1. Introduction

With the advent of the era of globalization, the saturation of brands in the coffee industry is increasing, and the per capita demand for coffee is increasing year by year. Not only is the demand for coffee consumption steadily increasing in first-tier and second-tier cities, but also in third-tier, fourth-tier, and even following cities, the demand for coffee is growing even faster. The more diversified types of coffee, the higher consumption level of modern consumers, the rapid progress of science and technology, and the more convenient payment methods have boosted coffee consumption to a certain extent. This topic mainly takes Luckin Coffee as an example to explore the marketing strategy of the coffee industry under the high saturation of globalized coffee brands.

The purpose of this topic is to solve the current problems in the coffee industry. By analyzing the current branding strategy of Luckin Coffee market, as well as the current marketing strategy problems of Starbucks, by using qualitative research, to provide suggestions for the optimization of the marketing strategy of the coffee industry, so that it can restore its vitality. The paper will start with the brand development history of Luckin Coffee, apply the theoretical knowledge of brand marketing of marketing to the field of coffee, and analyze the future development direction of the coffee industry through the study of Luckin Coffee's marketing status and advantages, as well as the strength of Starbucks' marketing strategy. In this topic, the author will use the STP market segmentation theory of marketing and SWOT analysis to analyze and conduct research.

2. Brand history of Luckin Coffee and Current Marketing Status

Luckin Coffee (China) was founded on March 28, 2018. Headquartered in Xiamen, Luckin Coffee is the coffee chain with the largest number of stores in China. Competing with Starbucks, it enters the coffee market with a high posture of 1 billion yuan and takes only 244 days to become the "unicorn" in the coffee market. By the end of 2018, Luckin Coffee had set up 2,073 physical stores in 22 cities across China, with 12.54 million customers and 89.68 million cups [1]. With the mission of "Creating Lucky Moments and Inspiring a Better Life," Luckin Coffee cooperates with high-quality suppliers in various fields to create a high-quality consumption experience and create lucky moments for customers. It is worth mentioning that Luckin Coffee is the only Chinese coffee chain brand to stay in the Forbidden City.

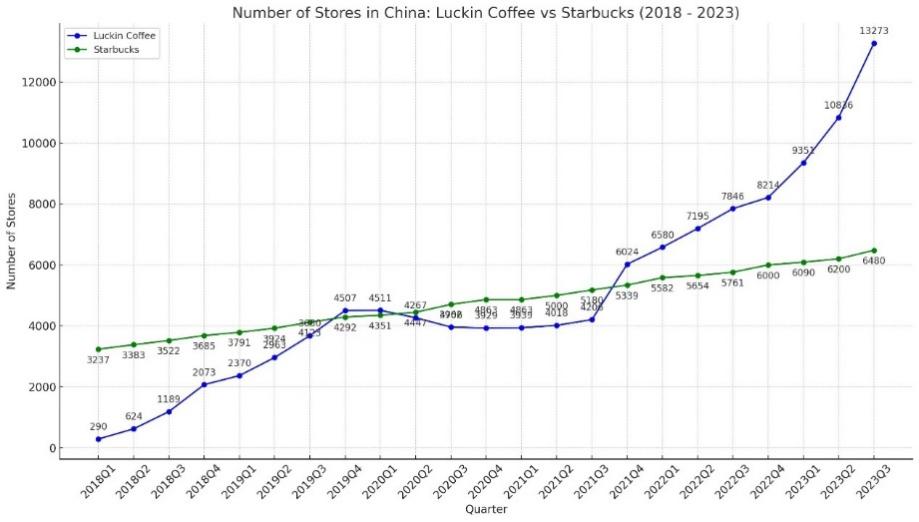

In 2020, Luckin put forward an intelligent unmanned retail strategy, complementing the established store network, utilizing cutting-edge technologies such as the Internet of Things, big data, and face recognition to create a new customer consumption experience, and constructing Luckin’s omnichannel traffic system. As of 2023, Luckin Coffee's marketing strategy appears to be centered around aggressive expansion and innovative product offerings. This approach has driven significant growth in sales and profitability for the company. In a news release issued by World Coffee Portal on August 1, 2023, it was mentioned that the rapid growth of Rexall stores and an increase in monthly transactional customers drove its sales up 88% year-over-year. Sales at company-owned stores grew 85 percent to $620 million. Partner store sales increased by 91 percent to $205 million in the quarter. Luckin Coffee also reported GAAP operating income of $161 million, with a margin of 18.9 percent, compared to $33.7 million in the same quarter in 2022, with a margin of 7.3 percent. This shows that its margins are growing at a faster rate [2]. As of the end of the third quarter, the total number of Luckin Coffee stores reached 13,273, and the store scale is expected to reach 15,000 by the end of the year. It has surpassed Starbucks in sales and the number of stores to become China's largest coffee chain brand. Their business model combines heavy discounting with a mix of small format and delivery-only sites, which has been effective in attracting a large number of monthly transacting customers.

3. Marketing Strategy Analysis of Luckin Coffee

3.1. Target Market and Market Positioning

Comparing the first- and second-tier cities, they are easier to enter as their consumption habits have already been initially formed, thus becoming the first focus of market development. The white-collar workers of commercial enterprises are mainly urban office workers, with high crowd density, frequent expenditures, a large affordable range of prices, and a high dependence on high-quality goods. The student population is more sensitive to price, the demand for quality goods and service standards is relatively small, and they do not pay much attention to the product brand. Combined with the above data analysis, based on the current customer profile of Luckin Coffee, the main target users identified are white-collar workers, managers, multiple groups of college and university students in primary and secondary metropolitan areas, and small business groups.

Luckin Coffee's most notable feature is the dual mode of "online + offline," which is mainly characterized by new retail rather than traditional online retail. Luckin’s "Any Moment" concept means that in all cases, three different stores are needed to realize it. The image design of "Little Blue Cup + Antlers" enables Luckin to achieve enhanced positioning at the consumer level. From the customer's point of view, it mainly targets white-collar workers and college students. At the market level, it competes directly with Starbucks, which dominates the industry and has a large number of customers.

3.2. Price Strategy

Fission marketing uses subsidies. The marketing method of advertising subsidy is used to subsidize the fission advertising of stores. Compared with the case of paying the advertising fees of the stores directly to the advertising company, fission advertising subsidy marketing is a kind of marketing method that transforms the advertising fees of the stores directly into the products and benefits of the consumers, with the knowledge of the consumers, to make the consumers gain more profits and traffic, increase the acceptance of the brand by the consumers, and at the same time, rapidly expand the offline stores [3]. In addition, Luckin Coffee's goal is to "make everyone affordable to drink a cup of good coffee," creating cost-effective products that consumers can afford to consume, targeting a more affordable consumer group, with pricing low compared to Starbucks, which is geared towards the high-end market, with a price of RMB 13–20. and starting in May 2023, Luckin launched a new product program under the pretext of the anniversary of its store celebration. Meanwhile, Luckin has introduced a subsidized policy called “9.9 yuan a drink” and sent out discount coupons to drive price-sensitive consumers to place orders. This gives Luckin Coffee not only high revenue growth but also accelerated store expansion. The statistics in the chart are extracted from quarterly reports and press releases from Luckin Coffee and Starbucks. For Luckin, only company-operated stores were included.

Figure 1: Number of Stores in China: Luckin vs. Starbucks (2018Q1–2023Q3) [4-5]

3.3. Product Strategy

For Luckin Coffee, the three most prominent product strategies are product line diversification, taste optimization and innovation, and innovative product development and promotion. First of all, Luckin Coffee's product line includes several categories, such as coffee, tea, juice, and pastries, to meet the different needs of consumers. Among them, coffee is Luckin‘s main product, and in expanding the coffee category, Luckin has made full use of the method of product line filling. Luckin Coffee's most popular product is "Raw Coconut Latte," and its official microblogging site declared that the Raw Coconut Latte has achieved 100 million cups of sales on the first anniversary of its birth. At the same time, other coffee products such as "Velvet Latte" and "Hot Red Wine Americano" have also been launched and gained popularity. In terms of optimizing taste, Luckin Coffee has built up its strength in product research and development and improved the taste of each product through continuous experimentation and improvement. For example, Luckin Coffee has launched a variety of flavors of coffee products, such as mocha, latte, vanilla, etc., to meet the needs of different customers. Finally, in terms of product innovation, Luckin Coffee not only sells peripheral products such as "Genki Bomb" cold brew instant coffee products but also launches "chilled coffee cans" and other innovative products, which are well received by consumers.

3.4. Promotion strategy

On the sales and delivery side, Luckin put forward the concept of "new retail", through the combination of online orders, integrated services in offline stores, and its delivery system, to achieve efficient delivery and convenient consumer experience. Luckin tried to differentiate itself from Starbucks. Steenkamp described Luckin as being “delivery-friendly and digitally savvy,” as the company focuses more on the takeaways food market and uses mobile apps to process customer orders and payments [6].

In terms of expanding its reach, Luckin Coffee flexibly utilizes brand co-branding in promotions, using cross-industry co-branding to attract the attention of many consumers, expand its influence among different groups of consumers, and enhance its brand image. For example, the Luckin Coffee & Maotai, which exploded across the internet in September 2023, is a perfect combination of traditional and modern, high-end and common people, Luckin Coffee co-branded with Guizhou Moutai to launch the "Soy Latte" under the slogan of "fine wine and coffee, just love this cup". For a while, the soy latte co-branded product triggered attention and discussion on the Internet, with topics such as "A cup of coffee, the silence of two generations"; "The raw material supplier of soy latte said that it added 30 million yuan worth of Maotai"; and "Luckin responded to the question of whether it is okay to drink and Maotai co-branded soy lattes to drive", rushing to the top of the list. In the current consumer environment of "revival of national products at high speed", the co-branding cooperation between Moutai, the national wine, and Luckin Coffee, an up-and-coming Chinese brand, has gained higher recognition and attention in the market [7]. Luckin Fancy is the "national first" Maotai brand. "For Luckin, Maotai cooperation certainly pulled up the brand premium of Luckin." Li Chengdong said.

For the application in social media, Luckin, like other FMCG products, uses advertising precision communication marketing combined with the major social media to promote and increase its exposure, such as in the jittery voice platform constantly live bandwagon, inviting a variety of netroots with popularity to publicize its new launch of peripheral products and preferential activities; in the microblogging signature photo or signature coffee cups of the lucky draw in the advertisement promotion. In the mid-term, the popularity of LUCKIN Coffee has increased, and it emphasizes interaction and promotion with young people and fans in the rice circle. Move like that stimulates the curiosity and collection desire of consumers and then attracts the purchase and spread of fans [8].

4. Evaluation of Luckin Coffee marketing strategy

4.1. Price

The use of subsidies for fission marketing, the conversion of advertising costs into customer benefits, and therefore access to huge traffic and high brand acceptance, pricing is lower than Starbucks and other coffee for the high-end market, aimed at a more inclusive audience of the mass market, to create more affordable, cost-effective products that more consumers can afford to consume. In the first half of 2018, the market for the first subsidy was about 1 billion, an average of nearly 1.5 billion per month, but this does not let Luckin stop its "burning money" strategy. The responsible person has said that "subsidies are Luckin's long-term strategy". Subsidies are Luckin's long-term strategy, and we will not stop subsidizing within five years. A large number of subsidies stimulate incremental volume and capture a large number of customers, making consumers dependent on the brand and diluting the brand proposition. However, once the subsidies are canceled, it will be more difficult to retain customers, and brand loyalty will be difficult to consider. However, once the subsidy is canceled, customer retention will become more difficult, and brand loyalty will not be considered.

4.2. Product

There is still a gap between the quality and taste of Luckin Coffee and big brand drinks, with low differentiation and low brand-added value, which makes it easy to attract customers but difficult to please them, and the quality perception is poor [9]. Although Luckin's product line is relatively rich, its low price makes it in the coffee market have a certain advantage, but Luckin's peripheral products are less. Compared to Starbucks' very mature peripheral product line, Luckin is more focused on its sales of coffee or desserts and has no derivatives, such as a variety of series of coffee cups, thermos flasks, and even the same brand of cell phone shells, earphone cases, etc. But Starbucks will make very clever use of peripheral products, and its co-branding means working with different brands. However, Starbucks has used its peripheral products and its co-branding with different brands very skillfully.

4.3. Promotion

The almost monthly co-branding activities of Luckin Coffee not only enrich Luckin's product line, but also give people a sense of the brand's vigor and innovation. Some netizens said that each co-branding has a different style, which makes them look forward to the surprises every month. Lucky's strong co-branding each time, such as co-branding with ”Tom and Jerry“ and presenting the related gift bags and stickers; with the well-known tea leaves, Bigelow Chun (tea) launched the "Bigelow zhi chun Latte“. All of them have gained a lot of hot-topic discussion. But Luckin Coffee lacks novelty and diversity in media selection, mainly using offline posters or WeChat to share and publicize. Although there is a Luckin Coffee app in the online channel, the template and consumption method of the app have rarely changed, and it has a single function, is not creative enough, is boring, is large in size, and occupies a lot of memory. As Luckin Coffee has not yet formed a three-dimensional, extensive promotion channel, the effect of Luckin Coffee's promotion is not ideal, and the target group of this promotion mode has a general response. Now, Luckin Coffee has more channels to communicate directly with consumers, but it is difficult to meet the needs of customers just by relying on marketing, which is the biggest problem facing Luckin Coffee at present. Luckin Coffee is now mainly promoted through WeChat's infomercials and advertisements in office buildings, and even the promotion of social media is not mature. The first two ways are built on models that are cured and backward, and it is difficult to arouse the interest of the masses. If Luckin Coffee relies solely on such marketing methods to promote its products, it will not be able to meet the diversified media communication needs of its audience.

5. Suggestions for Luckin Coffee Improvement

5.1. Client-oriented

Luckin focuses on ingredients and service to make the product and the customer come first. Its first task should be to establish a professional talent echelon, constantly research and develop various types of coffee, try to get closer to high-quality coffee beans in the selection of coffee beans, improve the technology, and upgrade the coffee appliances to satisfy consumers' taste buds. Occupy the market should not just expand, but also, with its rapid development, provide training for store staff to ensure quality service.

5.2. Accurate dissemination

Content-based collaborative filtering techniques utilize the statistical means of massive data to mine historical data from users. Luckin Coffee not only labels the products and services offered to customers but also constantly upgrades its marking bar to determine what kind of services to offer to customers based on whether or not the business is going to be labeled through marking. Collaborative filtering algorithms are also able to introduce similar service offerings to the customer in question through content or relationships between customers. Both of these approaches can be used frequently in the operational activities of a business. Dies can be learned from Starbucks, using such a business model for operation, through the membership card recharge, you can recover cash in advance. For enterprises like Luckin Coffee, which initially burned money to gain customers, or enterprises with huge pressure on the capital chain, adopting this method can not only recover cash in advance but also recover cash in advance. For enterprises like Luckin Coffee, which initially burned money to gain customers or have huge pressure on their capital chain, adopting this method can not only recover cash in advance but also increase user loyalty [10].

5.3. Product differentiation

Although Luckin Coffee is very skilled in the implementation of brand co-branding, for different consumer groups or in creating their own IP peripheral derivatives that are not as good as other coffee brands, Luckin Coffee’s product research and development, should be timely to capture the market dynamics of the popularity of the market, to correctly grasp the current tea market trends, and to keep up with the trend. For example, Luckin Coffee can launch "0 sugar, 0 calorie" coffee products for female consumers, and Luckin Coffee can also draw on relevant ideas to design peripheral products based on IP and co-branding, such as sending out irregularly updated mugs and thermos cups for female consumers. Luckin, in providing better services to consumers, should not only give the products a cultural component of the brand but also highlight its cultural significance when designing peripheral products; at the same time, it should fully explore and utilize IP to carry out leapfrog cooperation, such as combining the current popular elements and brands to jointly develop limited edition products to capture consumers' interest in fashion and cutting-edge things. The pursuit of fashion and cutting-edge things by consumers.

6. Conclusion

On the whole, Luckin Coffee has a clear positioning in the market and product end, there is no lack of explosive single product; it accurately seizes the opportunity of domestic coffee consumption upgrading, and its development prospects are very open. In the research process of this paper, it is found that Luckin's price subsidy strategy has stimulated sales so much that it can't easily cancel the subsidy; its peripheral products are less compared to other coffee brands; and Luckin Coffee lacks innovation and diversity in media publicity. In view of the above problems, this paper proposes that Luckin should first be customer and product oriented, use data statistics to explore users' needs, improve the channels of information dissemination, realize precise marketing, and most importantly, realize product differentiation. In the future, the coffee industry should fully explore the brand's own unique "IP", give full play to the brand's competitive advantages, achieve vertical integration - strengthen the win-win relationship with upstream suppliers, optimize the marketing strategy, and enhance customer stickiness. This paper focuses more on the analysis of the marketing strategy of the coffee industry, and does not use a large number of research methods and data for discussion. In future research, we will pay more attention to quantitative analysis and use more data for evaluation.

References

[1]. Lingyu Q. (2020). The Analysis on the marketing strategy of Luckin Coffee in China, The 4th International Seminar on Education, Management and Social Sciences (ISEMSS 2020). Atlantis Press, 469-472.

[2]. World Coffee Portal. (2023). Luckin Coffee surges with record-breaking sales and outlet growth http://www.worldcoffeeportal.com/

[3]. Cheng, Yunlong. (2023). Research on Precision Marketing Communication Strategy of Ruixing Coffee (Master's thesis, Henan University), 14-15.

[4]. Luckin Coffee, Investor Relations, quarterly results, Online: https://investor.lkcoffee.com/financial-information/quarterly-results

[5]. Starbucks, Investor Relations, Financial Data, Online: https://investor.starbucks.com/financial-data/quarterly-results/default.aspx

[6]. Zhe Peng, Yahui Yang, Renshui Wu. (2022). The Luckin Coffee scandal and short selling attacks, Journal of Behavioral and Experimental Finance, Volume 34, 100629.

[7]. Lu Li. (2023). Luckin's "soy latte" has become a hit, and how the brand expands the boundary of cross-border co-branding. China Advertising, (11):44-47.

[8]. Meng Huixin. (2022). Analysis of the marketing strategy of Luckin coffee from the perspective of new retail. Old Brand Marketing, (21):15-17.

[9]. Zhou Yang, Tang Jialan. (2020). Brand marketing strategy of Luckin coffee. Cooperative Economy and Technology, (20):104-105. DOI:10.13665/j.cnki.hzjjykj.2020.20.039.

[10]. Peng Xiaoli, Gao Yonghong, Zhang Zichu. (2022). Comparison of the competitiveness of Luckin Coffee and Starbucks based on the five forces model and the inspiration. Old brand sales, (17):9-11.

Cite this article

Xiao,J. (2024). Marketing Strategy of the Coffee Industry under High Saturation of Globalized Brands-Take Luckin Coffee as an Example. Advances in Economics, Management and Political Sciences,84,273-279.

Data availability

The datasets used and/or analyzed during the current study will be available from the authors upon reasonable request.

Disclaimer/Publisher's Note

The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of EWA Publishing and/or the editor(s). EWA Publishing and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content.

About volume

Volume title: Proceedings of the 2nd International Conference on Management Research and Economic Development

© 2024 by the author(s). Licensee EWA Publishing, Oxford, UK. This article is an open access article distributed under the terms and

conditions of the Creative Commons Attribution (CC BY) license. Authors who

publish this series agree to the following terms:

1. Authors retain copyright and grant the series right of first publication with the work simultaneously licensed under a Creative Commons

Attribution License that allows others to share the work with an acknowledgment of the work's authorship and initial publication in this

series.

2. Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the series's published

version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial

publication in this series.

3. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and

during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work (See

Open access policy for details).

References

[1]. Lingyu Q. (2020). The Analysis on the marketing strategy of Luckin Coffee in China, The 4th International Seminar on Education, Management and Social Sciences (ISEMSS 2020). Atlantis Press, 469-472.

[2]. World Coffee Portal. (2023). Luckin Coffee surges with record-breaking sales and outlet growth http://www.worldcoffeeportal.com/

[3]. Cheng, Yunlong. (2023). Research on Precision Marketing Communication Strategy of Ruixing Coffee (Master's thesis, Henan University), 14-15.

[4]. Luckin Coffee, Investor Relations, quarterly results, Online: https://investor.lkcoffee.com/financial-information/quarterly-results

[5]. Starbucks, Investor Relations, Financial Data, Online: https://investor.starbucks.com/financial-data/quarterly-results/default.aspx

[6]. Zhe Peng, Yahui Yang, Renshui Wu. (2022). The Luckin Coffee scandal and short selling attacks, Journal of Behavioral and Experimental Finance, Volume 34, 100629.

[7]. Lu Li. (2023). Luckin's "soy latte" has become a hit, and how the brand expands the boundary of cross-border co-branding. China Advertising, (11):44-47.

[8]. Meng Huixin. (2022). Analysis of the marketing strategy of Luckin coffee from the perspective of new retail. Old Brand Marketing, (21):15-17.

[9]. Zhou Yang, Tang Jialan. (2020). Brand marketing strategy of Luckin coffee. Cooperative Economy and Technology, (20):104-105. DOI:10.13665/j.cnki.hzjjykj.2020.20.039.

[10]. Peng Xiaoli, Gao Yonghong, Zhang Zichu. (2022). Comparison of the competitiveness of Luckin Coffee and Starbucks based on the five forces model and the inspiration. Old brand sales, (17):9-11.