background that China's macro economy is still in a downward trend, the risks of different businesses of shadow banking are more likely to infect and spread, and have become an important reason for the outbreak of systemic financial risks. Financial risks mainly include credit default risk, liquidity risk, systemic risk and regulatory arbitrage risk. Credit risk refers to the reduction of expected present value of cash flow due to the default of one party in a business transaction. Liquidity risk is the possibility that a bank will be unable to provide financing to ensure that its assets increase or decrease its liabilities, leading to bankruptcy or loss. Systemic factors are based on many mechanisms, and cause positive and negative correlation of most market asset prices at the same time. Regulatory arbitrage refers to the behavior of shadow banks to take advantage of loopholes in the regulatory system to obtain extra profits.[3]

3. The Analysis of Trust Loan Industry in China

3.1. The definition of trust loan

Trust loan refers to a financial business in which the trustee accepts the entrustment of the principal, issues the funds deposited by the principal according to the object, purpose, term, interest rate and amount specified by the trustee (or in the trust plan), and is responsible for recovering the principal and interest of the loan at maturity. The trustor has full autonomy in the object and purpose of the loan, and at the same time, it can make use of the advantages of the trust company in enterprise credit and fund management to increase the security of funds and improve the efficiency of the use of funds.

3.2. The structure of trust loan

3.2.1. Trust loans are direct financing

Trust loans are direct financial products. Trust loans are restricted by the specific purpose of trust, and the funds are in a circular and closed operation from the trustee to the trustee. The risk transmission is linear, and the risks and interests of different trust projects do not cross each other. If a trust loan project is at risk, other trust plans are not affected, even if the trust company is at fault, it can affect its inherent assets. The structure of risk is localized, not systemic contagion, diffusion. In contrast, bank loans are indirect financial products. Funds from surplus to shortage of funds through the bank intermediary, financial risk concentrated in the bank. Indirect financial risks have contagion effect and herd effect. If risks occur in one bank, they may be quickly transmitted to other banks. Driven by panic among depositors, group runs are prone to cause systemic risks.

The legal structure of financial products affects people's risk expectations and risk treatment methods: banks are free to withdraw deposits of depositors voluntarily, which is the bank's credit, so banks should bear liquidity risk; The trust, on the other hand, is bound by the trust property, and unless the trust document provides for liquidity, such as beneficiary redemption, the trustee is not obligated to provide liquidity and, therefore, does not bear liquidity risk.

The investment and financing system relates to the mechanism of how the financial system converts savings into investment effectively. Trust financing is the direct conversion of indirect financing, opening the channel of indirect financing and direct financing, and accelerating the transformation of financial system from bank standard to market standard. This transformation is of great significance for improving financial efficiency.[4]

3.2.2. Trust loans are highly flexible

Bank loan is a relatively standardized product, and the price of the product, that is, the interest rate, is relatively elastic. In order to reduce management costs, prevent operational risk and moral hazard, the rules of loans are relatively abstract and general. Measured from the borrower's point of view, it is inelastic. Unlike the one-size-fits-all style of bank loans, trust loans have a strong personalized color and are treated differently. The flexibility of the trust network is manifested as flexible pricing, flexible matching of risk and return, flexible lending, and meeting the individual needs of customers.

3.2.3. There are major differences in operation with bank loans

Trust loan and trust investment are combined and transformed each other to meet the maximum use of trust funds, and strive for the maximum balance in the combination of risk and return.

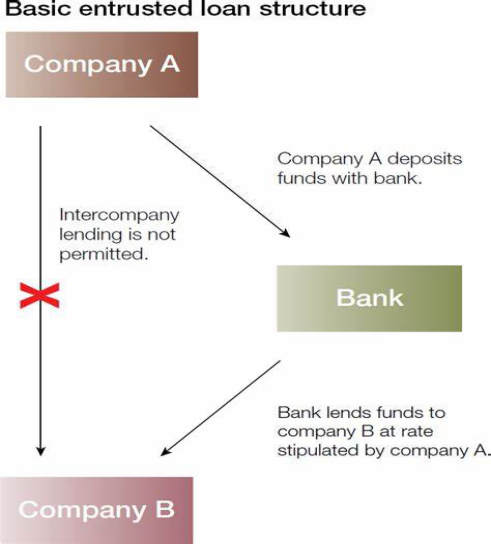

When issuing trust loans, trust companies often agree with borrowers to control the official seal of enterprises, restrict major business activities such as guarantee, borrowing, asset disposal and related transactions, and grasp the operation and financial status of enterprises in real time. There is a trend of the so-called demutualization of creditors, which is a feature that bank loans do not have. As shown in Figure 2, banks often evaluate the debt repayment ability and risk degree of enterprises from the aspects of financial indicators, management indicators, industry indicators, etc., but they do not exert a positive and active influence on the operation and management of enterprises. Their punishment measures are too powerful to deter, but not enough to influence, and the effect is often ineffective. The announcement of early maturity of loans is a double-edged sword, easy to cause multiple banks to accept loans at the same time, or make it more difficult for borrowers to operate.[4]

Figure 2: The Structure of Entrusted Loan.

3.3. Function of trust loan

3.3.1. Financial financing function

As a financing tool, trust can help enterprises realize the financing of funds. By transferring the assets of enterprises to trust property, enterprises can obtain more funds through trust financing and solve the problem of capital demand in operation.

3.3.2. Risk dispersion function

Another important role of trusts is to help companies diversify their risks. By transferring the assets of the enterprise to the trustee for management, the enterprise can spread the risk to the trustee, thereby reducing the enterprise's own risk bearing capacity.

3.3.3. Asset preservation and appreciation function

As an effective asset management tool, trust can help enterprises to maintain and increase the value of assets. As a professional asset management institution, the trustee can choose suitable investment targets for the enterprise according to the market situation and investment demand, so as to realize the preservation and appreciation of assets.

3.3.4. Funds use flexible functions

The flexibility of the trust is one of its unique features. Enterprises can formulate different trust plans and schemes according to their own needs and the use of funds to realize the flexible use of funds. The flexibility of trusts allows businesses to better respond to changes and challenges in their operations.

3.3.5. Specialized function of asset management

As a professional asset management method, trust can help enterprises realize the specialization of asset management. As a professional asset management institution, the trustee has rich experience and professional knowledge, and can provide professional asset management services for enterprises to help enterprises maximize the utilization of assets.

3.4. Risk analysis of trust loans

The risks of trust loans can be roughly divided into the following categories:

1.credit risk: This is one of the core risks of trust loan risk, it refers to the possibility of borrowers defaulting on loans. Unlike banks, which have strict loan approval standards, trust loans may attract borrowers with limited credit histories or financial instability. Robust risk assessment models are essential to minimize the likelihood of default.

2.Platform risk: The online platform that facilitates trust loans is responsible for matching borrowers and lenders, determining interest rates, and ensuring that transactions go smoothly. Platform risks include technical failures, security vulnerabilities, and potential fraud. If a platform does not maintain adequate security measures, the lender's investment may be compromised.

3.Regulatory risks: The regulatory environment for trust lending varies by jurisdiction. Some regions are heavily regulated, while others are less regulated. Changes in regulations or legal uncertainty may affect the operation of trust lending platforms, impacting both lenders and borrowers.

4.Liquidity risk: Lenders of trust loans may not have immediate access to their investment funds. Unlike traditional savings accounts, trust loans have a commitment period. If lenders urgently need access to funds, liquidity constraints may occur.

5.Market risk: The interest rate of trust loans is usually determined by market dynamics and the borrower's risk profile. Fluctuations in market interest rates or an economic downturn may affect the lender's returns, potentially resulting in lower than expected earnings.

6.Spread risk: Lenders who allocate a large portion of their funds to a single borrower or loan type face spread risk. If a borrower defaults or that loan category underperforms, the lender's overall return may be adversely affected.

In view of the above risks, the platform needs to do the following points for risk prevention and control. The first is to conduct a comprehensive investigation of the borrower, evaluate its credit reading, income stability and loan use, and minimize the credit risk associated with trust loans. The second is to strengthen the construction of risk assessment models to accurately predict the possibility of borrower default and help lenders make wise loan decisions.

Trust loans offer borrowers an innovative way to access credit, and lenders a potential path to higher returns. However, these benefits come with inherent risks that need to be carefully considered and mitigated. Thorough risk assessment, due diligence, transparent communication, and regulatory compliance are essential elements to create a robust trust lending ecosystem that protects both the lender's investment and the borrower's financial position. As the trust lending market continues to evolve, a balanced approach to risk management will be key to its sustainable development and success.

4. The impact of Shadow Banking on SME financing

4.1. The importance of SME

In the whole process of domestic economic development, small and medium-sized enterprises have played a certain role in promoting. As we all know, small and medium-sized enterprises have obvious advantages in operating flexibility and professionalism, so that the cost of the enterprise can be controlled within a reasonable range, the operation risk control effect is more ideal, and the profitability can be naturally improved. In addition, small and medium-sized enterprises provide a lot of jobs, and some rural people with low cultural level cannot enter large companies. Just because of the existence of small and medium-sized enterprises, these rural people can have better jobs. Therefore, the small and medium-sized enterprises are very important to our country.

4.2. The difficulty of SME financing

However, at the initial stage of development, small enterprises often cannot borrow from traditional commercial banks because of their small asset scale and lack of collateral assets. At the same time, small and medium-sized enterprises do not have large shareholder background, so it is difficult for them to obtain credit financing. Therefore, the development of shadow banking can provide a strong guarantee for the development of SMEs in the early stage and help them tide over difficulties. Moreover, because the credit of SMEs is not as good as that of large companies, banks often do not choose to cooperate with them, which makes it very difficult for SMEs to obtain financing.

4.3. The Shadow Financing of SMEs

With the continuous and rapid development of our country's economic level, more and more citizens choose to open a company to earn more money. According to statistics, by 2023, there will be more than 52 million small and medium-sized enterprises, which will bring many jobs to our country and promote economic development. However, because the product competitiveness and credit of small and medium-sized enterprises are not as good as that of leading enterprises, it is very difficult for them to raise financing. Small and medium-sized enterprises had to find other financing channels, and shadow banking grew out of this. This is because shadow banks have diversified business models, flexible operation methods, and are willing to finance small and medium-sized enterprises. This gives shadow banking hope for small and medium-sized enterprises. However, because the supervision of shadow banking is not in place and the information is not transparent, there are risks in the use of funds. At the same time, silver banks are closely related to traditional banks. If silver banks have problems, it will have a negative impact on China's economic development.[5]

At the initial stage of development, SMEs cannot borrow from traditional commercial banks because of their small asset scale and lack of collateral assets. At the same time, SMEs do not have a large background of shareholders, so it is difficult for them to obtain credit financing. Therefore, the development of shadow banking can provide a strong guarantee for the development of SMEs in the early stage and help them tide over difficulties. On the other hand, the existence and development of shadow banking also promoted the development of interest rate liberalization. At present, enterprises usually participate in the shadow banking business by means of entrusted financing and entrusted loans. At the same time, in order to avoid financial regulation in the process of participating in shadow banking, enterprises often make innovations in product structure and other aspects of their business carriers. The pricing methods of these business carriers are often close to the real market prices, which promotes the process of interest rate liberalization to a certain extent. The study and analysis of the influence of monetary policy on the shadow banking of domestic non-financial enterprises is not only of great significance to the rapid development of China's economy and society, but also conducive to the more effective implementation of monetary policy and the guarantee of long-term stability of the country. In addition, it also has a good role in promoting the progress and development of financial supervision and financial macro-control.

However, not all silver banks have a positive impact on SMEs. For example, large silver banks (often referred to as shadow banking in the form of wealth management products) do not usually work with SMEs. Because of the interest relationship, they are more willing to cooperate with large enterprises and commercial banks, resulting in most of the benefits generated by them are transferred within the financial system, and the funds that truly serve the real economy account for a small proportion. And because of the structure of society, the big silver banks give priority to government-controlled infrastructure, leaving little money for small and medium-sized enterprises. This will lengthen the capital chain, raise interest rates, and increase the pressure on small and medium-sized enterprises.[5]

5. Conclusion

In summary, China's shadow banking system refers to a network of informal financial institutions that provide financial services similar to traditional banks, but are not subject to strict regulation and supervision. These shadow banks usually exist in various forms, such as trust companies, lending companies, finance companies, etc., which provide financing, investment and wealth management services for enterprises and individuals through a variety of complex financial instruments and transactions. However, due to the lack of transparency and regulation, these institutions carry certain risks that can lead to financial instability and economic problems. The shadow banking system provides SMEs with an alternative source of financing, but its risks and costs also need to be carefully considered. In order to support the sound development of SMEs, the government and regulators need to strengthen the supervision of shadow banking and ensure the stability and transparency of the financial market. At the same time, small and medium-sized enterprises should also carefully assess the risk when financing, and choose the most appropriate financing channel according to the actual situation.

References

[1]. Zhang Xi. Research on the influence of shadow banking development on enterprise investment.2022. Zhongnan University of Economics and Law, MA thesis.

[2]. Yang Dan. Local Government Debt, Shadow Banking and Financing constraints of smes.2023. Lanzhou University,MA thesis.

[3]. Liu Chang. The impact of capital adequacy ratio on shadow banking business of commercial banks.2022. University of International Business and Economics,MA thesis. Xi 'an University of Science and Technology.

[4]. Justin E. Dmond. Enhanced Equipment Trust Certificate definition.2010. King's College London.

[5]. Shao Jiahui. Study on the influence of shadow banking on financing of small and medium-sized enterprises.2019.

Cite this article

Niu,J.;Ren,L.;Hu,C. (2024). The Research on the Impact of Shadow Banking on Small and Medium-sized Enterprises in China. Advances in Economics, Management and Political Sciences,82,142-149.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 2nd International Conference on Financial Technology and Business Analysis

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Zhang Xi. Research on the influence of shadow banking development on enterprise investment.2022. Zhongnan University of Economics and Law, MA thesis.

[2]. Yang Dan. Local Government Debt, Shadow Banking and Financing constraints of smes.2023. Lanzhou University,MA thesis.

[3]. Liu Chang. The impact of capital adequacy ratio on shadow banking business of commercial banks.2022. University of International Business and Economics,MA thesis. Xi 'an University of Science and Technology.

[4]. Justin E. Dmond. Enhanced Equipment Trust Certificate definition.2010. King's College London.

[5]. Shao Jiahui. Study on the influence of shadow banking on financing of small and medium-sized enterprises.2019.