1. Introduction

Under the trend of rapid development of China's capital market, mergers and acquisitions activities of public companies are increasing. However, weak regulation has led to the prominence of financial fraud, especially in relation to performance commitments. On 17 February 2023, the China Securities Regulatory Commission announced the full implementation of the registration system for stock issuance, which brought new opportunities to the market, but also put forward a higher requirement of self-financing. Financial malpractice has a negative impact on the market, and strengthening regulation and improving self-regulation has become an urgent task. Playing an important role in the capital market, public companies need to conduct in-depth research on how to prevent Financial Fraud of Merger and Acquisition (M&A) Target of public Company during the M&A process and promote the high-quality development of the capital market.

Under the trend of booming development of China's capital market, enterprises take such means as withdrawing materials to avoid IPO audit, or achieve securitisation by being acquired by public companies, which is prone to financial fraud and related transactions [1]. The key to solving these problems lies in strengthening information disclosure to ensure that the information is true and reliable. However, there is room for operation and fraud in financial information, and there is more room for human judgement and controversy in accounting standards and auditing procedures. Therefore, an in-depth study of financial fraud of M&A target of public companies is of key significance to promote the reform of comprehensive registration system and optimize the capital market environment.

Domestic and foreign scholars have summarized a variety of financial fraud drivers. Bologna et al. firstly proposed the GONE fraud four-factor theory, which describes the four factors of corporate accounting fraud drivers, which are Greed, Opportunity, Need, Exposure [2]. On the other hand, the motivation of financial fraud can also be attributed to profit-driven, the influence of macroeconomics and the pressure from betting agreements [3]. Meanwhile, financial fraud can also be induced when the enterprise is in poor operating conditions [4]. The imperfection of the internal control system will provide opportunities for financial fraud [5]. In the process of M&A and restructuring of public companies, there are often cases in which the acquired party is unable to fulfil its promises and commits financial fraud [6].

Research on the identification of financial fraud has always been a major focus, Zhang concluded that traditional financial fraud research mainly detects abnormal patterns and irregular rows [7]. Wen and Jiao concluded that the abnormalities of financial data have a greater correlation with the occurrence of financial fraud, including a significant increase in accounts receivable, abnormal operating cash flow, and the surplus does not meet expectations [8]. The study of specific cases can be derived from the characteristics of enterprises when financial fraud occurs, Liu by analysing the case of the acquisition of Longxin Technology by Connie's electromechanical, summed up including the abnormal growth of a number of accounting accounts, overestimation of the growth rate of performance, the customer is unstable and there are signs of related transactions, etc. [1].

In order to manage and prevent financial fraud, Wei et al. argued that the ethical awareness and legal cognition of corporate management should be improved, and the internal control system should be perfected [9]. Wang H. and Wang Y. suggest that the existing information disclosure system should be improved and perfected, and the independence of external auditors should be enhanced [10]. Bai argued that in the context of the registration system, investors and market entities will bear greater risks in the investment process, so intermediaries should focus on improving professionalism and professionalism [11]. Liu suggests that the Chinese capital market has not yet been able to understand the rights and responsibilities of market participants in the context of the registration system, and that the core concept of a comprehensive registration system should be strengthened [1].

2. Case Analysis

2.1. Basic Overview of Tianshan Animal Bio-Engineering

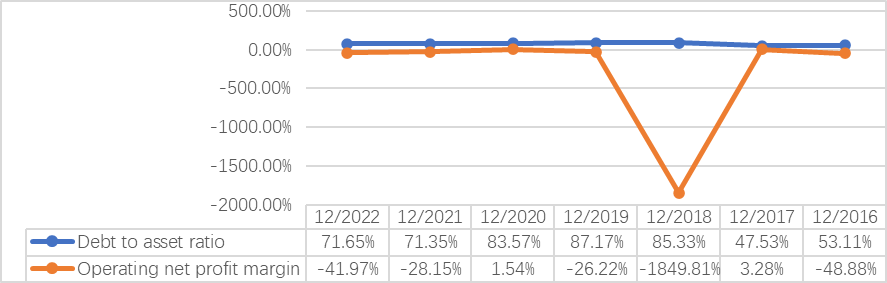

Tianshan Animal Bio-engineering, known as Xinjiang Tianshan Animal Husbandry Bio-engineering Co., Ltd, was founded in 2003 and listed on the GEM Board of the Shenzhen Stock Exchange in 2012. As the only company listed in the field of cattle and sheep animal breeding in China, the company's major business includes improvement of cattle and sheep breeds, provision of frozen semen, embryos and other genetic material, as well as related services. The two main financial indicators before and after the acquisition, debt to asset ratio and net operating profit margin, can be found in Figure 1.

Figure 1: Key financial indicators for Tianshan (2016-2022).

Tianshan Animal Bio-engineering's debt to asset ratio increased sharply between the end of 2016 and the middle of 2018, after which it was more stable and remained at a high level. Tianshan Animal Bio-engineering's net operating profit margin fluctuated between 2016 and mid-2018, and fell into a large loss (-1849.81%) at the end of 2018, after which it remained negative until the end of 2019. In 2020, the company's net profit margin improved slightly to 1.54%. However, in 2021 and 2022, the net profit margin declines again, to -28.15% and -41.97%, respectively.

In September 2017, Tianshan Animal Bio-engineering merged with Grand Image Advertising. In December 2018, Tianshan Bio-engineering found that Grand Image Advertising disclosure violations, and in that year, Tianshan Bio-engineering's assets and liabilities ratio increased, while the operating net profit margin decreased significantly. Among the reasons for the significant decline in the operating net profit margin in 2018 were the following: Tianshan Animal Bio-engineering faced business transformation after the M&A of Grand Image Advertising, the sales of biological assets declined, and the total operating income decreased; Grand Image Advertising was involved in the misappropriation of funds and financial falsification, etc., and Tianshan Animal Bio-engineering believed that the probability of recoverability of the relevant investment in Grand Image Advertising was relatively small, and made a provision for impairment of long term equity investments based on the expected recoverable amount of approximately 1,795 million yuan, resulting in a decrease in total operating profit; due to the uncertainty of the continuing operation of Grand Image Advertising, Tianshan Animal Bio-engineering is expected to assume a guarantee liability of 100 million yuan for Grand Image Advertising, which is a non-operating expense, which in turn will result in a decrease in total profit.

2.2. Basic Overview of Grand Image Advertising

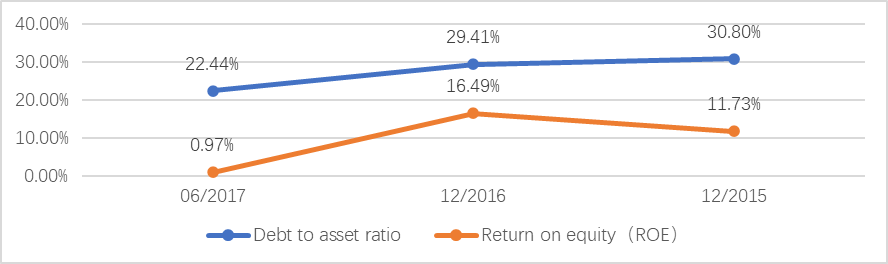

Grand Image Advertising Co., Ltd, founded in 2001, focuses on outdoor advertising media investment and operation, and is committed to building a professional advertising company, aiming to become China's first domestically listed pure outdoor media company. The company's business scope covers a wide range of advertising and media services, providing customers with a full range of advertising solutions. The two main financial indicators before the acquisition, debt to asset ratio and return on equity, can be found in Figure 2.

Figure 2: Key financial indicators for Grand Image Advertising before acquisition (2015-2017).

Grand Image Advertising's debt to asset ratio decreased from 30.80% in 2015 to 22.44% in 2017, indicating that the ability to repay debt has improved and the optimised capital structure has been optimised. It also reflects that Grand Image Advertising relied more on shareholders' equity than debt before the M&A, indicating its limited expansion ability. From the perspective of shareholders, a higher debt to asset ratio is more conducive to amplifying its return on investment through financial leverage, but Grand Image Advertising's persistently low debt to asset ratio is also conducive to reducing the risk of debt servicing. On the contrary, the return on net assets fluctuated considerably between the three years, rising from 11.73% in 2015 to 16.49% in 2016, but was only 0.97% for the period before and after the acquisition as of mid-2017, suggesting instability in the company's profitability.

3. Financial Fraud

3.1. Merger and Acquisition Process

Tianshan Animal Bio-engineering and 36 counterparties, including Chen Dehong, Huarong Yushan and Huarong Tianze, signed the Asset Purchase Agreement on 7 September 2017 in Changji City, Xinjiang. Tianshan Animal Bio-engineering purchased 96.21% equity interest in Grand Image Advertising held by the 36 counterparties through a combination of share issuance and cash payment. According to the Valuation Report issued by Pengxin Appraisal Agency, as at 30 June 2017, the overall valuation of Elephant Shares amounted to RMB2,470.6 million, and the appraised value of the subject asset of the M&A, i.e., 96.21% equity interest in Elephant Shares, amounted to RMB2,377.043 million. On the basis of the unanimous agreement of all the parties to the transaction, using the above valuation as the benchmark, the final total transaction price of the subject assets was finalised at RMB2,372,614,500. Tianshan Animal Bio-engineering adopted the method of issuing shares and/or paying cash to purchase the Subject Assets held by the counterparties, of which the aggregate payment ratio of issuing shares was 75.68%, totalling RMB1,795,650,400, and the aggregate payment ratio of cash was 24.32%, totalling RMB576,964,100. In addition, both parties agreed on the terms related to the performance commitment that Grand Image Advertising should achieve a certain amount of net profit attributable to the owners of the parent company after deducting non-recurring gains and losses for a three-year period. The actual calculation results were up to RMB187,366,000 in FY2018, RMB215,354,600 in FY2019 and RMB244,403,300 in FY2020, respectively.

In December 2018, nearly a year after Tianshan Animal Bio-engineering acquired Grand Image Advertising, Chen Dehong, the former legal representative of Grand Image Advertising, was suspected of falsifying accounts, inflating net assets and profits, and misappropriating funds. Chen Dehong continued to misappropriate huge amounts of funds after his removal from his position in the company, causing Tianshan Bio-engineering to lose actual control over Grand Image Advertising. In October 2019, Tianshan Animal Bio-engineering filed a lawsuit with the court, requesting to rescind the equity transactions with 33 counterparties.

Affected by Grand Image Advertising, Tianshan Animal Bio-engineering faced debt settlement problems, operating rights faced termination, and inflated financial reports, which led to the company's huge loss in 2018. In April 2021, Xinjiang Securities Regulatory Bureau gave Tianshan Animal Bio-engineering a warning and a fine for disclosure violations. Investors also filed a lawsuit against Tianshan Animal Bio-engineering, seeking compensation for financial losses. As of June 2022, the plaintiffs' lawsuit claims involved a total of RMB1,788,700 in compensation.2023 In April 2023, the court ruled that investors who bought shares of ST Tianshan (Tianshan Animal Bio-engineering) during the period from 14 August 2017 to 24 January 2019 and still held the shares as of 24 January 2019 could claim the relevant investment losses from the company.

3.2. Analysis of the Grand Image Advertising's Financial Fraud Motivation: Based on GONE Theory

The "greed" factor, defined more as a moral dimension, implies that morality has a psychological impact on the individual's ability to commit fraud. Fraudsters tend to produce fraudulent behaviours in line with their moral values under the influence of bad moral values. The late start of China's capital market, the moral concept of true and reliable financial presentation and information disclosure has not been deeply rooted in people's hearts, while the lack of a mature and complete market regulatory system and legal disciplinary system makes some entrepreneurs try to achieve their goals through improper means, so the problem of financial fraud is endless. After learning of Tianshan Animal Bio-engineering's willingness to acquire the company, Grand Image Advertising's founder, Chen Dehong, triggered the greed factor and not only falsified accounts and related materials, but also used his personal position and those of his associates to carry out a large-scale misappropriation of funds and misappropriation of the company's assets even after he fraudulently acquired Tianshan Animal Bio-engineering.

The "need" factor, or "motivation" factor, determines the propensity for accounting behaviour. Undesirable motives can be stimulated by external factors to produce improper accounting behaviour, i.e. accounting fraud. Although the motives for fraud are diverse, all motives can be attributed to the basic reason of "need". In the process of mergers and acquisitions of public companies, the subject of the merger or acquisition usually wants to sell at a high premium or is required to fulfil performance commitments beyond its own capacity. Although Grand Image Advertising was profitable from 2015 to 2017 before the acquisition, but the operating cash flow continued to be negative, which means that the working capital management problems, will largely affect the future operation, so the "need" for fraud is actually traceable.

The "opportunity" factor, as an external factor, is mainly reflected in two aspects, namely, the power of the fraudster in the enterprise, i.e., whether he or she has a relative information advantage and accounting authority; and whether his or her behaviour can be effectively supervised and restrained. Like most private enterprises in China, Grand Image Advertising has long been in a situation where the founder, Chen Dehong, has a dominant share of governance, meaning that Chen Dehong has absolute control over the company. In a governance structure that lacked reciprocal power checks and balances, Chen Dehong's intent to commit fraud, if any, could be carried out smoothly within Grand Image Advertising, including manipulating the board's decision-making and implementing improper accounting treatments.

The "exposure" factor has two main aspects: the likelihood of revealing and disclosing accounting fraud; and the nature and extent of the penalties for fraud. Based on the above analysis of the "opportunity" factors, Grand Image Advertising lacked effective internal supervision and control over Chen Dehong's behaviour, and therefore it was difficult to identify his fraudulent behaviour in the internal operation of the company. In the case of external M&A, if Chen Dehong had committed financial fraud and deliberately concealed it, it would have been difficult for the acquirer to detect the problem.

3.3. Analysis of Identification of Financial Fraud

Prior to its acquisition in 2017, Grand Image Advertising had positive net profit in 2015 and 2016, but consistently negative operating cash flow (see Table 1 and Table 2). With the sharp expansion of business scale, the company's operating costs and related expenses also rose rapidly. On the other hand, the risk of insufficient operating cash flow rises as the company becomes tight on working capital due to banks' restrictions on financing channels and amounts. This phenomenon may indicate that the company is facing cash flow problems in its operating activities, whereas earnings are mainly derived from non-operating activities, such as investment income or financing activities. Meanwhile, fictitious sales and revenue manipulation are effective ways to increase reported earnings. Grand Image Advertising may use these tactics to maintain or increase its share price, attract investors, and hide cash flow problems in its actual business operations.

Table 1: Grand Image Advertising 2015 Annual Report Partial Disclosure.

Accounting item | Current period amount (RMB) | Prior period amount (RMB) |

Net cash flows from operating activities | -25,771,685.43 | -2,569,646.25 |

Net cash flows from investing activities | 293,095.17 | -983,544.57 |

Net cash flows from financing activities | 118,286,584.25 | -74,701,808.85 |

Table 2: Grand Image Advertising 2016 Annual Report Partial Disclosure.

Accounting item | Current period amount (RMB) | Prior period amount (RMB) |

Net cash flows from operating activities | -111,032,515.84 | -25,771,685.43 |

Net cash flows from investing activities | -13,307,606.90 | 293,095.17 |

Net cash flows from financing activities | 216,079,954.21 | 118,286,584.25 |

Comparing the total operating revenue and accounts receivable, it can be seen that Grand Image Advertising had a rising accounts receivable balance and rising days to pay back before it was merged and acquired (see Table 3). The accounts receivable balance at the end of 2015 increased by nearly 100 million yuan compared with the previous year, which was higher than the increase in revenue, indicating that the quality of revenue growth was low. Then look at the disclosure in the middle of 2017, at this time Grand Image Advertising has just been merged and acquired, and the total operating revenue is only 278 million yuan, which is much lower than the accounts receivable of 352 million yuan, which indicates that Grand Image Advertising has a large number of uncollected delinquent payments, and the operating risk is significantly higher. At the same time, comparing the annual accounts receivable turnover days, the data of both 2015 and 2017 in the middle of the year are significantly higher than the previous year, and have been maintained at a high level since 2015, reflecting the slow pace of recovery, being owed money accumulated year by year. This phenomenon may indicate that the company is engaging in fictitious sales and manipulation of revenues in order to increase reported sales and revenues and thereby improve its financial performance. The company may delay the recognition of actual revenues and inflate the accounts receivable balance by extending the payback cycle. On the other hand, uncollectible payments lead to cash flow constraints and a decline in the company's net profit, which can be a motivating factor for financial fraud in the future.

Table 3: Grand Image Advertising 2014-2017 Annual Report Partial Disclosure.

Date | Gross operating income (RMB) | Accounts receivable (RMB) | Accounts receivable turnover days |

06/2017 | 278 million | 352 million | 224.83 |

12/2016 | 599 million | 342 million | 175.11 |

12/2015 | 403 million | 240 million | 173.20 |

12/2014 | 326 million | 147 million | 130.87 |

Grand Image Advertising disclosed reports from 2015 to mid-2017 show that the company is continuing to make profits (see Table 4), but in the 2015 annual report disclosed that "2016 stock issuance programme (see Table 5), proposed to issue no more than 30.9 million shares at $17/share, expected to raise funds of no more than $525,300,000, is currently is still under implementation", while in practice it was divided into 3 instalments. This phenomenon may reflect that Grand Image Advertising is in fact hiding its true profitability, especially when the profitability falls short of market expectations or the company's internal goals. If the company needs to raise a large amount of external financing even though it is operating at a stable and consistently profitable level, it is worth examining the true and accurate amount of its earnings. Investors and regulators should pay close attention to company financial reports to ensure their truthfulness and transparency in order to effectively assess the company's operating conditions and potential risks.

Table 4: Grand Image Advertising Net Profit, 2015-2017.

Date | Net profit (RMB) |

06/2017 | 10.97 million |

12/2016 | 110 million |

12/2015 | 74.05 million |

Table 5: Amount of Direct Financing Raised by Grand Image Advertising through Equity Offerings, 2015-2017.

Date | Amount of direct financing through equity issuance (RMB) |

07/2017 | 489.6 million |

12/2016 | 12.07 million |

03/2016 | 69.7 million |

The 2015 annual report of Grand Image Advertising (see Table 6) indicates that the accounting method of amortisation based on the revenue model has been adopted for the expense of the operating right of the advertising resources for projects such as the Wuhan Metro, which is held by the Company. During the year, the difference between the actual realised revenue and the forecasted revenue of Wuhan Metro was 19.32%. In addition, the Company measured the amortisation of the operating right of advertising resources of Wuhan Metro and Hefei Airport for the year 2015 as the operating right of advertising resources of Hefei Airport involved lease surrender and contract adjustment. The revised revenue forecast model resulted in a decrease in operating costs of RMB9,967,500 and a decrease in finance costs of RMB5,595,400 for the reporting period. This process involved multiple adjustments and changes in estimates, with the end result being a reduction in costs and expenses, a major indication of a whitewash of the financial statements.

Table 6: Grand Image Advertising 2015 Annual Report Partial Disclosure.

Contents, reasons and timing of application of changes in accounting estimates | Name of statement line affected | Amount affected (RMB million) |

Wuhan Metro Revenue Forecasting Model, Actual Realised Revenue and Forecasted Revenue Difference Ratio of More Than 10% | Operating costs | -3.9697 |

Changes to Hefei Airport's revenue forecasting model, spots and payment amounts for the right to operate advertising resources | Intangible assets | -73.7536 |

Long-term payables | -73.7536 | |

Operating costs | -5.9978 | |

Financial costs | -5.5954 |

4. Conclusion

In M&A transactions of public companies, the subject of M&A usually tends to be sold at a high premium, and the M&A parties usually require the subject of M&A to make performance commitments in order to ensure the rate of return. This leads to the possibility that the target company, especially the actual controller, may achieve the performance commitment target through financial fraud. The lack of a complete market regulatory system during the M&A process of public companies leads to the fact that M&A decisions and preliminary investigations are completed under information asymmetry, which makes it difficult to identify whether there is a tendency of Financial Fraud of M&A Target of public Company.

To address the above risks, this study gives the following suggestions. Before and after M&A, public companies should conduct comprehensive due diligence, paying special attention to the financial status of potential subject companies. If anomalies in financial data are found, they should be tracked in depth and the reasons for them should be understood. At the same time, it is necessary to pay attention to indicators such as the return on net assets of the subject company, review the operation of the company's capital and understand the quality of earnings. The subject company's accounting policies should be carefully reviewed, e.g. Grand Image Advertising's changes to the way expenses are amortized may be a means of financial manipulation. Performance commitments that are not in line with the subject company's capabilities may also increase the likelihood of financial fraud in its future. To prevent Financial Fraud of Merger and Acquisition of public companies in the process of M&A, the M&A party can carry out investigations to gain an in-depth understanding of the subject company's financial status and other aspects. At the same time, it is essential to establish a financial indicator monitoring system, strengthen the internal control of the subject company, review the contracts of the subject company to identify potential financial problems. In addition, the subject company is required to provide transparent financial information, and independent third-party auditors are commissioned to audit the financial statements of the subject company to ensure the authenticity and accuracy of the statements.

This study mainly analyses Grand Image Advertising as a case study, but does not fully consider the different situations that may exist in other industries and company types. Such an ad hoc analysis limits the generalizability of the findings, and a more comprehensive sample survey would help to improve the applicability of the study. Although this paper points out the shortcomings of the market regulatory system, it does not explore in depth possible reform programmes or policy recommendations, so more detailed suggestions for improving the market regulatory mechanism could make the study more practically relevant.

References

[1]. Liu, Z. (2023). Financial Fraud in Mergers and Acquisitions of Listed Companies, Jiangxi University of Finance and Economics.

[2]. Bologna, G. J., Lindquist, R. J., & Wells, J. T. (1993). The accountant's handbook of fraud and commercial crime. Wiley.

[3]. Chen, S. (2018). Common Methods and Typical Cases Analysis of Financial Fraud in IPOs. Financial Communication, 2018(16), 99-102.

[4]. Skousen, C. J., Smith, K. R., & Wright, C. J. (2009). Detecting and predicting financial statement fraud: The effectiveness of the fraud triangle and SAS No.99.

[5]. Johnson, S. A., Ryan, H. E., & Tian, Y. S. (2008). Managerial incentives and corporate fraud: The sources of incentives matter*. European Finance Review, 13(1), 115–145.

[6]. Liu, A. (2023). Corporate Financial Fraud Behavior under Performance Commitment Pressure, Yunnan University of Finance and Economics.

[7]. Zhang, X. (2023). Analysis of Corporate Financial Fraud from the Perspective of Behavioral Economics: A Case Study of Taike Company. Financial Research, 2023(12), 43-48+54.

[8]. Wen, B., & Jiao, S. (2020). Incentives, Intermediary Endorsement, and Financial Fraud in Listed Companies: Based on the Penalty Announcements of China Securities Regulatory Commission (2008–2017). Financial Communication, 2020(23), 96-100.

[9]. Wei, W., Hong, F., & Zhu, D. (2020). Financial Manipulation in Listed Companies, Auditor Professional Suspicion, and Audit Failure: A Case Study of Kangde Xin. Financial Research, 2020(07), 64-67.

[10]. Wang, X., & Wang, Y. (2021). Research on Financial Fraud and Violation Methods in Listed Companies. Financial Communication, 2021(06), 126-129.

[11]. Bai, M. (2021). Securities Market "Watchdog" Functions under the Registration System. China Finance, 2021(16), 57-58.

Cite this article

Feng,L. (2024). Identification and Prevention of Financial Fraud of Merger and Acquisition Target of Public Company: Taking the Acquisition of Grand Image Advertising by Tianshan Animal Bio-Engineering as an Example. Advances in Economics, Management and Political Sciences,83,117-125.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 2nd International Conference on Management Research and Economic Development

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Liu, Z. (2023). Financial Fraud in Mergers and Acquisitions of Listed Companies, Jiangxi University of Finance and Economics.

[2]. Bologna, G. J., Lindquist, R. J., & Wells, J. T. (1993). The accountant's handbook of fraud and commercial crime. Wiley.

[3]. Chen, S. (2018). Common Methods and Typical Cases Analysis of Financial Fraud in IPOs. Financial Communication, 2018(16), 99-102.

[4]. Skousen, C. J., Smith, K. R., & Wright, C. J. (2009). Detecting and predicting financial statement fraud: The effectiveness of the fraud triangle and SAS No.99.

[5]. Johnson, S. A., Ryan, H. E., & Tian, Y. S. (2008). Managerial incentives and corporate fraud: The sources of incentives matter*. European Finance Review, 13(1), 115–145.

[6]. Liu, A. (2023). Corporate Financial Fraud Behavior under Performance Commitment Pressure, Yunnan University of Finance and Economics.

[7]. Zhang, X. (2023). Analysis of Corporate Financial Fraud from the Perspective of Behavioral Economics: A Case Study of Taike Company. Financial Research, 2023(12), 43-48+54.

[8]. Wen, B., & Jiao, S. (2020). Incentives, Intermediary Endorsement, and Financial Fraud in Listed Companies: Based on the Penalty Announcements of China Securities Regulatory Commission (2008–2017). Financial Communication, 2020(23), 96-100.

[9]. Wei, W., Hong, F., & Zhu, D. (2020). Financial Manipulation in Listed Companies, Auditor Professional Suspicion, and Audit Failure: A Case Study of Kangde Xin. Financial Research, 2020(07), 64-67.

[10]. Wang, X., & Wang, Y. (2021). Research on Financial Fraud and Violation Methods in Listed Companies. Financial Communication, 2021(06), 126-129.

[11]. Bai, M. (2021). Securities Market "Watchdog" Functions under the Registration System. China Finance, 2021(16), 57-58.